- Home

- »

- Homecare & Decor

- »

-

Outdoor Lighting Market Size & Share, Industry Report, 2030GVR Report cover

![Outdoor Lighting Market Size, Share & Trends Report]()

Outdoor Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (LED Lights, Plasma Lamps, High-Intensity Discharge Lampsm, Fluorescent Lights), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-025-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Outdoor Lighting Market Summary

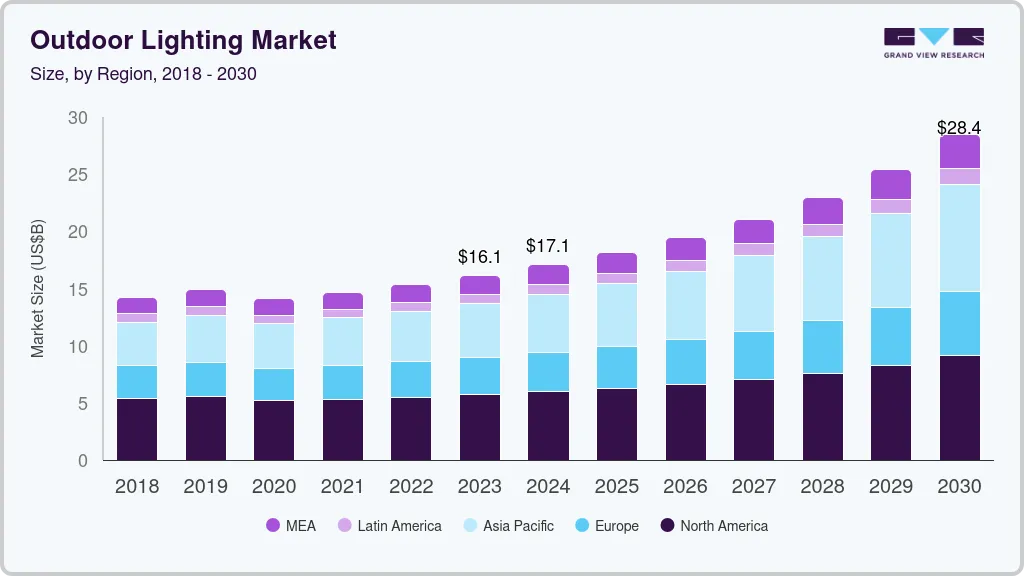

The global outdoor lighting market size was estimated at USD 17.06 billion in 2024 and is projected to reach USD 28.43 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The global demand for outdoor lighting is witnessing significant growth, driven by a confluence of urbanization, infrastructural development, and the rising emphasis on energy-efficient solutions.

Key Market Trends & Insights

- The North America outdoor lighting market held a share of 34.94% of the global revenue in 2024.

- The outdoor lighting market in the U.S. is expected to grow at a CAGR of 7.8% from 2025 to 2030.

- Based on source, the LED lights segment accounted for a market share of 49.52% in 2024.

- Based on application, the commercial segment held a market revenue share of 66.48% in 2024.

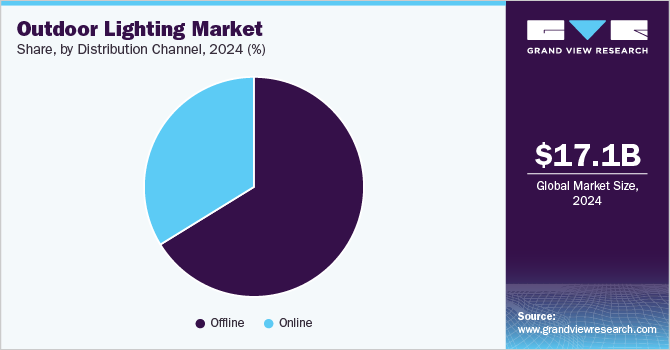

- Based on distribution channel, the offline channels segment accounted for a share of 66.22% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.06 Billion

- 2030 Projected Market Size: USD 28.43 Billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

Governments worldwide are investing heavily in smart city projects, which prioritize advanced lighting systems for streets, parks, and public spaces to enhance safety, energy conservation, and aesthetic appeal. For instance, initiatives such as India’s Smart Cities Mission and the European Union’s Green Cities Program underscore the integration of energy-efficient LED and solar lighting technologies into urban infrastructure.The expanding real estate sector and growing commercial construction activities are anticipated to drive the demand for outdoor lighting in North America. As reported by the World Property Journal, the combined value of all residential properties in the U.S. reached USD 47 trillion as of January 2023. Ongoing infrastructure advancements and the issuance of new building permits across the region are expected to create significant growth opportunities for the outdoor lighting market. Furthermore, data from the India Brand Equity Foundation (IBEF) highlights a 75% surge in luxury home sales in India in 2023, doubling their share of total housing sales and underscoring the increasing global focus on high-value residential developments.

