- Home

- »

- Pharmaceuticals

- »

-

Pharmaceutical Cartridges Market Size & Share Report, 2030GVR Report cover

![Pharmaceutical Cartridges Market Size, Share & Trends Report]()

Pharmaceutical Cartridges Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Glass Cartridges, Plastic Cartridges, Rubber), By Application, By Chamber Type, By Size, By Therapeutic Area, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-607-3

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Cartridges Market Trends

The global pharmaceutical cartridges market size was valued at USD 1.41 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.07% from 2024 to 2030. The market is driven by numerous factors such as growing demand for drug delivery devices, rising prevalence of chronic conditions, such as diabetes & arthritis, and novel product launches. For instance, as per the reports published by WHO in 2023, globally, approximately 422 million individuals are contending with diabetes, with a predominant concentration in low- and middle-income nations. Annually, diabetes is directly associated with 1.5 million fatalities. As the worldwide incidence of diabetes escalates, there is a concurrent surge in the requirement for pharmaceutical products, specifically insulin and other medications for diabetes management. The pivotal role played by pharmaceutical cartridges in the packaging and dispensing of these medications underscores their significance. The market dynamics of these cartridges are intricately linked to the expanding diabetic demographic, enhancing the landscape for these essential components.

Pharmaceutical cartridge market is anticipated to experience substantial expansion, driven by a rising need for advanced drug delivery devices. Devices such as injectors, pens, and inhalers are gaining popularity among patients and healthcare practitioners due to their user-friendly design and efficacy in improving medication adherence. A significant portion of these drug delivery devices depend on prefilled cartridges to ensure the secure and accurate administration of medications. For instance, when a patient employs an autoinjector to administer a critical medication like epinephrine, a prefilled cartridge containing the necessary drug is commonly employed. As the demand for these drug delivery devices grows, the demand for compatible pharmaceutical cartridges will also increase. Pharmaceutical companies need to design and manufacture cartridges that are compatible with various drug delivery devices to ensure the safe and effective delivery of medications.

In addition, Indian pharmaceutical businesses that focus on research are constantly making investments in the creation and dissemination of new medication delivery technologies. This has prompted frequent mergers and successful collaborations between major drug companies. Needle-free devices and other transdermal technologies have created new opportunities for pharmaceutical partners looking to develop delivery methods for existing compounds lacking effective ones. Over the forecast period, these factors are expected to drive the market for medication delivery systems, which will support the insulin and dental cartridges industry in India.

A new product often brings innovation and advanced technology to the industry. This can include improvements in drug delivery systems, materials, or design. In the pharmaceutical cartridges industry, innovations such as improved drug stability, enhanced safety features, or more precise dosing mechanisms can attract attention and drive market growth.

For instance, in January 2023, West Pharmaceutical Services, Inc. disclosed its involvement in Pharmapack Europe 2023, held in France. The company aimed to demonstrate its authoritative position and proficiency in addressing prevailing challenges and trends within the packaging and containment sector. As part of its commitment to advancing solutions for its global client and enhancing patient experiences, the company introduced three novel products. These included 2.25mL Insert Needle Syringe System namely Daikyo Crystal Zenith, West Ready Pack featuring Corning Valor RTU Vials leveraging Stevanato Group's EZ-fill SG EZ-fill technology, and the FluroTec (5-10mL Cartridge Plunger). The initiation of a novel product launch possessed the potential to unlock fresh segments or broaden the scope of the prevailing industry landscape. Moreover, the development of a pharmaceutical cartridge tailored for a particular therapeutic domain or patient demographic has the capacity to generate opportunities within that specialized market niche propelling the industry growth in the near future.

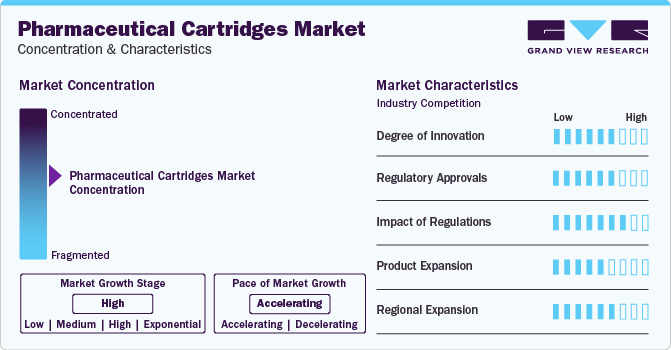

Market Concentration & Characteristics

The industry growth stage is high, and pace of the industry growth is accelerating. The industry is characterized by a high degree of growth owing to advancements in drug delivery system, increasing demand for injectable drugs and increasing prevalence of chronic conditions, such as diabetes & arthritis.

