- Home

- »

- Next Generation Technologies

- »

-

Optical Interconnect Market Size, Industry Report, 2030GVR Report cover

![Optical Interconnect Market Size, Share & Trends Report]()

Optical Interconnect Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Optical Transceivers, PIC-based Interconnects), By Interconnect Level, By Fiber Mode, By Data Rate, By Application, By Distance, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Interconnect Market Summary

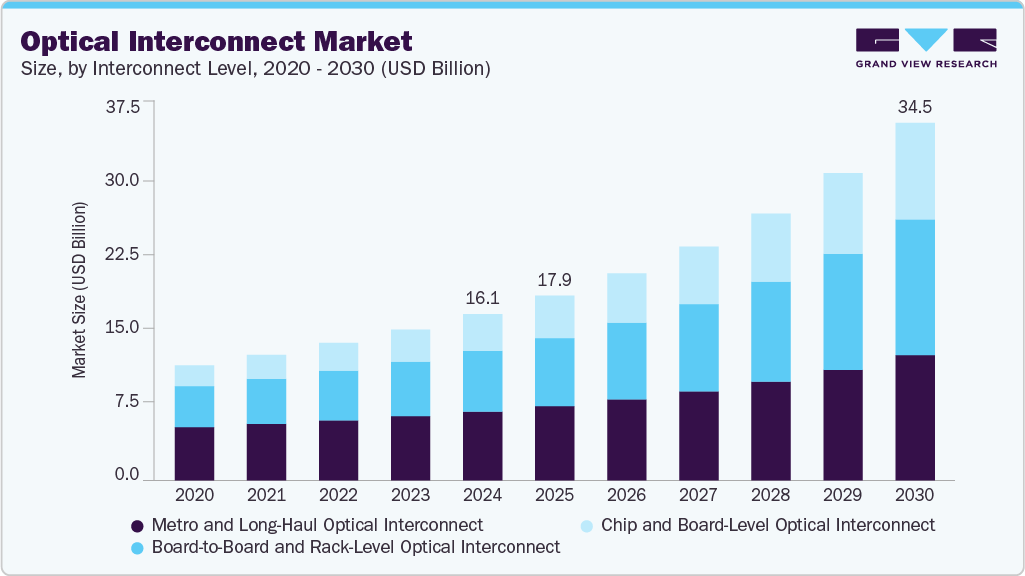

The global optical interconnect market size was estimated at USD 16.06 billion in 2024 and is projected to reach USD 34.54 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. The surge in data traffic drives this growth due to increased internet usage, cloud computing, and data centers, necessitating high-speed data transfer capabilities.

Key Market Trends & Insights

- North America represented a largest market share of 30.8% in 2024.

- The U.S. optical interconnect market is poised for substantial growth.

- By product, the optical transceivers segment led the market and accounted for over 34% of the global revenue in 2024.

- By interconnect level, the metro and long-haul optical interconnect segment led the market in 2024.

- By fiber mode, the single fiber mode segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.06 Billion

- 2030 Projected Market Size: USD 34.54 Billion

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in optical technology, such as silicon photonics and advanced fiber optics, are enhancing performance and efficiency, attracting various industries. The rollout of 5G networks also demands advanced optical interconnect solutions for higher bandwidth and lower latency. Additionally, data centers are increasingly adopting optical interconnects to support edge computing and faster data processing. These innovations are driving the development of next-generation communication infrastructure, enabling seamless integration with AI, IoT, and cloud technologies. Moreover, the growing need for energy-efficient and scalable connectivity solutions is pushing investments in high-speed optical components and photonic integration across diverse sectors.Optical interconnects are more energy-efficient than traditional electrical interconnects, making them useful for data centers and high-performance computing environments focused on reducing energy consumption. The trend towards smaller electronic devices demands advanced interconnect solutions capable of supporting higher data transfer rates in limited spaces, with optical interconnects providing a viable solution. Additionally, the increasing demand for High-Performance Computing (HPC) systems in applications such as scientific research and financial modeling necessitates extremely high data transfer rates, driving market growth. Advancements in manufacturing techniques have also reduced costs and increased the reliability of optical interconnects, making them accessible to a broader range of applications.

Government and institutional investments in advanced communication infrastructure, including fiber optic networks, further boost the demand for optical interconnect solutions. The adoption of artificial intelligence and machine learning technologies, which require rapid data transfer, supports the growth of the optical interconnect market. The growing media and entertainment industry, driven by high-definition video streaming and Virtual Reality (VR) and Augmented Reality (AR) applications, increases the need for high-speed data transfer. Additionally, the continuous expansion and upgrading of telecommunication infrastructure, especially in developing regions, creates a significant demand for optical interconnect solutions to support higher bandwidth requirements.

