- Home

- »

- Communication Services

- »

-

Open RAN Market Size And Share, Industry Report, 2033GVR Report cover

![Open RAN Market Size, Share & Trends Report]()

Open RAN Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Unit (Radio Unit, Distributed Unit, Centralized Unit), By Deployment, By Network, By Frequency, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-117-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Open RAN Market Summary

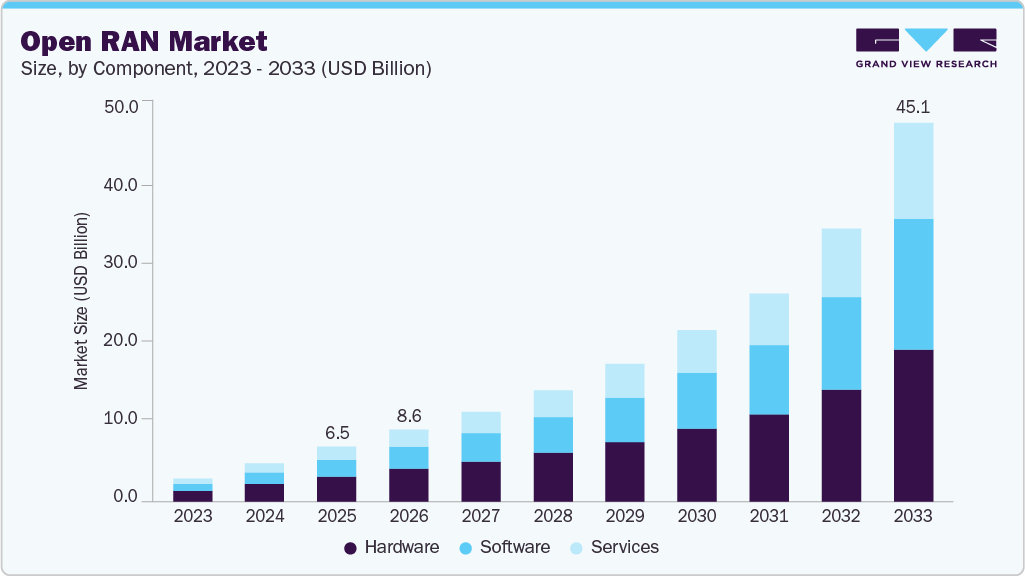

The global open RAN market size was estimated at USD 6.53 billion in 2025 and is projected to reach USD 45.09 billion by 2033, growing at a CAGR of 26.8% from 2026 to 2033. An open radio access network, open RAN or O-RAN, is a nonproprietary version of the radio access network (RAN) that allows interoperation between cellular network equipment provided by different vendors.

Key Market Trends & Insights

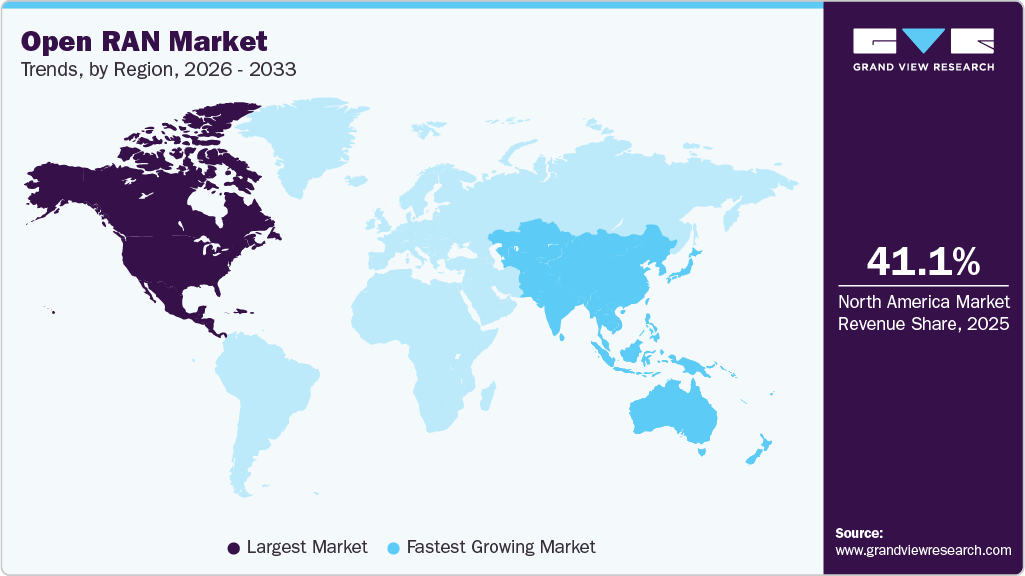

- North America dominated the open RAN industry and accounted for a share of 41.1% in 2025.

