- Home

- »

- Clinical Diagnostics

- »

-

Pharmacogenomics Technology Market Size Report, 2030GVR Report cover

![Pharmacogenomics Technology Market Size, Share & Trends Report]()

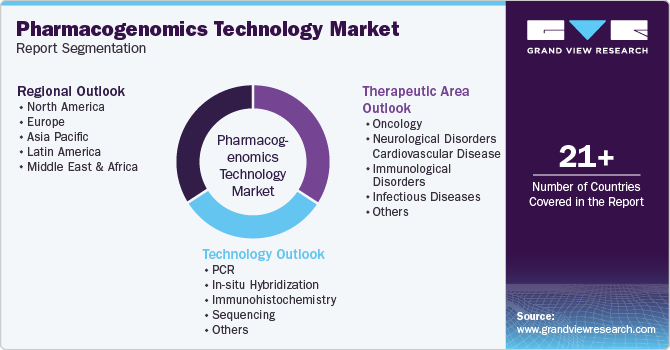

Pharmacogenomics Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapeutic Area (Neurological Disorders, Cardiovascular Disease), By Technology (PCR, In-situ Hybridization), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-940-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacogenomics Technology Market Summary

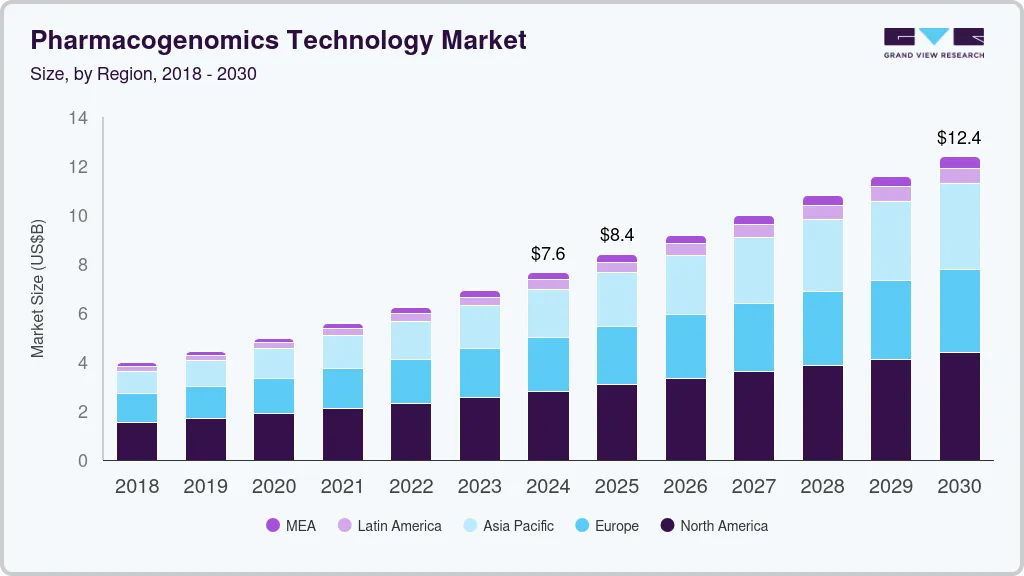

The global pharmacogenomics technology market size was estimated at USD 7.63 billion in 2024 and is projected to reach USD 12.38 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. Advancements in genomics have led to an increased understanding of genetic variations and their impact on drug response, which is a primary driving factor in the growth of the market for pharmacogenomics technology.

Key Market Trends & Insights

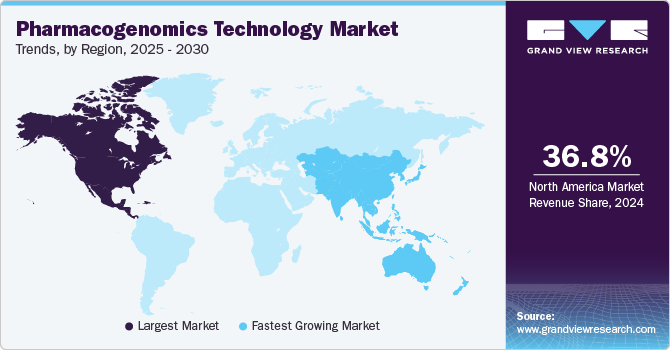

- North America dominated the market and accounted for the largest revenue share of 36.8% in 2024.

