- Home

- »

- Next Generation Technologies

- »

-

Passwordless Authentication Market Size, Share Report 2030GVR Report cover

![Passwordless Authentication Market Size, Share & Trends Report]()

Passwordless Authentication Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Product Type (Fingerprint Authentication, Iris Recognition, Face Recognition), By Authentication Type, By Portability, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-996-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Passwordless Authentication Market Summary

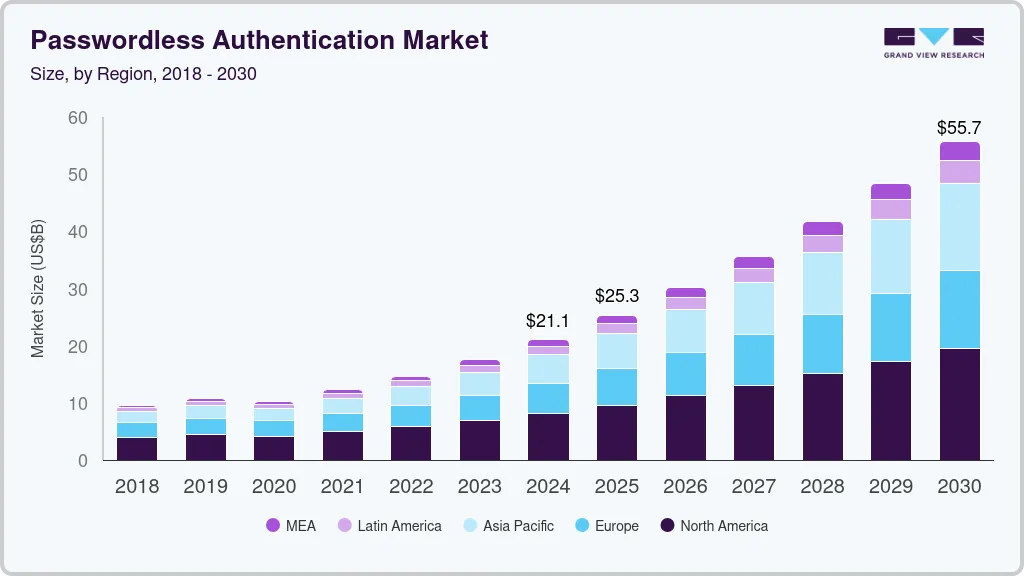

The global passwordless authentication market size was estimated at USD 21,071.7 million in 2024 and is projected to reach USD 55,702.8 million by 2030, growing at a CAGR of 17.1% from 2025 to 2030. The growth of the market is driven by technological advancements and rising adoption across industries like finance, healthcare, and retail.

Key Market Trends & Insights

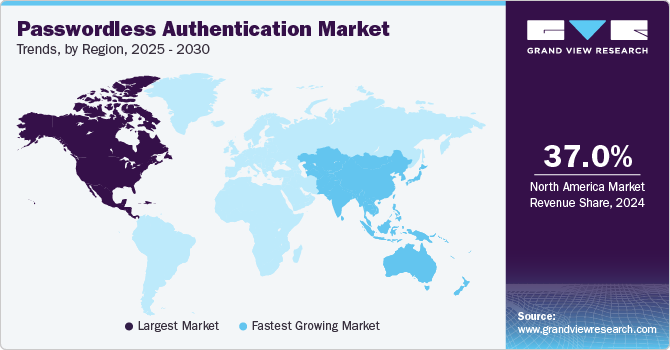

- North America dominated with a revenue share of over 37.0% in 2024.

- The passwordless authentication market in the U.S. is expected to grow at a CAGR from 2025 to 2030

- By product, the The fingerprint authentication segment accounted for the largest revenue share in 2024.

