- Home

- »

- Medical Devices

- »

-

Pharmaceutical Third-Party Logistics Market Report, 2030GVR Report cover

![Pharmaceutical Third-Party Logistics Market Size, Share & Trends Report]()

Pharmaceutical Third-Party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Branded, Generic, Biosimilar), By Temperature (Ambient, Refrigerated), By Therapeutic Area, By Manufacturer Size, By Service, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-495-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Third-Party Logistics Market Summary

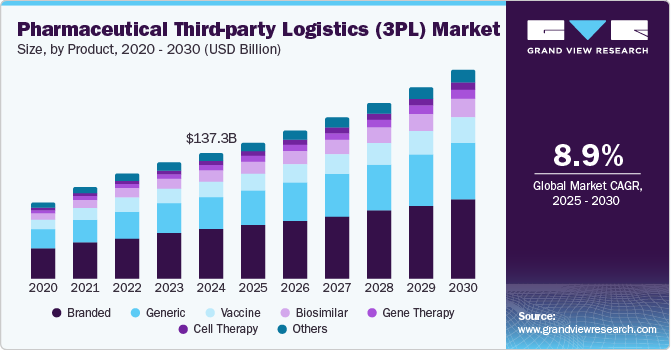

The global pharmaceutical third-party logistics (3pl) market size was estimated at USD 137,252.0 million in 2024 and is projected to reach USD 228,542.2 million by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide (TiO2)in the coming years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, branded accounted for a revenue of USD 53,613.1 million in 2024.

- Cell Therapy is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 137,252.0 million

- 2030 Projected Market Size: USD 228,542.2 million

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2024

Pharmaceutical companies are focusing on streamlining their operations, reducing costs, and improving delivery timelines.

Furthermore, growing demand for temperature-sensitive pharmaceuticals and biopharmaceuticals is significantly fueling the expansion of the cold chain logistics segment. Growing demand for the safe storage and transportation of these delicate products has led the companies to innovative cold chain solutions that safeguard product quality and efficacy. These solutions are designed to maintain precise temperature control throughout the entire supply chain, from manufacturing to end-user delivery. Moreover, the integration of cutting-edge technologies, such as artificial intelligence (AI), is further accelerating the adoption of cold chain logistics in the pharmaceutical sector. AI-driven systems enable enhanced monitoring, predictive analytics, and real-time tracking, allowing companies to optimize routes, reduce risks, and improve overall supply chain efficiency, thus driving the demand for innovative cold chain logistics solutions.

In addition, strict regulations regarding the handling, storage, and transportation of drugs, especially temperature-sensitive biologics and vaccines are also driving the demand for pharmaceutical third-party logistics industry. Third-party logistics providers are increasingly relied upon to ensure that shipments meet these stringent regulatory requirements, including Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP). As regulations become more complex across different regions, the demand for 3PL providers with the necessary certifications and expertise to navigate these requirements is expected to increase.

Product Insights

The branded drugs segment captured the highest market share of 39.06% in the pharmaceutical third-party logistics industry in 2024. The growth is mainly due to their high market value and established demand. Pharmaceutical companies producing branded drugs often rely on third-party logistics providers to manage the complex and global supply chains necessary for distributing these products. These drugs, often protected by patents, are typically high-margin products that require stringent storage and transportation conditions, especially for temperature-sensitive medications.

Cell therapy segment is projected to experience the highest CAGR of 9.86% due to its potential to treat a wide range of diseases, including cancer, autoimmune disorders, and genetic conditions. Increasing demand for cell-based therapies would subsequently lead to the growing demand for specialized logistics services, particularly in handling and transporting these delicate and time-sensitive products. These therapies often require precise temperature control, unique storage solutions, and real-time monitoring to maintain their viability.

Temperature Insights

The ambient segment dominated the pharmaceutical third-party logistics industry with 48% share in 2024 owing to the large volume of pharmaceutical products that do not require temperature-controlled environments. Many over the counter (OTC) drugs, generics, and other non-temperature-sensitive medications are typically stored and transported at room temperature, making ambient logistics the most cost-effective and widely used solution.The ease of managing ambient shipments, combined with the widespread use of these medications globally, are some of the factors contributing to the segment’s growth.

The refrigerated segment is expected to experience the highest growth rate during the forecast period. The growth is driven due to the increasing demand for temperature-sensitive products, such as biologics, vaccines, and cell therapies. These products require precise temperature control throughout their entire supply chain to maintain efficacy and safety. Moreover, with the rapid development of biopharmaceuticals and the growing need for vaccines, the demand for refrigerated logistics services is projected to increase.

