- Home

- »

- Renewable Chemicals

- »

-

Fatty Amines Market Size And Share, Industry Report, 2033GVR Report cover

![Fatty Amines Market Size, Share & Trends Report]()

Fatty Amines Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Primary, Secondary, Tertiary), By Application (Agrochemicals, Oilfield Chemicals, Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-939-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fatty Amines Market Summary

The global fatty amines market size was estimated at USD 4,660.5 million in 2024 and is projected to reach USD 7,420.02 million by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The market demand for fatty amines is increasingly supported by their critical role in anticaking agent formulations in agrochemicals, particularly within the fertilizer industry.

Key Market Trends & Insights

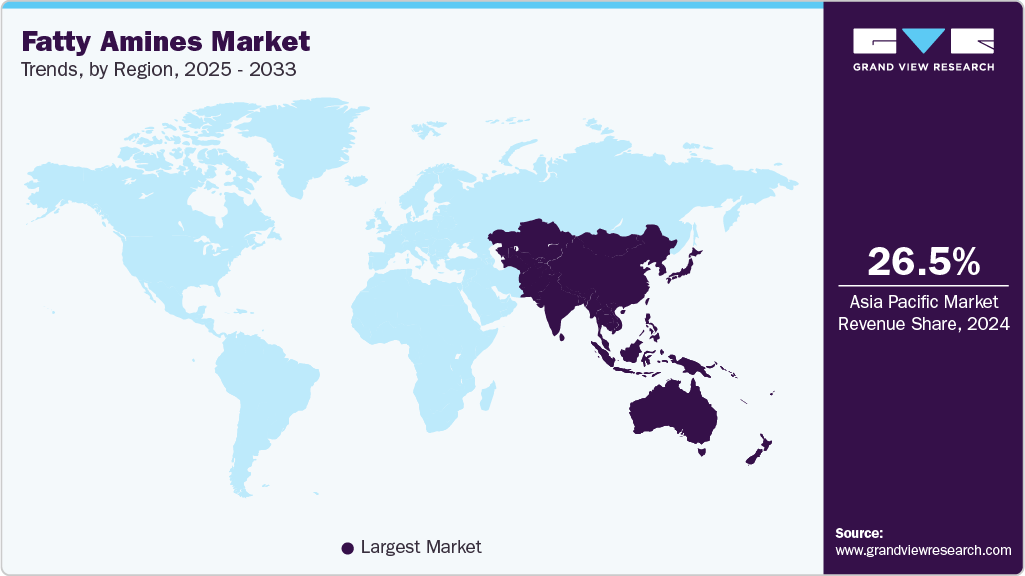

- Asia Pacific dominated the fatty amines market with the largest revenue share of 26.5% in 2024.

- The global fatty amines market is projected to grow at a CAGR of 5.3% from 2025 to 2033.

- By product, the primary fatty amines market is expected to witness the fastest growth of 5.8% from 2025 to 2033.

