- Home

- »

- Medical Devices

- »

-

Oncology Clinical Trials Market Size & Share Report, 2030GVR Report cover

![Oncology Clinical Trials Market Size, Share & Trends Report]()

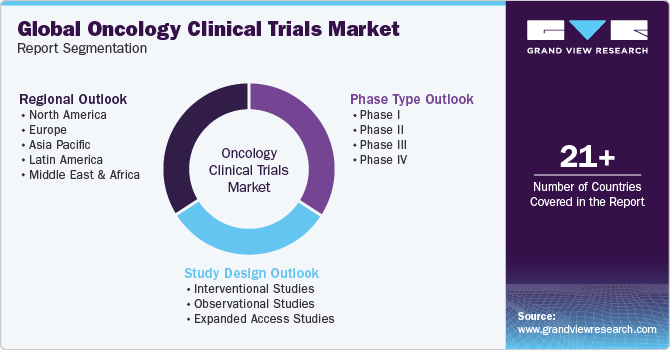

Oncology Clinical Trials Market (2023 - 2030) Size, Share & Trends Analysis Report By Phase Type (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional Study, Observational Study, Expanded Access Study), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-139-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oncology Clinical Trials Market Summary

The global oncology clinical trials market size was estimated at USD 12.92 billion in 2022 and is projected to reach USD 19.49 billion by 2030, growing at a CAGR of 5.2% from 2023 to 2030. The market is primarily driven by factors such as an increase in technological advancements, a rise in cancer incidences, and improvements in personalized medicine and cell and gene therapies, which are starting new approaches for developing new treatments for cancer-like diseases.

Key Market Trends & Insights

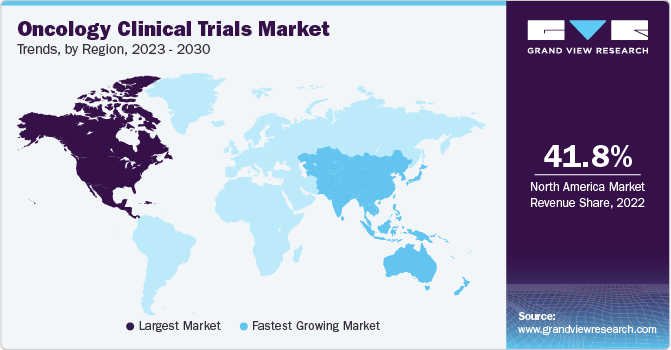

- North America dominated the market and accounted for the largest revenue share of 41.8% in 2022.

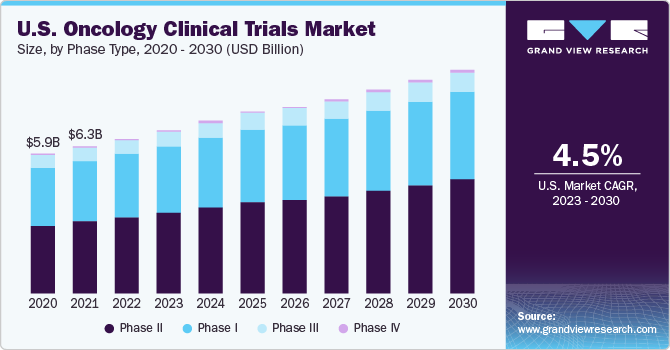

- Based on type, the market is segmented into phase I, phase II, phase III, and phase IV. The phase I clinical trials segment accounted for the largest revenue share of over 30.0% in 2022.

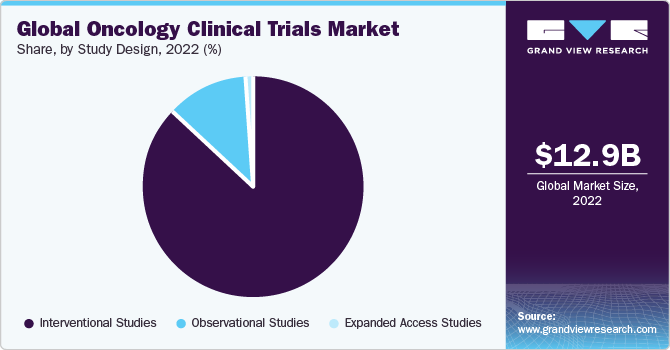

- Based on study design, the interventional studies segment accounted for the largest revenue share of around 87.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 12.92 Billion

- 2030 Projected Market Size: USD 19.49 Billion

- CAGR (2023-2030): 5.2 %

- North America: Largest market in 2022

Moreover, an increase in funding from pharmaceutical and biotech companies, non-profit organizations, and CROs for oncology clinical trials is further supporting market growth and the development of advanced products to gain substantial market share. The global market is driven by the rising number of cancer patients. Lung cancer is predicted to emerge as the leading cause of cancer-related deaths worldwide, with an estimated 1.8 million people diagnosed each year. The number of cancer cases in the U.S. reached 1.9 million in 2022. In addition, pancreatic cancer has a terrible prognosis, with just 1 to 3 years of survival. The market is expected to be hindered by factors such as cultural and social challenges associated with clinical trial participation, recruitment barriers in the clinical trial process, lack of scientific knowledge, misuse of statistics and data, and complexity of study protocol, whereas mostly the study is funded and organized by the federal government.