Product Insights

The optical transceivers segment led the market and accounted for over 34% of the global revenue in 2024. The growth is driven by the exponential growth in data traffic from cloud computing, big data, and IoT, necessitating high-speed data transmission solutions. The expansion of data centers and the rollout of 5G networks have further strengthened the demand for optical transceivers, which provide essential bandwidth and speed. Technological advancements, such as the development of higher-capacity transceivers, have improved their performance and reliability, leading to broader adoption.

The silicon photonics segment within the optical interconnect market is experiencing significant growth due to its ability to integrate optical and electronic components on a single chip, leading to reduced size, lower power consumption, and higher data transfer speeds. As data traffic surges across cloud platforms, data centers, and AI-driven applications, the demand for high-bandwidth and low-latency interconnects is rising in areas where silicon photonics excels. The technology supports dense integration and scalability, which is crucial for evolving network architectures such as 5G and edge computing. Moreover, advancements in hybrid integration techniques and packaging are overcoming limitations, further accelerating adoption.

Interconnect Level Insights

The metro and long-haul optical interconnect segment led the market in 2024 due to increased data traffic from internet usage, video streaming, cloud services, and IoT, necessitating high-capacity networks. The expansion of 5G networks has driven demand for these interconnects, which support the high bandwidth and low latency required for advanced 5G capabilities. Telecommunications companies are upgrading their infrastructure with metro and long-haul optical interconnects to enhance network efficiency and data transmission speed. Technological advancements such as DWDM and advanced modulation formats have enhanced the capacity and performance of metro and long-haul networks, making them cost-efficient and preferred for large-scale deployments by governments and enterprises.

The chip and board-level optical interconnect segment is experiencing substantial growth due to the demand for high-performance computing in applications such as AI, machine learning, and big data analytics, where superior performance over traditional electrical interconnects is essential. Optical interconnects consume less power than electrical ones, reducing heat generation and cooling needs and leading to more energy-efficient systems. Advancements in silicon photonics have enabled the integration of optical components directly onto silicon chips, allowing for higher data transfer rates and improved signal integrity. The growing data bandwidth requirements in data centers, HPC, and telecommunications further drive the need for optical interconnects, which offer enhanced signal integrity over longer distances compared to electrical interconnects.

Fiber Mode Insights

The single fiber mode segment led the market in 2024 due to its ability to support extremely high bandwidth and data rates over long distances, making it useful for data centers, telecommunications, and high-performance computing. Single-mode fibers minimize signal loss and dispersion, which is essential for long-haul communication networks. Their low attenuation and dispersion ensure signal integrity and reliability over extended distances, which is essential for 5G network deployment, as they meet the high data rates and low latency requirements of 5G technology. The widespread support and standardization of single-mode fiber technology have further facilitated its adoption across various industries.

The multifiber mode segment within the optical interconnect market is growing significantly due to its high-density connectivity, which enables simultaneous transmission of multiple data streams over a single cable, essential for modern data centers and telecom networks. These solutions offer cost efficiency by consolidating multiple fibers into one cable, reducing the expense and complexity of the cabling infrastructure. The rapid expansion of data centers drives the need for scalable, high-density solutions that manage numerous connections and data pathways while minimizing cable clutter. Multifiber solutions support high data bandwidth and throughput, meeting the demands for rapid data transmission in high-performance computing and large-scale networking environments.

Data Rate Insights

The 50 - 100 Gbps segment represented a significant market share in 2024 due to growing data demands for cloud computing, big data analytics, and video streaming, which require higher bandwidth for efficient data transfer. Data centers are increasingly adopting these speeds to handle growing data loads and improve performance, balancing high capacity with cost. The expansion of High-Performance Computing (HPC) applications and the rise of AI workloads also drive demand for 50 - 100 Gbps optical interconnects, which support the intensive data processing and transfer rates needed for these technologies. Advances in optical technology, including improved modulation techniques such as PAM-4, have enabled efficient and reliable 50 - 100 Gbps speeds.

The 10 - 50 Gbps segment is experiencing substantial growth due to its wide range of applications across enterprise networks, telecommunications, and data centers. It offers a cost-effective solution for high-speed data transmission, balancing performance and affordability, which appeals to many organizations upgrading their network infrastructure. As an intermediate step between lower-speed options and higher-speed solutions such as 100 Gbps, this range is practical for infrastructure upgrades. It enhances network efficiency by providing sufficient performance improvements while maintaining manageable costs and complexity.