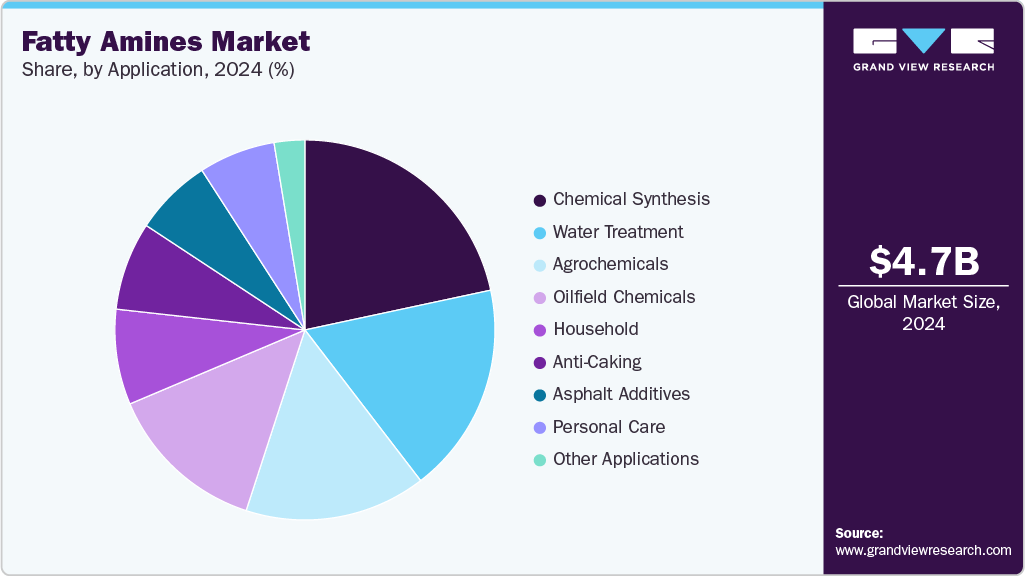

- By application, chemical synthesis dominated the fatty amines market with a revenue share of 21.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,660.5 Million

- 2033 Projected Market Size: USD 7,420.02 Million

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

Unlike short-chain amines, fatty amines possess long, nonpolar hydrophobic alkyl chains along with polar hydrophilic groups, making them highly effective as crystal habit modifiers. Their strong adsorption capability enables them to form a hydrophobic coating on fertilizer granules, minimizing moisture absorption and thereby reducing the formation of bridges between particles, a key cause of caking. This functional advantage directly contributes to their rising demand in fertilizer manufacturing, where maintaining product integrity during storage and transport is essential. Fatty amines prevent caking and help control dust generation by binding fine particles to the fertilizer grains through oily or waxy formulations.

This reduces abrasion and friction between particles, enhancing handling and shelf life. In addition, cost-effective alternatives such as tertiary short-chain amines are being considered, and primary and secondary fatty amines continue to demonstrate superior performance in anticaking applications. As the fertilizer industry expands and prioritizes product stability and environmental compatibility, the demand for high-performance fatty amines will remain strong, driving market growth in developed and emerging regions.

Rising demand for liquid detergent and fabric softeners, the industrial investments in the developed economies are expected to accelerate the market growth. In addition, low cost of raw materials and ample availability, coupled with low toxicity levels and low production cost, are the dynamics that are predicted to open lucrative growth opportunities over the forecast period.

The primary fatty amines are estimated to witness the fastest growth owing to their quality of being used as a basic raw material to produce secondary and tertiary amines, which is anticipated to drive the growth of this product in the forthcoming years. In addition, tertiary amines are used as ore floatation, fuel additives, chemical intermediates, and corrosion inhibitors, accelerating the demand for tertiary fatty amines.

Moreover, tertiary fatty amines have emerged as the largest application segment owing to the significant rise in demand for the product from developed and developing economies due to their wide-ranging abilities. Furthermore, the U.S. market is anticipated to witness steady growth owing to the high demand for the tertiary product, which is utilized in various end-use products.

Fatty amines are mainly used in the paints and coatings industry as they offer multifunctional performance properties and act as epoxy curing agents. Rising spending on construction in the emerging economies of Asia Pacific and the Middle East, owing to population expansion coupled with strong economic development, is expected to affect the product demand over the forecast period.

In emerging economies, the rate of economic growth was high, as it has provided governments with a substantial amount of capital to invest in public infrastructures such as hospitals, offices, and housing societies. The development of private-sector construction firms in China, India, and the UAE is estimated to further subsidize construction spending in the forthcoming years.

