- Home

- »

- Advanced Interior Materials

- »

-

Pharmaceutical Membrane Filtration Market Report, 2033GVR Report cover

![Pharmaceutical Membrane Filtration Market Size, Share & Trends Report]()

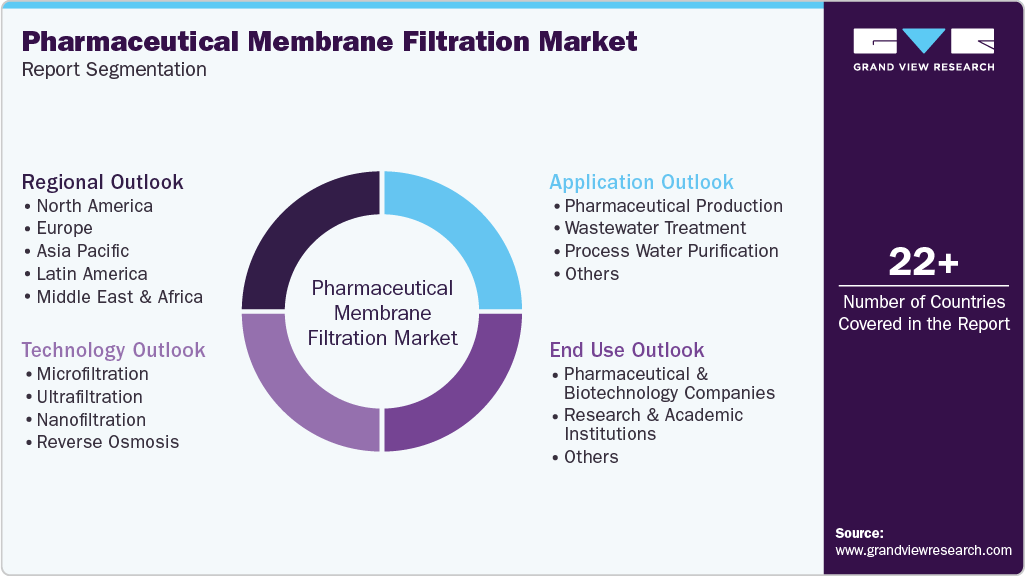

Pharmaceutical Membrane Filtration Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Microfiltration, Ultrafiltration, Nanofiltration), By Application (Pharmaceutical Production, Wastewater Treatment, Process Water Purification), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-847-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Membrane Filtration Market Summary

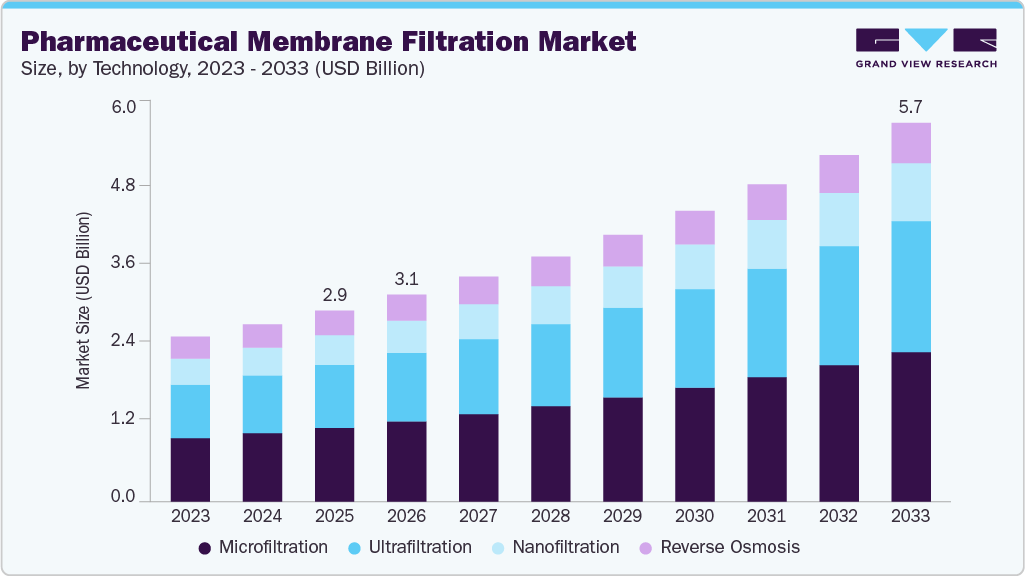

The global pharmaceutical membrane filtration market size was valued at USD 2,869.7 million in 2025 and is projected to reach USD 5,690.2 million by 2033, growing at a CAGR of 9.0% from 2026 to 2033. The industry is driven by the increasing need for safe, high-quality, and sterile pharmaceutical products.