The surge in residential and commercial construction, particularly in emerging economies, has amplified the demand for outdoor lighting to improve property value, security, and functionality. Technological advancements, including IoT-enabled lighting systems and motion-sensor integration, have further bolstered market growth by catering to evolving consumer preferences for smart, automated, and sustainable solutions. In addition, the growing popularity of outdoor recreational spaces, such as gardens, patios, and landscapes, has fueled demand for decorative and utility-based lighting systems, reflecting a global trend toward enhanced outdoor living experiences.

Governments and private sectors are investing heavily in the construction of smart cities, which integrate advanced technologies to improve the quality of life. Smart city projects often include sophisticated outdoor lighting systems that are energy-efficient, automated, and capable of enhancing safety and aesthetics. The demand for such systems is contributing significantly to the growth of the outdoor lighting industry. For example, as highlighted by the India Brand Equity Foundation (IBEF), the Ministry of Finance, in the 2024-25 interim Budget, announced a substantial expansion of India's affordable housing initiatives. This includes the addition of 20 million new houses under the Pradhan Mantri Awas Yojana - Urban (PMAY-U) flagship program, underscoring the government's commitment to strengthening the nation’s affordable housing sector.

The role of outdoor lighting extends beyond functionality to aesthetics and design. In commercial and real estate projects, outdoor lighting is used to highlight architectural features, create ambiance, and enhance the overall visual appeal of the property. Landscape lighting, in particular, is a key component in residential developments, adding value and improving the attractiveness of outdoor spaces. Consumers are increasingly opting for exclusive and aesthetically pleasing outdoor lighting and are willing to pay a higher price for soothing home décor. Furthermore, a rise in demand for outdoor lighting in urban areas has been witnessed. The adoption of LED lighting has seen a significant rise over the past decade, driven by its superior energy efficiency, long lifespan, and environmental benefits compared to traditional lighting technologies. This widespread shift toward LED technology is having a pronounced impact on the outdoor lighting industry, driving sales and fostering innovation.

The demand for smart outdoor lights is growing due to their seamless service with diagnostic, predictive, and prescriptive analytics. They address a significant challenge faced by lighting manufacturers: the service aspect. These fixtures offer automated fixture health status updates on mobile apps or web interfaces, alerting users to issues and providing diagnosis, failure prediction, and next steps. They pinpoint anomalies and identify compromised parts, streamlining repair processes. This eliminates the need for manual troubleshooting, reducing downtime and maintenance costs. The convenience and efficiency of smart outdoor lights make them increasingly popular for both residential and commercial use.

Source Insights

LED lights accounted for a market share of 49.52% in 2024. LED lights are preferred for outdoor lighting due to their exceptional energy efficiency, durability, and longevity. They consume significantly less energy compared to incandescent and CFL bulbs, resulting in lower utility bills and reduced carbon emissions. LEDs provide immediate illumination and operate at cooler temperatures, enhancing safety. Their directional lighting allows for precise control, reducing the need for additional fixtures and minimizing light pollution. In addition, LEDs offer a wide range of color tints and do not attract insects, making them ideal for creating pleasant outdoor environments. Despite a higher initial cost, the long lifespan and reduced maintenance of LEDs make them a cost-effective choice over time. As a result of these benefits, there is an increased adoption of LED lights in outdoor lighting.

The demand for plasm lights is projected to grow at a CAGR of 9.5% from 2025 to 2030. Plasma lamps, particularly Light Emitting Plasma (LEP) technology, are gaining traction in outdoor lighting due to their numerous benefits. LEP lamps are highly energy-efficient, capable of producing around 144 lumens per watt, which significantly reduces energy consumption compared to traditional lighting sources such as high-pressure sodium or metal halide lamps. They offer superior light distribution and full-spectrum illumination, enhancing visibility and safety in outdoor spaces. Moreover, LEP lamps maintain high lumen output and efficiency over long periods, making them low-maintenance and cost-effective for municipalities and large-scale outdoor applications. These lamps also perform well in extreme temperatures, adding to their reliability and suitability for diverse outdoor environments. These advantages make LEP a viable option for improving the quality and sustainability of the outdoor lighting industry.

Application Insights

The commercial demand for outdoor lights held a market share of 66.48% in 2024. In commercial settings, the growing demand for outdoor lighting is primarily driven by the need to enhance safety, operational efficiency, and customer experience. Retail establishments, hospitality venues, and office complexes are leveraging advanced lighting solutions to create inviting environments that align with brand aesthetics. In addition, the integration of intelligent lighting systems, including IoT-enabled and motion-sensor technologies, supports cost optimization and adherence to sustainability goals. Government regulations mandating energy-efficient infrastructure in public and commercial spaces have further spurred investments in high-performance outdoor lighting solutions, reinforcing their critical role in modern commercial environments.

