- Home

- »

- Medical Devices

- »

-

Ophthalmic Loupes Market Size, Share, Industry Report 2030GVR Report cover

![Ophthalmic Loupes Market Size, Share & Trends Report]()

Ophthalmic Loupes Market (2025 - 2030) Size, Share & Trends Analysis Report By Loupe Type (Galilean Type, Prismatic Type, Plate Loupe Type), By Loupe Design (Through-the-lens), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-251-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Loupes Market Size & Trends

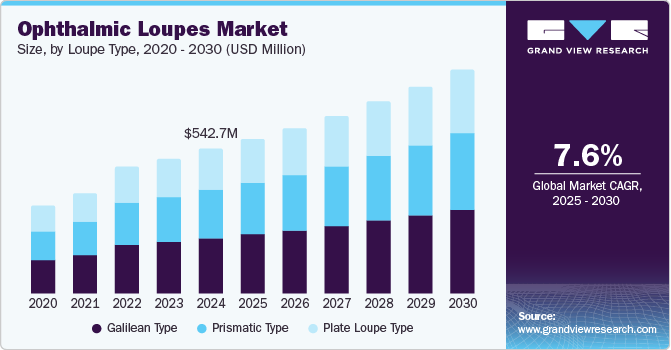

The global ophthalmic loupes market size was estimated at USD 542.7 million in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The increasing prevalence of eye-related disorders, such as cataracts and glaucoma, has heightened the demand for ophthalmic loupes. The aging population is another critical factor, as older adults are more susceptible to vision impairments that require specialized equipment during eye surgeries. According to the WHO, approximately 1 billion people globally suffered vision impairment in 2020, highlighting the urgent need for effective surgical interventions. Furthermore, technological advancements have led to the development of more sophisticated loupes, enhancing their functionality and appeal among healthcare professionals.

One major factor is the rising demand for ergonomic solutions in surgical environments. As healthcare professionals engage in prolonged procedures, they face physical strain from improper posture. Ophthalmic loupes are designed to promote better posture and reduce neck and back strain, allowing surgeons to maintain comfort and focus during operations. This ergonomic advantage encourages more practitioners to adopt these devices, leading to improved surgical outcomes and increased market demand.

In addition, advancements in ophthalmic loupes also play a crucial role in driving market growth. Innovations such as lightweight materials, customizable designs, and enhanced optical performance make loupes more accessible and user-friendly for healthcare professionals. For instance, integrating LED lighting and ergonomic features helps reduce strain during long procedures while improving overall surgical accuracy. As manufacturers invest in research and development to create advanced products that cater to the specific needs of clinicians, the appeal of ophthalmic loupes is expected to increase significantly.

Loupe Type Insights

The galilean type segment dominated the market with a revenue share of 38.3% in 2024, driven by its lightweight design and affordability. These loupes offer a magnification range typically between 1.7x and 3.0x, making them suitable for various surgical procedures, especially in ophthalmology. Their simple optical design provides a clear field of view, essential for precision during surgeries. Moreover, the ease of use and customization options available for Galilean loupes contribute to their popularity among healthcare professionals. Combining these features makes them ideal for new and experienced practitioners, reinforcing their market dominance.

The prismatic type segment is projected to grow at a CAGR of 8.1% over the forecast period, fueled by its superior magnification capabilities. Prismatic loupes can achieve magnification levels of up to 8.0x, offering better clarity and detail than galilean types. This enhanced performance is particularly beneficial in complex surgical scenarios where precision is critical. The increasing adoption of minimally invasive techniques in ophthalmic procedures further drives the demand for prismatic loupes as surgeons seek tools that provide optimal visualization. As healthcare providers prioritize high-quality outcomes, the prismatic type's advantages position it well for significant growth.

Loupe Design Insights

The Through-the-lens (TTL) segment dominated the market, with the largest revenue share in 2024, attributed to its ergonomic design and customization options. TTL loupes are mounted directly on the frame, allowing for a wider field of view and reduced weight on the user's face. This design minimizes neck strain during prolonged use, making them particularly appealing to professionals who perform intricate procedures regularly. Moreover, TTL loupes can be tailored to individual pupillary distance and prescription needs, enhancing comfort and usability. These factors collectively contribute to their strong market presence.

The flip-up segment is projected to grow at the highest CAGR over the forecast period due to its versatility and user-friendly features. Flip-up loupes have a hinge mechanism that allows users to easily adjust the declination angle and pupillary distance. This flexibility lets healthcare professionals quickly switch between viewing through the loupes and unobstructed vision. In addition, their lower price point compared to TTL loupes makes them accessible to a broader range of users. As more practitioners recognize the benefits of adjustable designs, the flip-up segment is expected to gain significant traction in the market.

End Use Insights

The Hospitals segment dominated the market with the largest revenue share in 2024, driven by the high volume of surgical procedures performed in these settings. Hospitals have advanced surgical facilities requiring precise instruments such as ophthalmic loupes for optimal outcomes. The increasing prevalence of eye diseases necessitates frequent surgical interventions, further boosting demand within this segment. In addition, hospitals often invest in high-quality equipment to ensure patient safety and improve surgical success rates. This commitment to quality care solidifies hospitals as a primary end-user of ophthalmic loupes.

The Ambulatory Surgical Centers (ASCs) segment is expected to grow at the highest CAGR over the forecast period, which can be attributed to the trend toward outpatient surgeries. ASCs provide cost-effective alternatives for surgical procedures that do not require extended hospital stays, making them increasingly popular among patients and healthcare providers. The growing preference for minimally invasive techniques aligns well with the capabilities of ophthalmic loupes, which enhance visualization during such procedures. As ASCs expand their offerings and patient volumes increase, demand for ophthalmic loupes is expected to rise significantly.

