- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Paint Protection Film Market Size And Share Report, 2030GVR Report cover

![Paint Protection Film Market Size, Share & Trends Report]()

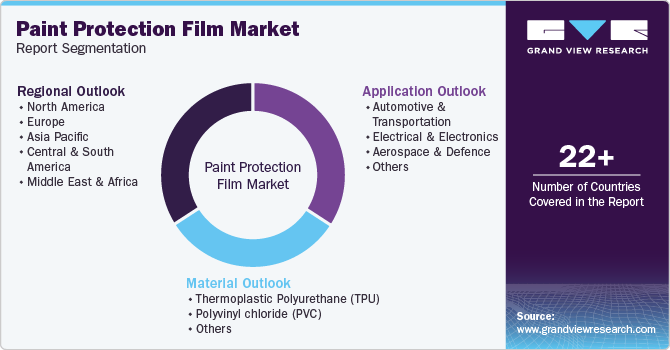

Paint Protection Film Market Size, Share & Trends Analysis By Material (Thermoplastic Polyurethane (TPU), Polyvinyl Chloride (PVC), Others), By End-use, By Region And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-732-2

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Paint Protection Film Market Size & Trends

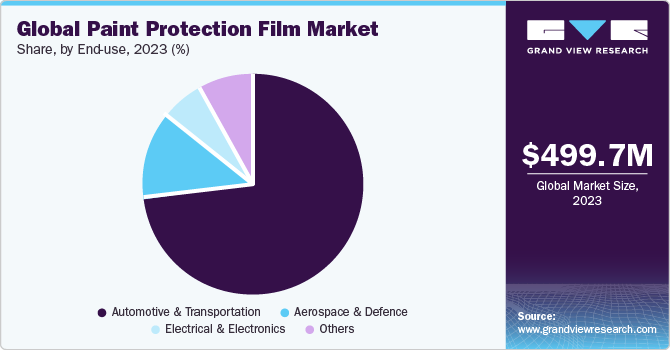

The global paint protection film market size was estimated at USD 499.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. The shift in consumer preference toward keeping the finish of their vehicles intact, coupled with the rising awareness among them for ensuring proper maintenance of their automobiles, is expected to fuel the demand for paint protection films worldwide.

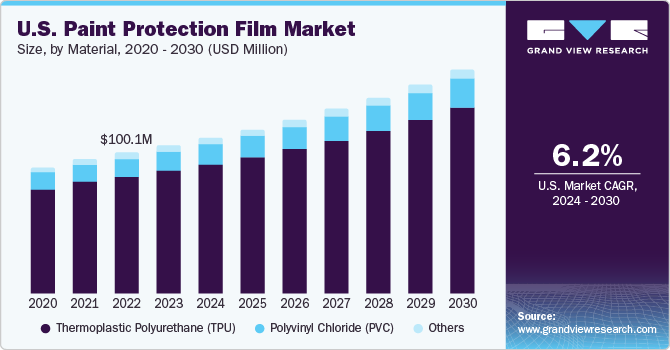

The U.S. is one of the leading automotive markets in the world. As such, the country is expected to witness significant demand for paint protection films throughout the forecast period. The presence of major paint protection film (PPF) manufacturers and many of their installers in the U.S. is anticipated to further boost the market growth for these films in the country from 2024 to 2030. Increasing awareness among consumers regarding the benefits of paint protection films is expected to surge the consumption of these films in the U.S. during the next few years.

Asia Pacific was the fastest-growing market for PPF in 2023, as the establishment of automobile manufacturing facilities in India, Thailand, and Indonesia by leading automotive manufacturers, coupled with rising automotive sales in Asia Pacific, is anticipated to drive the demand for PPFs in the region. This, in turn, leads to market growth for these films in the Asia Pacific during the forecast period.

The market for second-hand or used cars has witnessed considerable growth in Asia Pacific owing to the increasing preference of consumers for mobility. Moreover, the emergence of online portals to promote the selling of used cars and conduct condition checks to estimate the proper value of used cars has enhanced the confidence of consumers to procure them.

For novice drivers, investing in new vehicles will not be economical. As such, they prefer used vehicles over new vehicles, thereby leading to the growth of the used vehicles market in the Asia Pacific. Thus, the flourishing used vehicles market in the region is expected to drive the demand for paint protection films that protect the exterior paint of these cars and reduce their repainting costs.

Market Concentration & Characteristics

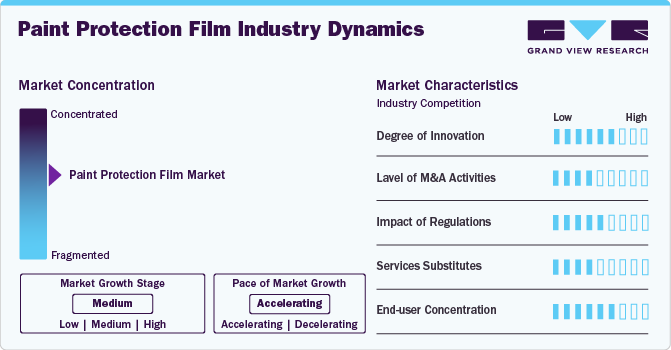

Market growth stage is medium and pace of the market growth is accelerating. The paint protection film industry is characterized by a high degree of innovation owing to the rapid technological advancements.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market.

The market is also subject to increasing regulatory scrutiny. The global paint protection film industry is subject to numerous regulations, guidelines, and restrictions suchas Regulation (EC) No 1935/2004,Regulation (EU) No 10/2011,Commission Regulation (EU) 2016/1416,US FDA Regulations, ASTM D882, U.S. EPA, and EU DIRECTIVE 2000/53/EC, among others.