- U.S. dominated the market with the largest revenue share in 2024.

- By therapeutic area, the oncology segment accounted for the largest revenue share of 39.8% in 2024.

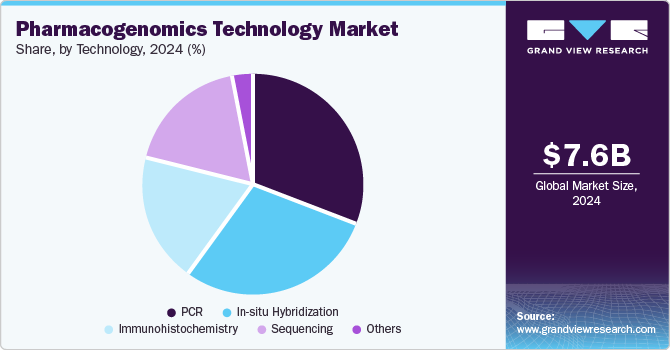

- By technology, the polymerase chain reaction (PCR) segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.63 Billion

- 2030 Projected Market Size: USD 12.38 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising prevalence of chronic disease has led to an increased demand for personalized medicine, which is contributing to market growth. According to a World Health Organization (WHO) report published in May 2023, chronic diseases such as cardiovascular diseases, diabetes, cancer, and respiratory illnesses are expected to cause 86% of all deaths globally, representing a 90% increase since 2019. Furthermore, the reduction in the cost of genomic sequencing and technological advancements is aiding market growth.

Advancements in genomics have greatly improved the understanding of how genes affect health. Next-generation sequencing technologies have made analyzing DNA and RNA sequencing faster, which has led to the analysis of large amounts of genetic information. Genome-wide association studies have led to the identification of specific gene variations linked to various illnesses, therefore providing insights into the genetic causes of diseases. In May 2024, Qiagen launched the QIAseq Multimodal DNA/RNA Library Kit. This kit facilitates multiomic studies by enabling the simultaneous preparation of DNA and RNA libraries from a single sample, advancing precision medicine research.

The rising prevalence of personalized care has significantly contributed to the growth of the pharmacogenomics technology market. The focus on tailoring medical treatments to individual patients has led to personalized care and the recognition of the impact of genetic factors on drug response. Pharmacogenomics technologies play a vital role in identifying genetic variations that influence drug metabolism and efficacy.

Theranostics’ role in decreasing the R&D costs and lowering the time involved in clinical trials pushes its adoption by pharmaceutical companies. Market opportunities encourage smaller participants to focus on developing novel tests for already licensed drugs, thus leading to growth in the coming years. The pharmacogenomics technology market is driven by collaborations and pipelines for upcoming products. The goal of the partnerships between the companies is the identification of appropriate tumor targets by expanding known mutations associated with defective DNA repair. Companies are developing single comprehensive tests that can capture much relevant content.

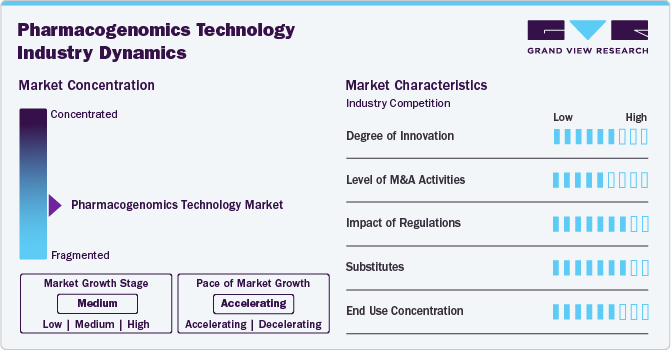

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The pharmacogenomics industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in genomics research, personalized medicine, and the increasing focus on innovative medicine.