Key strategies implemented by players in the pharmaceutical cartridges market are new product launches, expansion, acquisitions, partnerships, and other strategies. In May 2022, SCHOTT Pharma has disclosed a substantial financial commitment in the double-digit million Euros range for the expansion of its ready-to-use cartridge production. This strategic investment aimed to augment the production capabilities dedicated to ready-to-use cartridges within Switzerland. Proprietary drug delivery solution, tailored for the administration of pharmaceuticals like insulin, growth hormones, and sizable quantities of delicate biologics, is intended for use in both hospital and home care environments.

Continuous evolution of drug delivery technologies, including the preference for self-administration and pre-filled syringes, has spurred innovation in pharmaceutical cartridges. Cartridges are integral components of modern drug delivery systems, and innovations in these systems contribute to enhanced patient compliance and convenience.

Regulatory approvals play a pivotal role in shaping its landscape. Regulatory bodies, such as the U.S. FDA and EMA in Europe, set stringent standards for pharmaceutical packaging to ensure the safety, efficacy, and quality of drugs. The market is highly regulated, and adherence to these standards is imperative for pharmaceutical cartridge manufacturers.

Regulations play a pivotal role in shaping the pharmaceutical cartridges market. Stringent regulatory standards, imposed by health authorities like the FDA and EMA, ensure the safety, quality, and efficacy of pharmaceutical products. Compliance with these regulations is a significant factor influencing market dynamics. Pharmaceutical cartridge manufacturers must navigate complex and evolving regulatory landscapes, meeting rigorous standards for materials, manufacturing processes, and labeling.

Companies in different regions often engage in product expansion to meet the growing demand for advanced, user-friendly, and technologically advanced pharmaceutical cartridges propelling the market growth.

Various companies, including startups and established players, compete to introduce cutting-edge technologies, such as advanced materials and smart packaging features, to gain a competitive edge. The global pharmaceutical industry operates across diverse markets and regions, each with unique regulatory requirements and preferences. Local and regional players often emerge to address specific industry needs, contributing to the overall fragmentation as companies tailor their offerings to regional demands.

The industry is driven by a robust healthcare infrastructure, high adoption of advanced drug delivery technologies, and a significant focus on biologics and specialty drugs particularly in the U.S. Stringent regulatory standards set by the FDA influence market trends, pushing manufacturers to innovate and comply with the latest quality and safety requirements. The region's emphasis on patient-centric drug delivery solutions and a mature pharmaceutical industry fosters consistent growth in the market.

Material Type Insights

Glass cartridges segment dominated the market in 2023. The utilization of glass in pharmaceutical packaging, such as cartridges, is common and their production is consistently increasing. Companies are undertaking strategic initiatives to expand their share in pharmaceutical glass cartridges. For instance, Stevanato Group holds a significant position in the market for cartridge manufacturing with its Ompi brand. Additionally, in March 2023, Stevanato Group announced its partnership with Thermo Fisher Scientific, Inc. to introduce a comprehensive on-body delivery system platform for subcutaneous administration. In addition to the platform, Stevanato Group is expected to provide EZ-fill cartridges and assembly equipment. This partnership can enable pharmaceutical companies to take advantage of a cartridge-based on-body delivery system that includes a preloaded and prefilled drug container compatible with standard fill-finish techniques. This platform technology can significantly reduce time-to-market and optimize the supply chain.

Plastic cartridges segment is expected to register the fastest CAGR of 8.93% during the forecast period. Plastic possesses favorable characteristics such as low weight, malleability, and cost-effectiveness in comparison to metal and glass. Consequently, end-use enterprises exhibit a preference for packaging solutions based on plastic. The escalating need for pharmaceutical products packaged for convenience reduced weight, and portability within the pharmaceutical industry is anticipated to significantly contribute to the expansion of the plastic material segment in the foreseeable future.

Application Insights

Pen injectors segment dominated the market in 2023. A pen injector cartridge is a type of medical device that is used to deliver medication through a pen-like device. It consists of a cartridge that contains the medication and a delivery system that allows the medication to be injected into the body. The companies are focused on developing and manufacturing pen injector cartridges that are safe, effective, and easy to use, to meet the needs of patients and healthcare providers. They work closely with pharmaceutical companies to develop customized solutions for specific medications, ensuring that the cartridges are compatible with the drug and can be easily administered. For instance, in February 2023, Phillips-Medisize-a subsidiary of Molex and involved in the design & production of MedTech devices, diagnostic tools, & drug delivery devices-announced the expansion of its product line with the launch of a disposable pen injector.

