- Home

- »

- Advanced Interior Materials

- »

-

Smart Label Market Size, Share And Trends Report, 2030GVR Report cover

![Smart Label Market Size, Share & Trends Report]()

Smart Label Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (EAS, RFID, NFC, Sensing Labels), By Component (Transceivers, Memories, Batteries), By Application (Retail Inventory, Equipment), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-739-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Label Market Summary

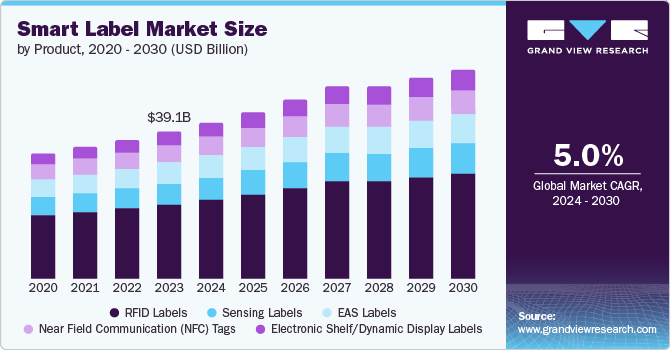

The global smart label market size was valued at USD 39.1 billion in 2023 and is projected to reach USD 55.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. A smart label acts as a responsive electronic device that is embedded in the object body as an identification slip.

Key Market Trends & Insights

- Asia Pacific smart label market dominated the global market with a revenue share of 33.4% in 2023.

- China holds a significant share in the market.

- Based on technology, the RFID labels segment dominated the market and accounted for a revenue share of 50.7% in 2023.

- Based on component, the batteries segment accounted for the largest revenue share of 29.1% in 2023.

- Based on application, the retail inventory segment dominated the market and accounted for a revenue share of 22.8% in 2023.

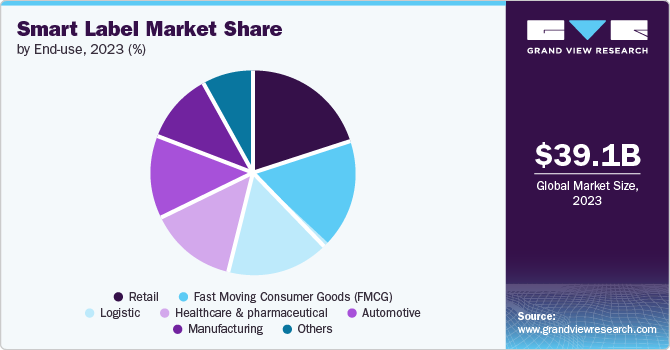

- Based on end use, the retail segment dominated the market with the largest revenue share of 20.2%in 2023.

Market Size & Forecast

- 2023 Market Size: USD 39.1 Billion

- 2030 Projected Market Size: USD 55.6 Billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

They are configured with chips, antenna, and bonding wires which help in real-time tracking of assets and goods. A smart label is designed to implement advanced technology which leads to advantageous features such as automated reading, quick identification, re-programmability, high tolerance, and reduced errors. As a result, it is being preferred over conventional bar code systems in retail, FMCG, and logistics industries. These are mostly made from plastics, paper, and fibers.The U.S. was one of the major consumers of the global smart label market in the recent past. Improvement in inventory management, asset tracking, and consumer goods distribution has driven the market in the U.S. A smart label is designed to receive, record, and transmit digital information which results in a significant reduction of total tracking time. Thus, rising industrial use of the aids to minimize human intervention and errors, owing to its accuracy and efficiency.

The smart label provides effective solutions for major challenges faced by retailers and manufacturers. This is widely used to prevent theft and shoplifting. Companies are investing to improve their anti-theft system to prevent revenue loss and inventory damage caused by shoplifting and theft. This, in turn, is expected to boost the demand over the forecast period.

Counterfeit is another key issue faced in numerous industries which leads to poor product performance, deterioration of brand, and threatened consumer safety. Increasing awareness in industry regarding the harmful effects of counterfeit is anticipated to further boost the demand, especially in the automotive and manufacturing industries.

Recent economic growth, rapid urbanization, and increasing per capita income in developing countries has propelled the demand in the recent past. However, the cost associated with installation of the smart label tracking systems is likely to hinder the market in growing economies. Furthermore, lack of uniformity in the standardization system and low susceptibility is predicted to obstruct the market growth over the forecast period.

Technology Insights

The RFID labels dominated the market and accounted for a revenue share of 50.7% in 2023. RFID provides long-term cost savings because of improved operational efficiency, reduced labor costs, and minimized errors making RFID labels a cost-effective solution for many businesses. It offers real-time tracking capabilities boosting efficiency in supply chains, warehouses, and retail stores. Also, RFID tags can store data more than basic product details which enhances inventory management. According to Nexqo Technology Co., Ltd., RFID have 2 Kilobyte to 128 Kilobyte capacity of storage depending on type and manufacturer.

