- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Pea Derivatives Market Size, Share & Growth Report, 2030GVR Report cover

![Pea Derivatives Market Size, Share & Trends Report]()

Pea Derivatives Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Pea Protein, Pea Starch, Pea Fiber), By Protein Type (Isolates, Concentrates), By Application (Meat Substitutes, Bakery Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-046-3

- Number of Report Pages: 193

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global pea derivatives market size was valued at USD 2,865.41 million in 2022, and is expected to expand at a compound annual growth rate (CAGR)of 11.5% from 2023 to 2030. The growth of the pea derivatives is being driven by the increased demand for pea protein owing to the growing demand for gluten-free food products. Moreover, the demand for binding and texturizing agents such as pea fiber and pea starch in food applications is supporting the growth of the market. Pea derivatives are derived from peas and are used in various industries, including food and beverage, animal feed, and personal care. Pea protein, for example, is a popular plant-based protein alternative to animal protein, and its demand has increased in recent years due to increasing consumer interest in health and sustainability. Several factors impact the market growth. One of the most significant drivers of the market is consumer interest in plant-based alternatives to animal products. As more consumers seek meat- and dairy-free options, the pea protein and other derivatives market are likely to exhibit continuous growth. The market experiences growth due to the rising demand for peas, particularly in developing regions. Commercially grown varieties include yellow peas and green peas, with yellow peas spearheading global production.

Advances in pea derivatives manufacturing practices are also supporting the growth of the market. Companies are increasingly investing in technologies that reduce their carbon footprint, minimize waste generation, and use renewable energy sources in their production processes. Another manufacturing trend in the pea derivatives industry is using advanced extraction technologies to improve the efficiency of the production process. Companies are investing in new equipment and technologies to extract more value from raw materials, reducing the amount of waste generated and increasing the yield. Advanced extraction techniques such as high-pressure processing and supercritical fluid extraction have been employed to improve the efficiency of protein and starch extraction from peas.

One of the technological trends in the market is the development of novel pea-derived products, such as pea protein isolates, pea starch, and pea fibers. Companies are investing heavily in research and development to create new, innovative products with unique properties for specific applications. For example, pea protein isolates have gained immense popularity as a vegan protein alternative due to their high protein content and amino acid profile. Pea fibers are used to enhance the texture and taste of food products.In July 2020, Nestlé introduced a new line of YES! Snack bars infused with 10 grams of plant protein derived from nuts and peas. These bars are crafted using natural, nutritious ingredients rich in fiber and are free from artificial colors or preservatives. Additionally, they are gluten-free and cater to the dietary requirements of vegetarians.

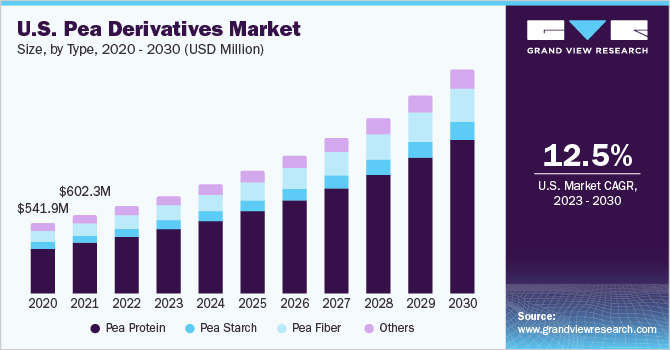

Type Insights

The pea protein segment dominated the market and accounted for the largest revenue share of 66.07% in 2021. The increasing prevalence of health issues such as obesity and diabetes, particularly among younger generations, has resulted in a growing preference for vegan diets. Furthermore, animal rearing negatively impacts natural resources and contributes to global warming to some extent. Although this impact has not been precisely measured, it is widely acknowledged, and awareness of this factor has encouraged the adoption of a more plant-based diet, thus boosting the meat substitutes market. As a result, pea protein as a meat substitute is expected to become more prevalent during the forecast period due to its excellent texturing properties, which make it suitable for use in the production of meat products such as chicken, beef, lamb, and mutton.

Pea proteins offer several functional benefits in bakery applications, including water holding, gelation, and increased browning, particularly in gluten-free applications. Besides, using pea proteins in bakery goods also replaces potential allergens such as gluten or soy. The increased health consciousness among consumers is prompting bakery manufacturers to introduce products with functional ingredients to increase their health appeal. This changing consumer pattern is anticipated to benefit the market over the forecast period.