Application Insights

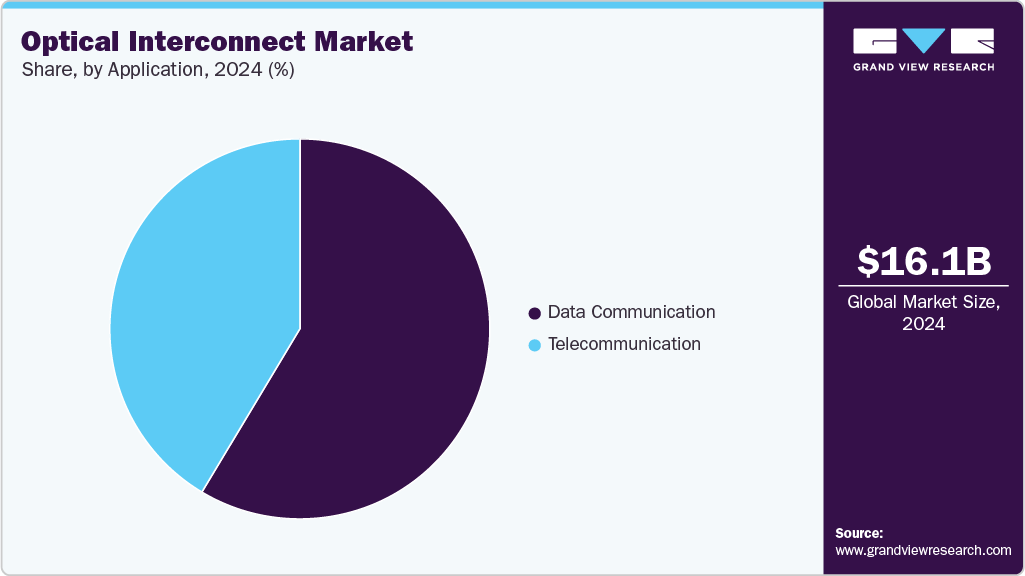

The data communication segment led the market in 2024 due to the explosion of data traffic from cloud computing, video streaming, social media, and IoT applications, which necessitates efficient optical interconnect solutions for high-speed and low-latency data handling. The expansion of data centers globally has increased the need for optical interconnects to manage large data volumes and ensure reliable connectivity. The growth of cloud computing and high-speed internet services further drives demand for advanced optical solutions to support distributed networks and meet consumer expectations. Additionally, telecommunications networks are upgrading to higher data rates, with optical interconnects playing a vital role in improving connectivity and communication efficiency.

The telecommunications segment is experiencing substantial growth due to the deployment of 5G networks, which drives demand for high-speed, low-latency optical interconnects essential for handling new network technologies. Increasing data traffic from mobile devices, streaming services, and IoT applications heightens the need for optical interconnects that provide the necessary bandwidth and speed. Telecommunications companies are upgrading their networks to support higher data rates and improve efficiency, with optical interconnects playing an essential role in these upgrades. Additionally, optical interconnects offer cost efficiency compared to traditional copper options and support global connectivity initiatives and the growing demand for high-speed internet services.

Distance Insights

The less than 10 km segment accounted for the largest market revenue share in 2024 due to its suitability for high-speed data transfer in data center interconnects and metro networks. These optical interconnects are ideal for short-distance connections within facilities and urban infrastructures, offering cost efficiency compared to longer-distance solutions. Their affordability and ease of deployment make them favored for network upgrades and expansions aimed at higher bandwidth and faster data rates. The increasing demand for local and regional connectivity drives the segment's growth.

The more than 100 km segment is poised for substantial growth due to the rising need for long-haul optical interconnects to manage increasing global data traffic and support international communications. The expansion of fiber networks to connect larger geographic areas and the rollout of 5G networks drive demand for these long-distance solutions, which are essential for high-capacity data transmission. The surge in data consumption and bandwidth requirements further supports the need for optical interconnects exceeding 100 km. Additionally, emerging applications such as global financial transactions and large-scale research collaborations necessitate reliable long-distance connections.

Regional Insights

North America represented a largest market share of 30.8% in 2024 due to its leadership in adopting advanced technologies, including optical interconnects. The region's substantial presence of data centers and cloud computing facilities drives demand for high-speed optical solutions. Additionally, its well-developed telecommunications infrastructure requires ongoing upgrades, further boosting demand for optical interconnects. The active investment in 5G network deployment also contributes to the growth of the optical interconnect market.

