- Home

- »

- Plastics, Polymers & Resins

- »

-

Peelable Seal Market Size, Share, Industry Report, 2033GVR Report cover

![Peelable Seal Market Size, Share & Trends Report]()

Peelable Seal Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Peelable Lidding Films, Easy-Peel Flexible Films, Peel & Reseal Films, Rigid Peelable Packaging), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-749-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peelable Seal Market Summary

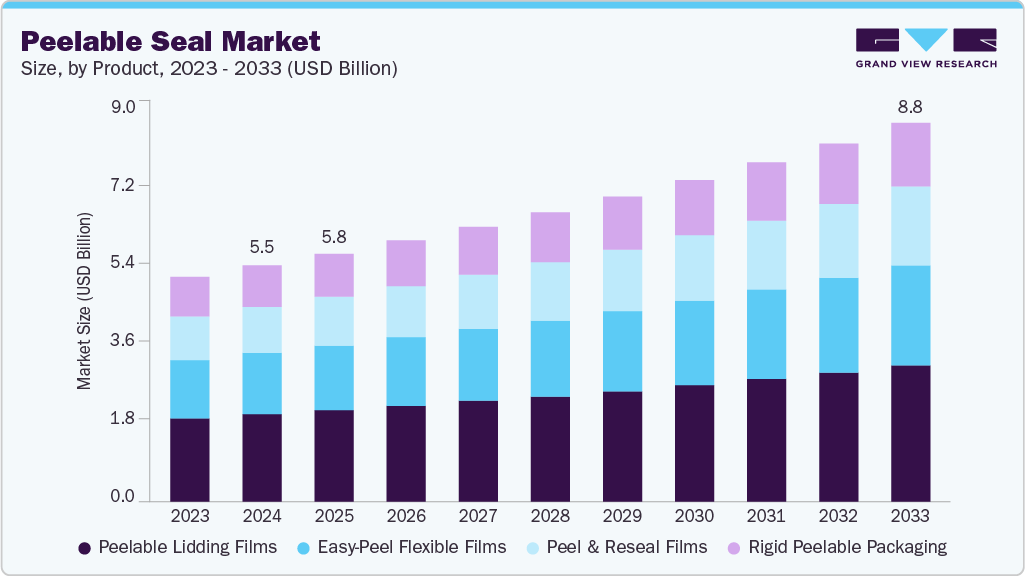

The global peelable seal market size was estimated at USD 5.51 billion in 2024 and projected to reach USD 8.84 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is driven by the rising demand for convenient and easy-to-open packaging solutions in the food, beverages, and healthcare sectors.

