- Home

- »

- Medical Imaging

- »

-

Orthopedic Imaging Equipment Market Size Report, 2030GVR Report cover

![Orthopedic Imaging Equipment Market Size, Share & Trends Report]()

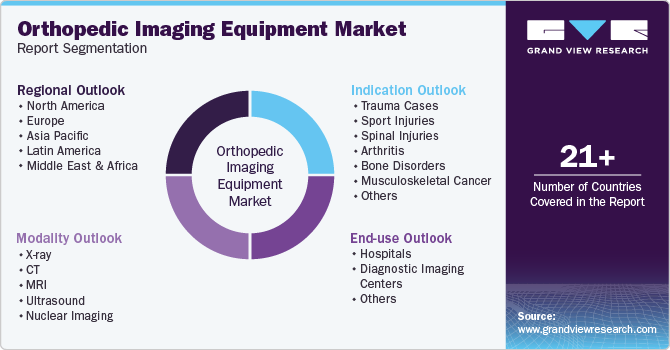

Orthopedic Imaging Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (X-ray, MRI), By Indication (Trauma Cases, Bone Disorders), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-241-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Imaging Equipment Market Summary

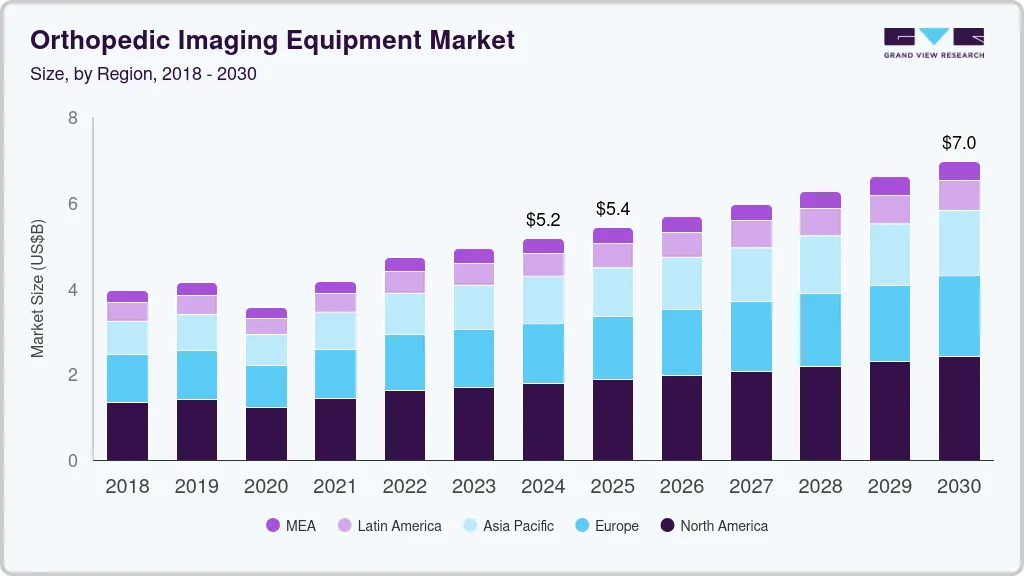

The global orthopedic imaging equipment market size was estimated at USD 5.16 billion in 2024 and is projected to reach USD 6.96 billion by 2030, growing at a CAGR of 5.15% from 2025 to 2030. Growing incidence of bone injuries and orthopedic disorders and increasing penetration of imaging technology in orthopedic treatment are some of the major factors contributing to the market growth.

Key Market Trends & Insights

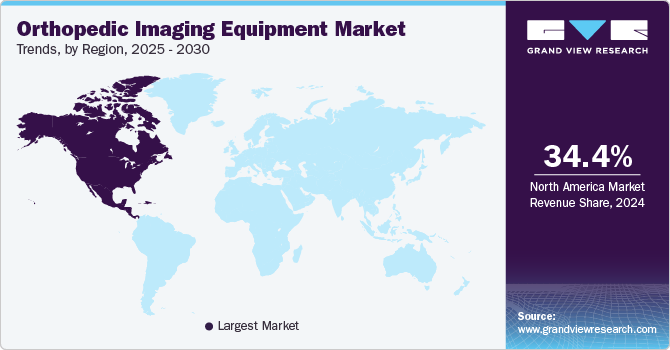

- North America orthopedic imaging equipment market held the largest revenue share of 34.4% in 2024.

