- Home

- »

- Medical Devices

- »

-

Orthopedic Implants Market Size And Share Report, 2030GVR Report cover

![Orthopedic Implants Market Size, Share & Trends Report]()

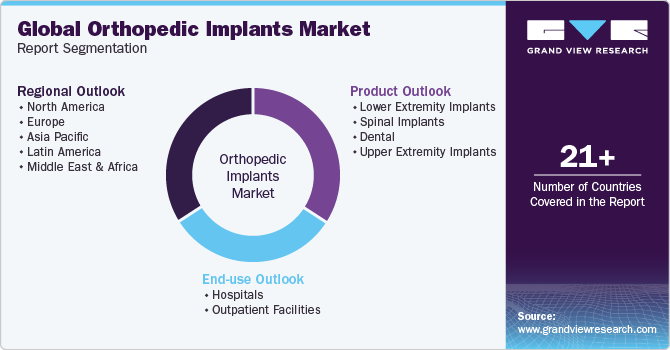

Orthopedic Implants Market Size, Share & Trends Analysis Report By Product (Lower Extremity Implants, Spinal Implants, Dental Implants, Upper Extremity Implants), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-020-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Orthopedic Implants Market Size & Trends

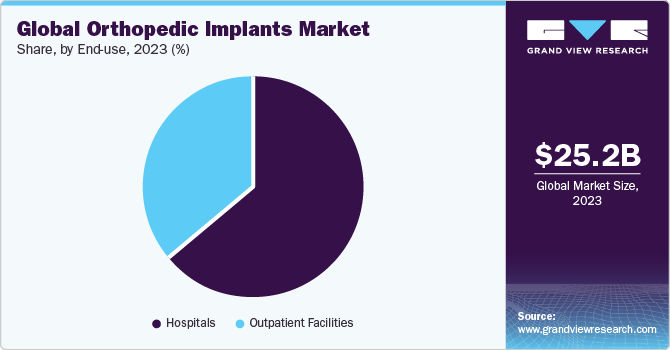

The global orthopedic implants market size was estimated at USD 25.2 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. The market is driven by the growing prevalence of reduced bone density, weakened bones, and musculoskeletal disorders. The surging risk of degenerative bone disorders is another factor driving market growth over the forecast period. In addition, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are expected to impact market growth positively.

The growing penetration of robots in orthopedic procedures is further supplementing market growth. For instance, in June 2021, Stryker UK Limited reported that approximately 13,000 patients worldwide receive Mako robotic arm surgery monthly. Companies investing in robotics are Stryker Corporation, Zimmer Biomet, Mazor Robotics, Smith & Nephew, Medtronic plc, Think Surgical, OMNlife Science Inc., Intuitive Surgical, and Verb Surgical. In addition, companies are increasingly receiving approvals for surgical robots, further driving the market’s growth. For instance, in April 2023, Think Surgical announced that its TMINI small robotic system, designed for orthopedic surgery, has been granted clearance under FDA 510(k) for compatibility with implants. The TMINI system features a wireless robotic handpiece, enhancing the precision of surgeons during total knee replacement procedures.

Signs of aging, such as weakening of bones due to excessive loss of bone mass, which is common above 50 years of age, and decreasing bone density, which becomes more prominent from 55 years & above, are expected to drive market demand. Thus, the aging population is propelling the demand for orthopedic solutions globally. According to October 2022 WHO estimates, by 2030, one in six people worldwide will be aged 60 years or older. In 2022, the population of people aged 60 years and above will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of people aged 60 years and above will double to 2.1 billion. Improvement in life expectancy has led to an increase in the geriatric population, which is expected to grow significantly. Aging causes major changes in skeletal & neuromuscular systems, which may lead to arthritis, weakened ligaments, and other orthopedic injuries. The senior population is increasing rapidly, leading to a rise in global demand for orthopedic surgeries.

Moreover, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are anticipated to influence market growth positively. Increasing awareness and availability of minimally invasive surgical techniques, which offer multiple benefits, is another key driver of market growth. The rising demand for smart implants is another factor driving the market growth. Smart implants can be used in many procedures, such as spine fusion & fracture fixation, and they are designed to integrate with the human body and provide real-time data to patients & healthcare providers. They can measure important parameters such as pressure, force, strain, stress, displacement, proximity, and temperature inside the body. This technology enables continuous monitoring of implant health and function, which can help providers make informed treatment decisions.