The pea fiber segment is predicted to expand at a CAGR of 11.1% during the forecast period of 2023-2030. Pea fiber is a dietary fiber that is extracted from peas, which are a type of legume. It is a natural, non-allergenic, and gluten-free ingredient with several health benefits. Pea fiber contains soluble and insoluble fiber, which are important for maintaining digestive health and preventing chronic diseases. There is a growing awareness of the health benefits of fiber, including its ability to aid digestion, promote weight loss, and lower cholesterol levels. As a result, there is a growing demand for foods high in fiber, including those containing pea fiber. Pea fiber is a good source of insoluble fiber, which promotes regularity and prevents constipation. It also helps to regulate blood sugar levels by slowing down the absorption of carbohydrates, which can reduce the risk of spikes in blood sugar.

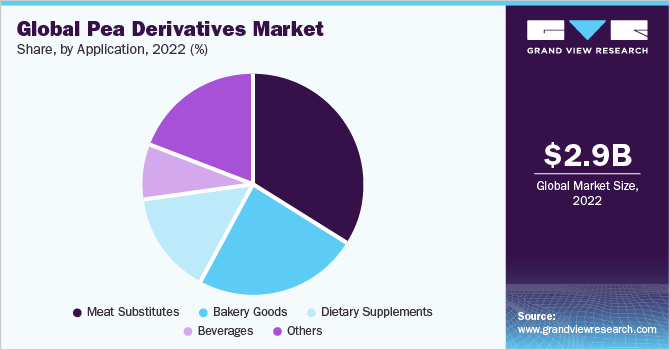

Application Insights

The meat substitute segment dominated the market and accounted for the largest share of 33.4%. Pea derivatives have gained considerable attention in recent years as an alternative source of protein in meat substitutes. Peas are a rich source of essential amino acids, and their protein content ranges from 20-30%, which is comparable to other plant-based protein sources such as soy, wheat, and rice. Additionally, pea protein is hypoallergenic, non-GMO, and gluten-free, making it an ideal choice for individuals with specific dietary requirements. In December 2020, Ingredion introduced a pea protein isolate in response to the increasing demand from consumers for high-protein products. VITESSENCE Pulse 1803 pea protein contains at least 80% protein, enabling manufacturers to make "high-in-protein" claims on the product packaging for various applications. These include sports and nutrition bars, plant-based meat and dairy alternatives, snacks, powdered and ready-to-drink beverages, baking mixes, and healthier baked goods.

The bakery goods segment is anticipated to expand at a CAGR of 12.0% during the forecast period. Pea proteins offer several functional benefits in bakery applications, including water holding, gelation, and increased browning, particularly in gluten-free applications. Besides this, using pea proteins in bakery goods also replaces potential allergens such as gluten or soy. The increased health consciousness among consumers is prompting bakery manufacturers to introduce products with functional ingredients to increase their health appeal. This changing consumer behavior is anticipated to benefit the market growth over the forecast period.

Pea starch can also be used as a gluten-free alternative to wheat flour in baked goods. Gluten-free bakery products are gaining popularity as more people are diagnosed with celiac disease or gluten intolerance. Pea starch can also be used as a thickener or binder in bakery products, providing a clean-label alternative to chemical additives.

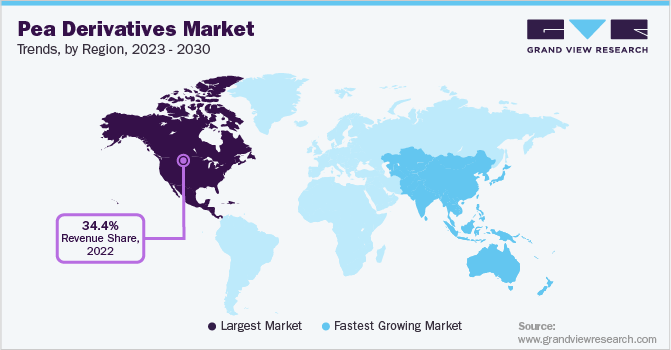

Regional Insights

North America region dominated the market and accounted for the largest revenue share of 34.4% in 2022. The North American pea derivatives market is expected to experience significant growth in the coming years, driven by the increasing consumption of energy bars, cold cereals, and snacks. Canada, in particular, is home to several pea protein manufacturers such as Burcon, Nutri-Pea, and Roquette. This is due to the extensive cultivation of peas in the country, which has led to a high availability of pea-based products in the market, thereby favoring market growth in North America.

The demand for pea derivatives is also being fueled by the growing trend of plant-based diets and the increasing awareness about the health benefits of consuming protein-rich foods. Pea protein, in particular, is gaining popularity as an alternative to animal-based proteins, as it is a sustainable and plant-based source of protein with a high nutritional value. In addition, the growing prevalence of meat allergies in the region is expected to fuel the demand for textured plant proteins, including pea protein. As more consumers become aware of the health risks associated with consuming meat, they are turning to plant-based alternatives, which are considered to be safer and healthier.