The National Center for Biomedical Imaging (NCI) funds approximately 50% of all cancer clinical trials in the U.S., according to Mooney's description of the National Center for Biomedical Imaging Clinical Trials Cooperative Group Program. However, the COVID-19 pandemic slowed down clinical trials of oncology. Many clinical trials were postponed or delayed due to safety concerns and difficulties in recruiting participants during the pandemic.

Phase Type Insights

Based on type, the market is segmented into phase I, phase II, phase III, and phase IV. The phase I clinical trials segment accounted for the largest revenue share of over 30.0% in 2022. The phase I clinical trial segment in the oncology clinical trials industry is driven by scientific, regulatory, financial, and patient-centric factors. In phase I of clinical trials, a small group of individuals (20 to 100 healthy volunteers) undergoes testing with an experimental drug or treatment.

The phase III segment is estimated to register the fastest CAGR of 5.6% over the forecast period. The driving factors for the phase III segment include the high share of phase III trials, which is attributed to the fact that phase III trials are the most expensive but involve many subjects. Long-term safety studies are conducted for registration and post-marketing commitments in phase III trials. For instance, in Jul 2020, a phase III clinical trial of alpelisib in the mix with pertuzumab and trastuzumab was started by Novartis AG to assess the well-being and viability of use as a support therapy for patients with HER2-positive advanced breast cancer.

Study Design Insights

Based on study design, the interventional studies segment accounted for the largest revenue share of around 87.6% in 2022. The driving factors for interventional study design in the oncology clinical trials sector primarily revolve around these conditions' unique challenges. Given the limited patient populations, studies must be meticulously designed to maximize the chances of detecting meaningful treatment effects.

The observational studies segment is estimated to register the fastest CAGR of 6.1% over the forecast period. Due to several driving factors, observational trial study designs play a crucial role in the oncology clinical trials industry. The scarcity of patients with oncology makes traditional randomized controlled trials challenging, making observational studies a more feasible option for assessing treatment efficacy and safety.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.8% in 2022 and is expected to maintain its dominance during the forecast period due to various favorable reimbursement policies and the presence of major market players in the region, leading to investment and the development of innovative products. Also, the U.S. FDA has a fast-track approval process for drugs that treat cancer. For instance, according to the U.S. Government Accountability Office, the National Institutes of Health (NIH), an agency under the Department of Health and Human Services (HHS), stands as the foremost public financier of biomedical research and development (R&D).

During the fiscal years 2017 to 2021, NIH allocated a staggering USD 97 billion for fundamental research and USD 28 billion for clinical trials and associated endeavors. Whereas, Asia Pacific is expected to grow at the fastest CAGR of 7.1% during the forecast period. This is due to the availability of a significant number of Food and Drug Administration (FDA), Therapeutic Goods Administration (TGA), and European Medicines Agency (EMA)-approved facilities in the region. Moreover, the large patient pool and low cost of conducting clinical trials in the region further support the regional market.

Key Companies & Market Share Insights

The oncology clinical trials industry is highly competitive, with a large number of manufacturers accounting for most of the market share. Phase launches, approvals, strategic acquisitions, partnerships, and technological innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach.

Key Oncology Clinical Trials Companies:

- Astrazeneca

- Merck & Co., Inc

- IQVIA Inc

- Gilead Sciences, Inc.

- F. Hoffmann-La Roche Ltd

- PAREXEL International Corporation

- PRA Health Sciences

- Syneos Health

- Medpace

- Novotech

- Pivotal

Oncology Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.71 billion

Revenue forecast in 2030

USD 19.49 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Phase type, study design, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AstraZeneca; Merck & Co. Inc.; IQVIA Inc.; Gilead Sciences, Inc.;F. Hoffmann-La Roche Ltd.; PRA Health Sciences; Syneos Health; Medpace; Novotech; Parexel International Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oncology Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oncology clinical trials market report based on phase type, study design and region:

-

Phase Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Studies

-

Observational Studies

-

Expanded Access Studies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global carbon footprint management market size was estimated at USD 12.04 billion in 2024 and is expected to reach USD 13.12 billion in 2025.

b. The global carbon footprint management market is expected to witness a compound annual growth rate of 9.3% from 2025 to 2030 to reach USD 20.44 billion by 2030.

b. Cloud accounted for the largest deployment segment in 2024 and is expected to grow at a CAGR of about 12.0% over the forecast period.

b. Wolters Kluwer, IBM Corporation, Schneider Electric, and Dakota Software are some of the key companies operating in the carbon footprint management market.

b. The global carbon footprint management market is expected to be driven by increasing concerns regarding the detrimental effects of carbon emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.