- Home

- »

- Electronic Devices

- »

-

Consumer Electronics Market Size And Share Report, 2030GVR Report cover

![Consumer Electronics Market Size, Share & Trends Report]()

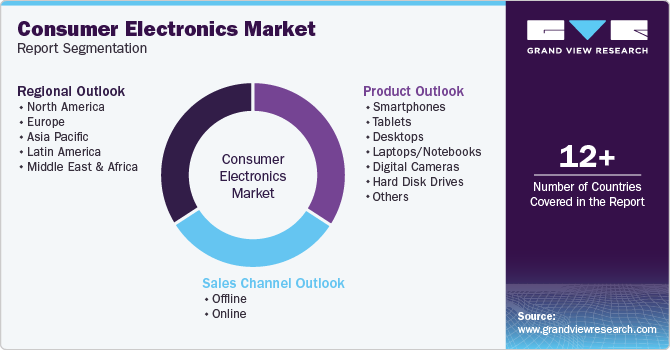

Consumer Electronics Market Size, Share & Trends Analysis Report By Product (Smartphones, Tablets, Desktops, Laptops, Digital Cameras, Hard Disk Drives, E-readers), By Sales Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-510-6

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Consumer Electronics Market Size & Trends

The global consumer electronics market size was valued at USD 1,068.22 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Smartphone proliferation is expected to fuel the global market for consumer electronics. Technological advancements, the emergence of 3G and 4G technologies, and innovation are expected to drive demand for the market for consumer electronic.

The industry has evolved significantly over the last few years owing to several new technological developments. Technological proliferation and the emergence of smart devices is expected to be the key factor driving growth over the next six years. However, the growing adoption of tablets has led to declining sales of traditional desktop PCs and laptops, which is expected to challenge growth.

The surge in demand for devices with large screens, referred to as ‘phablets’, offers significant growth opportunities. Furthermore, advancements such as the emergence of IoT across devices such as fitness bracelets, rising consumer disposable income, and the growing popularity of smart devices provide avenues for industry growth.

Developing devices compatible with emerging technologies such as 3G/4G is expected to propel demand. The industry offers ample opportunities for personal electronics suppliers and manufacturers to harness consumer behavior, intent, and trends to emerge as a leader. Increasing penetration of the BYOD market offers avenues for growth.

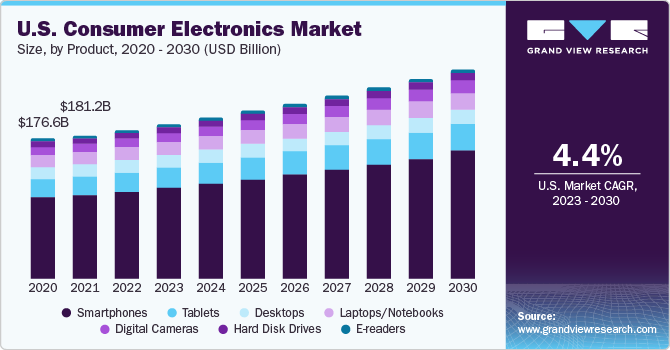

Product Insights

Based on the product, the global market is segmented into smartphones, tablets, desktops, laptops/notebooks, digital cameras, hard disk drives, and e-readers. The smartphones segment captured the largest revenue share of over 58.3% in 2022 and is estimated to register the fastest CAGR of 7.3% over the forecast period. This is attributed to the high degree of digital convergence and product innovation initiatives by key manufacturers. The smartphone market is dominated by three major operating platforms: Android, iOS, and Windows. The availability of multi-functional and cost-effective devices is expected to be the key force driving demand. The industry is extensively driven by increased demand in the Asia-Pacific.

Moreover, the tablets segment is estimated to significantly grow with a CAGR of 7.0% over the forecast period. Introducing new innovative and smarter tablets with extensive input capabilities offers growth opportunities for the market. In addition, government-driven initiatives in developing regions may also fuel demand over the next few years. Tablets address a few traditional technology barriers. Impairments or arthritis limits motor skills in users; however, tablets provide touch technology facilitating usage.

Desktops are expected to rapidly lose revenue share due to the demand for portable devices. The digital camera market is expected to be restrained by the advent of powerful cameras embedded in smartphones and associated devices. Introducing new innovative and smarter tablets with extensive input capabilities offers growth opportunities. In addition, government-driven initiatives in developing regions may also fuel demand over the next few years. Tablets address a few traditional technology barriers. Impairments or arthritis limits motor skills in users; however, tablets provide touch technology facilitating usage.

