- Home

- »

- Animal Health

- »

-

Pet At-home Diagnostic Tests Market, Industry Report, 2030GVR Report cover

![Pet At-home Diagnostic Tests Market Size, Share & Trends Report]()

Pet At-home Diagnostic Tests Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Others), By Sample Type, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-594-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet At-home Diagnostic Tests Market Summary

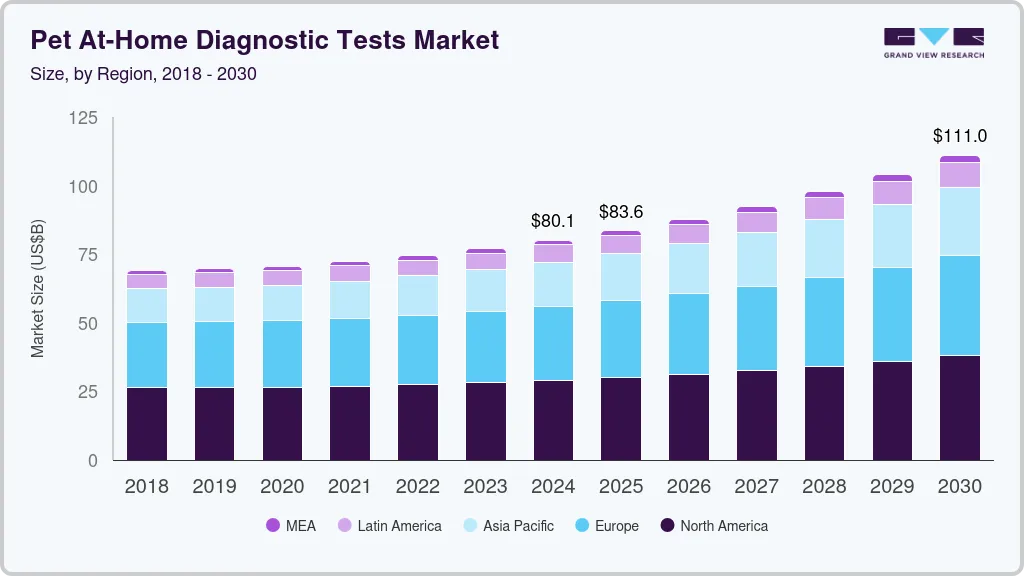

The global pet at-home diagnostic tests market size was estimated at USD 80.14 million in 2024 and is projected to reach USD 110.97 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. Convenience and accessibility of at-home testing kits, such as those for urinary tract infections, allergies, and diabetes monitoring, enable timely health management without frequent vet visits.

Market Size & Trends:

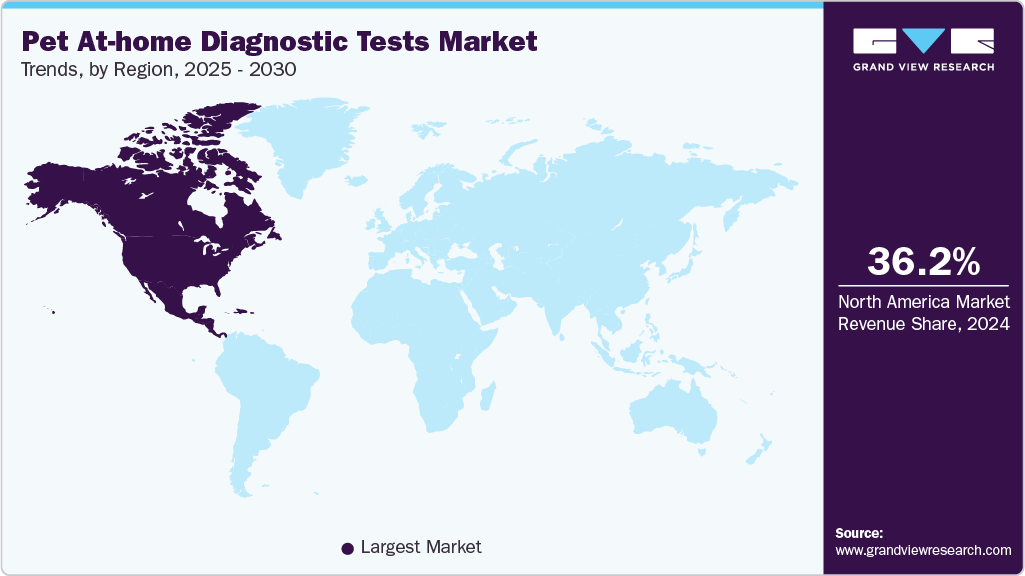

- North America pet at-home diagnostic tests market held the largest market share, 36.25%, in 2024.