The pharmacogenomics industry is also characterized by a high level of merger and acquisition (M&A) activity by leading players. For instance, in January 2023, QIAGEN completed the acquisition of California-based biotechnology company Verogen to strengthen its leadership in forensic investigation and Human Identification (HID). With the acquisition of Verogen, QIAGEN aims to assist researchers and investigators in advancing forensic science.

The pharmacogenomics industry is also subject to increasing regulatory inspection. This is due to the increasing use of genetic data in determining drug treatments and strict guidelines to ensure the safety and effectiveness of genetic-based treatment. This regulation helps to protect genetic testing and ensures that the treatments are reliable.

There are a limited number of direct product substitutes for pharmacogenomics. However, there are a number of technologies that can be used to achieve similar outcomes to pharmacogenomics, such as genotyping, microarray analysis, and sequencing. These technologies can be used as substitutes for pharmacogenomics in certain applications, but they do not offer the same level of performance or flexibility as pharmacogenomics.

Therapeutic Area Insights

The oncology segment accounted for the largest revenue share of 39.8% in 2024. The oncology segment is further segmented into lung cancer, breast cancer, colorectal cancer, cervical cancer, and others. The ever-expanding armamentarium of therapies based on the principles of molecular diagnostics for cancer treatment is attributed to the increase in the penetration rates of oncology-based tests. Appropriate selection of predictive biomarkers that can provide clinical benefit in a small subset of patients is the crucial step for the implementation of companion diagnostics in cancer.

The cardiovascular disease segment is expected to grow at the fastest CAGR during the forecast period. Cardiovascular diseases include conditions such as coronary artery disease, heart failure, arrhythmias, and congenital heart defects. Pharmacogenomics technologies enable cardiologists to identify genetic variations within tumors that can be targeted by specific drugs, leading to more precise and effective treatment options.

Technology Insights

The polymerase chain reaction (PCR) segment accounted for the largest revenue share in 2024. PCR is driving market growth due to its crucial role in genetic analysis and diagnostics. PCR allows for the amplification of specific DNA sequences, making it a fundamental tool in genotyping and identifying genetic variations associated with drug response. It is widely used for detecting single nucleotide polymorphisms (SNPs) and genetic mutations that affect drug metabolism and efficacy. In January 2025, Firalis Molecular Precision upgraded its services, such as rare mutation detection, Gene expression profiling, and Pathogen detection, by acquiring the QuantStudio Absolute Q Digital PCR System. This helps them improve the detection of rare gene mutations, measure gene activity, quantify viral loads, and analyze genetic variations.

The immunohistochemistry market is expected to grow at the fastest CAGR of 8.5% over the forecast period due to its significant impact on drug development and personalized medicine. IHC plays a vital role in analyzing protein expression patterns and biomarkers, enabling the identification and localization of specific proteins within tissues. For instance, in April 2023, Leica Biosystems received the clearance for BOND MMR Antibody Panel, which is expected to aid customers by offering the IHC Mismatch Repair (MMR) option when screening patients with colorectal cancer who may have Lynch syndrome.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 36.8% in 2024, owing to the presence of established players operating in this region. These players are engaged in active collaborations to gain a share in the pharmacogenomics companion diagnostics market. Accelerated R&D of integrated medicine in the U.S. as a consequence of the active participation of regulatory bodies and the government is anticipated to bolster growth over the forecast period. FDA has issued guidance documents for coordination of milestone reviews with the different agencies, expected performance requirements, clarification of appropriate regulatory strategy, and defining timeliness to enable a smooth application process and key deliverables.