- The orthopedic imaging equipment industry in the U.S. held the largest market share in 2024 in the North America region.

- By modality, the x-ray segment held the largest market share of over 32.41% in 2024.

- By indication, the trauma cases segment held the largest market share of more than 21.09% in 2024.

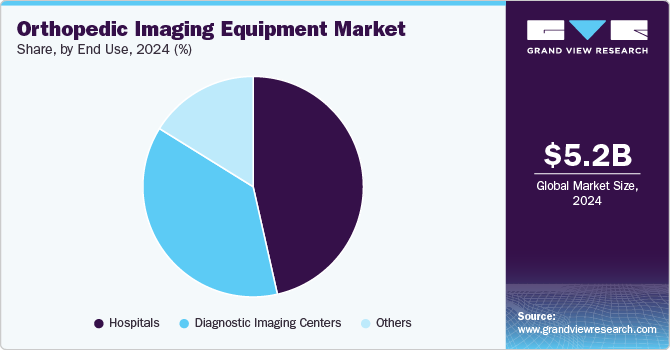

- By end-use, the hospitals segment dominated the market with a share of over 46.10% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.16 Billion

- 2030 Projected Market Size: USD 6.96 Billion

- CAGR (2025-2030): 5.15%

- North America: Largest market in 2024

For instance, according to the data published by WHO in July 2022, about 1.71 billion people worldwide have musculoskeletal conditions. Furthermore, constant technological advancements are expected to drive the growth of the orthopedic imaging equipment industry. The growing prevalence of orthopedic disorders such as osteoporosis, osteomalacia, arthritis, and also increasing incidences of trauma cases resulting in bone injuries are expected to be a major driving factor for the market growth. This may be due to various factors such as changes in lifestyle, the aging population, and increased awareness about these conditions. For instance, according to the international osteoporosis foundation, osteoporosis causes over 8.9 million fractures worldwide each year, which suggests that there is an osteoporosis-related fracture occurring every three seconds. X-rays, CT scans, and MRI scans are some of the imaging techniques used to diagnose bone fractures. These imaging techniques help to accurately diagnose and classify the type of fracture, which then guides the treatment plan. In addition, medical imaging plays a vital role in monitoring the healing process and identifying any complications that may arise during recovery. Overall, medical imaging is an important tool in the management of bone fractures, allowing for timely and accurate diagnosis and treatment.

Technological advancements, whether in the form of new product launches or product upgrades, such as the integration of AI, the introduction of miniature handheld devices, and the emergence of virtual and augmented reality in medical imaging devices used for orthopedic applications, are another major factor accelerating the market growth. For instance, in February 2023, Clarius Mobile Health announced that its MSK AI model had been granted FDA approval. The model incorporates advanced artificial intelligence (AI) technology to identify and measure tendons in the foot, ankle, and knee with high precision. Clarius Mobile Health is a renowned provider of high-definition handheld ultrasound systems.

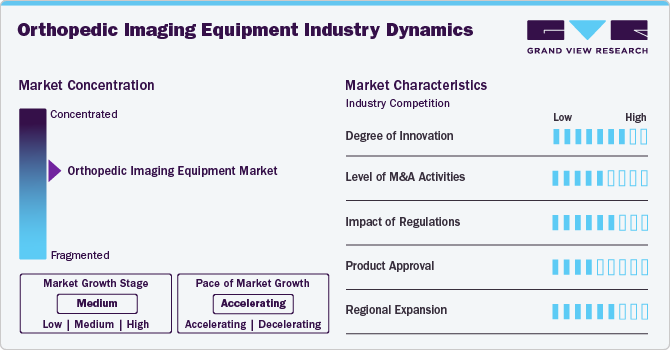

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The orthopedic imaging equipment industry has seen significant innovation, characterized by advancements in technology that have led to more accurate and efficient imaging results, ultimately improving treatment planning. X-ray continues to be the primary imaging modality for bone imaging, while MRI is preferred for musculoskeletal imaging as it provides better visualization of soft tissues. The integration of AI with these modalities has also played a key role in driving market growth.

