- Home

- »

- Next Generation Technologies

- »

-

Payment Orchestration Platform Market Size Report, 2030GVR Report cover

![Payment Orchestration Platform Market Size, Share & Trends Report]()

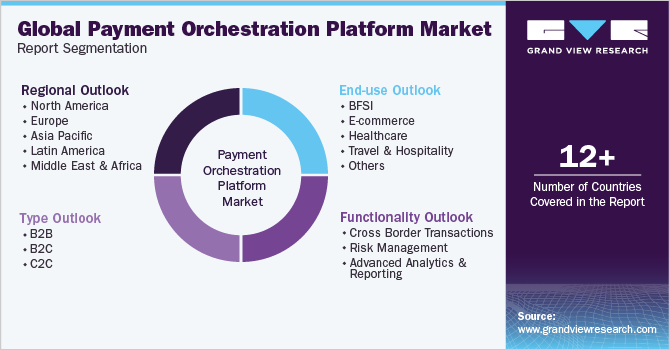

Payment Orchestration Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (B2B, B2C, C2C), By Functionality, By End-use (BFSI, Healthcare, E-Commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-958-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Payment Orchestration Platform Market Summary

The global payment orchestration platform market size was estimated at USD 1,386.9 billion in 2023 and is projected to reach USD 6,520.4 million by 2030, growing at a CAGR of 24.7% from 2024 to 2030. The growth of the market can be attributed to the increasing use of digital payments across the globe. For instance, according to the Global Findex 2021 database, two-thirds of adults across the globe leverage digital payments for paying or receiving funds.

Key Market Trends & Insights

- North America dominated the global payment orchestration platform market with the largest revenue share of 31.0% in 2022.

- By type, the B2B segment led the market, holding the largest revenue share of 62.0% in 2022.

- By functionality, the advanced analytics & reporting segment is expected to grow at the fastest CAGR from 2023 to 2030.

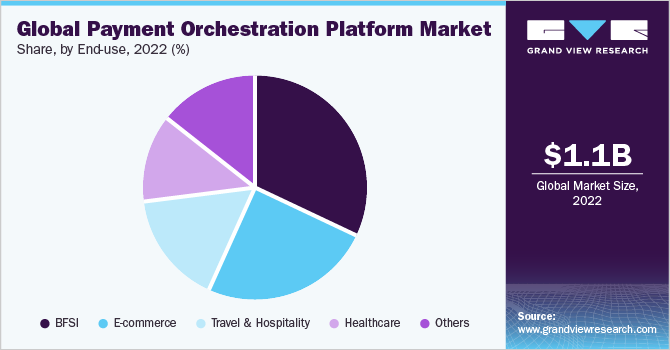

- By end use, the BFSI segment led the market, holding the largest revenue share of 22.0% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 1386.9 Million

- 2030 Projected Market Size: USD 6520.4 Million

- CAGR (2024-2030): 24.7%

- North America: Largest market in 2022

The share of digital payments in developing economies has climbed from 35% in 2014 to 57% in 2021. Furthermore, the rising penetration of the internet and smartphone are other significant factors driving the growth of the market.

Additionally, the rising e-commerce and online shopping trends also bode well for the growth of the market. For instance, in September 2022, according to BigCommerce’s Global Consumer Report, ‘Current and Future Shopping Trends’, more than half of consumers (55%) shop online at least once a week. Furthermore, payment orchestration platforms are assisting vendors in fast-tracking Buy Now Pay Later (BNPL) payments. As a result, the increasing popularity of the BNPL platform among vendors worldwide is one of the key factors fueling the adoption of the payment orchestration platform.

The technological advancements in the areas, including application programming interfaces (APIs) and cloud computing, have accelerated the growth of the payment orchestration platform market. With the API, the payment orchestration platforms allow businesses to manage multiple payment methods by integrating with several banks, payment service providers (PSPs), and other financial institutions. Furthermore, the increasing digitalization across various sectors, including banking, bodes well for the market’s growth. In addition, advanced data analytics tools enable payment orchestration platforms to provide businesses with valuable insights related to consumer behavior, aiming to enhance customer experience.

