- Home

- »

- Medical Devices

- »

-

Peripheral Nerve Injury Market Size, Industry Report, 2030GVR Report cover

![Peripheral Nerve Injury Market Size, Share & Trends Report]()

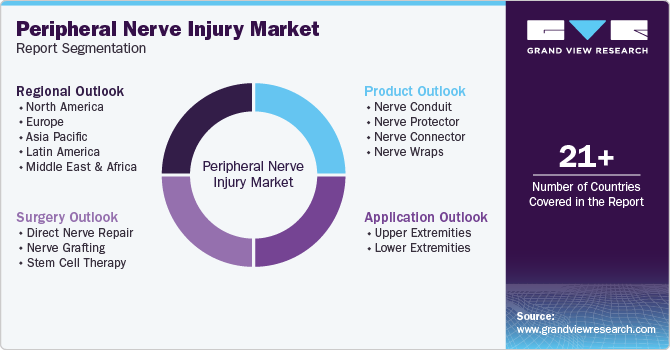

Peripheral Nerve Injury Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Nerve Conduit, Nerve Protector), By Surgery (Direct Nerve Repair, Nerve Grafting, Stem Cell Therapy), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-957-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peripheral Nerve Injury Market Summary

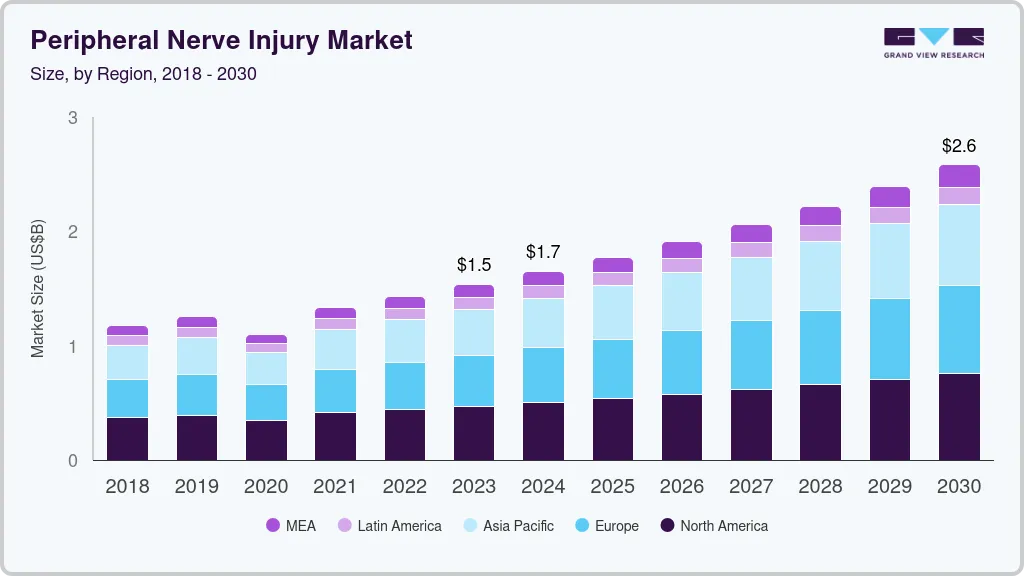

The peripheral nerve injury market size was estimated at USD 1.65 billion in 2024 and is projected to reach USD 2.58 billion by 2030, growing at a CAGR of 7.80% from 2025 to 2030. The market growth is primarily driven by the increasing aging population and the rising incidence of Peripheral Nerve Injuries (PNI).

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The Asia Pacific region is expected to register the fastest CAGR fro 2025 to 2030.

- By product, the nerve conduit led the market with a revenue share of more than 64.30% in 2024.

- By surgery, the stem cell therapy segment is anticipated to witness the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 1.65 Billion

- 2030 Projected Market Size: USD 2.58 Billion

- CAGR (2025-2030): 7.80%

- North America: Largest market in 2024

For instance, a study published by the National Library of Medicine in December 2024 indicates that the incidence rate of PNI ranges from 13 to 23 cases per 100,000 person-years. Most chronic PNIs occur in the wrists and hands, often resulting from minor injuries that require less than a week of treatment. Therefore, the growing incidence of PNIs is expected to propel market growth in the coming years.