On the other hand, Asia Pacific is anticipated to expand at the fastest CAGR of 13% during the forecast period. The Asia Pacific region has a large and rapidly growing population, which is driving demand for protein-rich foods. Additionally, the region is undergoing rapid urbanization, which has led to changes in dietary habits and increased demand for convenience foods. Furthermore, the rising vegetarian population, growing consumption of fortified bakery & dairy products, and increasing demand for pre-workout & post-workout protein shakes are fueling product demand. Furthermore, several consumers are focusing on training and fitness activities in countries such as India, China, and Indonesia, who are increasingly opting for products containing pea derivatives owing to their low-fat content as compared to animal-based proteins

In addition, market players are investing in advanced technology owing to the increasing popularity of plant-based ingredients. For instance, in January 2023, Roquette invested in Daiz, a start-up in Japan that devised a method of using plant seed germination and extrusion technology to improve the texture, taste, and nutritional value of plant-based foods. Roquette plans to utilize Daiz's technology to improve the quality of pea protein to boost its plant-based portfolio.

Key Companies & Market Share Insights

The global market is expected to witness competition among the companies due to the presence of several players across the industry.The key players in this industry include Nutri-Pea Limited, Roquette Frères, Puris Protein LLC, COSCURA, and Burcon. Expansions and new product launches are the most prominent strategies in the market. For instance, in June 2022, Roquette launched NUTRALYS, a new line of organic pea proteins to cater to the growing demand for textured pea proteins.

Manufacturers are expanding their production capacities to meet the growing demand for pea derivatives from the application industry. For instance, In October 2022, International Flavors & Fragrances Inc announced the opening of an innovation center in Singapore. Through this innovation center, the company aims to expand its reach and product portfolio in Asia Pacific. Some of the prominent players in the pea derivatives market are:

-

International Flavors & Fragrances Inc.

-

Nutri-Pea

-

COSCURA

-

Roquette Frères

-

PURIS

-

Burcon

-

Shandong Jianyuan Group

-

SOTEXPRO

-

The Scoular Company

-

FENCHEM

-

The Green Labs LLC

Pea Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,178.88 million

Revenue forecast in 2030

USD 6.8 billion

Growth rate (Revenue)

CAGR of 11.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, protein type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Australia; South Korea, Brazil; Argentina; South Africa

Key companies profiled

International Flavors & Fragrances Inc.;Nutri-Pea ;COSCURA; Roquette Frères; PURIS; Burcon; Shandong Jianyuan Group; SOTEXPRO ; The Scoular Company; FENCHEM; The Green Labs LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

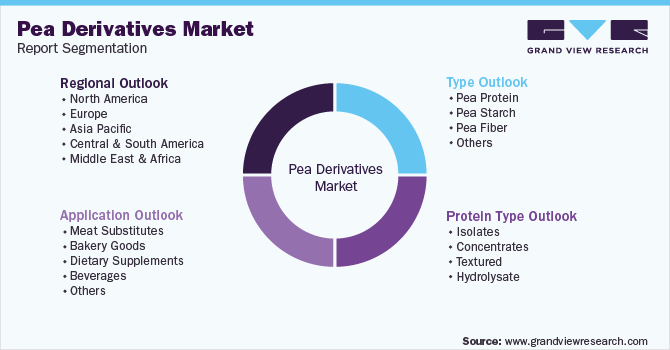

Global Pea Derivatives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global pea derivatives market report on the basis of type, protein type, application, and region:

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Pea Protein

-

Pea Starch

-

Pea Fiber

-

Others

-

-

Protein Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysate

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Meat Substitutes

-

Bakery Goods

-

Dietary Supplements

-

Beverages

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pea derivatives market size was estimated at USD 2,865.41 million in 2022 and is expected to reach USD 3,178.8 million in 2023.

b. The pea derivatives market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030 to reach USD 6.8 billion by 2030.

b. North America region dominated the pea derivatives market with a revenue share of 34.4% in the year 2022 owing to the high demand and large consumer base present in the region.

b. Some of the key market players in the pea derivatives market are International Flavors & Fragrances Inc.,Nutri-Pea ,COSCURA, Roquette Frères, PURIS ,Burcon, Shandong Jianyuan Group,SOTEXPRO , The Scoular Company ,FENCHEM,The Green Labs LLC

b. Key factors that are driving the pea derivatives market growth is increasing consumer awareness regarding wellness & health, and increasing investments in the meat substitute industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.