- Home

- »

- Medical Devices

- »

-

Pharmacy Benefit Management Market, Industry Report 2033GVR Report cover

![Pharmacy Benefit Management Market Size, Share & Trends Report]()

Pharmacy Benefit Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Business Model (Standalone PBM, Health Insurance Providers, Retail Pharmacy), By End Use (Commercial, Federal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-752-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacy Benefit Management Market Summary

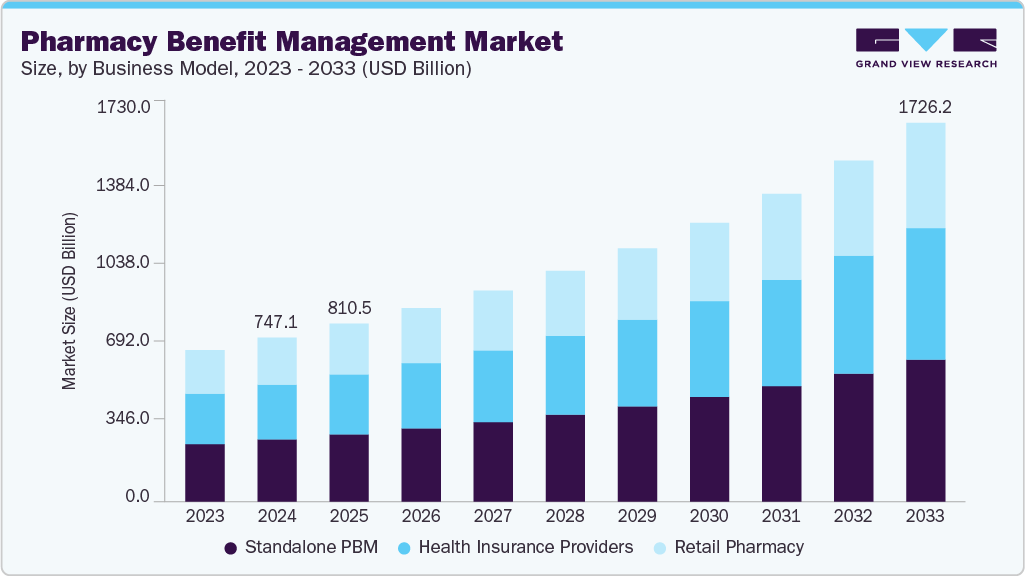

The global pharmacy benefit management market size was estimated at USD 747.08 billion in 2024 and is projected to reach USD 1,726.27 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. This growth is attributed to the growing demand for cost-containment solutions in healthcare, and the shift toward value-based care and outcomes-driven healthcare models, which have motivated providers and payers to collaborate with PBMs to improve medication adherence, optimize formularies, and ensure better therapeutic outcomes.