U.S. Pharmacogenomics Technology Market Trends

The U.S. dominated the North America pharmacogenomics technology market with the largest revenue share in 2024. This is due to the country’s strong healthcare infrastructure, advanced research in genetics, and a high number of pharmaceutical companies. The growing demand for personalized medicine, where treatments are tailored based on genetic information, also contributes to this dominance.

Europe Pharmacogenomics Technology Market Trends

The Europe pharmacogenomics technology market was identified as a lucrative region with revenue share of 28.6% in 2024. Norway has the fastest growth rate in this region, which is driven by strong government support for precision medicine and advanced genomic research. The UK pharmacogenomics market is expected to grow rapidly in the coming years, owing to ongoing investments in genomic research and infrastructure. The UK government allocated USD 210.6 million to advanced genomics research to improve diagnoses for rare genetic conditions in newborns and enhance cancer diagnosis accuracy.

Asia Pacific Pharmacogenomics Technology Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 9.7% during the forecast period. The market is rapidly growing in the region due to factors such as a diverse population for genetic research, increasing prevalence of chronic diseases, emphasis on precision medicine, and advancements in technology. The rising burden of chronic diseases in Asia Pacific drives the demand for personalized medicine and targeted therapies. In addition, governments and healthcare institutions are investing in research and infrastructure to support pharmacogenomics initiatives, thereby increasing market growth.

The China pharmacogenomics technology market had a significant share of 27.1% in 2024. This growth is largely due to the rising prevalence of cardiovascular disease (CVD) caused by demographic changes and lifestyle-related health issues. The high death rate associated with CVD highlights its impact on public health in China.

Key Pharmacogenomics Technology Company Insights

The market is highly competitive with players undertaking strategies such as product launches, approvals, strategic acquisitions, and innovations to increase their global reach. For instance, in January 2023 QIAGEN announced a strategic partnership with Helix a population genomics company to aid companion diagnostics for genetic diseases.

-

QIAGEN N.V. specializes in next-generation sequencing (NGS) technologies, providing comprehensive workflows from sample preparation to data analysis. These solutions enhance precision medicine by enabling personalized treatment decisions based on detailed genetic insights.

-

GE HealthCare uses advanced technologies to analyze medical data and improve patient care, especially in the field of pharmacogenomics. The main focus of its healthcare solutions is to understand how genetic factors affect a patient's response to treatments.

Key Pharmacogenomics Technology Companies:

The following are the leading companies in the pharmacogenomics technology market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- GE HealthCare

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- FOUNDATION MEDICINE, INC.

- Thermo Fisher Scientific Inc.

- Oxford Nanopore Technologies plc.

- Twist Bioscience

- Leica Biosystems Nussloch GmBH

- Pfizer Inc.

- Abbott

Recent Developments

-

In October 2024, QIAGEN Digital Insights launched a new tool called Pharmacogenomic Insights (PGXI). This tool helps researchers understand how a person's genes affect their medication response and is designed to support scientific and medical researchers in pharmacogenomics.

-

In May 2024, Oxford Nanopore Technologies and Twist Bioscience launched a Pharmacogenomics Beta Program to improve personalized medicine. This program integrates Twist’s next-generation sequencing technology with Oxford Nanopore’s sequencing platform, aiming to enhance sequencing accuracy and efficiency.

Pharmacogenomics Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.39 billion

Revenue forecast in 2030

USD 12.38 billion

Growth Rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic area, technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

QIAGEN; GE HealthCare; Agilent Technologies, Inc.; F. Hoffmann-La Roche Ltd; FOUNDATION MEDICINE, INC.; Thermo Fisher Scientific Inc.; Oxford Nanopore Technologies plc.; Twist Bioscience; Leica Biosystems Nussloch GmBH; Pfizer Inc.; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmacogenomics Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmacogenomics technology market report based on therapeutic area, technology, and region.

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Others

-

-

Neurological Disorders

-

Cardiovascular Disease

-

Immunological Disorders

-

Infectious Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

In-situ Hybridization

-

Immunohistochemistry

-

Sequencing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of America

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.