- Home

- »

- Medical Devices

- »

-

Patient Positioning And Support Aids Market Report, 2030GVR Report cover

![Patient Positioning And Support Aids Market Size, Share & Trends Report]()

Patient Positioning And Support Aids Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pillows And Wedges, Air-Assisted Transfer Aids, Slide Sheets) By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

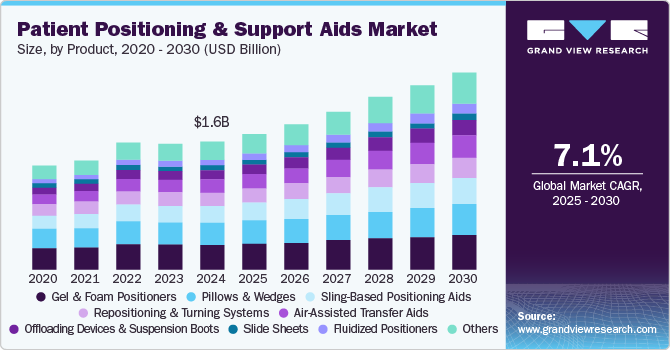

The global patient positioning and support aids market size was estimated at USD 1.62 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. This growth can be attributed to the aging global population, increasing prevalence of chronic diseases, technological advancements, rising healthcare expenditure, and increasing emphasis on patient safety and comfort, further contributing to market growth. The increasing number of surgical procedures is expected to boost the demand for patient positioning and support aids. The surgeries require positioning and support aids such as fluidized positioners, gel positioners, pillows, wedges, transfer aids, repositioning products, turning systems, slide sheets, and offloading devices to prevent the patient from pressure ulcers and to move the patient from one area to another area post-surgical procedures. Various surgical procedures, such as orthopedic, neurosurgeries, and cosmetic surgeries, are being carried out. For instance, as per a study published by the National Library of Medicine in July 2020, around 310 million major surgical procedures are performed annually, of which around 40 to 50 million are conducted in the U.S. and 20 million in Europe.

The increasing number of orthopedic surgeries, such as hip and knee replacement surgeries that need patient positioning and support aids, is anticipated to propel market growth over the forecast period. According to data published by the American College of Rheumatology in February 2024, about 544,000 hip and 790,000 total knee replacements are performed annually in the U.S. As per the Canadian Institute for Health Information (CIHI), in 2021-2022, around 58,635 hip & knee replacement surgeries were conducted by hospitals in Canada compared to 55,300 surgeries conducted in 2020-2021.

Technological advancements in the patient positioning and support aids market are expected to drive significant growth. Industry players are focusing on developing products that incorporate advanced features, such as anti-skid strips on the back, smart labels, integrated arm protectors, and additional safety straps to enhance patient safety. For instance, in August 2023, U.S. Surgitech, Inc., a manufacturer, was awarded a patent for its innovative SurgyPad patient positioning system. This system includes enhanced safety features, integrated arm protectors, and an anti-skid strip on the back. It has obtained widespread recognition from healthcare professionals and surgeons. It has been included in several top Group Purchasing Organization (GPO) contracts in the U.S. due to its potential to revolutionize patient positioning. As a result, the increasing adoption of innovative patient positioning and support aids is anticipated to contribute to market growth in the coming years.

The increasing burden of hospital-acquired infections (HAIs) is anticipated to bring novel patient positioning and support aids, such as pillows and mattresses, that mitigate the spread of HAIs, thus driving the market growth in the coming years. For instance, in December 2020, Spry Therapeutics partnered with the Healthcare Surfaces Institute to prevent HAIs and reduce their spread. The pillows and mattresses from Spry Therapeutics use soft-surface filter technology, Pneumapore, to block even the slightest "superbugs" from penetrating or exiting any soft surface to which it's applied, assisting in preventing the transmission of deadly infections among patients and caregivers. Pneumapure also reduces costs associated with HAIs, from environmental impact to disposal costs, annual purchase expenditures, and more. Such partnerships among industry stakeholders focus on increasing the adoption of patient-supporting aids that help HAI prevention, which is anticipated to propel market growth in the coming years.

Market Concentration & Characteristics

The degree of innovation in this market is high, fueled by an aging population, increased focus on patient-centered care, and the need for cost-effective solutions in healthcare settings.