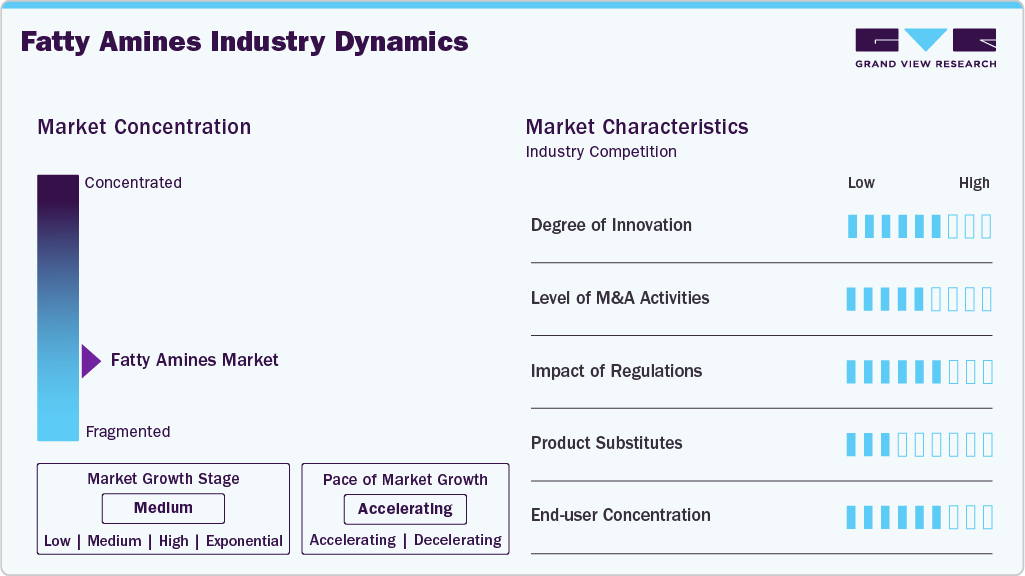

Market Concentration & Characteristics

The fatty amines industry is moderately fragmented, with dominance by a few large, vertically integrated chemical producers. These leading companies leverage economies of scale, in-house raw material sourcing from natural oils or fatty acids, and robust global distribution networks to maintain strong competitive positions. Their integration across the oleochemical value chain, from feedstock processing to amine synthesis, ensures cost efficiency, consistent product quality, and reliable supply to key end-use sectors such as agriculture, personal care, water treatment, and textiles.

At the same time, emerging players in the Asia-Pacific and Middle East regions are expanding their market share by tapping into abundant local feedstocks, low energy costs, and increasing domestic demand. These regional manufacturers, supported by strategic investments in oleochemical and amine production facilities within industrial zones, focus on price-competitive markets and high-volume applications, including agrochemicals, asphalt additives, and fabric softeners. This evolving dynamic, characterized by global consolidation among established players and regional growth driven by cost advantages, continues to shape the competitive structure of the fatty amines industry.

However, the fatty amines industry faces several challenges, with one major restraint being the growing environmental and regulatory pressures surrounding the use of amine-based chemicals, particularly in agrochemical and water treatment applications. Concerns over toxicity, biodegradability, and potential bioaccumulation have led to stricter regulations, especially in North America and Europe, limiting the use of certain fatty amine derivatives in formulations.

Product Insights

The tertiary segment led the market with the largest revenue share of 39.95% in 2024, due to its wide range of applications in personal care products. Tertiary fatty amines, synthesized from fatty alcohols and dimethylamine using advanced catalytic processes, play a vital role in personal care product formulations. These amines, often converted into quaternary ammonium compounds, serve as effective conditioning agents, emulsifiers, and mild surfactants. In hair care, compounds like behentrimonium chloride are derived from tertiary amines and used in conditioners and rinses to reduce static and improve manageability. In skincare, they act as emulsifiers in lotions and creams, providing a smooth, stable texture. Tertiary amine derivatives such as lauryl dimethylamine oxide are also incorporated in hand soaps and dishwashing liquids for gentle yet effective cleansing. In addition, quaternized forms like cetrimonium chloride offer antimicrobial properties, making them suitable for disinfectants and antiseptic formulations. Their multi-functionality and adaptability make tertiary fatty amines indispensable in modern personal care applications.

The primary segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2033, during the forecast period, due to its wide range of applications across multiple industries. These organic compounds, derived from fatty acids, are crucial in producing surfactants, detergents, corrosion inhibitors, lubricants, agrochemicals, and personal care products. Their versatility and effectiveness in enhancing chemical performance make them increasingly valuable in textiles, agriculture, and automotive manufacturing sectors. In addition, there is a need for chemical surfactants, where fatty primary amines are essential components. Their use significantly improves the efficiency and sustainability of cleaning agents and personal care formulations. This is particularly important as consumers and industries shift toward eco-friendly, high-performance solutions.

Application Insights

The chemical synthesis segment led the market with the largest revenue share of 21.66% in 2024, due to its use as amine-ended polyalkylene glycol derivatives, highly effective as dispersants and adjuvants in chemical synthesis in agrochemical applications. These compounds offer superior performance in stabilizing aqueous formulations of active ingredients, especially in high-electrolyte environments such as those containing water-soluble herbicides like glyphosate. Their unique structure, combining a long-chain hydrophobic (C22-C60) hydrocarbyl group derived from polymerized fatty acids or aralkyl-substituted phenols with hydrophilic amine-ended polyethylene glycol, allows fatty amines to disperse solid agrochemicals in water efficiently. In addition, fatty amine-based surfactants are gaining preference for suspension concentrates, suspoemulsions, and sprayable aqueous dispersions. Their ability to enhance the performance of herbicides, fungicides, and other crop protection agents, even under challenging formulation conditions, contributes significantly to their growing adoption.

