- Home

- »

- Healthcare IT

- »

-

Operating Room Integration Market, Industry Report, 2033GVR Report cover

![Operating Room Integration Market Size, Share & Trends Report]()

Operating Room Integration Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Type (Audio Video Management Systems, Display Systems, Documentation Management Systems), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-540-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Operating Room Integration Market Summary

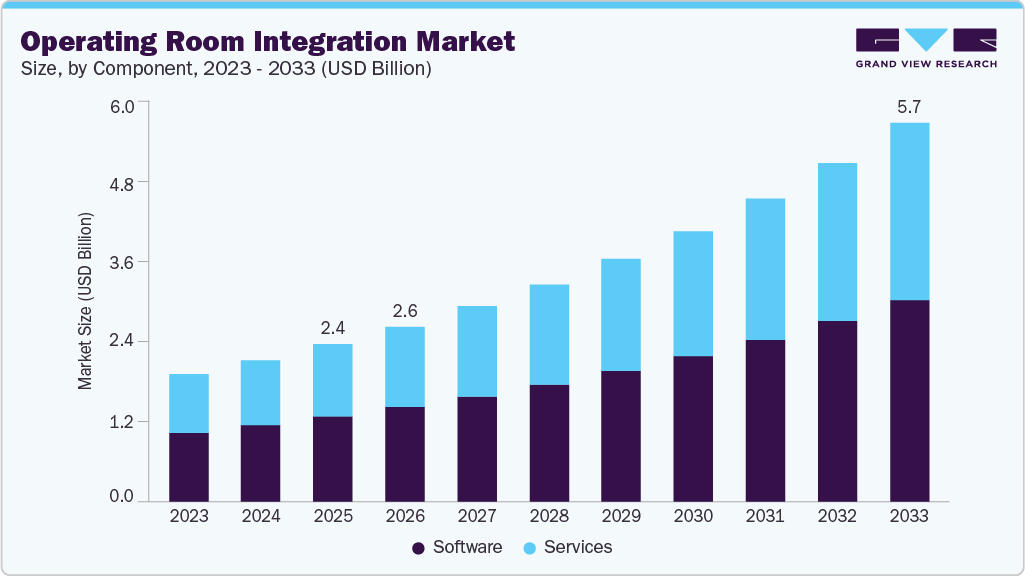

The global operating room integration market size was valued at USD 2.35 billion in 2025 and is expected to reach USD 5.67 billion by 2033, expanding at a CAGR of 11.67% from 2026 to 2033. This growth is primarily attributed to the increasing demand for technologically advanced applications, a growing number of surgical procedures, congestion in Operating Rooms (OR), patient safety concerns in OR, coupled with the surge in preference for Minimally Invasive Surgeries (MIS).

