- Home

- »

- Medical Devices

- »

-

Paper Diagnostics Market Size And Analysis Report, 2030GVR Report cover

![Paper Diagnostics Market Size, Share & Trends Report]()

Paper Diagnostics Market (2023 - 2030) Size, Share & Trends Analysis Report By Kit Type (Lateral Flow Assays, Paper Based Microfluidics), By Device Type (Diagnostics, Monitoring), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-725-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global paper diagnostics market size was estimated at USD 16.39 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. The increasing need for cost-effective healthcare in remote areas of developing countries is leading to the rising popularity of point-of-care diagnostic methods in these countries. Moreover, in developed countries, heightened adoption of point-of-care diabetes test kits and pregnancy test kits is projected to work in favor of market growth.

Furthermore, changing lifestyle habits, including smoking and an unhealthy diet coupled with an increased incidence of obesity, is anticipated to lead to an increase in the prevalence of lifestyle-associated diseases, such as diabetes and cardiac diseases, worldwide. For instance, as per the International Diabetes Federation (IDF), in 2021, around 540 million people were diagnosed with diabetes globally. In addition, about 10.5% of adults between 20 to 79 years of age have diabetes, and half of them are unaware of it. IDF estimates an increase of 46% in diabetes cases by 2045, which is approximately 783 million people.

Moreover, increasing investments by government organizations in R&D about the development of novel in vitro diagnostics tests and devices have been providing an upthrust to the market. For instance, the European Diagnostic Manufacturers Association (EDMA), which focuses on the development and overall growth of the in vitro diagnostic industry in Europe, invests in the R&D of in vitro diagnostics every year.

The rising focus of established players in Japan on developing technologically advanced paper diagnostics, increasing healthcare initiatives, and clinical development frameworks of emerging economies are poised to create ample growth opportunities for the market in APAC. The rising incidence of hospital-acquired urinary tract infections in India is prompting hospitals and doctors to focus on the delivery of proper care and the incorporation of diagnostic techniques.

In addition, an urgent need for the development of new systems and replacement & upgradation of medical infrastructure is also projected to positively influence the market during the forecast period. Furthermore, the presence of untapped opportunities in emerging economies such as India, China, and Brazil in the field of paper-based point-of-care diagnostics is anticipated to boost the growth of the market during the forecast period.

The COVID-19 pandemic has had a significant impact on the market. The demand for rapid and low-cost testing methods for COVID-19 has increased the adoption of paper-based diagnostics, such as lateral flow assays and paper-based microfluidics. These devices offer portability, simplicity, and scalability advantages, which are essential for mass testing in resource-limited settings. However, restrictions imposed by the lockdown and disruption in the supply chain also created challenges for the paper diagnostics industry.

Paper diagnostics is considered to be one of the mature segments in the point-of-care market. The key characteristics of paper diagnostics such as being inexpensive with high-performance and easily disposable are the key growth determinants of the market. Numerous companies expressed their interest in developing paper diagnostics technology and gaining patents for the same. For instance, in March 2022, researchers from the University of Illinois at Chicago built an ink and paper-based test for preeclampsia. The test can be employed in decentralized settings in low- and middle-income countries.

The rising demand for point-of-care and in-vitro diagnostics in emerging markets such as Africa and Asia-pacific is anticipated to have a significant impact on the development of the market. The paper-based point-of-care tests have been receiving interest in recent years as it enables rapid, low-cost detection without the requirement of external instruments. Researchers from Shenzhen Technology University and Fuzhou University collaborated on a study on paper-based POCT of COVID-19. The research stated that lateral flow immunoassay is the most commercially successful paper-based POC and the key application is the home pregnancy test.

Similarly, initiatives by academic and research institutions to advance technology in paper diagnostics are expected to increase during the forecast period and fuel the growth of the market. For instance, Hansjorg Wyss Institute for Biologically Inspired Engineering at Harvard University developed paper-based diagnostic tools. It is a paper-based synthetic gene network as a next-generation diagnostic technology. Institutes receive licensing fees from the users for the technology.

