- Home

- »

- Plastics, Polymers & Resins

- »

-

Packaging Laminates Market Size, Industry Report, 2030GVR Report cover

![Packaging Laminates Market Size, Share & Trends Report]()

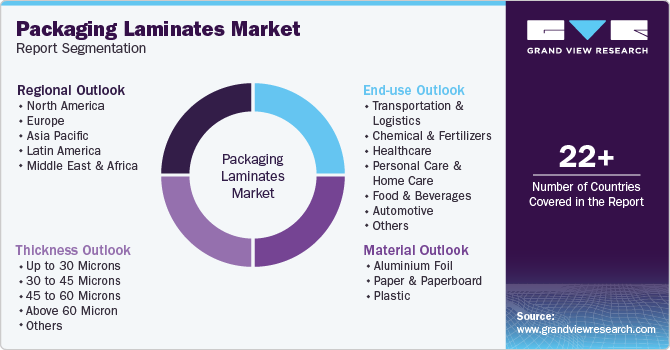

Packaging Laminates Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Aluminium Foil, Paper & Paperboard), By Thickness (Up To 30 Microns, 30 To 45 Microns, Above 60 Micron), By End-use (Transportation & Logistics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-563-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaging Laminates Market Summary

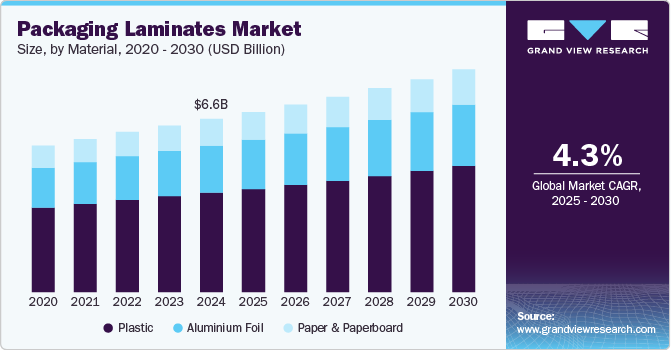

The global packaging laminates market size was estimated at USD 6.55 billion in 2024 and is projected to reach USD 8.43 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The growing demand for longer shelf life in pharmaceuticals and food products is pushing companies to use high-barrier laminates for better protection.

Key Market Trends & Insights

- Asia Pacific packaging laminates market dominated the global market and accounted for largest revenue share of 37.47% in 2024.

- China’s packaging laminates market is fueled by a strong push for automation in food processing and pharmaceutical sectors.

- By material, plastic segment dominated the industry, accounting for a market share of 57.31% in 2024.

- By end-use, food and beverage segment dominated the industry, accounting for a market share of 38.46% in 2024.

- By thickness, 30 to 45 microns segment dominated the industry, accounting for a market share of 35.21% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.55 Billion

- 2030 Projected Market Size: USD 8.43 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

Additionally, rising investments in advanced packaging technologies are helping improve product safety and appearance, driving market growth. The packaging laminates market is witnessing a significant transition toward sustainable and recyclable materials, driven by regulatory pressure and shifting consumer preferences.

Brands are increasingly adopting mono-material laminates and solvent-free adhesives to meet stringent environmental mandates and to position themselves as environmentally responsible. This trend is most visible in the food and personal care packaging segments, where companies are aggressively investing in R&D to reduce material complexity without compromising barrier performance.

As extended producer responsibility (EPR) frameworks and circular economy policies gain momentum across developed and emerging economies, the demand for eco-designed laminates is expected to reshape product innovation pipelines and procurement strategies over the coming years.

Drivers, Opportunities & Restraints

One of the primary growth drivers for the packaging laminates market is the accelerated expansion of the global packaged food and beverage sector. Rapid urbanization, changing consumption patterns, and the growing demand for convenience foods are collectively increasing the need for high-performance laminated materials that ensure extended shelf life, moisture resistance, and contamination protection.

Advancements in multilayer laminate technology are allowing manufacturers to develop packaging that can withstand complex supply chains, particularly in cold chain logistics. As global retail networks expand and e-commerce channels integrate with direct-to-consumer food delivery models, laminated packaging solutions are becoming indispensable to ensure product integrity and brand consistency.

Emerging economies such as India, Vietnam, Brazil, and parts of Sub-Saharan Africa present a lucrative opportunity for packaging laminates manufacturers due to rising disposable incomes and evolving retail infrastructure. With increased consumer exposure to branded and premium packaged goods, sectors such as pharmaceuticals, nutraceuticals, and personal care are demonstrating exponential growth potential.

A major constraint impacting the packaging laminates market is the volatility in the cost and availability of key raw materials, including aluminum foil, polyethylene, polyester and adhesives. These fluctuations are influenced by geopolitical disruptions, energy price shocks and global logistics challenges that continue to strain the upstream value chain. Small and medium-sized converters, in particular, face significant margin pressure due to their limited pricing power and dependency on third-party suppliers.