Key Market Trends & Insights

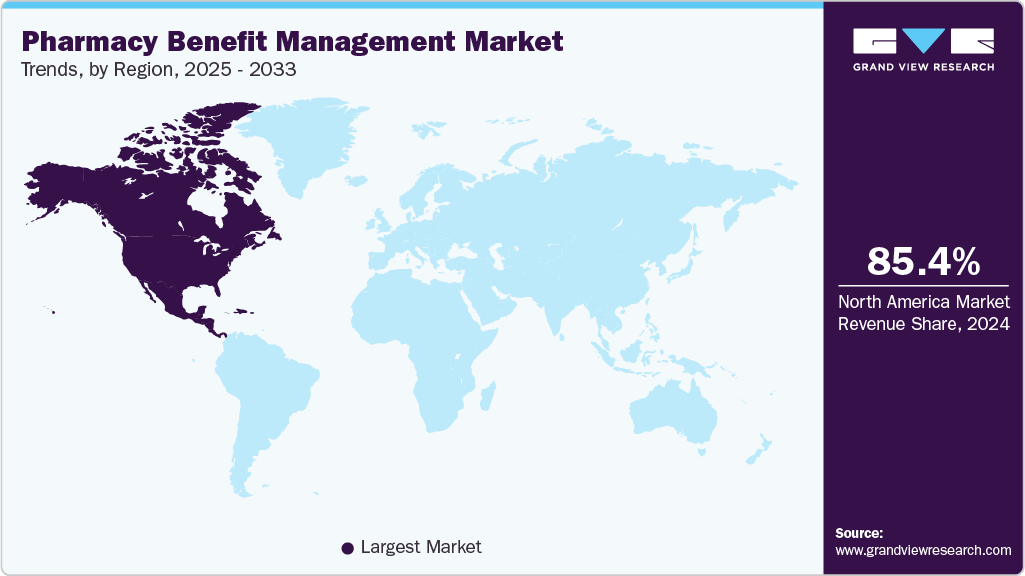

- North America dominated the global with the largest revenue share of 85.44% in 2024.

- The pharmacy benefit management market in the U.S. is anticipated to register at the fastest CAGR during the forecast period.

- In terms of business model, the standalone PBM segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 747.08 Billion

- 2033 Projected Market Size: USD 1,726.27 Billion

- CAGR (2025-2033): 9.9%

- North America: Largest market in 2024

In addition, regulatory changes and rising healthcare spending in emerging markets contribute to market growth.

Rising Costs of Prescription Medications & Increasing Therapeutic Complexity

As pharmaceutical prices continue to rise, especially for specialty drugs and innovative therapies, healthcare providers and payers are under increasing financial pressure to control expenses without sacrificing patient care. Simultaneously, treatment regimens have grown more complex, characterized by advanced biologics, targeted therapies, and personalized medicine. This complexity requires specialized management to ensure appropriate drug selection, dosing, and patient adherence. PBMs play a vital role in tackling these challenges by utilizing their expertise in formulary design, negotiating drug prices, and employing data-driven strategies to optimize therapeutic outcomes.

PBMs' ability to navigate the complexities of modern pharmacology while reducing unnecessary costs makes them essential for improving healthcare affordability and ensuring patient access to effective treatments.

Case Study By National Library of Medicine: Trends and Projections in U.S. Pharmaceutical Expenditures - 2024 Outlook

Background and Purpose:

This case study examines historical trends in pharmaceutical expenditures in the U.S., identifies key factors influencing future drug spending, and offers projections for 2024, with a particular focus on the nonfederal hospital and clinic sectors. Understanding these trends is essential for healthcare stakeholders, including policymakers, hospital administrators, and insurers, to prepare for the financial challenges posed by rising drug costs and evolving therapeutic needs.

Findings:

In 2023, total U.S. pharmaceutical expenditures reached USD 722.5 billion, representing a 13.6% increase from 2022. The primary contributors to this growth were:

-

Increased utilization (6.5%): More prescriptions being filled or longer durations of therapy.

-

New drug approvals (4.2%): Innovative therapies entering the market.

-

Price increases (2.9%): Higher costs for existing medications.

Among top-selling drugs, semaglutide led the list, followed by adalimumab and apixaban, reflecting the high demand for treatments in metabolic, autoimmune, and cardiovascular diseases.

In sector-specific findings:

-

Nonfederal hospitals reported USD 37.1 billion in drug spending, marking a 1.1%decrease from the previous year. This decline was largely driven by reduced utilization, although price and new products contributed modestly to the overall expenditure.

-

Clinics recorded USD135.7 billion in drug spending; a 15.0% increase compared to 2022. The rise was primarily fueled by greater utilization of therapies, with minor effects from pricing changes and new drugs.

The study highlighted that specialty drugs, endocrine therapies, and cancer treatments will remain key drivers of pharmaceutical spending in the coming year.

Projections for 2024:

Based on the analysis, the study forecasts the following:

-

Overall U.S. prescription drug spending is expected to increase by 10.0% to 12.0%.

-

Clinics are projected to see an 11.0% to 13.0% rise in expenditure.

-

Nonfederal hospitals are likely to experience a modest 0% to 2.0% increase.

The study also cautions that these national projections may not fully capture local dynamics, as each health system faces unique challenges influenced by regional prescribing patterns, patient demographics, and contractual arrangements.

