- Home

- »

- Consumer F&B

- »

-

Pandan Tea Market Size, Share And Growth Report, 2030GVR Report cover

![Pandan Tea Market Size, Share & Trends Report]()

Pandan Tea Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Loose Leaves, Powder, Tea Bags), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-426-5

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pandan Tea Market Size & Trends

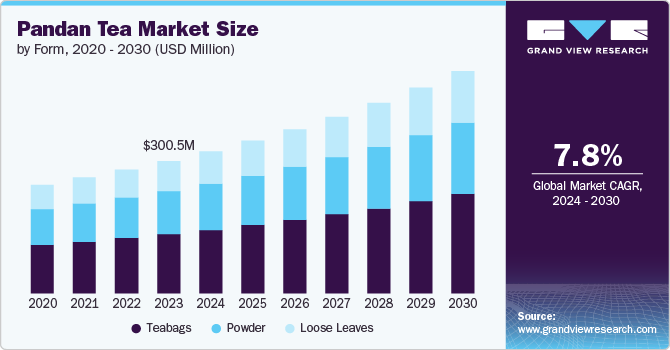

The global pandan tea market size was estimated at USD 300.5 million in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. Pandan leaves are a staple in Southeast Asian cuisine, cherished for their sweet, floral fragrance, which elevates many dishes, particularly desserts. The leaves are not only prized for their culinary uses, but they are also rich in antioxidants, vitamins, and minerals. Traditionally consumed as tea in countries such as Indonesia, Malaysia, and Thailand, pandan tea is gaining popularity beyond its regional origins.

The growing consumer awareness about the health benefits of herbal teas, including pandan tea, is a significant driver. Pandan leaves are rich in antioxidants, and their tea is believed to aid in digestion, reduce blood sugar levels, and have anti-inflammatory properties. Health-conscious consumers are seeking alternatives to sugary drinks and caffeinated beverages, leading to greater acceptance of herbal teas. Moreover, the rise of the wellness culture and the emphasis on organic and natural products have positioned pandan tea favorably among other herbal options.

The market is predominantly strong in Southeast Asia, particularly in countries like Thailand, Malaysia, and Indonesia, where pandan leaves are a common ingredient in traditional cuisine. However, the market is expanding globally, especially in regions with a growing interest in herbal and wellness products, such as North America and Europe.

Companies that focus on innovative product development, such as creating ready-to-drink pandan-infused beverages, tea blends, or functional foods, can capture a larger share of the market. E-commerce platforms are also expected to play an essential role in reaching a broader audience, making it easier for consumers across the globe to access pandan tea.

Consumers are increasingly seeking beverages that offer health benefits beyond simple hydration. Pandan tea, known for its antioxidant properties, anti-inflammatory effects, and potential to aid digestion, aligns well with this trend. The demand for functional teas that support wellness and healthy lifestyles is boosting the popularity of pandan tea.

The market for pandan tea is set for sustained growth, driven by innovations in product formulations, campaigns, and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Form Insights

The tea bags segment accounted for a share of 44.69% of the global revenue in 2023. Teabags offer a convenient, pre-portioned way to brew tea without the need for measuring or additional tools. This appeals to busy consumers who value quick and easy preparation, especially in fast-paced environments like workplaces or on-the-go situations. Teabags allow for easier control over the strength of the brew, as consumers can simply adjust the steeping time. This control appeals to both new and seasoned tea drinkers who might be exploring pandan tea for the first time. Moreover, they are the most common and widely available format for tea, making them easily accessible to a broader audience. Retailers and supermarkets typically stock teabags over loose-leaf tea due to their popularity, ensuring that pandan teabags are more likely to be found in a variety of outlets, from local stores to global chains.