There is a limited number of direct product substitutes for paint protection films. However, products such as ceramic coatings, car waxes and sealants, vinyl wraps, nanotechnology coatings, self-healing films, custom clear bras, among others, can serve as substitutes.

End-user concentration is a significant factor in the market growth. There are a large number of end-users which drive the demand for paint protection films. Increasing sales of passenger cars and EVs are expected to propel product demand.

Material Insights

Based on material, the global market is segmented into thermoplastic polyurethane (TPU), polyvinyl chloride (PVC), and others. PPFs are high-grade thermoplastic polyurethane films that are either colored or translucent and are professionally applied to the uppermost layer of the vehicle's paint.

The thermoplastic polyurethane (TPU) film segment held a market share of 82.8% in 2023 and is anticipated to maintain its dominance throughout the forecast period. TPU films are produced from TPU pellets manufactured using polyether polyurethanes or polyester polyurethanes. Methylene diphenyl diisocyanate (MDI) is a raw material for manufacturing polyurethane.

These films require low-temperature flexibility, hydraulic stability, and fungal resistance. Various additives are also added to thermoplastic polyurethanes during the process to enhance their properties. Various methods are used to produce TPU films from pellets. These processes include cast films and sheet extrusion, extrusion coating, blown film, wire & cable coating, hose jacketing, and tubing & profile extrusion.

The first and most popular type of paint protection film was polyvinyl chloride (PVC) film. These films are frequently referred to as first-generation paint protection films. PVC films provide some paint protection for automobiles, but because of their rigid construction, the installation might be difficult. In addition, PVC ages in 1 to 3 years before hardening and gradually loses color and elasticity. Another disadvantage is that the vehicle’s paint may flake when PVC sheets are removed.

Application Insights

The automotive & transportation application segment held a 72.7% share of the overall market, in terms of revenue, in 2023. Increasing sales in countries such as India, China, and the U.S., are expected to augment the product demand during the next seven years. For instance, according to the Society of Indian Automobile Manufacturers (SIAM), sales of passenger cars increased from 1.46 million units to 1.75 million units in 2022 compared to the previous year.

The aerospace & defense industry is expected to grow at a CAGR of 5.1% during the forecast period owing to the increasing number of air passengers yearly. Strong growth in the aerospace & defense sector in India, the U.S., and the U.K. is another critical factor driving this segment. Paint protection films have been widely used in numerous end-use industries since their invention, and their demand is expected to grow strongly.

Regional Insights

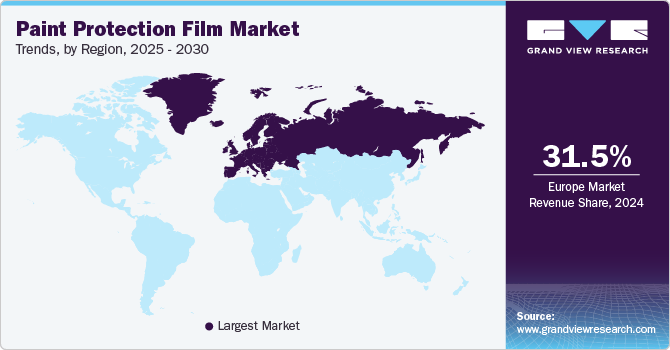

Based on region, Europe held the largest revenue share of 31.6% of the market in 2023. Europe has a robust automotive sector. According to the European Commission, the automotive sector in Europe represents more than 7% share of the European Union GDP and is linked with upstream and downstream industries such as textiles, chemicals, steel & mobility, repair, and ICT.

The automotive sector in Europe consists of leading manufacturers such as Volkswagen AG, Stellantis NV, Renault Group, and Mercedes-Benz Group AG. The region also has assembly lines set up by foreign automobile manufacturers such as Hyundai Motor Company, TOYOTA MOTOR CORPORATION, and Kia. Furthermore, the region has a significant presence of many SMEs specialized in manufacturing automobile components in the EU member countries such as Italy, Spain, France, the Czech Republic, and Hungary, which is expected to play a pivotal role in driving the automotive industry in Europe.

North America is anticipated to grow at a CAGR of 5.9% over the forecast period. Several states in the U.S., including California, New Jersey, Washington, and Louisiana, offer tax credits, exemptions, and rebates for promoting the procurement of electric vehicles (EVs). New Jersey and Washington exempt the sales and use taxes on electric vehicles (EVs), while California offers rebates on the purchase and usage of plug-in hybrid electric vehicles (PHEVs) and other light-duty zero-emission vehicles.

These tax incentives implemented by the different states of the U.S. are anticipated to contribute to the growth of the market for electric vehicles in the country from 2024 to 2030. This, in turn, is anticipated to fuel the consumption of paint protection films applied to exterior parts of vehicles in the U.S. during the coming years.

The growing aerospace & defense industry in North America is further anticipated to fuel the demand for paint protection films in the region. Countries such as the U.S. and Canada are mature automotive markets and are expected to account for significant shares of the demand for pre-owned vehicles in terms of revenue in the coming years. In addition, surging concerns regarding vehicle protection in North America and increasing penetration of paint protection films in various applications are expected to drive the demand for them in the region. The demand for TPU-based paint protection films in North America is expected to be driven by the superior scratch resistance and aesthetic appeal offered by them.

The region is expected to witness increasing demand for fuel-efficient aircraft in the coming years owing to the rising fuel prices. The plans of airlines in the region to modify/replace their existing inefficient aircraft with fuel-efficient airplanes are expected to augment the market growth in the region from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3M and XPEL, Inc.