Furthermore, the increasing focus on research related to peripheral nerve injuries is anticipated to drive market growth. Several research institutions and academic institutions are conducting research projects to progress peripheral nerve injury treatment. In addition, government authorities are funding such research activities. For instance, in December 2024, the National Science Foundation (NSF) provided funding of USD 0.5 Million to Liqun Ning and Geyou Ao with Cleveland Clinic researchers to better understand how to help the body repair damaged peripheral nerves through tissue scaffolds. This funding will be used for the project titled “Multi-functional 3D Printed Bioprinted Tissue Scaffolds with Schwann Cell Density Gradients and Electrical Conductivity for Peripheral Nerve Regeneration.” Such research initiatives are anticipated to propel the market growth over the forecast period.

In addition, the growing prevalence of chronic conditions such as diabetes is expected to drive market growth in the coming years. Several studies estimate significant increases in diabetes incidence and prevalence. For instance, a study published by the National Library of Medicine in 2024 reported that the global number of people with type 2 diabetes mellitus was 445 million in 2020, projected to rise to 730 million by 2050. This indicates a considerable increase in the number of individuals living with type 2 diabetes mellitus (T2DM), particularly affecting low-income countries and those in Sub-Saharan Africa. The rising prevalence of diabetes is also anticipated to lead to an increase in cases of diabetic neuropathy, which is a condition resulting from peripheral nerve injury. Therefore, the increasing prevalence of diabetes is expected to drive market growth significantly over the forecast period.

There is an increasing emphasis on developing novel technologies and using bioactive materials for treating peripheral nerve injuries (PNI). Government departments and authorities are investing more in advancing and evaluating these new treatment options. For instance, the Department of Defense has allocated USD 2 million to the University of Connecticut Health Center and the Department of Biomedical Engineering at Stevens Institute of Technology for a project titled “Bioactive Nerve Grafts for Peripheral Nerve Regeneration.” This initiative aims to enhance treatment methods for peripheral nerve injuries. Such advancements are expected to contribute to market growth significantly.

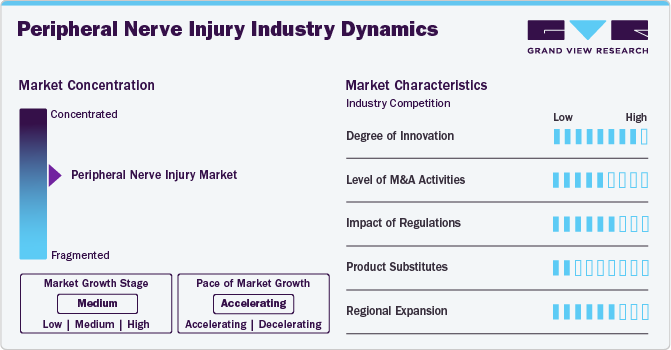

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The peripheral nerve injuries market is characterized by growth owing to the rising number of accidental injuries and the increasing research activities focusing on PNI treatments.

Industry players and researchers are focusing on developing advanced peripheral nerve injury treatment products. Ongoing advances in 3D printing combined with tissue engineering for nerve repair and regeneration are anticipated to drive innovation in the market.

Regulatory agencies such as the Food and Drug Administration (FDA), Health Canada, the European Union, and other bodies establish quality and safety standards for medical devices, including peripheral nerve injury products. The regulatory authorities are involved in marketing authorizations and clinical trials of peripheral nerve injury products. For instance, in December 2023, Rebuilder Nerve Guidance Conduit from the CelestRay Biotech Company, LLC received regulatory approval from the U.S. FDA under the Class II medical device category.

Companies are increasingly acquiring development-stage firms to expand their product offerings and reach a broader patient population. Major players often purchase smaller firms to enhance their market position, diversify their product lines, or access innovative technologies.

The market for peripheral nerve injuries is fragmented, characterized by a wide range of small, medium, and large companies that provide various products, including nerve conduits, wraps, protectors, and connectors. For instance, Stryker offers type I collagen conduits and wraps, which encase peripheral nerve injuries and protect the surrounding neural environment.

Players in the peripheral nerve injury industry strategically focus on provincial expansion to capitalize on emerging prospects and broaden their market presence. For instance, in January 2022, Toyobo Co., Ltd. launched a major U.S. marketing initiative for Nerbridge, a conduit for peripheral nerve regeneration. Such initiatives help companies expand their presence across various regions.

Product Insights

The nerve conduit led the market and accounted for a more than 64.30% revenue share in 2024. This can be attributed to technological advances and government funding for innovations. Furthermore, the availability of numerous approved nerve conduits from regulatory authorities is anticipated to support the segment's growth. According to data published by PubMed Central in May 2023, some of the FDA-approved nerve conduits for clinical use include NeuroTube, SaluBridge, NeuraGen, NeuroMatrix, SaluTunnel, and Neurolac, among others. Therefore, the presence of such widely approved products is anticipated to drive growth in this segment in the coming years.