The rising adoption of payment orchestration platforms has attracted increased investments from venture capital firms into payment orchestration platform provider companies, driving the growth of the market. For instance, in March 2023, APEXX Global announced that it raised USD 25 million in a Series B funding round. The investors participating in the Series B funding round included MMC Ventures, a capital market company. The firm aimed to use these funds to expand its presence across North America and enhance its capabilities.

Although the payment orchestration platform market is projected to grow over the forecast period, some of the challenges, such as security and compliance concerns among the users, might hinder the growth of the market. Furthermore, in the rapidly evolving technological landscape characterized by the constant emergence of new payment methods, regulations, and security standards, payment orchestration platforms face the imperative to promptly adapt to these changes to stay ahead of market trends.

Moreover, merchants might experience lower control over the payment process while using payment orchestration platforms, as it limits their ability to customize payment flows and manage specific payment scenarios. In addition, the use of a payment orchestration platform requires additional costs as businesses need to pay for additional services, such as the white-label payment gateway. Thus, these factors might hinder the growth of the market over the forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic has accelerated the shift toward digital financial transactions, leading to a rise in the use of payment orchestration platforms. Businesses worldwide are embracing these platforms to provide their customers with a smooth payment experience, offering multiple payment options while maintaining the integrity of their payment systems. To effectively handle large-scale operations, numerous organizations are opting for payment orchestration services to ensure the security and safety of their transactions. As a result, the industry is expected to experience sustained growth after the pandemic.

Type Insights

Based on type, the global industry is further segmented into B2C, B2B, and C2C. The B2B type segment dominated the industry in 2022 and accounted for the largest share, accounting for 62.0% of the global revenue. The segment is anticipated to retain its leading industry position throughout the forecast years. The expansion of global trade has accelerated the need for B2B payments among businesses and is expected to create growth opportunities for POPs. Moreover, businesses are eager to establish a presence in new countries to expand their operations, thereby boosting international business transactions. In addition, the increasing use of technology in B2B payments and growing developments in small- & medium-sized organizations are also boosting segment growth.

The B2C segment is expected to register the fastest growth rate during the forecast period. The rising adoption of digital payments, such as digital wallets, mobile banking, and cashless trends, is anticipated to boost segment growth significantly. Furthermore, the increased convenience provided to consumers across payment segments also bodes well for the segment’s growth. For instance, the deployment of payment orchestration platforms enables transparent cross-border transactions at a lower cost.

Functionality Insights

Based on functionality, the industry has been further categorized into cross-border transactions, risk management, and advanced analytics & reporting. The cross-border transactions Functionality segment in 2022 dominated the payment orchestration platform industry and accounted for the highest 45.0% share of the global revenue. The cross-border transactions growth is anticipated owing to increasing advancements in payment technologies and cashless transactions.

Furthermore, the improved logistics and international supply chain platforms are anticipated to fuel the growth of cross-border transactions over the forecast period. Numerous developing countries depend on remittances as a crucial source of foreign income, enabling them to establish and grow their assets. Moreover, as per World Bank data, in 2020, the total global remittances amounted to USD 702 billion, despite the negative effect due to the pandemic, indicating the increase in cross-border transactions.

The advanced analytics & reporting segment is projected to register the fastest growth during the forecast period. The growing demand for AI-powered centralized dashboards for business efficiency is expected to boost segment growth. Several businesses across the globe are adopting AI-enabled POPs to process payment transactions. For instance, in June 2022, ESW, a global DTC e-commerce business, selected APEXX Global as the primary processor of payment transactions in the U.S. and Canada.

End-use Insights

The BFSI segment dominated the market in 2022 and accounted for a share of more than 32.0% of the global revenue. Instant, online, and easier payments are considered the way of future banking. These trends have evolved based on the developments of newer business models and POP features, such as greater connectivity, responsiveness, reliability, and security for financial services. Furthermore, as per EQUINIX, a global digital infrastructure company, payment orchestration platforms are modernizing traditional core banking solutions, and around 85% of the IT budgets at banks are aimed at maintaining the integrity of their payment system. Thus, investments in BFSI for payment security are expected to propel the BFSI segment growth.