U.S. Optical Interconnect Market Trends

The U.S. optical interconnect market is poised for substantial growth due to significant investments in data center expansion driven by the demand for cloud computing and big data analytics. The ongoing rollout of 5G networks further fuels growth as it requires advanced optical interconnect solutions for connecting base stations, core networks, and data centers. Technological advancements in optical technologies, including Dense Wavelength Division Multiplexing (DWDM) and silicon photonics, are enhancing performance and reducing costs.

Europe Optical Interconnect Market Trends

The optical interconnect market in Europe is experiencing significant growth due to the EU's Digital Single Market strategy, which promotes investment in high-speed broadband and 5G infrastructure. Leading data center hubs in countries such as Ireland, the Netherlands, Germany, and the Nordics are expanding rapidly, driving demand for advanced optical interconnects. European countries are leaders in 5G rollout and fiber-optic network expansion, with substantial investments in nations such as Germany, the UK, and France.

Asia Pacific Optical Interconnect Market Trends

The Asia Pacific optical interconnect market is poised for significant growth driven by rapid urbanization and industrialization, which increases the demand for high-speed internet and advanced communication networks. Government initiatives, such as China's "New Infrastructure" strategy and India's "Digital India" program, are promoting digital transformation and boosting investment in 5G, data centers, and AI. The region's growing internet penetration, mainly in countries such as India and Indonesia, further fuels the need for high-speed broadband services. Significant investments in expanding and upgrading broadband infrastructure, including fiber-to-the-home (FTTH) networks, are also driving demand for optical interconnect solutions.

Key Optical Interconnect Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in March 2024, Quintessent, an optical products manufacturer, closed an oversubscribed seed funding round of USD 11.5 million led by Osage University Partners. The funds will support the development of ultra-high-speed optical interconnects using heterogeneous silicon photonics and quantum dot (QD) lasers. This new photonic connectivity is essential for high-speed computing required by AI applications. Quintessent collaborates with Tower Semiconductor, which provides silicon photonics foundry services at its California facility.

-

Amphenol Communications Solutions, a division of Amphenol Corporation, is a key player in the optical interconnect market, offering high-speed connectors, cable assemblies, and fiber-optic solutions tailored for data centers, telecom, and industrial applications. The company provides a wide range of active optical cables (AOCs), transceivers supporting up to 800 Gbps, and fiber connector systems such as LC, MPO/MTP, and expanded-beam types. Amphenol Communications Solutions has a strong global manufacturing and R&D presence, enabling it to meet the demands of hyperscale and AI-driven infrastructure. Its optical interconnect solutions support high-performance computing, PCIe Gen5/6, and silicon photonics applications.

-

Broadcom Inc. is a global leader in optical interconnect technology, particularly in the expanding horizon of AI and high-performance data center applications. In March 2024, Broadcom introduced Bailly, the industry’s first 51.2 Tbps co‑packaged optics (CPO) switch, which integrates eight silicon photonics engines with its Tomahawk 5 ASIC, delivering ~70% lower power and significantly higher bandwidth density than traditional pluggable transceivers. The company also extends its optical portfolio with 200 Gbps-per-lane VCSEL, electro-absorption modulated lasers (EML), and CW lasers designed for AI/ML cluster interconnects, positioning itself at the forefront of terabit connectivity.

Key Optical Interconnect Companies:

The following are the leading companies in the optical interconnect market. These companies collectively hold the largest market share and dictate industry trends.

- Amphenol Communications Solutions

- Broadcom

- Coherent Corp.

- Fujitsu Limited

- InnoLight

- Lumentum Operations LLC

- Molex

- NVIDIA Corporation

- Sumitomo Electric Industries, Ltd

- TE Connectivity

Recent Developments

-

In June 2025, PCI-SIG introduced the Optical Aware Retimer ECN, an update to the PCIe 6.4 and 7.0 specifications, the first industry-standard method to run PCIe over optical fiber. This revision enables the use of timer-based solutions to extend PCIe performance over longer optical links, paving the way for high-speed, fiber-based PCIe interconnects in data centers and advanced computing environments.

-

In March 2025, Sumitomo Electric Industries, Ltd. and 3M announced an agreement to offer optical fiber connectivity products using 3M’s Expanded Beam Optical (EBO) technology. Optimized for hyperscale and edge data centers, EBO provides high-performance, low-maintenance optical links with non-contact coupling, reducing wear, contamination sensitivity, and installation effort ideal for rapidly scaling fiber networks.