To expand their customer base and gain a larger market share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances, and engaging in important cooperation activities. For instance, in June 2023, MARS Bioimaging and the Hospital for Special Surgery (HSS) in the USA announced a partnership to advance musculoskeletal imaging and diagnosis. The partnership will be focused on MARS' photon-counting spectral CT imaging technology. The two organizations will collaborate to evaluate specific aspects of the MARS 5x120 Extremity Scanner and explore the potential development of new scanning systems and technologies through the HSS Innovation Institute.

The orthopedic imaging equipmentindustry is witnessing a high degree of innovation, owing to remarkable technological advancements that have positioned them at the forefront of medical diagnostics. For instance, in July 2023, Konica Minolta Healthcare Americas, Inc., launched PocketPro H2, a wireless handheld ultrasound device. This wireless handheld ultrasound system is optimized for musculoskeletal (MSK), needle guidance applications, vascular access, and pain management.

Companies that manufacture orthopedic imaging devices are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand market reach, and maintain competitiveness. For instance, in March 2022, Canon Medical Systems acquired Nordisk Røntgen Teknik A/S, a Danish medical equipment manufacturer, to strengthen its global X-ray business.

The development and use of medical orthopedic imaging equipment are significantly influenced by regulations set by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations ensure that medical devices are safe and effective for patient use and cover all aspects of the device, ranging from its design and manufacturing to its usage in clinical settings.

New product launches by manufacturers to stay competitive in the market and the growing demand and adoption of medical imaging devices for orthopedic applications is an important factor driving market growth. For instance, in January 2023, Adaptix Limited (Adaptix) received FDA clearance for its first orthopedic medical imaging product.This innovative product is a portable, low-dose imaging system that can provide fast, affordable X-ray imaging at the point of care for patients.

The geographical reach of the orthopedic imaging equipment industry has been expanding at a moderate to high level. For instance, in April 2023, Siemens Healthineers introduced a new production facility in India to manufacture Magnetic Resonance Imaging (MRI) machines.

Modality Insights

The x-ray segment held the largest market share of over 32.41% in 2024. X-rays are a valuable diagnostic tool primarily utilized for detecting diseases and abnormalities within bone structures. These include degenerative conditions, fractures, dislocations, infections, and tumors. Furthermore, they provide a cost-effective and easily accessible imaging option, readily available in hospitals and clinics. However, X-rays may not always provide a comprehensive diagnosis for soft tissue injuries like muscle, tendon, or ligament damage, as their strength lies in bone and dense tissue visualization.

The CT segment is expected to grow at the fastest CAGR from 2025 to 2030. CT scan is an efficient technique for orthopedic imaging owing to its capability of providing detailed images of bone structures. This is beneficial for diagnosing complex fractures or evaluating the severity of damage in cases of trauma. Furthermore, a CT scan can be utilized for image guidance during bone biopsy or joint injection.

Indication Insights

The trauma cases segment held the largest market share of more than 21.09% in 2024, owing to increasing sports injuries and accidents. For instance, according to the data published by WHO in December 2023, about 1.19 million people die each year as a result of road traffic accidents. Thus, timely and accurate diagnosis is important for effective treatment, particularly in sports medicine and emergency care settings. Orthopedic imaging plays a vital role in assessing the extent of injury and managing important interventions.

The arthritis segment is expected to grow at the fastest CAGR from 2025 to 2030, owing to the growing cases of arthritis and the increasing geriatric population. Although arthritis affects people of all ages, its prevalence increases sharply from the age of 45 years. It can have a significant impact on a person’s physical health due to the pain and physical limitations associated with the disease. Its easy availability, low cost, and non-invasive nature are another major factor contributing to the segment growth. For instance, according to the Centers for Disease Control and Prevention, about 1 in 5 US adults (21.2%), or about 53.2 million people, were diagnosed with arthritis during 2019 -2021.