The residential demand is anticipated to grow with a CAGR of 10.1% from 2025 to 2030. The demand for outdoor lights in residential settings is growing as homeowners increasingly prioritize aesthetic appeal, security, and functionality in their outdoor spaces. Enhanced outdoor living trends, including the popularity of patios, gardens, and terraces, have driven demand for decorative lighting solutions that create ambient environments while increasing property value. Moreover, the rising adoption of energy-efficient technologies such as LED and solar lighting reflects consumer preferences for cost-effective and sustainable solutions. Smart lighting systems equipped with automation and smartphone control are also gaining traction, enabling homeowners to integrate convenience and energy management into their outdoor lighting infrastructure.

Distribution Channel Insights

The sales of outdoor lights through offline channels accounted for a market share of 66.22% in 2024. Sales of outdoor lighting through offline channels are growing due to the immersive shopping experience they provide, allowing customers to physically inspect products and seek personalized recommendations. Retail stores, showrooms, and specialty lighting outlets attract consumers by showcasing a wide range of lighting solutions, including the latest designs and technologies, in curated displays. Moreover, the offline channel benefits from partnerships with contractors, architects, and interior designers who often source outdoor lighting for large-scale residential and commercial projects. Enhanced customer support, after-sales services, and the ability to bundle products with installation services further solidify the dominance of offline channels.

The sales through online channels are projected to grow at a CAGR of 4.9% from 2025 to 2030. Consumers increasingly prefer online shopping for its access to a broader product catalog, detailed product descriptions, and customer reviews, enabling informed purchasing decisions. Advancements in digital technologies, including augmented reality tools for the virtual placement of lighting products, have further enhanced the online shopping experience. In addition, the proliferation of exclusive online discounts and direct-to-consumer models has made online platforms an attractive option for tech-savvy and price-conscious buyers, driving their growing adoption.

The B2C market for outdoor lighting is increasingly influenced by e-commerce trends, with consumers seeking convenience, variety, and competitive pricing through online shopping platforms. The rise of smart home technology has driven demand for innovative outdoor lighting solutions that can be controlled via smartphones and other devices. In addition, online reviews and social media strongly influence purchasing decisions, enhancing market transparency and compelling manufacturers to offer high-quality, aesthetically pleasing, and energy-efficient lighting products to meet consumer expectations.

Regional Insights

North America Outdoor Lighting Market Trends

The outdoor lighting market in North America held a share of 34.94% of the global revenue in 2024. The broader North American region benefits from robust infrastructural development and an increased emphasis on sustainability, which are key drivers of outdoor lighting demand. Canada’s initiatives, such as the Green Infrastructure Fund, support energy-efficient lighting installations in public spaces, while advancements in solar and LED lighting technologies offer sustainable alternatives for municipalities and businesses. In addition, the growing demand for aesthetically appealing and functional outdoor lighting in commercial complexes, combined with the region's high adoption rate of smart city projects, ensures consistent growth across residential and commercial applications.

U.S. Outdoor Lighting Market Trends

The outdoor lighting market in the U.S. is expected to grow at a CAGR of 7.8% from 2025 to 2030. In the U.S., the demand for outdoor lighting is growing due to advancements in smart lighting technologies and an increasing focus on energy efficiency. Government programs such as the Energy Star certification and federal incentives for LED lighting adoption are driving the transition from traditional lighting to energy-efficient alternatives. Residential applications, fueled by the trend of outdoor living spaces, and commercial sectors such as retail and hospitality are embracing innovative lighting solutions to enhance aesthetics and safety. Moreover, the rise of IoT-enabled outdoor lighting systems that integrate with smart home technologies is reshaping consumer preferences, and fostering sustained market growth.

Asia Pacific Outdoor Lighting Market Trends

Asia Pacific outdoor lighting market accounted for a revenue share of around 29.82% in the year 2024. Asia Pacific is witnessing rapid growth in outdoor lighting demand due to urbanization, expanding infrastructure projects, and government-led cleanliness and beautification drives. For instance, India’s Smart Cities Mission and China’s New Urbanization Plan emphasize the integration of energy-efficient outdoor lighting systems in urban areas. The surge in residential construction, coupled with a growing middle-class population, is driving demand for aesthetically appealing and functional lighting solutions. Moreover, the region's increasing adoption of solar and LED lighting technologies, supported by government subsidies and the rising penetration of e-commerce platforms, is further accelerating market growth.