Growth of Public and Private Health Insurance Coverage:

The expansion of public and private health insurance coverage is a significant factor driving the market growth. This increase in coverage directly enhances access to prescription medications and generates greater demand for cost management and formulary optimization. As more individuals gain coverage through government programs such as Medicare and Medicaid, along with private insurance plans provided by employers or marketplaces, there has been a surge in the volume of prescription drug claims. For instance, with over 51 million Medicare beneficiaries in Part D, drug utilization has surged, partly due to significant subsidies covering about 75% of costs. This has increased the demand for efficient management of premiums and assistance programs such as the Low-Income Subsidy (LIS) for nearly 14 million beneficiaries. In 2022, Part D expenditure reached USD 117.3 billion, primarily funded by Medicare. Consequently, Pharmacy Benefit Managers (PBMs) play a crucial role in negotiating prices and managing access to affordable medications.

Moreover, the forecasted growth of Medicare Part D to account for 36% of U.S. drug spending by 2032, along with policy changes such as the Inflation Reduction Act’s cap on out-of-pocket costs at USD 2,000 for 18.7 million beneficiaries starting in 2025, strongly drives the PBM market by expanding public health insurance coverage and increasing reliance on managed care solutions. As a larger share of prescription drug spending shifts to Medicare, there is a corresponding rise in the volume of claims, beneficiaries, and benefit programs that require oversight, cost control, and clinical management.

Furthermore, as insurance coverage expands in developed and emerging markets, the demand for streamlined, efficient, cost-effective pharmacy benefit solutions becomes increasingly important. This trend drives the growth and adoption of PBM services throughout the healthcare ecosystem.

Transition to Value-Based and Outcome-Driven Pharmacy Benefits:

Healthcare systems increasingly focus on patient outcomes rather than just the volume of services offered. In this model, payers, providers, and employers aim to tie reimbursement and coverage decisions to the effectiveness and quality of treatments instead of merely the number of prescriptions filled. PBMs are instrumental in this transition. They utilize their knowledge in formulary management, medication adherence strategies, and real-world evidence to ensure patients have access to the most suitable and effective therapies. By emphasizing outcomes, PBMs contribute to the reduction of unnecessary treatments, lower healthcare expenses, and better patient health, aligning with overall efforts to enhance care quality and efficiency.

In addition, regulatory backing and the demand from stakeholders for more accountable and transparent healthcare systems further elevate the role of PBMs in executing and managing value-based pharmacy benefit approaches. This evolution solidifies the position of the pharmacy benefit management industry as a crucial partner in achieving improved healthcare outcomes while managing costs effectively.

Digital Advancements and Workflow Automation in PBM Operations:

Innovations in digital technology and workflow automation are crucial for enhancing PBM operations and driving efficiency, accuracy, and cost-effectiveness improvements. Automation solutions simplify tasks such as claims processing, prior authorizations, and drug utilization assessments, decreasing administrative workloads and reducing the risk of human error. Utilizing advanced data analytics, machine learning, and artificial intelligence, PBMs can more effectively anticipate patient behavior, refine formulary management, and boost medication adherence.

Moreover, digital platforms enable real-time data exchanges among stakeholders, leading to quicker decisions and improved care coordination. These technological advancements also aid in meeting regulatory standards and enhance patient engagement through tailored medication management solutions, ultimately assisting healthcare providers and payers in managing costs while improving health outcomes.

Development Area

Description

Impact on PBM Operations

Data Analytics & Predictive Modeling

Utilizes vast prescription claims and patient data to optimize drug use, manage costs, and forecast trends.

Identify inefficiencies, anticipates fraud, ensures compliance, improve decision-making.

Artificial Intelligence & Machine Learning

Automates administrative tasks, improves patient care, and personalizes treatment.

Reduces wait times, optimizes formularies, enables tailored medication plans, enhances treatment effectiveness.

Personalized Medicine Plans

AI analyzes patient-specific data including genetics and lifestyle factors.

Enhances precision treatment, reduces adverse reactions, improves outcomes.

Streamlined Prior Authorizations

AI-powered automation of approval processes.

Cutting wait times, reduces administrative burden, ensures timely medication access.

Formulary Optimization

AI evaluates cost and effectiveness to recommend optimal drug options.

Balances and cost and clinical benefits support better prescribing decisions.