The asphalt additives segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2033 during the forecast period, due to their wide use in road construction, surface sealing, and various industrial coating applications, including automotive and pipeline protection. After setting, these emulsions develop desired asphalt characteristics as the asphalt droplets coalesce and adhere to surfaces following water evaporation. To restore the stiffness, elasticity, and brittleness physical properties of aged asphalt, emulsified systems, particularly oil-in-water or asphalt-in-water emulsions incorporating fatty amines, are employed. Fatty amines act as effective emulsifiers in these emulsions, enabling stable dispersion, aiding the curing process, and enhancing the compatibility and workability of the asphalt mix. However, conventional emulsifiers, including some fatty amine derivatives, may present challenges such as high cost, limited availability, or environmental concerns, prompting the need for more sustainable and efficient alternatives.

Regional Insights

Asia Pacific dominated the fatty amines market with the largest revenue share of 26.53% in 2024, owing to the high level of technological innovations in the personal and household care sector in countries like India and China. The demand for tertiary fatty amines has witnessed a surge in Asia Pacific, which accounts for the maximum share, due to its extensive applications and flexible properties. Advantageous petrochemical amendments and regulations are expected to further propel the product demand during the forecast period. Moreover, the consumption of household and personal care products in Japan and the developing economies like China and India has been observed to have steady growth over the past. It is anticipated to contribute to the market in the forthcoming years.

The fatty amines market in China accounted for the largest market revenue share in Asia Pacific in 2024, owing to its key role in personal care products used as conditioning agents, emulsifiers, and surfactant precursors. Derived from fatty acids, they contribute to the stability, texture, and performance of formulations such as shampoos, creams, and lotions. Their ability to modify surface properties makes them essential for skin and hair care applications. With a growing focus on sustainability, plant-based fatty amines are gaining importance as eco-friendly functional ingredients.

Europe Fatty Amines Market Trends

The fatty amines market in Europe accounted for the second-largest market revenue share in 2024. This can be credited to using fatty amines in water treatment applications, driven by strict environmental regulations, a heightened focus on sustainability, and increasing concerns over water quality. Countries such as Germany, France, and the Netherlands are at the forefront of investing in advanced water and wastewater treatment technologies to comply with the EU’s environmental standards, including the Water Framework Directive and REACH regulations. Fatty amines, especially primary and tertiary types, are valued in these applications for their strong cationic surfactant properties. They function effectively as flocculants, corrosion inhibitors, and dispersants, playing a key role in coagulation and flocculation processes by aiding in the aggregation and removal of suspended particles. In addition, fatty amine derivatives are used in scale and corrosion control, particularly in industrial boilers and cooling systems, and sludge conditioning to enhance dewatering and reduce operational costs.

North America Fatty Amines Market Trends

The fatty Amines market in North America is anticipated to grow at the fastest CAGR during the forecast period, owing to the demand from detergent and surfactant manufacturers, where these compounds are essential intermediates. Fatty amines, especially tertiary amines, are widely used to produce cationic surfactants and amine oxides, key ingredients in household and industrial cleaning products. The region's well-established cleaning product industry, coupled with rising demand for eco-friendly and performance-enhancing formulations, continues to drive the consumption of fatty amines. In addition, advancements in green chemistry and bio-based surfactants are prompting manufacturers in North America to adopt sustainable fatty amine derivatives in detergent applications.

Middle East & Africa Fatty Amines Market Trends

The fatty amines market in the Middle East & Africa is experiencing strong growth, primarily driven by the key role of tallow amine-based fatty amine, as oilfield chemicals that play a crucial role in the oil and gas industry, where energy production is a dominant sector. Its application is driven by its excellent surfactant properties and long hydrophobic chain, making it highly effective in multiple oilfield chemical formulations. One of its primary uses is as a corrosion inhibitor, where it forms a protective layer on metal surfaces to prevent rusting and degradation caused by moisture, brine, and acidic environments. In addition, tallow amine is used as both an emulsifier and demulsifier, helping to manage oil-water emulsions during extraction and processing, thus improving oil-water separation and operational efficiency. It also disperses heavy hydrocarbons such as asphaltenes and paraffins, which can clog pipelines and reduce flow, enhancing flow assurance.