The growing incidence of infectious diseases such as the COVID-19 pandemic, Ebola in Africa, and other viral infections, demonstrate the need for cost-effective paper-based diagnostic tools. In addition, the introduction of advanced paper-based sensors and 3D wax printing methods has the potential to cut down the cost of bulk testing to USD 1. Hence, various players consider rural areas in developing countries as essential markets.

However, the limited quantitative application of paper diagnostics can hamper the growth of the market. Considering the immunoassay tests, specificity and sensitivity have been key concerns. As the outcome of the test depends on the quality and preparation of the antibodies, it is challenging to obtain accurate quantitative data from the test.

The lack of a specific regulatory framework for developing paper-based diagnostics is also a restraining factor for the market. The regulatory framework becomes the base of industrial policies to shape the competition, pricing range, and product variety in the market. Low demand for products differentiates the paper-based diagnostics market and discourages the players from entering the market with a high investment strategy. Therefore, the market is anticipated to witness a stagnant growth trend during the forecast period.

Kit Type Insights

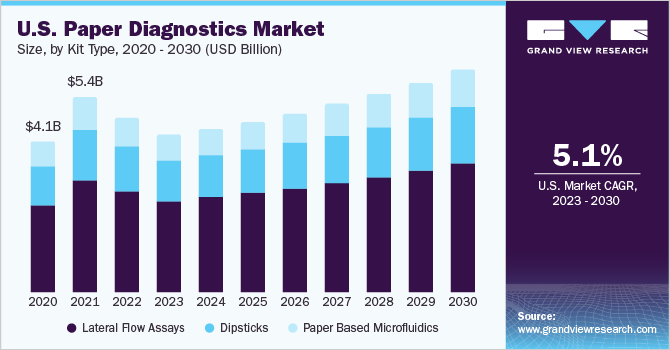

Based on kit type, the market is segmented into dipsticks, lateral flow assays, and paper-based microfluidics. The lateral flow assays segment held the largest revenue share in 2022. The growth of the segment can be attributed to the wide usage rates of pregnancy tests and a wide range of applications of the product type. Furthermore, the growing incidence of infectious diseases such as human immunodeficiency virus (HIV), tuberculosis (TB), and pneumonia is estimated to spur the growth of the segment during the forecast period.

According to the World Health Organization (WHO), in 2021, 1.6 million people globally died due to TB, making it the 13th leading cause of death and 2nd leading infectious exterminator. Moreover, 10.6 million people were diagnosed with TB in the same year. The increasing efforts by the government and healthcare organizations to create awareness about the detection and treatment of TB are contributing to the segment's growth.

The paper-based microfluidics segment is expected to exhibit significant growth over the forecast period owing to surging demand for point-of-care testing and R&D investments by life sciences and pharmaceutical companies. For instance, researchers from Purdue University, U.S., developed "Self-powered and Paper-based Electrochemical Devices (SPEDs)," a portable paper-based device that can identify diseases such as anemia. It is a medical diagnostic device made of paper, which helps detect biomarkers and identify disease by performing an electrochemical analysis.

In December 2020, ACON Laboratories, Inc. received the Food and Drug Administration (FDA) approval for its over-the-counter (OTC) Distinct Early Detection Pregnancy test, which is a rapid chromatographic immunoassay able to detect human chorionic gonadotropin (hCG) in urine. The kit can detect pregnancy earlier up to six days.

Device Type Insights

In terms of device type, the diagnostic devices held the largest revenue share in in 2022. Paper diagnostic devices are used in blood separation and glucose detection. The rising awareness regarding associated merits, such as improved intensity, quality, and frequency of diagnosis along with new product launches and approvals is likely to supplement the growth of the segment.

Novel wax patterning technology can provide greater flexibility and adaptability, thereby increasing the potential of the diagnostics devices segment. Furthermore, the burgeoning popularity of programmable microfluidics devices in urinalysis is poised to augment the growth of the segment during the forecast period.