Blockchain for Transparency & Trust

Secure, immutable ledger for tracking drugs and contracts.

Improves traceability, combats counterfeit drugs, fosters trust among stakeholders.

Pharmacy Network Optimization Tools

Tools using geolocation data and performance metrics to enhance networks.

Expands patient access, ensures quality care, and incentivizes high-performing pharmacies.

Geolocation Data

Analyzes patient location data to optimize pharmacy networks.

Ensures equitable access, minimizes costs, enhances convenience.

Performance-Based Contracting

Monitors real-time pharmacy performance and rewards efficiency.

Aligning pharmacy operations with healthcare outcomes, boosts accountability.

Source: Secondary Research, Xevant, Inc.

Growing Need for Cost Transparency and Pass-through Pricing Strategies

As healthcare expenses, particularly prescription drugs, continue to rise, payers, employers, and patients call for clearer insights into how drug prices are established and where markups exist. By enhancing cost transparency, stakeholders can better understand the total expenses associated with medications, including rebates, administrative costs, and other concealed fees, which drive trust and enable informed choices. Pass-through pricing models allow PBMs to directly transfer negotiated discounts and rebates to clients without hidden profits, aligning incentives and supporting initiatives to reduce drug spending while improving access to vital medications. This shift has encouraged PBMs to implement innovative contracting strategies and reporting tools that offer deeper insights into pricing frameworks, promoting accountability and competitive pricing within the healthcare landscape.

Consolidation and Vertical Integration Within the Drug Supply Chain

Consolidation and vertical integration within the drug supply chain are significant factors driving the pharmacy benefit management industry, as they allow for enhanced control over drug pricing, distribution, and patient access. As pharmaceutical manufacturers, wholesalers, pharmacies, and insurers increasingly merge or form strategic alliances, PBMs can negotiate better prices, streamline operations, and minimize administrative burdens. This integration drives better coordination among stakeholders, ensuring that formulary management, rebate negotiations, and patient adherence initiatives are optimized throughout the supply chain.

In July 2024, MedPharm and Tergus Pharma announced their merger, which significantly influences the pharmacy benefit management industry by enhancing the capabilities of Contract Development and Manufacturing Organizations (CDMOs) in the topical and transepithelial pharmaceutical sectors. This strategic consolidation enables the combined entity to offer comprehensive services, including scientific research, formulation development, clinical trial manufacturing, and commercial production, all within a unified organization.

CEO of MedPharm said: “This strategic partnership is an exciting opportunity to deliver extensive pharmaceutical product development resources fuelled by a robust team of scientific experts while leveraging our cutting-edge topical GMP facility to meet our customers’ commercial production needs seamlessly. With locations in both the United Kingdom and the United States, we are well-positioned to provide exceptional support to our existing and prospective pharmaceutical clients.”

Moreover, vertical integration facilitates data sharing and provides real-time insights into medication utilization trends, enabling PBMs to offer customized solutions while controlling costs. Such structural cohesion helps reduce supply disruptions and strengthens bargaining power with drug manufacturers, positioning PBMs as crucial intermediaries in delivering value-based pharmaceutical care.