- The U.S. open RAN market held a dominant position in the region in 2025.

- By unit, the distributed unit segment dominated the market in 2025.

- By deployment, the hybrid cloud segment dominated the market in 2025.

- By network, the 5G segment dominated the market in 2025.

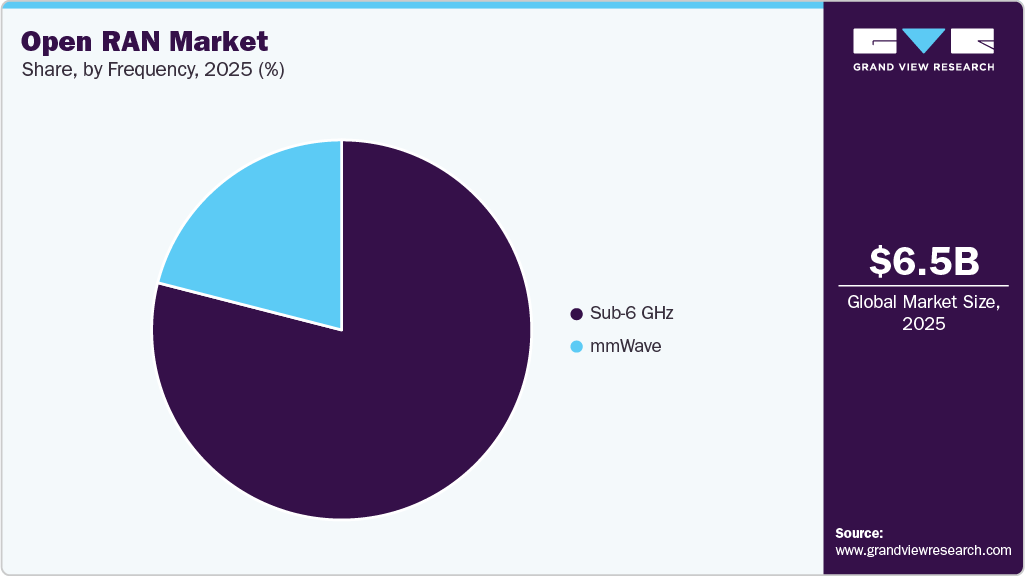

- By frequency, the sub-6 GHz segment held the largest market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.53 Billion

- 2033 Projected Market Size: USD 45.09 Billion

- CAGR (2026-2033): 26.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Open RAN adoption is accelerating as operators seek cost-efficient alternatives to traditional single-vendor RAN systems. By separating hardware and software, operators gain the flexibility to source lower-cost components from multiple vendors. This reduces both upfront investment and long-term operational expenses. As 5G networks expand and densify, the economic benefits of Open RAN become even more compelling for operators globally.

The shift toward cloud-native and virtualized architecture is a key growth driver for the Open RAN market. Virtualization allows operators to run RAN functions on standardized hardware using containers and automation tools. This enhances network scalability, agility, and performance while lowering infrastructure costs. More operators are embracing cloud infrastructure and edge computing, which strengthens Open RAN’s technological alignment and increases adoption momentum.

The global rise of 5G deployments, across urban, suburban, and rural areas is increasing demand for flexible RAN solutions. Open RAN supports diverse deployment models that fit varied coverage and capacity needs. Operators are using it for targeted rural coverage, indoor enterprise networks, and selective 5G modernization. The expansion of 5G standalone architecture makes Open RAN a more adaptable and future-ready alternative to traditional RAN systems.