-

3M is engaged in providing adhesives, sealants, consumer goods, tapes, films, and other allied products. The key business divisions of the company include safety & industrial, healthcare, transportation & electronics, and consumer. Paint protection films are manufactured by the company through its films segment under the safety & industrial business division. 3M produces automotive films, electronics films, paint protection films, window films, and architectural finishes under the brand name Scotchgard. The Scotchgard Paint Protection Film Pro Series offers superior protection to automotive surfaces against weathering, chips, and scratches. Internationally, 3M operates 89 manufacturing facilities in 30 countries.

-

XPEL, Inc. manufactures, distributes, and installs aftermarket automotive products in the U.S., Canada, and the UK. In the U.S., Canada, and parts of Europe, the company operates primarily by selling complete paint protection film solutions directly to independent installers and car dealerships with the products including XPEL protection films, installation training, and access to the company’s proprietary design software, marketing support, and lead generation. The company operates six company-owned installation centers in the U.S. and one installation center each in the UK, and the Netherlands, which serve the wholesale and retail customers. It operates through third-party distributors in the rest of the world, who operate under contracts with the company to distribute and install the company’s products. The product portfolio of XPEL Technologies Corp. includes paint protection films, automotive window films, flat glass window films, and plotters.

-

Beijing Kangde Xin Composite Material Co., Ltd. and Premier Protective Films International are some of the emerging market participants in the market.

-

Beijing Kangde Xin Composite Material Co., Ltd. has three major business segments including new materials, intelligent display, and carbon fiber. The six core markets for the company include healthcare, transportation, consumer products, industrial, energy, and smart cities. KDX Group operates through KDX America LLC, KDX Europe BV, and K3DX display. Kangde Xin Optical Film Materials (Shanghai) Co., Ltd. or KDX Window Films registered in 2014 in Shanghai Pilot Free Trade Zone operates as a subsidiary of KDX Composite Material Co., Ltd. It handles the paint protection and window film business of the KDX Composite Material Co., Ltd.

-

Premier Protective Films International specializes in advanced paint protection films, window tint installations, and radar detector/laser jamming systems. The company is involved in the installation of paint protection films for the automotive industry. For installation purposes, the company uses products manufactured by different companies including Bekaert, Avery, Venture, Llumar, 3M, and Madico. Primarily, Premier Protective Films International uses products from Prestige Film Technologies, which manufactures paint protection films, window films, and screen protection for the automotive industry.

Key Paint Protection Film Companies:

- 3M

- XPEL Inc.

- Schweitzer-Mauduit International, Inc.

- Eastman Chemical Company

- Avery Dennison Corporation

- Saint-Gobain S.A.

- RENOLIT SE

- Ziebart International Corporation

- Hexis S.A.S

- Garware Hi-Tech Films Ltd.

Recent Developments:

- In May 2023, Covestro AG, a Germany-based company, announced the launch of its new production line in Taiwan for the manufacturing of high-performance TPU suited for paint protection film grades. The company also introduced a new series of paint protection film, Desmopan UP TPU, designed for the automotive and wind sectors.

- In October 2022, XPEL, Inc. acquired the paint protection film business of Car Care Products Australia. The Car Care Products Australia is a distributor of automotive protective films with a strong presence in Australia. This acquisition can enable XPEL, Inc. to expand its reach in Australia.

- In July 2022, XPEL, Inc. was selected as the exclusive supplier to Rivian Automotive LLC for its new paint protection film (PPF) factory. The companies will cooperatively develop paint protection films and offer factory direct PPF options for the R1S and R1T vehicle models.

- In February 2022, XPEL, Inc. launched ULTIMATE FUSION, its newest paint protection film offering protection against light scratches, bird droppings, bug acids, and rock chips. ULTIMATE FUSION will be available globally in the second quarter of 2022.

- In June 2022, HEXIS S.A.S. introduced three new paint protection films series under the HEXIS BODYFENCE range. The new film series launched were BFWIDE, DFENCEXTRM, and BODYFENCEXM. The self-healing properties of these films will enable HEXIS S.A.S. to expand its product reach in automobile industry.

Paint Protection Film Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 524.20 million

Revenue forecast in 2030

USD 739.4 million

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in Thousand Sq. Meters, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; XPEL Inc.; Schweitzer-Mauduit International, Inc.; Eastman Chemical Company; Avery Dennison Corporation; Saint-Gobain S.A.; RENOLIT SE; Ziebart International Corporation; Hexis S.A.S; Garware Hi-Tech Films Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paint Protection Film Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paint protection film market report based on material, application, and region:

-

Material Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl chloride (PVC)

-

Others

-

-

Application Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America (MEA)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global paint protection film market size was estimated at USD 499.7 million in 2023 and is expected to reach USD 524.2 million in 2024.

b. The paint protection film market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 739.40 million by 2030.

b. Europe dominated the paint protection film market with a revenue share of 31.6% in 2023, on account of several factors including the presence of high automotive production and consumption in the region.

b. Some of the key players operating in the paint protection film market include KDX Composite Material, 3M Company, Eastman Chemical Company, Premier Protective Films International, Renolit, SWM, Inc., XPEL, Inc., and Avery Dennison Corp.

b. The key factors that are driving the paint protection film market include the growing application scope of the product and the development of high-performance films and innovations in technology to offer sustainable products with minimal environmental impact.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Paint Protection Film Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Distribution Channel Analysis

3.2.2. Raw Material Trends

3.2.3. Technological Overview

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Paint Protection Film Market: Material Estimates & Trend Analysis