Key Market Trends & Insights

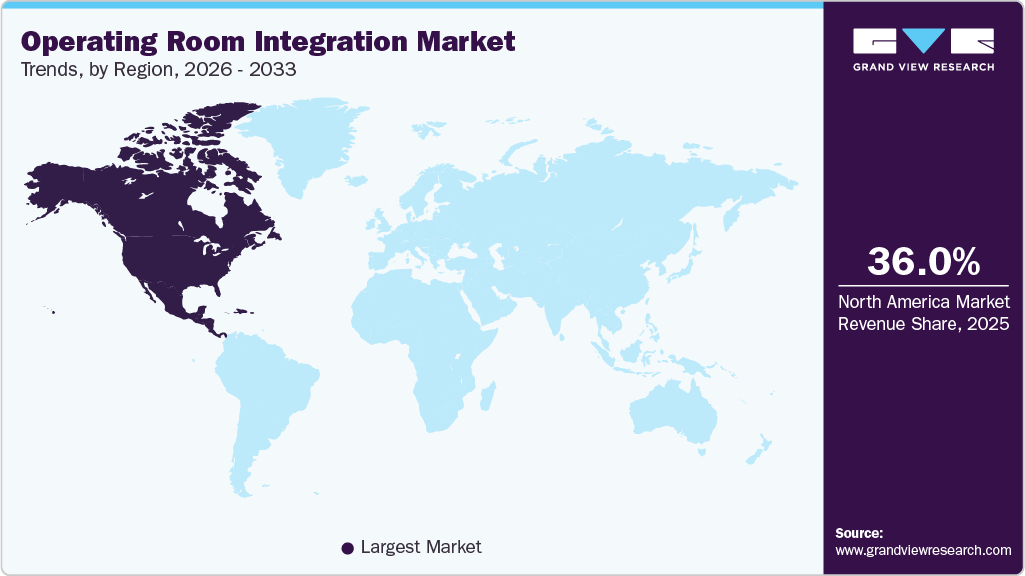

- The North American operating room integration market held the largest revenue share of 36% in 2025.

- By component, the software segment dominated the market in 2025 and accounted for the largest revenue share of 54.5%.

- By type, the documentation management systems segment held the largest share of 35.84% in 2025.

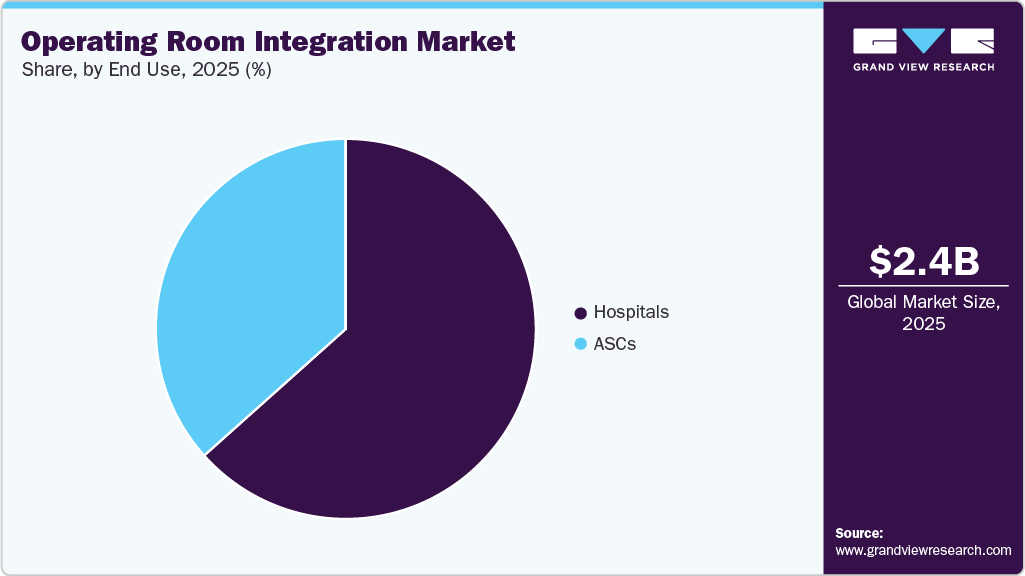

- By end use, hospitals dominated the market in 2025 and accounted for the largest revenue share of 63.39%.

Market Size & Forecast

- 2025 Market Size: USD 2.35 Billion

- 2033 Projected Market Size: USD 5.67 Billion

- CAGR (2026-2033): 11.67%

- North America: Largest market in 2025

There is a growing focus on improving patient safety in operating rooms. Integrated systems enhance real-time data visualization and structured documentation, which are vital for maintaining high standards of care during surgeries. By consolidating information from various sources into a single platform, these systems reduce the risk of errors and improve overall patient outcomes. The concept of a 3D operating room with unlimited perspective change and remote support represents a significant advancement in surgical technology, integrating information and communication technologies with extended reality (XR). This innovative approach enhances the capabilities of medical professionals during surgical procedures by providing immersive visualizations and remote collaboration tools.

The integration of advanced IT solutions within healthcare facilities supports better management of surgical workflows and enhances operational efficiencies. Innovations such as cloud-based solutions provide flexibility and scalability for managing OR operations, further driving market growth. For instance, in July 2023, Olympus Corporation launched its latest procedure room visualization and integration solution, the EASYSUITE ES-IP system. This innovative system is designed to enhance clinical operations and improve patient care pathways through a modular and scalable approach.