The rising number of people participating in sports and physical activities is directly linked to an increase in sports-related injuries that require medical attention, which is expected to supplement the market's development further. According to the American Academy of Pediatrics and the National SAFE KIDS Campaign, over 3.5 million children aged 14 and under suffer injuries each year while playing sports or engaging in recreational activities. More than 775,000 children in the same age group are treated in emergency rooms for sports-related injuries annually. Furthermore, rising demand for orthopedic apps, platforms, and software solutions is also driving the demand, as these tools offer various benefits, such as improved patient engagement, efficient practice management, and better clinical outcomes. Some of the popular orthopedic implants include Exer Health, iOrtho+, PeekMed Orthogeriatrics, AO Surgery Ref., myrecovery, OrthoClass, Ortho Traumapedia, and DrawMD Ortho.

Increasing technological advancement and collaboration in the field of orthopedic industry is escalating market growth. In July 2023, Parkview Regional Medical Center and Orthopedics Northeast launched an osseointegration initiative in collaboration with Integrum, the producer of the OPRA Implant System. This program marks a pioneering effort in Indiana, using advanced bone-anchored prosthesis technology to enhance the well-being of individuals who have undergone lower extremity amputations. Such advanced technologies will boost the adoption of dental implants, thereby supplementing market growth.

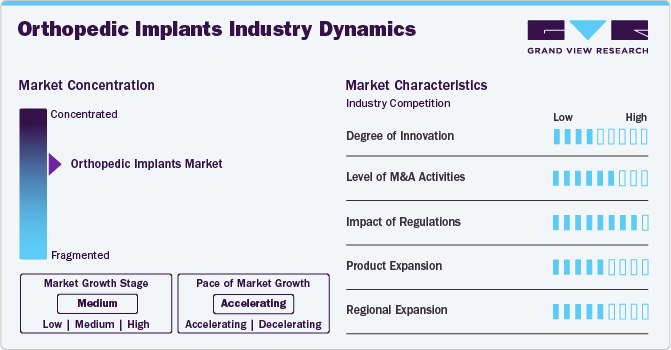

Market Concentration & Characteristics

The treatment of orthopedic conditions and injuries has been significantly transformed by recent advancements in the field of orthopedic implants. Advanced techniques such as 3D printing in orthopedic care are providing new opportunities for patient-specific implants, which can eliminate the need for off-the-shelf implants. Furthermore, market players are investing in innovative technologies and procedures to keep up with the demand. For instance, in February 2023, Medline announced the launch of its UNITE Ankle Fusion Plating System, offering innovative features to aid foot and ankle surgeons in treating patients with ankle-related conditions.

The orthopedic implants industry is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for orthopedic implants and to maintain a competitive edge. In February 2024, SATO Europe GmbH collaborated with Medacta, a Swiss-based pioneer in orthopedic implants, to optimize the logistics of orthopedic implantation using PJM RFID technology.

Orthopedic implants must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards before they can be introduced to the market. In the U.S., the U.S. FDA regulates orthopedic medical devices. The FDA and EMA agencies heavily regulate the market to ensure patient safety and product efficacy. However, these regulations create significant barriers for manufacturers, leading to a lengthy and costly approval process for new orthopedic implants. Furthermore, the stringent regulatory framework also hampers innovation and competition within the market. This can limit patients' access to new and advanced orthopedic implant options.

Substitutes of orthopedic implants are non-surgical treatment options, such as physiotherapy, drug therapy, and allied product options. Moreover, technologically advanced products are likely to be considered as a substitute. The threat of substitutes is expected to be moderate in the industry because, even though substitutes are available for orthopedic implants, some key products still hold a strong place and are growing in demand because of established clinical evidence.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In January 2022, TÜV SÜD company expanded its medical device testing laboratory in Minnesota with a 20,000-square-foot laboratory extension to its existing 36,000-square-foot facility.