The nerve wraps segment is projected to witness the fastest CAGR from 2025 to 2030 due to increasing demand. Nerve wraps are crucial in reducing the risk of nerve entrapment and preventing the ingrowth of scar tissue. In addition, ongoing research into the effectiveness of novel nerve wraps, particularly those coated with innovative materials for treating peripheral nerve injuries, is expected to drive market growth. For instance, a study published by MDPI in September 2024 assessed the efficacy of an electrospun polycaprolactone (PCL) nerve wrap coated with graphene oxide to promote axonal growth. Such research is anticipated to contribute to the segment's growth in the coming years.

Surgery Insights

The direct nerve repair segment led the market and accounted for more than 53.26% share of the global revenue in 2024. According to data published by Salem News in April 2024, over 20 million Americans suffer from some form of peripheral neuropathy, a disorder characterized by peripheral nerve injuries. Direct nerve repair is utilized to treat these injuries and is regarded as the gold standard for surgical treatment of severe cases. Such injuries can impair the ability to communicate due to the malfunction of motor and sensory nerves that connect the peripheral organs to the Central Nervous System (CNS). In addition, various organizations are promoting research and development for new product innovations, which is expected to drive market growth. For instance, in April 2023, researchers from the University of Oxford and MedUni Vienna showed that nerve damage can be effectively repaired by using tubes made of a combination of silk from spiders and silkworms.

The stem cell therapy segment is anticipated to witness the fastest CAGR from 2025 to 2030. This growth is expected to be driven by increasing government initiatives and approvals for clinical trials related to stem cell therapy treatments. Several studies have demonstrated the effectiveness of stem cell therapy in treating peripheral nerve injuries. For instance, the study published by the MDPI in September 2024, which was funded by the Research Eureka Accelerator Program (REAP), reported that mainly in vitro and in vivo animal models at present support the effectiveness of stem cell therapy as a potential therapeutic method in different types of peripheral nerve injuries. Animal models of stem-cell-induced peripheral nerve regeneration have shown impressive results. Thus, such positive results are anticipated to propel the segment's growth.

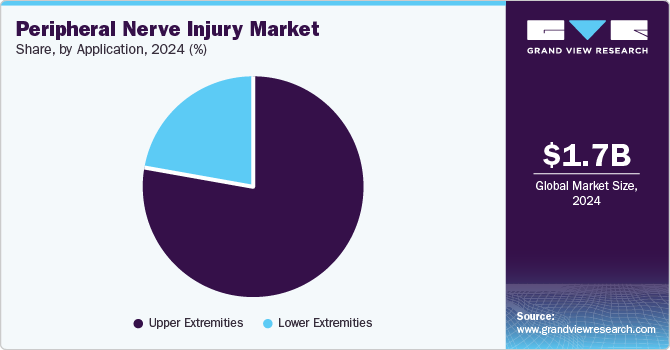

Application Insights

The upper extremities segment accounted for the largest market share in 2024 and is anticipated to grow further at the fastest CAGR from 2025 to 2030. PNIs in the upper extremity are extremely common. For instance, a study published by the National Library of Medicine in February 2022 reported a mean annual incidence rate of upper extremity nerve injuries of 18.18 cases per 100,000 person-years among males and 8.15 cases among females during the study period in Finland.

The lower extremities segment is anticipated to grow significantly in the coming years. The increasing prevalence of lower extremities and growing sports and accidental injuries are expected to support the segment's growth in the coming years. Several studies have reported the lower extremities in sports activities. For instance, the study published by the BMJ Open Sports & Exercise Medicine in February 2023 found that contact sports caused 23.2% of lower extremity injuries. Thus, the increasing prevalence of lower extremities is anticipated to support the segment growth in the coming years.

Regional Insights

North America held the largest revenue share of more than 30.43% in the market in 2024. The key drivers of growth in the region include the rising number of research activities, growing funding for developing novel PNI treatments, and the increasing prevalence of peripheral nerve injuries such as carpel tunnel syndrome., particularly in the U.S. According to the data published by the American Medical Association in October 2023, carpal tunnel syndrome affects up to 10 million people in the U.S. Such rising prevalence of carpal tunnel syndrome is anticipated to support the regional market growth in the coming years.

