- Home

- »

- Automotive & Transportation

- »

-

Off-road Vehicle Market Size, Share & Growth Report, 2030GVR Report cover

![Off-road Vehicle Market Size, Share & Trends Report]()

Off-road Vehicle Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (ATVs, UTVs, Snowmobile), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-097-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

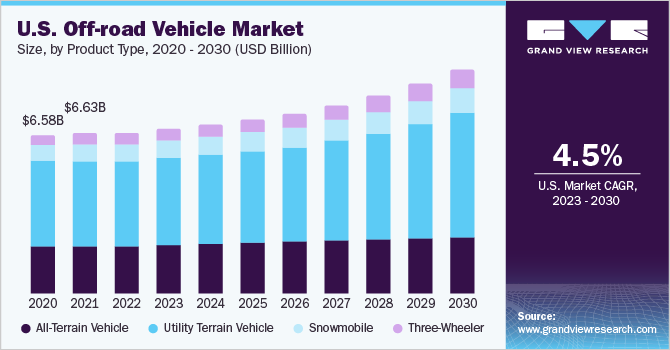

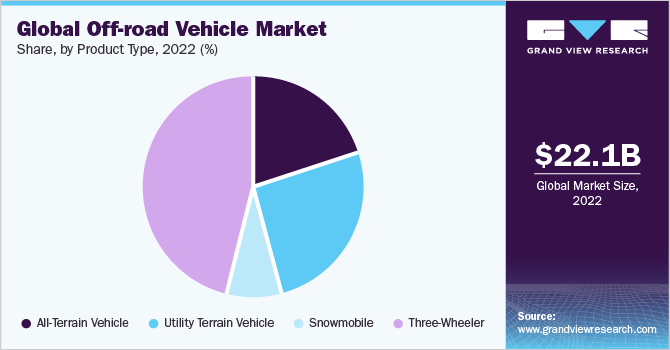

The global off-road vehicle market size was estimated at USD 22.09 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising adoption of off-road vehicles for recreational activities, such as sports & trail riding, increasing demand for All-Terrain Vehicles (ATVs) for farming & gardening activities, such as lawn mowing, field plowing, and seed spreading, and growing popularity & availability of such vehicles through online & offline sales channels are some of the key factors boosting the market growth. Moreover, increasing efforts in developing battery-powered off-road vehicles coupled with rising consumer preference for Electric Vehicles (EVs) for recreational as well as regular commuting purposes are expected to fuel the market growth over the forecast period.

However, the high upfront total cost of ownership limits the market growth to some extent. The growing popularity of off-road adventure sports and recreational activities is spurring the demand for off-road vehicles in the global market. Increased consumer preference for adventure tourism, since the outbreak of the COVID-19 pandemic, is observed as one of the key trends triggering product sales at tourist places in several countries. Since the COVID-19 pandemic, the surge in recreational activities is observed owing to the desire for outdoor adventure, the need for safe & socially distant entertainment options, and the recognition of the physical & mental health benefits of spending time in nature. Hiking, exploring, trail riding, and off-roading have been some of the major activities preferred by tourists in recent years.

All these activities engage the use of off-road vehicles for various purposes, such as transporting tourists across the mountains, beaches, and snowy areas and enabling tourists to pay on an hourly basis to enjoy the off-road rides. Thus, increased adoption of ATVs and UTVs is witnessed across the tourist places situated in the hilly regions. The rising popularity of electric ATVs is attributed to their compliance with emerging environmental regulations, offering advantages over traditional gas-powered models. Electric ATVs require minimal maintenance and have fewer components in motion, thereby minimizing the likelihood of mechanical breakdowns. In addition, ATV manufacturers are increasingly investing in research & development activities to develop technologically advanced, energy-efficient, and cost-effective vehicles.