Therapeutic Area Insights

The oncology segment dominated the pharmaceutical third-party logistics industry with 23.02% share in 2024. The growth is mainly driven due to an increasing incidence of cancer globally coupled with the growing demand for specialized treatments such as chemotherapy, immunotherapy, and targeted therapies. Cancer drugs often require highly regulated and temperature-controlled logistics to ensure their stability and efficacy, leading pharmaceutical companies to rely on third-party logistics providers with advanced cold chain capabilities. Thus, the aforementioned factors are contributing to the segment’s growth.

The neurology segment is expected to experience a lucrative growth rate during the forecast period. The growth is driven due to the growing number of neurology drug pipelines with its subsequent approvals in the coming years. These factors would further boost the demand for specialized pharmaceutical logistics services, including temperature-sensitive and time-critical deliveries.

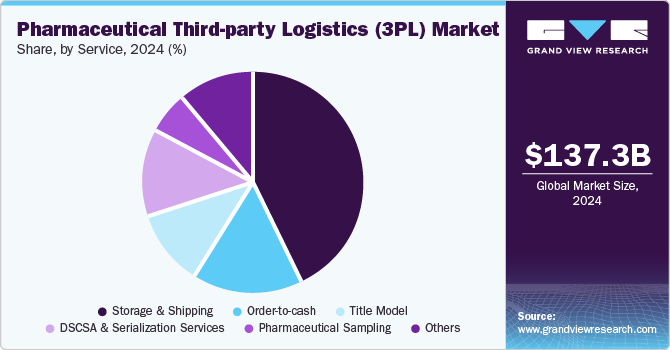

Service Insights

The storage and shipping segment held the largest share of 42.84% in 2024 due to an increasing demand for secure, compliant storage and timely shipping, particularly for temperature-sensitive drugs. Companies rely heavily on securing storage facilities and optimized shipping solutions to maintain the integrity of pharmaceuticals and comply with complex distribution regulations. These factors coupled with increasing global trade and the growing demand for more efficient supply chains is driving the segment’s growth.

DSCSA and serialization services are projected to grow at the highest CAGR from 2025 to 2030. The growth is driven due to the expanding regulatory landscape focused on enhancing drug traceability and combating counterfeit medications. The Drug Supply Chain Security Act requires pharmaceutical companies to serialize their products with unique identifiers, enabling full visibility and traceability from manufacturing to point-of-sale. Moreover, stringent government regulations worldwide to ensure drug safety and integrity, serialization services the demand for efficient logistics services is projected to increase.

Manufacturer Size Insights

The large manufacturer size segment dominated the pharmaceutical third-party logistics industry in 2024. The growth is mainly driven due the substantial production volumes and the extensive global distribution networks of major pharmaceutical companies. Large manufacturers typically have a diverse portfolio of products, ranging from generics to branded drugs, which require efficient and reliable logistics solutions to manage the complexities of supply chains across multiple regions. In addition, their ability to invest in advanced technologies, including automated systems and real-time tracking, allows them to optimize logistics operations, reduce costs, and ensure compliance with stringent regulatory standards.

The medium-sized manufacturing segment is expected to experience the fastest growth rate during the forecast period. Medium-sized manufacturers are typically in a phase of growth and innovation, with a focus on developing new products, such as specialized biologics and therapies, that require more tailored logistics services. As these companies grow, they are looking to optimize their supply chains by partnering with third-party logistics providers to ensure reliable and compliant transportation, especially for temperature-sensitive or regulated products. The growing trend of outsourcing logistics functions and the increasing adoption of digital solutions by medium-sized manufacturers is projected to contribute to the pharmaceutical third-party logistics (3PL)industry growth.

Regional Insights

North America accounted for the largest market share of 38.3% in 2024 owing to the region's well-established healthcare infrastructure, advanced logistics networks, and the high demand for pharmaceutical products. The U.S., in particular, is home to a vast number of pharmaceutical manufacturers, distributors, and biotech companies, which heavily rely on 3PL providers for efficient storage, transportation, and compliance with regulatory standards.

U.S. Pharmaceutical Third-party Logistics Market Trends

The pharmaceutical third-party logistics market in the U.S. is fueled increasing complexity of pharmaceutical supply chains and the demand for efficient distribution of a wide range of drugs, including specialty pharmaceuticals and biologics. The country’s market is one of the largest market globally, and as regulatory standards become more stringent, manufacturers are increasingly turning to 3PL providers to ensure compliance with the Drug Supply Chain Security Act (DSCSA) and other regulations. In addition, the growing trend of outsourcing logistics to reduce costs and improve efficiency, along with the rise of e-commerce for pharmaceutical products, has further accelerated the demand for 3PL services in the U.S.

