Oxycodone Drugs Market Size & Trends

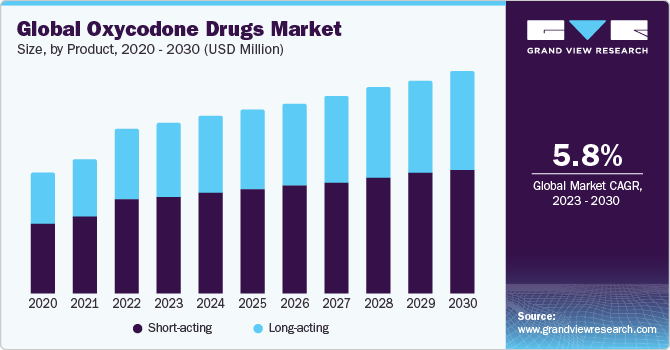

The global oxycodone drugs market is expected to grow at a compound annual growth rate (CAGR) of 5.8 % from 2023 to 2030. This growth is due to the increasing demand for effective pain management solution, and rising prevalence of chronic diseases like arthritis and cancer. Additionally, factors such as ongoing research and clinical trials and focused on oxycodone-based pain management are likely to fuel the market growth.

The rising prevalence of chronic pain diseases is a major factor driving the market. For instance, according to The National Rheumatoid Arthritis Society (NRAS), over 400,000 individuals in the UK were anticipated to have rheumatoid arthritis (RA) in 2021, with it being two to three times more common in women than in men. This burden of RA is creating a demand for opioids such as Oxycodone/acetaminophen. These opioids are prescribed to patients at low dosages for the treatment of chronic pain due to RA. They serve as a better alternative to non-steroidal anti-inflammatory drugs (NSAIDs). Thus, the prevalence of several diseases and the increasing demand for oxycodone drugs for treatment purposes are expected to contribute to the overall market growth.

In addition to the increasing prevalence, the awareness and acceptance of palliative care are contributing to the market growth. Oxycodone drugs, known for their strong pain-relieving properties, are frequently utilized in palliative care to enhance the comfort and well-being of patients. For instance, healthcare organizations and professionals increasingly emphasize palliative care as an essential component of comprehensive medical treatment, and this emphasis has a direct impact on the market growth.

Moreover, the global aging population is contributing to the growth of the market. As people age, conditions like osteoarthritis and associated chronic pain become more prevalent. For instance, the World Health Organization (WHO) reported that between 2015 and 2022, the world's population aged above 60 years is set to double from 12% to 22%. By 2050, an estimated 80% of older individuals will reside in low and middle-income countries. Given that the elderly often require pain management solutions, oxycodone drugs are frequently prescribed to alleviate their discomfort. With the projected growth of the global elderly population, the demand for oxycodone drugs for pain relief among seniors is expected to see a substantial increase. This demographic shift is evident in the rising number of seniors turning to these medications for relief, further fueling the expansion of the market.

Product Insights

On the basis of product type, the short-acting drugs segment accounted for the largest share in 2022. This is because doctors often recommend them as the first choice for treatment. Additionally, the demand is increasing because people experience more side effects with prolonged-release (PR) formulations. These PR medications can lead to long-lasting side effects, especially for those new to oxycodone and elderly patients just starting treatment.

Short-acting drugs have become increasingly popular, especially in treating cancer-related pain. For instance, a study from April 2021 in the Cancer Journal found that over 53.8% of advanced cancer patients were given short-acting oxycodone drugs, indicating a significant shift in pain management. This increased use of short-acting opioids in pain management is boosting the demand for this type of product.