Moreover, governments and private organizations are investing in healthcare infrastructure improvements, including operating room technologies. These funding initiatives aim to modernize healthcare facilities and support the adoption of integrated OR systems that can accommodate advanced surgical techniques. In January 2025, VitVio, a London-based healthcare technology startup, successfully raised USD 2.05 million in pre-seed funding aimed at developing artificial intelligence (AI)-powered operating rooms for hospitals. This funding round was led by LDV Capital, with participation from Bek Ventures, Tiny Supercomputer Investment Company, and various angel investors. The investment reflects growing confidence in the potential of artificial intelligence to enhance surgical efficiency and patient outcomes.

The increasing popularity of hybrid operating rooms (ORs) is a significant factor driving the growth of the market. By combining traditional surgical methods with minimally invasive techniques, these hybrid ORs require advanced integration solutions to effectively manage a variety of equipment. This evolution in surgical practices aims to enhance both efficiency and the overall quality of patient care.

Furthermore, hospitals are under increasing pressure to control costs while maintaining high-quality care. Integrated OR solutions can lead to significant cost savings by optimizing resource utilization, reducing operation times, and minimizing complications associated with surgeries. This economic incentive drives hospitals to invest in integrated technologies. Moreover, solutions such as ENDOALPHA by Olympus Corporation help reduce surgical times, improve patient safety, and ensure faster recovery. The complexity of advanced surgeries has driven hospitals to adopt technological advancements in the OR, such as integrated ORs equipped with surgical instruments and technologies like digital imaging diagnostics, robotic 3D imaging, surgical robots, and virtual reality.

AI-Driven Operating Room Integration: Enhancing Efficiency and Outcomes

Operating room integration has progressed from simple device connectivity to advanced platforms that centralize the control of lighting, audio, video, and clinical systems via touchscreen consoles. Artificial intelligence further advances integration by automating "wheels-in, wheels-out" timing documentation, thereby reducing revenue loss associated with manual logging errors. AI analyzes large datasets from integrated systems to detect trends in case overruns and produces actionable insights for process optimization within hours, rather than months.

Advanced platforms facilitate real-time anomaly detection, including the identification of prolonged operative times that may signal equipment malfunctions or variations in surgical technique. Artificial intelligence (AI) supports predictive modeling for resource allocation, reducing anesthesia exposure and enhancing patient safety. Scalable integration platforms enable incremental upgrades, ensuring adaptability to emerging technologies.

Predictive analytics further reinforces this strategy by assessing surgical duration and anesthesia exposure metrics, thereby supporting data-driven decisions that surpass those based on intuition. For instance, in January 2025, VitVio's AI platform was piloted at the UK's Royal Orthopaedic Hospital, tracking tools/stages/protocols via cameras/sensors for real-time dashboards, scheduling, and analytics, thereby increasing the efficiency and safety in operating rooms.

Similarly, in March 2024, Johnson & Johnson MedTech partnered with NVIDIA to integrate AI into surgery via IGX/Holoscan platforms for real-time analysis, decision-making, and education in the OR ecosystem.

"We’ve heard from surgeons about their desire to augment their expertise with data-driven insights and improve patient outcomes using AI. We intend to fulfill this unmet need by supporting access to real-time data analysis and the availability of AI algorithms that enhance surgical decision-making."

"Scaling AI will boost surgical efficiency, augment clinical decision guidance and improve surgical training to deliver better experiences for surgeons, clinical staff and patients.”

-Shan Jegatheeswaran, vice president and global head of digital at J&J MedTech

Thus, integrating connectivity, analytics, and AI transforms operating rooms into precision environments, where data-driven processes optimize both clinical and financial outcomes.