- The U.S. pet at-home diagnostic tests market is growing rapidly due to high pet ownership and increasing demand for early disease detection and preventive care.

- By animal type, the dogs segment dominated the market with a share of 58.82% in 2024.

- By application, the parasitic diseases segment held the largest market share in 2024.

- By sample type, the blood segment accounted for the highest market share in 2024.

Key Market Statistics:

- 2024 Market Size: $80.14 Million

- 2030 Estimated Market Size: $110.97 Million

- CAGR: 5.8% (2025-2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The growing shift toward preventative care is a significant factor driving the expansion of the pet at-home diagnostic test market. Pet owners increasingly prioritize early detection and ongoing health monitoring to prevent serious illnesses rather than reacting to symptoms after they appear. At-home diagnostic kits enable owners to regularly check vital health indicators such as blood glucose levels, urinary tract infections, and allergies in a convenient and timely manner. For instance, home urine test kits from companies like Petnostics allow pet parents to monitor conditions such as diabetes and kidney issues early, facilitating quicker veterinary intervention and better disease management.

This preventative care trend is further supported by the rising awareness of chronic diseases in pets, such as obesity-related diabetes and skin allergies, which require consistent monitoring. By integrating at-home testing into routine pet care, owners can catch potential health issues before they escalate, reducing emergency vet visits and improving long-term outcomes. The availability of easy-to-use DIY kits and professional home blood collection services exemplifies how this shift transforms pet healthcare into a proactive rather than reactive, practice.

Market Concentration & Characteristics

The market is also highly fragmented, with numerous startups and established veterinary companies competing to innovate and expand product offerings. Increasing awareness of pet wellness and the humanization of pets continues to propel demand, making the market dynamic and consumer-driven.

The pet at-home diagnostic test market is characterized by rapid growth driven by increasing pet ownership and a rising focus on preventive healthcare. The market features various products, including urine and fecal test kits, allergy tests, and rapid disease diagnostic test cards, catering to various pet health needs. Convenience and ease of use are key attributes, with many kits designed for simple sample collection by pet owners at home, often accompanied by digital platforms for result interpretation and veterinary consultation.

The pet at-home diagnostic test market is experiencing significant innovation, driven by technological advancements and a growing demand for personalized pet care. Companies like Innovative Pet Lab are leading the way with comprehensive tests assessing gut health, stress levels, and inflammation in dogs and cats, utilizing biomarkers such as zonulin and antigliadin-IgA. These tests offer pet owners valuable insights into their pets' health, enabling early detection and proactive management of potential issues.

The pet at-home diagnostic test market is experiencing significant consolidation, driven by strategic mergers and acquisitions (M&A) among key industry players. In August 2024, private equity firm Bansk Group acquired PetIQ for approximately $1.5 billion, gaining access to PetIQ's extensive range of pet health products, including diagnostic tests. This acquisition enables companies to enhance their product offerings, access new technologies, and strengthen their market presence, accelerating growth in the pet diagnostics sector.

Regulations significantly influence the pet at-home diagnostic tests market, impacting product development, market access, and adoption rates across different regions. In the United States, the FDA classifies certain pet diagnostic kits as medical devices, requiring premarket approval through processes like the 510(k) pathway. This ensures product safety and efficacy, but can extend time-to-market and increase costs. Similarly, the European Union enforces the In Vitro Diagnostic Regulation (IVDR), necessitating CE marking for at-home diagnostic kits. This regulation mandates rigorous clinical validation and post-market surveillance, which can be resource-intensive for manufacturers. In contrast, regions with less stringent regulatory frameworks may experience faster product introductions but face challenges related to product quality and consumer trust.

Product substitutes primarily include traditional in-clinic veterinary diagnostics and telemedicine consultations. These alternatives offer professional oversight and immediate access to a veterinarian’s expertise, which many pet owners still prefer for complex or urgent health concerns. While at-home kits provide convenience and privacy, clinic-based diagnostics often feature more advanced tools (e.g., imaging, lab cultures, comprehensive blood panels) that yield higher diagnostic accuracy. Additionally, wearable pet health monitors such as smart collars that track vital signs, activity levels, and sleep patterns are emerging as indirect substitutes, providing continuous wellness insights without sample collection. However, these substitutes typically require higher upfront costs or ongoing subscriptions, making affordable, one-time at-home kits more attractive for routine monitoring. Thus, while substitutes exist, they tend to complement rather than replace at-home kits, especially for preliminary screening and chronic condition management.