Latin America Fatty Amines Market Trends

The fatty amines market in Latin America is witnessing steady growth, largely driven by their critical role as surfactants, dispersants, and adjuvants in crop protection formulations. Soya amine, derived from soybean oil, is valued for its excellent emulsifying and dispersing abilities, making it ideal for herbicide and fungicide formulations that require effective distribution of active ingredients. Its biodegradability also supports the rising demand for environmentally sustainable agrochemical inputs. In addition, coco amine, sourced from coconut oil, is widely used in pesticide formulations for its strong wetting and emulsifying properties, ensuring better coverage and adhesion on plant surfaces. As agrochemical producers increasingly seek high-performance, plant-based, and eco-friendly ingredients, fatty amines like soya and coco amines are becoming indispensable, reinforcing their growing market.

Key Fatty Amines Company Insights

Some of the key players operating in the fatty amines industry include Evonik and Kao Corporation.

-

Evonik, headquartered in Essen, Germany, is a leading global chemical company and a dominant, mature player in the fatty amines industry. With decades of amine and surface chemistry expertise, Evonik offers an extensive portfolio of fatty amines and their derivatives, including primary, secondary, and tertiary amines tailored for a wide range of industrial and specialty applications. Evonik’s fatty amines deliver essential performance attributes such as emulsification, hydrophobicity, anti-static behavior, surface activity, and corrosion inhibition, making them indispensable in end-use industries like agriculture as adjuvants, personal and home care as conditioning agents, oil & gas as corrosion inhibitors, textiles, and water treatment. Backed by vertically integrated production and global manufacturing sites, Evonik ensures consistent quality, robust supply chains, and regional responsiveness. Its advanced R&D centers, particularly in Germany, the U.S., and Asia, focus on green chemistry, sustainable synthesis methods, and performance optimization tailored to customer-specific needs. Evonik also leads the development of eco-friendly fatty amine solutions, including biogenic and low-VOC formulations.

KLK OLEO and Indo Amines Limited are emerging market participants in the fatty amines industry.

-

KLK OLEO, headquartered in Malaysia, is an emerging and dynamic player in the global fatty amines industry, steadily expanding its presence across key regions such as Asia-Pacific, Europe, and the Americas. Traditionally recognized for its strength in oleochemicals, KLK OLEO is increasingly integrating advanced fatty amine technologies into its product portfolio to address the growing demand for high-performance, sustainable, and biodegradable surfactants. Its fatty amines are used extensively in personal care, home care, agriculture, oilfield chemicals, and water treatment applications. Through strategic investments, vertical integration, and technology collaborations, KLK OLEO is enhancing its capability to deliver consistent quality, regulatory-compliant, and customized fatty amine solutions tailored to global customer needs. The company emphasizes sustainability, leveraging renewable feedstocks and green chemistry principles to support environmentally responsible production. In addition, KLK OLEO offers comprehensive value-added services such as technical consultation, application development, and supply chain reliability, positioning itself as a trusted and agile partner in the evolving global fatty amines industry.

Key Fatty Amines Companies:

The following are the leading companies in the fatty amines market. These companies collectively hold the largest market share and dictate industry trends.

- India Glycols Ltd

- Indo Amines Limited

- Qida Chemical Pty Ltd

- Shandong Dafeng Biotechnology Co., Ltd.

- Global Amines Company Pte. Ltd.

- Huntsman International LLC.

- Solvay

- KLK OLEO

- Evonik

- PT. Ecogreen Oleochemicals

- Kao Corporation

Recent Developments

-

In April 2023, KLK OLEO, a major global player in oleochemicals, has completed the acquisition of a controlling stake in Italy-based Temix Oleo SpA. This move enhances KLK OLEO’s product portfolio and market presence in the fatty acid and derivatives sector, especially in Europe. Temix Oleo, known for producing esters derived from renewable fatty acids, caters to industries such as lubricants, cosmetics, ceramics, coatings, rubber, and plastics. The acquisition aligns with KLK’s strategy to expand its specialty chemicals segment and reinforces its position in the value-added fatty acid derivatives market. This consolidation also improves KLK OLEO's access to key customers and expertise in ester-based applications, driving further growth and innovation in the fatty acid space.