End-use Insights

The hospitals segment dominated the market with a share of over 46.10% in 2024. Hospitals are the first choice for patients seeking orthopedic care, whether for chronic conditions or acute injuries, as they are well-equipped to handle various orthopedic cases with a wide range of medical services under one roof, including emergency departments, surgical units, and inpatient care. Hospitals also have access to advanced orthopedic imaging equipment, such as nuclear imaging, MRI, CT, and X-ray machines, which are crucial in the diagnostic process and treatment monitoring.

The diagnostic imaging centers segment is expected to grow at a significant CAGR during the forecast period from 2025 to 2030. These centers focus mainly on providing a wide range of imaging modalities, including those specifically made for orthopedic evaluations. Patients prefer radiology centers for their efficiency, specialized expertise, and reduced appointment waiting times. This is particularly advantageous for individuals seeking routine orthopedic assessments or non-emergency diagnostics.

Regional Insights

North America orthopedic imaging equipment market held the largest revenue share of 34.4% in 2024. Technological innovations and the growing incidence of chronic conditions are anticipated to further propel the market growth in the region. Furthermore, the growing adoption of advanced imaging modalities for orthopedic imaging by end users is further expected to contribute to market growth. For instance, in September 2023, UC Davis Health launched a clinic specializing in musculoskeletal ultrasound to cater to patients with rheumatological conditions.

U.S. Orthopedic Imaging Equipment Market Trends

The orthopedic imaging equipment industry in the U.S. held the largest market share in 2024 in the North America region. The growth can be attributed to technological advancements, such as the integration of advanced orthopedic software in imaging modalities. For instance, in January 2024, Orthofix Medical Inc., a company specializing in spine and orthopedics, entered into a distribution agreement with MRI guidance to offer Bone MRI imaging software in the U.S.

Europe Orthopedic Imaging Equipment Market Trends

The orthopedic imaging equipment industry in Europe held a significant market share in 2024. The growing focus on R&D activities in the region is a major factor contributing to the regional market growth. For instance, in September 2022, Qure.ai, a prominent health technology company, announced a partnership with Erasmus MC, University Medical Center Rotterdam, to establish the AI Innovation Lab for Medical Imaging. The primary objective of this program, which will run for three years, is to conduct thorough research into the identification of abnormalities through artificial intelligence (AI) algorithms, focusing on both infectious and non-infectious diseases.

The orthopedic imaging equipment industry in the UK is expected to grow owing to the increasing cases of orthopedic injuries in the country. Furthermore, growing awareness and adoption of medical imaging are expected to expand market growth. For instance, according to NHS England, about 43.3 million imaging tests were performed in England from April 2021 to March 2022.

The orthopedic imaging equipment market in France is expected to grow over the forecast period due to the rising cases of orthopedic surgeries in the country, necessitating the use of diagnostic imaging devices. For instance, according to the data published by the OECD, about 73,011 total knee replacement surgeries were performed in 2021, compared to 30,808 performed in 2020.

The orthopedic imaging equipment market in Germany is expected to grow over the forecast period, which can be attributed to a rapidly aging population, a growing prevalence of orthopedic disorders, the presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending.

Asia Pacific Orthopedic Imaging Equipment Market Trends

Asia Pacific orthopedic imaging equipment industry is estimated to witness the fastest CAGR during the forecast period due to the growing aging population, which is more prone to geriatric orthopedic injuries, and the rising demand for advanced imaging devices is further expected to increase the growth of orthopedic imaging equipment.

The orthopedic imaging equipment industry in China is expected to grow, over the forecast period, owing to the presence of many market players in the country and adopting various strategies to stay competitive. For instance, in March 2023 in China, Medtronic and First Imaging collaborated to provide improved and easily accessible orthopedic treatments by combining Medtronic's orthopedic navigation system with First Imaging's mobile 3D C-arm.

The orthopedic imaging equipment industry in Japan is expected to grow over the forecast period. This growth can be attributed to the country's strong focus on technological innovation and the adoption of advanced solutions in the country. For instance, in November 2023, RapidAI expanded into Japan by launching an AI platform for hospitals.