Regulatory support and geopolitical considerations are also driving the Open RAN market forward. Governments, particularly in the U.S. and Europe, are increasingly viewing Open RAN as a strategic approach to enhancing network security and reducing dependency on specific vendors, especially in light of concerns about potential security risks associated with certain foreign suppliers. This endorsement from regulators not only promotes competition but also encourages local and smaller technology vendors to enter the telecom space, fostering innovation and strengthening regional technology ecosystems. As a result, Open RAN is emerging as a crucial component of next-generation telecommunications infrastructure, aligning with broader priorities for security, cost-effectiveness, and flexibility in global markets.

Market growth is being constrained by ongoing concerns related to performance parity, integration complexity, and multi-vendor coordination. Higher technical expertise requirements are being recognized as a barrier, particularly for brownfield operators with complex legacy networks. Limited availability of fully mature, carrier-grade Open RAN solutions is being viewed as a challenge for large-scale nationwide rollouts. Questions around long-term reliability, operational overhead, and ecosystem consistency continue to influence adoption pace.

Component Insights

The hardware segment dominated the market in 2025 and accounted for the largest share of 46.2%. Open RAN hardware specifically refers to the physical equipment and infrastructure of the radio access network in an open RAN architecture. Some of the common hardware components include baseband units (BBUs), remote radio units (RRUs), and virtualized RAN (vRAN) servers, among others. The O-RAN hardware allows operators to replace legacy 4G/3G/2G systems with fully virtualized Open RAN technology. Moreover, the hardware enables multiple technologies to run simultaneously on the same RRH to provide flexible and superior voice and data services to the end-users, driving the segment’s adoption and growth.

The services segment is expected to register a notable CAGR over the forecast period. The services segment is further bifurcated into consulting, deployment & implementation, and support & maintenance. Since O-RAN is comparatively new technology, network operators need adequate support to ensure the efficiency and operability of the network. In addition, operators and vendors need to be trained in how to use the O-RAN to their maximum advantage. The growing demand for consulting, deployment & implementation, and support & maintenance services is anticipated to propel the segment’s growth over the forecast period.

Unit Insights

The distributed unit segment dominated the market in 2025.The distribution unit converts a signal from one form to another and aggregates all data to be transmitted over a communication channel. The distribution unit takes the digitized radio signal from the radio unit and sends it into the network. The DU is used at the base station for computation, and it plays an important role in transmitting the radio signal, which is anticipated to drive the segment’s growth over the forecast period.

The radio unit segment is expected to grow at a moderate CAGR over the forecast period. The radio unit is an important component of the open RAN architecture. It transmits, receives, amplifies, and digitizes the radio frequency signals. The radio unit is near or integrated into the antenna. The radio unit has significance in the O-RAN market as it enables wireless communication between the user device and the core network. The growing use of radio units to enhance network performance is driving the open RAN radio unit market growth.

Deployment Insights

The hybrid cloud segment dominated the market in 2025. Open RAN's hybrid cloud deployment combines on-premises and cloud infrastructure, optimizing network performance while leveraging scalability and cost efficiency. Hybrid cloud deployment offers the public cloud's flexibility while providing the private cloud's security. Thus, the amalgamation of the two provided by hybrid cloud deployment is contributing to the segment's growth.

The private cloud segment is expected to grow at a notable CAGR over the forecast period.Open RAN's private cloud deployment involves utilizing dedicated cloud infrastructure for enhanced network control and security. The private cloud deployment segment's growth can be attributed to the growing need for tailored solutions, data privacy compliance, and optimal resource utilization. Private cloud deployment offers efficient network management while addressing specific operational requirements of the organization, which is anticipated to drive the adoption of the private cloud segment over the forecast period.

Network Insights

The 5G segment dominated the market in 2025. The majority of network operators and telecom equipment providers are focusing on creating a robust 5G ecosystem. Many countries have already released 5G networks. The shift from 4G to 5G networks is driving open RAN network operators and providers to opt for 5G networks, which is driving the segment’s growth.

The 4G segment is expected to grow at a moderate CAGR over the forecast period.The market has witnessed 4G network deployments primarily due to their established infrastructure and widespread adoption across the globe. The dominant share of the 4G network can be attributed to the compatibility of open RAN solutions with the existing 4G setups. Moreover, the mature technology of 4G has led to significant deployments of Open RAN on the 4G network. Key players are focusing on enhancing and modernizing these networks while maintaining operational efficiency, thus boosting the segment’s growth.