4.1. Material Movement Analysis & Market Share, 2023 & 2030

4.2. Paint Protection Film Market Estimates & Forecast, By Material, 2018 to 2030 (Thousand Sq. Meter) (USD Million)

4.3. Thermoplastic Polyurethane (TPU)

4.3.1. Thermoplastic Polyurethane (TPU) Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

4.4. Polyvinyl chloride (PVC)

4.4.1. Polyvinyl chloride (PVC) Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

4.5. Others

4.5.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Chapter 5. Paint Protection Film Market: End-Use Estimates & Trend Analysis

5.1. End-Use Movement Analysis & Market Share, 2023 & 2030

5.2. Paint Protection Film Market Estimates & Forecast, By End-Use, 2018 to 2030 (Thousand Sq. Meter) (USD Million)

5.3. Automotive &Transportation

5.3.1. Automotive &Transportation Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

5.4. Electrical & Electronics

5.4.1. Electrical & Electronics Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

5.5. Aerospace & Defense

5.5.1. Aerospace & Defense Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

5.6. Other Applications

5.6.1. Others Applications Market Revenue Estimates and Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Chapter 6. Paint Protection Film Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2023 & 2030

6.2. North America

6.2.1. North America Paint Protection Film Market Estimates & Forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.2.2. U.S.

6.2.2.1. Key country dynamics

6.2.2.2. U.S. Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.2.3. Canada

6.2.3.1. Key country dynamics

6.2.3.2. Canada Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.2.4. Mexico

6.2.4.1. Key country dynamics

6.2.4.2. Mexico Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3. Europe

6.3.1. Europe Paint Protection Film Market Estimates & Forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.2. Germany

6.3.2.1. Key country dynamics

6.3.2.2. Germany Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.3. UK

6.3.3.1. Key country dynamics

6.3.3.2. UK Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.4. France

6.3.4.1. Key country dynamics

6.3.4.2. France Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.5. Italy

6.3.5.1. Key country dynamics

6.3.5.2. Italy Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.6. Spain

6.3.6.1. Key country dynamics

6.3.6.2. Spain Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.7. Netherlands

6.3.7.1. Key country dynamics

6.3.7.2. Netherlands Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.8. Norway

6.3.8.1. Key country dynamics

6.3.8.2. Norway Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.3.9. Russia

6.3.9.1. Key country dynamics

6.3.9.2. Russia Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Paint Protection Film Market Estimates & Forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.2. China

6.4.2.1. Key country dynamics

6.4.2.2. China Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.3. Japan

6.4.3.1. Key country dynamics

6.4.3.2. Japan Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.4. India

6.4.4.1. Key country dynamics

6.4.4.2. India Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.5. Australia

6.4.5.1. Key country dynamics

6.4.5.2. Australia Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.6. South Korea

6.4.6.1. Key country dynamics

6.4.6.2. South Korea Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.7. Indonesia

6.4.7.1. Key country dynamics

6.4.7.2. Indonesia Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.8. Malaysia

6.4.8.1. Key country dynamics

6.4.8.2. Malaysia Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.4.9. Thailand

6.4.9.1. Key country dynamics

6.4.9.2. Thailand Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.5. Central & South America

6.5.1. Central & South America Paint Protection Film Market Estimates & Forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.5.2. Brazil

6.5.2.1. Key country dynamics

6.5.2.2. Brazil Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.5.3. Argentina

6.5.3.1. Key country dynamics

6.5.3.2. Argentina Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.6. Middle East & Africa

6.6.1. Middles East & Africa Paint Protection Film Market Estimates & Forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.6.2. Saudi Arabia

6.6.2.1. Key country dynamics

6.6.2.2. Saudi Arabia Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.6.3. UAE

6.6.3.1. Key country dynamics

6.6.3.2. UAE Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

6.6.4. South Africa

6.6.4.1. Key country dynamics

6.6.4.2. South Africa Paint Protection Film Market estimates & forecast, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Chapter 7. Paint Protection Film Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share/Position Analysis, 2023

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Product Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. Kangde Xin Composite Material Co. Ltd