The e-commerce segment is anticipated to register the fastest growth rate during the forecast period. Changing customer expectations towards payment experiences while shopping online is expected to create growth opportunities for the segment in this period. In line with this, several e-commerce merchants are finding ways to differentiate their services in the market. Moreover, these merchants are focusing on offering a variety of quick payment options. These aforementioned factors are expected to propel the segment's growth.

Regional Insights

North America dominated the global market in 2022 and accounted for the maximum share of more than 31.0% of the overall revenue. The dominance of this region can be attributed to the presence of several prominent players across North America, along with the rising need to prevent fraudulent activities due to the growing cybercrimes. For instance, in June 2022, Spreedly, a payment orchestration provider, in collaboration with Mastercard, launched its Network Tokenization payment program, enabled by Mastercard’s MDES for vendors across North America. The new offering enables customers and merchants across North America to choose network tokens for maintaining payment integrity. This, in turn, is further creating growth opportunities for the regional market.

The Asia Pacific is expected to register the fastest growth rate during the forecast period. This growth is attributed to the growing e-commerce sector and increased foreign investments in this region. In addition, numerous global fintech players are partnering to expand payment orchestration platforms in the Asia Pacific, further boosting regional market growth. For instance, in April 2022, Gr4vy, a payment orchestration platform, announced its partnership with Boku, Inc., a consumer banking company, and EBANX, a banking firm. This partnership was aimed at providing merchants with access to local payment methods in new geographies, including Asia, Africa, Latin America, and the Middle East.

Key Companies & Market Share Insights

The payment orchestration platform industry can be described as a competitive market characterized by the presence of several prominent market players. Payment orchestration providers are exploring various methods to improve their services, including new product releases and strategic alliances. For instance, in June 2023, Judopay, a UK-based mobile payments provider, announced the launch of its payment orchestration solution. The company extended this new product launch by partnering with its sister company, Axerve. This launch was aimed at enabling merchants to link and route to any global payment player via a single platform.

Several venture capital firms are funding payment orchestration companies, which helps them enhance their market growth. For instance, in June 2022, a payment orchestration platform, IXOPAY, partnered with Concardis/Nets, a Payment Service Provider (PSP) that provides a complete service for digital payments. Through this cooperation, merchants are expected to have access to Concardis/Nets solutions support and access to IXOPAY’s more complicated installations. Moreover, with this new partnership, IXOPAY’s presence across the globe has expanded. Some prominent players in the global payment orchestration platform market include:

-

CellPoint Digital

-

IXOLIT Group

-

Payoneer Inc.

-

APEXX Fintech Limited

-

Rebilly

-

Spreedly

-

Modo Payments

-

Akurateco

-

BNT Soft

-

Aye4fin GmbH

Payment Orchestration Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1706.3 million

Revenue forecast in 2030

USD 6,520.4 million

Growth rate

CAGR of 24.7% from 2024 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Type, functionality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Cellpoint Digital; IXOLIT Group; Payoneer Inc.; APEXX Fintech Limited; Rebilly; Spreedly; Modo Payments; Akurateco; BNT Soft; Aye4fin GmbH

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payment Orchestration Platform Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global payment orchestration platform market report based on type, functionality, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

C2C

-

-

Functionality Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cross Border Transactions

-

Risk Management

-

Advanced Analytics & Reporting

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

E-commerce

-

Healthcare

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom Of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global payment orchestration platform market size was estimated at USD 1.13 billion in 2022 and is expected to reach USD 1.39 billion in 2023.

b. The global payment orchestration platform market is expected to grow at a compound annual growth rate of 24.7% from 2023 to 2030 to reach USD 6.52 billion by 2030.

b. North America dominated the payment orchestration platform market with a share of 31.67% in 2022. The dominance is attributable to the presence of several prominent players in the region.

b. Some key players operating in the payment orchestration platform market include Cellpoint Digital, IXOLIT Group, Payoneer Inc., APEXX Fintech Limited, Rebilly, Spreedly, Modo Payments, Akurateco, BNT Soft, aye4fin GmbH

b. Key factors that are driving the payment orchestration platform market growth include growing e-commerce platforms and increasing penetration of smartphones and the internet

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.