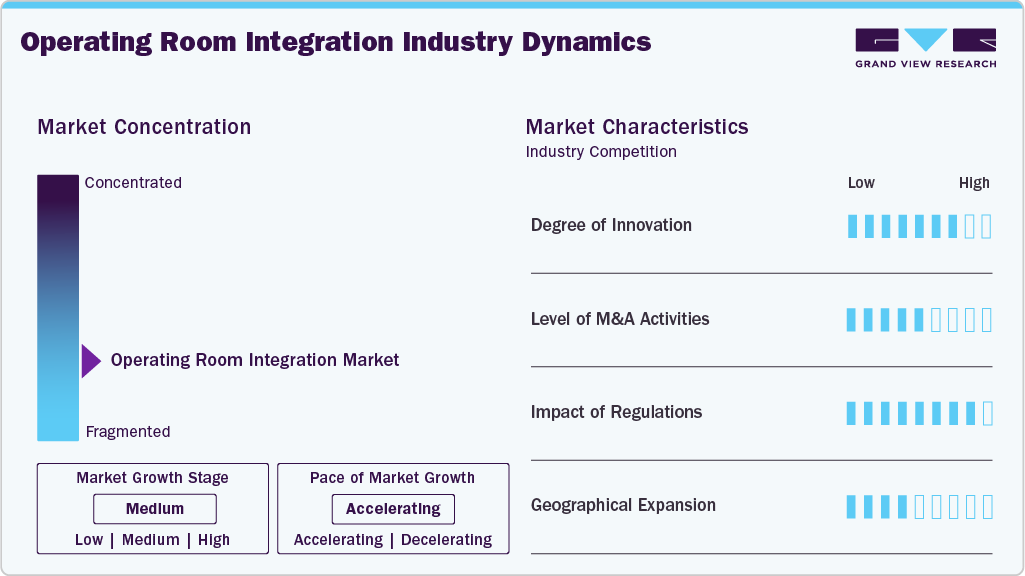

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of merger & acquisition activities, and geographic expansion.

The degree of innovation is notably high, driven by continuous technological advancements, growing patient demand for minimally invasive procedures, and the need for improved diagnostic accuracy and therapeutic outcomes. Companies are investing heavily in research and development to introduce products integrated with digital. For instance, in July 2024, Baxter International Inc. launched its Helion Integrated Surgical System in Thailand, marking a significant advancement in operating room (OR) technology. It aims to improve OR efficiency by enabling surgical teams to remain focused and connected during procedures. The system consolidates multiple functions into a single device, which helps reduce distractions and streamline workflows.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business. For instance, in April 2024, Medline acquired the global surgical solutions business from Ecolab, Inc. This acquisition includes the well-known Microtek product lines, which are recognized for their innovative sterile drape solutions and fluid temperature management systems designed for use in surgical settings.

The industry is regulated by a variety of national and international standards, such as those set by the FDA in the U.S. and the EMA in Europe. Manufacturers must demonstrate compliance with safety and performance criteria, often through clinical testing, to ensure their medical devices are safe and effective before they can be marketed.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in June 2024, Baxter launched Helion Integrated Surgical System in Thailand, simplifying ORs via single-device integration: 4K/3D video, rapid setup, patient data access, and videoconferencing.

Case Study

Integrated AV Solution for Northern England Hospital Operating Theatres

A large hospital in Northern England undertook a multi-phase project to upgrade its operating room audiovisual technology, led by the estates manager with collaboration from the main contractor and IT department. The initiative aimed to enhance surgical and teaching capacities across multiple operating theatres through advanced AV integration.

Component Insights

The software segment dominated the market in 2025 and accounted for the largest revenue share of 54.5%. These integrated software solutions offer seamless communication within various systems operational in the OR to streamline surgical workflows and ensure ease of use and effective operation. In addition, companies are also marking their presence in the market for operating room integration by adopting attainment strategies to broaden their portfolio in the operating room integration space. For instance, in June 2024, Johnson & Johnson MedTech introduced the Polyphonic digital ecosystem, a significant advancement aimed at enhancing surgical experiences through improved connectivity and collaboration among healthcare teams. This ecosystem is designed to leverage surgical data effectively, addressing the challenges faced in modern operating rooms.

The services segment is expected to grow at the fastest CAGR over the forecast period. Growing demand for support and maintenance services, owing to cost-effectiveness, and well-trained and experienced technicians, is expected to boost segment growth over the forecast period. In addition, service solutions assist customers in safeguarding their investment, comprising on-site and remote support, maintenance, regular software updates, along on-site training.