Key Market Trends & Insights

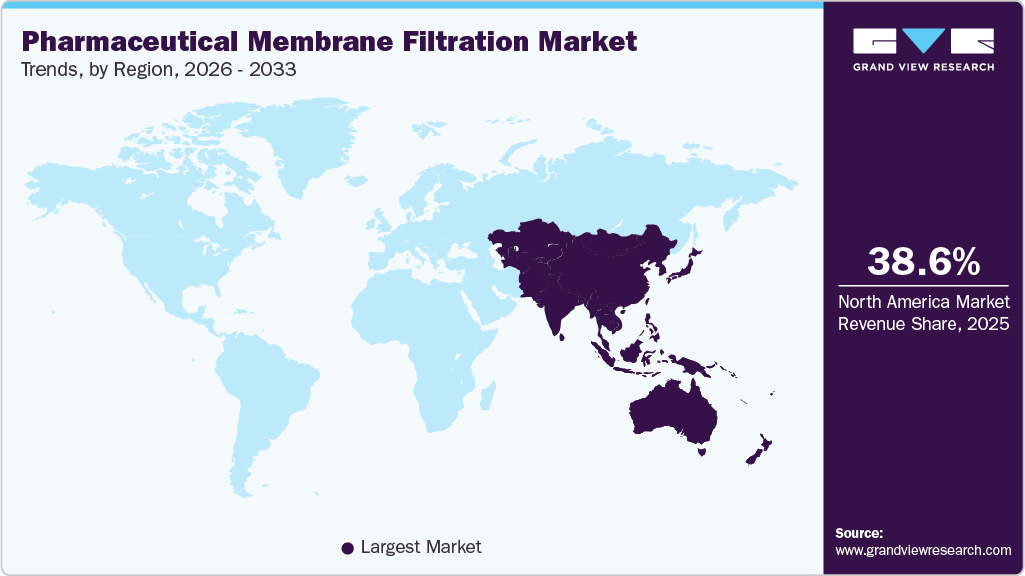

- Asia Pacific dominated the pharmaceutical membrane filtration market with the largest revenue share of 38.6% in 2025.

- By technology, the ultrafiltration segment is expected to grow at a considerable CAGR of 9.7% from 2026 to 2033 in terms of revenue.

- By application, the process water purification segment is expected to grow at a considerable CAGR of 9.1% from 2026 to 2033 in terms of revenue.

- By end use, the research & academic institutions segment is expected to grow at a considerable CAGR of 8.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 2,869.7 Million

- 2033 Projected Market Size: USD 5,690.2 Million

- CAGR (2026-2033): 9.0%

- Asia Pacific: Largest market in 2025

Growing production of biologics, vaccines, and injectable drugs is encouraging manufacturers to adopt advanced membrane filtration technologies to ensure contamination-free processing. Stricter regulatory standards for drug safety and purity are further boosting the demand for reliable filtration systems across pharmaceutical manufacturing stages.

In addition, the shift toward single-use systems and continuous manufacturing processes is enhancing operational efficiency and reducing cross-contamination risks, supporting market expansion. Technological advancements in membrane materials and filtration performance are also improving product yield and cost-effectiveness. Rising investments in pharmaceutical research and development, along with expanding production capacities in emerging economies, are expected to create new growth opportunities.