Europe Pharmaceutical Third-party Logistics Market Trends

The pharmaceutical third-party logistics market in Europe is experiencing growth due the region's expanding pharmaceutical industry, evolving regulatory environment, and increasing demand for efficient, temperature-controlled logistics. Europe is a hub for pharmaceutical manufacturing and research, which is driving the demand for biologics and other temperature-sensitive drugs and the need for specialized logistics solutions.

The pharmaceutical third-party logistics market in the UK held a significant share in 2024 due to the country's established role as a major pharmaceutical hub in Europe and its robust healthcare infrastructure. The UK is home to numerous global pharmaceutical manufacturers and distributors, and the market benefits from a well-developed logistics network, making it an ideal location for pharmaceutical logistics operations. With the growing demand for specialized logistics services, particularly in temperature-sensitive pharmaceuticals, the UK’s reliance on 3PL providers to ensure compliance with regulatory standards such as GDP and to manage the complexity of international trade is projected to contribute to the market growth.

The pharmaceutical third-party logistics market in France is drive due to an increasing demand for innovative therapies, and the country’s strategic position within Europe. The country’s regulatory environment, which includes strict compliance requirements for drug distribution, is also one of the factors contributing to the market growth as most of the companies are turning to third party logistics providers that can ensure timely and secure deliveries while adhering to Good Distribution Practices (GDP).

The pharmaceutical third-party logistics market in Germany is anticipated to grow significantly over the forecast period. The country has a high volume of drug production, which requires efficient supply chain management to ensure timely distribution of products both domestically and internationally. The rise in demand for biologics, vaccines, and other temperature-sensitive products has further fueled the need for cold chain logistics solutions.

Asia Pacific Pharmaceutical Third-party Logistics Market Trends

The Asia Pacific pharmaceutical third-party logistics market is projected to grow at the highest CAGR over the forecast period. The growth of the market is mainly due to the increasing demand for healthcare products, rising investments in the pharmaceutical sector, and the region's expanding manufacturing capabilities. Countries like China, India, and Japan are becoming key players in the global pharmaceutical market, driving the need for efficient logistics solutions to support both local and international distribution. The rapid growth of the healthcare infrastructure, coupled with rising consumer awareness and the demand for innovative drugs and biologics, has created an urgent need for 3PL providers to offer specialized services, including temperature-controlled logistics and regulatory compliance solutions.

The pharmaceutical third-party logistics market in China is expected to grow over the forecast period. The growth is driven due to the country’s rapidly expanding pharmaceutical industry, increased government investments in healthcare, and rising domestic demand for both traditional and biologic drugs. Moreover, growing country’s focus towards improving healthcare infrastructure and expanding access to advanced treatments is driving demand for temperature-sensitive logistics services.

Japan pharmaceutical third-party logistics Market is witnessing significant growth over the forecast period. The growth is due to the country's aging population coupled with growing demand for effective healthcare solutions. Moreover, Japan's advanced healthcare system and large pharmaceutical industry has created a significant demand for specialized logistics solutions, particularly for temperature-sensitive products such as biologics and vaccines.

India pharmaceutical third-party logistics Market is witnessing a considerable growth due to the country's expanding pharmaceutical manufacturing sector, increasing demand for healthcare products, and a rapidly growing healthcare infrastructure. The country is one of the largest producers of generic medicines globally and has witnessed a significant surge in both domestic and international demand for pharmaceutical products. This growth is driving the need for specialized logistics solutions, including temperature-controlled storage and transportation, to ensure the safe distribution of a wide range of drugs, particularly biologics and vaccines.

Latin America Pharmaceutical Third-Party Logistics Market Trends

The Latin America pharmaceutical third-party logistics (3PL) Market is projected to grow over the forecast period. The growth in the region is due to the increasing demand for pharmaceutical products, improvements in healthcare infrastructure, and rising pharmaceutical manufacturing activities in countries such as Brazil, Mexico, and Argentina. The region’s large and growing population, coupled with the need for better access to healthcare, is driving the need for efficient logistics solutions.

