- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Pearlescent Pigment Market Size, Industry Report, 2033GVR Report cover

![Pearlescent Pigment Market Size, Share & Trends Report]()

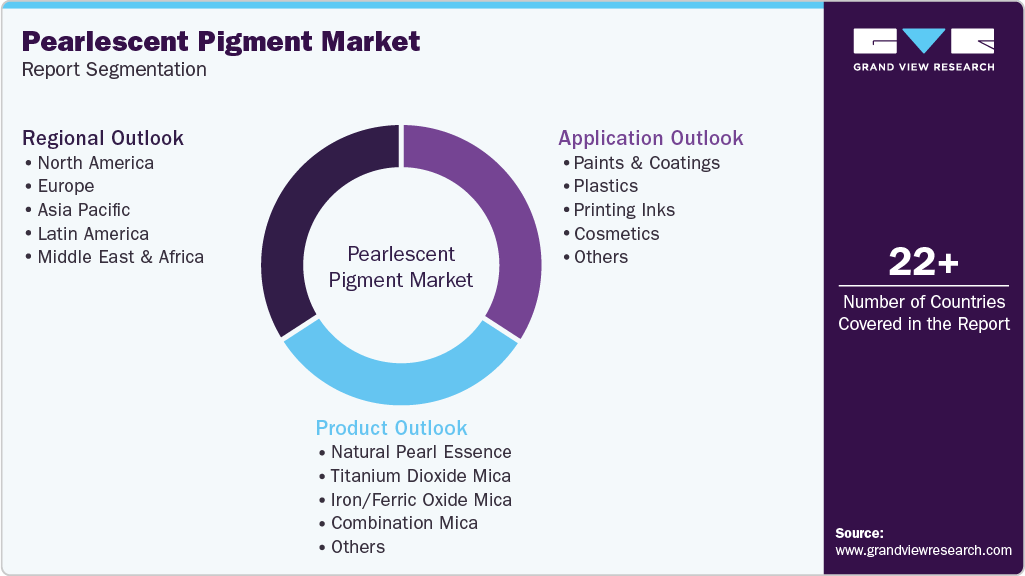

Pearlescent Pigment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Natural Pearl Essence, Titanium Dioxide Mica, Iron/Ferric Oxide Mica), By Application (Paints & Coating, Plastics, Printing Inks, Cosmetics), By Region, and Segment Forecasts

- Report ID: 978-1-68038-737-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pearlescent Pigment Market Summary

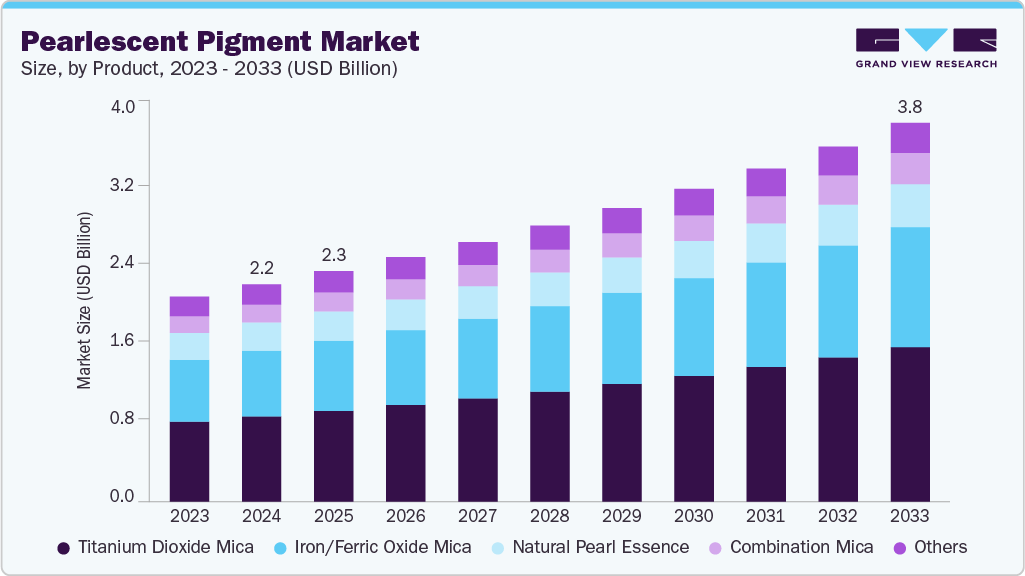

The global pearlescent pigment market size was estimated at USD 2,291.3 million in 2025 and is projected to reach USD 3,769.1 million by 2033, growing at a CAGR of 6.5% from 2026 to 2033. The market growth is primarily driven by rising demand for premium aesthetics across industries such as automotive, cosmetics, packaging, and consumer electronics.