Type Insights

The documentation management systems segment held the largest share of 35.84% in 2025, owing to its wide applications in ORs. This system helps in managing all the records from various sources and presents them on a single platform to help surgeons with patients’ history and other necessary information during the surgery. Operating rooms are increasingly becoming complex and congested with the inclusion of a variety of equipment such as surgical lights, operating tables, and surgical displays. In basic ORs, individual devices are arranged, which are pulled or pushed back according to their use, and cords and cables are spread all over the room. This heightens the risk of tripping or pulling out the essential cord during surgery or damaging any equipment. Integrated operating rooms (I-ORs) help to curb this problem.

The audio-video management systems segment is expected to grow at the fastest CAGR over the forecast period. The high demand for MIS has spurred the implementation of I-ORs owing to their associated advantages, such as safety. In addition, industry players are involved in continuous research and development activities for application innovation. For instance, in April 2024. EIZO GmbH announced the launch of two new monitors in their CuratOR series, specifically designed for use in operating rooms and interventional radiology. These monitors are the 55-inch LL550W and the 19-inch LS1910, both optimized for displaying medical images with high precision.

Application Type Insights

The general surgery segment dominated the market in 2025 and accounted for the largest revenue share of 34.89%. The increasing number of hospitals adopting MIS technology, coupled with the rising number of chronic illnesses requiring surgical procedures, is further fueling the market growth. For instance, in the U.S., approximately half of the surgeries are done with MIS technology. The rising number of surgical interventions, with the high number of MIS being carried out due to its several benefits, such as reduced hospital stay, less painful features, and a high focus on patient safety in the OR, is driving the demand. As this technology continues to grow, along with telemedicine and robotic surgery becoming more common healthcare services, the I-ORs are expected to become an industry-standard in the coming years.

The orthopedic surgery segment is expected to grow at the fastest CAGR over the forecast period due to increasing demand for orthopedic procedures in the coming years. For instance, according to AAHKS, the number of hip replacement procedures grew by 3.8%, reaching approximately 766,000 procedures. In addition, Knee replacements have experienced even more substantial growth, with an increase of 5.1%, resulting in around 1.3 million procedures performed. Moreover, the increasing demand for advanced healthcare infrastructure, the high adoption rate of I-ORs due to the expanding pool of patients with chronic diseases, are further boosting market growth.

End Use Insights

The hospital segment dominated the market in 2025 and accounted for the largest revenue share of 63.39%. This growth is owing to the high penetration of integrated ORs. With the large patient population being exposed to chronic diseases, there is a need for I-ORs to reduce the burden on physicians and complexity so that they can efficiently manage their surgical workflow. Furthermore, ongoing technological innovations in medical devices are contributing to the growing adoption of I-ORs over the forecast period.

The ambulatory surgical center segment is expected to grow at the fastest CAGR over the forecast period. Ambulatory surgery is being increasingly performed in developed countries. The shortage of beds in hospitals and scarce economic resources are expected to boost the growth of this segment. However, the high initial and maintenance costs of integrated OR are hampering segment growth. The development of various medical devices that aid in performing minimally invasive surgeries is allowing physicians to carry out a greater number of surgical procedures on a day-care basis. The availability of technologically advanced I-ORs has contributed largely to the improvement of day-care surgery.

Regional Insights

North America operating room integration industry dominated in 2025 and accounted for the largest revenue share of 36%. It can be attributed to the increasing demand for surgical automation. Major factors attributed to the market growth are the rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations. Furthermore, the presence of established players in the market, technologically advanced HCIT, and funding to improve OR infrastructure are other factors propelling the market growth.

U.S. Operating Room Integration Market Trends

The operating room integration market in the U.S. held the largest share in 2025 due to technological advancements and recent approvals received for technological devices. Manufacturers are investing in R&D to obtain approvals for new products for commercialization. For instance, in October 2024, Olympus Corporation announced a strategic partnership with Proximie, a global health technology company, aimed at revolutionizing the digitization of operating rooms. This collaboration is significant as it seeks to enhance patient care and improve clinical practices through advanced telecollaboration technologies.