For instance, in September 2022, Suzuki Motor USA LLC announced the launch of its KingQuad ATV product line, which consists of independent double A-arm front suspension, and fully independent A-arm/I-beam rear suspension. The growing dependence of businesses on smaller transportation options for commercial purposes in the Asia Pacific region and an increasing number of start-ups offering advanced electric three-wheelers are observed as major factors influencing the sales of three-wheelers in the global market. Three-wheelers are largely adopted for transporting sufficient loads within shorter distances. This allows businesses to save ample amounts of time & expenses in transport resources, thereby enhancing the profit margins to some extent.

Consistent government support for the development and proliferation of EVs has been one of the most encouraging factors responsible for the high sales of electric three-wheelers in the Asia Pacific and Africa regions. Thus, several OEMs are targeting these regions to launch their three-wheeler models to obtain maximum benefits from emerging markets. For instance, in March 2023, an Indian electric vehicle start-up, Zen Mobility, announced the launch of its cargo electric three-wheeler. The three-wheeler comprises Zen’s EV drivetrain technology, a 2kW motor, 24 Nm torque, and a range of over 120 km. Rising competition in the global market for off-road vehicles has compelled manufacturers to enhance innovation with respect to components and the launch of advanced vehicles that appeal to the growing consumer requirements.

For instance, in July 2022, the U.S.-based electric powersports company, Volcon Inc., announced the launch of a four-seater Stag Utility Terrain Vehicle (UTV) with a peak power of 107Kw and peak torque of 360 Nm, over 160 km of range, and 42kWh battery pack. Moreover, in April 2023, Sypris Technologies, Inc., the U.S.-based supplier and manufacturer of drivetrain and other vehicle components for commercial vehicles was granted a program of supplying drivetrain components of UTVs in America. Thus, the company has signed a multi-year agreement with one of the key players in the UTVs market thereby, adhering to the production requirements from the year 2024.

Product Type Insights

Based on product type, the three-wheeler segment accounted for the largest share of more than 45% in 2022 due to the high demand for recreational three-wheeled motorcycles in the North America region and increased use of conventional three-wheelers in the Asia Pacific region for logistics purposes. In March 2023, Polaris Slingshot, a brand of Polaris Inc., announced a partnership with ROUSH Performance, an assembled vehicle manufacturer, for introducing a new Slingshot ROUSH Edition model featuring a 203 horsepower ProStar engine, enhanced stopping power with Brembo brakes, paddle shifters, 7-inch display by RIDE COMMAND, and billet pedal covers.

In April 2022, BRP announced updates to its three-wheeled motorcycle models Can-Am Spyder and Ryker. Furthermore, the updates, which were designed to enhance vehicle performance & stability and included a triple engine with eco mode, semi-automatic 6-speed transmission, vehicle stability control system, and touring footboards, among others, are driving the market growth. The UTV product type segment is projected to register the highest CAGR over the forecast period. The growth of this segment is ascribed to the increasing popularity of adventure sports and leisure pursuits.

For instance, vendors are planning and introducing electric UTVs as part of a long-term goal to reduce vehicular emissions. In July 2022, an electric power sports company, Volcon Inc., announced the launch of its fully electric UTV, named the Stag, which provides better performance with less noise and emissions from the companies in the North American, Latin American, and Caribbean distributor networks. This announcement aims to provide all-electric vehicles with all-wheel drive for off-road enthusiasts and newcomers for work purposes and adventure sports.

Regional Insights

The North American region accounted for the largest share of more than 65% of the global revenue in 2022. A considerable rise in the adoption of ATVs & UTVs for recreational activities, such as trailing and mountain riding, was observed as one of the key factors driving the segment growth. In addition, the increased use of ATVs for farming activities and the growing availability of off-road vehicles at local stores at various places owing to supportive government policies proved to be the driving factor for the segment growth. The Europe region is expected to register the fastest CAGR over the forecast period.

The high growth of this region is majorly attributed to factors, such as growth in adventure sports & tourism in Nordic Countries coupled with increased government focus on attracting tourists from all over the world. Moreover, the rising demand for snowmobiles in various European countries, owing to their easy availability and high promotion of adventure sports on social media & other public platforms, is projected to drive the segment growth over the forecast period, thereby creating numerous growth opportunities for marketers. Rising demand for electric three-wheelers for logistics purposes is also poised to offer considerable growth opportunities to the stakeholders in the coming years.