Key Market Trends & Insights

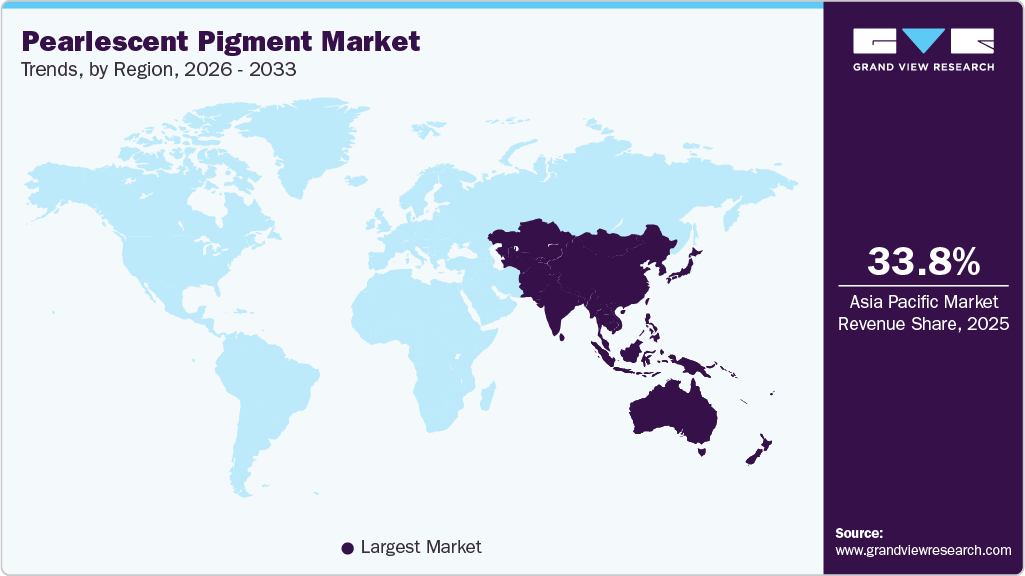

- Asia Pacific dominated the market with the largest revenue share of 33.8% in 2025.

- By product, the titanium dioxide mica segment is expected to grow at a significant CAGR of 6.9% from 2026 to 2033.

- By application, the paints & coatings segment led the market with the largest revenue share of 36.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,291.3 Million

- 2033 Projected Market Size: USD 3,769.1 Million

- CAGR (2026-2033): 6.5%

- Asia Pacific: Largest market in 2025

Increasing consumer preference for high-gloss and color-shifting finishes, coupled with the expansion of the beauty and personal care sector, is fueling product adoption. In addition, advancements in pigment technology, the shift toward sustainable and ethically sourced raw materials, and the growing use of pearlescent effects in eco-friendly packaging and decorative coatings are further supporting market expansion.The market presents significant growth opportunities driven by the rising demand for sustainable and ethically sourced pigments, particularly in cosmetics and packaging. The shift toward synthetic mica and clean-label formulations is opening new avenues in personal care and eco-conscious brands. In addition, the increasing use of pearlescent pigments in smart coatings, 3D printing, luxury packaging, and electric vehicles offers lucrative prospects for innovation and product diversification. Expansion into emerging economies, where rising disposable incomes are boosting demand for premium products, further enhances market potential.

Despite promising growth, the pearlescent pigments market faces several challenges, including fluctuating raw material prices, particularly for titanium dioxide and mica, which impact production costs. Stringent environmental and safety regulations around pigment formulation and mica mining, especially concerning child labor, pose compliance and sourcing risks. Furthermore, achieving consistency in particle dispersion and color stability across diverse end use applications remains a technical barrier. Intense competition among global and regional players also puts pressure on pricing and innovation cycles.