Key Market Trends & Insights

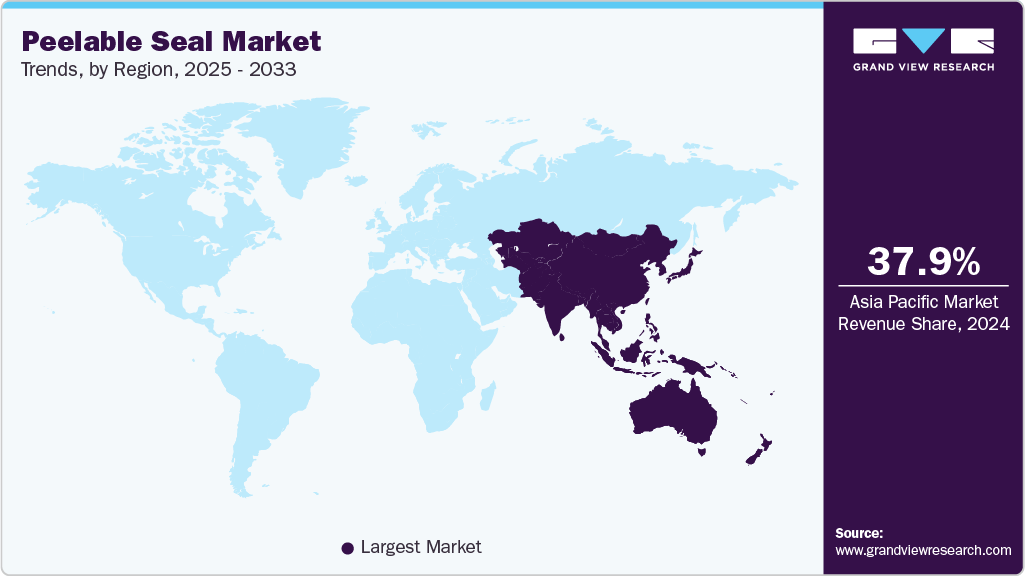

- Asia Pacific dominated the peelable seal market with the largest revenue share of 37.98% in 2024.

- The peelable seal market in China is the single most significant driver of growth within the Asia Pacific region, acting as both a massive manufacturing hub and a colossal consumer market.

- By product, the peel & reseal films segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2033 in terms of revenue.

- By end use, the ready meals & frozen foods segment is expected to grow at the fastest CAGR of 6.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.51 Billion

- 2033 Projected Market Size: USD 8.84 Billion

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

Increasing focus on product safety, tamper evidence, and extended shelf life further accelerates its adoption. Peelable seals offer an ideal balance between secure sealing and consumer-friendly opening, enhancing user experience while maintaining product safety. For instance, in the food packaging industry, consumers prefer packaging formats such as yogurt cups, ready-to-eat meals, and snack trays with peelable seals that ensure freshness but can be opened without scissors or knives. This convenience-driven demand aligns with the growing lifestyle trend of on-the-go consumption, especially in urban markets.

The increasing emphasis on product safety and tamper-evidence is positively influencing the outlook of peelable seal industry. Peelable seals provide a strong initial barrier that ensures product integrity, hygiene, and protection against contamination until the consumer decides to open it. In the pharmaceutical and medical device industries, peelable seals are widely used for sterile barrier systems, such as blister packs and medical trays, where aseptic conditions are critical. For example, hospitals rely on peelable seals for single-use surgical instruments, where a clean peel ensures sterility without leaving behind fibers or residues. This functionality not only complies with regulatory requirements but also builds trust with end-users.

Sustainability trends are also fueling the adoption of peelable seals, as manufacturers develop recyclable and eco-friendly materials. The industry is witnessing innovations in mono-material packaging films with peelable sealing properties, reducing the complexity of recycling while maintaining performance. For example, companies like Amcor and Mondi have introduced recyclable lidding films with peelable features that meet both consumer demand for convenience and global sustainability targets. As Extended Producer Responsibility (EPR) regulations and plastic packaging taxes become more widespread, these sustainable peelable seal solutions will likely gain further traction.

Moreover, the expansion of the e-commerce and online food delivery sector is boosting the peelable seal industry. Peelable seals play an essential role in ensuring leak-proof, tamper-evident, and consumer-friendly packaging for products that need to be transported over long distances. For example, ready-to-cook meal kits and perishable goods delivered through online platforms often use peelable seals to balance protection with easy access for the consumer. The growing penetration of e-commerce in emerging economies like India, Brazil, and Southeast Asia is expected to amplify demand for peelable seal packaging as consumer expectations for safety, freshness, and convenience converge with industry needs for cost-effective, secure packaging solutions.

