- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Paint Additives Market Size, Share & Growth Report, 2030GVR Report cover

![Paint Additives Market Size, Share & Trends Report]()

Paint Additives Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Rheology Modifiers, Biocides), By Application (Architectural, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-324-9

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

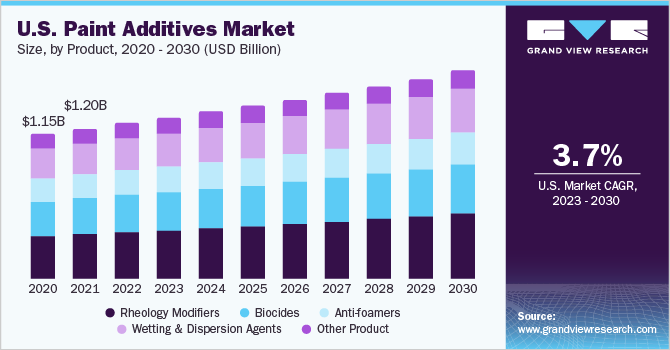

The global paint additives market size was valued at USD 9,056.03 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. The demand for paint additives is attributed to its rich properties such as wetting agents, foam control, and dispersion ability that enhance the surface effectiveness and viscosity of substrate of buildings, automobiles, and others. Paint additives are essential element to increase the consistency and long lasting effects of the paints. The demand for paint and coating is growing at a steady rate owing to increase in consumption from architectural applications and end-use industries such as oil & gas, aerospace, marine, steel industry etc. This in turn is expected to have a positive impact on the market over the forecast period.

The quantity of paints and coatings manufactured worldwide is large, however most of these are produced by regional manufacturers with approximately ten or so dominant global players. These key multinational companies have expanded to other regions or are planning for expansion in any region that has a potential for paint & coating market. Rising demand for paint is expected to boost need for paint additives need over the forecast period.

Increased use of paints and coatings in the construction as well as the automotive sector, to elevate the aesthetical appearance and provide protection from external effects such as water, dust, and others is expected to fuel product growth over the next few years. Increased construction spending and growing automotive sector in emerging countries of Asia Pacific has made it largest region for paint & coating market, which in turn will have a positive impact on the additives demand over the forecast period.

Aerospace sector is a big market for paint and coatings. The four major worldwide commercials for Original Equipment Market (OEM) are: Bombardier, Embraer, Boeing, and Airbus. The aerospace coatings sector is huge sector for meeting consumer demand where companies like AkzoNobel N.V. have split the market into further sub-sectors. This is expected to fuel paint additive demand in this sector over the next few years.

The paint and coating industry faces stringent regulations from EPA, OSHA, EU and other regional agencies worldwide for manufacturing wet paints and coatings. This in turn will have a negative impact on the overall paint additives market over the forecast period. Volatile Organic Compounds (VOC) are required to conform to various statutory regulations and legislations. These organic compounds, which are widely utilized in paints, coatings, and technical applications, are subject to several governmental and federal regulations for controlling VOC emissions and limit human exposure to toxic substances.

Product Insights

Rheology modifiers product segment dominated the market with the highest revenue share of 29.7% in 2022. Its high share is driven by its growing usage as a key ingredient in inks, coatings, and paints. They are used to control the properties and characteristics of fluid products. During application, paints tend to spatter in all directions, have little hiding power and exhibit a much shorter shelf life. By using rheology modifiers, the flow behavior of paints and coatings can be adjusted. Rheology additives can be both organic and inorganic in nature.

Wetting and dispersing agents are used in paints and coatings for preventing the formation of agglomerates. These agents get adsorbed on the surface of the pigments as a spacer. The dispersing and wetting agents, allow the formed agglomerates to separate easily into single particles and then permanently stabilize in a uniform distribution. Paint additives are used in all types of paints and coatings that are further used in industrial, architectural, wood and furniture and automotive applications. For uniform distribution of the paint of on a surface, wetting and dispersion additives are required.

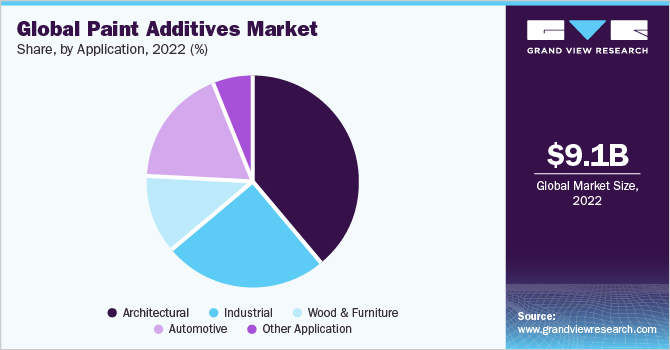

Application Insights

Architectural application segment dominated the market with the highest revenue share of 39.3% in 2022. Its high share is driven by excessive rise in consumption of paint additives to coat buildings and homes. The growth of the building & construction sector across the globe is expected to propel the demand for architectural coating which in turn is expected to boost the demand for paint additives. The paints and coatings are used as deck finishers, roof coatings, and wall paints. In addition, the rising need for green coatings that can be used in interiors is expected to positively impact the market over the forecast period.