7.6.1.1. Participant’s overview

7.6.1.2. Financial performance

7.6.1.3. Product benchmarking

7.6.1.4. Recent developments

7.6.2. 3M

7.6.2.1. Participant’s overview

7.6.2.2. Financial performance

7.6.2.3. Product benchmarking

7.6.2.4. Recent developments

7.6.3. XPEL Inc.

7.6.3.1. Participant’s overview

7.6.3.2. Financial performance

7.6.3.3. Product benchmarking

7.6.3.4. Recent developments

7.6.4. Schweitzer-Mauduit International, Inc. (SWM, Inc.)

7.6.4.1. Participant’s overview

7.6.4.2. Financial performance

7.6.4.3. Product benchmarking

7.6.4.4. Recent developments

7.6.5. Premier Protective Films International

7.6.5.1. Participant’s overview

7.6.5.2. Financial performance

7.6.5.3. Product benchmarking

7.6.5.4. Recent developments

7.6.6. Eastman Chemical Company

7.6.6.1. Participant’s overview

7.6.6.2. Financial performance

7.6.6.3. Product benchmarking

7.6.6.4. Recent developments

7.6.7. Avery Dennison Corporation

7.6.7.1. Participant’s overview

7.6.7.2. Financial performance

7.6.7.3. Product benchmarking

7.6.7.4. Recent developments

7.6.8. Saint-Gobain S.A.

7.6.8.1. Participant’s overview

7.6.8.2. Financial performance

7.6.8.3. Product benchmarking

7.6.8.4. Recent developments

7.6.9. Matrix Films

7.6.9.1. Participant’s overview

7.6.9.2. Financial performance

7.6.9.3. Product benchmarking

7.6.9.4. Recent developments

7.6.10. RENOLIT SE

7.6.10.1. Participant’s overview

7.6.10.2. Financial performance

7.6.10.3. Product benchmarking

7.6.10.4. Recent developments

7.6.11. Ziebart International Corporation

7.6.11.1. Participant’s overview

7.6.11.2. Financial performance

7.6.11.3. Product benchmarking

7.6.11.4. Recent developments

7.6.12. Hexis S.A.S

7.6.12.1. Participant’s overview

7.6.12.2. Financial performance

7.6.12.3. Product benchmarking

7.6.12.4. Recent developments

7.6.13. Orafol Europe GmbH

7.6.13.1. Participant’s overview

7.6.13.2. Financial performance

7.6.13.3. Product benchmarking

7.6.13.4. Recent developments

7.6.14. Sharp line Converting Inc.

7.6.14.1. Participant’s overview

7.6.14.2. Financial performance

7.6.14.3. Product benchmarking

7.6.14.4. Recent developments

7.6.15. Madico Inc.

7.6.15.1. Participant’s overview

7.6.15.2. Financial performance

7.6.15.3. Product benchmarking

7.6.15.4. Recent developments

7.6.16. Garware Hi-Tech Films Ltd

7.6.16.1. Participant’s overview

7.6.16.2. Financial performance

7.6.16.3. Product benchmarking

7.6.16.4. Recent developments

List of Tables

Table 1 List of abbreviation

Table 2 Paint protection film market 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Table 3 Global market estimates and forecasts by region, 2018 - 2030 (Thousand Sq. Meter)

Table 4 Global market estimates and forecasts by region, 2018 - 2030 (USD Million)

Table 5 Global market estimates and forecasts by material, 2018 - 2030 (Thousand Sq. Meter)

Table 6 Global market estimates and forecasts by material, 2018 - 2030 (USD Million)

Table 7 Global market estimates and forecasts by end-use, 2018 - 2030 (Thousand Sq. Meter)

Table 8 Global market estimates and forecasts by end-use, 2018 - 2030 (USD Million)

Table 9 Global market estimates and forecasts by region, 2018 - 2030 (Thousand Sq. Meter)

Table 10 Global market estimates and forecasts by region, 2018 - 2030 (USD Million)

Table 11 North America paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 12 North America paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 13 U.S. paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 14 U.S. paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 15 Canada paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 16 Canada paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 17 Mexico paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 18 Mexico paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 19 Europe paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 20 Europe paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 21 Germany paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 22 Germany paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 23 U.K. paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 24 U.K. paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 25 France paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 26 France paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 27 Italy paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 28 Italy paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 29 Spain paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 30 Spain paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 31 Netherlands paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 32 Netherlands paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 33 Norway paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 34 Norway paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 35 Russia paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 36 Russia paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 37 Asia Pacific paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 38 Asia Pacific paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 39 China paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 40 China paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 41 Japan paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 42 Japan paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 43 India paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 44 India paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 45 Australia paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 46 Australia paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 47 South Korea paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 48 South Korea paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 49 Malaysia paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 50 Malaysia paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 51 Indonesia paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 52 Indonesia paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 53 Thailand paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 54 Thailand paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 55 Central & South America paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 56 Central & South America paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 57 Brazil paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 58 Brazil paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 59 Argentina paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 60 Argentina paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 61 Middle East & Africa paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 62 Middle East & Africa paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 63 Saudi Arabia paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 64 Saudi Arabia paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 65 UAE paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 66 UAE paint protection film market by end-use, 2018 - 2030 (USD Million)

Table 67 South Africa paint protection film market by material, 2018 - 2030 (Thousand Sq. Meter)

Table 68 South Africa paint protection film market by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 QFD modeling for market share assessment

Fig. 6 Information Procurement

Fig. 7 Market Formulation and Validation

Fig. 8 Data Validating & Publishing

Fig. 9 Market Segmentation & Scope

Fig. 10 Paint Protection Film Market Snapshot

Fig. 11 Segment Snapshot (1/2)

Fig. 12 Segment Snapshot (1/2)

Fig. 13 Competitive Landscape Snapshot

Fig. 14 Parent market outlook

Fig. 15 Paint Protection Film Market Value, 2023 (USD Million)

Fig. 16 Paint Protection Film Market - Value Chain Analysis

Fig. 17 Paint Protection Film Market - Price Trend Analysis 2018 - 2030 (USD/Sq. Meter)

Fig. 18 Paint Protection Film Market - Market Dynamics

Fig. 19 Paint Protection Film Market - PORTER’s Analysis

Fig. 20 Paint Protection Film Market - PESTEL Analysis

Fig. 21 Paint Protection Film Market Estimates & Forecasts, By Material: Key Takeaways

Fig. 22 Paint Protection Film Market Share, By Material, 2022 & 2030

Fig. 23 Thermoplastic Polyurethane (TPU) Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 24 Polyvinyl chloride (PVC) Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 25 Others Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 26 Paint Protection Film Market Estimates & Forecasts, By End-Use: Key Takeaways

Fig. 27 Paint Protection Film Market Share, By End-Use, 2023 & 2030

Fig. 28 Paint Protection Film Market Estimates & Forecasts, in Automotive &Transportation, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 29 Paint Protection Film Market Estimates & Forecasts, in Electrical & Electronics, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 30 Paint Protection Film Market Estimates & Forecasts, in Aerospace & Defense, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 31 Paint Protection Film Market Estimates & Forecasts, in Other Applications, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 32 Paint Protection Film Market Revenue, By Region, 2023 & 2030 (USD Million)