Monitoring devices are also projected to post healthy growth during the forecast period. This can be attributed to the increasing usage of devices in the application, which includes food testing and nutrient monitoring in aquatic systems. Moreover, rising incorporation by government organizations, such as the Ministry of Food Processing and the International Food Protection Training Institute or agricultural groups, for enhanced monitoring will support the growth of the overall market.

End-use Insights

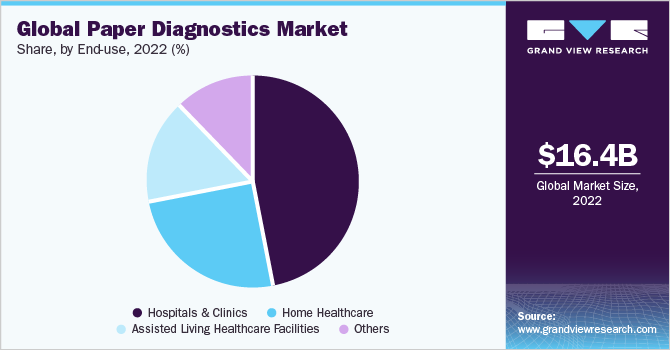

In terms of end-use, the hospitals & clinics segment held the largest revenue share of 46.5% in 2022, owing to the increasing demand for rapid and accurate diagnosis of various diseases. Paper diagnostics are low-cost, easy-to-use, and portable devices that can provide results within minutes without requiring sophisticated equipment or trained personnel. These can also be used for detecting infectious diseases, such as COVID-19, malaria, dengue, and HIV, as well as chronic diseases, such as diabetes, cardiovascular diseases, and cancer.

The assisted living healthcare facilities segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, which can be attributed to the increasing geriatric population and prevalence of chronic diseases. According to a fact sheet released by the World Health Organization in October 2022, the proportion of the population over 60 years is expected to reach 1.4 billion by 2030, and 2.1 billion by 2050.

Home healthcare is likely to register a lucrative growth during the forecast period. High adoption of pregnancy and diabetes test kits in-home healthcare is one of the key factors escalating the growth of the segment. Growing inclination towards affordable healthcare systems and government initiatives are also playing a vital role in the growth of the segment.

Annually, November 14, is celebrated as World Diabetes Day to raise awareness and reduce the incidence rate of diabetes. In 2022, the Pan American Health Organization celebrated the day with the theme “Education to Protect Tomorrow,” which aimed at strengthening access to quality education on diabetes for patients as well as healthcare providers. Thus, rising efforts to create awareness about diabetes and the need for its early detection will further fuel the demand for paper diagnostics in the home healthcare segment.

Biotech pharma research institutions use paper-based molecular assays, ELISA, cell assays, and nucleic acid assays. These diagnostics are incorporated to support the clinical development of drugs and as an aid in drug discovery. Moreover, growing R&D and fundraising activities in emerging countries are poised to propel the segment's growth.

Application Insights

In terms of application, the clinical diagnostics segment is anticipated to witness lucrative growth during the forecast period, owing to the increasing usage of filter paper, microfluidics, and paper-based biosensors in diagnosing liver disorders. In addition, the segment is estimated to dominate the market throughout the forecast horizon owing to the increasing prevalence of infectious diseases such as Ebola, malaria, dengue, tuberculosis, and HIV.

Moreover, new product launches and technological advancements are expected to bolster the segment's growth further. For instance, in November 2022, LumiraDx introduced a rapid microfluidic immunoassay C-Reactive test in India to help reduce the prescribing of antibiotics that can lead to antimicrobial resistance. In April 2017, Alere introduced "Malaria Ag.P.F," a sensitive malaria RDT that can detect antigens of Plasmodium falciparum, i.e., histidine-rich protein II antigen, even with very low parasitemia.

Regional Insights

Based on region, North America captured a major market share in 2022 with 35.9%. The region is expected to maintain a similar trend over the forecast period. This growth can be attributed to the presence of key market players, including academic and research institutes in the region, and the increasing incidence of infectious diseases. For instance, engineers from MIT have developed an inexpensive and easy-to-use paper-based test that could improve diagnosis rates and assist individuals in receiving treatment at an early stage. Similarly, a biochemist from the University of Washington developed a handheld plastic device.

