- Home

- »

- Automotive & Transportation

- »

-

Pharmaceutical Logistics Market Size, Industry Report, 2033GVR Report cover

![Pharmaceutical Logistics Market Size, Share & Trends Report]()

Pharmaceutical Logistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Cold Chain Logistics, Non-cold Chain Logistics), By Component (Storage (Warehouse, Refrigerator Containers), Transportation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-829-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Logistics Market Summary

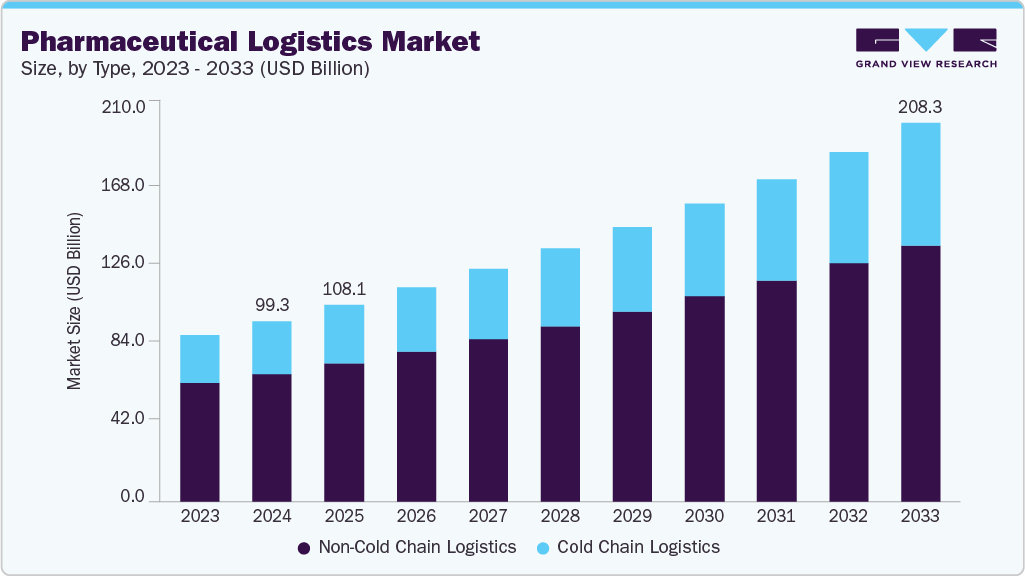

The global pharmaceutical logistics market size was estimated at USD 99.33 billion in 2024 and is projected to reach USD 208.26 billion in 2033, growing at a CAGR of 8.5% from 2025 to 2033. The pharmaceutical logistics market is driven by the growing demand for temperature-sensitive drugs and biologics, rising global pharmaceutical trade, and the expansion of e-commerce in healthcare.

Key Market Trends & Insights

- Europe dominated the pharmaceutical logistics industry with the largest revenue share of 36.81% in 2024.

- The UK pharmaceutical logistics market accounted for a significant revenue share in the European market.

- By type, the non-cold chain logistics segment held the largest revenue share of 70.84% in 2024.

- By component, the storage segment held the largest revenue share of 66.75% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 99.33 Billion

- 2033 Projected Market Size: USD 208.26 Billion

- CAGR (2025-2033): 8.5%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in cold chain logistics, stringent regulatory requirements for drug safety, and increasing adoption of track-and-trace technologies further propel market growth. Additionally, the rising prevalence of chronic diseases and the need for timely and secure delivery of medications, including vaccines and specialty drugs, are contributing to the increased reliance on specialized logistics services in the pharmaceutical sector. With the approval of the aforementioned vaccines for usage, key vaccine producers are actively looking to distribute these vaccines around the globe. It would need a resilient supply chain to make vaccines available across the globe for urgent usage. Therefore, it is estimated to drive the growth of the market at a significant pace during the forecast period.