- By authentication type, the the single-factor authentication segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21,071.7 Million

- 2030 Projected Market Size: USD 55,702.8 Million

- CAGR (2025-2030): 17.1%

- North America: Largest market in 2024

Moreover, growing demand for seamless digital experiences in mobile and cloud-based services is pushing enterprises to adopt passwordless authentication. As the workforce becomes more distributed and remote work environments expand, companies are investing in secure, scalable authentication solutions that do not rely on passwords. This trend is expected to continue driving growth in the passwordless authentication market over the forecast period. For instance, in June 2024, Thales introduced a new product, Passwordless 360, to provide a complete passwordless authentication solution. This tool allows businesses to move beyond traditional passwords, enhancing security by using more secure forms of authentication like biometrics or multi-factor authentication (MFA). This solution supports zero-trust security models and reduces the risks associated with password theft or breaches, which are common vulnerabilities for organizations.Passwordless technology modifies the core security architecture by relocating verification to the device rather than transmitting credentials over an online connection. While traditional multi-factor authentication (MFA) adds protection and usability to the authentication process, passwordless systems are more advanced. Organizations often attempt to strike a balance between workforce access security and user experience while also managing supply chain security, which is critical for B2B financial infrastructure. For instance, in August 2024, SK Telecom Co., Ltd. launched a passkey authentication system offered as a Software as a Service (SaaS) model for enterprises. This passwordless login solution enables users to access their accounts using device-supported methods like PIN codes and biometric authentication. It is designed to function seamlessly across various platforms, including smartphones, PCs, and applications.

According to Verizon' June 2022 data breach investigations report (DBIR), weak and repeated passwords account for around 81% of hacking-related breaches. Over 90% of people duplicate passwords between work and personal accounts, making the banking sector lean toward passwordless authentication as an additional layer of security for their customers' accounts. There are various approaches for IT to reduce risk, and professional security professionals are mainly focused on this. As authentication is weak, passwordless authentication systems in the banking sector are being used significantly as the risk of weak or stolen passwords grows.

Product Type Insights

The fingerprint authentication segment accounted for the largest revenue share in 2024. This is attributable mainly to factors such as rise in identity threats, pervasive use of fingerprint sensors for authentication in consumer electronics, increasing usage of biometric authentication in government offices, and the advent of touchless fingerprint technology solutions. Fingerprints modernize the authentication stack, making digital banking more manageable and secure. Furthermore, effectively implementing biometric time and attendance systems for assessing employee productivity, work hours, and other aspects boosts the segment's growth.

The face recognition segment is predicted to foresee significant growth in the coming years. The substantial increase in the segment's growth can be attributed to the law enforcement sector's increasing use of face recognition technology. Border authorities increasingly utilize facial recognition technology to check travelers' identities, particularly at airports. Smartphones are another application where the technology has seen widespread adoption, like unlocking the phone, signing into mobile apps, and verifying payment.

Authentication Type Insights

The single-factor authentication segment accounted for the largest revenue share in 2024. This high share is primarily attributed to its simplicity and widespread adoption of methods like biometrics and one-time codes, which offer both security and convenience. Single-factor authentication, such as facial recognition and fingerprint scanning, requires only one step for user verification, making it appealing for industries prioritizing user experience. Its ease of implementation and lower cost compared to multi-factor authentication also contributed to its high market share.

The multi-factor authentication segment is anticipated to witness significant growth in the coming yearsdue to increasing security concerns and the rising sophistication of cyber threats. Organizations are recognizing the need for enhanced security measures, particularly in sensitive sectors like finance, healthcare, and government. MFA combines two or more verification methods, such as biometrics, hardware tokens, or one-time codes, significantly reducing the risk of unauthorized access. As regulatory compliance demands grow and the workforce shifts towards remote operations, the adoption of MFA is expected to surge, further driving the segment's growth.

Portability Insights

The fixed segment accounted for the largest revenue share in 2024.This growth is primarily attributed to the increasing demand for secure and efficient access in static environments, such as offices and data centers. Fixed mobility solutions, including biometric scanners and access control systems, provide a reliable authentication method that enhances security without the complexities of traditional passwords. Their integration into existing infrastructure allows organizations to streamline user access while maintaining robust security protocols. The need for secure environments, particularly in sectors like finance and healthcare, further drives the adoption of fixed mobility authentication solutions.

The mobile segment is anticipated to exhibit the fastest CAGR over the forecast period. As remote work and mobile applications become more prevalent, organizations are prioritizing authentication solutions that can seamlessly integrate with smartphones and tablets. Mobile authentication methods, such as biometrics and one-time passwords sent via SMS, offer users convenience while maintaining high security. The rise in mobile transactions and digital services further fuels the demand for effective mobile authentication solutions, positioning this segment for significant growth in the coming years.