Frequency Insights

The sub-6 GHz segment held the largest market in 2025. The sub-6 GHz frequency enables expansive coverage and better penetration through dense urban areas and rural areas where network connectivity is otherwise slow/poor. Hence, the sub-6 GHz frequency is better suited for urban as well as rural applications. It provides efficient data transmission to improve user experience and fulfills open RAN’s aim to enhance connectivity and accessibility. These benefits are anticipated to drive the market’s growth over the forecast period.

The mmwave segment is expected to grow at the fastest CAGR during the forecast period. The growth of the mmWave segment can be attributed to its ability to bring ultra-fast speeds and high data capacity. Even though mmWave offers network connectivity over a shorter range, the ultra-fast speeds provided by the frequency are driving its adoption in the O-RAN market. Moreover, as 5G expands, mmWave's role within O-RAN becomes more crucial for delivering the high-speed, high-capacity performance users expect in various environments, thus propelling the segment’s growth.

Regional Insights

North America open RAN industry dominated and accounted for a share of 41.1% in 2025. The regional growth can be attributed to several factors, including the presence of prominent key players, such as AT&T, Inc., and the region's technological inclination toward early adoption of advanced solutions. Moreover, the region is witnessing significant investment in telecommunication infrastructure, creating significant growth opportunities for adopting O-RAN. The convergence of these factors has propelled North America to the forefront of Open RAN expansion, fostering the regional market’s growth and development in the market.

U.S. Open RAN Market Trends

The U.S. open RAN market held a dominant position in the region in 2025. The market is witnessing a significant growth, driven by the demand for more flexible and cost-effective network solutions. Major telecom players are actively adopting Open RAN technologies to diversify their network infrastructure and enhance operational efficiency.

Europe Open RAN Market Trends

Europe open RAN market is expected to register a notable CAGR from 2026 to 2033. In Europe, the Open RAN market is experiencing rapid expansion fueled by the continent's push towards the adoption of 5G and the desire for more flexible network architectures. Governments across Europe are investing in improving their networking infrastructure.

The Germany Open RAN market is expected to grow at the fastest CAGR from 2026 to 2033. In Germany major players such as Deutsche Telekom and Vodafone Germany are actively exploring Open RAN solutions to drive network agility and efficiency. For instance, Deutsche Telekom has initiated various pilot projects and collaborations to test Open RAN technology, aiming to leverage its potential for cost reduction and vendor diversification.

The open RAN market in the UK held a substantial market share in 2025. The market is burgeoning as telecom operators embrace this technology to drive network innovation and efficiency. Leading players such as BT Group (including EE) and Vodafone UK are at the forefront of Open RAN trials and deployments across the country. For example, BT Group has launched several initiatives to pilot Open RAN solutions, aiming to enhance network flexibility and reduce vendor lock-in.

Asia Pacific Open RAN Market Trends

The Asia Pacific open RAN market is expected to grow at the fastest CAGR during the forecast period. The region's growth can be attributed to the increasing demand for advanced telecommunication infrastructure, a growing mobile subscriber base, and favorable government regulations. Countries, such as Japan, South Korea, and India, are at the forefront of regional growth due to their technological prowess and growing emphasis on fostering a robust digital ecosystem. All these factors are contributing to the growth of the regional market.

Japan open RAN market is expected to grow at the moderate growth rate during the forecast period. Favorable government initiatives and strategic initiatives by the major providers to boost 5G connectivity are benefiting the growth of the Open RAN market in Japan. Japanese telecom operators are taking initiatives to develop and deploy 5G RAN solutions nationwide, which in turn propelling the growth of the market.

Open RAN market in India is expected to grow at the fastest CAGR from 2026 to 2033. Major players such as Bharti Airtel, Reliance Jio, and Vodafone Idea are actively investing in Open RAN technologies to drive network efficiency and innovation. For instance, Reliance Jio has been at the forefront of Open RAN adoption, deploying it in its nationwide 4G network and preparing for 5G rollout to enhance scalability and cost-effectiveness.

Key Open RAN Company Insights

Some of the key companies in the open RAN industry include Samsung Electronics Co., Ltd., NEC Corporation, Fujitsu Limited, and others. Telefonaktiebolaget LM Ericsson and Nokia Corporation, among others. These companies provide advanced standalone 5G solutions and benefit from government-backed support in 5G infrastructure development. These companies focus on product innovation, R&D, and strategic initiatives such as new product launches, business expansions, partnerships, collaborations, and mergers and acquisitions.