The market has witnessed significant merger and acquisition (M&A) activity in recent years, driven by companies aiming to expand their geographic reach and enter new territories. Major players such as Medtronic, Hill-Rom Holdings, Inc., and Stryker Corporation have been actively involved in these M&A activities. This trend is part of a broader strategy to enhance product offerings and strengthen market presence.

Regulations can significantly impact the market, shaping medical device development, production, distribution, and usage. Regulatory bodies such as the FDA (U.S.), EMA (EU), and others mandate strict testing and certification to ensure product safety and efficacy. Manufacturers must invest in compliance-related activities, such as quality assurance, documentation, and audits, which can increase operational costs.

Combining sustainability through eco-friendly materials can further differentiate products. Strategic partnerships with healthcare providers, manufacturers, and technology firms can enhance product validation and technological integration. Effective marketing and distribution strategies can boost product reach, including leveraging e-commerce platforms and forming direct hospital partnerships. Training programs for healthcare professionals and caregivers will also support adoption.

Regional expansion in the market requires a strategic focus on understanding the target region's healthcare landscape, regulatory requirements, and patient demographics. Key factors include assessing regional demand driven by aging populations, increasing surgical procedures, chronic disease prevalence, and evaluating healthcare infrastructure and hospital density. Compliance with local regulations for medical devices, such as CE marking in Europe or FDA standards in the U.S., is crucial to ensure market entry.

Product Insights

The gel and foam positioners segment dominated the market in revenue share in 2024. Gel and foam positioners have emerged as crucial components for healthcare settings, prioritizing patient comfort and safety. These products are designed to alleviate pressure, enhance stability, and support patients during medical procedures, ensuring optimal positioning for various treatments. The segment of gel and foam positioners is driven by several critical factors and is characterized by evolving trends shaping the future of patient care. Advancements in technology also contribute to the growth of this segment. Manufacturers are continually innovating their products, incorporating advanced materials that enhance the performance of gel and foam positioners. These materials provide better pressure redistribution, temperature regulation, and moisture management, crucial for maintaining skin integrity and patient comfort. For instance, in August 2023, U.S. Surgitech, Inc., one of the prominent medical device manufacturers, announced that it had been granted a patent for its innovative SurgyPad patient positioning system.

The fluidized positioners segment is anticipated to grow at the fastest CAGR. Fluidized positioners are specialized support aids designed to stabilize patients in various clinical scenarios while facilitating mobility and reducing the risk of pressure ulcers. These aids utilize a unique mechanism that combines fluid dynamics principles with ergonomic design, allowing them to mold the patient's body shape. Moreover, the adaptability of fluidized positioners enhances their usability across various clinical environments, including surgical theaters, intensive care units, and long-term care facilities. They aid in multiple procedures, such as surgeries and diagnostic imaging, where precise positioning is crucial for patient safety and procedural efficacy.

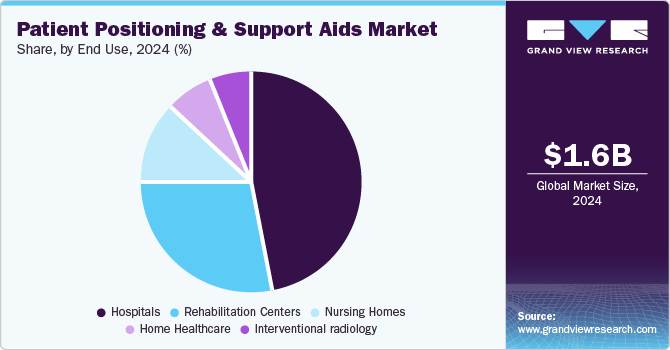

End Use Insights

Hospitals dominated the market with the largest revenue share in 2024. Hospitals are essential healthcare facilities that provide comprehensive medical services, including surgeries, diagnostic procedures, and emergency care. Within this setting, patient positioning aids, such as cushions, pads, and positioning devices, are essential in ensuring that patients are securely positioned during various procedures. The main objective is to prevent complications such as pressure ulcers, nerve damage, and musculoskeletal injuries for patients and healthcare providers.

