- Home

- »

- Biotechnology

- »

-

Oligonucleotide Synthesis Market Size & Share Report, 2033GVR Report cover

![Oligonucleotide Synthesis Market Size, Share & Trends Report]()

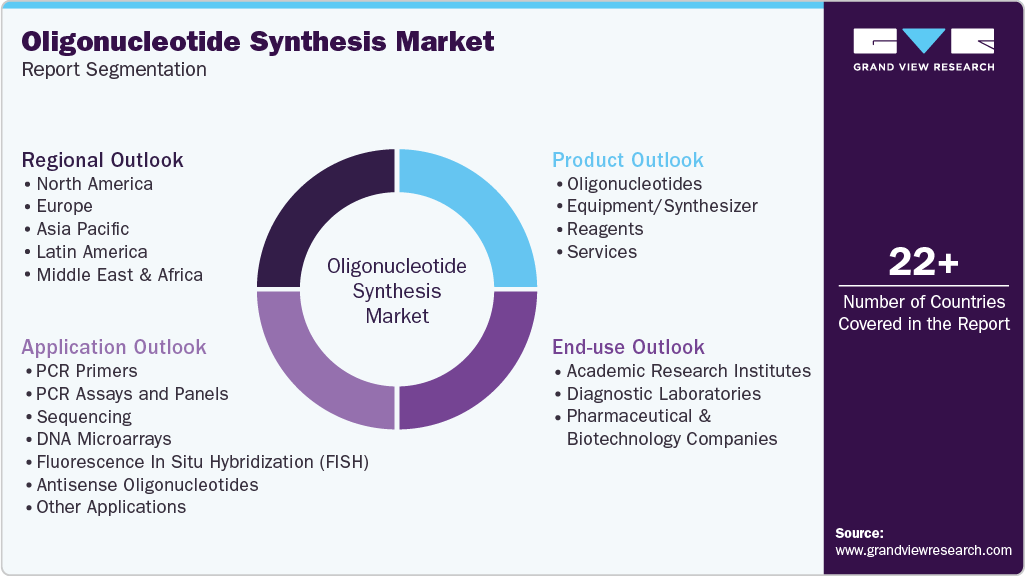

Oligonucleotide Synthesis Market (2026 - 2033) Size, Share & Trends Analysis Report By Product & Service (Oligonucleotides, Reagents, Services, Equipment/Synthesizer), By Application (PCR Primers, Sequencing, DNA Microarrays), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-593-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oligonucleotide Synthesis Market Summary

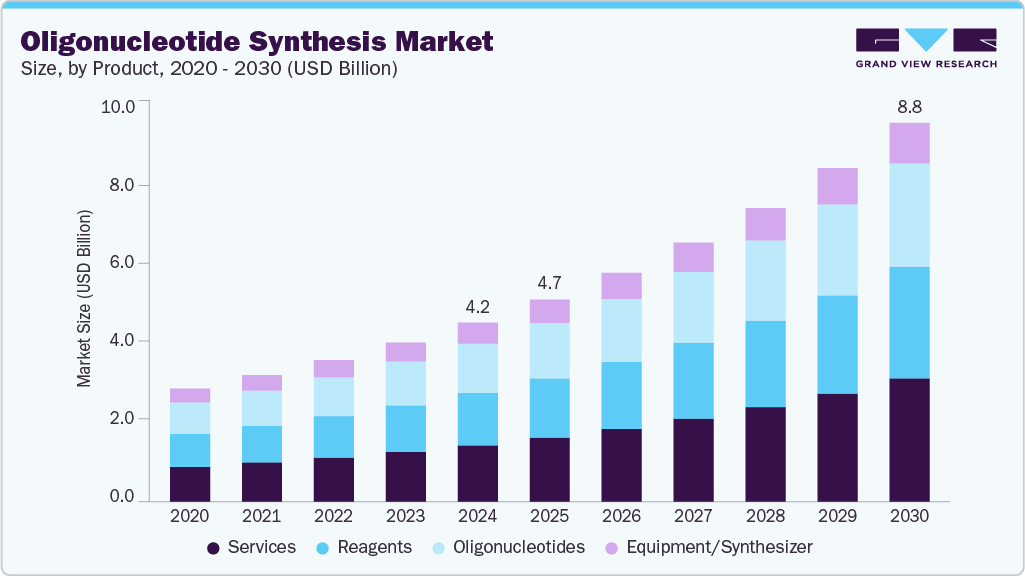

The global oligonucleotide synthesis market size was estimated at USD 3.64 billion in 2025 and is projected to reach USD 10.86 billion by 2033, growing at a CAGR of 14.95% from 2026 to 2033. Growth is driven by increasing use of oligonucleotides in therapeutics and diagnostics, rising genomics research investments, and technological advances in scalable synthesis, with strong demand from pharmaceutical and biotechnology companies supporting market expansion.

