- Home

- »

- Pharmaceuticals

- »

-

Parenteral Nutrition Market Size And Share Report, 2030GVR Report cover

![Parenteral Nutrition Market Size, Share & Trends Report]()

Parenteral Nutrition Market Size, Share & Trends Analysis Report By Stage Type (Adults, Pediatrics), By Nutrient Type, By Indication, By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-867-1

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global parenteral nutrition market size was estimated at USD 6.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Development of technically advanced parenteral nutrition (PN) products with barcode assistance, growing preference for PN over enteral nutrition in patients with COVID-19, shorter hospital stays, along with the reduced risk of infection are some of the factors boosting the product demand, thereby driving the market growth. According to the ASPEN20 Virtual Conference, providing appropriate nutrition to adults with COVID-19 remained a priority for optimizing outcomes. This included overcoming various challenges amid the pandemic, such as a shortage of PN products due to a disrupted supply chain.

Moreover, the increasing prevalence of chronic conditions, majorly cancer & malnutrition, and the rapidly growing geriatric population and natality incidence are high impact-rendering drivers for market growth. Increasing natality is expected to be a major growth driver. Various benefits associated with parenteral nutrition cover easy usage, stimulating stomach blood flow, providing efficient nutrients, and preserving muscle catabolism. An increase in awareness about these benefits is likely to help boost product demand. For instance, educational campaigns pertaining to health awareness, particularly emphasizing nutrition, and various initiatives have been undertaken to promote health & social care.

PN can be given to children and infants suffering from a disease or medical condition, thereby requiring special nutritional management. Specialized Nutrition Europe (SNE) estimated that nearly 300,000 EU children are anticipated to require medical nutrition for their special medical needs in early life stages, which supports growth and development. The study further reveals that about 40% of hospitalized adult patients are malnourished and need medical nutrition to manage the disease-related malnutrition condition, thereby reducing the duration of hospital stay. PN further lowers the infection risk and underdevelopment, thereby promoting its adoption worldwide.

Most of the premature babies suffer from low weight and undeveloped immunity, which puts them at risk. In addition, individuals and healthcare authorities are extensively focusing on limiting mortality due to early birth, thereby driving the use of parenteral lipid emulsions. In 2016, the premature birth rate in the U.S. was about 9.6% and national authorities are working toward reducing it to 8.1%, according to the National Center for Healthcare Statistics. Moreover, a rise in the number of hospitalizations for COVID-19 patients during the pandemic further boosted product adoption in various hospitals, clinics, and Ambulatory Surgical Centers (ASCs).

Changing reimbursement scenarios coupled with other emerging trends to facilitate product adoption are projected to boost market growth in the near future. Various health plans are now available in the U.S. to cope with the problems caused by the COVID-19 pandemic. The immediate implementation of reforms in the Value-based Insurance Design (V-BID) model by the Centers for Medicare & Medicaid Services (CMS) ensures affordable and easy access to critical, clinical services. Thus, the COVID-19 pandemic positively impacted the market and will augment product adoption in the coming years.

Furthermore, the increasing prevalence of chronic conditions, such as cancer, is boosting product usage worldwide. PN helps in the administration of vital nutrients, which helps in maintaining strength, energy, and hydration levels in patients suffering from cancer at all stages, i.e., from diagnosis to recovery. According to the WHO, approximately 8.2 million deaths are recorded each year due to cancer, accounting for 13.0% of deaths worldwide. Moreover, there is expected to be a 70.0% increase in new cases of cancer in the next couple of decades. Thus, the increasing prevalence of cancer is one of the key factors contributing to market growth.

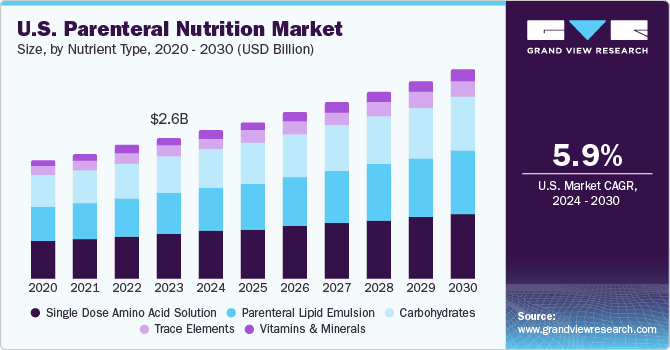

Nutrient Type Insights

In 2022, the single-dose amino acid solution segment accounted for the largest share of more than 30.9% of the overall revenue. This can be attributed to the increased usage of amino acid solutions, which can be related to a rise in the influx of regulatory-approved solutions. Moreover, newly available amino acid solutions possess fewer side effects, thereby enhancing patient benefits. Aminosyn (by Hospira, Inc.) and Nirmin (by Nirlife Pharma) are a few of the single-dose amino acid solutions available in the market. Formulations of mixed amino acids provide essential and nonessential amino acids.