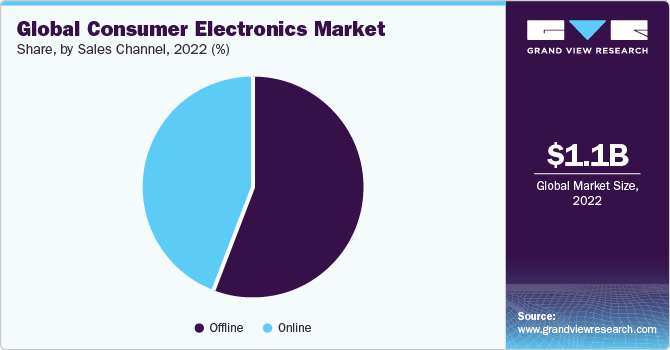

Sales Channel Insights

Based on sales channel, the market is segmented into offline and online. The offline segment accounted for the largest revenue share of around 56.0% in 2022. The offline segment facilitates personalized customer service. Sales representatives can offer tailored recommendations based on individual needs and preferences, guiding consumers through decision-making. This personalized assistance enhances the shopping experience and fosters customer loyalty, encouraging repeated visits and word-of-mouth referrals.

The online segment is estimated to register the fastest CAGR of 8.7% over the forecast period. The widespread adoption of internet connectivity and mobile devices drives the segment's growth. The proliferation of smartphones, tablets, and laptops has facilitated easy access to online shopping platforms, enabling consumers to browse and purchase electronic products conveniently from anywhere. Additionally, the convenience of doorstep delivery and hassle-free return policies offered by e-commerce platforms have significantly contributed to the growth of the online segment.

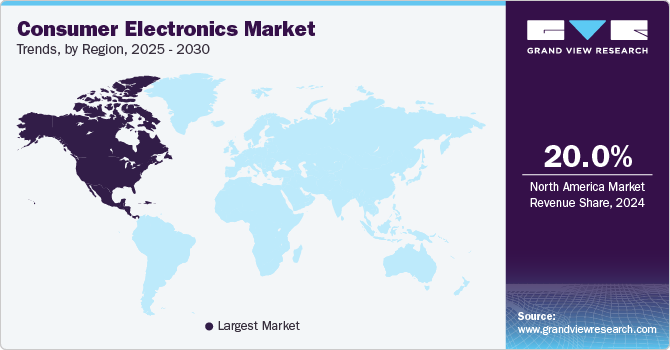

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 49.7% in 2022. Government initiatives and supportive policies have contributed to the growth of the consumer electronics industry in the Asia Pacific region. Governments in countries like China, India, and South Korea have implemented measures to promote the adoption of digital technology, provide subsidies for manufacturing, and encourage domestic production. These initiatives have stimulated the local market and attracted multinational companies to invest and establish their regional manufacturing facilities.

Latin America is expected to grow steadily, with a CAGR of 6.8% during the forecast period. Latin America has witnessed significant advancements in digital connectivity and internet penetration. The region has experienced a rapid expansion of mobile networks and increased internet users. This has created a greater demand for consumer electronics, enabling individuals to stay connected, access online services, and engage in e-commerce activities.

North America is expected to grow at a significant CAGR over the forecast period. Due to high penetration, North America's consumer electronics industry is expected to emerge as the dominant regional industry. However, growth is also accompanied by significant disruption. The barriers to entry for smartphones have dropped considerably owing to the rise of the Android operating system and several reference design platforms. North America and Europe are mature markets expected to witness impetus from network operators' early upgrade programs and smartphone growth. Replacement sales largely drive smartphone sales in these markets.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in February 2023, Vivo Mobile Communication Co., Ltd. launched its latest flagship smartphones, the X90 and X90 Pro, as part of the X90 series. These smartphones bring a range of enhanced camera features and overall performance upgrades owing to the implementation of advanced dual flagship chip technology. Additionally, Vivo has continued collaborating with ZEISS, an imaging and camera system company. This collaboration encompasses various aspects such as optics, antireflective coating, software, and system integrations, ensuring exceptional imaging capabilities and a seamless user experience. Some of the major players in the global consumer electronics market include:

-

Apple Inc.

-

ASUSTeK Computer Inc.

-

BLACKBERRYS

-

Canon Inc.

-

Dell Inc.

-

Google LLC

-

HP Development Company, L.P.

-

HTC Corporatio

-

Huawei Technologies Co., Ltd.