Along with this, the demand for medicines used for curing the novel coronavirus disease is also expected to boost the market growth. The growth of the market is also attributed to the increasing demand for Over-the-Counter (OTC) medicines such as Vitamins, Minerals, and Supplements (VMS), common cough and cold drugs, gastrointestinal drugs, and dermatology products. The rising importance of fast-track assistance in the healthcare sector is also driving the market for pharmaceutical logistics. Moreover, decreasing the distribution cost by creating a single source distribution channel further increases the demand for pharmaceutical logistics.

Many companies are entering into mergers and acquisitions to expand their geographical presence and proprietary knowledge. They are also focusing on reducing the overall packaging costs of their products. The biocomponent and pharmaceutical supply chains are particularly prone to the risks associated with product adulteration during transport as well as non-compliance with federal regulations, standards, and guidelines. As a result, the players are actively investing in state-of-the-art technologies such as telematics and remote monitoring to provide safety and convenience during transportation operations, which is, in turn, propelling the market growth.

Pharmaceutical manufacturing companies are increasingly outsourcing labeling and packaging activities to third-party providers. Many pharmaceutical companies are expanding their operations in untapped regions, including Latin America and Sub-Saharan Africa. The preference for local logistics providers with high expertise in pharmaceuticals is of great importance to drug manufacturers. However, deteriorating service levels and loss of control are significant threats that are faced in outsourcing operations.

The demand for pharmaceutical logistics is growing in the U.S. due to increasing sales of generic drugs, as well as reforms in the healthcare sector favoring generics. The market for pharmaceutical logistics in North America is significantly fragmented, owing to several regional and international companies. The industry is highly competitive due to the presence of many local and global companies.

Major companies strive to offer cloud-based supply chain solutions and secure supply chain functions, as it helps manufacturers ensure the authenticity of the drugs. These solutions prevent the production of counterfeit drugs and medical devices. The increasing demand for sea and air freight pharmaceutical logistics is anticipated to propel industry growth during the forecast period. The transportation of pharma products by sea reduces the transportation cost by up to 80.0% and decreases the staffing requirements.

In addition, these advancements help optimize packaging and storage requirements while minimizing the carbon footprint of logistics operations. The growing reliance on air freight logistics for the long-distance and intercontinental transport of high-value medicines and vaccines is also anticipated to further drive market growth.

Type Insights

The non-cold chain logistics segment dominated the market with a revenue share of over 70.00% in 2024. This dominance can be attributed to the widespread distribution and higher volume of pharmaceutical products that do not require temperature-sensitive handling, such as over-the-counter (OTC) medications, medical consumables, general prescription drugs, and surgical supplies. Unlike cold chain products that require specialized storage, temperature monitoring, and refrigeration equipment, non-cold chain logistics involve less stringent regulatory requirements and lower operational costs, making it a preferred option for a large portion of the pharmaceutical supply chain.

The cold chain logistics segment is anticipated to register the highest growth rate of 9.8% over the forecast period. This growth is driven by the increasing demand for temperature-sensitive pharmaceutical products, including vaccines, biologics, insulin, and oncology drugs, which require stringent temperature control throughout the supply chain to maintain efficacy and regulatory compliance. The expansion of biologics manufacturing, rising adoption of cell and gene therapies, and ongoing global immunization initiatives have further intensified the need for advanced cold storage and transportation solutions.

Component Insights

The storage segment dominated the market with a revenue share of 66.75% in 2024. This dominance is primarily due to the critical role that warehousing and storage facilities play in maintaining the integrity, security, and inventory control of pharmaceutical products. With the growing complexity of drug formulations, particularly temperature-sensitive biologics and vaccines, pharmaceutical companies are increasingly investing in compliant storage infrastructure that supports both cold and ambient conditions. Additionally, the rise in demand for just-in-time (JIT) inventory practices and the growing need for specialized storage capabilities such as controlled humidity, narcotics storage, and segregation for hazardous materials have further contributed to the segment’s leading position.

