- Home

- »

- Renewable Chemicals

- »

-

Palmitic Acid Market Size, Share And Trends Report, 2030GVR Report cover

![Palmitic Acid Market Size, Share & Trends Report]()

Palmitic Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Soap & Detergent, Personal Care And Cosmetics, Greases And Lubricants, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-052-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Palmitic Acid Market Size & Trends

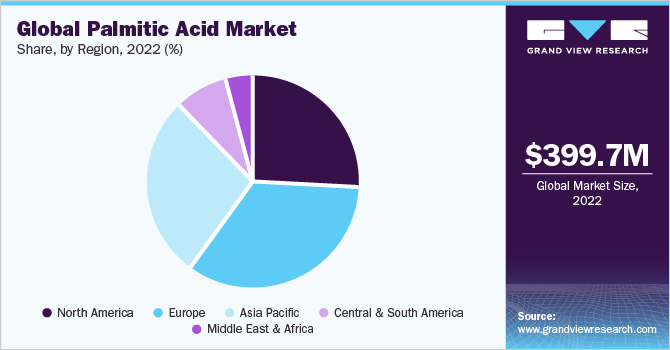

The global palmitic acid market size was valued at USD 399.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. Growing utilization of palmitic acid in the formulation of several esters, metallic soaps, and surfactants in cosmetics, fatty alcohols, fatty amines, and agricultural chemicals is anticipated to trigger market growth in the near future. Palmitic acid is most commonly used in surfactant and soap manufacturing due to its ability to keep the skin smooth and moisturized. It also brings hardness to the soap when saponified, whereas linoleic acid and oleic acid provide softness. Initially, the hydrogenation of palmitic acid is done, which produces acetyl alcohol, and this compound is further used for the production of detergents and soaps. Furthermore, it is also used in make-up products to hide blemishes.

Palmitic acid is widely utilized as an essential feedstock for the production of cosmetics and personal care products for skin care, hair care, etc. In addition, it is also used in the manufacturing of soaps and detergents. Surging consumption of cosmetics and personal care products and increasing use of soaps and detergents by almost every household globally are expected to be the key driver for the growth of the market.

Cosmetics and personal care products form an essential part of human life. They are regularly used by the global population. Growing concerns to protect skin and hair from dust and pollution have been driving the demand for cosmetics and personal care products worldwide over the past years. The consumption of cosmetics and personal care products has further seen a surge due to the rising spending power of consumers and the increasing disposable income of the masses in countries such as China, India, the U.S., Germany, and the U.K.

The rising usage of soaps and detergents by a vast majority of the global population is another driver triggering the demand for palmitic acid worldwide. This acid is extensively used as a raw material for the production of soaps and detergents. Soaps are commonly used products for residential and commercial applications. They are easily available at supermarkets and local grocery stores. In addition, detergents are mainly used for day-to-day activities such as dishwashing and laundering in every household worldwide. Increasing consumption of soaps and detergents is anticipated to fuel the demand for palmitic acid in the coming years.

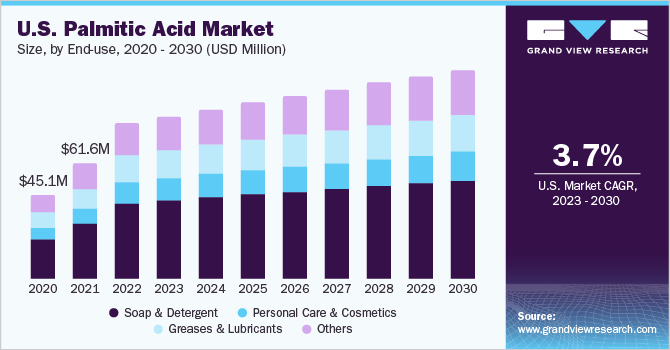

End-use Insights

Soaps & detergents end-use segment dominated the market with the highest revenue share of over 48% in 2022. This can be attributed to the increasing use of palmitic acid in soaps and detergents due to its excellent cleansing and foaming properties. It is used as a raw material for the production of various types of soaps and detergents, such as laundry soaps, dishwashing liquids, shampoos, and body washes.

In soap production, it is often used as a hardening agent to increase the durability and longevity of the soap bar. It also helps to create a rich lather and provides a creamy texture to the soap. In detergent production, it is used as a surfactant and emulsifier to help break down and remove dirt and grease from fabrics and surfaces. It also helps to stabilize the detergent formulation and improve its overall performance.

Also, the growing demand for dispersants as they provide stability, protection from harmful UV rays, and coating strength. It also helps in improving the workability of fluid. Due to such properties, it is widely used in the paint & coatings industry, which is anticipated to drive the market.