Latin America Orthopedic Imaging Equipment Market Trends

The orthopedic imaging devices industry in Latin America is anticipated to undergo moderate growth throughout the forecast period. Increasing awareness in the region about orthopedic disorders has led to a substantial number of diagnosed cases, boosting the demand for early disease diagnosis. Major investments by key market players in the emerging economy and the presence of a large target population are factors expected to drive market growth.

The Brazil orthopedic imaging equipment market held the largest revenue share in 2024, owing to the increasing cases of traumatic injury in the country. The market is also expected to grow owing to the adoption of technologically advanced imaging devices in the country.

MEA Orthopedic Imaging Equipment Market Trends

The Middle East & Africa orthopedic imaging equipment market is anticipated to experience moderate growth during the forecast period owing to the increased focus of countries like Saudi Arabia and Kuwait towards enhancing their healthcare sectors. Advancements in healthcare systems are expected to increase the demand for ultrasound systems and other imaging systems in this region. On the contrary, some countries in the African region lack healthcare infrastructure. However, countries are undertaking initiatives in coordination with the WHO and other independent organizations, which is expected to propel market growth.

Key Orthopedic Imaging Equipment Company Insights

The key players operating in the global orthopedic imaging equipment industry are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the market share.

Key Orthopedic Imaging Equipment Companies:

The following are the leading companies in the orthopedic imaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems Corporation

- Fujifilm Healthcare Solutions

- Esaote

- Carestream Health

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- United Imaging Healthcare Co.

- Shimadzu Corporation

- Hologic, Inc.

Recent Developments

-

In June 2023, GE HealthCare announced the FDA approval and product launch of Sonic DL, which is a deep learning-based technology designed to significantly accelerate image acquisition in Magnetic Resonance Imaging (MRI).

-

In May 2023, Carestream Health launched the DRX-Rise Mobile X-ray System, a fully integrated digital X-ray unit that provides customers with a cost-effective solution for transitioning to digital imaging.

-

In February 2023, GE Healthcare announced that it reached an agreement to acquire a privately held Artificial Intelligence (AI) healthcare provider, Caption Health, Inc. Caption Health develops clinical applications to help with early disease diagnosis and uses AI to help with ultrasound scans.

-

In November 2022, Canon, Inc. decided to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of the medical business by expanding its position in the American medical market.

Orthopedic Imaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.41 billion

Revenue forecast in 2030

USD 6.96 billion

Growth Rate

CAGR of 5.15 % from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, indication, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Philips Healthcare; Siemens Healthineers; Canon Medical Systems Corporation; Fujifilm Healthcare Solutions;

Esaote; Carestream Health; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; United Imaging Healthcare Co.; Shimadzu Corporation; Hologic, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Imaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic imaging equipment market report based on modality, indication, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

CT

-

MRI

-

Ultrasound

-

Nuclear Imaging

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma Cases

-

Sport Injuries

-

Spinal Injuries

-

Arthritis

-

Bone Disorders

-

Musculoskeletal Cancer

-

Muscle Atrophy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic imaging equipment market size was estimated at USD 4.92 billion in 2023 and is expected to reach USD 5.16 billion in 2024.

b. The global orthopedic imaging equipment market is expected to grow at a compound annual growth rate of 5.10% from 2024 to 2030 to reach USD 6.95 billion by 2030.

b. North America dominated the orthopedic imaging equipment market with a share of 34.4% in 2023. This is attributable to technologically advanced healthcare infrastructure, adoption of novel technologies, and the existence of several market players in the region.

b. Some key players operating in the orthopedic imaging equipment market include GE Healthcare; Philips Healthcare; Siemens Healthineers; Canon Medical Systems Corporation; Fujifilm Healthcare Solutions; Esaote; Carestream Health; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; United Imaging Healthcare Co.; Shimadzu Corporation; Hologic, Inc.

b. Key factors that are driving the market growth include growing incidence of bone injuries and orthopedic disorders and increasing penetration of imaging technology in orthopedic treatment are some of the major factors contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.