- Home

- »

- Medical Devices

- »

-

Ophthalmic Packaging Market Size & Share Report, 2030GVR Report cover

![Ophthalmic Packaging Market Size, Share & Trends Report]()

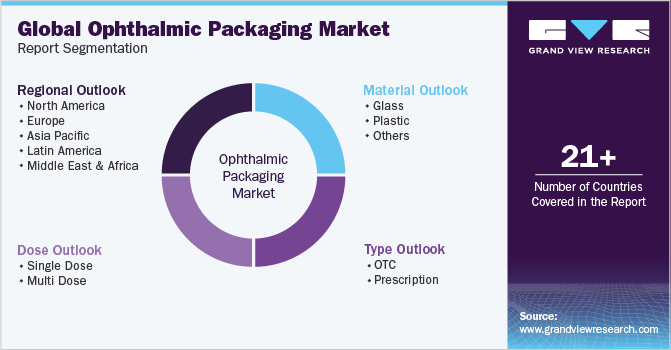

Ophthalmic Packaging Market (2023 - 2030) Size, Share & Trends Analysis Report By Dose (Single Dose, Multi Dose), By Type (OTC, Prescription), By Material (Plastic, Glass), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-779-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global ophthalmic packaging market size was valued at USD 10.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The growing need for brand enhancement and differentiation in a highly competitive environment, the development of novel packaging material, and the growing need to adhere to new regulatory guidelines on recycling packaging materials contribute to the market's growth. The market witnessed a sharp decline in size in 2020 compared to 2019 due to the COVID-19 pandemic. COVID-19 had a severely disruptive impact on the entire ophthalmic industry, with a limited number of patients visiting hospitals.

However, major market players rapidly adapted to the environment with innovative strategies. For example, Johnson & Johnson’s Vision focused largely on using the market slowdown to train healthcare professionals with their advanced portfolio. This is expected to have a long-term positive impact on its brand image. Carl Zeiss Meditec also focused on providing remote care solutions and training ophthalmologists. Alcon focused on developing its SMART Suite, a cloud-based platform to manage data in clinics and ORs. Like other healthcare practices, the ophthalmology space is expected to witness lucrative growth using telemedicine services. In addition, increased demand for prescription and OTC products for managing COVID-19-related ophthalmic complications during the pandemic is expected to fuel market growth over the forecast period.

The growing prevalence of various ophthalmic conditions, such as dry eye and conjunctivitis, is anticipated to augment the demand for ophthalmic packaging devices, a primary factor driving the global need for eye care services. According to the USA General Population Cross-sectional Study, 2018, around 16.7 to 50.2 million Americans have a dry eye disease, accounting for 5% to 15% of the total population.

Emerging economies such as China, India, and Brazil are providing the opportunity for the growth of ophthalmology. Growing population, rising focus on increasing life expectancy, and increasing disposable income are expected to provide growth prospects to companies in the coming years as they face challenges due to the stagnation of mature markets, expiration of patents, and rise in regulatory barriers.

Drug delivery refers to different approaches, systems, technologies, and formulations for transporting pharmaceutical compounds in the body as and when required for safely achieving their desired therapeutic effect. The rising prevalence of eye disorders, rapid technological advancements, increasing adoption of individual therapies, and growing awareness regarding eye care are some of the major factors driving the demand for drug delivery devices, which, in turn, are positively impacting the market growth.

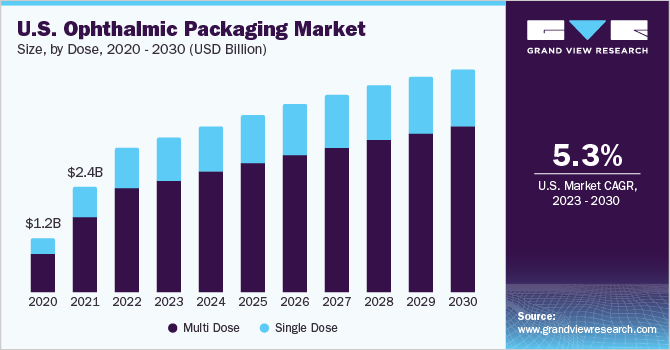

Dose Insights

The market is segmented based on doses into single-dose and multidose segments. The multidose segment accounted for the largest revenue share of 72.1% in 2022 and is expected to grow at the fastest CAGR of 8.8 during the forecast period. The high penetration index of multidose containers in the OTC market is a key factor fueling the segment growth. In addition, multidose containers are highly patient-compliant and environment-friendly. It is easier for a patient to carry an eye drop than single-dose container strips.

