- Home

- »

- Beauty & Personal Care

- »

-

Personal Care Wipes Market Size And Share Report, 2030GVR Report cover

![Personal Care Wipes Market Size, Share, & Trends Report]()

Personal Care Wipes Market (2023 - 2030) Size, Share, & Trends Analysis Report By Product (Baby Wipes, Facial & Cosmetic Wipes, Hand & Body Wipes), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-862-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Care Wipes Market Summary

The global personal care wipes market size was estimated at USD 11.86 billion in 2022 and is projected to reach USD 19.33 billion by 2030, growing at a CAGR of 6.3% from 2023 to 2030. Convenience, hygiene, easy disposability, and consumer-centric aesthetics are some of the major characteristics of these products influencing the industry’s growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, the UK is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, baby wipes accounted for a revenue of USD 8,119.1 million in 2022.

- Flushable Wipes is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 11.86 Billion

- 2030 Projected Market Size: USD 19.33 Billion

- CAGR (2023-2030): 6.3%

- North America: Largest market in 2022

In addition, the rising awareness about hygiene is another factor driving the growth. Rising usage of the product as a more convenient alternative to cloth, liquid washes, and paper towels is further propelling the industry's growth. The COVID-19 pandemic positively influenced the industry, majorly due to the sudden rise in the demand for wipes as a result of the increased importance of cleanliness and hygiene to curb the spread of the infection.

In addition, the demand for organic and eco-friendly wipes also increased. For instance, in April 2022, Walgreens Boots Alliance, Inc. announced to replace wipes containing plastic with wood fiber or plant-based alternatives by the end of 2022. This trend among the consumers of organic products is expected to continue growing in the coming years. Personal care wipes enable easy maintenance of hygiene as they are portable. Moreover, most of these are made from natural ingredients, thus being environment-friendly and fulfilling the need of customers looking for sustainable products. Furthermore, the demand for skin and personal care products has been growing in various areas including cosmetics, makeup, and hygiene. Facial and cosmetic wipes do not require the need for lather & rinse and are travel-friendly, contributing to their growing use.

This growth can be attributed to the advantages of these products along with the growing awareness among consumers. The increasing consumer disposable income and the shift toward an improved lifestyle are also boosting product usage, thus fueling industry growth. Moreover, the growing usage of organic wipes to avoid the side effects of harsh chemicals on the skin is expected to drive the industry. Increasing marketing initiatives, such as media & broadcasting, product branding, advertisements, and others, have been leading to substantial growth in product use, thus driving the overall market. The product acceptance has been growing due to the fact that they are manufactured with compostable materials and natural ingredients.

In addition, these products are used for various purposes, such as patient care, diapering a baby, post-workout, and others. The surging product usage due to their effectiveness as an alternative to several other products used for cleansing, including facewash, soap, handkerchief, cloth, and napkin, along with their small and convenient packaging, is expected to propel the market growth. However, their high cost in comparison to cloth napkins and the presence of certain harsh chemicals may cause skin-related allergies, which may hinder industry growth. Thus, manufacturers are launching natural, organic wipes to cater to such issues. For instance, in August 2021, Unicharm Corp. launched Mamy Poko Premium Baby Wipes, a range of organic baby wipes in Taiwan.

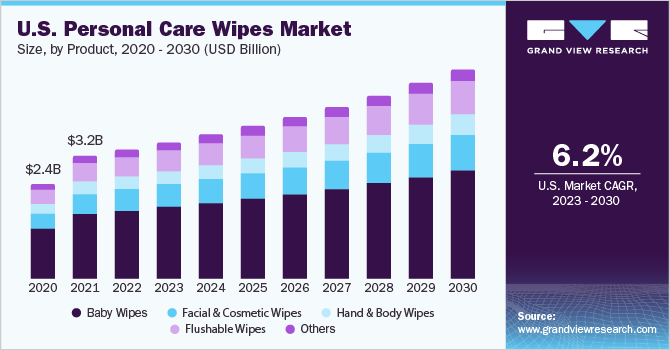

Product Insights

On the basis of products, the global industry has been divided into baby wipes, facial & cosmetic wipes, hand & body wipes, flushable wipes, and others. The baby wipes segment dominated the global industry in 2022 and accounted for the maximum share of more than 53% of the overall revenue. A rise in the usage of baby wipes by millennial parents due to the growing concerns regarding the sensitive skin of infants is a primary factor contributing to the high share of the segment. The baby wipes segment is an established segment; however, the price of these products remains one of the major competitive factors in this product segment, thereby providing enough space for companies to enter the market.

The flushable wipes segment is expected to advance at the fastest CAGR of 7.1% during the forecast period. Flushable wipes have deodorization and antibacterial properties and provide skin protection, which results in their increased adoption over traditional toilet paper, thus boosting the segment growth. These are designed in a manner so that they can be flushed down, thus making them septic-safe, leading to their increasing usage. Moreover, the usage of flushable wipes provides a better cleaning experience and is more refreshing, which results in their high adoption rate. These factors are anticipated to boost the growth of this segment during the forecast period.