Key Market Trends & Insights

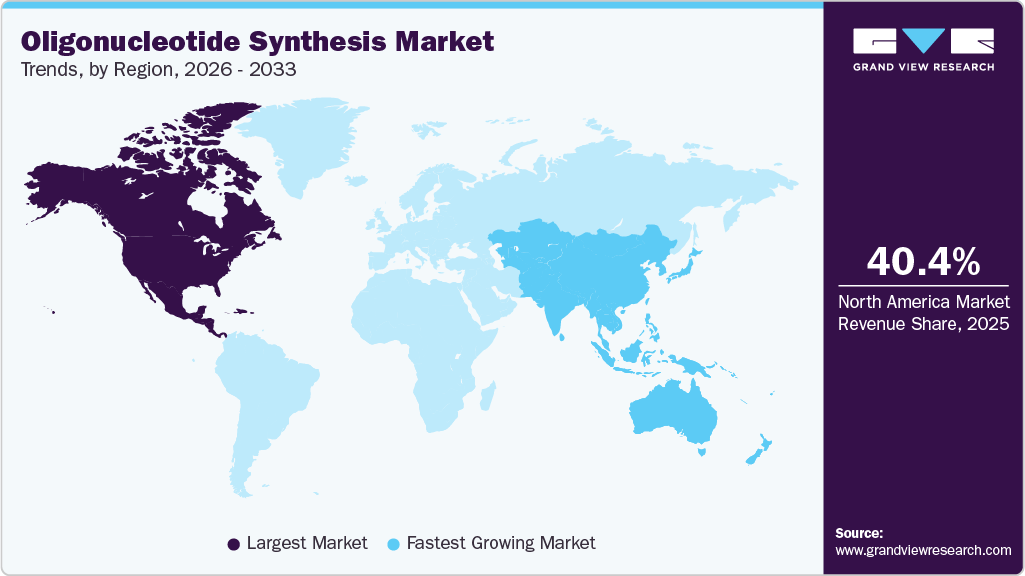

- The North America oligonucleotide synthesis market held the largest share of 40.37% of the global market in 2025.

- The oligonucleotide synthesis industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the oligonucleotides segment accounting for the largest revenue share of 32.30% in 2025.

- By application, PCR primers led the industry with the largest revenue share in 2025.

- By end use, the academic research institutes dominated with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.64 Billion

- 2033 Projected Market Size: USD 10.86 Billion

- CAGR (2026-2033): 14.95%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growth of Nucleic Acid-Based Therapies

The primary factor responsible for the growth of the oligonucleotide synthesis market is the rapidly growing nucleic acid-based therapies. High-precision oligonucleotides are needed for therapeutic measures like antisense oligonucleotides, siRNA, mRNA therapies, and gene-editing technologies, which, in turn, require more accurate and more extensive synthesis. Moreover, the increasing number of regulatory approvals and the ongoing strong clinical pipeline against genetic, oncological, and infectious diseases are also contributing to the growth of the market.

List of approved NA therapeutics (up to 2024)

RNA Type

Drug Name(s)

Target Profile

Developer(s)