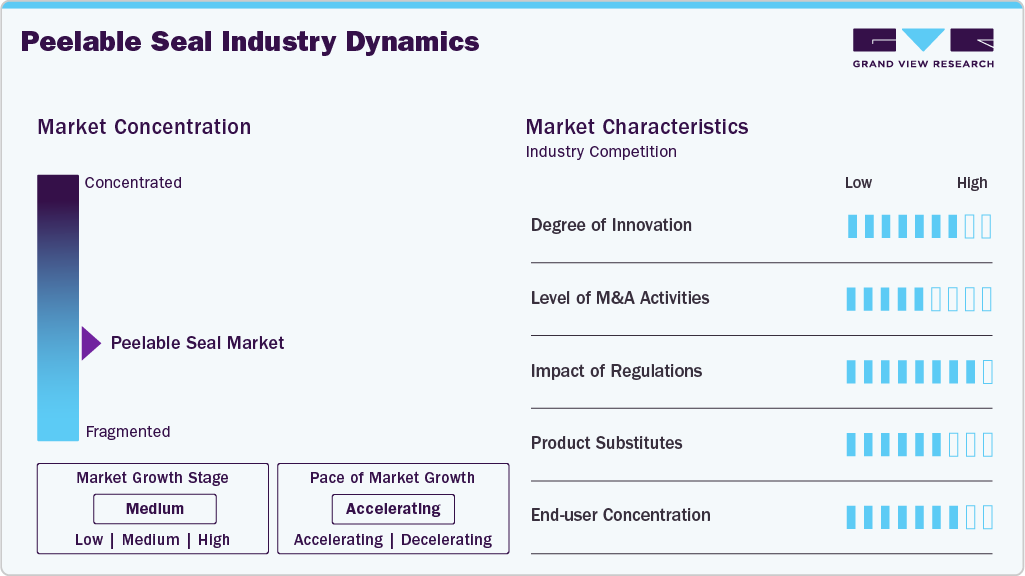

Market Concentration & Characteristics

The peelable seal industry is highly innovation-centric, as manufacturers continuously focus on developing new materials and sealing technologies that balance strong adhesion with easy opening. This includes advancements in multilayer films, heat-sealable coatings, and recyclable mono-material solutions.

Compliance with global packaging regulations is a crucial characteristic of the industry. Peelable seals are often used in sensitive applications such as pharmaceuticals, medical devices, and food, where product safety, sterility, and tamper-evidence are non-negotiable. Standards like ISO 11607 for medical device packaging or FDA/EU guidelines for food contact materials influence material selection and design. Manufacturers must strike a balance between user convenience and adherence to stringent hygiene and safety requirements, making regulatory compliance a cornerstone of the industry’s dynamics.

Product Insights

The peelable lidding films segment led the market with the largest revenue share of 37.0% in 2024. Peelable lidding films are thin, flexible films used as the top layer on containers, trays, and cups in food, beverage, and pharmaceutical packaging. These films provide tamper evidence, ensure product freshness, and allow easy removal without tearing or spilling. They are widely used in yogurt cups, ready-to-eat meals, and medical trays. For example, yogurt brands such as Danone and Yoplait use peelable lidding films on single-serve containers to maintain hygiene while providing convenience.

The peel & reseal films segment is expected to grow at the fastest CAGR of 6.3% during the forecast period. Peel & reseal films provide both peelability and the option to reseal packages multiple times, ensuring product freshness after opening. They are commonly used in bakery items, deli meats, fresh produce, and snack packaging. For example, resealable salad packs by Fresh Express and resealable cheese packs by Kraft rely on these films. The growing emphasis on food waste reduction and extended shelf life is driving demand for peel & reseal films.