-

In February 2025, Welinq and QphoX B.V. partnered to develop optical quantum interconnects for superconducting quantum computers, enabling scalable, modular quantum systems. QphoX B.V. provides microwave-to-optical signal conversion, while Welinq offers quantum memory and synchronization tools. The collaboration supports Europe's leadership in quantum tech and is backed by the EIC Accelerator and Quantum Internet Alliance.

-

In June 2024, Intel Corporation unveiled its integrated optical input/output (I/O) chiplet at the Optical Fiber Communication Conference (OFC). The OCI chiplet, designed for GPUs and CPUs, offers low power consumption, high bandwidth, and extended-reach I/O connectivity. Supporting 64 PCIe 5.0 channels with a total throughput of 4 Tbps over 100 meters using fiber optics, this chiplet is essential for AI/HPC applications and next-generation data centers and enables high-performance connections for GPU and CPU clusters.

-

In March 2024, Marvell Technology, Inc., an American semiconductor company, unveiled the Spica Gen2-T, a cutting-edge 5nm 800 Gbps transmit-only PAM4 optical DSP. Developed specifically for use with TRO (Transmit Retimed Optical) modules, this new DSP significantly reduces power consumption in 800 Gbps optical modules by over 40%. Additionally, it remains compatible with standard optical modules and host devices that adhere to IEEE 802.3 standards.

-

In March 2024, StarIC Inc. partnered with GlobalFoundries to advance silicon photonics innovation by developing a breakthrough library of high-speed foundational blocks for the GF Fotonix 45SPCLO process. This library includes silicon-proven Trans Impedance Amplifiers (TIAs) and Micro Ring Modulator (MRM) drivers and supports PAM4 and NRZ data rates over 100GS/s. This addition enhances StarIC Inc.'s growing portfolio of IPs for silicon photonics applications.

Optical Interconnect Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.85 billion

Revenue forecast in 2030

USD 34.54 billion

Growth Rate

CAGR of 14.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, interconnect level, fiber mode, data rate, application, distance, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Amphenol Communications Solutions; Broadcom; Coherent Corp; Fujitsu Limited; InnoLight; Lumentum Operations LLC; Molex; NVIDIA Corporation; Sumitomo Electric Industries, Ltd; TE Connectivity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Interconnect Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical interconnect market report based on product, interconnect level, fiber mode, data rate, application, distance, and region:

-

Optical Interconnect Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cable Assemblies

-

Indoor Cable Assemblies

-

Outdoor Cable Assemblies

-

Active Optical Cables

-

Multi-source Agreements

-

-

Connectors

-

LC Connector

-

SC Connector

-

ST Connector

-

MPO/MTO Connector

-

-

Optical Transceivers

-

Free Space Optics, Fiber, and Waveguides

-

Silicon Photonics

-

PIC-based Interconnects

-

Optical Engines

-

-

Optical Interconnect Level Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metro & Long-haul Optical Interconnect

-

Board-to-Board & Rack-Level Optical Interconnect

-

Chip & Board-Level Optical interconnect

-

-

Optical Interconnect Fiber Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Fiber Mode

-

Multifiber Mode

-

-

Optical Interconnect Data Rate Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 10 GBPS

-

10 - 50 Gbps

-

50 - 100 Gbps

-

More than 100 Gbps

-

-

Optical Interconnect Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Communication

-

Telecommunication

-

-

Optical Interconnect Distance Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 10 Km

-

11 - 100 Km

-

More than 100 Km

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global optical interconnect market size was estimated at USD 16.06 billion in 2024 and is expected to reach USD 17.85 billion in 2025.

b. The global optical interconnect market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2030 to reach USD 34.54 billion by 2030.

b. North America dominated the market in 2024, accounting for over 30.8% share of the global revenue, due to its leadership in adopting advanced technologies, including optical interconnects. The region's substantial presence of data centers and cloud computing facilities drives demand for high-speed optical solutions.

b. Some key players operating in the optical interconnect market include Amphenol Communications Solutions; Broadcom; Coherent Corp; Fujitsu Limited; InnoLight; Lumentum Operations LLC; Molex; NVIDIA Corporation; Sumitomo Electric Industries, Ltd; TE Connectivity.

b. Key factors driving the optical interconnect market growth include the rising demand for high-speed connectivity and the emerging technologies drive the need for optical interconnects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.