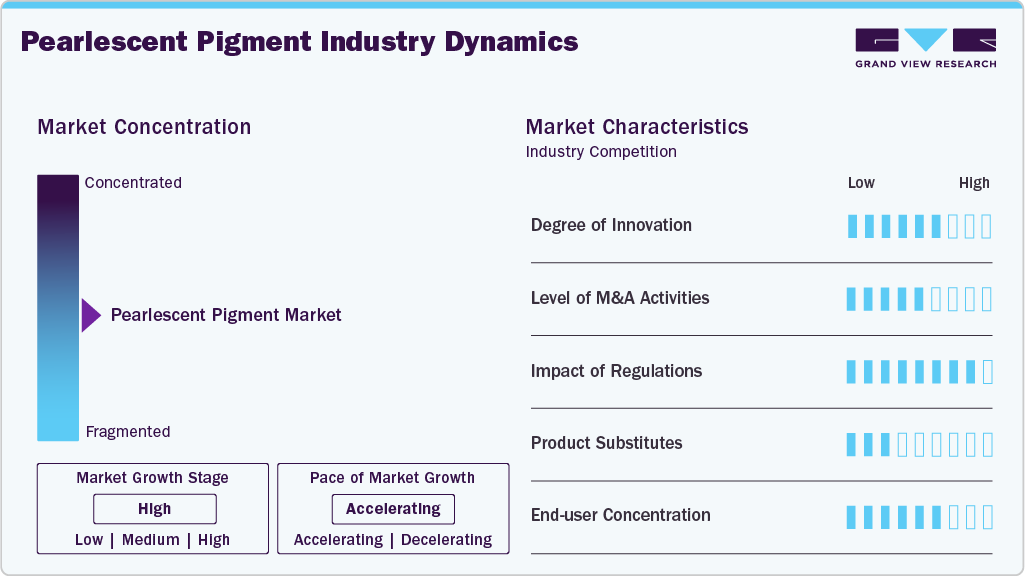

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Huaian Concord Cosmetics Product Co. Ltd. (Kolortek), BASF SE, and Sun Chemical Performance Pigments, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global pearlescent pigments industry are adopting a mix of strategic initiatives to strengthen their market position, including product innovation, sustainable sourcing, and geographic expansion. Companies are increasingly focusing on developing bio-based and synthetic mica pigments to meet the rising demand for clean beauty and eco-friendly products. Strategic mergers, acquisitions, and partnerships are also being pursued to enhance technological capabilities and global distribution networks.

Product Insights

The titanium dioxide mica segment led the market with the largest revenue share of 38.2% in 2025, primarily due to its widespread applicability, cost-effectiveness, and superior optical performance. These pigments, created by coating mica flakes with titanium dioxide, deliver high brightness. These pearlescent effects are highly desirable across a range of end-use industries, including automotive coatings, decorative paints, plastics, and packaging. Their ability to produce a broad spectrum of interference colors, from silvery-white to vibrant hues, combined with excellent chemical stability, UV resistance, and weather durability, makes them a preferred choice for both indoor and outdoor applications.

The other products segment is expected to grow at the fastest CAGR during the forecast period. Although smaller in scale, the other product segments witnessing demand for various niche application. Natural Pearl Essence, once popular in cosmetics, has declined due to limited availability and ethical concerns. Iron/Ferric Oxide Mica pigments are gaining popularity for their warm, metallic tones used in industrial coatings and color cosmetics. Combination Mica offers premium effects by layering multiple materials and is increasingly used in luxury automotive and high-end consumer products. The Others category, including synthetic mica and bismuth oxychloride-based pigments, is growing rapidly due to increased adoption in clean beauty formulations and environmentally conscious product lines.

Application Insights

The paints & coating segment led the market with the largest revenue share of 36.6% in 2025, driven by the increasing use of pearlescent pigments in automotive, architectural, and industrial coatings. These pigments enhance visual appeal by imparting depth, brilliance, and shimmer to surfaces, making them highly sought after in luxury and specialty finishes. In the automotive sector, manufacturers are leveraging pearlescent pigments to differentiate vehicle models and strengthen brand identity, especially in premium and electric vehicle categories. In addition, the growing demand for decorative and protective coatings in residential and commercial construction, particularly in the Asia Pacific and the Middle East, is further fueling segment growth.