The pharmaceutical third-party logistics (3PL) Market in Brazil is expected to grow over the forecast period due to the country’s increasing pharmaceutical production, expanding healthcare sector, and growing demand for innovative treatments. As Brazil is the largest pharmaceutical market in Latin America, the need for reliable logistics services that can ensure the safe, timely, and compliant distribution of pharmaceuticals would further contribute to the market growth.

Key Pharmaceutical Third-Party Logistics Company Insights

Key players operating in the pharmaceutical third-party logistics services industry are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Companies are continuously involved in expanding their services, collaborating, and engaging in partnerships, mergers, and acquisitions of companies. These are key strategic initiatives that are influencing industry dynamics. For instance, in January 2024,Kuehne+Nagel and FFF Enterprises mentioned tackling gaps in frozen storage and distribution and successfully delivering millions of COVID-19 vaccine doses nationwide.

Key Pharmaceutical Third-Party Logistics Companies:

The following are the leading companies in the pharmaceutical third-party logistics (3PL) market. These companies collectively hold the largest market share and dictate industry trends.

- CEVA Logistics

- Cencora Corporation (ICS)

- DB SCHENKER

- Kuehne+Nagel

- Kerry Logistics Network Limited

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Thermo Fisher Scientific

- Knipper Health

Recent Developments

-

In September 2024, DSV announced to acquire DB Schenker from Deutsche Bahn for USD 14.74 billion. This acquisition aims to enhance DSV's global network, expertise, and competitiveness, benefiting employees, customers, and investors.

-

In September 2024, CEVA Logistics announced an agreement to take over CMA CGM's freight management responsibilities to enhance CEVA’s business growth while enabling CMA CGM to focus on its core shipping operations. This strategic shift strengthened the company’s partnership and streamlined operations for both companies.

-

In May 2023, Yaral Pharma, the U.S. generics subsidiary of IBSA, has expanded its partnership with EVERSANA to enhance the commercialization of its pain and endocrinology portfolio in the U.S. Through this acquisition, EVERSANA delivered comprehensive support, including third-party logistics (3PL) and operational services, ensuring seamless customer service and market expansion.

Pharmaceutical Third-Party Logistics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 148.91 billion

Revenue forecast in 2030

USD 228.54 billion

Growth rate

CAGR of 8.95% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, temperature, therapeutic area, manufacturer size, service

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

CEVA Logistics; Cencora Corporation (ICS); DB SCHENKER; Kuehne+Nagel; Kerry Logistics Network Limited; Cardinal Health; McKesson Corporation; EVERSANA, Thermo Fisher Scientific, Knipper Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Third-Party Logistics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the pharmaceutical third-party logistics (3PL) market on the basis of product, temperature, therapeutic area, manufacturer size, service and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded

-

Generic

-

Biosimilar

-

Vaccine

-

Cell Therapy

-

Gene Therapy

-

Others

-

-

Temperature Outlook (Revenue, USD Million, 2018 - 2030)

-

Ambient

-

Refrigerated

-

Frozen

-

Ultra-frozen/Deep-Frozen

-

Cryogenic

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Infectious Diseases

-

Neurology

-

Diabetes

-

Nephrology

-

Rheumatology

-

Allergy/Asthma

-

Gastroenterology

-

Ophthalmology

-

Others

-

-

Manufacturer Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large

-

Medium

-

Small

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Storage and Shipping

-

Order-to-cash

-

Title Model

-

DSCSA and Serialization Services

-

Pharmaceutical Sampling

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical third-party logistics market size was estimated at USD 137.25 billion in 2024 and is expected to reach USD 228.54 billion in 2030.

b. The global pharmaceutical third-party logistics market is expected to grow at a compound annual growth rate of 8.95% from 2025 to 2030 to reach USD 228.54 billion by 2030.

b. branded drugs segment dominated the (3PL) market with a share of 38.2% in 2024. The growth is mainly due to their high market value and established demand.

b. North America dominated the pharmaceutical third-party logistics market with a share of 39.06% in 2024. This is attributable to the region's well-established healthcare infrastructure, advanced logistics networks, and the high demand for pharmaceutical products.

b. Some key players operating in the pharmaceutical 3PL market include CEVA Logistics, Cencora Corporation (ICS), DB SCHENKER, Kuehne+Nagel, Kerry Logistics Network Limited, Cardinal Health, McKesson Corporation, EVERSANA, Thermo Fisher Scientific, Knipper Health

b. Key factors that are driving the market growth include increasing complexity of global supply chains, stringent regulatory compliance, especially for temperature-sensitive products like biologics and vaccines, and globalization of the pharmaceutical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.