Europe Operating Room Integration Market Trends

The operating room integration market in Europe is expected to register considerable growth during the forecast period. The UK, Germany, Italy, France, and Spain are the main markets in this region. The increasing geriatric population in developed countries, such as the UK, Germany, Italy, and France, is one of the factors anticipated to drive growth over the forecast period.

Germany operating room integration market is anticipated to register a significant growth rate during the forecast period. Germany is one of the countries with the fastest aging population. Factors such as increasing adoption of minimally invasive surgeries, introduction of advanced products, and other business activities, such as mergers & acquisitions, will contribute to the growth of the market in Germany. For instance, in March 2024, Eurazeo announced that it had signed an agreement to sell all the share capital of Peters Surgical to Advanced Medical Solutions Group plc (AMS). The agreement entails a complete transfer of ownership of Peters Surgical, which specializes in surgical products and has a strong market presence in Europe and beyond. The sale is part of Eurazeo's strategy to optimize its portfolio by divesting from certain assets while focusing on others that align more closely with its long-term investment goals.

Asia Pacific Operating Room Integration Market Trends

The operating room integration market in Asia Pacific is anticipated to grow significantly. There is a significant increase in healthcare expenditure across the region, which facilitates investments in advanced medical technologies and infrastructure improvements. This trend is particularly evident in countries like China and India, where rising economic strength and government initiatives are promoting the adoption of integrated operating room systems. The integration of advanced technologies such as robotic surgery and telemedicine further supports this growth by improving surgical precision and reducing recovery times.

Japan operating room integration market held a significant revenue share in 2025. This is attributed to technological advancements, rising inclination for minimally invasive surgeries, increasing penetration for treatment & diagnosis, investment by global players, ongoing R&D, and presence of key manufacturers. For instance, in November 2024, Stille AB launched the imagiQ3, a next-generation C-arm table, during the Radiological Society of North America (RSNA) conference. This innovative product represents a significant advancement in surgical imaging technology, building on the legacy of its predecessors while introducing new features designed to enhance operational efficiency and patient safety.

Latin America Operating Room Integration Market Trends

The operating room integration market in Latin America is expected to register significant growth during the forecast period. The primary driver is the increasing demand for advanced healthcare technologies, which is spurred by a growing prevalence of chronic diseases and a rising number of surgical procedures across the region. As hospitals strive to improve patient outcomes and operational efficiency, they are increasingly adopting integrated operating room solutions that facilitate better communication, data management, and workflow optimization. Furthermore, government initiatives aimed at improving healthcare services and funding for health information technology (HCIT) infrastructure are also contributing to the robust development of the ORI market in Latin America.

Brazil accounted for a major share of the Latin American market in 2025. A large population suffering from chronic diseases, coupled with the rapid development of technologically advanced devices, is expected to increase the market penetration of operating room integration in the coming years. In September 2024, Purple Surgical launched its operations in Brazil. This strategic move is aimed at expanding the company's presence in the Latin American market, which is increasingly recognized for its growing healthcare sector and demand for high-quality medical supplies.

Middle East and Africa Operating Room Integration Market Trends

The operating room integration market in the Middle East and Africa is anticipated to register considerable growth during the forecast period. There is a significant increase in healthcare expenditure across the region, with countries such as Kuwait, Saudi Arabia, and the UAE investing heavily in advanced healthcare technologies to improve patient outcomes and operational efficiency. This investment is largely fueled by a rising geriatric population and an increasing prevalence of chronic diseases, which necessitate more surgical procedures.

The UAE operating room integration market is experiencing significant growth during the forecast period. This growth is primarily driven by the growing product innovations and improvements. For instance, in January 2025, RAIN Technology ME LTD announced a significant leadership transition with the appointment of Abbes Seqqat as the new CEO. This change is part of RAIN's strategic efforts to enhance its presence in the UAE and globally launch its innovative surgical voice assistant, Orva. Seqqat succeeds Nithya Thadani, who has led the company since 2017 and will continue to contribute as a member of the Board of Directors.