The loose leaves segment is expected to grow at a CAGR of 8.1% from 2024 to 2030. Many consumers are increasingly seeking authentic and traditional tea experiences. Pandan loose leaves provide a more natural and unprocessed option compared to teabags, appealing to tea connoisseurs and those who prefer a richer, more nuanced flavor profile. This interest in authenticity is driving demand for loose leaves over more processed tea formats. The trend toward personalized and DIY tea blends is gaining traction, with consumers mixing pandan loose leaves with other herbs, spices, or teas to create unique blends. This customization capability is a significant factor in the rising demand for loose leaves, as it allows consumers to experiment and tailor their tea to their specific tastes.

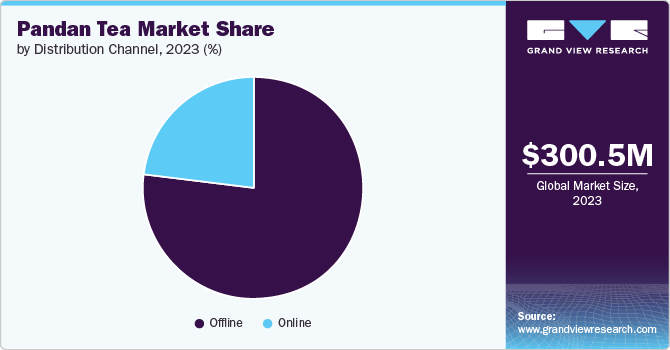

Distribution Channel Insights

The sales of pandan tea through offline channels accounted for a revenue share of 76.95% in 2023. Companies producing pandan tea have established partnerships with major retail chains such as supermarkets, hypermarkets, and convenience stores. These collaborations ensure that pandan tea is widely available to a broad consumer base. Through these partnerships, pandan tea brands can penetrate markets more effectively and establish a strong presence in both urban and rural areas. This widespread availability helps in maintaining a majority market share. Offline channels like supermarkets and convenience stores offer consumers the ease of picking up pandan tea during their regular shopping trips. This convenience encourages repeat purchases.

The sales of pandan tea through online channel is expected to grow at a CAGR of 8.9% from 2024 to 2030. Online shopping provides unmatched convenience, enabling consumers to purchase pandan tea from the comfort of their homes at any time. Brands can harness digital marketing tools to target specific demographics, enhancing the impact of advertising campaigns. Platforms such as Instagram, Facebook, and Twitter are utilized to promote pandan tea products, engage with customers, and direct traffic to online stores. In addition, online reviews and ratings allow potential buyers to make informed decisions based on the experiences of other consumers.

Regional Insights

The pandan tea market in North America captured a global revenue share of over 22.53% in the market. Pandan tea's popularity in Asian cultures is increasingly influencing North American consumers, particularly in metropolitan areas with diverse populations and a rising interest in Asian cuisine and wellness practices. Brands are highlighting sustainable pandan sourcing and eco-friendly packaging to attract environmentally-conscious consumers. Health professionals, nutritionists, and wellness influencers are also promoting pandan tea as a healthier alternative to sugary and caffeinated beverages, further enhancing its appeal.

U.S. Pandan Tea Market Trends

The pandan tea market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030. U.S. consumers are becoming more eco-conscious, and brands are responding by emphasizing sustainable sourcing of pandan and offering environmentally friendly packaging. This focus on sustainability resonates with a growing segment of the market. Brands are introducing innovative pandan tea products, including blends with other herbs and spices, which appeal to adventurous consumers looking for new and unique flavors.

Europe Pandan Tea Market Trends

The pandan tea market in Europe is expected to grow at a CAGR of 8.1% from 2024 to 2030. European consumers are increasingly exploring Asian flavors, driven by the growing popularity of Asian cuisine across the continent. Pandan tea, with its distinct aromatic profile and cultural significance, is becoming a sought-after option among tea enthusiasts looking for exotic and authentic experiences. Specialty tea shops, Asian grocery stores, and high-end cafés across Europe are beginning to stock pandan tea, making it more accessible to a broader audience. These outlets often position pandan tea as a premium product, appealing to consumers willing to pay more for quality and authenticity.