According to the company, pen injector is specifically designed for high-volume manufacturing, making it an attractive option for pharmaceutical companies looking for a competitive and familiar product to assist them to enter the market more quickly, efficiently, and cost-effectively. In addition, the company anticipates that the pen injector will assist in expanding its platform and product portfolio and allow biopharmaceutical companies to increase the rollout of novel & generic drug treatments at significant economies of scale. Such initiatives drive the segment growth in the near future.

Wearable injectors segment is expected to register the fastest CAGR of 9.33% during the forecast period. This is attributed to the increasing prevalence of homecare settings and advancements in drug delivery technologies. Industry stakeholders are strategically implementing various competitive measures to strengthen their industry presence in this segment. A notable example is the strategic initiative undertaken by SCHOTT Pharma in June 2022, where the company announced its plans to expand its manufacturing facilities in Hungary and China. As a major provider of injection devices, with a focus on wearable injectors, SCHOTT Pharma aimed to enhance its cartridge production capabilities to bolster its industry position. Such initiatives propel industry growth.

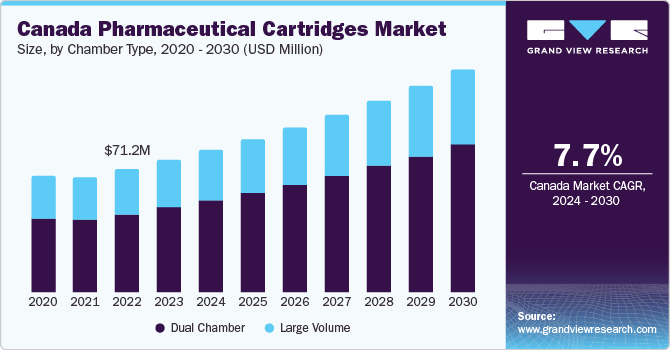

Chamber Type Insights

Dual chamber segment dominated the market in 2023. Dual chamber cartridges are frequently employed for the reconstitution of pharmaceuticals, particularly for substances like certain vaccines, biologics, and hormone therapies. The prevalence of delicate drug formulations has witnessed a steady increase in recent years and is anticipated to continue expanding, presenting noteworthy hurdles in terms of shelf-life stability. The individual reconstitution of lyophilized compounds may compromise both dosage precision and operational efficiency. Nevertheless, the utilization of dual chamber cartridges emerges as a proficient remedy to address these challenges. By segregating the two substances through the incorporation of a plunger, these cartridges enable the reconstitution of the components immediately prior to administration, thus enhancing both accuracy and handling efficiency.

The segment is further expected to register the fastest CAGR of 8.61% during the forecast period. Employing dual chamber cartridges offers numerous advantages in the pharmaceutical administration domain. These advantages include compatibility with diverse injection devices, accelerated time-to-market, more efficient administration with fewer preparatory steps compared to traditional vial/syringe combinations, increased efficiency, and convenience in administering lyophilized drugs, elevated patient safety through a reduced risk of contamination, enhanced dose accuracy, and a decrease in reconstitution errors. Furthermore, these cartridges provide a high level of flexibility, making them suitable for both single and multidose pen applications. These factors propel the segment growth in near future.

Size Insights

3ml segment dominated the market in 2023. 3 mL cartridges are commonly used for drugs that require a larger volume of medication to be delivered to the patient, such as certain hormone therapies, anticoagulants, and other biologics. One of the primary advantages of 3 mL cartridges is that they can reduce the number of injections required to administer a given dose of medication, which can be particularly beneficial for patients who require frequent injections. The 3 mL cartridge kit from Pii supports a variety of therapies that call for frequent injections and variable doses, which increases patient compliance.

The segment is further expected to register the fastest CAGR of 9.26% during the forecast period. 3ml size might be preferred for certain drug delivery applications due to factors such as dosage requirements, patient convenience, or specific therapeutic needs. Additionally, pharmaceutical formulations often require flexibility in dosing, and a 3ml cartridge provides a good balance between accommodating a range of dosages while still maintaining a manageable size for ease of use.