Key Companies & Market Share Insights

The market is consolidated and characterized by the presence of key players. These players offer a wide range of products to the defense, agriculture, and mining & construction industries. Key companies are focused on manufacturing off-road vehicle products with a better range for the long haul. New product launches and upgradation of the existing off-road vehicle products have remained the key strategies of these players.

For instance, in August 2022, Arctic Cat Inc. (Textron Inc.) announced a strategic partnership with tread lightly! Inc. to protect motorized trail access as well as public lands through responsible recreation education and stewardship projects. Tread lightly! Inc. is a non-profit organization that promotes responsible recreation through ethics education and stewardship programs. Some prominent players in the global off-road vehicle market include:

-

Arcimoto

-

Arctic Cat Inc. (Textron Inc.)

-

ARGO

-

BRP

-

Deere & Company

-

DRR USA

-

Electra Meccanica

-

Harley-Davison, Inc.

-

HISUN

-

Honda Motor Co., Ltd.

-

Italika

-

Kawasaki Heavy Industries

-

KYMCO

-

MOTO AVANZADA SA DE CV

-

Polaris Inc.

-

Segway Technology Co., Ltd. (Ninebot Inc.)

-

SSR Motorsports

-

Taiga Motors Inc.

-

Yamaha Motor Co., Ltd.

-

Zhejiang Chunfeng Power Co., Ltd. (CFMOTO)

Off-road Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.93 billion

Revenue Forecast in 2030

USD 32.94 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America

Country scope

U.S.; Canada; UK; Germany; Italy; China; India; Japan; South Korea; Brazil; Mexico; Chile; Argentina; Colombia

Key companies profiled

Arcimoto; Arctic Cat Inc. (Textron Inc.); ARGO; BRP; Deere & Company; DRR USA; Electra Meccanica; Harley-Davison, Inc.; HISUN; Honda Motor Co., Ltd.; Italika; Kawasaki Heavy Industries; Kymco; Moto Avanzada Sa de Cv; Polaris Inc.; Segway Technology Co., Ltd. (Ninebot Inc.); SSR Motorsports; Taiga Motors Inc.; Yamaha Motor Co., Ltd.; Zhejiang Chunfeng Power Co., Ltd. (CFMOTO)

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Off-road Vehicle Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the off-road vehicle market report based on product type and region:

-

Product Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

All-Terrain Vehicle

-

Utility Terrain Vehicle

-

Snowmobile

-

Three-Wheeler

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Colombia

-

-

Frequently Asked Questions About This Report

b. The global off-road vehicle market size was estimated at USD 22.09 billion in 2022 and is expected to reach USD 22.93 billion in 2023.

b. The global off-road vehicle market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 32.94 billion by 2030.

b. North America dominated the off-road vehicle market with a share of 65% in 2022. This can be attributed to the rising enthusiasm among individuals seeking thrilling experiences and outdoor adventures in the region.

b. Some key players operating in the off-road vehicle market include Arcimoto, Arctic Cat Inc. (Textron Inc.), ARGO, BRP, Deere & Company, DRR USA, Electra Meccanica, Harley-Davison, Inc., HISUN, Honda Motor Co., Ltd., ITALIKA, Kawasaki Heavy Industries, KYMCO, MOTO AVANZADA SA DE CV, Polaris Inc., Segway Technology Co.,Ltd (Ninebot Inc.), SSR Motorsports, TAIGA MOTORS INC., Yamaha Motor Co., Ltd., and Zhejiang Chunfeng Power Co., Ltd. (CFMOTO).

b. Key factors driving the off-road vehicle market growth include the rising adoption of off-road vehicles for recreational activities such as sports and trail riding, increasing demand for all-terrain vehicles (ATVs) for farming & gardening activities such as lawn mowing, field plowing and seed spreading and growing popularity and availability of such vehicles through online & offline sales channels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.