End user concentration in the pet at-home diagnostic test market is moderate. A diverse consumer base primarily comprises individual pet owners, followed by breeders and pet shelters. The majority of demand stems from tech-savvy, health-conscious pet parents seeking convenient, proactive health monitoring solutions. Urban and suburban households with higher disposable incomes are key market drivers. No single user group dominates, ensuring a balanced market distribution.

Animal Type Insights

The dogs segment dominated the market with a share of 58.82% in 2024. Dogs are prone to a wide range of health conditions such as obesity, diabetes, cancer, infectious diseases (e.g., parvovirus, distemper), and chronic conditions that require regular monitoring and early diagnosis. Dogs often show clearer clinical signs of illness than other pets, prompting quicker diagnostic intervention. For instance, symptoms like lethargy, vomiting, or limping are more likely to be noticed in dogs, leading to early at-home testing before a clinic visit. This has boosted the demand for urinalysis strips, glucose monitors, and fecal diagnostic kits personalized for dogs.

The cats segment is anticipated to grow at the fastest CAGR of 6.3% over the coming years. This growth is driven by increasing cat ownership, a shift in feline healthcare awareness, and the development of cat-specific diagnostic solutions that address previously underserved needs. Additionally, cats are more stressed by vet visits and restraint than dogs, often resulting in delayed or missed diagnoses. At-home testing reduces the need for stressful clinical procedures, allowing early intervention in diseases like diabetes, chronic kidney disease, and hyperthyroidism, which are common in older cats.

Application Insights

The parasitic diseases segment held the largest market share in 2024 due to the high prevalence of parasitic infections among pets, ease of home-based detection, and growing emphasis on preventive care by pet owners. Parasitic infections are relatively easier to test for using at-home kits that analyze stool, blood, or urine. These tests provide rapid results and eliminate the need for frequent vet visits. Additionally, Veterinary guidelines from organizations such as the American Animal Hospital Association (AAHA) and the Companion Animal Parasite Council (CAPC) recommend regular parasite screening, particularly in younger animals and those with outdoor exposure. These recommendations have increased awareness among pet owners and contributed to the higher market share of this segment.

The genetic conditions and allergies segment is expected to register the fastest growth rate from 2025 to 2030 due to rising demand for personalized pet care, increased awareness of hereditary disorders, and advances in at-home testing technology. Allergic conditions in pets, especially dogs, are becoming more common due to environmental changes, dietary sensitivities, and overexposure to certain allergens. Symptoms like itching, chronic ear infections, gastrointestinal issues, and dermatitis prompt owners to seek at-home solutions for identification and management.

Sample Type Insights

In terms of sample type, the blood segment accounted for the highest market share in 2024 due to its diagnostic versatility, high accuracy, and ability to detect a broad range of critical health conditions in both dogs and cats. Blood samples provide rich diagnostic information, making them essential for detecting a wide variety of conditions that cannot be accurately diagnosed through other sample types. Recent advances have made capillary blood collection more feasible at home. Pet owners can now collect small samples using lancets or collection devices included in at-home kits. These samples can be analyzed by a reader at home or sent to a lab. For example, Basepaws' upcoming blood-based biomarker tests aim to screen for early indicators of kidney disease and cardiovascular issues, highlighting the expanding use of blood diagnostics.

The fecal segment is projected to grow the fastest in the near future due to increasing awareness of intestinal parasites and gastrointestinal health, especially in young pets and those with outdoor exposure. Fecal tests are essential for detecting conditions like Giardia, roundworms, hookworms, coccidia, and fecal blood, which are common yet often asymptomatic in early stages. The rise in zoonotic concerns and recommendations from veterinarians for routine fecal screening-particularly in puppies, kittens, and rescue animals-are driving demand.