Rehabilitation centers are projected to experience the fastest growth over the forecast period due to the rising incidence of disabilities resulting from various factors, including aging populations, obesity, and chronic conditions such as stroke and arthritis. As the number of patients requiring rehabilitative services continues to increase, the demand for effective patient positioning aids has also grown. These aids enhance patients’ comfort during rehabilitation sessions and facilitate better therapist access, promoting efficient therapeutic practices.

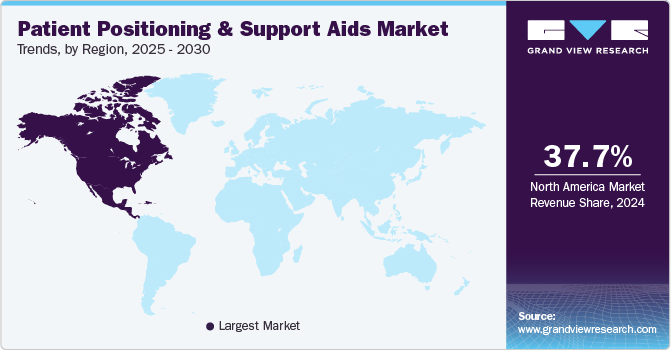

Regional Insights

North America dominated the market and accounted for a 37.68% share in 2024, fueled by an aging population, increasing prevalence of chronic diseases, and advancements in medical technology. Within North America, the U.S. holds a significant market share due to its advanced healthcare infrastructure and higher healthcare expenditure. The increasing number of elderly individuals necessitates advanced patient positioning and support aids to manage age-related health issues.

U.S. Patient Positioning And Support Aids Market Trends

The patient positioning and support aids market in the U.S. is experiencing robust growth, driven by rising healthcare demands, stricter regulations, and an increasing focus on public safety. The growing prevalence of chronic diseases and the expansion of home healthcare services further accelerate the demand for positioning aids across the country.

Europe Patient Positioning And Support Aids Market Trends

The patient positioning and support aids market in Europe is expanding, driven by the rising number of hospital surgical procedures. As surgical operations increase across the region, the need for efficient and safe positioning and support aids has become more critical. Strict regulations and heightened awareness of infection control further contribute to the demand for high-quality support aids, supporting market expansion in Europe’s healthcare sector.

The UK patient positioning and support aids market is growing significantly. Many chronic conditions, such as cardiovascular diseases and joint disorders, necessitate surgical interventions. Post-surgical care for these patients involves positioning aids to promote healing, reduce discomfort, and prevent complications, driving demand for these products. In 2022, CVD was responsible for around 27% of all deaths in the UK, or about 175,000 people. Diabetes UK 2023 estimates that more than 5.6 million people in the UK are living with diabetes, which is an all-time high. This data shows that 4.4 million people in the UK live with diabetes. Additionally, 1.2 million people could be living with type 2 diabetes who are yet to be diagnosed.

The patient positioning and support aids market in Germany is witnessing significant growth, driven by increased surgical procedures and stringent regulations for safe medical waste disposal. Rising awareness of infection control in healthcare settings further fuels demand. Hospitals and surgical centers prioritize safety, encouraging innovations in support aid design and boosting market expansion.

Asia Pacific Patient Positioning And Support Aids Market Trends

The patient positioning and support aids market in Asia Pacific is experiencing significant growth, driven by advancements in healthcare infrastructure, increasing surgical procedures, and rising awareness of patient safety and comfort. The market comprises various products designed to enhance patient stability, comfort, and proper positioning during medical procedures, imaging, and recovery. Increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and orthopedic conditions has boosted the number of surgeries performed, driving the demand for patient positioning aids.

China patient positioning and support aids market is growing rapidly, driven by rising hospital admissions and the increasing prevalence of infectious diseases. Stringent regulations for patient-supporting aids further boost demand. Hospitals prioritize safe support aid solutions as healthcare infrastructure expands, fueling innovation and market growth for patient positioning and support aids.

Latin America Patient Positioning And Support Aids Market Trends

The patient positioning and support aids market in Latin America is experiencing steady growth, driven by the continuous increase in its elderly population. This leads to a higher demand for healthcare services, including patient positioning and support aids. The introduction of automated and portable devices has enhanced the efficiency and convenience of patient positioning systems, contributing to market growth.