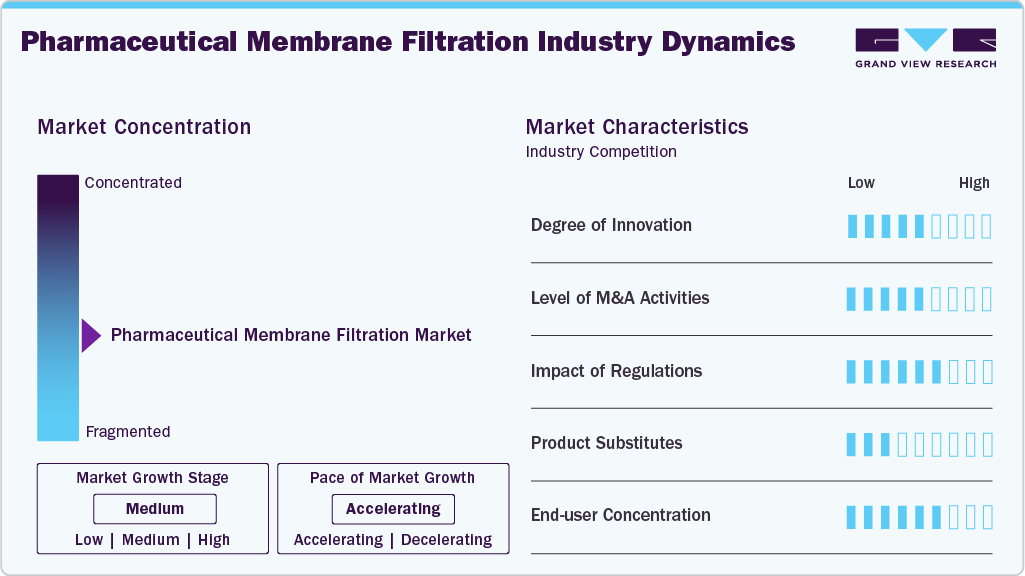

Industry Concentration & Characteristics

The pharmaceutical membrane filtration industry is moderately fragmented, with several global and regional players offering varied technologies and solutions. No single company dominates the market, as competition is spread across established multinational manufacturers and specialized niche firms. Differentiation is driven by product innovation, application focus, and service capabilities. This fragmentation allows customers choices in terms of technology and price, but also encourages strategic partnerships and acquisitions as companies seek stronger market positions and broader geographic reach.

The industry shows a strong degree of innovation, driven by demand for more efficient, high-performance filtration solutions. Companies are developing advanced membrane materials, improved pore control, and single-use systems to enhance sterility and reduce contamination risks. Innovations focus on higher throughput, longer membrane life, and integration with automated and continuous processing. These advancements help manufacturers meet stricter quality standards and lower production costs while improving overall process reliability.

Merger and acquisition activity in the industry is significant as firms seek to expand capabilities, technology portfolios, and global presence. Larger companies often acquire specialized membrane technology providers to strengthen their product offerings and enter new sub-segments. These deals help accelerate innovation, broaden customer bases, and achieve economies of scale. Such strategic consolidation is shaping competitive dynamics by combining resources and expertise, enabling faster commercialization of advanced filtration solutions.

Regulations play a key role in shaping the industry by setting strict standards for product purity, safety, and process validation. Authorities require rigorous testing and documentation to ensure that membranes effectively remove contaminants and meet quality criteria. Compliance drives investment in advanced filtration systems and encourages adoption of validated, single-use technologies. Regulatory emphasis on good manufacturing practices and sterility assurance pushes manufacturers to upgrade processes, reinforcing market demand for reliable, high-quality filtration solutions.

Drivers, Opportunities & Restraints

Growing demand for sterile and contamination-free drug products is driving the market. Increasing production of biologics, vaccines, and injectable formulations requires highly reliable filtration systems to ensure product safety and regulatory compliance. Membrane filtration plays a critical role in removing microorganisms and particulates, making it essential across manufacturing processes. This rising emphasis on quality, safety, and patient protection continues to drive market growth.

Expansion of biopharmaceutical manufacturing in emerging economies is significantly creating opportunities for the market. Growing investments in healthcare infrastructure, local drug production, and research facilities are increasing demand for advanced filtration technologies. Additionally, the adoption of single-use and continuous manufacturing systems presents opportunities for suppliers to offer innovative, cost-effective solutions. These trends allow companies to expand their presence and capture new customer segments globally.

A major challenge in the pharmaceutical membrane filtration market is the high cost of advanced filtration systems and membrane replacement. Small and mid-sized manufacturers may face budget constraints when adopting high-performance or single-use technologies. Additionally, issues such as membrane fouling, limited lifespan, and the need for frequent validation can increase operational costs and downtime. These factors may slow adoption and impact overall process efficiency in pharmaceutical manufacturing.

Technology Insights

The microfiltration segment led the market and accounted for a share of 38.6% in 2025 as manufacturers increasingly adopt this technology for critical clarification and sterilization steps. Microfiltration effectively removes particulates and microorganisms from liquids without affecting product integrity, making it essential for vaccine processing, cell culture harvests, and sterile drug production. Rising demand for biologics and injectable drugs drives the need for reliable microfiltration systems. Continuous improvements in membrane materials and pore-size control also enhance performance and reduce fouling, encouraging broader adoption and supporting segment growth throughout the forecast period.