Therapeutic Area Insights

Diabetes segment dominated the market in 2023. Within the domain of diabetes management, pharmaceutical cartridges assume a crucial role in the administration of insulin through specialized mechanisms such as insulin pens and pumps. As a result, the evolution of these delivery devices is anticipated to have a significant impact on the pharmaceutical cartridges market. This holds particular significance since both insulin pens and pumps depend on prefilled cartridges for the controlled dispensation of insulin to individuals overseeing diabetes.

The segment is further expected to register the fastest CAGR of 9.69% during the forecast period. Key companies are involved in acquisitions and mergers to enhance their diabetes management product portfolio. For instance, in January 2023, Tandem Diabetes Care, Inc. successfully concluded the acquisition of AMF Medical SA, marking a strategic move in bolstering its diabetes management product offerings. Notably, the acquisition included AMF Medical's innovative Sigi Patch Pump, a rechargeable patch pump meticulously engineered to alleviate complexities associated with diabetes management for patients. The Sigi Patch Pump operates by utilizing prefilled insulin cartridges for insulin delivery and is presently in the developmental stage, lacking present commercial availability. Tandem Diabetes Care, Inc. envisions leveraging this acquisition to enhance and diversify its suite of diabetes management solutions. Such initiatives drive segment growth.

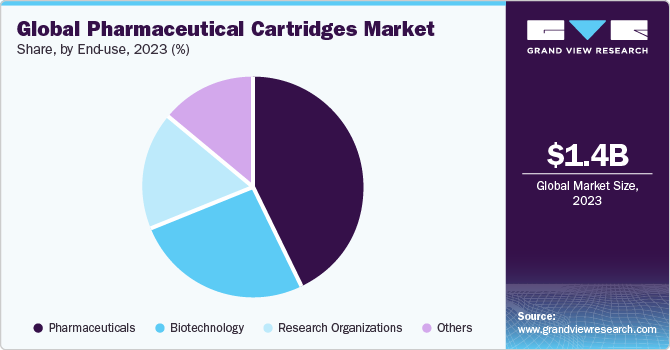

End-Use Insights

Pharmaceuticals segment led the market in 2023. Pharmaceutical enterprises can strategically employ cartridges to enhance their manufacturing and packaging processes, as illustrated by the utilization of prefilled cartridges engineered to accommodate precise drug volumes. This methodology reduces the need for manual filling, thereby lowering the risk of errors. Furthermore, the integration of cartridges into automated filling and packaging systems elevates operational efficiency and cost-effectiveness. Pharmaceutical cartridges offer a reliable and streamlined approach for storing and delivering drugs while simultaneously adhering to stringent standards for patient safety and product quality. With the increasing demand for injectable drugs, the continual ascent of pharmaceutical cartridge adoption is anticipated within the pharmaceutical sector.

Others segment is further expected to register the fastest CAGR of 9.61% during the forecast period. Other end-users segment includes life sciences companies, academic institutes, and drug product/ fill & finish contract manufacturers. Academic institutes, such as universities, use cartridges to store and deliver various types of drugs, including experimental formulations & clinical trial samples. Academic institutes may use cartridges made of glass or plastic, depending on the specific needs of their research. Overall, while the market for pharmaceutical cartridges is primarily driven by the needs of the pharmaceutical industry, academic institutes may be an important customer segment for manufacturers. As R&D efforts in the pharmaceutical and biotech industries continue to expand, the demand for cartridges by academic institutes is likely to continue growing, driving the growth in near future.

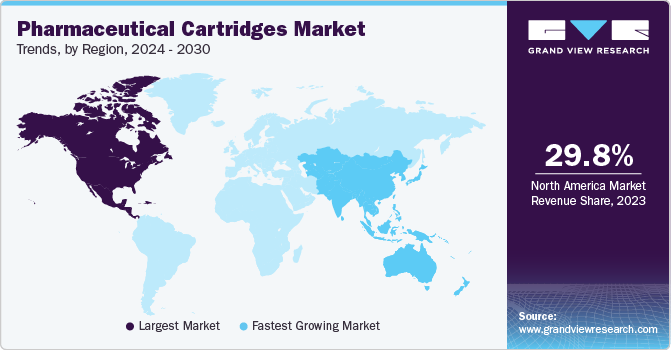

Regional Insights

North America accounted for 29.81% of the global market in 2023 and is expected to continue its dominance over the forecast period. There are several factors that contribute to this growth, including increasing demand for advanced drug delivery systems, increasing focus on patient safety and convenience, and a growing number of chronic diseases. Pharmaceutical companies are constantly looking for ways to improve the efficacy and safety of their products, and drug delivery systems play a key role in achieving these goals. Cartridges are the most effective medication delivery devices as they provide precise & accurate dosing, simple handling & storage, and little contamination risk. The expansion of the pharmaceutical cartridge market in North America is also being fueled by surge in demand for self-administered injectable medications and the development of new biologic drugs with complicated formulation needs.