Product Insights

The lower extremity implants segment dominated the market in 2023 with the largest revenue share of 52.6%. The growth can be attributed to the aging population, increasing prevalence of orthopedic conditions, advancements in implant materials & designs, and growing demand for improved quality of life through surgical interventions. In addition, the number of R&D initiatives by manufacturers is increasing to enhance these implants’ longevity, functionality, & biocompatibility through innovative materials and minimally invasive surgical techniques. For instance, in October 2023, DePuy Synthes, a company within the Johnson & Johnson Medical Devices Companies, received FDA clearance for the TRILEAP Lower Extremity Anatomic Plating System. This system is designed to aid in the treatment of various lower extremity conditions, providing orthopedic surgeons with advanced tools to address patient needs effectively.

The dental implants product type segment is anticipated to witness the fastest CAGR over the forecast period. The rising incidence of dental injuries due to car accidents and sports injuries is one of the major factors supporting the need for dental implants. According to a report by the American Academy for Implant Dentistry, over 15 million individuals in the U.S. receive crown and bridge replacements for missing teeth annually. Dental implants are long-term replacements and are restorative treatments that protect and encourage natural bone while simultaneously serving as a secure foundation for a prosthesis. In a recent development in December 2022, ProSmile introduced the SmartArches Dental Implants in the U.S. SmartArches provides an extensive range of affordable and trustworthy dental implant services, encompassing individual implants and full-mouth reconstruction.

End-use Insights

The hospitals segment dominated the market in 2023 with the largest revenue share, owing to the high preference for hospitals in case of any injury. This trend is especially observed in developing countries. Furthermore, the rising number of hospital admissions in case of bone fractures and injuries caused by road accidents is estimated to boost the market growth. Favorable reimbursement policies for patients who visit hospitals as compared to those seeking treatment at outpatient facilities and presence of numerous hospitals & primary care centers in developed & developing economies are key factors that can be attributed to the high demand for hospitals. The segment is also expected to witness the fastest CAGR of 3.8% over the forecast period.

The market is expected to experience significant growth in the outpatient facilities segment over the forecast period. This is due to the increasing preference for daycare centers and ambulatory surgery centers in surgical procedures. Outpatient facilities offer advantages such as reduced waiting times, quick discharge, lower procedural costs, and improved efficiency. In addition, they provide patients with adequate postoperative pain control, rapid discharge, minimal side effects, and overall cost containment.

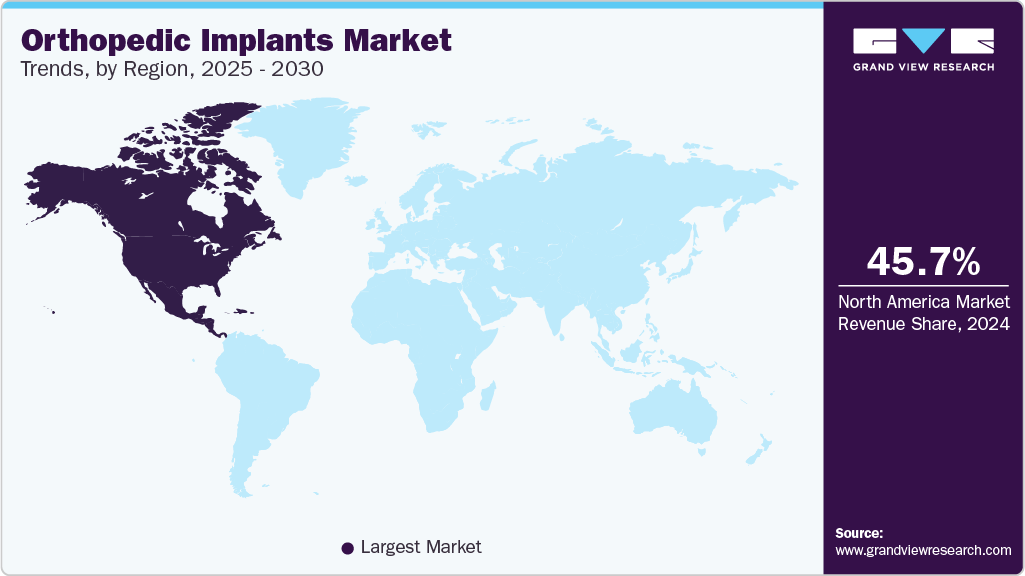

Regional Insights

The North America orthopedic implants market accounted for the largest global revenue share of over 52.4% in 2023. The growth is attributed to the growing need for advanced healthcare services, owing to the presence of major industry players, well-established healthcare infrastructure, and comprehensive reimbursement coverage. Moreover, growing number of middle-aged & geriatric patients opting for orthopedic implants, increase in prevalence of low bone density, and introduction of biodegradable implants & internal fixation devices also drive the regional market.