-

In February 2025, KLK OLEO has established a new representative office, KLK OLEO India (KLKOI), in Mumbai as part of its global expansion. This strategic move enhances the company's presence in the Indian Subcontinent and strengthens its position in the fatty acid market. As a key producer of basic oleochemicals, including Fatty Acids, KLK aims to better serve local industries such as home & personal care, pharmaceuticals, and industrial chemicals. The new office will support relationship building with regional customers and partners while promoting sustainable, high-quality fatty acid solutions to meet India's growing market demand.

Fatty Amines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,912.1 million

Revenue forecast in 2033

USD 7,420.02 million

Growth rate

CAGR of 5.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Russia; Turkey; Denmark; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

India Glycols Ltd; Indo Amines Limited; Qida Chemical Pty Ltd; Shandong Dafeng Biotechnology Co. Ltd.; Global Amines Company Pte. Ltd.; Huntsman International LLC; Solvay, KLK OLEO; Evonik; PT. Ecogreen Oleochemicals; Kao Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

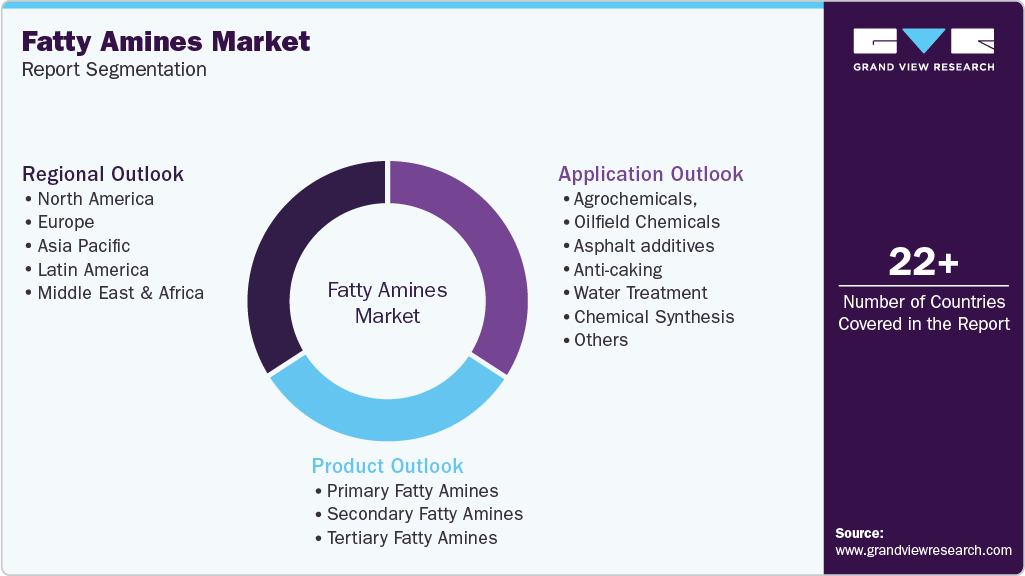

Global Fatty Amines Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fatty amines market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Primary Fatty Amines

-

Secondary Fatty Amines

-

Tertiary Fatty Amines

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Agrochemicals,

-

Oilfield Chemicals

-

Asphalt additives

-

Anti-caking

-

Water Treatment

-

Chemical Synthesis

-

Personal Care

-

Household

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

Russia

-

Denmark

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fatty amines market size was estimated at USD 4,660.5 million in 2024 and is expected to reach USD 4,912.1 million in 2025.

b. The global fatty amines market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach USD 7,420.2 million by 2033.

b. The tertiary fatty amines segment led the market and accounted for the largest revenue share of 40.0 % in 2024, due to its wide range of applications in personal care products.

b. Some of the key players operating in the Fatty Amines Market include India Glycols Ltd, Indo Amines Limited, Qida Chemical Pty Ltd, Shandong Dafeng Biotechnology Co. Ltd., Global Amines Company Pte. Ltd., Huntsman International LLC, Solvay, KLK OLEO, Evonik, PT. Ecogreen Oleochemicals, Kao Corporation.

b. The growth is attributed to fatty amines ’s is increasingly supported by their critical role in anticaking agent formulations in agrochemicals, particularly within the fertilizer industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.