The electronic shelf/dynamic display label segment is expected to grow at the fastest CAGR of 6.0% from 2024 to 2030. Usage of dynamic display labels is predicted to increase significantly on a dynamic display of product information and pricing would lead to easy price management and accuracy. The segment is projected to experience the fastest growth rate over the forecast period.

Component Insights

The batteries segment accounted for the largest revenue share of 29.1% in 2023. The primary factor driving the segment is the continuous advancements in technology. The development of miniaturized electronic components and wireless communication technologies has enabled the integration of batteries into smart labels. These batteries power various functionalities of smart labels, such as data storage, sensing capabilities, and wireless communication. The availability of compact and long-lasting batteries has made it possible to create smart labels that can operate for extended periods without requiring frequent battery replacements.

The transceivers segment accounted for a revenue share of 27.4% in 2023 due to its smooth data transmission, enabling communication between the label and readers. Their flexibility, range capabilities, and efficiency make it an essential component since every smart label needs a reliable way to communicate leading to high demand for transceivers for smart labels.

The memories segment is expected to grow at the fastest CAGR of 5.6% from 2024 to 2030. Increasing usage in inventory management and asset tracking is estimated to drive the demand for this market segment over the forecast period. Smart labels with memory components enable real-time tracking and monitoring of products throughout the supply chain. This helps in reducing inventory errors, improving order accuracy, and enhancing overall operational efficiency. With the increasing complexity of global supply chains, businesses are adopting smart labels to gain better visibility and control over their inventory.

Application Insights

The retail inventory segment dominated the market and accounted for a revenue share of 22.8% in 2023. Protective measures taken by retailers to prevent shoplifting and theft are estimated to drive substantial demand in retail inventory application over the forecast period.

Factors driving the adoption of smart labels in the retail inventory include the need for improved inventory management, increased demand for real-time data, and the growing adoption of IoT technologies. Smart labels offer retailers a more efficient and accurate way to manage their inventory, provide real-time data for better decision-making, and enable seamless integration with other IoT devices. As the retail industry continues to evolve, smart labels are expected to play a crucial role in optimizing inventory management processes and enhancing overall operational efficiency.

The perishable goods segment is expected to grow at the fastest CAGR of 5.9% during the forecast period. Smart labels are being widely used in threshold detection and shelf life monitoring of perishable goods such as food, beverages, and medicines. The main factor driving the use of smart labels in the perishable goods segment is the need for enhanced supply chain visibility. Perishable goods require strict temperature control and monitoring throughout the supply chain to maintain their quality and safety. Smart labels equipped with sensors can provide real-time data on temperature, humidity, and other environmental conditions, allowing stakeholders to track and monitor the condition of perishable goods from production to consumption. This visibility helps identify potential issues or deviations from optimal conditions, enabling proactive measures to be taken to prevent spoilage or contamination.

End Use Insights

The retail segment dominated the market with the largest revenue share of 20.2%in 2023. Smart labels offer benefits that drive their adoption in the retail market. One key benefit is improved operational efficiency. With smart labels, retailers can automate various processes such as inventory management, price updates, and checkout procedures. This automation reduces human errors, saves time, and lowers operational costs. Additionally, smart labels enable retailers to track and trace products throughout the supply chain, enhancing visibility and enabling faster recall processes in case of product quality issues or safety concerns.

The healthcare & pharmaceutical segment is projected to experience the fastest CAGR of 6.0% during the forecast period. Rising use in spoil detection of hospital goods, test samples, medical equipment, drugs are anticipated to bolster the demand in the healthcare & pharmaceutical. One of the major factors driving the demand for smart labels in the healthcare sector is the need to enhance patient safety. Smart labels provide real-time information about medications, including dosage instructions, potential side effects, and expiration dates. This enables healthcare professionals to ensure that patients receive the correct dosage and medication, reducing the risk of medication errors and adverse drug events. Additionally, smart labels can also assist in tracking medication usage and adherence, allowing healthcare providers to monitor patient compliance and intervene if necessary.

Regional Insights

North America smart label market held a significant share in the global market in 2023 due to strong retail & manufacturing sectors, focus on efficiency & cost saving, and increasing e-commerce in the region.

U.S. Smart Label Market Trends

The U.S. smart label market held a considerable share in 2023 due to the highly developed digital infrastructure, with widespread adoption of technologies such as cloud computing and the Internet of Things (IoT). This digital readiness provides a strong foundation for the implementation and integration of smart label technology. Businesses in the U.S. are highly focused on optimizing operations and reducing costs..