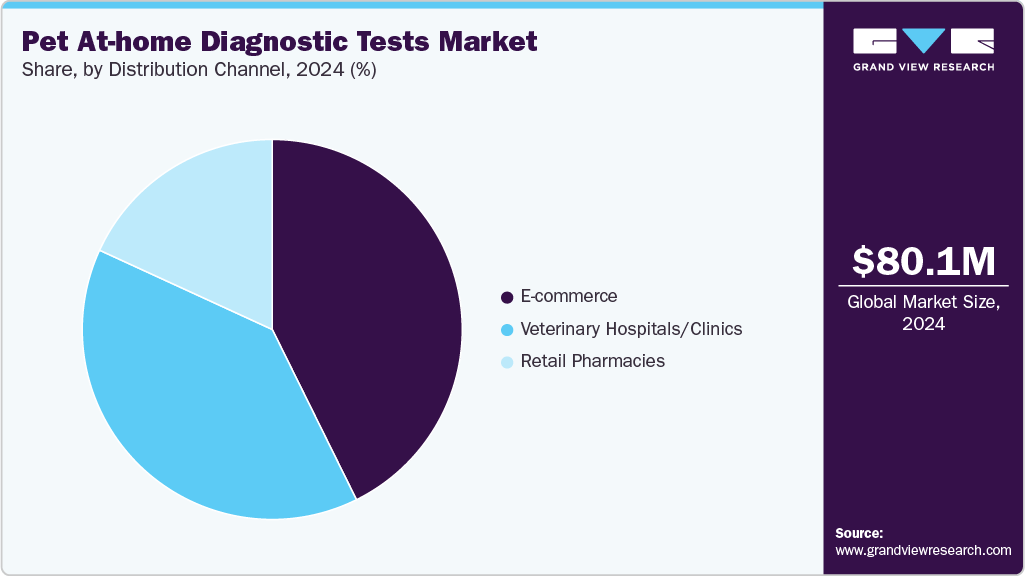

Distribution Channel Insights

The e-commerce segment held the largest share of the market in 2024 and is estimated to grow at the fastest CAGR in the coming years. This is due to its convenience, broad product availability, and increasing digital adoption among pet owners. Online platforms offer easy access to a wide range of diagnostic kits such as DNA tests, allergy screens, and fecal or blood testing kits often with home delivery and customer reviews that guide purchasing decisions. The rise of pet-focused online retailers (e.g., Chewy, Amazon, Petco) and direct-to-consumer brands (e.g., Affordable Pet-Labs, Ring Biotechnology Co Ltd.) has significantly expanded market reach. Additionally, subscription models and auto-refill options for routine tests encourage repeat purchases. The COVID-19 pandemic accelerated the shift to online shopping, and this behavior has persisted, driving sustained growth in the e-commerce channel.

The veterinary hospitals/clinics segment holds a significant share of the pet at-home diagnostic tests market due to their role as trusted sources for professional guidance, test validation, and follow-up care. Many at-home diagnostic products are recommended or distributed through veterinary practices, ensuring proper usage and interpretation of results. For example, clinics often provide or endorse heartworm antigen test kits, fecal parasite screens, and blood glucose monitors for home use in chronic disease management. Additionally, veterinarians guide pet owners in collecting samples correctly and deciding when home testing is appropriate versus in-clinic diagnostics are necessary. Integrating at-home testing into professional care pathways reinforces veterinary clinics' strong position in the market.

Regional Insights

North America pet at-home diagnostic tests marketheld the largest market share, 36.25%, in 2024. This is owing to high pet ownership rates, advanced veterinary infrastructure, and significant investments in diagnostic technologies. The region's well-established healthcare systems and the presence of key market players have facilitated the adoption of innovative diagnostic solutions. Additionally, the increasing humanization of pets has increased the demand for comprehensive and preventive healthcare services. These factors collectively contribute to North America's dominant position in the global pet at-home diagnostic tests market.

U.S. Pet At-home Diagnostic Tests Market Trends

The U.S. pet at-home diagnostic tests market is growing rapidly due to high pet ownership and increasing demand for early disease detection and preventive care. Advanced technologies, including molecular and DNA-based tests, enhance diagnostic accuracy and convenience for pet owners. Growing awareness of pet health and the rise of telemedicine further support market growth, with key players offering a broad range of easy-to-use home testing kits for conditions such as allergies, parasitic infections, and genetic disorders.

Europe Pet At-home Diagnostic Tests Market Trends

Europe pet at-home diagnostic tests market is witnessing robust growth, driven by increased integration of telemedicine and AI-powered result interpretation. Regulatory support in countries like France and Germany enables at-home test results to inform remote veterinary consultations. Subscription-based health monitoring models, especially popular in Nordic countries, focus on chronic disease management and preventive care, with monthly fees ranging from €25-60 (USD 28.28-67.87) and annual growth rates of 40-45%. Genetic testing has expanded to include breed-specific health panels and hereditary disease screening, particularly in Germany, France, and the UK, supporting responsible breeding and early disease prevention. This ecosystem approach enhances pet health management through continuous monitoring and personalized diagnostics.