Material Insights

Plastic segment dominated the packaging laminates market across the material segmentation in terms of revenue, accounting for a market share of 57.31% in 2024. Plastic-based laminates continue to dominate the market due to their exceptional versatility, cost efficiency and strong performance in maintaining barrier properties. In 2024, brands across sectors are emphasizing lightweight and durable packaging that supports high-speed filling lines and product safety during long-haul logistics. The surge in flexible packaging formats, especially stand-up pouches and sachets, is heavily reliant on multilayer plastic laminates that offer heat sealability, puncture resistance and visual appeal. Moreover, new grades of recyclable polyethylene and polypropylene films are reinforcing plastic’s competitive edge amid tightening sustainability targets.

The paper and paperboard segment is emerging as a rapidly growing with a CAGR of 4.77% over the forecast period in the packaging laminates market. The rapid growth of eco-conscious consumer segments and governmental regulations around single-use plastics are creating a strong tailwind for paper and paperboard-based laminates. These materials are gaining traction, particularly in dry food, personal care, and retail packaging, where biodegradability and recyclability are key differentiators.

The integration of water-based coatings and bio-barrier layers makes paper laminates more functional, enabling them to compete with plastic variants in selective moisture-sensitive thicknesses. This trend encourages converters and brand owners to invest in hybrid structures that offer functionality and environmental compliance.

Thickness Insights

30 to 45 microns dominated the packaging laminates market across the thickness segmentation in terms of revenue, accounting for a market share of 35.21% in 2024. Laminates within the 30 to 45 microns range are gaining preference in industries where light weight, high speed, and low-cost packaging are critical. This thickness category is particularly suited for single-use sachets and smaller volume packs in personal care, condiments and pharmaceuticals. As companies look to optimize material use without compromising barrier integrity, this segment is benefiting from material innovation and downgauging strategies.

The 45 to 60 microns segment is expected to grow at a substantial CAGR of 4.7% from 2025 to 2030. Increased demand for medium-barrier packaging that balances durability and flexibility is propelling the growth of 45 to 60 microns laminates. These structures are widely used in dairy, snack foods, and frozen goods where moderate mechanical strength and moisture resistance are necessary. Recent supply chain pressures have led manufacturers to favor this segment for its compatibility with varied product types and filling technologies. Furthermore, it allows cost-effective customization in multilayer formats while ensuring compliance with food safety standards.

End-use Insights

Food and beverage dominated the packaging laminates market across the end use segmentation in terms of revenue, accounting for a market share of 38.46% in 2024, driven by rising demand for processed and ready-to-eat products across urban markets. Consumers are placing a premium on freshness, tamper-proofing and portion control, all of which laminates are well-positioned to deliver.

The adoption of smart packaging features such as freshness indicators and QR codes is further accelerating laminate usage in premium food categories. Growth in direct-to-consumer delivery models and online grocery platforms is also reinforcing the need for protective, visually appealing laminated packaging.

The healthcare segment is projected to witness a substantial CAGR of 4.8% through the forecast period. In the healthcare sector, the rising demand for tamper-evident, high-barrier and contamination-resistant packaging is a core driver of laminate consumption. With increased global focus on sterile drug delivery and medical diagnostics, especially post-COVID, laminated packaging is essential for blister packs, sachets and strip packs. Regulatory standards from agencies such as the FDA and EMA are pushing for packaging materials that maintain drug efficacy throughout shelf life. Innovation in anti-counterfeiting technologies embedded in laminated layers is also gaining momentum to secure pharmaceutical supply chains.

Regional Insights

Asia Pacific packaging laminates market dominated the global market and accounted for largest revenue share of 37.47% in 2024 and is expected to grow at the fastest CAGR of 4.7%. Rapid urbanization, population growth and expanding middle-class demographics are driving unprecedented demand for affordable, single-serve and shelf-stable packaged goods. This surge is pushing both domestic and multinational brands to invest in efficient, cost-effective laminates that offer printability, durability and protection across diverse climate zones. Additionally, the booming e-commerce ecosystem in countries like India, Indonesia and Vietnam is prompting adoption of flexible laminated formats optimized for last-mile delivery and brand visibility.

China’s packaging laminates market is fueled by a strong push for automation in food processing and pharmaceutical sectors, which require advanced laminated films compatible with high-speed machinery. With government initiatives like “Made in China 2025,” there is also a focus on localizing the production of high-performance barrier films to reduce reliance on imports. Meanwhile, consumer demand for traceability and premium packaging in fast-growing health, wellness and pet food categories is encouraging innovation in laminate structures with QR-enabled smart labeling and anti-counterfeit features.

