- Home

- »

- Plastics, Polymers & Resins

- »

-

Organosilicon Polymers Market Size, Industry Report, 2030GVR Report cover

![Organosilicon Polymers Market Size, Share & Trends Report]()

Organosilicon Polymers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Silicone Resin, Silicone Rubber, Silicone Oil, Silicone Emulsion), By Application (Coatings, Foams, Adhesives & Sealants, Elastomers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-521-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organosilicon Polymers Market Trends

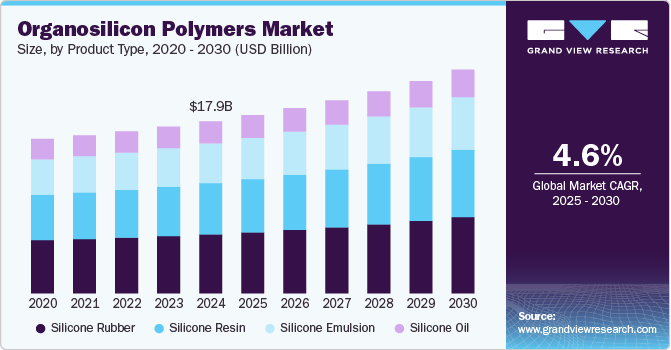

The global organosilicon polymers market size was estimated at USD 17.91 billion in 2024 and projected to grow at a CAGR of 4.65% from 2025 to 2030. The increasing use of organosilicon polymers (polysiloxane) in electronics, such as smartphones, wearables, and semiconductors, is driving market growth due to its excellent thermal stability and electrical insulation properties.

The organosilicon polymers (polysiloxane) market is witnessing a strong shift toward high-performance coatings, driven by industries such as automotive, aerospace, construction, and electronics. Polysiloxane-based coatings offer superior weather resistance, thermal stability, and chemical durability compared to conventional polymer coatings. With the increasing focus on sustainability, manufacturers are also developing low-VOC (volatile organic compound) and waterborne polysiloxane coatings to meet stringent environmental regulations. As industries continue to demand long-lasting protective solutions, this trend is expected to shape the market’s growth trajectory over the coming years.

Drivers, Opportunities & Restraints

The growing use of polysiloxane materials in medical applications is a major driver for the market expansion. Their biocompatibility, non-toxicity, and flexibility make them ideal for use in medical devices, drug delivery systems, and prosthetics. Silicone-based elastomers, a key category of polysiloxanes, are increasingly preferred in catheters, tubing, and implantable medical components due to their resistance to bacterial growth and ability to maintain structural integrity over time. Additionally, advancements in 3D printing using silicone-based resins are further driving innovation in the healthcare sector, strengthening demand for high-purity organosilicon polymers.

The rapid growth of the electric vehicle (EV) industry presents a significant opportunity for polysiloxane materials. As EV manufacturers seek to enhance battery efficiency, thermal management, and component durability, silicone-based polymers are being integrated into battery packs, insulation materials, and electronic encapsulation solutions. Their ability to withstand extreme temperatures, electrical stress, and mechanical wear makes them essential for ensuring long-term performance in EV systems. With the push for higher EV adoption worldwide and the expansion of charging infrastructure, the demand for advanced silicone-based materials is expected to rise, opening lucrative growth prospects for market participants.

One of the primary restraints in the organosilicon polymers market is the high production cost associated with polysiloxane synthesis. The manufacturing process involves complex chemical reactions and high-purity raw materials such as silicon metal and methyl chloride, both of which are subject to price fluctuations due to supply chain constraints and geopolitical factors. Additionally, polysiloxane production requires specialized facilities and stringent quality control measures, increasing operational expenses for manufacturers. These cost challenges often lead to higher end-product prices, limiting the market’s penetration in cost-sensitive industries and regions with lower purchasing power.

Product Type Insights

Silicone resin dominated the organosilicon polymers (polysiloxane) market across the product segmentation in terms of revenue, accounting for a market share of 35.0% in 2024. The increasing demand for high-performance materials in extreme industrial environments is driving the growth of silicone resins. These resins are widely used in heat-resistant paints, adhesives, and insulation materials due to their superior thermal stability and oxidative resistance. Industries such as metallurgy, power generation, and heavy machinery are increasingly adopting silicone resin-based solutions to enhance the durability of components exposed to continuous high heat and chemical stress. With the push for advanced manufacturing and energy-efficient solutions, the adoption of silicone resins in high-temperature applications is expected to expand significantly.

