- Home

- »

- Personal Care & Cosmetics

- »

-

Optical Brighteners Market Size, Share, Growth Report, 2030GVR Report cover

![Optical Brighteners Market Size, Share & Trends Report]()

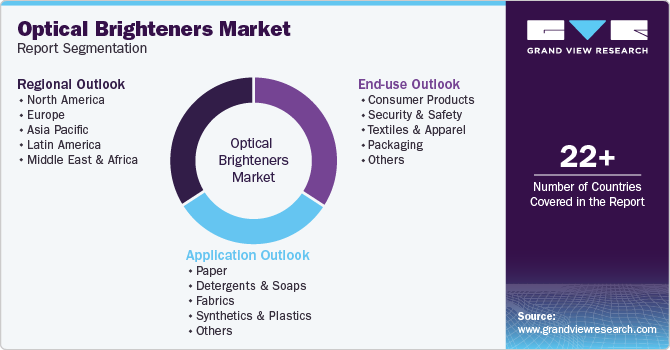

Optical Brighteners Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Paper, Detergents & Soaps, Fabrics), By End-use (Consumer Products, Security & Safety, Textiles & Apparel), By Region, And Segment Forecasts

- Report ID: 978-1-68038-892-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Brighteners Market Size & Trends

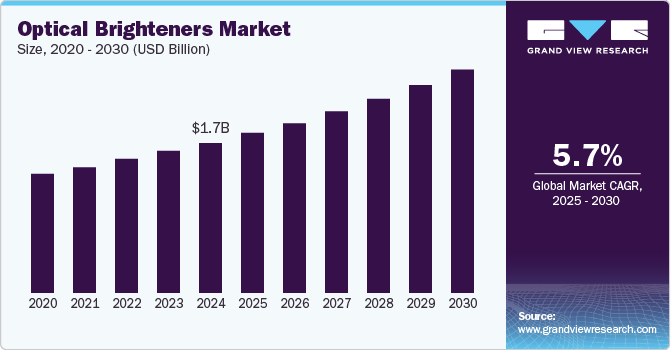

The global optical brighteners market size was estimated at USD 1.67 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. According to the U.S. Bureau of Labor Statistics, the textile and apparel industry employed approximately 150,000 workers in the U.S. in 2023, underscoring the strong workforce supporting the demand for optical brighteners. The Asia-Pacific region, with over 2.5 billion residents and a substantial textile workforce, also highlights the increasing consumption of optical brighteners as the region’s growing population drives heightened demand for textiles.

Consumer preference for aesthetic quality is another critical driver propelling market expansion. The Japan Consumer Affairs Agency reported that consumer spending on cosmetics reached approximately USD 11.8 billion in 2023, indicating a robust inclination towards high-quality and visually appealing products. This trend aligns with the expansion of the Brazilian middle class, which exceeded 100 million in 2024, leading to increased spending on aesthetically pleasing goods. Manufacturers are keenly integrating optical brighteners into their formulations to meet evolving consumer expectations across multiple sectors.

The expansion of industrial applications is further augmenting the optical brighteners market. These compounds are increasingly adopted in diverse sectors, such as plastics and personal care, and traditional markets, such as textiles and paper. In developing economies such as South Africa, the beauty and personal care products industry has showcased substantial growth in sectors utilizing optical brighteners. Their versatility as color-correcting additives in cosmetics enhances their appeal and drives demand within the beauty sector.

Furthermore, the United Nations Environment Programme (UNEP) indicates that over 70% of global consumers prefer environmentally friendly products as of 2024. Approximately 60% of textile manufacturers in India adopt sustainable practices, reflecting a commitment to eco-friendly production methods. As manufacturers innovate to create bio-based alternatives, market growth is further strengthened, particularly in emerging economies prioritized for sustainable industrialization.

Application Insights

Detergents & soaps dominated the market in 2024 due to their capability to enhance fabric brightness and cleanliness. Optical brighteners absorb UV light and emit blue light, rendering clothes whiter and more vibrant. This characteristic is crucial for consumers seeking effective laundry solutions, prompting manufacturers to integrate these compounds into their products to boost aesthetic appeal and cleaning efficiency, thus fulfilling market expectations for superior performance.

Optical brighteners used in the paper are expected to grow lucratively over the forecast period. Optical brighteners play a vital role in enhancing the whiteness and brightness of paper products. These compounds are instrumental in improving the aesthetic quality of coated and uncoated papers, making them more desirable for printing and packaging applications. As industries increasingly prioritize high-quality paper with enhanced brightness for marketing materials, the demand for optical brighteners consistently rises.

End-use Insights

Consumer products held the largest market share in 2024, owing to their ability to enhance the visual appeal of cosmetics and personal care items. These compounds are incorporated into various formulations to enhance brightness and improve color correction, making products more appealing to consumers. Manufacturers increasingly utilize optical brighteners as evolving beauty standards drive consumer expectations for high-quality, aesthetically pleasing products.