U.S. Peripheral Nerve Injury Market Trends

The peripheral nerve injury market in the U.S. is expected to dominate the North American market over the forecast period due to the rising prevalence of PNIs such as diabetic neuropathy and carpal tunnel syndrome. Furthermore, the presence of key players such as Axogen Inc., Stryker, Baxter, and Integra Lifesciences is anticipated to support the country's market growth in the coming years.

Europe Peripheral Nerve Injury Market Trends

The peripheral nerve injury market in Europe is projected to experience significant growth in the coming years. This growth is attributed to the region's well-established healthcare infrastructure and a growing awareness of peripheral nerve injuries. In addition, the rising prevalence of nerve injuries caused by accidents, sports, and surgical complications is driving an increased demand for effective therapies.

The peripheral nerve injury market in the UK is expected to grow moderately over the forecast period. This growth is largely driven by increasing research activities focused on PNI treatments and a rising prevalence of peripheral nerve injuries, including carpal tunnel syndrome (CTS). According to data published by the Royal College of Surgeons of England in November 2022, CTS is one of the most common compressive neuropathies, with a prevalence in the UK ranging from 7% to 16%.

France's peripheral nerve injury market is projected to grow during the forecast period, driven by rising healthcare spending and increasing awareness about neurological disorders nationwide. In addition, the rising prevalence of chronic diseases such as diabetes is anticipated to increase the risk for peripheral nerve injury due to associated complications such as diabetic neuropathy. International Diabetes Federation estimated that the age-adjusted prevalence of diabetes in France is anticipated to increase from 5.3% in 2021 to 6.5% in 2045 among people aged 20-79 years.

The peripheral nerve injury market in Germany is experiencing steady growth driven by several factors. These include a rising incidence of nerve injuries, advancements in medical technology, increased awareness of treatment options, a robust healthcare infrastructure, and a growing aging population that is more susceptible to such injuries.

Asia Pacific Peripheral Nerve Injury Market Trends

The Asia Pacific region is expected to register the highest CAGR during the forecast period, driven by significant peripheral nerve injury industry growth. Some key regional market driving factors include a high incidence of traumatic injuries from road accidents and sports, rapid advancements in healthcare technology, increasing investment in medical research, and a growing awareness of nerve repair options. In addition, a rising aging population in the region contributes to the demand for effective treatments. In addition, increasing healthcare expenditure is expected to boost market growth in the area further.

China's peripheral nerve injury market is expected to grow throughout the forecast period, driven by increasing demand for solutions to address the increasing prevalence of peripheral nerve injuries, such as diabetic neuropathy and carpal tunnel syndrome. According to the study published by the National Library of Medicine in December 2024, the prevalence of carpal tunnel syndrome among Chinese workers was 9.60%. Thus, the high prevalence of carpal tunnel syndrome and other peripheral nerve injuries is anticipated to propel the country's market growth.

The market for peripheral nerve injury in Japan is expected to grow significantly due to the rapidly increasing aging population, which is at a higher risk for nerve injuries. In addition, there is a rising incidence of nerve injuries resulting from accidents and chronic conditions. Advancements in surgical techniques, along with a strong emphasis on healthcare innovation and research in nerve repair therapies, are also expected to support this market growth.

Middle East and Africa Peripheral Nerve Injury Market Trends

The Middle East and Africa peripheral nerve injury market is projected to witness moderate growth due to a rising incidence of traumatic injuries, particularly from road accidents. Moreover, increasing healthcare investments, a growing emphasis on advanced treatment options, and a rising awareness of nerve repair technologies further support market growth in the region. In addition, the growing healthcare expenditure is anticipated to drive the market growth. As per Federal budget data published in June 2024, around USD 1.33 billion was allocated for 2023, which increased to 1.36 billion in 2024.

The peripheral nerve injury market in Saudi Arabia is anticipated to grow over the forecast period. The country market is driven by the rising prevalence of chronic conditions like diabetes, an aging population, and increasing healthcare investments. According to the study published by the Journal of Family and Community Medicine in January 2024, Saudis are 30% more likely to have diabetes than other nationalities. Thus, the increasing prevalence of diabetes is anticipated to increase the prevalence of diabetic neuropathy, which further supports market growth.