ASO

Fomivirsen

Eye, CMV retinitis; binds and degrades UL123 mRNA, inhibits IE2 protein

Ionis

ASO

Mipomersen

Liver, homozygous familial hypercholesterolemia; ApoB-100 mRNA degradation

Kastle Therapeutics, Ionis

ASO

Nusinersen

CNS, spinal muscular atrophy; SMN2 pre-mRNA splicing

Ionis

ASO

Eteplirsen

Muscle, DMD; exon 52 skipping of DMD

Sarepta

ASO

Inotersen

Liver, familial amyloid polyneuropathy; inhibits TTR mRNA translation

Ionis

ASO

Milasen

CNS, Batten disease (CLN7); CLN7 mRNA splicing

Boston Children’s Hospital

ASO

Golodirsen

Muscle, DMD; exon 53 skipping of DMD

Sarepta

ASO

Viltolarsen

Muscle, DMD; exon 53 skipping of DMD

NS Pharma

ASO

Casimersen

Muscle, DMD; exon 45 skipping of DMD

Sarepta

ASO

Eplontersen

Polyneuropathy of hATTR amyloidosis

AstraZeneca, Ionis

siRNA

Patisiran

Liver, polyneuropathy; inhibits TTR mRNA translation

Alnylam

siRNA

Givosiran

Liver, acute hepatic porphyria; ALAS1 mRNA downregulation

Alnylam

siRNA

Lumasiran

Liver, PH1; HAO1 mRNA targeting

Alnylam

siRNA

Inclisiran

Liver, ASCVD; PCSK9 mRNA downregulation

Novartis

siRNA

Vutrisiran

Liver, hATTR amyloidosis; TTR mRNA

Alnylam

siRNA

Nedosiran

Primary hyperoxaluria

Dicerna

Aptamer

Pegaptanib

Eye, AMD; VEGF165 inhibition

Bausch + Lomb

Aptamer

Izervay

Eye, geographic atrophy; C5 inhibition

Iveric Bio, Astellas

mRNA

BNT162b2

COVID-19 vaccine; SARS-CoV-2 spike protein expression

BioNTech, Pfizer

mRNA

mRNA-1273

COVID-19 vaccine; SARS-CoV-2 spike protein expression

Moderna

CRISPR-Cas9

Casgevy

Blood; CRISPR-Cas9 editing of CD34+ HSPCs

Vertex, CRISPR Therapeutics

Source: Molecular Therapy Nucleic Acid, Secondary Research, Grand View Research

At the same time, pharmaceutical and biotechnology companies are gradually transferring their oligonucleotide synthesis processes to specialized providers for the sake of research, clinical development, and marketing. The increasing sophistication of therapeutic designs, such as modification with chemicals and long-chain oligos, is the main reason for the demand for high-tech synthesis skills, proving the market’s long-term growth potential even more.

Rising Use in Molecular Diagnostics

Molecular diagnostic techniques are becoming more widespread, and they are the main reason for the increasing demand in the oligonucleotide synthesis market. Oligonucleotides are vital for PCR, qPCR, NGS, and hybridization-based assays, thus enabling the applications in disease detection, pathogen identification, and genetic testing. The growing demand for high-quality oligonucleotides stems from the ongoing use of molecular diagnostics in clinical laboratories and the production of diagnostic kits.

In addition, the expansion of precision medicine and companion diagnostics is further boosting market growth. Targeted diagnostic tests require highly customized oligonucleotides to ensure accuracy and reliability. At the same time, rising testing volumes in oncology, infectious diseases, and genetic disorders continue to support long-term demand for scalable oligonucleotide synthesis.

Market Concentration & Characteristics

The oligonucleotide synthesis industry is characterized by a moderate to high degree of innovation due to rapid advancements in gene editing technology. Gene editing technology - Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) is projected to be the most influential and innovative technology in biotechnology.

The oligonucleotide synthesis sector is further characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new DNA & RNA facilities, increase their capabilities, expand product portfolios, and improve competencies. For instance, in January 2025, Maravai LifeSciences acquired Molecular Assemblies’ intellectual property and assets, strengthening TriLink BioTechnologies’ enzymatic DNA synthesis capabilities for advanced mRNA, oligonucleotide, and CRISPR manufacturing applications.

Regulatory requirements for quality, safety, and GMP compliance increase production complexity and costs in the oligonucleotide synthesis industry. At the same time, clearer approval pathways for nucleic acid-based therapies support market growth and favor compliant manufacturers.

Product expansion in the oligonucleotide synthesis industry is driven by demand for customized, chemically modified, and GMP-grade oligonucleotides for therapeutic and diagnostic applications, enabling companies to strengthen portfolios and address complex research and clinical needs.