The Asia Pacific market is projected to register the fastest CAGR of 7.0% over the forecast period, which can be a result of the increasing investment in the healthcare sector, various government initiatives, education, and an increase in awareness about health. The Indian market is anticipated to register the fastest CAGR in the forecasted period; the key factors supporting the market growth are increasing demand for cost-effective diagnostic tools for the rural population and acceleration in product development through regional players.

Key Companies & Market Share Insights

Key established players focus on high R&D investments to deliver novel product portfolios as their key strategies to expand market growth. For instance, Abbott invested around USD 2.24 billion in FY 2017 for research and developmental activities. The company has HIV Combo Fingerstick, SD BIOLINE HAT 2.0, and Malaria Ag.P.F. Test products under its product portfolio serving the market. In December 2020, Abbott announced receiving emergency use authorization (EUA) for the BinaxNOW Ag Card for rapid testing and detection of COVID-19 infection at home from the FDA and started its shipment in April 2021.

In January 2018, ARKRAY, Inc. completed the expansion and transfer of its Pinghu factory in China to strengthen its manufacturing capabilities pertinent to diabetes testing instruments and in vitro diagnostic reagents. Through R&D unit expansion, the company is expanding its presence in China to grab untapped opportunities. Similarly, in March 2023, a medical technology company, Siemens Healthineers, announced an investment of RS.1,300 crore to set up a new campus in Bengaluru, India, inclusive of R&D facilities and a manufacturing center.

Other emerging players, such as Abcam Plc; Chembio Diagnostic Systems, Inc.; and Creative Diagnostics, are continually focusing on new product development and expanding their presence in developing economies to grab untapped opportunities. Some prominent players in the global paper diagnostics market include:

-

Arkray, Inc.

-

Acon Laboratories, Inc.

-

Abbott (Alere Inc.)

-

Bio-Rad Laboratories, Inc.

-

Gvs S.P.A.

-

Siemens Healthcare Gmbh

-

Diagnostics For All, Inc.

-

Ffei Life Science (Biognostix)

-

Navigene

-

Micro Essential Laboratory Inc

-

Kenosha Tapes

Paper Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.97 billion

Revenue forecast in 2030

USD 22.5 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Kit type, device type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Arkray, Inc.; Acon Laboratories, Inc.; Abbott (Alere Inc.); Bio-Rad Laboratories, Inc.; Gvs S.P.A.; Siemens Healthcare Gmbh; Diagnostics For All, Inc.; Ffei Life Science (Biognostix); Navigene; Micro Essential Laboratory Inc; Kenosha Tapes

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Paper Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paper diagnostics market report based on kit type, device type, application, end-use, and region:

-

Kit Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lateral Flow Assays

-

Dipsticks

-

Paper Based Microfluidics

-

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Monitoring Devices

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Diagnostics

-

Cancer

-

Infectious Diseases

-

Liver Disorders

-

Others

-

-

Food Quality Testing

-

Environmental Monitoring

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Healthcare

-

Assisted Living Healthcare Facilities

-

Hospital and Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global paper diagnostics market size was estimated at USD 16.39 billion in 2022 and is expected to reach USD 14.97 billion in 2023.

b. The global paper diagnostics market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 22.5 billion by 2030.

b. North America dominated the paper diagnostics market with a share of 35.9% in 2022. This is attributable to the presence of major players in the market with a strong network of technology distribution in the U.S. and rising government initiatives to promote advanced diagnosis for infectious diseases.

b. Some key players operating in the paper diagnostics market include ARKRAY Inc.; Acon Laboratories, Inc.; Abbott; Bio-Rad Laboratories; GVS S.P.A.; Diagnostics For All, Inc.; Ffei Life Science (Biognostix); Navigene; Kenosha Tapes; and Siemens Healthineers.

b. Key factors that are driving the market growth include increasing need for cost-effective healthcare in remote areas of developing countries and in developed countries, heightened adoption of point-of-care diabetes test kits and pregnancy test kits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.