Key Operating Room Integration Companies Insights

Key participants in the operating room integration market are focusing on devising innovative business growth strategies in the form of product portfolio expansion, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Operating Room Integration Companies:

The following key companies have been profiled for this study on the operating room integration market.

- Stryker

- Getinge AB

- Brainlab AG

- Barco

- Drägerwerk AG & Co. KGaA

- Steris Plc.

- KARL STORZ SE & CO. KG

- Olympus

- Caresyntax

- Arthrex, Inc.

- ALVO Medical

- Skytron, LLC

- Merivaara

- Caresyntax

- Richard Wolf GmbH

- Ditec Medical

Recent Developments

-

In March 2025, Artisight expanded its collaborations with NVIDIA and KARL STORZ to develop Pathway.AI, an AI solution for smart operating rooms that uses NVIDIA Jetson edge computing.

-

In January 2025, e& enterprise, the digital transformation arm of e&, announced a strategic partnership with RAIN Technology, a leader in AI-powered healthcare solutions. This collaboration aims to significantly enhance the efficiency of Operating Room (OR) workflows in hospitals across the Middle East and Africa (MEA) through the introduction of Orva, the world's first operating room voice assistant.

-

In December 2024, AUO Corporation made significant strides in expanding its smart healthcare ecosystem, particularly with the introduction of its 3D Smart Surgical Imaging Platform. This platform is part of a broader initiative to leverage advanced display and sensing technologies to enhance medical services and improve patient outcomes.

-

In December 2024, KARL STORZ, partnered with Artisight to enhance operating room efficiency through advanced technology. This collaboration aims to streamline OR workflows by utilizing artificial intelligence (AI) and automation, thereby reducing manual tasks and improving data accuracy.

-

In December 2024, Getinge, a global leader in medical technology, has recently inaugurated its new Experience Center in Mumbai, India. The Experience Center replicates real-world hospital settings, including operating rooms and intensive care units. This setup allows visitors to experience firsthand how Getinge's advanced solutions can be integrated into everyday healthcare practices.

Operating Room Integration Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.62 billion

Revenue forecast in 2033

USD 5.67 billion

Growth rate

CAGR of 11.67% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Getinge AB; Brainlab AG; Barco; Drägerwerk AG & Co. KGaA; Steris Plc.; KARL STORZ SE & CO. KG; Olympus; Caresyntax; Arthrex, Inc.; ALVO Medical; Skytron, LLC; Merivaara; Caresyntax; Richard Wolf GmbH; Ditec Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Operating Room Integration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global operating room integration market report based on component, type, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Audio video management systems

-

Display systems

-

Documentation management systems

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Orthopedic Surgery

-

Neurosurgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global operating room integration market is expected to grow at a compound annual growth rate of 11.67% from 2026 to 2033 to reach USD 5.67 billion by 2033.

b. North America dominated the operating room integration market with a share of 36.00% in 2025. This is attributable to the rise in demand for efficient healthcare services and effective EHR implementation by healthcare organizations.

b. Key factors that are driving the operating room integration market growth include the increasing number of minimally invasive surgeries, funding to improve operating room (OR) infrastructure, and rising congestion in the OR.

b. The global operating room integration market size was estimated at USD 2.35 billion in 2025 and is expected to reach USD 2.62 billion in 2026.

b. Some key players operating in the operating room integration market include Stryker; Getinge AB; Braiblab AG; Barco; Dragerwerk AG & Co. KGaA; Steris Plc.; KARL STORZ SE & CO. KG; Olympus; Care Syntax; Arthrex, Inc.; ALVO Medical; Skytron, LLC; Merivaara; TRILUX Medical GmbH & Co. KG; Caresyntax; Sony Corporation; Richard Wolf GmbH; FUJIFILM Holdings Corporation; Ditec Medical; Doricon Medical Systems; Hill-Rom Holdings, Inc.; EIZO GmbH; OPExPARK; ISIS-Surgimedia; Meditek; and Zimmer Biomet Holdings, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.