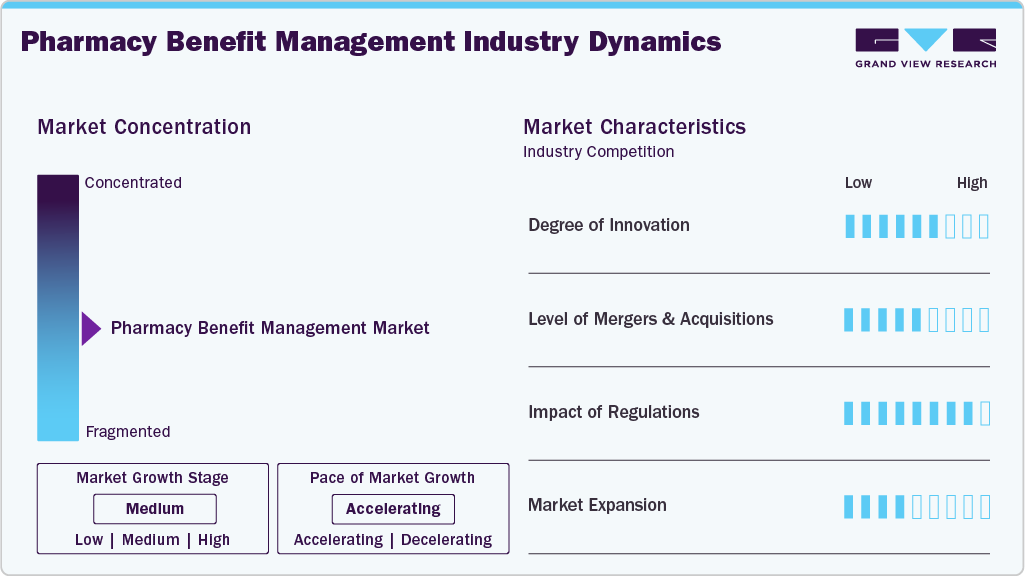

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. There is a moderate degree of innovation, moderate level of merger & acquisition activities, high impact of regulations, and moderate expansion of industry.

The pharmacy benefit management industry is experiencing a moderate degree of innovation. In December 2023, Elevance Health's pharmacy benefit manager launched its 24/7 digital pharmacy. This initiative aims to enhance medication access and adherence by offering members the ability to engage with pharmacists via text, chat, or phone around the clock. The platform also allows users to compare medication costs and track their prescriptions throughout the order process.

CarelonRx President said: “Members should be able to compare costs of medications easily, speak to a staff member at any time of day to address questions, be able to track the status of their prescriptions, and have those prescriptions delivered on time to their doorsteps. CarelonRx Pharmacy will place the pharmacy experience directly into the hands of consumers to help enhance their health care journeys.”

Several key players are actively engaging in mergers & acquisitionsto promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in June 2025, MacroHealth, a healthcare technology company specializing in intelligent health marketplaces, announced its acquisition of Foundational Pharmacy Strategies (FPS). This strategic move aims to address the escalating costs associated with pharmacy benefits, which have become a significant component of overall healthcare expenditures. This acquisition empowers benefit advisors, consultants, health plans, and employers to optimize high-cost drugs and enhance their pharmacy benefit management strategies.

The pharmacy benefit management industry is regulated by a variety of guidelines designed to ensure patient safety, quality of care, and ethical business practices. In Europe, the regulation of PBM is influenced by a combination of EU-wide directives and national frameworks, with a growing emphasis on transparency, cost-effectiveness, and patient access to medications. In Germany, the Arzneimittelmarkt-Neuordnungsgesetz (AMNOG) mandates that pharmaceutical companies provide evidence of added benefit for new drugs compared to existing treatments. This requirement informs Health Technology Assessment (HTA) processes and affects PBM strategies in formulary management and pricing negotiations. Moreover, the UK's Voluntary Scheme for Branded Medicines Pricing and Access (VPAS) caps NHS spending on branded drugs, compelling PBMs to negotiate effectively with manufacturers to manage costs within these constraints.

In July 2021, Anthem and Humana, two major U.S. health insurers, invested approximately USD 138.3 million to launch DomaniRx, a next-generation PBM platform. This joint venture with SS&C Technologies aims to disrupt the traditional PBM model, which has been criticized for a lack of transparency and inefficiency. This initiative reflects a broader trend in the healthcare industry toward leveraging technology to enhance transparency, reduce costs, and improve patient outcomes in pharmacy benefit management.

Business Model Insights

The standalone PBM segment led the market with the largest revenue share of 37.91% in 2024. Standalone PBMs offer specialized services such as formulary management, price negotiation with manufacturers, and claims processing, helping payers reduce overall costs. Technological advancements in data analytics and real-time reporting enable standalone PBMs to provide personalized drug utilization insights and optimize patient outcomes, enhancing their value proposition. Moreover, growing awareness among stakeholders about the need for transparency in drug pricing and reimbursement has strengthened the role of standalone PBMs as independent intermediaries capable of delivering cost savings and operational efficiency.