U.S. Pharmaceutical Cartridges Market Trends

The pharmaceutical cartridges market in the U.S. is expected to grow over the forecast period due to demand for pharmaceutical cartridges is being driven by the rising prevalence of chronic diseases like diabetes, cancer, and autoimmune disorders, as well as the aging population.

Europe Pharmaceutical Cartridges Market Trends

Europe pharmaceutical cartridges market is a significant and growing market in the pharmaceutical packaging industry. The demand for patient-administered medications that may be used at home is increasing as a result of the aging population and the rise in chronic diseases. The need for cartridges in the European market is being fueled by the fact that pharmaceutical cartridges offer an efficient and accurate method of delivering these medications. To create new drugs and medication delivery methods, pharmaceutical companies are actively spending on research & development. This investment promotes innovation in the market for pharmaceutical cartridges and assists in the launches of new goods.

Pharmaceutical cartridges market in the UK is expected to grow over the forecast period due to driven by the increasing demand for innovative drug delivery systems to treat chronic disorders.

France pharmaceutical cartridges market is expected to grow over the forecast period owing to increasing number of product launch in this region propelling the market growth.

The pharmaceutical cartridges in Germany is expected to grow over the forecast period. The industry key players are involved in mergers and acquisitions to expand the product portfolio propelling the industry growth in this region.

Asia Pacific Pharmaceutical Cartridges Trends

The Asia Pacific pharmaceutical cartridges market is anticipated to grow at the fastest CAGR over the forecast period. The robust growth observed in the market can be attributed to the significant presence of key companies and the rising incidence of chronic diseases. Asia Pacific is anticipated to emerge as the fastest-growing region in this market. This accelerated growth is substantiated by the proliferation of numerous small and medium-sized production units in the region. Additionally, the presence of lenient regulatory regimes in the region serves to facilitate manufacturers and fosters an environment that attracts foreign investments.

The substantial expansion of the population, aligned with consistent economic advancement, is fueling the growth of the regional market. The increasing disposable income among the middle-class demographic and the robust expansion of credit facilities stand out as key contributing factors fostering the overall growth of the industry in the region.

The pharmaceutical cartridges industry in China is expected to grow over the forecast period owing to increasing government initiatives, growing contract manufacturing activities, and growing aging population.

Japan pharmaceutical cartridges market is expected to grow over the forecast period owing to rising healthcare expenditure, which has emerged as a pivotal factor propelling the expansion of the pharmaceutical cartridges industry in Japan.

MEA Pharmaceutical Cartridges Market Trends

Pharmaceutical cartridges industry in Middle East & Africa is anticipated to grow in the coming years. The growth can be ascribed to several variables, including the increasing prevalence of chronic diseases, the rising demand for vaccinations, and the rising investments in healthcare infrastructure. The market for pharmaceutical cartridges is anticipated to experience significant expansion as a result of the rising demand for vaccinations in the area. Moreover, as many of these ailments necessitate routine pharmaceutical injections, the rising prevalence of chronic diseases, including diabetes and cancer, is also anticipated to support the market's expansion.

Saudi Arabia pharmaceutical cartridges industry is expected to grow over the forecast period due to the rising number of healthcare facilities addressing the growing requirements of an expanding and aging population propel the industry growth.

Kuwait pharmaceutical cartridges industry is expected to grow over the forecast period due to the confluence of early disease diagnosis and the escalating prevalence of chronic conditions and rising healthcare expenditure.

Key Pharmaceutical Cartridges Company Insights

Well Mark Associates, SiNi Pharma, Kapoor Glass India Pvt. Ltd., are some of the emerging players in the pharmaceutical cartridges market. The pharmaceutical cartridges market has witnessed significant trends in recent years, with notable implications for emerging players in the industry. One prominent trend is the increasing demand for pre-filled syringes and cartridges due to their advantages in drug delivery, convenience, and patient compliance. This shift is driven by the growing preference for self-administration of medications and the rise of biologics and biosimilars.

Adoption of advanced materials and technologies in manufacturing pharmaceutical cartridges has become another noteworthy trend. Innovations such as the use of high-quality polymers, enhanced barrier properties, and improved drug compatibility have contributed to the development of more sophisticated and reliable cartridge systems. This trend not only ensures the safety and efficacy of drug delivery but also opens avenues for differentiation among industry players.