Multidose packaging is expected to maintain its lead throughout the forecast period due to the growing patient demand and convenience of usage. Typically, multidose packaging for liquid ophthalmic products consists of a bottle, dispensing tip or nozzle, cap, and tamper-evident features. Preservatives are used to maintain product quality and avoid microbial contamination.

Single-dose packaging is intended for one-time use of ophthalmic products. Single-dose packaging does not contain preservatives, thus minimizing patients' risk of allergic reactions. The demand for single-dose packaging in eye-related surgeries and improved healthcare manufacturing facilities is expected to drive the single-dose packaging segment.

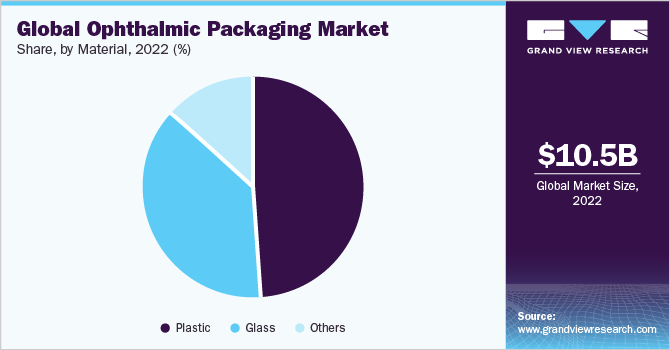

Material Insights

The plastic segment accounted for the largest revenue share of 49.3% in 2022 and is expected to grow significantly during the forecast period. Most of the commercially available ophthalmic preparations are packaged in plastic containers. Ease of use, cost-efficiency, and inertness contribute to its rising adoption.

The glass segment is expected to grow at the fastest CAGR of 8.8% during the forecast period. The plastic segment is mainly driven by its lower weight, cost-efficiency, and convenience. Certain ophthalmic products, such as eye drops, are packed in entirely plastic dispensers. Most plastic bottles and dispensing tips used for this purpose are made of low-density polyethylene (LDPE) resin. Harder resins such as polyethylene or polypropylene are used for the cap. LDPE offers key clinical advantages, such as inertness, flexibility, and decreased chances of contamination. In addition, LDPE is compatible with most resins and formulation compounds; however, translucency and permeability characteristics are some of their disadvantages.

Type Insights

The prescription segment accounted for the largest revenue share in 2022 owing to its large-scale use as a first-line treatment. The prescription segment is expected to be driven by an increased geriatric population worldwide and advanced drug delivery mechanisms. Prescription medicines are generally used for more complicated ophthalmic diseases, such as glaucoma or severe conjunctivitis.

The OTC segment is expected to grow fastest over the forecast period. Frequent launches of products, an increasing number of pharmacies, and growing awareness about self-medication and preventive care are expected to drive the segment.

Severe cases of conjunctivitis and neurotrophic keratitis that are unresponsive to OTC medications are treated using antibiotics. The increasing number of product approvals for various ophthalmic conditions is anticipated to accelerate segment growth. In February 2019, Aptar Pharma received EU approval for its multidose ophthalmic prescription drug Taflotan/Saflutan, used to reduce elevated Intraocular Pressure (IOP) in Europe.