End Use Insights

The government segment accounted for the largest revenue share in 2024.This high share is largely attributed to the growing emphasis on securing sensitive data and enhancing identity verification processes within government agencies. With rising concerns over cyber threats and the need for compliance with stringent regulations, government bodies are increasingly adopting passwordless solutions to improve security and efficiency. These solutions, including biometric identification and secure access tokens, facilitate seamless user experiences while safeguarding critical information, making them essential for government operations.

The BFSI segment is anticipated to exhibit the fastest CAGR over the forecast period. Financial organizations can scale their passwordless authentication to greater heights by granting users access to more formerly password-protected data. This provides for increased productivity per employee as well as more widespread access. As cyber threats become more sophisticated, financial institutions are adopting passwordless solutions like biometrics and one-time passcodes to enhance security while providing a seamless user experience. Furthermore, regulatory compliance and the demand for frictionless access to banking services drive the adoption of advanced authentication methods. This trend positions the BFSI segment for significant growth in the coming years.

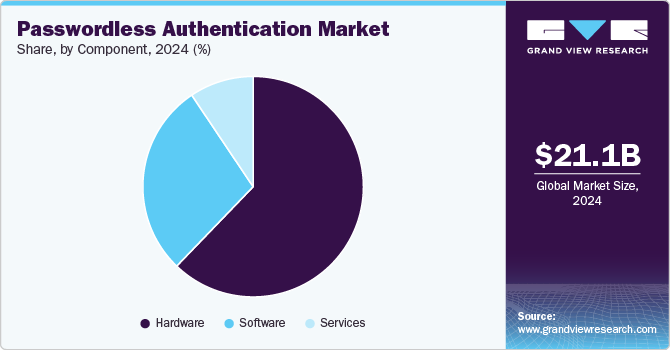

Component Insights

The hardware segment led the market in 2024, accounting for over 61% share of the global revenue. Users can utilize hardware-based security devices to perform multi-factor authentication using cryptographically secure hardware. Hardware in passwordless authentication comprises biometric systems, smart cards, tokens, key fobs, wristbands, and mobile solutions. Additionally, growing demand for multi-factor authentication in sectors like finance, healthcare, and government further boosted the reliance on hardware-based solutions for secure authentication.

The services segment is predicted to foresee significant growth in the coming yearsdue to the growing demand for consulting, integration, and maintenance services. As businesses increasingly adopt passwordless solutions, they require expert support for implementing and customizing these systems to fit their specific needs. Additionally, the shift towards cloud-based services and remote work has amplified the need for managed security services, enabling companies to monitor and maintain secure authentication infrastructure. This ongoing support, coupled with rising cybersecurity threats, is driving growth in the services sector.

Regional Insights

North America dominated with a revenue share of over 37.0% in 2024. Various advantages, including improved user experience, increased security, the lower total cost of ownership, and growing investments in developed countries such as the U.S., Canada, and Mexico for the implementation of passwordless authentication technology, are key factors driving market expansion. Furthermore, growing data security concerns in these countries have fueled the growth of passwordless authentication in this region. The rising adoption of technologies such as the IoT and AI in this region is also driving the expansion of the market.

U.S. Passwordless Authentication Market Trends

The passwordless authentication market in the U.S. is expected to grow at a CAGR from 2025 to 2030 due to increasing investments in cybersecurity and the rising demand for secure, user-friendly authentication methods. With a large number of tech-savvy consumers and a significant number of businesses transitioning to digital platforms, the U.S. is witnessing a surge in the adoption of passwordless solutions.

Europe Passwordless Authentication Market Trends

The passwordless authentication market in Europe is expected to witness significant growth over the forecast period. The rise in cyber threats and the growing demand for seamless user experiences are driving enterprises across various sectors to invest in passwordless solutions. As businesses prioritize digital transformation, the European market is poised for significant growth in passwordless authentication technologies.

Asia Pacific Passwordless Authentication Market Trends

The passwordless authentication market in Asia Pacific is anticipated to register the fastest CAGR from 2025 to 2030, driven by rapid digital transformation and a growing emphasis on cybersecurity. As businesses increasingly adopt cloud-based services and mobile applications, the demand for secure, user-friendly authentication methods is surging. Additionally, governments in the region are implementing stringent regulations to protect sensitive data, prompting organizations to explore passwordless solutions. The rise of e-commerce and online banking further fuels this growth as companies seek to enhance customer experience while safeguarding against cyber threats.