The ultrafiltration segment is anticipated to experience significant growth due to its vital role in concentration and purification of high-value biotherapeutics. Ultrafiltration enables efficient removal of low-molecular-weight impurities while concentrating proteins, peptides, and other complex molecules, which is crucial in biologics and biosimilar production. Expansion of biopharmaceutical pipelines and scale-up of downstream processing facilities are key factors boosting demand.

Application Insights

The pharmaceutical production segment dominated the market and accounted for a share of 58% in 2025 as manufacturers prioritize product quality, sterility, and compliance. Membrane filtration is integral to multiple stages of drug production, including clarification, purification, and final sterilization of pharmaceuticals. Rising production of biologics, vaccines, and injectables drives demand for advanced filtration systems that ensure contaminant-free output and meet stringent regulatory requirements. Additionally, the shift toward continuous manufacturing and single-use technologies enhances efficiency, further supporting adoption.

The process water purification segment is projected to grow steadily due to increasing emphasis on high-quality water systems for drug manufacturing. Ultra-pure water is essential for formulation, cleaning, and ancillary processes, requiring efficient removal of dissolved solids, microbes, and endotoxins. Regulatory standards for water quality in pharmaceutical facilities remain stringent, prompting investments in membrane technologies such as reverse osmosis and microfiltration. Expansion of pharmaceutical production capacities, particularly in emerging regions, further drives demand for robust water purification solutions, supporting growth in this application segment.

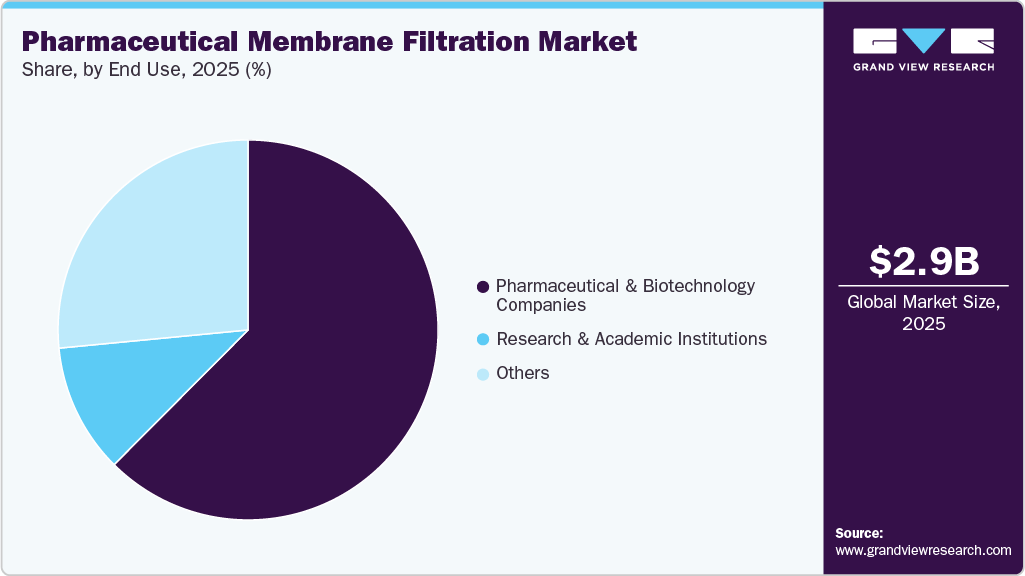

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the industry and accounted for a share of 62.4% in 2025 as these organizations scale up production of biologics, vaccines, and complex therapeutics. Strict regulatory requirements for purity and sterility drive the adoption of advanced filtration technologies across research, development, and manufacturing stages. Increasing investments in bioprocessing infrastructure and continuous manufacturing further boost demand. Additionally, partnerships with membrane technology providers accelerate innovation and implementation.

The research & academic institutions segment is projected to experience strong growth in the pharmaceutical membrane filtration market supported by rising research activities in life sciences, drug discovery, and bioprocess development. Universities and research centers increasingly require reliable filtration systems for laboratory-scale experiments, process optimization, and pilot studies. Funding increases for biotech research and collaborations with industry partners further stimulate demand. Adoption of advanced membrane technologies at the research stage accelerates translation of innovations to commercial production.

Regional Insights

North America pharmaceutical membrane filtration market is expected to grow at a 9.2% CAGR during the forecast period due to its advanced pharmaceutical and biopharmaceutical manufacturing base. The region benefits from high adoption of innovative filtration technologies, strong regulatory enforcement, and significant investments in biologics and vaccine production. The presence of major pharmaceutical companies and membrane technology providers further supports demand. Continuous manufacturing, single-use systems, and focus on product safety and quality continue to drive market expansion across the region.