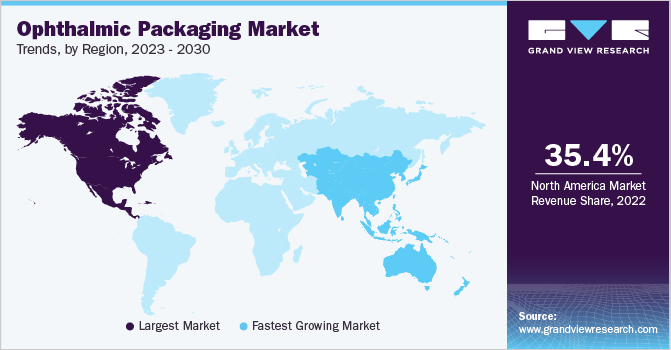

Regional Insights

North America dominated the ophthalmic packaging market and accounted for the largest revenue share of 35.4% in 2022 owing to the rising prevalence of ocular disorders, the growing export of ophthalmic products, increasing investment in R&D specific to the ophthalmic field, and stringent regulatory policies in parametrical packaging. For instance, in February 2023, West Pharmaceutical Services announced the expansion of its current collaboration with Corning. This expansion included exclusive rights to distribute Corning Valour glass vials. It also involved launching the company's primary product, West Ready Pack, containing Corning Valour RTU vials.

Patent expiries, a rise in the aging population, favorable government policies, and an increase in healthcare expenditure are expected to drive the regional market. North America is one of the largest consumers of plastics owing to the high demand from the packaging industry. Plastics find numerous applications in various industries due to their varied features, such as easy molding, acquiring desired shapes, and resistance to water and climate. Plastic containers are easy to manufacture and available in various shapes and types. These factors are likely to augment the demand for plastics and polymers over the forecast period.

Asia Pacific is expected to grow at the fastest CAGR of 11.7% during the forecast period owing to the need for speedy and reliable packaging solutions that fulfill a combination of security requirements, enhance patient comfort, comprise tamper-evident technology, and provide high-quality products and product protection. The recent trend of enhanced social security and healthcare systems in Asia is expected to offer new growth opportunities to ophthalmic packaging providers. For instance, in March 2023, SCHOTT launched the production of amber medical glass in India to address rising demand. This initiative extended the availability of borosilicate glass variants to pharma packaging producers in India and Asia.

Key Companies & Market Share Insights

Key market players are adopting strategic initiatives such as M&As, partnerships, product differentiation, product design, and collaborations to gain a competitive edge in the marketplace. For instance, in October 2020, Gerresheimer launched a novel dropper insert for modern ophthalmic drugs with low viscosity. In August 2021, Becton Dickinson (BD) made the BD COR System available in the United States. This entirely self-contained diagnostic technology improves the standard for detecting infections and disorders. In August 2021, Schott AG and Serum Institute of India announced a pharmaceutical packaging partnership. Serum Institute of India acquired a 50% investment in Schott Kaisha to become a joint venture partner with Schott and secured a pharma packaging supply.

Similarly, in July 2021, Nolato expanded its geographic reach by opening an office in Baldwin, Wisconsin. As a result of this move, the company's logistics and manufacturing services for medical products expanded. Furthermore, the extension was designed to aid in the creation of diagnostic devices as well as pharmaceutical medication manufacturing parts. The following are some of the major participants in the global ophthalmic packaging market:

-

Amcor Ltd.

-

West Pharmaceutical Service Inc.

-

Gerresheimer AG

-

BD

-

Schott AG

-

Aptar Group

Ophthalmic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.6 billion

Revenue forecast in 2030

USD 20.3 billion

Growth Rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Dose, material, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Amcor Ltd.; West Pharmaceutical Service Inc.; Gerresheimer AG; BD; Schott AG; Aptar Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic packaging market based on dose, material, type, and region:

-

Dose Outlook (Revenue, USD Million, 2018 - 2030)

-

Single dose

-

Multi dose

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescription

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic packaging market size was estimated at USD 10.5 billion in 2022 and is expected to reach USD 11.5 billion in 2023.

b. The global ophthalmic packaging market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 20.3 billion by 2030.

b. North America dominated the ophthalmic packaging market with a share of 35.4% in 2022. This is attributable to the large consumption of plastic packaging in the region due to various advantages associated with it such as easy molding.

b. Some key players operating in the ophthalmic packaging market include Amcor Ltd.; West Pharmaceutical Service Inc.; Gerresheimer AG; BD; Schott AG; and Aptar Group.

b. Key factors that are driving the ophthalmic packaging market growth include the increasing prevalence of ocular disorders and the growing importance of brand differentiation and brand awareness in a competitive market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.