- Home

- »

- Organic Chemicals

- »

-

Para Nitrochlorobenzene Market Size Report, 2020-2027GVR Report cover

![Para Nitrochlorobenzene Market Size, Share & Trends Report]()

Para Nitrochlorobenzene Market (2020 - 2027) Size, Share & Trends Analysis Report By Application (Dyes, Pesticides, Rubber Chemicals), By End Use (Pharmaceuticals, Chemicals), And Segment Forecasts

- Report ID: GVR-4-68038-534-2

- Number of Report Pages: 113

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global para nitrochlorobenzene market size was valued at USD 304 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% over the forecast period. The market is mainly driven by the consumption of para nitrochlorobenzene (PNCB) for the production of generic medicine. Para nitrochlorobenzene is one of the primary raw materials used for the manufacturing of paracetamol, which is the most common generic medicine globally. Para nitrochlorobenzene, also called 4-Nitrochlorobenzene, is a pale yellow solid. It is a form of nitrochlorobenzene (NCB) and accounts for a global share of 59% in the total NCB market. NCB is produced by the reaction of nitric acid and chlorobenzene. NCB and its derivatives are majorly used in the production of a wide range of chemical intermediates, dyes, and antioxidants used in rubber processing.

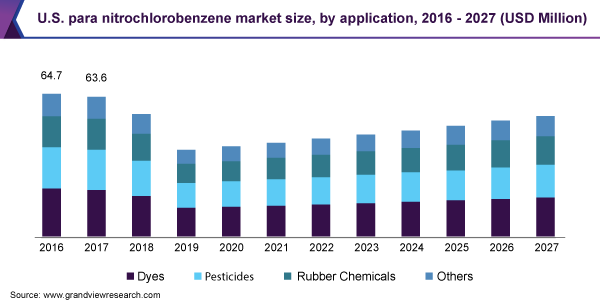

The U.S. is one of the major chemical manufacturing countries globally. Significant capital investments in the petrochemical sector are expected to boost the production of para nitrochlorobenzene over the forecast period. The trade war with China and overstocking due to slow downstream demand for benzene negatively affected the product demand in 2017 and 2018. However, positive signs for the future are appearing due to a substantial number of refinery facilities that produce benzene are expected to come online in 2020.

Pesticide manufacturing is one of the major contributors to the U.S. economy and has been witnessing steady growth since the past few years. However, the outlook for pesticides is expected to remain weak as it is a highly regulated sector and the active ingredients are subjected to reviews with concerns surrounding their toxicity. Pharmaceuticals are expected to grow at a significant pace as they are extensively being used in the production of generic medicine.

Paracetamol is manufactured by reacting para nitrochlorobenzene with caustic soda at 150 °C for 8 hours under a pressure of 5 kg/sq.cm. Paracetamol formulations are commonly helpful in fighting viral fever, cold, and cough, and are used as pain reducers. These medicines are also easily available over the counter, which has further increased awareness about their benefits and, in turn, their consumption. In addition, these medications are cheaper compared to specialized drugs and have minimal side effects. It is also proven to be useful in curing dental pains and swellings. Paracetamol powder and solutions, thus find applications in dental gels and tablets.

Another important factor contributing to the rise in the production of generic medicine is the expiration of patents. Due to this, various paracetamol combinations such as paracetamol and codeine and paracetamol, codeine, and doxylamine are being formulated and sold over the counter. China, Germany, the U.S., and India are the leading paracetamol manufacturing countries and are marked by the presence of major manufacturers such as GlaxoSmithKline, Farmson Pharmaceutical Gujarat Private Limited, and McNeil Consumer Healthcare.

However, in the pharmaceutical industry, para nitrochlorobenzene is mainly used in the production of paracetamol, which can be alternatively produced using different formulations, such as nitration of phenol with ortho para-nitrotoluene or nitrobenzene and p-nitrophenol. The production of medicine from p-nitrophenol reduces the PAP production step and is thus considered to have economic advantages. Such substitutes are anticipated to hinder the demand for para nitrochlorobenzene in the pharmaceutical industry.

Application Insights

Para nitrochlorobenzene finds application in the production of dyes, pesticides, rubber chemicals, and other products, such as pharmaceutical intermediates and other chemicals. In 2019, the dyes segment led the market and accounted for a share of 28.5% in terms of revenue. Increasing demand for dyes in the textile industry and the launch of several high-quality pigments are expected to drive the product demand for dye manufacturing over the forecast period.

The rubber chemicals segment is anticipated to register the fastest CAGR of 4.8% in terms of revenue from 2020 to 2027. This is attributed to the rising demand for rubber and plastic products across different end-use industries, including automotive, construction, electronics, and consumer goods. General rubber goods are primarily used in the automotive industry. They also find applications in the construction, mechanical, and pharmaceutical industries owing to properties such as durability and abrasion resistance, resulting in high demand for rubber chemicals.

Rubber finds the majority of its usage in the production of tires, which have a significant demand in the global 4-Nitrochlorobenzene market due to growing automotive OEM and aftermarket industries. Tire manufacturers constantly upgrade and make improvements to their existing line of products to meet consumer, regulatory, and environmental requirements.

