- Home

- »

- Organic Chemicals

- »

-

Paraxylene Market Size And Share, Industry Report, 2030GVR Report cover

![Paraxylene Market Size, Share & Trends Report]()

Paraxylene Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Dimethyl Terephthalate, Purified Terephthalic Acid), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-693-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Paraxylene Market Size & Trends

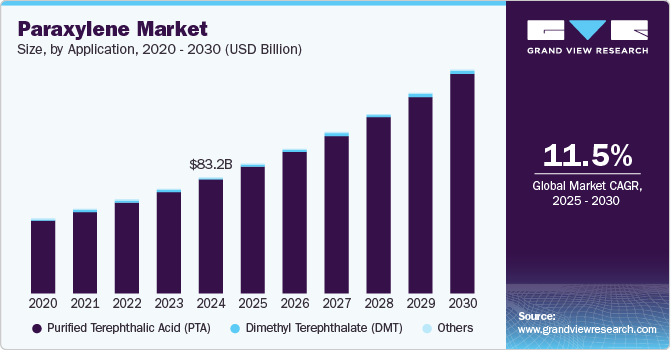

The global paraxylene market size was valued at USD 83.25 billion in 2024 and is expected to grow at a CAGR of 11.5% from 2025 to 2030. This growth is attributed to the increasing demand for polyester fabrics, where paraxylene is a crucial raw material. The expansion of PET bottle production, especially in the beverage industry, also boosts demand for paraxylene. In addition, the growing use of polyester in the textile and packaging sectors significantly contributes to market growth. Furthermore, increasing adoption in the automotive industry and capacity expansions by major companies also play a role in market growth.

Paraxylene, known for its sweet aroma, is a crucial chemical primarily derived from benzene. This clear, flammable hydrocarbon serves as a fundamental building block in the manufacturing of numerous industrial materials, most notably polyethylene terephthalate, commonly known as PET, and various polyester fabrics. Obtaining paraxylene involves sophisticated processes, including the catalytic reforming of petroleum derivatives. Refinement methods such as crystallization and the reaction of ethylbenzene play a pivotal role in isolating this valuable compound.

The widespread adoption of paraxylene stems from its role as a key raw material in the production of essential industrial chemicals. These chemicals, including terephthalic acid and dimethyl terephthalate, serve as critical intermediates in the creation of PET polyesters. These PET polymers exhibit exceptional qualities, including remarkable strength and shatter resistance, rendering them ideally suited for a diverse range of applications. The bottling of beverages, for example, relies heavily on PET's ability to maintain structural integrity and prevent carbonation loss.

In addition, the textile industry also benefits significantly from paraxylene's properties, with polyester fibers contributing to clothing, upholstery, and various fabrics. Moreover, PET films are employed in numerous packaging solutions, providing barrier properties and protection for various goods. Furthermore, the growth of the paraxylene market is closely tied to the escalating demand for PET across various industries. This surge in demand is, in turn, propelled by factors such as rapid urbanization and population growth, which fuel the need for textiles and consumer goods. Moreover, the construction and electrical sectors utilize paraxylene-derived materials in applications such as electrical insulation and specialized fabrics, contributing to the overall market expansion.

Application Insights

The purified terephthalic acid (PTA) segment dominated the global paraxylene industry and accounted for the largest revenue share of 97.8% in 2024. This growth is attributed to its widespread use in producing PET resins, a cornerstone of the packaging, textile, and beverage sectors. In addition, escalating demand for polyester fibers, especially in apparel and home furnishings, significantly drives PTA consumption. The ever-growing packaged beverage industry relies heavily on PET, thus contributing to PTA's market growth. Furthermore, the automotive sector's increasing adoption of PET-based components for lightweighting purposes provides a substantial boost to overall PTA demand, and it’s also used in coating solutions.

Dimethyl terephthalate (DMT) application segment is expected to grow at a CAGR of 5.0% from 2025 to 2030, owing to its role in the creation of polyester films, crucial for packaging and electronics. DMT's application in engineering resins, valued for their durability and heat resistance, further fuels its demand, especially in the automotive sector. In addition, the need for specialized polymers that utilize DMT as an intermediate also bolsters market expansion. Moreover, the construction industry requires DMT for manufacturing, and its demand is also fueled by the increased use of polyester film for coating purposes.

Regional Insights

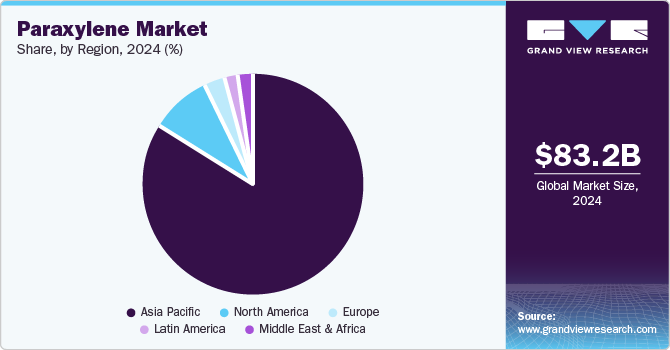

Asia Pacific paraxylene market dominated the global market and accounted for the largest revenue share of 83.7% in 2024, primarily driven by the robust demand for polyethylene terephthalate from the plastics industry. In addition, rapid industrialization and economic growth, coupled with the expansion of the textile industry, further contribute to market growth. Furthermore, rising e-commerce and increased consumption of packaged goods also drive the need for plastics, supporting paraxylene demand.