The European market is projected to grow at a CAGR of 9.3% from 2025 to 2030. In Europe, stringent regulations promoting energy efficiency, such as the European Union's Ecodesign Directive, are major catalysts for the growing demand for outdoor lighting. The region’s focus on smart city developments, exemplified by initiatives such as the EU Urban Agenda, has led to the widespread deployment of IoT-enabled lighting systems in public spaces to enhance safety and reduce energy consumption. Furthermore, the commercial sector, particularly hospitality and retail, is investing in innovative lighting designs to create engaging outdoor environments, while advancements in solar-powered solutions are gaining traction in residential applications due to growing consumer preference for sustainable living.

Key Outdoor Lighting Company Insights

The outdoor lighting industry exhibits a dynamic and competitive landscape, driven by the presence of global, regional, and local players vying for market share through innovation and strategic partnerships. Leading companies such as Signify (formerly Philips Lighting), Acuity Brands, and OSRAM dominate the market with comprehensive portfolios encompassing LED, solar, and smart lighting solutions. These players leverage advanced technologies, such as IoT-enabled lighting systems and AI-driven energy management tools, to deliver innovative products that align with the growing demand for energy-efficient and sustainable solutions. Their global distribution networks and collaborations with government bodies for large-scale infrastructure projects further strengthen their competitive positioning.

Regional and local players also hold a significant share of the market by catering to niche demands and offering cost-effective, customizable solutions. These companies excel in addressing localized requirements, particularly in emerging economies, where affordability and simplicity in design are key purchase drivers. The rise of e-commerce platforms has enabled smaller players to expand their reach and compete with established brands by showcasing diverse product offerings online. The competitive environment is further intensified by mergers, acquisitions, and joint ventures, as companies seek to broaden their geographic footprint, enhance technological capabilities, and address the evolving needs of residential, commercial, and municipal clients.

Key Outdoor Lighting Companies:

The following are the leading companies in the outdoor lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Signify Holding

- ACUITY BRANDS, INC.

- Hubbell

- Zumtobel Group

- ams-OSRAM AG

- Outdoor Lighting Perspectives

- Savant Systems Inc (GE Lighting)

- Cree LED

- SYSKA

- Virtual Extension

Recent Developments

-

In March 2024, Signify Holding acquired Intelligent Lighting Controls, Inc. (ILC), a U.S.-based manufacturer of wired control systems, thereby broadening its connected portfolio. ILC, previously part of Cooper Lighting Solutions under Signify's Digital Solutions division, offered its branded wired control systems. The addition of ILC's wired control systems further enhances Cooper Lighting Solutions' lineup of energy-saving solutions, presenting increased prospects to market a wide array of energy-efficient LED lighting products across the U.S., Canada, and Mexico.

-

In August 2024, Govee, a prominent leader in the smart home lighting industry, unveiled the second generation of its Permanent Outdoor Lights, the Permanent Outdoor Lights 2. This latest iteration introduced enhanced brightness, improved reliability, and Matter compatibility, all while maintaining the pricing of its predecessor. Designed to elevate both holiday decor and outdoor events, the Permanent Outdoor Lights 2 redefined convenience and performance, setting a new benchmark for outdoor lighting solutions during the holiday season and beyond.

Outdoor Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.15 billion

Revenue forecast in 2030

USD 28.43 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Signify Holding; ACUITY BRANDS, INC.; Hubbell; Zumtobel Group; ams-OSRAM AG; Outdoor Lighting Perspectives; Savant Systems Inc (GE Lighting); Cree LED; SYSKA; Virtual Extension

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Outdoor Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the outdoor lighting market on the basis of source, application, distribution channel, and region.

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

LED Lights

-

Plasma Lamps

-

High-Intensity Discharge Lamps

-

Fluorescent Lights

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global outdoor lighting market was estimated at USD 17.06 billion in 2024 and is expected to reach USD 18.15 billion in 2025.

b. The outdoor lighting market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 28.43 billion by 2030.

b. North America dominated the outdoor lighting market with a share of around 34.94% in 2024. The demand for outdoor lighting in North America has risen owing to the growing trend of family gatherings and dinners in outdoor spaces at home.

b. Some of the key players operating in the outdoor lighting market include Signify Holding, ACUITY BRANDS, INC., Hubbell, Zumtobel Group, ams-OSRAM AG, Outdoor Lighting Perspectives, Savant Systems Inc (GE Lighting), Cree LED, SYSKA, and Virtual Extension.

b. Key factors driving the outdoor lighting market's growth are the increasing adoption of energy-efficient lighting systems, growing government initiatives toward energy efficiency, and rising infrastructure development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.