The transportation segment is expected to register the highest growth rate of 8.9% over the forecast period, driven by the increasing global distribution of pharmaceutical products, expansion of cross-border trade, and rising demand for time-sensitive deliveries. The growing prevalence of biologics and temperature-sensitive drugs, such as vaccines, insulin, and oncology treatments, has significantly increased the need for reliable and compliant transportation solutions, particularly those that support cold chain integrity.

Regional Insights

Europe pharmaceutical logistics market accounted for a revenue share of over 36.81% in 2024 and is estimated to expand at a significant growth rate from 2025 to 2033. The high market share is due to the substantial growth in pharmaceutical product trades across key European countries. These countries mainly include Germany, the UK, France, the Nordics, and others. Additionally, growing production and demand for several categories of pharma products, such as OTC medicines, in the domestic region have further helped the market to gain a huge market share.

The UK pharmaceutical logistics market accounted for a significant revenue share in the European market. Manufacturers' approach towards addressing the complex multilayer networks and material movement problems that not only affect inventory levels but also increase overall supply chain costs. These factors are expected to support the growth of the market.

The pharmaceutical logistics market in France accounted for a notable revenue share in the Europeon market. The growth is attributed to pharma manufacturers' approach towards the adoption of transportation services that provide product storage facilities at the required conditions throughout its transition.

Asia Pacific Pharmaceutical Logistics Market Trends

The Asia Pacific pharmaceutical logistics market is projected to be the fastest-growing region, owing to the rapid economic growth in emerging countries, such as China and India. High demand for OTC medicines among a huge population is expected to increase the market for pharmaceutical logistics in the Asia Pacific. Moreover, the pharmaceutical industry is undergoing a geographic shift in production and sales locations. The market players are finding lucrative opportunities in the developing economies in Asia and South America, which is, in turn, expected to boost the market growth in these regions.

The pharmaceutical logistics market in China accounted for a major revenue share of the Asia Pacific market. Companies have fearlessly embarked on a growth trajectory, aspiring to become a hub for low-cost manufacturing and R&D, and yet they are also facing a unique set of local and global challenges that are creating significant pressure to tighten the end-to-end operations

India pharmaceutical logistics market accounted for a revenue share of 18.4% in the Asia Pacific market. Indian pharmaceutical manufacturing companies are focused on integrating enterprise software and automating the supply chain process in order to enhance the logistic aspects.

North America Pharmaceutical Logistics Market Trends

The North America pharmaceutical logistics market is experiencing significant growth, primarily driven by the region's well-established pharmaceutical manufacturing base and advanced healthcare infrastructure. The U.S., being home to several leading pharmaceutical companies, contributes heavily to the demand for sophisticated logistics solutions capable of handling a wide range of products, from over-the-counter (OTC) medications to high-value biologics and specialty drugs. The region's strong focus on research and development (R&D), particularly in biologics, gene therapies, and personalized medicine, is creating a steady pipeline of temperature-sensitive and high-compliance pharmaceutical products that require specialized logistics support.

The pharmaceutical logistics market in the U.S. accounted for a revenue share of 86.8% in the North America market. Pressure to bring down the cost of drugs is an additional element, resulting in the need to reexamine the supply chain is expected to support the growth of the pharmaceutical logistics market.

Key Pharmaceutical Logistics Company Insights

To maintain their position in the market, pharma companies continuously undertake strategic initiatives, such as mergers and acquisitions. Furthermore, companies operating in the market are investing in advanced technologies such as telematics, remote sensing and monitoring systems, and the integration of GPS and GIS to enhance cargo transportation. These innovations enable safer and more efficient pharmaceutical logistics services, offering improved reliability and convenience for customers. Some prominent players in the market include Agility; CEVA Logistics; Air Canada; Deutsche Post AG; DB Schenker; LifeConEx; Marken; FedEx; United Parcel Service of America, Inc.; VersaCold Logistics Services, among others.