The pharmaceutical membrane filtration market in the U.S. is driven by extensive biopharmaceutical research, large-scale drug manufacturing, and strong regulatory oversight. High demand for biologics, cell and gene therapies, and vaccines increases reliance on advanced filtration technologies. Ongoing investments in production capacity expansion and process optimization support market growth.

Mexico pharmaceutical membrane filtration market is supported by expanding pharmaceutical manufacturing and increasing foreign investments. The country serves as a strategic production hub for North American markets, driving demand for compliant and efficient filtration systems. Improving regulatory frameworks and rising focus on quality manufacturing practices encourage the adoption of membrane filtration.

Europe Pharmaceutical Membrane Filtration Market Trends

The pharmaceutical membrane filtration market in Europe is entering a period of strong, sustained growth due to its well-established pharmaceutical industry and strong regulatory standards. The region emphasizes high-quality drug production, biologics manufacturing, and sustainable processes, driving demand for advanced filtration technologies. Investments in research, continuous manufacturing, and single-use systems further support growth. Additionally, increasing production of biosimilars and vaccines across European countries contributes to consistent market expansion.

Germany pharmaceutical membrane filtration market is supported by its strong pharmaceutical and biotechnology sectors. The country’s focus on innovation, high manufacturing standards, and advanced bioprocessing drives adoption of sophisticated filtration solutions. Increasing production of biologics, biosimilars, and specialty drugs boosts demand. Strong research infrastructure and collaborations between industry and academia further enhance growth opportunities for membrane filtration technologies in Germany.

The pharmaceutical membrane filtration market in the UK is set for sustained growth due to robust research activities, biopharmaceutical manufacturing, and regulatory emphasis on quality and safety. Expansion of biologics and vaccine development, along with investments in advanced manufacturing technologies, supports demand for membrane filtration systems. The presence of leading research institutions and strong industry-academia collaborations accelerates innovation. Adoption of single-use filtration and continuous processing further contributes to market growth in the UK.

Asia Pacific Pharmaceutical Membrane Filtration Market Trends

The pharmaceutical membrane filtration market in Asia Pacific dominated in 2025, accounting for 38.6% market share, driven by expanding pharmaceutical manufacturing and rising healthcare demand. Increasing investments in biopharmaceutical production, cost-effective manufacturing, and supportive government initiatives boost the adoption of membrane filtration technologies. Growth in generic drugs, vaccines, and biosimilars further accelerates demand. The region’s focus on upgrading manufacturing standards and scaling production capacities supports strong long-term market growth.

China pharmaceutical membrane filtration market is growing rapidly due to expanding drug manufacturing and strong government support for biopharmaceutical development. Increasing production of biologics, vaccines, and active pharmaceutical ingredients drives demand for advanced filtration systems. Upgrading manufacturing facilities to meet global quality standards further boosts adoption. Rising investments in research, innovation, and domestic healthcare infrastructure continue to support sustained market growth in China.

The pharmaceutical membrane filtration market in India is driven by its strong generic drug manufacturing base and expanding biopharmaceutical sector. Increasing exports and compliance with international quality standards encourage the adoption of reliable filtration technologies. Growth in vaccine production, biosimilars, and contract manufacturing organizations further fuels demand. Government initiatives supporting pharmaceutical innovation and manufacturing capacity expansion contribute to continued market growth in India.

Middle East & Africa Pharmaceutical Membrane Filtration Market Trends

The pharmaceutical membrane filtration market in the Middle East & Africa is growing steadily as regional pharmaceutical manufacturing capabilities expand. Increasing investments in healthcare infrastructure, local drug production, and regulatory improvements drive the adoption of membrane filtration technologies. Rising demand for quality medicines and vaccines supports market growth. Although still emerging, the region shows strong potential as governments focus on reducing import dependence and improving pharmaceutical self-sufficiency.

Saudi Arabia pharmaceutical membrane filtration market is growing due to its focus on expanding domestic pharmaceutical manufacturing. Government initiatives to localize drug production and improve healthcare infrastructure encourage the adoption of advanced filtration systems. Increasing production of sterile drugs and injectables drives demand for reliable membrane technologies. Strategic investments and partnerships with global pharmaceutical companies further support market growth within the Kingdom.

Latin America Pharmaceutical Membrane Filtration Market Trends

The pharmaceutical membrane filtration market in Latin America is supported by expanding pharmaceutical manufacturing and improving regulatory standards. Rising demand for affordable medicines and vaccines increases the adoption of efficient filtration technologies. Investments in local production facilities and growing biopharmaceutical activities contribute to market expansion. Although challenges remain, increasing healthcare spending and industrial development continue to create growth opportunities across the region.