Fig. 33 North America Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 34 U.S. Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 35 Canada Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 36 Mexico Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 37 Europe Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 38 Germany Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 39 UK Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 40 France Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 41 Italy Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 42 Spain Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 43 Netherlands Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 44 Norway Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 45 Russia Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 46 Asia Pacific Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 47 China Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 48 India Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 49 Japan Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 50 South Korea Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 51 Australia Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 52 Indonesia Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 53 Malaysia Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 54 Thailand Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 55 Central & South America Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 56 Brazil Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 57 Argentina Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 58 Middle East & Africa Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 59 Saudi Arabia Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 60 UAE Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 61 South Africa Paint Protection Film Market Estimates & Forecasts, 2018 - 2030 (Thousand Sq. Meter) (USD Million)

Fig. 62 Key Company Categorization

Fig. 63 Company Market Positioning

Fig. 64 Key Company Market Share Analysis, 2023

Fig. 65 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Paint Protection Film Material Outlook (Volume, Thousand Sq. Meter, Revenue, USD Million, 2018 - 2030)

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Paint Protection Film End-Use Outlook (Volume, Thousand Sq. Meter, Revenue, USD Million, 2018 - 2030)

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Paint Protection Film Regional Outlook (Volume, Thousand Sq. Meter, Revenue, USD Million, 2018 - 2030)

- North America

- North America Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- North America Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- U.S.

- U.S. Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- U.S. Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- U.S. Paint Protection Film Market, By Material

- Canada

- Canada Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Canada Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Canada Paint Protection Film Market, By Material

- Mexico

- Mexico Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Mexico Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Mexico Paint Protection Film Market, By Material

- North America Paint Protection Film Market, By Material

- Europe

- Europe Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Europe Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- UK

- UK Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- UK Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- UK Paint Protection Film Market, By Material

- Germany

- Germany Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Germany Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Germany Paint Protection Film Market, By Material

- France

- France Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- France Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- France Paint Protection Film Market, By Material

- Italy

- Italy Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Italy Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Italy Paint Protection Film Market, By Material

- Spain

- Spain Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Spain Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Spain Paint Protection Film Market, By Material

- Norway

- Canada Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Canada Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Canada Paint Protection Film Market, By Material

- Netherlands

- Netherlands Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Netherlands Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Netherlands Paint Protection Film Market, By Material

- Europe Paint Protection Film Market, By Material

- Asia Pacific

- Asia Pacific Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Asia Pacific Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- China

- China Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- China Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- China Paint Protection Film Market, By Material

- Japan

- Japan Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Japan Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Japan Paint Protection Film Market, By Material

- India

- India Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- India Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- India Paint Protection Film Market, By Material

- Australia

- Australia Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Australia Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Australia Paint Protection Film Market, By Material

- Thailand

- Thailand Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Thailand Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Thailand Paint Protection Film Market, By Material

- South Korea

- South Korea Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- South Korea Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- South Korea Paint Protection Film Market, By Material

- Indonesia

- Indonesia Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Indonesia Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Indonesia Paint Protection Film Market, By Material

- Malaysia

- Malaysia Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Malaysia Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Malaysia Paint Protection Film Market, By Material

- Asia Pacific Paint Protection Film Market, By Material

- Central & South America

- Central & South America Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Central & South America Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Brazil

- Brazil Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Brazil Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Brazil Paint Protection Film Market, By Material

- Argentina

- Argentina Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Argentina Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Argentina Paint Protection Film Market, By Material

- Central & South America Paint Protection Film Market, By Material

- Middle East and Africa (MEA)

- MEA Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- MEA Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Saudi Arabia

- Saudi Arabia Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- Saudi Arabia Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- Saudi Arabia Paint Protection Film Market, By Material

- South Africa

- South Africa Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- South Africa Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- South Africa Paint Protection Film Market, By Material

- UAE

- UAE Paint Protection Film Market, By Material

- Thermoplastic Polyurethane (TPU)

- Polyvinyl chloride (PVC)

- Others

- UAE Paint Protection Film Market, By End-Use

- Automotive &Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

- UAE Paint Protection Film Market, By Material

- MEA Paint Protection Film Market, By Material

- North America

Paint Protection Film Market Dynamics

Driver: Increasing Consumer Awareness Regarding Automobile Paint Protection

Considering the trend from the recent past, emerging economies like India, Malaysia, Thailand, and Vietnam along with a few Central American countries such as Brazil and Argentina have been at the crux of global automotive industry growth. The growing population coupled with industrialization has resulted in high income levels and a rising standard of living, thereby increasing the demand for personal vehicles. Paint protection films find their origin in military transport and defense applications and continue their use in these industries to date. Consumers believed in spending on repainting the vehicle instead of making use of paint protection films in the past. Over the last few years, this trend has been changing with the retailers and manufacturers of paint protection films observing considerable growth in sales.

This is attributed to the added customer awareness through marketing and expansion into the OEM market. The shift in consumer preference toward keeping the vehicle’s finish intact coupled with the rising awareness for automobile maintenance is expected to boost the demand for paint protection films. Automobile manufacturers saw the added advantage of using these films when they started applying these films on new vehicles. Paint protection film usage in the electrical and electronics sector for mobile phones, keyboards, and screens has increased owing to the increasing consumer awareness regarding the benefits of the product which can drive the consumption of paint protection film over the forecast period.

Driver: High Demand from Automotive Industry

The global automotive industry has been witnessing booming growth and profitability with annual sales reaching pre-pandemic levels in some regions. Over the recent past, there has been a positive outlook in the automotive sector across various regions, from developed markets such as the U.S. to developing markets such as India.