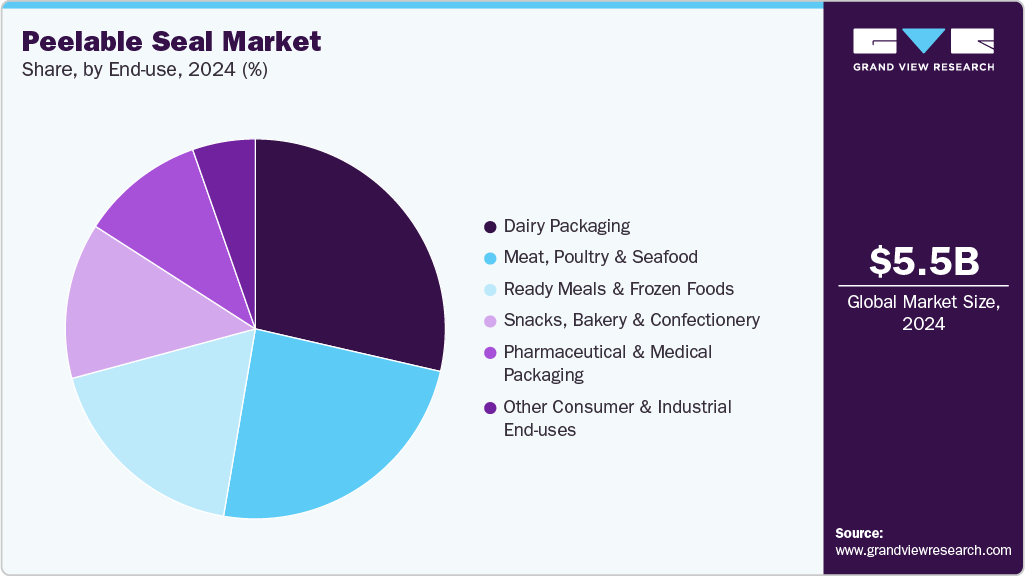

End Use Insights

The dairy packaging segment led the market with the largest revenue share of 28.60% in 2024.Peelable seals are widely used in dairy packaging for products such as yogurt cups, cream cheese tubs, butter packs, and milk-based dessert containers. A common application is yogurt multipacks, where a peelable lidding film provides tamper evidence and hygienic convenience. The dairy sector’s reliance on peelable seals is driven by rising demand for single-serve packaging, the growing cold-chain supply infrastructure, and increasing consumer preference for hygienic and resealable packaging. The popularity of probiotic yogurts and flavored milk drinks is pushing innovation in packaging that enhances convenience while reducing the risk of spillage or spoilage.

The ready meals & frozen foods segment is projected to grow at the fastest CAGR of 6.5% during the forecast period. Peelable seals are widely adopted in the ready meals and frozen foods segment, where convenience and safety are major selling points. Microwave-ready trays, frozen pizzas, and instant meal bowls often feature peelable lids to allow steam release or direct serving. Companies such as Nestlé (Stouffer’s), Conagra (Healthy Choice), and ITC Master Chef use peelable seals in frozen food trays to combine safety with ease of handling. The driving force here is the global surge in demand for convenience foods, fueled by urbanization, busy lifestyles, and dual-income households.

Regional Insights

The peelable seal market in North Americais a mature and highly sophisticated market for peelable seals, driven by stringent regulatory standards, a strong culture of convenience, and advanced healthcare and food industries. The region, particularly the U.S., has rigorous regulations from the FDA (Food and Drug Administration) regarding food safety and pharmaceutical packaging, mandating features like tamper evidence and child resistance, which peelable seals expertly provide. The high consumer spending power fuels demand for premium, convenient packaging formats like resealable pouches for snacks, coffee, and pet food, as well as ready-meal trays that can go from refrigerator to microwave to table.

U.S. Peelable Seal Market Trends

The peelable seal market in the U.S. is driving innovation and volume demand. Its vast and diversified economy encompasses every major end-use industry: a massive food & beverage sector obsessed with convenience packaging, a world-leading pharmaceutical industry, and a robust industrial goods market. The presence of packaging giants and material science corporations, such as Amcor plc, Sealed Air, ProAmpac, and TOPPAN USA Inc. ensures continuous R&D into new sealant technologies, often setting global trends.

Asia Pacific Peelable Seal Market Trends

Asia Pacific dominated the peelable seal market with the largest revenue share of over 37.98% in 2024 and is expected to grow at the fastest CAGR of 5.9% over the forecast period. This positive outlook is due to its massive population, rapid urbanization, and the explosive expansion of its food & beverage and pharmaceutical sectors. The demand is primarily fueled by the growing middle class, which desires greater convenience, product safety, and packaged food with longer shelf lives. Countries such as China, India, and Japan are major consumers, with their vast manufacturing bases requiring high-performance packaging for everything from fresh produce and ready-to-eat meals to electronics components.