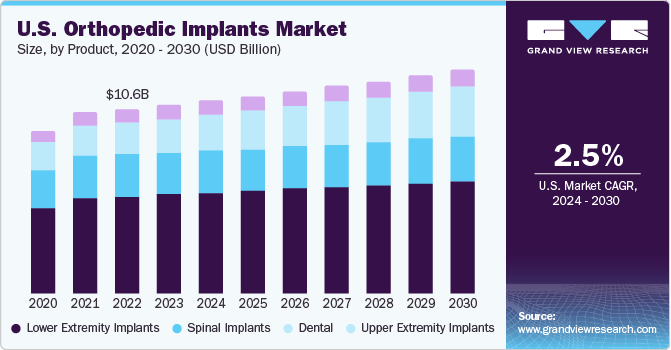

U.S. Orthopedic Implants Market Trends

The orthopedic implants market in the U.S. held the largest revenue share of over 90% in 2023 in the North American region. The market is driven by factors such as an increase in healthcare expenditure worldwide and a rise in the applications of 3D printing in the healthcare sector. The need for regulatory compliance and the requirement of high capital investment restricts the entry of new players into the market. Companies offering various types of implants are increasingly adopting expansion strategies, such as product launches, mergers, acquisitions, partnerships, and collaborations. For instance, in March 2023, Bioretec Ltd received FDA approval for its bioresorbable metal product, RemeOs trauma screw, which heals bone fractures. This product is a combination of traditional surgical techniques with the latest bioresorbable polymer implants, which is patient-friendly and eliminates the need for implant removal operations.

Canada orthopedic implants market is anticipated to register the fastest CAGR over the forecast period. Market players are concentrating on boosting R&D efforts to introduce advanced products and maintaining their market position through various strategies. In February 2024, Tyber Medical LLC, an orthopedic device manufacturer, received clearance from Health Canada for its anatomical plating system. The plating system includes a comprehensive range of titanium and stainless-steel plates. Previously, the portfolio had received clearance for FDA 510(k) in the U.S.

Europe Orthopedic Implants Market Trends

The orthopedic implants market in Europe is anticipated to register a significant CAGR during the forecast period. This is attributed to several factors, including increased healthcare spending as well as a rise in the number of elderly people suffering from osteoarthritis, osteoporosis, bone injuries, and obesity. According to Eurostat, as of January 2023, the EU population reached 448.8 million, with 21.3% of the population aged 65 or older.

Germany orthopedic implants market is anticipated to register a considerable growth rate during the forecast period. In 2021, Germany was among the countries with the highest rate of hip and knee replacement procedures. According to the Organization for Economic Co-operation and Development (OECD), in Germany, 301 individuals per 100,000 population required hip replacements, and 201 individuals per 100,000 required knee replacements. Thus, an increase in the incidence of these diseases is fueling the market in Germany.

Asia Pacific Orthopedic Implants Market Trends

The orthopedic implants market in Asia Pacific is anticipated to be the fastest-growing regional market globally. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for orthopedic implants in the region. The number of orthopedic implantations performed in the region is growing due to the rising incidence of chronic orthopedic ailments and improved diagnostic tools.

The orthopedic implants market in China is expected to grow over the forecast period. China, with the largest population in the world, is a highly lucrative market for orthopedic implants. It is driven by the country's increasing aging population. Medical tourism is growing in the country, the healthcare infrastructure is constantly improving, and patients are becoming more aware of the commercial availability of orthopedic implants. All these factors are contributing to market growth in the country. However, the high cost of orthopedic procedures and strict government policies for the approval of implants is hampering market growth to a certain extent.

The Japan orthopedic implants market is anticipated to grow over the forecast period. Japan has a highly developed medical device industry with advanced manufacturing facilities and technologies. The majority of the locally present companies are adopting strategies such as mergers, collaborations, and product launches to maintain a competitive edge. For instance, in September 2022, Smith+Nephew announced the introduction of its OR3O Dual Mobility System in Japan; the system can be used in both revision and primary hip arthroplasty procedures.