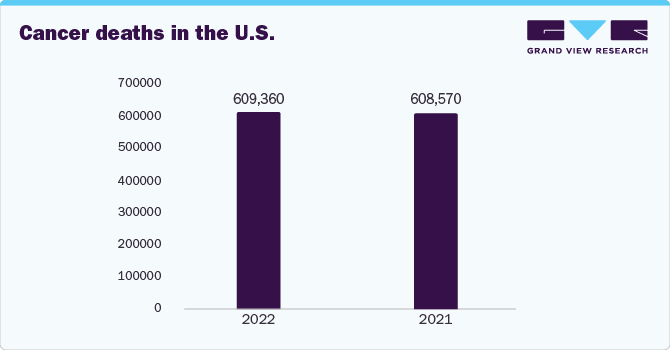

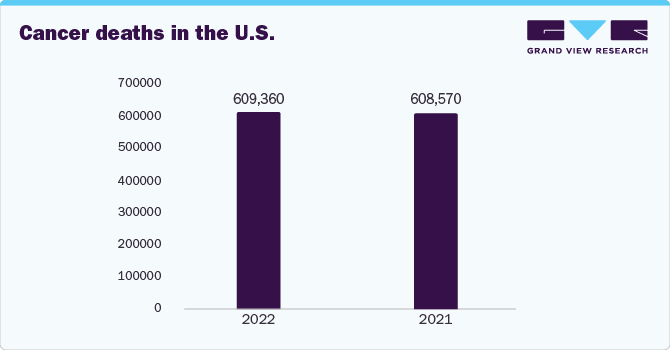

Furthermore, the growing number of cancer cases is expected to boost the growth of the short-acting drugs segment. This drug is commonly used for cancer pain management. According to a recent study published in the Cancer Journal in 2021, it stated that over 53.8% of people with cancer were prescribed short-acting oxycodone drugs, underscoring their growing significance in palliative care. With the rise in the number of cancer diagnoses worldwide, the demand for oxycodone drugs is likely to increase.

End-use Insights

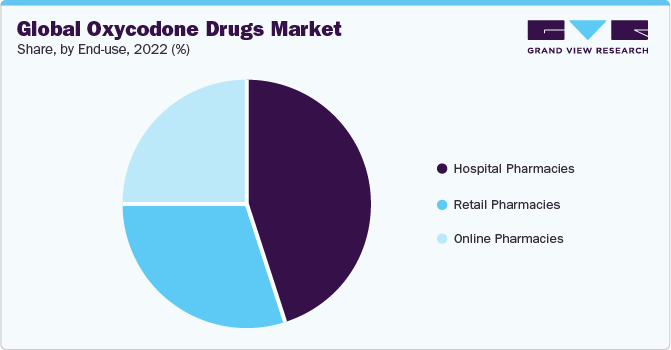

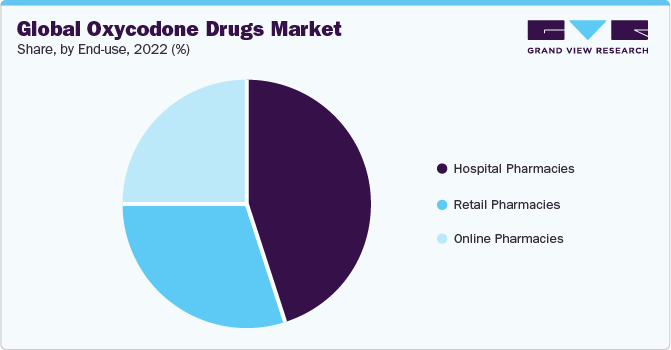

The hospital pharmacies segment accounted for the largest share in 2022 as hospitals serve as crucial hubs for patients suffering from various pain-related conditions such as cancer, post-surgery recovery, and chronic illnesses. This creates a substantial demand for oxycodone drugs within the hospital setting, as healthcare professionals often prescribe these medications to address severe and chronic pain. Furthermore, the stringent regulatory oversight and controlled nature of oxycodone necessitate close monitoring and supervision, readily available within the controlled environment of a hospital pharmacy. This emphasizes the significance of hospital pharmacies as the leading end-use segment in the oxycodone drugs market.

Regional Insights

North America dominated the market in 2022. This growth is attributed to the rising prevalence of chronic pain, cancer, and arthritis, which has driven the demand for pain management solutions like oxycodone in the region. For instance, the American Cancer Society (ACS) data for 2022 projected a significant 1.9 million new cancer cases in the United States this year, with breast cancer being the most prevalent. Additionally, oxycodone drugs have played a crucial role in alleviating pain for individuals dealing with conditions like rheumatoid arthritis (RA) and osteoarthritis. As the burden of these orthopedic diseases continues to rise across North America, the demand for oxycodone drugs has increased. For instance, a report from the Arthritis Community Research and Evaluation Unit (ACREU) in 2021 revealed that around 15% of Canadians aged 20 and above were diagnosed with osteoarthritis. These factors collectively contribute to the prominence of North America in the oxycodone drugs market.

Key Companies & Market Share Insights

Key players operating in the market include Teva Pharmaceutical Industries Ltd, Endo Pharmaceuticals Inc, Sun Pharmaceutical Industries Ltd, Mallinckrodt Pharmaceuticals, Akrimax Pharmaceuticals LLC, Zyla Life Sciences, and Mundipharma Pty Limited. These market participants consistently work towards new product development, engage in M&A activities, and form other strategic alliances to explore new market avenues. The following are some instances of such initiatives:

-

In November 2020, Purdue Pharma, the manufacturer of OxyContin, pleaded guilty to fraud and kickback conspiracies, admitting to misleading the public about OxyContin's safety and effectiveness and its role in the U.S. opioid epidemic.

-

Protega Pharmaceuticals LLC introduced RoxyBond (oxycodone) immediate-release tablets in the U.S. in July 2022, aimed at managing severe pain when other treatments are insufficient.