The peelable seal market in China is the single most significant driver of growth within the Asia Pacific region, acting as both a massive manufacturing hub and a colossal consumer market. Its "Made in China 2025" initiative emphasizes advanced manufacturing, including high-quality packaging for its electronics, automotive parts, and consumer goods exports, all requiring protective peelable seal packaging.

Europe Peelable Seal Market Trends

The peelable seal market in Europe is anticipated to grow at the second-fastest CAGR during the forecast period.Europe’s position in the global market is characterized by its extremely strict regulatory environment, a strong consumer focus on sustainability, and a well-established processed food industry. Regulations and consumer advocacy push for advanced packaging that minimizes food waste, a key benefit of resealable packages with peelable seals that maintain product freshness. The European market is at the forefront of demanding sustainable packaging solutions, driving innovation in mono-material plastic structures that are recyclable yet still require high-performance peelable sealing capabilities. Furthermore, Europe's powerful pharmaceutical sector, with its strict requirements for patient safety, drug integrity, and child-resistant packaging, is a major driver for technically advanced peelable lidding films for blister packs and medical device packaging.

Key Peelable Seal Company Insights

The competitive environment of the peelable seal industry is characterized by moderate to high rivalry. Established global players such as Amcor, Sealed Air, ProAmpac, Constantia Flexibles, and TOPPAN Inc. dominate through strong R&D, broad product portfolios, and strategic partnerships. At the same time, regional manufacturers compete on cost efficiency and customization.

Competition is further intensified by innovations in eco-friendly and recyclable peelable seal films, as companies race to align with sustainability regulations and consumer expectations. In addition, rising private-label brands, advancements in multi-layer film technology, and mergers & acquisitions continue to reshape the market, forcing players to balance price competitiveness with performance differentiation and regulatory compliance.

Key Peelable Seal Companies:

The following are the leading companies in the peelable seal market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed Air

- Huhtamaki

- UFlex Limited

- ProAmpac

- Coveris

- TOPPAN Inc.

- Constantia Flexibles

- KM Packaging

- SWAN

- Profol GmbH

- RTG Films

- PAXXUS

Recent Development

-

In June 2025, KM Packaging launched K-Peel 4G, a mono PET lidding film for APET and rPET trays, delivering strong, clean peels even through contamination. With a low seal initiation temperature (110°C), fast 0.3s dwell time, anti-fog, ovenability, and OM7 compliance, it suits ambient, chilled, and frozen foods. Available in 21µm and 25µm, it supports sustainability by reducing film gauge and meeting upcoming EPR legislation requirements.

-

In April 2025, TOPPAN Inc. completed its acquisition of Sonoco Products Company’s Thermoformed & Flexibles Packaging (TFP) business for approximately USD 1.8 billion, marking a significant expansion of TOPPAN’s global packaging operations and its commitment to sustainable packaging solutions. This acquisition aligns with TOPPAN’s strategy to drive innovation in sustainable packaging and streamline its global operations, further strengthening its market position and ability to deliver advanced packaging solutions worldwide.

-

In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc, creating a global packaging leader with around 400 facilities, 75,000 employees, and operations in 140 countries. The merger, valued at approximately USD 13.0 billion, enhances Amcor's portfolio with expanded material science and innovation capabilities, positioning it to deliver more consistent growth and improved margins.

Peelable Seal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.79 billion

Revenue forecast in 2033

USD 8.84 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; Sealed Air; Huhtamaki; UFlex Limited; ProAmpac; Coveris; TOPPAN Inc.; Constantia Flexibles; KM Packaging; SWAN; Profol GmbH; RTG Films; PAXXUS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peelable Seal Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study; Grand View Research has segmented the global peelable seal market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Peelable Lidding Films

-

Easy-Peel Flexible Films

-

Peel & Reseal Films

-

Rigid Peelable Packaging

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Dairy Packaging

-

Meat, Poultry & Seafood

-

Ready Meals & Frozen Foods

-

Snacks, Bakery & Confectionery

-

Pharmaceutical & Medical Packaging

-

Other Consumer & Industrial end-uses

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.