Silicone oil is experiencing strong growth due to its increasing use in personal care and cosmetic formulations, driven by consumer demand for high-performance skincare and haircare products. Its lightweight texture, non-greasy feel, and excellent spreadability make it a preferred ingredient in moisturizers, serums, and anti-aging products. Additionally, the growing preference for long-lasting and water-resistant cosmetics has led to a surge in demand for silicone-based formulations. As beauty and personal care brands focus on innovation and sustainability, the market for silicone oils, including bio-based and naturally derived variants, is poised for steady expansion.

Application Insights

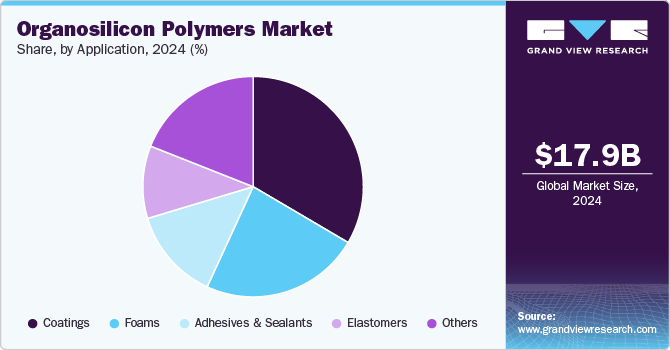

Coatings dominated the organosilicon polymers (polysiloxane) market across the technology segmentation in terms of revenue, accounting to a market share of 33.5% in 2024 due to the need for advanced corrosion-resistant solutions in infrastructure and industrial applications. Governments and private enterprises are heavily investing in infrastructure modernization, including bridges, highways, and offshore structures, which require long-lasting protective coatings. Silicone-based coatings offer excellent weatherability, UV resistance, and chemical durability, making them ideal for extending the lifespan of critical assets. With increasing global investments in sustainable and smart infrastructure, polysiloxane-based coatings are becoming an essential choice for long-term protection and maintenance efficiency.

The medical sector is driving significant demand for silicone elastomers, particularly in next-generation medical devices and implants. These elastomers are widely used in prosthetics, medical tubing, and implantable components due to their biocompatibility, flexibility, and resistance to bacterial growth. As healthcare technology advances, the need for high-performance materials that offer durability and patient safety is rising. Additionally, the development of custom-engineered medical-grade silicone elastomers for wearable health monitoring devices and robotic-assisted surgery components is opening new avenues for market expansion.

Regional Insights

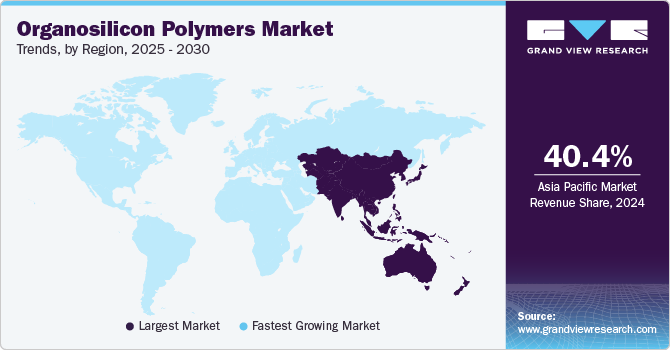

Asia Pacific organosilicon polymers (Polysilixane) market dominated the global organosilicon market and accounted for the largest revenue share of 40.4% in 2024, which is attributable to rapid industrialization and large-scale infrastructure development projects. Countries such as India, Japan, and South Korea are investing heavily in transportation networks, smart cities, and renewable energy projects, creating a surge in demand for high-performance silicones used in construction materials, protective coatings, and electrical insulation. Additionally, the expansion of regional manufacturing hubs in automotive and consumer electronics is driving the need for silicone-based adhesives, sealants, and lubricants. As the region continues to industrialize, the widespread application of polysiloxane materials across multiple industries is expected to drive strong market growth.

North America Organosilicon Polymers Market Trends

North America organosilicon polymers (polysiloxane) market is growing due to the increasing demand for high-performance materials in advanced manufacturing and aerospace applications. With major aircraft manufacturers and defense contractors investing in lightweight, heat-resistant, and durable materials, polysiloxane-based coatings, adhesives, and sealants are being widely adopted.

U.S. Organosilicon Polymers Market Trends

The U.S. organosilicon polymers (polysiloxane) market is experiencing a surge in demand for organosilicon polymers due to the rapid expansion of the electric vehicle (EV) sector and advancements in battery technologies. With government incentives promoting EV adoption and manufacturers increasing investments in next-generation battery materials, polysiloxane-based thermal interface materials and encapsulants are in high demand. These materials enhance the safety, efficiency, and lifespan of lithium-ion batteries by providing superior thermal management and electrical insulation. As the U.S. accelerates its transition toward clean energy and sustainable transportation, the adoption of polysiloxane in EV components and energy storage solutions is expected to rise significantly.