Pet at-home diagnostic tests marketinGermany is anticipated to grow constantly due to increasing pet ownership and awareness of preventive healthcare. These kits allow pet owners to monitor conditions such as diabetes, urinary tract infections, and parasites from home. Demand is boosted by convenience, cost-effectiveness, and a growing focus on early disease detection. Companies are innovating with smartphone-compatible and mail-in lab testing options. The market is supported by Germany's strong veterinary infrastructure and consumer trust in diagnostic technologies.

UK Pet At-home Diagnostic Tests Market Trends

The UK pet at-home diagnostic tests market is experiencing significant growth during the forecast period due to rising veterinary costs, growing pet ownership, and the adoption of digital health solutions. Pet owners increasingly turn to affordable home-use kits such as urine tests, glucose monitors, parasite detection, and genetic testing for early detection and routine health monitoring. Average veterinary consultation fees have increased significantly, with routine visits costing £40-80 (USD 53.81-107.62) and diagnostic procedures ranging from £100-500 (USD 134.52-672.60). This cost pressure has driven demand for affordable at-home alternatives for routine monitoring and early detection.

Asia Pacific Pet At-home Diagnostic Tests Market Trends

The Asia Pacific pet at-home diagnostic tests market is driven by increasing pet ownership, rising disposable incomes, and heightened awareness of pet health. Countries like China, India, and South Korea are witnessing significant adoption of at-home diagnostic kits facilitated by the expansion of e-commerce platforms and advancements in molecular diagnostics. The increasing humanization of pets and the demand for preventive care further contribute to the market's expansion in the region.

Pet at-home diagnostic tests market in India is witnessing notable growth, driven by a surge in pet ownership and increasing awareness about preventive healthcare. Similarly, technological advancements, such as smartphone-compatible diagnostic tools and mail-in lab testing options, enhance the accessibility and accuracy of at-home pet diagnostics. As pet owners continue to prioritize preventive care and early disease detection, the demand for reliable and user-friendly at-home diagnostic kits is expected to grow, shaping the future of pet healthcare in India. Most consumers use diagnostic tests as screening tools before veterinary consultation rather than as a replacement for professional diagnosis, with positive results typically leading to immediate veterinary care.

Latin America Pet At-home Diagnostic Tests Market Trends

The Latin America pet at-home diagnostic tests market is experiencing significant growth, driven by rising urbanization, growing middle-class pet ownership, and heightened awareness of preventive care. Brazil and Mexico lead the market, accounting for a combined 65% share, supported by robust veterinary infrastructure, intense e-commerce penetration, and increasing consumer demand for affordable, accessible diagnostics. Popular products include parasite detection kits, urine strips, and infectious disease tests, reflecting the region's tropical climate and veterinary access disparities. Digital tools, telemedicine integration, and mobile payment systems are reshaping care delivery, especially in urban centers.

The pet at-home diagnostic tests market in Brazil is witnessing significant growth due to technological advancements, changing consumer behaviors, and a growing emphasis on preventive pet healthcare. The market's evolution towards more sophisticated, connected health ecosystems is poised to improve pet health outcomes while offering cost-effective healthcare solutions for pet owners. As the world's third-largest pet market by population, Brazil hosts over 54 million dogs and 23 million cats across 44.3% of Brazilian households, creating substantial demand for accessible and affordable diagnostic solutions.

Middle East & Africa Pet At-home Diagnostic Tests Market Trends

The Middle East & Africa pet at-home diagnostic tests market is witnessing significant growth, driven by rising pet ownership, urbanization, and increasing awareness of animal health. Countries like South Africa and the United Arab Emirates are leading this expansion, with increasing investments in veterinary infrastructure and services. The demand for point-of-care diagnostic solutions is rising, particularly in urban centers, as pet owners seek convenient and rapid testing options. Additionally, the growing prevalence of zoonotic diseases in the region underscores the importance of accessible and efficient diagnostic tools for early detection and management. Despite challenges such as limited access to veterinary services in rural areas, the MEA market is poised for continued growth, supported by technological advancements and a shifting cultural perspective towards pet care.