Beyond paints and coatings, other application areas are also contributing to market expansion. Plastics is an emerging segment, as manufacturers increasingly incorporate pearlescent pigments into consumer packaging, cosmetic containers, and household products to enhance shelf appeal. Printing Inks are gaining traction in the packaging and labeling industries, particularly for security and branding purposes. The Cosmetics segment is witnessing robust growth due to consumer preferences for luminous, glowing skin and clean-label formulations. Others, including textiles, ceramics, and 3D printing, represent niche but expanding markets.

Regional Insights

North America pearlescent pigment market accounted for the second largest revenue share of 33.1% in 2025, supported by high consumer demand for premium aesthetics in automotive finishes, cosmetics, packaging, and home décor applications. The region’s focus on innovation, regulatory compliance, and sustainable product development has led to the increased adoption of synthetic mica and eco-friendly pigment formulations. Well-established industries, particularly in the U.S. and Canada, are driving consistent demand across both industrial and consumer segments.

U.S. Pearlescent Pigment Market Trends

The pearlescent pigment market in theU.S. accounted for the largest revenue share in North America in 2025, owing to its advanced automotive, personal care, and packaging industries. Demand is fueled by consumer preferences for luxurious finishes and visually appealing product designs, particularly in cosmetics and high-end coatings. The presence of key global manufacturers, along with strong R&D capabilities and a highly regulated environment promoting safe and sustainable materials, has positioned the U.S. as a leader in pigment innovation.

Asia Pacific Pearlescent Pigment Market Trends

Asia Pacific dominated the pearlescent pigment market with the largest revenue share of 33.8% in 2025, driven by strong growth across key end-use industries such as automotive, construction, cosmetics, and packaging. The region benefits from a large manufacturing base, cost-effective labor, and increasing investments in infrastructure and industrial development. Rapid urbanization, rising disposable incomes, and evolving consumer preferences for premium aesthetics are fueling demand for pearlescent pigments in decorative coatings, personal care products, and consumer goods.

The pearlescent pigment market in China accounted for the largest market revenue share in 2025, supported by its robust manufacturing capabilities and high domestic consumption. The country is a leading producer and exporter of pearlescent pigments, particularly titanium dioxide and mica-based variants, driven by well-established supply chains and raw material availability. Rapid expansion in the automotive and construction sectors, coupled with the booming cosmetics and packaging industries, is accelerating demand for high-performance and visually appealing pigments.

Europe Pearlescent Pigment Market Trends

The pearlescent pigment market in Europe accounted for the third-largest revenue share of 13.4% in 2025, driven by its strong regulatory emphasis on sustainability, product safety, and ethical sourcing. The region is at the forefront of adopting eco-friendly and synthetic mica-based pigments, particularly in cosmetics, automotive coatings, and packaging. Consumer demand for premium and sustainable products, combined with the region's advanced manufacturing and R&D infrastructure, continues to support market growth.

The Germany pearlescent pigment market accounted for the largest market revenue share in Europe in 2025, backed by its robust automotive and industrial coatings sectors, advanced chemical industry, and commitment to sustainable innovation. The country’s strong export-oriented manufacturing base relies heavily on high-performance, visually appealing coatings and materials, driving consistent demand for pearlescent pigments. Germany also leads in R&D and technological advancements, with companies investing in next-generation pigment solutions that align with EU environmental standards.

Latin America Pearlescent Pigment Market Trends

The pearlescent pigment market in Latin America is emerging as a promising market for pearlescent pigments, driven by the expanding automotive, cosmetics, and packaging industries across countries such as Brazil, Mexico, and Argentina. Rising urbanization, a growing middle-class population, and increasing consumer preference for visually appealing and premium products are fueling demand in the region. In addition, the local manufacturing sector is gradually adopting advanced coatings and specialty pigments to enhance product aesthetics and competitiveness.

Middle East & Africa Pearlescent Pigment Market Trends

The pearlescent pigment market in the Middle East & Africa is witnessing gradual growth, supported by infrastructure development, expanding construction activities, and growing demand for high-end coatings and decorative finishes. The cosmetics and personal care segment, particularly in Gulf countries, is also contributing to market expansion due to rising consumer interest in luxury and beauty products. Furthermore, the region’s strategic focus on diversifying economies beyond oil is attracting investments in manufacturing and packaging, creating new opportunities for pigment suppliers.