Regional Insights

North America ophthalmic loupes market dominated the global market with a revenue share of 25.9% in 2024, driven by a robust healthcare infrastructure and high demand for advanced medical devices. The region is home to numerous leading manufacturers specializing in innovative ophthalmic solutions, contributing to a competitive market landscape. High awareness levels regarding eye health and increasing incidences of eye disorders drive demand for surgical interventions requiring precision tools such as loupes. Hence, these factors position North America as a key player in the global ophthalmic loupes market.

U.S. Ophthalmic Loupes Market Trends

The U.S. ophthalmic loupes market dominates North America with a significant revenue share in 2024 due to its advanced healthcare system and extensive research initiatives. The presence of major industry players fosters innovation and the development of cutting-edge products tailored to meet specific clinical needs. Furthermore, high rates of ophthalmic surgeries performed across various healthcare settings reinforce the demand for effective visual aids during procedures. As healthcare providers continue to seek tools that enhance precision and efficiency, the U.S. market is expected to maintain its leadership position in the ophthalmic loupes sector.

Asia Pacific Ophthalmic Loupes Market Trends

Asia Pacific ophthalmic loupes market is expected to register the highest CAGR of 8.5% over the forecast period, which can be attributed to the increasing prevalence of eye diseases and enhanced healthcare infrastructure. The region is witnessing a surge in eye-related conditions, such as cataracts and glaucoma, necessitating surgical interventions requiring precise visual aids. Countries such as India and China are investing significantly in healthcare improvements, making advanced medical technologies more accessible to practitioners, thereby driving the demand for ophthalmic loupes.

The China ophthalmic loupes market dominates the Asia Pacific with a significant revenue share in 2024 due to its large population and rapid advancements in healthcare services. China has one of the highest rates of eye disorders globally, creating a substantial demand for surgical tools that enhance precision during procedures. For instance, the Chinese government has implemented various health initiatives to improve eye care access, including programs to combat blindness and visual impairment. Local manufacturers are increasingly producing affordable and innovative ophthalmic loupes tailored to meet the specific needs of Chinese healthcare providers, reinforcing China's leadership position in the regional market.

Europe Ophthalmic Loupes Market Trends

Europe ophthalmic loupes market held a substantial market share in 2024, driven by the rising prevalence of eye diseases and an increasing emphasis on advanced surgical techniques. The region is experiencing a growing number of ophthalmic surgeries due to an aging population and higher awareness of eye health issues. According to a report by the European Commission published in March 2023, age-related vision impairments are becoming more common, necessitating improved surgical tools such as ophthalmic loupes. Furthermore, established manufacturers in Europe are continuously innovating their product offerings to enhance comfort and optical performance, which is crucial for surgeons who rely on these devices for precision during complex procedures.

Key Ophthalmic Loupes Company Insights

Some key companies operating in the market include SurgiTel, SheerVision Loupes & Headlights, Keeler, ZEISS, and Rudolf Riester GmbH. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands through the ophthalmic loupes market.

-

SurgiTel offers a diverse range of products and solutions in the ophthalmic loupes market, focusing on ergonomic design and superior optical performance. Their product lineup includes both Through-The-Lens (TTL) and Front-Lens-Mounted (FLM) surgical loupes, customizable to meet individual user needs. The company also provides advanced surgical lighting solutions, such as the Surgical Mini Light, noted for its lightweight design and extended battery life, enhancing visibility during surgeries.

-

Rudolf Riester GmbH offers a range of products and solutions in the ophthalmic loupes market. Its product lineup includes binocular loupes available in various magnifications, specifically designed for dental and surgical applications. The flagship product is the XL Advantage Binocular Loupe, which provides magnification options of 3.5x, 4.5x, and 5.5x, ensuring clarity and precision during intricate procedures. These loupes are engineered for comfort, featuring lightweight designs that reduce strain during extended use.

Key Ophthalmic Loupes Companies:

The following are the leading companies in the ophthalmic loupes market. These companies collectively hold the largest market share and dictate industry trends.

- SurgiTel

- SheerVision Loupes & Headlights

- Keeler

- ZEISS

- Rudolf Riester GmbH

- NEITZ INSTRUMENTS Co., Ltd.

- Orascoptic

- Univet S.r.l.

- Ocutech Inc.

- Designs for Vision, Inc.

Recent Developments

-

In April 2023, NEITZ INSTRUMENTS Co., Ltd. launched a new BX LED ophthalmoscope, which features a unique boost mode designed to enhance brightness during examinations. This innovative product is particularly beneficial for screening in brightly lit environments, improving the visibility of ocular structures and facilitating accurate diagnoses.

-

In October 2022, SurgiTel launched the next generation of ErgoDeflection loupes. The new design features a patent-pending prism that allows for a customizable deflection angle of 40 to 50 degrees, enabling clinicians to maintain an ideal working posture without leaning too close to patients. Available in 3.5x magnification, with plans to introduce 4.5x, 5.5x, and 6.5x options soon, these loupes include a pantoscopic lens tilt that enhances eye protection and provides a wider view of the working area.

Ophthalmic Loupes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 580.5 million

Revenue forecast in 2030

USD 837.9 million

Growth rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Loupe type,loupe design, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden,Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

SurgiTel, SheerVision Loupes & Headlights, Keeler, ZEISS, Rudolf Riester GmbH, and NEITZ INSTRUMENTS Co., Ltd.; Orascoptic; Univet S.r.l.; Ocutech Inc.; Designs for Vision, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Loupes Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic loupes market report based on loupe type, loupe design, end use, and region:

-

Loupe Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Galilean Type

-

Prismatic Type

-

Plate Loupe Type

-

-

Loupe Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Through-the-lens (TTL)

-

Flip Up

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.