The rise of personalized medicine and the growing biopharmaceutical sector are additional factors shaping the pharmaceutical cartridges market. As the industry evolves to meet the demands of individualized therapies and complex biologics, cartridge systems play a pivotal role in ensuring accurate dosing and precise drug delivery. This trend creates opportunities for both established and emerging players to collaborate with pharmaceutical companies in developing customized cartridge solutions.

Key Pharmaceutical Cartridges Companies:

The following are the leading companies that collectively hold the largest market share and dictate industry trends.

- Stevanato Group

- NIPRO

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Schott AG

- Transcoject GmbH

- Shandong Medicinal Glass Co., Ltd.

- Dätwyler Holding Inc.

- AptarGroup, Inc.

- Sonata Rubber

Recent Developments

-

In August 2023, Alcresta Therapeutics, Inc. recently reported that the U.S. FDA granted clearance for the expanded use of RELiZORB among children aged 2 to <5 years. RELiZORB is a digestive enzyme cartridge that emulates the functioning of pancreatic lipase. It was initially cleared by the FDA in 2015 for use in adult patients and was later granted clearance in 2017 for children as young as five years old. It is essential to note that RELiZORB is the sole enzyme product authorized by the FDA for use in conjunction with enteral feeding.

-

In June 2023, Stevanato Group S.p.A. recently announced the launch of Vertiva, the latest iteration of its patented On-Body Delivery System (OBDS). Designed to cater to a diverse range of subcutaneous therapies, this OBDS can seamlessly switch between basal and bolus injections.

-

In February 2023, Flyte launched a vaporizer cartridge with a 2-gram capacity. The Flyte CBG 2-gram cartridge works and pairs with the majority of reliable pen-style batteries, unlike other cartridges that weigh more than 1 gram.

-

In September 2022, Gerresheimer AG and Stevanato Group announced a collaboration for the development of an innovative Ready-To-Use vial platform for the pharmaceutical industry. The partnership aimed to develop and market innovative drug delivery solutions, including prefilled syringes & cartridges, for the pharmaceutical market in Europe.

-

In May 2022, SCOTT AG announced the introduction of revolutionary glass biologics cartridges in Canada. These cartridges are made to be used with prefilled biologic syringes to provide a whole drug delivery system.

Pharmaceutical Cartridges Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.52 billion

Revenue forecast in 2030

USD 2.43 billion

Growth rate

CAGR of 8.07% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Material type, application, chamber type, size, therapeutic area, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stevanato Group; NIPRO; Gerresheimer AG; West Pharmaceutical Services, Inc.; Schott AG; Transcoject GmbH; Shandong Medicinal Glass Co., Ltd.; Dätwyler Holding Inc.; AptarGroup, Inc.; Sonata Rubber

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Cartridges Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical cartridges market report based on material type, application, chamber type, size, therapeutic area, end-use, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Cartridges

-

Type 1

-

Type 2

-

Type 3

-

-

Plastic Cartridges

-

Polypropylene (PP)

-

Cyclic Olefin Copolymer (COC)

-

Cyclic Olefin Polymer (COP)

-

Polyethylene

-

-

Rubber

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Anesthesia

-

Pen Injectors

-

Autoinjectors

-

Wearable Injectors

-

-

Chamber Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dual Chamber

-

Large Volume

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

0.5 ml

-

1.8 ml

-

2ml to 2.5 ml

-

3 ml

-

5 ml

-

More than 10 ml

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Respiratory

-

Neurology

-

Oncology

-

Immunology

-

Cardiology

-

Diabetes

-

Dental

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Biotechnology

-

Research Organizations

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical cartridges market size was estimated at USD 1.41 billion in 2023 and is expected to reach USD 1.52 billion in 2024.

b. The global pharmaceutical cartridges market is expected to grow at a compound annual growth rate of 8.07% from 2024 to 2030 to reach USD 2.43 billion by 2030.

b. North America dominated the pharmaceutical cartridges market with a share of 29.81% in 2023. This is attributable to rising healthcare awareness coupled with the rising prevalence of chronic conditions.

b. Some key players operating in the pharmaceutical cartridges market include Gerresheimer AG; SCHOTT AG; West Pharmaceutical Services, Inc.; Merck KGaA; Stevanto Group; Transcoject GmbH; and Baxter International, Inc.

b. Key factors that are driving the market growth include the rising prevalence of chronic conditions, such as diabetes and arthritis, and various advantages offered by pharmaceutical cartridges over the traditional ones.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.