Regional expansion in the oligonucleotide synthesis industry is driven by rising genomics research and biopharmaceutical demand, with companies establishing local facilities to meet regulatory requirements, improving supply chains, and serve key markets in North America, Europe, and the Asia Pacific. For instance, in December 2024, Co-Dx and CoSara Diagnostics Pvt. Ltd opened an oligonucleotide synthesis facility in Ranoli, India. Aligned with the “Make in India” initiative, the facility is designed to manufacture Co-Primers oligos in-house

Product & Service Insights

In 2025, the oligonucleotide synthesis industry was primarily driven by the increasing adoption of molecular diagnostics and oligonucleotide therapeutics, with the services segment contributing the largest share of 38.03% to the total revenue. Major companies are growing their presence through new market penetration.

The services segment is also projected to grow at the fastest CAGR in the oligonucleotide synthesis market due to increasing outsourcing by pharmaceutical and biotechnology companies seeking specialized, high-quality, and scalable synthesis capabilities while avoiding high infrastructure and regulatory compliance costs.

Application Insights

PCR primers led the oligonucleotide synthesis market in 2025 with a 20.58% share, driven by their use in sequencing, amplification, and advanced PCR techniques such as qPCR, RT-PCR, and digital PCR, which boosted demand for specialized designs and accurate gene expression analysis.

The sequencing segment is expected to grow at the fastest CAGR, driven by applications in genomics and genetic analysis, pathogen detection, and oligonucleotide-based assays. Market growth is further powered by the improvements in sequencing technologies and bioinformatics, like DNA Script's 2025 milestone, which allowed the production of custom DNA sequences of up to 500 nucleotides.

End Use Insights

In 2025, academic research institutes dominated the oligonucleotide synthesis market with a share of 44.48%, due to the applications of oligonucleotides in PCR, gene editing, mutagenesis, and diagnostics. In February 2025, the Jawaharlal Nehru India Centre for Advanced Scientific Research held the first Nucleic Acid Therapeutics Regional Meeting. The meeting fostered industry-based and academic research for the development of oligonucleotide therapeutics.

The pharmaceutical and biotechnology companies segment is expected to grow fastest over the forecast period. Oligonucleotides are key in modulating gene expression, targeting specific genetic sequences, and facilitating various molecular biology techniques. In September 2024, Lilly joined hands with Genetic Intelligence in a USD 409 million agreement to create RNA-targeted oligonucleotide therapies incorporating the AI technology Genetic Leap.

Regional Insights

North America led the oligonucleotide synthesis market in 2025 with the share of 40.37%, driven by numerous local companies and research institutes, strong demand from pharmaceutical and biotech firms, and Canada’s focus on personalized medicine and life sciences investments.

U.S Oligonucleotide Synthesis Market Trends

The United States oligonucleotide synthesis industry is growing rapidly. This market demand can be attributed to the country’s robust healthcare infrastructure, significant research and development investments, and a thriving pharmaceutical and biotechnology industry.

Europe Oligonucleotide Synthesis Market Trends

The Europe oligonucleotide synthesis market held a substantial market share in 2025. The European Union's funding programs and collaborative research initiatives contribute to the market's growth. In May 2025, in response to U.S. research funding cuts, Europe launched a USD 566 million initiative to attract top scientists from the U.S. The plan is expected to strengthen the European Research Council and offer "super grants" to top researchers.

The UK oligonucleotide synthesis market is growing rapidly, driven by increasing investments in genomics research, personalized medicine, and biotechnology, alongside strong government support and rising demand for oligonucleotide-based diagnostics and therapeutics.

The Germany oligonucleotide synthesis market is growing steadily, driven by strong pharmaceutical and biotech sectors, extensive research in molecular biology and genetics, and increasing adoption of oligonucleotide-based diagnostics and therapies.

Asia Pacific Oligonucleotide Synthesis Market Trends

The Asia Pacific oligonucleotide synthesis industry is projected to grow fastest at a 17.93% CAGR, driven by strategic collaborations, acquisitions, and rising initiatives in countries like Japan, China, and India, including new oligonucleotide production facilities. Increasing investments in biotechnology, growing research infrastructure, and government support for genomics and personalized medicine are further boosting market expansion.

The China oligonucleotide synthesis market led the regional market, accounting for the largest revenue share in 2025. This growth is primarily fueled by increased investments in biotechnology, rising research & development initiatives, and a growing demand for targeted therapies and diagnostics.

The Japan oligonucleotide synthesis market is rapidly expanding, fueled by cutting-edge genomics research, strong industry-academia collaborations, and the development of advanced oligonucleotide-based therapies and diagnostics.