-

Samsung Electronics Co., Ltd. specializes in providing telecommunications equipment. The company has been actively involved in the development and implementation of open RAN solutions, leveraging its expertise in telecommunications and network infrastructure. Besides, Samsung Electronics has a vast global footprint, with subsidiaries, manufacturing facilities, and sales offices in numerous countries. The company distributes its products worldwide with a significant presence in key markets such as the U.S., Europe, China, and emerging markets in Asia, Africa, and Latin America. Samsung Electronics Co., Ltd. invests heavily in research and development to maintain its position as a technology leader.

-

NEC Corporation is a global technology company, renowned for its contributions to various sectors, including IT, telecommunications, and electronics. Established in 1899, NEC Corporation has grown into a multinational corporation with a diverse portfolio of products and services. As for Open RAN, the company has been actively involved in this space. It has been developing open RAN solutions to enable mobile network operators to deploy more flexible and cost-effective radio access networks.

Key Open RAN Companies:

The following are the leading companies in the open RAN market. These companies collectively hold the largest market share and dictate industry trends.

- Mavenir

- NEC Corporation

- Fujitsu Limited

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Radisys Corporation (Reliance Industries)

- Parallel Wireless

- ZTE Corporation

- AT&T Inc.

- Casa Systems, Inc.

Recent Developments

-

In March 2025, o2 Telefónica rolled out its first Cloud RAN network using Ericsson’s technology. This architecture enables telecom operators to run virtualized elements within the radio access network. Customers in Offenbach can access 5G mobile data services through o2 Telefónica. The company, in collaboration with Ericsson, aims to advance the growth of open and interoperable mobile network solutions.

-

In November 2024, Viettel launched a commercial Open RAN 5G network, incorporating core equipment developed in-house. This deployment represents the world’s first O-RAN-based 5G network built on Qualcomm Technologies’ 5G RAN platforms.

Open RAN Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.57 billion

Revenue forecast in 2033

USD 45.09 billion

Growth rate

CAGR of 26.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, unit, deployment, network, frequency and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; India; Japan; South Korea; Australia; Malaysia; Brazil; KSA; UAE; South Africa

Key companies profiled

Mavenir; NEC Corporation; Fujitsu Limited; Nokia Corporation; Samsung Electronics Co., Ltd.; Radisys Corporation (Reliance Industries); Parallel Wireless; ZTE Corporation; AT&T Inc.; and Casa Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Open RAN Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global open RAN market report based on component, unit, deployment, network, frequency, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

Consulting

-

Deployment and Implementation

-

Support and Maintenance

-

-

-

Unit Outlook (Revenue, USD Million, 2021 - 2033)

-

Radio Unit

-

Distributed Unit

-

Centralized Unit

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Hybrid Cloud

-

Public Cloud

-

-

Network Outlook (Revenue, USD Million, 2021 - 2033)

-

2G/3G

-

4G

-

5G

-

-

Frequency Outlook (Revenue, USD Million, 2021 - 2033)

-

Sub-6 GHz

-

mmWave

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global open RAN market size was estimated at USD 6.53 billion in 2025 and is expected to reach USD 8.57 billion in 2026.

b. The global open RAN market is expected to grow at a compound annual growth rate of 26.8% from 2026 to 2033 to reach USD 45.09 billion by 2033.

b. North America dominated the open RAN industry and accounted for a share of 39.7% in 2025. The regional growth can be attributed to several factors, including the presence of prominent key players, such as AT&T, Inc., and the region's technological inclination toward early adoption of advanced solutions.

b. Some key players operating in the open RAN market include Mavenir, NEC Corporation, Fujitsu Limited, Nokia Corporation, Samsung Electronics Co., Ltd., Radisys Corporation (Reliance Industries), Parallel Wireless, ZTE Corporation, AT&T Inc., and Casa Systems, Inc.

b. Open RAN enables operators to choose hardware and software solutions from various vendors, which can lead to reduced equipment and operational costs. The vendor diversity, cost reduction, and flexibility offered by open RAN are anticipated to drive the market's growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.