-

Lenovo

-

LG Electronics

-

Micromax

-

Motorola Mobility LLC

-

Nikon Corporation

-

Panasonic

-

SAMSUNG

-

Seagate Technology LLC

-

Sony Corporation

-

TOSHIBA CORPORATION

-

ZTE Corporation

Recent Developments

-

In May 2023, Ekka Electronics announced a significant investment of USD 121.1 million to establish a manufacturing facility in Noida, India. The company aims to produce various consumer electronics, including washing machines, smartwatches, wearables, and true wireless stereo (TWS) devices. Moreover, the company has plans to increase this capacity to 800,000 to 900,000 units per month within the next three years.

-

In April 2023, OnePlus launched its flagship tablet, the OnePlus Pad. The OnePlus Pad exhibits the brand's signature design aesthetics characterized by elegance and functionality. Incorporating their self-developed Star Orbit metal craft and precise aluminum alloy CNC cutting techniques, OnePlus aims to deliver a unique, fast, and seamless user experience which sets new industry standards and offers users the best available choices, injecting new vitality and possibilities into the market.

-

In March 2023, CUI Devices announced that it had signed a distribution agreement with J.P. Electronic Devices Pvt. Ltd., a supplier of electronic components, services, and solutions for various industries. By forming this partnership, CUI Devices aims to leverage the extensive network and expertise of J.P. Electronic Devices to effectively reach and serve a wide range of customers in the Indian market.

-

In January 2023, the Indian government announced its strategy to achieve a target of USD 300 billion in electronics manufacturing by FY26, aiming to propel the country towards becoming a USD 1 trillion economy by 2025. The government introduced several initiatives and incentives to foster and strengthen the electronics manufacturing sector. These included the Production Linked Incentive (PLI) scheme and the scheme for fostering electronic components and semiconductors (SPECS).

-

In October 2022, Electrolux, a global appliance company, launched its inaugural exclusive retail store in Basavanagudi, India. This marks the company's first brand-exclusive outlet in Bangalore, and it plans to establish an additional 50 outlets in the city by the year-end through partnerships with leading retailers. The exclusive business outlet across 3500 square feet offers an open format that allows consumers to engage in hands-on experiences, facilitating their purchase decisions.

-

In October 2022, SAMSUNG partnered with Google LLC, enabling users of Samsung Galaxy phones and tablets to effortlessly connect Matter-compatible devices to the SmartThings and Google Home ecosystems. By leveraging the multi-admin capabilities of the Matter standard, this partnership allows devices to be directly connected to multiple applications and ecosystems, providing consumers with enhanced flexibility and options.

-

In June 2022, HP Development Company, L.P. acquired Poly, a global provider of workplace collaboration solutions. This strategic acquisition aligns with HP's goal of expanding its portfolio and driving growth, particularly in the hybrid work solutions sector. By acquiring Poly, HP aims to offer a comprehensive range of devices, software, and digital services that enhance employee experiences, boost workforce productivity, and provide enterprise customers with enhanced visibility, security, insights, and manageability across their hybrid IT environments.

Consumer Electronics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,138.83 billion

Revenue forecast in 2030

USD 1,782.60 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

AppleInc.; ASUSTeK Computer Inc.; BLACKBERRYS; BOSAL; Canon Inc.; Dell Inc.; Google LLC; HP Development Company; L.P.; HTC Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Consumer Electronics Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global consumer electronics market report based on product, sales channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Smartphones

-

Tablets

-

Desktops

-

Laptops/Notebooks

-

Digital Cameras

-

Hard Disk Drives

-

E-readers

-

-

Sales Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer electronics market size was estimated at USD 1,068.22 billion in 2022 and is expected to reach USD 1,138.83 billion in 2023.

b. The global consumer electronics market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 1,782.60 billion by 2030.

b. Smartphones dominated the consumer electronics market with a share of 58% in 2022. This is attributed to the high degree of digital convergence and product innovation initiatives by key manufacturers. The smartphone market is dominated by three major operating platforms: Android, iOS, and Windows.

b. Some key players operating in the consumer electronics market include AppleInc., ASUSTeK Computer Inc., BLACKBERRYS, BOSAL, Canon Inc., Dell Inc., Google LLC, HP Development Company, L.P., HTC Corporation.

b. Smartphone proliferation is expected to fuel the global consumer electronics market. Technological advancements, the emergence of 3G and 4G technologies, and innovation are expected to drive demand for the consumer electronics market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."