Also, the growing demand for palmitic acid in the manufacturing of greases and lubricants due to its excellent lubricating properties. Greases and lubricants are used to reduce friction and wear between mechanical parts, which improves the performance and lifespan of machines and equipment. It is used as a thickening agent in the production of greases, which helps to maintain a consistent texture and improve its adhesive properties. Greases made with palmitic acid have excellent water resistance and are ideal for use in outdoor applications or in wet environments.

Additionally, in lubricant production, it is used as a base oil or as an additive to enhance the lubricating properties of the final product. It helps to reduce friction and wear between moving parts, which results in smoother operation and longer equipment lifespan.

Moreover, the product is often used in the formulation of rust preventatives and metalworking fluids. It provides a protective barrier against corrosion and oxidation, which helps to extend the lifespan of metals and alloys. Overall, the demand for greases and lubricants is increasing in various industries such as automotive, aerospace, and industrial manufacturing, and palmitic acid is becoming an increasingly popular ingredient due to its excellent lubricating and protective properties.

Regional Insights

The Europe region dominated the market with the highest revenue share of over 33% in 2022.This growth is attributed to the presence of numerous end users in the region. Furthermore, with the high production of soaps & detergents, and cosmetic products in the region, Europe is estimated to continue its dominance in the near future. AkzoNobel N.V., BASF SE, Emery Oleochemical, Vantage Specialty Chemicals and Godrej Industries Chemicals, are key producers of palmitic acid.

As per Cosmetics Europe (European trade association for the cosmetics and personal care industry) the European cosmetics and personal care market is, alongside the USA, the largest market for cosmetic products in the world including Germany, France, Italy, the U.K., Spain, and Poland. This will further boost the demand for palmitic acid owing to its increasing use in cosmetics and personal care products like emollients and moisturizers.

Furthermore, Europe is a leading raw material provider of palm oil and other vegetable oil such as olive oil for the production of palmitic acid and has refineries of palm oil in Denmark, the Netherlands, Belgium, France, the U.K., Germany, Sweden, and Italy. Abundance of sustainable raw materials is produced in the region owing to initiatives of the U.K. government for fully sustainable vegetable oil production in the region. Additionally, the presence of end-use giant players like Unilever and L’Oréal is estimated to boost the market for palmitic acid in Europe.

Asia Pacific region is estimated to grow at a CAGR of 3.4% by 2030. This is attributed to the increasing demand for product from India, China, and other developing countries of Asia Pacific like Indonesia, Malaysia, and Thailand. Rising population and increasing disposable income can be seen in India and China resulting in increasing demand for personal care and food and beverages. This is further estimated to rise the demand for palmitic acid in the region.

Key Companies & Market Share Insights

The global palmitic acid market is highly fragmented, with several small and medium-sized players operating in the market. The market is also characterized by intense competition, with companies focusing on product differentiation, pricing strategies, and geographical expansion to gain a competitive advantage. For example, VVF LLC offers a range of bio-based lubricants and greases made from renewable raw materials, including palmitic acid.

These companies are constantly involved in research and development activities to improve their production process and product quality. They also focus on expanding their product portfolio and increasing their market presence through strategic partnerships, collaborations, and mergers and acquisitions. For instance, Kao Chemicals has developed a bio-based palmitic acid derived from palm oil, which is used in the production of various personal care and household products. Some prominent players in the global palmitic acid market include:

-

ADM

-

Akzo Nobel N.V.

-

BASF SE

-

Emery Oleochemicals

-

Vantage Specialty Chemicals

-

KLK OLEO

-

IOI Oleochemicals

-

Acme Synthetic Chemicals.

-

Kao Chemicals

Global Palmitic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 415.9 million

Revenue forecast in 2030

USD 519.0 million

Growth rate

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

ADM; Akzo Nobel N.V.; BASF SE; Emery Oleochemicals; Vantage Specialty Chemicals; KLK OLEO; IOI Oleochemicals; Acme Synthetic Chemicals.; Kao Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Palmitic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global palmitic acid market report based on end-use, and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Soap & Detergent

-

Personal care and Cosmetics

-

Greases and Lubricants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global palmitic acid market size was estimated at USD 399.7 million in 2022 and is expected to reach USD 415.9 million in 2023.

b. The global palmitic acid market is expected to grow at a compound annual growth rate of 3.3% from 2023 to 2030 to reach USD 519 million by 2030.

b. Europe dominated the palmitic acid market with a share of 33.8% in 2022. This is attributable to growing awareness for the product and high production of soaps and detergents in the region.

b. Some key players operating in the palmitic acid market include ADM, Akzo Nobel N.V., BASF SE, Emery Oleochemicals, Vantage Specialty Chemicals, KLK OLEO, IOI Oleochemicals, Acme Synthetic Chemicals, Kao Chemicals, and others.

b. Key factors that are driving the market growth include growing utilization of palmitic acid in the formulation of several esters, metallic soaps, and surfactants in cosmetics, fatty alcohols, fatty amines, and agricultural chemical

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.