Asia Pacific Pandan Tea Market Trends

The pandan tea market in the Asia Pacific is expected to witness a CAGR of 8.2% from 2024 to 2030. Pandan has long been a staple in Southeast Asian cuisine and traditional medicine, which continues to fuel its popularity in the region. The familiarity and cultural significance of pandan make pandan tea a preferred beverage, particularly in countries like Indonesia, Thailand, Malaysia, and the Philippines. To cater to varying consumer tastes, brands are experimenting with pandan tea blends, combining them with other popular ingredients like lemongrass, ginger, or green tea.

These blends are gaining popularity as they offer a unique twist on traditional pandan tea. Moreover, there is also a trend towards supporting local farmers and small-scale producers of pandan leaves. This not only ensures the sustainability of pandan cultivation but also appeals to consumers who prefer locally sourced and community-supported products.

Key Pandan Tea Company Insights

The market is characterized by competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace pandan tea.

Key Pandan Tea Companies:

The following are the leading companies in the pandan tea market. These companies collectively hold the largest market share and dictate industry trends.

- Tsaa Laya

- ETTE TEA COMPANY

- My Blue Tea

- Rishi Tea & Botanicals

- FreshDrinkUS

- Dilmah Ceylon Tea Company PLC

- T2 Tea

- Zhejiang Chunli Tea Co., Ltd.

- WILD & TEA

- Thienthanhtea Ltd.

Recent Developments

-

In August 2021, LiHO TEA unveiled its latest creation: the Singa-Pandan series, featuring a delightful Pandan Shake paired with cookies and caramel. This innovative lineup was thoughtfully crafted to celebrate the Singapore Food Festival 2021, showcasing the vibrant flavors of Singaporean cuisine. The Singa-Pandan series promises to be a tasty addition to LiHO TEA's offerings, blending traditional tastes with contemporary flair.

-

In January 2021, Gong Cha joined forces with Singapore's beloved toy store, ActionCity, to commemorate the 25th anniversary of the iconic Japanese toy character, To-fu Oyako. As part of this special collaboration, Gong Cha is set to launch a limited-edition drink that pays homage to this charming character. Available exclusively in a medium size, the drink features a light green milky base that is expertly infused with distinct Singaporean flavors-rose, vanilla, coconut, almond, and pandan.

Pandan Tea Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 322.1 million

Revenue forecast in 2030

USD 504.2 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Thailand; Malaysia; Brazil; and South Africa

Key companies profiled

Tsaa Laya; ETTE TEA COMPANY; My Blue Tea; Rishi Tea & Botanicals; FreshDrinkUS; Dilmah Ceylon Tea Company PLC; T2 Tea; Zhejiang Chunli Tea Co., Ltd.; New Mexico Tea Company; Thienthanhtea Ltd.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Pandan Tea Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pandan tea market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Loose Leaves

-

Powder

-

Tea Bags

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pandan tea market size was estimated at USD 300.5 million in 2023 and is expected to reach USD 322.1 million in 2024.

b. The global pandan tea market is expected to grow at a compounded growth rate of 7.8% from 2024 to 2030 to reach USD 504.2 million by 2030.

b. The teabags segment dominated the pandan tea market with a share of 44.69% in 2023. Teabags provide a convenient, pre-measured method for brewing tea, eliminating the need for extra tools or measuring. This convenience appeals to busy consumers, particularly those who value quick and easy preparation in fast-paced settings such as workplaces or on the go.

b. Some key players operating in the pandan tea market include Tsaa Laya; ETTE TEA COMPANY; My Blue Tea; Rishi Tea & Botanicals; FreshDrinkUS; Dilmah Ceylon Tea Company PLC; and T2 Tea

b. Key factors that are driving the market growth include the growing consumer awareness about the health benefits of herbal teas and health-conscious consumers seeking alternatives to sugary drinks and caffeinated beverages

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.