Europe Smart Label Market Trends

Europe smart label market was identified as a lucrative region in 2023 due to factors such as strict regulations. European regulations such as the Falsified Medicines Directive (FMD) encourages the use of smart labels for product authentication, traceability, and safety compliance.

Germany smart label market held a substantial market share in 2023 owing to a manufacturing sector growth and focus on pharmaceutical applications in compliance with FMD, retail inventory management for cost efficiency, and perishable goods tracking for reduced waste.

Asia Pacific Smart Label Market Trends

Asia Pacific smart label market dominated the global market with a revenue share of 33.4% in 2023. Rising disposable income coupled with rapid urbanization in developing regions has propelled the growth of retail, logistics, and FMCG industries in these regions. This, in turn, has led to growing demand for smart labels in end-user industries.

China holds a significant share in the market. This can be attributed to the manufacturing industry in the country and the booming e-commerce market. China’s manufacturers are focusing on optimizing production processes and reducing costs. According to the World Population Review, China alone holds 31.6% of global manufacturing. Smart labels offer solutions for inventory management, supply chain tracking, and anti-counterfeiting, which leads to these goals.

Key Smart Label Company Insights

The key companies of the smart label industry primarily focus on expansion of product portfolio and production capacity. Major manufacturers are extensively investing in research and innovation to introduce products that can be used in specific applications. Manufacturers are focusing on strengthening their presence in emerging economies. The companies emphasize to enter partnership collaboration and joint ventures to increase their market shares.

-

AVERY DENNISON CORPORATION specializes in smart labels using RFID technology, enhancing connectivity and efficiency across various sectors such as retail apparel, cosmetics, aviation, food, and pharmaceuticals. Their products include UHF, HF, and NFC solutions for inventory management, loss prevention, and consumer engagement.

Key Smart Label Companies:

The following are the leading companies in the smart label market. These companies collectively hold the largest market share and dictate industry trends.

- AVERY DENNISON CORPORATION

- CCL Industries

- Zebra Technologies Corporation

- Alien Technology, LLC.

- Checkpoint Systems, Inc.

- Impinj, Inc.

- MPI Labels

- Invengo Information Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors.

Recent Developments

-

In January 2023, AVERY DENNISON CORPORATION entered into a contract to acquire Thermopatch, a player with expertise in labeling. Thermopatch will join the company's Apparel Solutions segment of Retail Branding and Information Solutions (RBIS). Through the utilization of this company's expertise, quality, and service, the merged business will be able to capitalize on its combined industry knowledge and fuel growth in external embellishments.

-

In January 2023, Pod Group in a strategic collaboration with SODAQ and Lufthansa Industry Solutions announced the introduction of a paper-thin monitoring tool in the form of a Smart Label, which is expected to revolutionize the logistics sector by enabling tracking of small and light products that was previously impossible with existing tracking tools.

-

In April 2023, CCL Industries disclosed the acquisition of two intelligent labels, Alert Systems ApS's intellectual property and eAgile Inc. The Healthcare & Specialty division of CCL Label will greatly benefit from the addition of eAgile, further integrating its RFID expertise throughout the organization. The technology from Alert will be a crucial addition to the company’s MAS platform at Checkpoint.

-

In July 2023, CCL Industries announced the acquisition of Faubel & Co. Nachf. GmbH, a German pharmaceutical label business. The acquisition increases the organizational and operational capability of CCL Industries in Europe in order to establish a global presence.

-

In July 2022, Oil-Tech developed new smart label technology for time- and temperature-sensitive items. Products with a shelf life of five to fifteen days can utilize these smart labels, which have a built-in, temperature- and time-sensitive display indicator. This indicator gradually transforms from yellow to red, slower in mild temperatures and more quickly in warmer ones, both at known and repeatable rates. Retailers and customers can quickly understand the call to action provided by this straightforward color-changing indicator.

Smart Label Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.5 billion

Revenue forecast in 2030

USD 55.6 billion

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Turkey, China, Japan, India, Indonesia, Thailand, Brazil, Argentina, UAE, and South Africa

Key companies profiled

AVERY DENNISON CORPORATION; CCL Industries; Zebra Technologies Corporation; Alien Technology, LLC.; Checkpoint Systems, Inc.; Impinj, Inc.; MPI Labels; Invengo Information Technology Co., Ltd.; Murata Manufacturing Co., Ltd. and NXP Semiconductors.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Label Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart label report based on technology, component, application, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

EAS Labels

-

RFID labels

-

Sensing labels

-

Electronic Shelf/Dynamic Display Labels

-

Near Field Communication (NFC) Tags

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transceivers

-

Memories

-

Batteries

-

Microprocessors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Inventory

-

Perishable Goods

-

Electronic & IT Assets

-

Equipment

-

Pallets Tracking

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Fast Moving Consumer Goods (FMCG)

-

Healthcare & pharmaceutical

-

Logistic

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.