The global automotive industry is growing at a rapid pace on account of the accelerating technological transformations including no petroleum-based fuel or hybrid vehicles, autonomous driving, and new mobility services. The industry is expected to witness significant growth owing to the increasing sales and demand in the emerging economies of India, China, and Brazil. However, the outbreak of COVID-19 in China and other countries in the Asia Pacific, including India, Australia, Thailand, and Malaysia resulted in nationwide or partial lockdowns to contain the spread of coronavirus. The outbreak has also caused a sharp slowdown in the automobile industry, which hindered overall market growth. However, the auto manufacturing sector in the Asia Pacific is slowly resuming its operations due to vaccination drives, which fueled the market growth in 2021.

Restraint: Increasing Use of Ceramic Coating in the Automotive Sector

Ceramic coating is gaining prominence in the automotive sector due to its ability to blend with the paint of the vehicle and the creation of an additional hydrophobic layer of protection. The chemically intrinsic properties of ceramic coating prevent it from breaking down in normal atmospheric conditions during summer or monsoon seasons. In addition, ceramic coating includes matte and gloss finishes, which further make it a viable alternative to paint protection films. Unlike paint protection films, ceramic coating does not require proper installation training and can be easily applied on car surfaces, thus contributing to its adoption in the automotive market. Ceramic coatings exhibit high impact resistance, superior heat resistance, abrasion resistance, and water and chemical resistance, making them suitable to be used as a protective sealant for automotive components such as the undercarriage, wheel hubs, engine bay, and other interior components. Paint protection films face limitations compared to ceramic coating, in terms of vehicle interior components. This drives automotive manufacturers to consider ceramic coatings for vehicle surface protection, thus, posing a significant challenge to the paint protection film market growth. The growing demand for ceramic coating, on account of the benefits offered by it, has witnessed the launching of new products by ceramic coating manufacturers, thus, creating growth opportunities for ceramic coatings in the automotive market. In January 2022, Advanced Nanotech Lab announced to launch of 10H ceramic coating, 9H ceramic coating, and hybrid variants for one of the largest automotive manufacturers in Asia. This is expected to further challenge the paint protection film consumption in Asia Pacific.

What Does This Report Include?

This section will provide insights into the contents included in this paint protection film market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Paint protection film market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Paint protection film market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the paint protection film market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for paint protection film market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of paint protection film market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Paint Protection Film Market Categorization:

The paint protection film market was categorized into three segments, namely material (Thermoplastic Polyurethane (TPU), Polyvinyl chloride (PVC)), application (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense) and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The paint protection film market was segmented into material, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The paint protection film market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; Mexico; Germany; France; the UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Paint protection film market companies & financials:

The paint protection film market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Beijing Kangde Xin Composite Material Co., Ltd - The company was established in August 2001 and is headquartered in China. The company has three major business segments including new materials, intelligent display, and carbon fiber. The six core markets for the company include healthcare, transportation, consumer products, industrial, energy, and smart cities. KDX Group operates through KDX America LLC, KDX Europe BV, and K3DX Display. Kangde Xin Optical Film Materials (Shanghai) Co., Ltd. or KDX Window Films registered in 2014 in the Shanghai Pilot Free Trade Zone operates as a subsidiary of KDX Composite Material Co., Ltd. It handles the paint protection and window film business of the KDX Composite Material Co., Ltd. The KDX Window Films business caters to fields such as 3D smart displays, new energy electric cars, pre-coating materials, and optical materials. Its product portfolio includes automotive films, architectural films, safety & security films, and paint protection films. As of December 2021, the company employed about 4,000 personnel globally.

-

3M - was established in 1902 with the name Minnesota Mining and Manufacturing Company and is headquartered in Minnesota, U.S. The company is listed on the New York Stock Exchange and is engaged in providing adhesives, sealants, consumer goods, tapes, films, and other allied products. The key business divisions of the company include safety & industrial, healthcare, transportation & electronics, and consumer. Paint protection films are manufactured by the company through its films segment under the safety & industrial business division. 3M produces automotive films, electronics films, paint protection films, window films, and architectural finishes under the brand name Scotchgard. The Scotchgard Paint Protection Film Pro Series offers superior protection to automotive surfaces against weathering, chips, and scratches. Internationally, 3M operates 89 manufacturing facilities in 30 countries. As of December 2021, the company had an employee strength of 95,000 personnel.

-

XPEL, Inc.- The company was founded in 1997 and is based in Texas, U.S. The company was formerly known as XPEL Technologies Group, which changed its name in June 2018. It manufactures, distributes, and installs aftermarket automotive products in the U.S., Canada, and the UK. In the U.S., Canada, and parts of Europe, the company operates primarily by selling complete paint protection film solutions directly to independent installers and car dealerships with the products including XPEL protection films, installation training, and access to the company’s proprietary design software, marketing support, and lead generation. The company operates six company-owned installation centers in the U.S. and one installation center each in the UK, and the Netherlands, which serve wholesale and retail customers. It operates through third-party distributors in the rest of the world, who operate under contracts with the company to distribute and install the company’s products. The product portfolio of XPEL Technologies Corp. includes paint protection films, automotive window films, flat glass window films, and plotters. In China, the company operates through a sole distributor named Shanghai Xing Ting Trading Co., Ltd. As of December 2021, XPEL, Inc. operates 11 company-owned installation centers globally with an employee strength of 709 personnel.