Key Passwordless Authentication Company Insights

Some key players in the passwordless authentication market, such as ASSA ABLOY, DERMALOG Identification Systems GmbH, East Shore Technology, LLC, and Fujitsu, are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

ASSA ABLOY is a prominent player in access solutions, including door-opening solutions, identification technology, and digital security. The company has a strong presence in the passwordless authentication market, driven by its investment in biometric and mobile access technologies. Through its subsidiary HID Global Corporation, ASSA ABLOY offers various passwordless authentication products such as biometric readers, smart cards, and mobile-based credential systems, all integrated into access control systems. The company focuses on providing seamless, secure solutions for sectors like healthcare, finance, government, and commercial enterprises.

-

Fujitsu is a global IT services company known for its innovation in computing, data management, and cybersecurity. In the market for passwordless authentication, the company offers advanced solutions focusing on biometrics and MFA. Fujitsu’s focus on integrating biometric data for secure access aligns with the growing industry shift toward passwordless security, offering organizations a way to reduce reliance on passwords while improving security and user experience. Additionally, the company combines its passwordless solutions with cloud services and Zero Trust models to help organizations meet modern security requirements.

Key Passwordless Authentication Companies:

The following are the leading companies in the passwordless authentication market. These companies collectively hold the largest market share and dictate industry trends.

- ASSA ABLOY

- DERMALOG Identification Systems GmbH

- East Shore Technology, LLC

- Fujitsu

- HID Global Corporation

- M2SYS Technology

- Microsoft

- NEC Corporation

- Safran

- Thales

Recent Developments

-

In June 2024, REA Group Ltd. launched a password-less sign-in experience across its platforms, utilizing its authentication service "Locke." Locke now offers a streamlined authentication process by using one-time codes and social sign-ins, eliminating the need for traditional passwords. This enables users to access REA Group Ltd.'s products with just a single account, making the login experience more convenient and user-friendly.

-

In April 2024, Center Identity, a prominent cybersecurity firm, introduced its patented secret location authentication technology, revolutionizing how businesses handle digital identity for their workforce. This innovative approach allows users to verify their identity by selecting a secret location on a map. Additionally, Center Identity is integrating this technology with OpenID Connect, a widely accepted open standard, simplifying the integration process for businesses.

-

In April 2024, Hawcx Inc., one of the prominent players in intelligent passwordless authentication, reached a major milestone with the launch of its advanced platform. This innovative solution aims to transform authentication for enterprises and end-users by offering a perfect balance of security and convenience, marking the beginning of a new era in digital authentication.

Passwordless Authentication Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.29 billion

Revenue forecast in 2030

USD 55.70 billion

Growth rate

CAGR of 17.1% from 2025 to 2030

Base year for estimation

2024

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product type, authentication type, portability, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ASSA ABLOY; DERMALOG Identification Systems GmbH; East Shore Technology, LLC; Fujitsu; HID Global Corporation; M2SYS Technology; Microsoft; NEC Corporation; Safran; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passwordless Authentication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global passwordless authentication market report based on component, product type, authentication type, portability, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fingerprint Authentication

-

Palm Print Recognition

-

Iris Recognition

-

Face Recognition

-

Voice Recognition

-

Smart Card

-

Others

-

-

Authentication Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Single-factor Authentication

-

Multi-factor Authentication

-

-

Portability Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed

-

Mobile

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

Retail

-

Transportation & Logistics

-

Aerospace & Defence

-

BFSI

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global passwordless authentication market size was estimated at USD 21.07 billion in 2024 and is expected to reach USD 25.29 billion in 2025.

b. The global passwordless authentication market is expected to grow at a compound annual growth rate of 17.1% from 2025 to 2030 to reach USD 55.70 billion by 2030.

b. North America dominated the passwordless authentication market with a share of 38.4% in 2024. This is attributable to the plenty of investments in developed countries such as the U.S., Canada, and Mexico for implementing passwordless authentication technology.

b. Some key players operating in the passwordless authentication market include ASSA ABLOY; DERMALOG Identification Systems GmbH; East Shore Technology, LLC; Fujitsu; HID Global Corporation; M2SYS Technology; Microsoft; NEC Corporation; Safran; Thales

b. Key factors that are driving the passwordless authentication market growth include the rise in identity threats, the pervasive use of fingerprint sensors for authentication in consumer electronics, the increasing usage of biometric authentication in government offices, and the advent of touchless fingerprint technology solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.