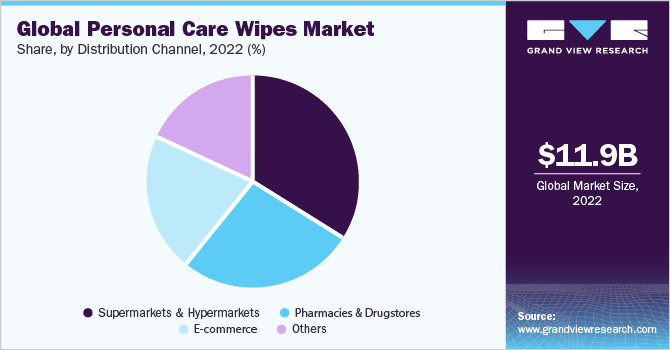

Distribution Channel Insights

The supermarkets & hypermarkets segment was the largest contributor to the industry in 2022 and accounted for the maximum revenue share of more than 34%. The dominance of the segment is attributed to the availability of a diverse range of products at affordable prices in one place. Products in these stores are organized on shelves making them easily accessible to the customers. Supermarkets & hypermarkets provide various offers and discounts to reach a larger consumer base. Moreover, such channels allow the buyers to compare different products before purchasing, which is driving product sales through these channels.

In addition, these stores are located in convenient places making them easily accessible to consumers. The e-commerce segment is estimated to advance at the fastest CAGR of 6.9% from 2023 to 2030. E-commerce has rapidly gained popularity to a large extent in the retail business across the world. The easy accessibility of online shopping is significantly driving consumers’ attention toward e-commerce. Countries, such as India, China, and Germany, have witnessed rapid growth in online shopping for these products. Moreover, the introduction of various platforms, such as Amazon.com, and Flipkart.com, and the availability of different, safe, and convenient payment gateways are contributing to the segment growth.

Regional Insights

On the basis of geographies, the global industry has been divided into North America, Asia Pacific, Middle East & Africa, Central & South America, and Europe. North America emerged as the leading region in 2022 and accounted for the maximum share of more than 34% of the overall revenue owing to the growing demand for wipes for hygiene and household work. In 2022, the U.S. was the largest market in the North American region owing to the growing demand for hygiene products and increasing health consciousness among consumers. In addition, the availability of a diverse range of products in the region is further contributing to its growth.

On the other hand, the Asia Pacific region is expected to register the fastest CAGR of 6.7% during the forecast period. The growth of the region is attributed to the rising population, majorly in the developing economies, along with their increasing purchasing power. In addition, the high infant population in the region will also support the growth in the years to come. For instance, according to the East Asia Forum (EAF), in 2020, twelve million babies were born in China alone. Furthermore, the availability of a wide range of products at reasonable prices is another key factor driving the region’s growth.

Key Companies & Market Share Insights

The global industry is moderately fragmented as well as still in the developing stage, with global players engaging in product innovation strategies. Key players are adopting various steps to strengthen their presence in the industry. These steps include strategies such as partnerships, mergers & acquisitions, development & launch of new products, global expansion, and others. For instance, in April 2022, Essity announced the acquisition of Legacy Converting Inc., which offers a wide range of products including chemical-ready wipes, wet wipes, and dry wipes. Some of the prominent players in the global personal care wipes market include:

-

Edana

-

Diamond Wipes International Inc.

-

Medline Industries

-

The Honest Company, Inc.

-

Procter and Gamble Co.

-

Edgewell Personal Care Co.

-

Johnson & Johnson Services, Inc

-

Pluswipes

-

Rockline Industries

-

KCWW

Personal Care Wipes Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.52 billion

Revenue forecast in 2030

USD 19.33 billion

Growth rate

CAGR of 6.3 from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; Indonesia; Brazil; South Africa

Key companies profiled

Edana Diamond Wipes International Inc.; Medline Industries; The Honest Company, Inc.; Procter and Gamble Co.; Edgewell Personal Care Co.; Johnson & Johnson Services, Inc; Pluswipes; Rockline Industries; KCWW

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Care Wipes Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. Grand View Research has segmented the global personal care wipes market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Baby Wipes

-

Facial & Cosmetic Wipes

-

Hand & Body Wipes

-

Flushable Wipes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacies & Drugstores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global personal care wipes market was estimated at USD 11.86 billion in 2022 and is expected to reach USD 12.52 billion in 2023.

b. The global personal care wipes market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 19.33 billion by 2030.

b. North America dominated the personal care wipes market with a share of 34.37% in 2022. The high share of the region is attributed to the presence of a high number of health-conscious consumers in the region and the rising demand for hygiene products among them.

b. Some key players operating in the personal care wipes market include Amway Enterprises Pvt. Ltd.; Herbalife Nutrition Ltd.; Natura & Co.; Vorwerk; Nu Skin Enterprises; Tupperware Brands Corporation; Oriflame Holding AG; Belcorp Corporation; and Mary Kay Inc.

b. The personal care wipes market is driven by the growing use of these products due to their various characteristics such as hygiene, ease to use, easy disposal, and others coupled with their surging use due to rising consumer spending and improved lifestyle of consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.