-

SWM, Inc. - SWM or Schweitzer-Mauduit International, Inc. was established in 1995 after its spin-off from the Kimberly-Clark Corporation and is based in Georgia, U.S. The company and its subsidiaries provide custom solutions and advanced materials for various markets globally such as agriculture, packaging & beverage, consumer goods, energy, erosion control, filtration, healthcare, home industrial, infrastructure, reverse osmosis, safety solutions, transportation, and tobacco. SWM, Inc. operates its business through two different segments, including engineered papers (EP) and advanced materials & structures (AMS). Under the advanced materials & structures, the company is involved in manufacturing and selling highly engineered resin-based non-woven, films, and nets. The overall product portfolio of SWM, Inc. includes engineered composites, fibers & yarn, films, netting, non-woven, paper, soil stabilization, tapes & adhesives, tobacco products, and tubing & parts. The films division comprises antimicrobial films, aperture films, glass lamination interlayer films, graphic films, industrial textile lamination films, medical films, medical films for dental alignment, medical utility applications, paint & surface protective films, specialty films, and tekra films.

-

Premier Protective Films International: - The company was established in 1997 and headquartered in California, the U.S. The company is also known as Premier Mobile and specializes in advanced paint protection films, window tint installations, and radar detector/laser jamming systems. The company is involved in the installation of paint protection films for the automotive industry. For installation purposes, the company uses products manufactured by different companies including Bekaert, Avery, Venture, Llumar, 3M, and Madico. Primarily, Premier Protective Films International uses products from Prestige Film Technologies, which manufactures paint protection films, window films, and screen protection for the automotive industry. The company is mainly into paint protection film installation for super-premium cars. Other business segments include dealing with pre-owned cars, and installation of films on window glasses to prevent accidental damages.

-

Eastman Chemical Company: Eastman Chemical was established in 1920 and is headquartered in Tennessee, U.S. The company's business consists of four segments such as additives & functional products, advanced materials, chemical intermediates, and fibers. The major markets served by the company include transportation, building and construction, consumables, tobacco, consumer durables, industrials & chemicals processing, food, feed and agriculture, and health and wellness. In the advanced materials segment, Eastman Chemical Company manufactures and markets plastics, films, and polymers for end-use markets such as consumables, medical & pharma, building & construction, durables & electronics, and transportation. The paint protection film business of the Eastman Chemical Company is operated by Eastman Performance Films, LLC, and the paint protection films are marketed under the brand names LLumar, SunTek, and V-KOOL.

-

Avery Dennison Corporation: The company was established in 1935 and headquartered in California, the U.S. It is a global material science and manufacturing company specializing in the design and production of labeling and functional materials. The business segments of the company include label & graphic materials, retail branding & information solutions, and industrial & healthcare materials. Under the label & graphic materials, Avery Dennison Corporation produces paint protection films for vehicle & transportation applications. It markets its paint protection film under the brand name Supreme. The major industries served by the company include advertising and promotions, apparel, architecture and buildings, automotive, consumer packaged goods, durable goods and equipment, electronic & electrical, food, medical and healthcare, retail, RFID, supply chain & logistics, and transportation. As of December 2021, the company is present at 287 locations in more than 50 countries with an employee strength of more than 35,000 people.

-

Saint-Gobain S.A.: The company was founded in 1665 in Paris and headquartered in Courbevoie, France. The company started its operations in mirror manufacturing with the business expanding to the construction of a variety of construction and high-performance materials. The key areas served by the company are construction (Residential and commercial), civil engineering & infrastructure, automobile & transportation, aeronautical & aerospace, defense & security, health, industrial, and household appliances. Saint-Gobain’s manufacturing plant in Massachusetts is involved in manufacturing coatings and plastic films for industrial applications. It provides a solution for automotive paint protection needs and manufactures advanced products for use in the automotive industry. The product for paint protection is named Saint-Gobain CSPro, which was designed using the latest urethane film technology. The film can heal itself when scratched and return to the gloss level from the original application over time. As of December 2021, Saint-Gobain S.A. has a presence in 75 countries with a total employee strength of more than 166,000 people.

-

Matrix Films: The company was founded in 1982 and is headquartered in Massachusetts, U.S. The company manufactures, sells, and installs urethane-based films for automobiles. PremiumShield and PremiumShield Elite are two different grades of the product used widely for automobile applications. The product, PremiumShield Elite comes with a lifetime warranty and provides clear paint protection films. Protective Solutions, Inc. is the leading installer, which uses PremiumShield products for premium automobiles. The company provides PremiumShield Cut Studio software to help customers with templates. Matrix Films has satellite offices and warehouses across the UK and the U.S. In October 2021, Eastman Chemical Company acquired the business assets of Matrix Films.

-

RENOLIT SE: The company was established in 1946 and headquartered in Worms, Germany. The company operates as a subsidiary of JM Holding GmbK & Co. KGaA. RENOLIT SE was formerly known as Renolit-Werke GmbH and changed its name to Renolit in 2003. It manufactures high-quality plastic films and related products for technical applications. The major industries served by the company include automotive, home & building, packaging, maritime, healthcare, wind energy, and visual communication. The product range for the automotive industry includes digital printing films and car wrapping products, composites, tapes, paint protection films, and pressed sheets. The company serves the building industry with products including geo membranes, composites, interior finishing products, windows and facades, roofing membranes, tents & awnings, and roofing & cladding sheets. The company caters to civil engineering applications with hydraulic works, underground works, and environmental protection. It also offers films for furniture and door in-fills, composites, stretch ceilings, and tapes for furniture surfaces. RENOLIT SE manufactures paint protection films for automotive and sign & graphics segments. Its transparent film provides surface protection for numerous applications such as posters, digital prints, books, or vehicle paint finishes. For floor graphic applications the company has a structural embossing for an anti-slip surface. As of 31st December 2021, the employee strength of the company is 5,084 people working in 19 production sites, and 14 sales offices in over 20 countries.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Paint Protection Film Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-