Hence, the standard component acts as comprehensive parenteral nutrition for overall biological functioning. The parenteral lipid emulsion segment is anticipated to register the fastest CAGR during the forecast period. The development of hybrid parenteral lipid emulsions using mixed lipid emulsions of fish oil and olive oil, the growing adoption of parenteral nutrition over enteral nutrition in COVID-19 patients, shorter hospital stays, and reduced risk of infection are the key factors expected to boost the demand for parenteral lipid emulsions, thereby driving the segment growth.

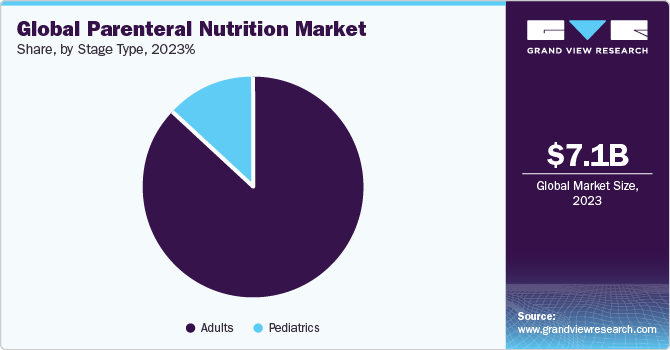

Stage Type Insights

In 2022, the adult segment held the largest share of 87.0% of the overall revenue.The growing older adult population and an increased prevalence of chronic disorders, such as Alzheimer’s disease, sarcopenia, cancer, and diabetes, among the adult population, support the segment growth. PN products are frequently used by patients when they are unable to consume food and nutrients naturally. The segment is also anticipated to register the fastest growth rate during the forecast period due to the increased product adoption by pregnant women as they need more nutrients to provide adequate nutrition to the developing fetus, which includes iron, fatty acids, amino acids, and vitamins.

Severe malnutrition in pregnant women is associated with factors, such as intrauterine growth restriction, preterm delivery, congenital malformations, low birth weight, and perinatal mortality. Thus, parenteral nutrition is advisable for pregnant women whose nutritional requirements are not being fulfilled by enteral intake.Moreover, the adoption of fat emulsion as part of total parenteral nutrition is increasing for pregnant women. The pediatric segment is anticipated to witness lucrative growth over the forecast period. This is owing to the rising consumption of parenteral nutrition among preterm neonates in their initial life after birth, due to their intolerance to full enteral nutrition and the benefits of PN that provides a relatively safe means for preventing nutritional deficiency.

Indication Insights

Based on indications, the others segment dominated the market with a share of 30.9% in 2022.The others indication segment mainly involves Crohn’s disease, cystic fibrosis, pancreatitis, other cancer-related treatment, and other health ailments. Patients undergoing heavy therapies, such as radiation therapy, immunotherapy, and medication, have severe loss of nutrition due to metabolic changes, loss of appetite, and changes in the immune system. Weight loss is the major physical change observed among such patients. Therefore, parenteral nutrition is suggested to such patients to balance their nutrition.

The rising prevalence of various conditions wherein PN can be used for the restoration of nutritional balance is impelling segment growth. However, the dysphagia segment is anticipated to witness the fastest growth rate over the forecast period due to the rising disease prevalence. According to an article published in MDPI in 2022, the prevalence of dysphagia among elderly nursing home residents was around 58.69%, which was evaluated by Standard Swallowing Assessment (SSA). Also, the prevalence of dysphagia in combined community-dwelling elderly was around 30.52%. Furthermore, aspiration pneumonia due to dysphagia is a major complication of this condition, which boosts the need for parenteral nutrition.

Sales Channel Insights

In 2022, the institutional sales channel segment dominated the global market with a share of 48.5% of the overall revenue owing to the growing number of private and public healthcare institutions and the increasing chronic disease patient population across the globe. In addition, the purchase decision of parenteral nutrition is influenced by doctors, thereby, impelling the segment growth. The online sales channel segment is expected to witness the fastest growth rate during the forecast period.

This is owing to a shift in a trend toward direct selling to the customer via e-commerce platforms. The preference for online purchase of parenteral nutrition is rising owing to the convenience offered by this sales channel. Although consumed under medical surveillance, these products are intended for long-term nutrition management, resulting in growing sales through e-commerce. Thus, with the penetration of e-commerce, there is a gradual shift toward online purchase of enteral nutrition, thereby offering lucrative market growth opportunities.