Middle East and Africa Patient Positioning And Support Aids Market Trends

The patient positioning and support aids market in the Middle East and Africa is driven by the increasing prevalence of chronic diseases, advancements in healthcare infrastructure, and a rising number of surgical procedures. The increasing incidence of chronic conditions necessitates more diagnostic and surgical procedures, thereby driving the demand for patient positioning systems.

Saudi Arabia patient positioning and support aids market is expected to grow. Investment in healthcare in Saudi Arabia is one of the major drivers for the patient positioning and support aids market. The Saudi government and private sector have been significantly increasing their healthcare investments to enhance the quality of medical services, improve patient outcomes, and meet the demands of a growing population. This expansion and modernization of healthcare infrastructure positively impact the demand for patient positioning and support aids. For instance, in January 2023, the Saudi Arabian government announced an investment of USD 50.4 billion in healthcare and social development—16.96% of its 2023 budget.

Key Patient Positioning And Support Aids Company Insights

Key players operating in the patient positioning and support aids market are undertaking various initiatives to strengthen their market presence and increase the reach of their product types and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Patient Positioning And Support Aids Companies:

The following are the leading companies in the patient positioning and support aids market. These companies collectively hold the largest market share and dictate industry trends.

- Spry

- Medline Industries, LP

- Arjo

- EHOB

- DeRoyal Industries, Inc.

- Etac AB

- Hillrom (Baxter)

- Guldmann

- ANSELL LTD

- Mölnlycke Health Care AB

- Stryker

- Soule Medical

- STERIS

- Cardinal Health

Recent Developments

-

In April 2024, Pelstar LLC, a manufacturer of patient handling products, introduced its latest innovation, the Safe Turning and Repositioning (STAR) System. This system helps caregivers turn and reposition patients at the bedside.

-

In January 2024, BizLink, an interconnect solutions provider operating in France, revealed the delivery of its 100th ORION patient positioning system, celebrating a significant accomplishment in advancing precision cancer treatment worldwide.

-

In February 2024, Xodus Medical introduced the Pink Pad Air-Assist, two innovative lift-free patient positioning instrument variations. It includes the launch of the Pink Pad Air-Assist Trendelenburg + and the Pink Pad Air-Assist EXT + Trendelenburg.

-

In February 2023, Spry Therapeutics announced a new partnership with Fiberpartner, a global supplier of staple fibers, including PrimaLoft Bio, technical yarns, and plastics. This collaboration will enable Spry Therapeutics to introduce the world's first filtered, biodegradable positioning pillow to the healthcare market, tackling infection control and sustainability. Healthcare facilities can now offer patients a clean, eco-friendly alternative to conventional pillows and positioning devices.

Patient Positioning And Support Aids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 2.47 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Spry; Medline Industries, LP; Arjo; EHOB; DeRoyal Industries, Inc.; Etac AB; Hillrom (Baxter); Guldmann; ANSELL LTD; Mölnlycke Health Care AB; Stryker; Soule Medical; STERIS; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Positioning And Support Aids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global patient positioning and support aids market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gel & Foam Positioners

-

Pillows & Wedges

-

Sling-Based Positioning Aids

-

Repositioning & Turning Systems

-

Air-Assisted Transfer Aids

-

Offloading Devices & Suspension Boots

-

Slide Sheets

-

Fluidized Positioners

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Rehabilitation Centers

-

Nursing Homes

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient positioning and support aids market size was estimated at USD 1.62 billion in 2024 and is expected to reach USD 1.75 billion in 2025.

b. The global patient positioning and support aids market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030, reaching USD 2.47 billion by 2030.

b. North America dominated the patient positioning and support aids market with a share of 37.68% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technology acceptance and constant research and development initiatives.

b. Some key players operating in the patient positioning and support aids market include Spry; Medline Industries, LP; Arjo; EHOB; DeRoyal Industries, Inc.; Etac AB; Hillrom (Baxter); Guldmann; ANSELL LTD; Mölnlycke Health Care AB; Stryker; Soule Medical; STERIS; Cardinal Health.

b. The rising prevalence of chronic diseases, such as cardiovascular disorders, cancer, and orthopedic conditions, has led to an increase in surgical procedures, boosting the demand for patient positioning aids.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.