Paints are used on automotive surfaces for both protection as well as for decoration purpose. The growth of the automotive sector, especially in the countries of Asia Pacific is expected to impact the market for paint additives. The key factors driving the automotive coatings market are population growth, need for weather protection and improved standards of living. The increased trend of refurbishing, repair and maintenance, of older vehicles is expected to stimulate growth. In addition, the growing number of road accidents in countries with adverse road conditions in mountainous areas are anticipated to fuel the demand for these products over the upcoming years, particularly in Brazil and India. These trends are expected to propel the demand for automotive coatings which in turn is expected to boost the demand for paint additives over the forecast period

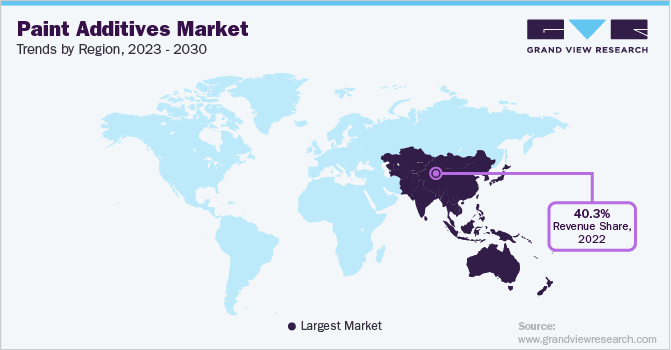

Regional Insights

Asia Pacific dominated the paint additives market with the highest revenue share of 40.3% in 2022. The growing population in Asia Pacific has been the key reason for rising architectural activities and increasing usage of automobiles in the region. The continuous increase in the population in Asia Pacific is driving infrastructure development activities across the region. As China and India are the two most populous countries in the world, they drive the growth of the construction industry in Asia Pacific. Ongoing urbanization and increasing individual disposable income owing to a surge in the number of private sector jobs in China, India, Japan, and South Korea have been driving citizens to construct their own houses for residential and investment purposes in these countries. This is anticipated to fuel the usage of paints, thereby augmenting the demand for paint additives in the region.

Europe is a global manufacturing hub for automobiles owing to the presence of leading automotive companies such as Volkswagen AG, Daimer-Chrysler, and Mercedes-Benz in countries such as Germany, Hungary, Austria, and Romania of the region. The automotive industry extensively utilizes paints and coatings in various applications. The flourishing automotive industry in Europe is anticipated to fuel the demand for paint additives in the region in the coming years. Moreover, rising architectural activities in countries such as Germany, the U.K., France, and Italy in Europe have been fueling the demand for paint additives in the region. The growth of the construction industry in Europe is propelled by supportive government policies and tax relaxations. The flourishing construction industry is expected to propel the consumption of paints in Europe, thereby surging the demand for paint additives in the region in the coming years.

Key Companies & Market Share Insights

The players in the market use the cost advantage approach for their products. The presence of major players such as AkzoNobel N.V, Arkema S.A, BASF SE, Evonik Industries and Ashland Global Holdings Inc. and a few others has intensified the competition in the market. These companies have enough capital to invest into research and development, thus giving them an opportunity to improve upon the quality of their products. Some of the prominent players in the global paint additives market include:

-

AkzoNobel N.V.

-

Arkema

-

BASF SE

-

The Dow Chemical Company

-

Evonik Industries

-

Ashland Global Holdings Inc.

-

ANGUS Chemical Company

-

Buckman Laboratories International, Inc.

-

Cabot Corporation

-

DAIKIN INDUSTRIES, Ltd.,

-

Eastman Chemical Company

-

Elementis Specialties, Inc.

-

Dynea Oy

-

The Lubrizol Corporation

Paint Additives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9372.99 million

Revenue forecast in 2030

USD 12,168.98 million

Growth rate

CAGR of 3.8 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated in

April 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AkzoNobel N.V.; Arkema; BASF SE; The Dow Chemical Company; Evonik Industries; Ashland Global Holdings Inc.; ANGUS Chemical Company; Buckman Laboratories International, Inc.; Cabot Corporation; DAIKIN INDUSTRIES, Ltd.; Eastman Chemical Company; Elementis Specialties, Inc.; Dynea Oy; The Lubrizol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paint Additives Market Report Segmentation

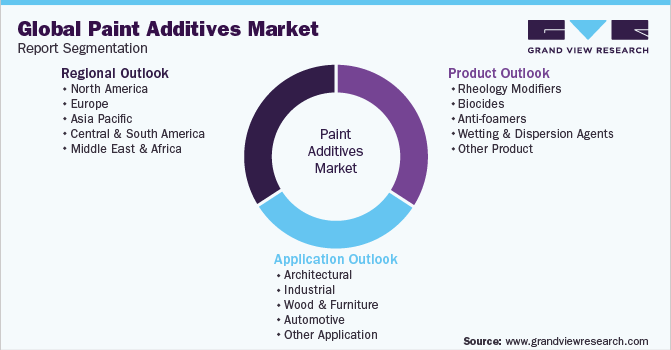

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global paint additives market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rheology Modifiers

-

Biocides

-

Anti-foamers

-

Wetting & Dispersion Agents

-

Other Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Industrial

-

Wood & Furniture

-

Automotive

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global paint additives market size was valued at USD 9,056.03 million in 2022 and is expected to reach USD 9372.99 million in 2023.

b. The global paint additives market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 forecast period to reach USD 12,168.98 million by 2030.

b. Architectural segment dominated the paint additives market with a share of 39.3% in 2022. This is attributable to the rising demand in application such as deck finishers, roof coatings, and wall paints.

b. Some key players operating in the paint additives market include AkzoNobel N.V.; Arkema S.A.; BASF SE; Evonik Industries; Ashland Global Holdings Inc.; ANGUS Chemical Company; and Buckman Laboratories International, Inc.

b. Key factors that are driving the market growth include increasing demand of paints and coatings in construction and automotive industry and rising demand of environment-friendly paints with zero volatile organic compound.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.