The paraxylene market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its position as a major production hub and consumer. The country's extensive petrochemical infrastructure and substantial production capacity drive paraxylene sales. Furthermore, growing demand for PET in the packaging and textile sectors is a key driver for the market growth. Moreover, the rise of e-commerce and increasing tech-savviness among the population boosts demand for plastic resins.

North America Paraxylene Market Trends

The North America paraxylene market is expected to grow at a CAGR of 10.2% over the forecast period, owing to the demand for PET in packaging and the automotive sector. In addition, the increasing awareness of sustainable materials is driving the adoption of bio-based PET, creating growth opportunities. Furthermore, the region's economic development and consumer spending contribute to the demand for plastic products, thereby driving the growth of the market.

The paraxylene market in the U.S. led the North American market and held for the highest revenue share in 2024, primarily driven by the demand for PET in the packaging and beverage industries. Furthermore, growing consumer spending and a focus on convenience contribute to the consumption of packaged goods, boosting the need for PET resins. The automotive industry's use of PET-based components for lightweighting also supports the market. Moreover, an increasing emphasis on recycling and sustainable packaging solutions influences market trends.

Europe Paraxylene Market Trends

The Europe paraxylene market is expected to grow significantly over the forecast period, owing to stringent environmental regulations and a focus on sustainability. In addition, the demand for bio-based PET and recycled plastics is growing, driven by environmental awareness. Furthermore, the packaging, textile, and automotive industries contribute to paraxylene consumption.

The growth of the paraxylene market in Germany is expected to be driven by its strong industrial base and focus on high-quality products. The automotive industry's demand for PET-based components and engineering plastics drives market growth. In addition, stringent environmental regulations promote the use of recycled and bio-based materials. Furthermore, the packaging sector's need for PET resins also contributes to paraxylene consumption.

Key Paraxylene Company Insights

Major players in the paraxylene industry include Sinopec, Reliance, ONGC, and others. These players strategically focus on technology launches, acquisitions, and robust research and development activities to enhance their product lines and market presence. In addition, expanding production capacity to meet rising polyester demand is also key strategy implemented by the companies to gain competitive edge.

-

Sinopec is involved in the production of PTA and PET. The company utilizes reformate C6+ to produce paraxylene, essential for synthetic fiber and engineering plastics. Sinopec has developed efficient PX suite technology. The company’s operations span industrial investment, petroleum and natural gas exploration, refining, coal production, and sales.

-

GS Caltex is involved in the aromatics business, which includes paraxylene production, using it as a feedstock for manufacturing PTA and other petrochemical products. The company operates in the refining and petrochemical segments, similar to other major players in the industry, transforming crude oil and other raw materials into a range of fuels and chemical products.

Key Paraxylene Companies:

The following are the leading companies in the paraxylene market. These companies collectively hold the largest market share and dictate industry trends.

- Sinopec

- JX Nippon Oil & Energy Corp

- CNPC

- Reliance

- NPC Iran

- GS Caltex

- ONGC

- Orpic, Oman Oil Refineries and Petroleum Industries Company

- Jurong Aromatics Corp

- China National Offshore Oil Corporation (CNOOC)

- Lotte KP Chemical

- ExxonMobil

- Saudi Aramco

- Dalian Fujia Dahua

- Idemitsu Kosan Co.Ltd.

- Toyo

- Teijin Fibers

Recent Developments

-

In January 2025, Lotte Chemical is expanding its collaboration with Hyundai Motor and Kia to develop eco-friendly plastic solutions for vehicles. Lotte Chemical is expected to supply innovative materials, including bio-PET, which uses paraxylene derived from biomass, and recycled plastics, reducing reliance on fossil fuels and promoting sustainability. The partnership aims to increase the application of these materials in Hyundai and Kia models, enhancing vehicle sustainability and contributing to a circular economy. This collaboration reflects a commitment to environmental responsibility and innovation in automotive materials.

-

In November 2024, Aramco, Fujian Petrochemical, and SINOPEC, have started construction of a major incorporated refining and petrochemical complex in Fujian Province, China. The complex is expected to have a 16 million tons’ oil refining unit, per annum, a 1.5 million tons- ethylene unit per annum, and a two million tons paraxylene capacity. Aramco and SINOPEC each hold a 25% stake, while FPCL owns 50%. The project supports China's petrochemicals demand and strengthens the China-Saudi partnership. It is expected to be operational by the end of 2030.

Paraxylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.63 billion

Revenue forecast in 2030

USD 159.80 billion

Growth rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Asia Pacific; Europe; Latin America;, Middle East and Africa

Country scope

U.S.; Germany; UK; France; China; India; Japan

Key companies profiled

Sinopec; JX Nippon Oil & Energy Corp; CNPC; Reliance; NPC Iran; GS Caltex; ONGC; Orpic, Oman Oil Refineries and Petroleum Industries Company; Jurong Aromatics Corp; China National Offshore Oil Corporation (CNOOC); Lotte KP Chemical; ExxonMobil; Saudi Aramco; Dalian Fujia Dahua; Idemitsu Kosan Co.Ltd.; Toyo; Teijin Fibers

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paraxylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global paraxylene market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dimethyl Terephthalate (DMT)&

-

Purified Terephthalic acid (PTA)

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.