The security & safety segment is projected to grow rapidly over the forecast period, fueled by their application in systems such as banknotes and identification documents. These brighteners enhance the visibility of security features when exposed to UV light, facilitating counterfeit detection. As concerns surrounding fraud and counterfeit goods intensify, integrating optical brighteners into security applications becomes increasingly vital.

Regional Insights

Asia Pacific optical brighteners market dominated the global market with the largest revenue share in 2024. This region, recognized for its thriving textile and apparel industry, significantly boosts demand for optical brighteners. As the largest producer and exporter of textiles, countries such as China and India contribute substantially to the market. Moreover, a population exceeding 2.5 billion, accompanied by a rapidly expanding middle class, leads to higher disposable incomes and increased spending on quality products, including those enhanced with these compounds. Furthermore, stringent environmental regulations compel manufacturers to use optical brighteners as sustainable alternatives, supporting their expanding applications in the cosmetics sector.

China Optical Brighteners Market Trends

The optical brighteners market in China dominated the Asia Pacific optical brighteners market in 2024. As the world’s largest producer of textiles, China has a high demand for optical brighteners to improve fabric aesthetics and quality. Moreover, rising disposable incomes among consumers lead to increased spending on visually appealing products, further driving market growth. The government’s support for sustainable manufacturing practices also encourages the adoption of optical brighteners as eco-friendly solutions.

Europe Optical Brighteners Market Trends

Europe optical brighteners market held substantial market share in 2024. European consumers increasingly prefer eco-friendly products, prompting manufacturers to adopt optical brighteners as safer alternatives to traditional bleaching agents. Moreover, the region’s well-established textile and paper industries continue to drive demand for optical brighteners as they enhance product quality and visual appeal across various applications.

The optical brighteners market in Germany is expected to grow in the forecast period. As one of Europe’s largest economies, Germany has a robust textile and paper industry that relies on optical brighteners to enhance product quality. The increasing focus on environmentally friendly practices among German manufacturers aligns with consumer preferences for sustainable products, driving demand for optical brighteners in various applications.

North America Optical Brighteners Market Trends

The North America optical brighteners market is expected to grow significantly over the forecast period. The increasing demand for optical brighteners in various applications, including textiles, detergents, and packaging, reflects consumer preferences for high-quality products. Moreover, stringent environmental regulations are encouraging the adoption of optical brighteners as alternatives to harsh chemicals, further driving market growth. The thriving e-commerce sector also boosts demand for visually appealing packaging materials.

The U.S. optical brighteners market dominated North America in 2024. With a focus on fashionable and visually appealing clothing, manufacturers increasingly incorporate optical brighteners to enhance fabric aesthetics. Furthermore, the U.S. benefits from a strong research and development infrastructure that fosters innovation in optical brightener formulations, ensuring the availability of high-quality products that meet consumer expectations.

Key Optical Brighteners Company Insights

Some key companies operating in the market include BASF, Huntsman International LLC, Archroma, and Milliken & Company. Strategic initiatives involve mergers and acquisitions to strengthen product portfolios and market presence, alongside investments in R&D for eco-friendly and effective formulations in various sectors.

-

Milliken & Company specializes in advanced optical brighteners that enhance the brightness and whiteness of textiles, papers, and plastics. Their eco-friendly products ensure durability and performance while adhering to stringent industry standards across various applications, including fabric care and laundry detergents.

-

3V Sigma S.p.A. focuses on the production of optical brighteners for the textiles, plastics, and paper industries. The company offers various brightening agents, emphasizing innovation and customization to meet specific customer requirements and application needs.

Key Optical Brighteners Companies:

The following are the leading companies in the optical brighteners market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Huntsman International LLC

- Archroma

- Milliken & Company

- 3V Sigma S.p.A.

- CLARIANT

- Aron Universal Limited

- RPM International Inc.

- Teh Fong Min International CO.LTD.

- BRILLIANT COLORS INC.

Recent Developments

-

In March 2024, Novonesis launched Luminous, a biodegradable enzyme that replaced petroleum-based technologies, enhancing fabric whiteness and brightness while reducing environmental impact and supporting sustainable laundry practices aligned with UN Sustainable Development Goals.

Optical Brighteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.77 billion

Revenue forecast in 2030

USD 2.48 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia

Key companies profiled

BASF; Huntsman International LLC; Archroma; Milliken & Company; 3V Sigma S.p.A.; CLARIANT; Aron Universal Limited; RPM International Inc.; Teh Fong Min International CO.LTD.; BRILLIANT COLORS INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Brighteners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical brighteners market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Detergents & Soaps

-

Fabrics

-

Synthetics & Plastics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Products

-

Security & Safety

-

Textiles & Apparel

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.