North America Packaging Laminates Market Trends

In North America, the growing demand for packaged functional foods, organic snacks and nutraceuticals is a key driver for the packaging laminates market. Consumers are increasingly seeking extended shelf life, clear labeling, and convenience packaging, which is pushing brands to adopt multi-layered laminates with enhanced barrier and printability properties. The region is also witnessing a resurgence in regional food manufacturing investments, which is directly boosting demand for localized, performance-driven laminate solutions that comply with FDA and USDA safety regulations.

In the U.S., stringent sustainability commitments from major CPG companies and retail chains are pushing the shift toward recyclable and mono-material laminates. With the U.S. Plastics Pact and state-level mandates like California's packaging EPR laws, manufacturers are being incentivized to innovate laminate structures that align with circular economy principles. Furthermore, the boom in direct-to-consumer product models, especially in food and health supplements, is demanding high-performance, e-commerce-ready laminated packaging that protects integrity and reduces return rates.

Europe Packaging Laminates Market Trends

Europe’s packaging laminates market is being propelled by regulatory pressure under the EU Green Deal and Packaging and Packaging Waste Regulation (PPWR), which mandate recyclability, compostability and reduced material complexity. Laminates that enable closed-loop recycling or contain bio-based layers are gaining traction across sectors. Additionally, premiumization trends in confectionery, dairy and alcoholic beverages are driving demand for high-end finishes and tactile laminates that deliver superior shelf appeal while meeting sustainability benchmarks.

Key Packaging Laminates Company Insights

The Packaging Laminates Market is highly competitive, with several key players dominating the landscape. Major companies include Amcor Plc, Berry Global Inc., Mondi Plc, Pro Ampac LLC, Constantia Flexibles Group, Coveris Packaging, Andpak Inc., Montebello Packaging Inc., Elitefill Inc., Kimac Industries, C-P Flexible Packaging, Aaron Thomas Company, Inc. The packaging laminates market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Packaging Laminates Companies:

The following are the leading companies in the packaging laminates market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Plc

- Berry Global Inc.

- Mondi Plc

- Pro Ampac LLC

- Constantia Flexibles Group

- Coveris Packaging

- Andpak Inc.

- Montebello Packaging Inc.

- Elitefill Inc.

- Kimac Industries

- C-P Flexible Packaging

- Aaron Thomas Company, Inc.

Recent Developments

-

In December 2024, Dow completed the sale of its flexible packaging laminating adhesives business for USD 150 million to Arkema. The business, part of Dow’s Packaging & Specialty Plastics segment, included five manufacturing sites in Italy, the U.S., and Mexico, and covered solvent-based and solventless laminating adhesives along with heat seal coating products.

-

In March 2025, Valorflex Packaging broadened its market presence by acquiring Jet Packaging Group. The financial details of the deal were not disclosed. This acquisition enables Valorflex to leverage Jet Packaging's expertise and resources, expanding its offerings in the packaging sector.

Packaging Laminates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.81 billion

Revenue forecast in 2030

USD 8.43 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, thickness, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor Plc; Berry Global Inc.; Mondi Plc; Pro Ampac LLC; Constantia Flexibles Group; Coveris Packaging; Andpak Inc.; Montebello Packaging Inc.; Elitefill Inc.; Kimac Industries; C-P Flexible Packaging; Aaron Thomas Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Laminates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the packaging laminates market report based on material, thickness, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminium Foil

-

Paper and Paperboard

-

Plastic

-

-

Thickness Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 30 Microns

-

30 to 45 Microns

-

45 to 60 Microns

-

Above 60 Micron

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation & Logistics

-

Chemical & Fertilizers

-

Healthcare

-

Personal Care & Home Care

-

Food & Beverages

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global packaging laminates market was estimated at USD 6.55 billion in the year 2024 and is expected to reach around USD 6.81 billion in 2025.

b. The global packaging laminates market is expected to grow at a compound annual growth rate of 4.35% from 2025 to 2030, reaching around USD 8.43 billion by 2030.

b. Plastic segment dominated the packaging laminates market across the material segmentation in terms of revenue, accounting for a market share of 57.31% in 2024. Plastic-based laminates continue to dominate the market due to their exceptional versatility, cost efficiency and strong performance in maintaining barrier properties.

b. The key players in the packaging laminates market include Amcor Plc, Berry Global Inc., Mondi Plc, Pro Ampac LLC, Constantia Flexibles Group, Coveris Packaging, Andpak Inc., Montebello Packaging Inc., Elitefill Inc., Kimac Industries, C-P Flexible Packaging, Aaron Thomas Company, Inc.

b. The growing demand for longer shelf life in pharmaceuticals and food products is pushing companies to use high-barrier laminates for better protection. Additionally, rising investments in advanced packaging technologies are helping improve product safety and appearance, driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.