The South Africa pet at-home diagnostic tests market is witnessing significant growth driven by increasing pet ownership, a rising focus on preventive healthcare, and advancements in diagnostic technologies. Pet owners, primarily in urban middle- to high-income households, increasingly use diagnostic kits for tick-borne diseases, parasite detection, and routine health monitoring. Demand is driven by the country's unique disease environment, growing pet humanization, and the high cost of veterinary visits. Distribution is strong through veterinary clinics, agricultural co-ops, and e-commerce platforms. Despite challenges like economic inequality and currency volatility, local manufacturing and telemedicine integration offer growth opportunities.

Key Pet At-home Diagnostic Tests Company Insights

Key players in the market, such as Affordable Pet-Labs, Ring Biotechnology Co. Ltd., and Wondfo USA Co. Ltd., are expanding their product offerings to meet this growing demand. Additionally, technological advancements and the rise of e-commerce platforms have made these diagnostic tools more accessible to pet owners worldwide.

Key Pet At-home Diagnostic Tests Companies:

The following are the leading companies in the pet at-home diagnostic tests market. These companies collectively hold the largest market share and dictate industry trends.

- Affordable Pet Labs

- Ring Biotechnology Co Ltd.

- Forte Healthcare Ltd.

- Diagnostic Depot

- Wondfo USA Co. Ltd.

- Vitrosens Biotechnology

- Hangzhou Evegen Biotech Co., Ltd.

- Targetvet

- TouchBio Australia

- FLASHTEST Technology Co. Ltd

Recent Developments

-

In August 2024, Affordable Pet Labs launched innovative at-home pet diagnostic services, including in-home professional blood collection and easy DIY urine and fecal testing kits. These services aim to reduce stress and improve accessibility for pet owners, enabling proactive health monitoring.

-

In July 2024, Researchers from Chulalongkorn University developed an easy, fast, and accurate Cat Urine Test Kit to help pet owners screen for early signs of kidney disease, gallstones, and cystitis in cats. The kit detects hematuria (blood in urine) and offers a pain-free, home-based alternative to invasive veterinary procedures.

Pet At-home Diagnostic Tests Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.63 million

Revenue forecast in 2030

USD 110.97 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, application, sample type, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Norway; Germany; France; Italy; Spain; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Affordable Pet Labs; Ring Biotechnology Co Ltd.; Forte Healthcare Ltd.; Diagnostic Depot; Wondfo USA Co. Ltd. Vitrosens Biotechnology; Hangzhou; Evegen Biotech Co., Ltd.; Targetvet; TouchBio Australia; FLASHTEST Technology Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet At-home Diagnostic Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet at-home diagnostic tests market report based on animal type, application, sample type, distribution channel, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parasitic Diseases

-

Infectious Diseases

-

Fertility testing

-

Chronic and Metabolic Diseases

-

Genetic Conditions and Allergies

-

Other

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Urine

-

Fecal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

E-commerce

-

Retail Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet at-home diagnostic tests market size was estimated at USD 80.14 million in 2024 and is expected to reach USD 83.63 million in 2025.

b. The global pet at-home diagnostic tests market is expected to grow at a compound annual growth rate of 5.82% from 2025 to 2030 to reach USD 110.97 million by 2030.

b. North America dominated the pet at-home diagnostic tests market with a share of 36.25% in 2024. This is attributable to high pet ownership rates, advanced veterinary infrastructure, and significant investments in diagnostic technologies. The region's well-established healthcare systems and the presence of key market players have facilitated the adoption of innovative diagnostic solutions. Additionally, the increasing humanization of pets has increased the demand for comprehensive and preventive healthcare services. These factors collectively contribute to North America's dominant position in the global pet at-home diagnostic tests market.

b. Some key players operating in the pet at-home diagnostic tests market include Affordable Pet Labs, Ring Biotechnology Co Ltd., Forte Healthcare Ltd., Diagnostic Depot, Wondfo USA Co. Ltd. Vitrosens Biotechnology, Hangzhou, Evegen Biotech Co., Ltd., Targetvet, TouchBio Australia, FLASHTEST Technology Co. Ltd

b. Key factors that are driving the market growth include increasing pet ownership, growing pet humanization trends, and rising awareness of preventive healthcare among pet owners. Convenience and accessibility of at-home testing kits, such as those for urinary tract infections, allergies, and diabetes monitoring, enable timely health management without frequent vet visits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.