Middle East & Africa Oligonucleotide Synthesis Market Trends

The oligonucleotide synthesis market in the Middle East & Africa is growing steadily, driven by increasing investments in biotechnology, expanding research infrastructure, and rising demand for oligonucleotide-based diagnostics and therapeutics.

The Kuwait oligonucleotide synthesis industry is emerging, driven by government initiatives to advance life sciences, collaborations with international biotech firms, and rising adoption of genetic research and personalized medicine.

Key Oligonucleotide Synthesis Company Insights

The oligonucleotide synthesis market is led by major players like Thermo Fisher, Merck KGaA, Danaher, Revvity, and Agilent, while innovators such as Bio-Synthesis, Kaneka Eurogentec, LGC Biosearch, Biolegio, and Twist Bioscience expand through customized solutions for research, pharma, and synthetic biology.

The market growth is primarily driven by the demand for high-quality oligonucleotides in genetic engineering, diagnostics, medicines, and synthetic biology, along with collaborations, mergers, and improvements in synthesis productivity, which the driving competition. The future of the market is being decided by companies that use innovation together with customer-focused solutions, as well as make their commitments to accessibility and ethical sourcing.

Key Oligonucleotide Companies:

The following key companies have been profiled for this study on the oligonucleotide synthesis market.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Revvity Discovery Limited

- Agilent Technologies, Inc.

- Bio-Synthesis, Inc.

- Kaneka Eurogentec S.A.

- LGC Biosearch Technologies

- Biolegio

- Twist Bioscience

Recent Developments

-

In December 2025, Aptamer Group and Alphazyme executed a licensing agreement granting Alphazyme non-exclusive rights to use Optimer synthetic aptamers for hot-start PCR, enhancing enzyme modulation and assay specificity.

-

In July 2025, Synoligo Biotechnologies launched a new e-commerce platform for oligonucleotide synthesis, providing researchers with streamlined ordering, advanced customization, fast delivery, and enhanced global access.

-

In May 2025, Oligo Factory launched a low-scale oligonucleotide synthesis capability at its Holliston, Massachusetts facility, expanding support for therapeutic, diagnostic, and life science researchers with flexible, rapid, and high-quality custom oligos.

Oligonucleotide Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.10 billion

Revenue forecast in 2033

USD 10.86 billion

Growth rate

CAGR of 14.95% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; Revvity Discovery Limited; Agilent Technologies, Inc.; Bio-Synthesis, Inc.; Kaneka Eurogentec S.A.; LGC Biosearch Technologies; Biolegio; Twist Bioscience

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Oligonucleotide Synthesis Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global oligonucleotide synthesis market on the basis of product & service, application, end-use, and region:

-

Product & Service Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Oligonucleotides

-

Product type

-

DNA

-

Technology

-

Column-based

-

Array-based

-

-

-

RNA

-

Technology

-

Column-based

-

Array-based

-

-

Type

-

Short RNA Oligos (<65 nt)

-

Long RNA Oligos (>65 nt)

-

CRISPR (sgRNA)

-

-

-

-

-

Equipment/Synthesizer

-

Reagents

-

Services

-

DNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

50 nmol

-

200 nmol

-

1000 nmol

-

10000 nmol

-

-

Modification Services

-

Purification Services

-

-

RNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

100 nmol

-

1000 nmol

-

10000 nmol

-

-

Modification Services

-

Purification Services

-

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR Primers

-

PCR Assays and Panels

-

Sequencing

-

DNA Microarrays

-

Fluorescence In Situ Hybridization (FISH)

-

Antisense Oligonucleotides

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical and Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the oligonucleotide synthesis market include Thermo Fisher Scientific, Inc; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies, Inc.; Bio-Synthesis; Kaneka Eurogentec S.A.; LGC Biosearch Technologies; Biolegio; Twist Bioscience

b. Key factors that are driving the oligonucleotide synthesis market growth include the declining cost of sequencing, technological advancements in gene editing technologies, and rising investments in genetic research.

b. The global oligonucleotide synthesis market size was estimated at USD 3.64 billion in 2025 and is expected to reach USD 4.10 billion in 2026.

b. The global oligonucleotide synthesis market is expected to grow at a compound annual growth rate of 14.95% from 2026 to 2033 to reach USD 10.86 billion by 2033.

b. Services dominated the oligonucleotide synthesis market with a share of 38.03 % in 2025. This is attributable to the increasing demand for oligonucleotides in precision medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.