Key Orthopedic Implants Company Insights

Key participants in the orthopedic implants industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Orthopedic Implants Companies:

The following are the leading companies in the orthopedic implants market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Medtronic plc

- Wright Medical Group N.V.

- NuVasive, Inc.

- Globus Medical, Inc.

- Arthrex, Inc.

- DJO Global, Inc.

- LimaCorporate S.p.A.

- MicroPort Scientific Corporation

- ConforMIS, Inc.

- Exactech, Inc.

- Invibio Biomaterial Solutions

- Aesculap Implant Systems, LLC (a subsidiary of B. Braun Melsungen AG)

- Acumed, LLC

- Tornier N.V. (acquired by Wright Medical Group N.V.)

- Alphatec Holdings, Inc.

- Integra LifeSciences Holdings Corporation

- Corin Group

- FH Orthopedic

- Medacta

- Pega Medical

- Orthofix Medical, Inc.

Recent Developments

-

In February 2024, Zeda, Inc. acquired the Orthopaedic Implant Company (OIC), based in Nevada. The acquisition can allow Zeda to produce OIC implants for its customers and strengthen its position in the orthopedic industry

-

In January 2024, Pacific Research Laboratories, Inc. launched a web application, ENDPOINT, which can allow orthopedic implant manufacturers to test devices using automated simulation applications

-

In January 2024, Accelus launched Linesider, a spinal implant system with a modular-cortical design. The technology can enable surgeons to insert screw shanks at the beginning of the procedure and customize the construct using modular rods & tulips

-

In May 2023, Henry Schein signed an agreement to acquire S.I.N. Implant System, a Brazil-based manufacturer of dental implants. This strategy helped the company expand its dental specialty businesses

-

In February 2023, Invibio opened a new orthopedic medical device product development and manufacturing center in Leeds, UK

-

In July 2022, Envista Holdings Corporation announced the extension and expansion of its commercial partnership with Canada's largest DSO, dentalcorp Holdings Ltd. This partnership extension further enhanced Dentalcorp's capacity to deliver the best possible care to its patients.

Orthopedic Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.0 billion

Revenue forecast in 2030

USD 32.5 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; Zimmer Biomet; DePuy Synthes; Smith+Nephew; Aesculap, Inc. - a B. Braun company; CONMED Corporation; NuVasive, Inc. (merged with Globus Medical); Enovis (formerly known as DJO)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global orthopedic implants market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lower Extremity Implants

-

Knee Implants

-

Hip Implants

-

Foot & Ankle Implants

-

-

Spinal Implants

-

Dental

-

Dental Implants

-

Craniomaxillofacial Implants

-

-

Upper Extremity Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

Shoulder Implants

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic implants market size was estimated at USD 25.2 billion in 2023 and is expected to reach USD 26.0 billion in 2024.

b. The global orthopedic implants market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 32.5 billion by 2030.

b. By product, the lower extremity implants segment dominated the orthopedic implants market in 2023 and accounted for the largest revenue share over 52.6%. The growth can be attributed to the aging population, increasing prevalence of orthopedic conditions, advancements in implant materials & designs, and the growing demand for improved quality of life through surgical interventions.

b. Some key players operating in the orthopedic implants market include Medtronic, DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Medtronic plc, Wright Medical Group N.V., NuVasive, Inc., Globus Medical, Inc., Arthrex, Inc., DJO Global, Inc., LimaCorporate S.p.A., MicroPort Scientific Corporation, ConforMIS, Inc., Exactech, Inc., Invibio Biomaterial Solutions, Aesculap Implant Systems, LLC (a subsidiary of B. Braun Melsungen AG), Acumed, LLC, Tornier N.V. (acquired by Wright Medical Group N.V.), Alphatec Holdings, Inc., Integra LifeSciences Holdings Corporation, Corin Group, FH Orthopedic.

b. The market is driven by the growing prevalence of reduced bone density, weakened bones, and musculoskeletal disorders. The surging risk of degenerative bone disorders is another factor driving market growth over the forecast period. In addition, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are expected to impact market growth positively.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."