Europe Organosilicon Polymers Market Trends

Europe’s focus on sustainability and stringent environmental regulations is a key driver for the growth of the organosilicon polymers market. The European Union's policies on reducing carbon footprints and banning hazardous chemicals have led to increased adoption of low-VOC, bio-based, and recyclable silicone materials. Industries such as automotive, construction, and personal care are shifting toward eco-friendly silicone alternatives to comply with regulatory standards while maintaining high performance. Additionally, growing investments in green infrastructure and energy-efficient buildings are further fueling demand for polysiloxane-based insulation materials, coatings, and sealants that contribute to long-term sustainability.

China organosilicon polymers (polysiloxane) market is witnessing growth due to the rapid advancements in semiconductor manufacturing and 5G technology deployment are significantly boosting the demand for organosilicon polymers. As the world’s largest producer of consumer electronics and telecommunications equipment, China relies heavily on high-performance silicones for chip fabrication, circuit protection, and thermal management in next-generation devices. The government’s push for self-sufficiency in semiconductor production, combined with large investments in 5G infrastructure, has further increased the need for silicone-based encapsulants, adhesives, and dielectric materials. With China maintaining its leadership in tech-driven industries, the demand for polysiloxane materials in electronics and communications will continue to rise.

Key Organosilicon Polymers Company Insights

The organosilicon polymers (polysiloxane) market is highly competitive, with several key players dominating the landscape. Major companies include Akzo Nobel N.V., Dow Chemical Company, Wacker Chemie AG, 3M, Shin-Etsu Chemical Co., Ltd., BASF SE, Mitsui Chemicals, and Momentive Performance Materials. The organosilicon polymers (polysiloxane) market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Organosilicon Polymers Companies:

The following are the leading companies in the organosilicon polymers market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- Dow Chemical Company

- Wacker Chemie AG

- 3M

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Mitsui Chemicals

- Momentive Performance Materials

Recent Developments

-

In January 2025, Evonik announced the launch of its new business line, Smart Effects, which resulted from the merger of its Silica and Silanes divisions, effective January 1, 2025. This strategic move aimed to enhance innovation and sustainability by combining the strengths of molecular silane chemistry and silica particle design. Smart Effects focused on delivering advanced solutions across industries such as green mobility, electronics, and carbon capture, emphasizing eco-friendly products with high value and performance.

-

In May 2024, The EU Commission announced new restrictions on the use of D4, D5, and D6 (siloxanes) under the REACH regulation due to environmental and health concerns. These chemicals, commonly used in cosmetics, cleaning products, and industrial applications, were classified as persistent, bioaccumulative, and toxic (PBT). The restrictions aimed to limit their release into the environment, with specific concentration limits set for products. Businesses were given a transition period to comply with the new rules.

Organosilicon Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.55 billion

Revenue forecast in 2030

USD 23.29 billion

Growth rate

CAGR of 4.65% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, Volume Kilotons, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Akzo Nobel N.V.; Dow Chemical Company; Wacker Chemie AG; 3M; Shin-Etsu Chemical Co. Ltd.; BASF SE; Mitsui Chemicals; and Momentive Performance Materials.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organosilicon Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented organosilicon polymers market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Silicone Resin

-

Silicone Rubber

-

Silicone Oil

-

Silicone Emulsion

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Coatings

-

Foams

-

Adhesives & Sealants

-

Elastomers

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume,fd Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organosilicon polymers market size was estimated at USD 17.91 billion in 2024 and is expected to reach USD 18.55 billion in 2025.

b. The global organosilicon polymers market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 23.29 billion by 2030.

b. Silicone resin dominated the organosilicon polymers (polysiloxane) market across the product segmentation in terms of revenue, accounting for a market share of 35.04% in 2024. The increasing demand for high-performance materials in extreme industrial environments is driving the growth of silicone resins.

b. Some key players operating in the organosilicon polymers market include Akzo Nobel N.V., Dow Chemical Company, Wacker Chemie AG, 3M, Shin-Etsu Chemical Co., Ltd., BASF SE, Mitsui Chemicals, and Momentive Performance Materials.

b. The increasing use of polysiloxane in electronics, such as smartphones, wearables, and semiconductors, is driving market growth due to its excellent thermal stability and electrical insulation properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.