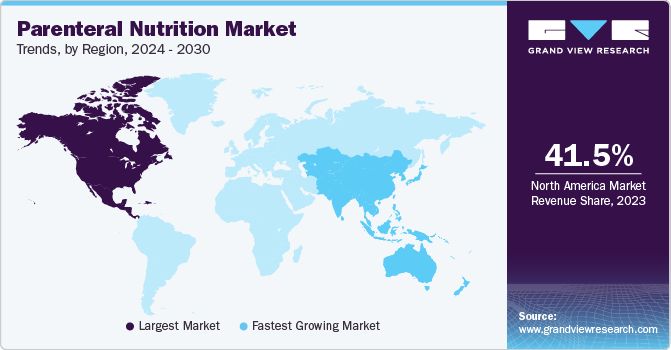

Regional Insights

North America accounted for the largest share of more than 41.5% of the overall revenue in 2022. Key factors responsible for its largest market share include high research expenditure by private entities & government agencies in the healthcare sector; technologically advanced medical devices; and collaborations among the medical device industry, regulatory authorities, universities, and others. In addition, the growing prevalence of various chronic diseases, such as cancer and malnutrition, and the presence of advanced healthcare facilities, favorable reimbursement policies & regulations in the region have led to a high hospital admission rate.

This supported the high product demand. The Asia Pacific region is anticipated to register the fastest CAGR during the forecast period. The growing prevalence of chronic diseases due to unhealthy eating habits and rising demand for cost-effective treatment of care are some of the factors expected to drive the Asia Pacific regional market growth. Moreover, the growing population, coupled with poverty, and less awareness about nutrition in the region are leading to malnutrition, which is one of the key factors boosting the product demand in the region.

Key Companies & Market Share Insights

Continuous investments from key operating players for the development of advanced PN solutions have led them to gain a competitive edge in the market, thereby driving market growth. For instance, in January 2020, Fresenius Kabi completed its clinical trial for SmofKabiven. SmofKabiven is their new launch in the range of lipid emulsions. It is made of multiple oils (fish, soybean, & olive oils, and medium-chain triglycerides) along with a separate chamber for amino acids, glucose, and lipids. In addition, companies are actively involved in improving their current product portfolio to sustain their industry position. New drug development by companies and their entry into the untapped markets to expand their reach are also expected to boost industry growth. Some of the key players operating in the global parenteral nutrition market are:

-

Baxter

-

Allergan

-

Actavis Inc.

-

Otsuka Pharmaceutical Factory, Inc.

-

Grifols, S.A.

-

B. Braun Melsungen AG

-

Vifor Pharma

-

Fresenius Kabi AG

-

Sichuan Kelun Pharmaceutical Co., Ltd.

-

Pfizer Inc. (Hospira Inc.)

Parenteral Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.1 billion

Revenue forecast in 2030

USD 10.7 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nutrient type, stage type, indication, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden, Denmark, Norway, Thailand, Japan; India; China; Australia; South Korea; Brazil; Mexico; Argentina, South Africa; Saudi Arabia, UAE, Kuwait

Key companies profiled

Baxter; Grifols, S.A.; Allergan; Otsuka Pharmaceutical Factory, Inc.; Actavis Inc.; B. Braun Melsungen AG; Fresenius Kabi AG; Vifor Pharma; Sichuan Kelun Pharmaceutical Co., Ltd.; Pfizer Inc. (Hospira Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Parenteral Nutrition Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global parenteral nutrition market report based on nutrient type, stage type, indication, sales channel, and region:

-

Nutrient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrates

-

Parenteral Lipid Emulsion

-

Single Dose Amino Acid Solution

-

Trace Elements

-

Vitamins & Minerals

-

-

Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatrics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the parenteral nutrition market with a share of more than 41.5% in 2022. This is attributable to the high research expenditure by government agencies and private entities in the healthcare sector and the presence of technologically advanced medical devices.

b. Some key players operating in the parenteral nutrition market include Baxter; Grifols, S.A.; Allergan; Otsuka Pharmaceutical Factory, Inc.; Actavis Inc.; B. Braun Melsungen AG; Fresenius Kabi AG; Vifor Pharma; Sichuan Kelun Pharmaceutical Co., Ltd.; and Pfizer, Inc. (Hospira Inc.)

b. Key factors that are driving the parenteral nutrition market growth include the growing presence of a large number of malnourished children, a high natality rate around the globe, increasing premature births, and the rising occurrence of cancer.

b. The global parenteral nutrition market size was estimated at USD 6.7 billion in 2022 and is expected to reach USD 7.1 billion in 2023.

b. The global parenteral nutrition market is expected to grow at a compound annual growth rate of 6.0% from 2022 to 2030 to reach USD 10.7 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."