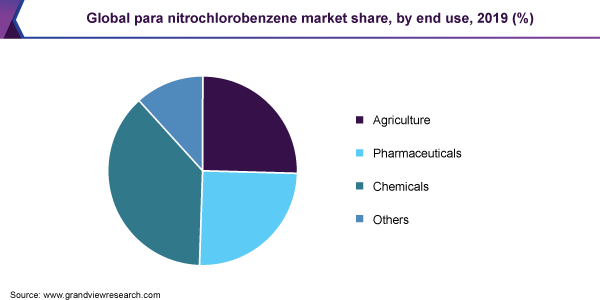

End-Use Insights

The chemicals end-use segment held the largest share of 37.9% in 2019 based on revenue. This segment is anticipated to witness favorable growth in the years to come owing to high captive consumption by manufacturers. The chemical is used for the synthesis of para nitro aniline, para chloro aniline, and para fluoro nitrobenzene.

The pharmaceuticals end-use segment is expected to expand at the fastest CAGR of 4.7% based on revenue over the forecast period. The rapidly growing pharmaceutical market is anticipated to have a positive impact on the para nitrochlorobenzene demand for drug manufacturing. Moreover, the advent of new diseases and growing awareness among the global population is anticipated to drive the demand for pharmaceuticals, especially over-the-counter medicines.

The growing geriatric population and rise in consumer disposable income have boosted the development of numerous healthcare facilities, especially in populous emerging economies, such as China and Brazil, where the outbreak of epidemics has created chaos in the past. Rising awareness among citizens regarding hygiene and sanitation has driven the demand for pharmaceutical intermediates.

Regional Insights

The Asia Pacific was the largest regional para nitrochlorobenzene market in 2019 with a 58.6% share of the overall volume. Rising product demand in China and India, along with significant capital investments in the emerging economies, has boosted the overall consumption of para nitrochlorobenzene. Integration of benzene facilities in the region is expected to play a major role in the future production of para nitrochlorobenzene.

Dyes and pesticides are the major applications of para nitrochlorobenzene in the Asia Pacific. Rising demand for dyes from the textile sector and pesticides owing to the presence of vast agricultural lands in the region is expected to drive the product demand over the forecast period. Rubber chemicals are expected to be the fastest-growing segment in the years to come owing to the widening application scope in plastic and rubber manufacturing. The outsourcing of specialty chemicals production to emerging economies is expected to positively impact the product demand in the Asia Pacific.

North America is expected to emerge as the second fastest-growing region with a revenue-based CAGR of 4.3% from 2020 to 2027. The PNCB market in North America is majorly dominated by the U.S., followed by Mexico and Canada. The presence of a large number of downstream chemical manufacturers in the region, along with the establishment of specialty chemical manufacturing facilities, has boosted the consumption of para nitrochlorobenzene. The presence of a well-established benzene value chain is also proving beneficial to suffice the local demand, thus driving the regional market.

Key Companies & Market Share Insights

The global market has been characterized by the presence of a large number of small-scale manufacturers and a few moderate-sized companies. Some of the market participants have completely integrated into the value chain by manufacturing raw materials (benzene and chlorobenzene), para nitrochlorobenzene, and the end products, such as para nitroaniline and para chloroaniline. Aarti Industries Limited, Hefei TNJ Chemical Industry Co., Ltd., and Seya Industries Ltd. lead the global PNCB market owing to their integrated presence across the value chain and a strong global reach. Some of the prominent players in the para nitrochlorobenzene market include:

-

Aarti Industries Limited

-

Hefei TNJ Chemical Industry Co., Ltd.

-

Seya Industries Ltd.

-

Panoli Intermediates India Private Limited

-

Chemdyes Corporation

-

Sarna Chemicals

-

Hefei TNJ Chemical Industry Co., Ltd.

-

Hangzhou Meite Industry Co., Limited

-

Charkit Chemical Company LLC

-

Jiangsu Yangnong Chemical Group Co., Ltd.

Para Nitrochlorobenzene Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 315.8 Million

Revenue forecast in 2027

USD 420.7 Million

Growth Rate

CAGR of 4.1% from 2020 to 2027

Base year for estimation

2019

Historical period

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Aarti Industries Limited; Hefei TNJ Chemical Industry Co., Ltd.; Seya Industries Ltd.; Panoli Intermediates India Private Limited; Chemdyes Corporation; Sarna Chemicals; Hefei TNJ Chemical Industry Co., Ltd.; Hangzhou Meite Industry Co., Limited; Charkit Chemical Company LLC; Jiangsu Yangnong Chemical Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global para nitrochlorobenzene market report on the basis of application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Dyes

-

Pesticides

-

Rubber Chemicals

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Agriculture

-

Pharmaceuticals

-

Chemicals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global para nitrochlorobenzene market size was estimated at USD 304.0 million in 2019 and is expected to reach USD 315.8 million in 2020.

b. The global para nitrochlorobenzene market is expected to grow at a compound annual growth rate of 4.1% from 2020 to 2027 to reach USD 420.7 million by 2027.

b. Asia Pacific dominated the para nitrochlorobenzene market with a share of 58.6% in 2019. This is attributable to rising demand for dyes from the textile sector and increase in the consumption of pesticides due to the presence of vast agricultural land.

b. Some key players operating in the para nitrochlorobenzene market include Aarti Industries Limited, Hefei TNJ Chemical Industry Co., Ltd, Seya Industries Ltd., Panoli Intermediates India Private Limited, Chemdyes Corporation and Sarna Chemicals.

b. Key factors that are driving the market growth include increasing production of generic medicines and significant growth in the textiles market, especially in the developing countries of Asia Pacific.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.