Key Pearlescent Pigment Company Insights

Key players, such as Huaian Concord Cosmetics Product Co. Ltd. (Kolortek), BASF SE, and Sun Chemical Performance Pigments, are dominating the market.

-

BASF SE is a leading player in the global pearlescent pigments industry, leveraging its extensive expertise in chemical innovation and materials science to offer a diverse portfolio of high-performance effect pigments under its Colors & Effects brand (now part of Sun Chemical/Cinven). The company focuses on delivering sustainable and visually striking solutions tailored for industries such as automotive coatings, plastics, cosmetics, and packaging. BASF emphasizes R&D-driven innovation, with continued investment in developing eco-friendly, synthetic mica-based pigments to meet rising consumer demand for clean beauty and environmentally responsible products. With a strong global manufacturing and distribution network, BASF SE remains well-positioned to serve both mature and emerging markets, aligning its product strategy with trends in aesthetics, functionality, and sustainability.

Key Pearlescent Pigment Companies:

The following are the leading companies in the pearlescent pigment market. These companies collectively hold the largest market share and dictate industry trends.

- Huaian Concord Cosmetics Product Co., Ltd. (Kolortek)

- BASF SE

- Sun Chemical Performance Pigments

- Lansco Colors

- L’Arca Srl (Arca Colours)

- Fujian Kuncai Fine Chemicals Co., Ltd.

- Geotech International B.V.

- RIKA Technology Co. Ltd.

- Smarol Technology

- Nanyang Lingbao Pearl Pigment Co. Ltd.

- Pritty Pearlescent Pigments

- Brenntag Specialties Inc.

Pearlescent Pigment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2,431.8 million

Revenue forecast in 2033

USD 3,769.1 million

Growth rate

CAGR of 6.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Germany; UK; China; India; Brazil

Key companies profiled

Huaian Concord Cosmetics Product Co. Ltd. (Kolortek); BASF SE; Sun Chemical Performance Pigments; Lansco Colors; L’Arca Srl (Arca Colours); Fujian Kuncai Fine Chemicals Co. Ltd.; Geotech International B.V.; RIKA Technology Co. Ltd.; Smarol Technology; Nanyang Lingbao Pearl Pigment Co. Ltd.; Pritty Pearlescent Pigments; Brenntag Specialties Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pearlescent Pigment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global pearlescent pigment market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Natural Pearl Essence

-

Titanium Dioxide Mica

-

Iron/Ferric Oxide Mica

-

Combination Mica

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Paints & Coatings

-

Plastics

-

Printing Inks

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Middle East & Africa

-

Latin America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global pearlescent pigment market size was estimated at USD 2,291.3 million in 2025 and is expected to reach USD 2,431.8 million in 2025

b. The pearlescent pigment market is expected to grow at a compound annual growth rate of 6.5% from 2026 to 2033 to reach USD 3,769.1 million by 2033.

b. The titanium dioxide mica segment held the largest revenue share in 2025 due to its versatile optical properties, cost-effectiveness, and broad applicability across high-demand industries such as automotive coatings, plastics, and decorative paints. Its ability to deliver high brightness, color consistency, and excellent UV resistance makes it the preferred choice for both functional and aesthetic applications globally.

b. Some of the key players operating in the pearlescent pigment market include Huaian Concord Cosmetics Product Co. Ltd. (Kolortek), BASF SE, Sun Chemical Performance Pigments, Lansco Colors, L’Arca Srl (Arca Colours), Fujian Kuncai Fine Chemicals Co. Ltd., Geotech International B.V., RIKA Technology Co. Ltd., Smarol Technology, Nanyang Lingbao Pearl Pigment Co. Ltd., Pritty Pearlescent Pigments and Brenntag Specialties Inc.

b. The growth of the pearlescent pigments market is driven by rising demand for premium aesthetics across automotive, cosmetics, packaging, and consumer goods industries, coupled with increasing consumer preference for sustainable and visually striking products. Advancements in pigment technology and the shift toward eco-friendly and ethically sourced raw materials are further accelerating market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.