Brazil pharmaceutical membrane filtration market leads the region due to its large pharmaceutical industry and expanding biopharmaceutical production. Increasing demand for vaccines, biologics, and generic drugs drives the adoption of membrane filtration technologies. Government support for local manufacturing and improvements in regulatory compliance further boost market growth. Rising investments in healthcare infrastructure and research activities strengthen Brazil’s position as a key regional market.

Key Pharmaceutical Membrane Filtration Companies Insights

Key players operating in the pharmaceutical membrane filtration market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include 3M, Thermo Fisher Scientific, Donaldson Company, and Merck KGaA.

-

3M is a diversified global technology company with a strong presence in healthcare and life sciences. In pharmaceutical membrane filtration, 3M provides advanced filtration solutions that support sterile drug manufacturing and contamination control. Its focus on innovation, material science expertise, and regulatory-compliant products serves pharmaceutical and biotechnology customers worldwide.

-

Thermo Fisher Scientific is a global life sciences company offering comprehensive solutions for pharmaceutical and biopharmaceutical manufacturing. Its membrane filtration portfolio supports critical applications such as sterile filtration, purification, and bioprocessing. Strong R&D capabilities, global reach, and integrated service offerings enable efficient, compliant drug development and production.

Key Pharmaceutical Membrane Filtration Companies:

The following key companies have been profiled for this study on the pharmaceutical membrane filtration market.

- Merck KGaA

- Danaher Corporation

- Sartorius AG

- Parker Hannifin Corp

- Eaton Corporation PLC

- Thermo Fisher Scientific

- Donaldson Company

- Religen Corporation

- Porvair plc

- Alfa Laval

- Corning Inc.

- Mann+ Hummel

- Saint-gobain

- Steris

Recent Developments

-

In September 2025, Thermo Fisher Scientific completed its acquisition of Solventum’s Purification & Filtration business for approximately USD 4.0 billion in cash, integrating it into its Life Sciences Solutions segment to strengthen bioproduction and filtration offerings.

-

In March 2025, Memsift Innovations, in partnership with the Murugappa Group, commercially launched the Gosep ultrafiltration membrane and inaugurated a state-of-the-art membrane manufacturing facility. The launch highlights their focus on advanced, durable, and chemically resistant ultrafiltration solutions for water treatment, and chemical processing applications, strengthening their market presence.

Pharmaceutical Membrane Filtration Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,108.9 million

Revenue forecast in 2033

USD 5,690.2 million

Growth rate

CAGR of 9.0% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

3M; Merck KGaA; Danaher Corporation; Sartorius AG; Parker Hannifin Corp; Eaton Corporation PLC; Thermo Fisher Scientific; Donaldson Company; Religen Corporation; Porvair plc; Alfa Laval; Corning Inc.; Mann+ Hummel; Saint-gobain; Steris

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Membrane Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical membrane filtration market report based on technology, end use, application, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Microfiltration

-

Ultrafiltration

-

Nanofiltration

-

Reverse Osmosis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Production

-

Wastewater Treatment

-

Process Water Purification

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Research & Academic Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical membrane filtration market size was estimated at USD 2,869.7 million in 2025 and is expected to be USD 3,108.9 million in 2026.

b. The global pharmaceutical membrane filtration market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.0% from 2026 to 2033 to reach USD 5,690.2 million by 2033.

b. Microfiltration segment hold the dominant share in the market and accounted for a share of 38.6% in 2025. Microfiltration effectively removes particulates and microorganisms from liquids without affecting product integrity, making it essential for vaccine processing, cell culture harvests, and sterile drug production. Rising demand for biologics and injectable drugs drives the need for reliable microfiltration systems.

b. Some of the key players operating in the global pharmaceutical membrane filtration market include 3M, Merck KGaA, Danaher Corporation, Sartorius AG, Parker Hannifin Corp, Eaton Corporation PLC, Thermo Fisher Scientific, Donaldson Company, Religen Corporation, Porvair plc, Alfa Laval, Corning Inc., ArmorSource LLC, Saint-gobain.

b. Key factors driving the global pharmaceutical membrane filtration market include rising biologics and vaccine production, strict regulatory requirements for sterility and purity, increasing adoption of advanced filtration technologies, continuous manufacturing trends, and growing investments in pharmaceutical research and biopharmaceutical infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.