Ongoing Clinical Trials for Peripheral Nerve Injuries

Study Name

Intervention/ Treatment

Enrollment

Sponsor

Study Completion

A Comparison of NeuroSpan Bridge, NeuraGen Nerve Guide, and Nerve Autograft for Peripheral Nerve Repair (NeuroSpan-1)

Device: NeuroSpan Bridge

80

Auxilium Biotechnologies

2026-08

Device: NeuroGen Nerve Guide

Device: Nerve Autograft

Registry of Avance Nerve Graft's Utilization and Recovery Outcomes Post Peripheral Nerve Reconstruction (RANGER)

Other: Processed Human Nerve Graft

5000

Axogen Corporation

2025-12

Other: Standard Treatment, Autogenous Nerve Graft, Direct Suture, etc.

Other: Autogenous Nerve Graft

Device: Nerve Tube Conduit

Procedure: Autologous Breast Reconstruction with Neurotization

Procedure: Autologous Breast Reconstruction without Neurotization

Nerve Protection Evaluation: Revision Cubital Tunnel Syndrome Decompression (COVERED)

Device: Axoguard HA+ Nerve Protector

20

Axogen Corporation

2026-12

Source: ClinicalTrials.gov

Industry players such as Axogen Corporation and Auxilium Biotechnologies are actively conducting clinical trials for innovative peripheral nerve injury products, including nerve protectors and nerve conduits. Positive outcomes from these trials are expected to introduce groundbreaking therapies to the market, significantly enhancing treatment options. This introduction of innovative products is anticipated to drive substantial market growth in the coming years, addressing the rising demand for effective nerve repair solutions.

Key Peripheral Nerve Injury Company Insights

Axogen Corporation, Stryker, Baxter, Polyganics, Renerva, LLC., INTEGRA LIFESCIENCES, . TOYOBO CO., LTD, Orthocell Ltd and Newrotex are some of the major players in the peripheral nerve injury industry. Companies are expanding their peripheral nerve injury treatment solutions portfolios and acquiring smaller firms to gain a competitive advantage in the rapidly growing industry. Moreover, industry players are also launching advanced products to meet the growing demand.

Key Peripheral Nerve Injury Companies:

The following are the leading companies in the peripheral nerve injury market. These companies collectively hold the largest market share and dictate industry trends.

- AxoGen, Inc.

- Stryker

- Baxter International, Inc.

- Polyganics BV

- Integra Lifesciences Corporation

- Renerva, LLC

- Toyobo Co., Ltd.

- Newrotex

- Orthocell Ltd

Recent Developments

-

In January 2025, Orthocell is planning to expand the accessibility of its Remplir nerve repair product in Thailand, Canada, the United Kingdom, the European Union, and Brazil, with a target timeline of 2025. Entering these markets is expected to significantly increase the company's revenue opportunity to approximately USD 3.2 billion, to capture a 20% market share.

-

In June 2024, BioCircuit Technologies announced the first human implantations of Nerve Tape, the first FDA-approved device for sutureless nerve repair. This technology enables rapid and precise repair of injured nerves.

Peripheral Nerve Injury Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.77 billion

Revenue forecast in 2030

USD 2.58 billion

Growth rate

CAGR of 7.80 % from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Axogen Corporation; Stryker; Baxter; Polyganics; Renerva, LLC.; Orthocell Ltd; INTEGRA LIFESCIENCES; TOYOBO CO., LTD; Newrotex.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peripheral Nerve Injury Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peripheral nerve injury market report based on product, surgery, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nerve Conduit

-

Nerve Protector

-

Nerve Connector

-

Nerve Wraps

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct nerve repair

-

Nerve Grafting

-

Stem Cell Therapy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremities

-

Lower Extremities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peripheral nerve injury market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 1.77 billion in 2025.

b. The global peripheral nerve injury market is expected to grow at a compound annual growth rate of 7.80% from 2025 to 2030 to reach USD 2.58 billion by 2030.

b. North America dominated the peripheral nerve injury market in 2024 and is expected to witness a growth rate of 7.12% over the forecast period. This is due to the rising prevalence of peripheral nerve injuries coupled with the growing geriatric population in the region, which is highly susceptible to these injuries. In addition, an increase in government funding and initiatives for raising awareness about peripheral nerve injuries is expected to drive the demand for peripheral nerve injury market in the region.

b. Prominent key players operating in the peripheral nerve injury market include Axogen Corporation, Stryker, Baxter, Polyganics, Renerva, LLC., INTEGRA LIFESCIENCES, TOYOBO CO., LTD, Orthocell Ltd, Newrotex and others.

b. The market for peripheral nerve injuries is expected to grow due to ongoing clinical trials focused on nerve repair, technological advancements, an increase in research and development activities, and a rise in awareness among people about different regenerative medicines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.