-

Deutsche Post AG, based in Bonn, Germany, operates globally through its DHL divisions, offering services in parcel delivery, freight forwarding, supply chain management, and express logistics. The company is active across various sectors, including healthcare and pharmaceuticals, through its DHL Life Sciences & Healthcare segment. In pharmaceutical logistics, Deutsche Post AG provides services designed to meet regulatory and temperature control requirements. These include temperature-managed warehousing and transportation, particularly for products requiring ambient, refrigerated, or frozen conditions. The company maintains a network of GDP-compliant (Good Distribution Practice) facilities and distribution routes, which support the storage and movement of pharmaceutical products, medical devices, and clinical trial materials.

-

United Parcel Service of America, Inc. (UPS), headquartered in Atlanta, Georgia, is a global logistics and package delivery company offering services across transportation, distribution, freight, and supply chain solutions. The company operates through various segments, including U.S. Domestic Package, International Package, and Supply Chain Solutions, with operations in over 220 countries and territories. Within the pharmaceutical logistics sector, UPS delivers specialized services through its UPS Healthcare division.

Key Pharmaceutical Logistics Companies:

The following are the leading companies in the pharmaceutical logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Agility

- Air Canada

- CEVA Logistics

- DB Schenker

- Deutsche Post AG

- FedEx

- LifeConEx

- Marken

- United Parcel Service of America, Inc.

- VersaCold Logistics Services

Recent Developments

-

In May 2025, SkyCell launched its pharma monitoring solution, equipped with AI-driven predictive analytics and enhanced smart hardware aimed at improving the management of temperature-sensitive pharmaceutical shipments. The system continuously tracks both temperature and location in real time, offering a complete visibility timeline that addresses the shortcomings of disposable data loggers, which typically provide insights only after delivery, too late to prevent product damage.

-

In April 2025, Deutsche Post AG, through its DHL Supply Chain division, opened a new pharmaceutical logistics facility in Jurong Pier, Singapore, as part of its expanding Life Sciences & Healthcare infrastructure in the Asia Pacific region. The new hub spans 8,200 square meters and includes both ambient storage (15-25 °C) and cold room (2-8 °C) zones, built in accordance with Good Manufacturing Practice (GMP) standards. This facility is designed to support the handling of temperature-sensitive pharmaceutical products and strengthen Singapore’s position as a logistics hub for healthcare distribution across Southeast Asia.

-

In February 2021, Agility launched an express road freight network that connects consumers and businesses across the GCC region. The new service aims to provide full truckload (FTL) and less-than-truckload (LTL) options to its customers.

-

In December 2020, Agility announced that Maersk has chosen its 5,000 SQM warehouse project in Abidjan as a storage, deconsolidation and distribution facility. It aims to meet the requirements of Maersk customers across various industries.

Pharmaceutical Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 108.09 billion

Revenue forecast in 2033

USD 208.26 billion

Growth rate

CAGR of 8.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Agility; Air Canada; CEVA Logistics; DB Schenker; Deutsche Post AG; FedEx; LifeConEx; Marken; United Parcel Service of America, Inc.; VersaCold Logistics Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Logistics Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical logistics market report based on type, component, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cold Chain Logistics

-

Non-Cold Chain Logistics

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Storage

-

Warehouse

-

Refrigerated container

-

-

Transportation

-

Sea freight Logistics

-

Airfreight Logistics

-

Overland Logistics

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical logistics market size was estimated at USD 99.33 billion in 2024 and is expected to reach USD 108.09 billion in 2025.

b. The global pharmaceutical logistics market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2033 to reach USD 208.26 billion by 2033.

b. The non-cold chain segment dominated the pharmaceutical logistics market for pharmaceutical logistics and accounted for the largest revenue share of 70.84% in 2024. The segment is expected to have a considerable share in the next seven years owing to the increasing demand for non-cold chain pharma medicines and other products.

b. The storage segment dominated the pharmaceutical logistics market and accounted for the largest revenue share of approximately 66.75% in 2024.

b. Europe accounted for the largest revenue share of more than 36.81% in 2024 in the pharmaceutical logistics market and is estimated to witness a significant growth rate from 2025 to 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.