The health insurance providers segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the increasing demand for cost-effective prescription drug management and the need to optimize healthcare expenditures. Health insurers are leveraging PBM services to negotiate better pricing with drug manufacturers, manage formulary designs, and ensure efficient claims processing, which ultimately helps control rising drug costs for both payers and patients. In addition, regulatory support and initiatives promoting transparency in drug pricing incentivize insurers to collaborate with PBM providers to enhance affordability and efficiency in prescription drug management.

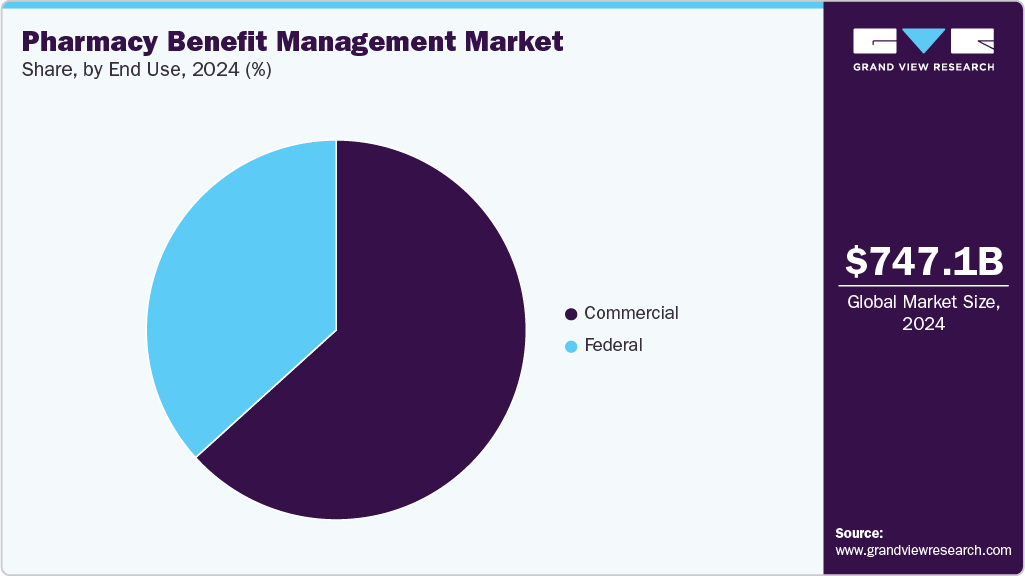

End Use Insights

The commercial segment led the market with the largest revenue share of 63.28% in 2024, due to the need for cost containment, efficient drug utilization, and enhanced healthcare outcomes for employees covered under employer-sponsored health plans. Employers are seeking PBM solutions to improve transparency in drug pricing, streamline claims processing, and offer customized benefit plans, which collectively enhance employee satisfaction and overall healthcare efficiency. The combination of cost optimization, regulatory compliance, and improved clinical outcomes continues to drive the commercial segment’s growth in the pharmacy benefit management industry.

The federal segment is expected to grow at the fastest CAGR over the forecast period, owing to government initiatives aimed at controlling healthcare costs, improving access to medications, and ensuring efficient management of prescription drug benefits for federal employees and beneficiaries. Increasing emphasis on regulatory compliance, cost containment, and transparency in drug pricing encourages federal agencies to adopt PBM services that streamline claims processing, formulary management, and utilization review. The federal segment also benefits from large-scale contracts and budget allocations, which create stable and predictable demand for PBM services.

Regional Insights

North America dominated the pharmacy benefit management market with the largest revenue share of 85.44% in 2024, owing to the escalating healthcare expenditures. This surge in spending has heightened the demand for cost-containment solutions, positioning PBMs as essential intermediaries between insurers, drug manufacturers, and pharmacies. PBMs negotiate drug prices, manage formularies, and process claims, thereby aiming to reduce overall prescription drug costs. Moreover, the expansion of employer-sponsored health plans and government programs such as Medicare Part D has increased the reliance on PBMs to manage prescription benefits efficiently. Technological advancements, including the adoption of artificial intelligence and digital tools, have further enhanced PBMs' capabilities in streamlining operations and improving patient outcomes.

U.S. Pharmacy Benefit Management Market Trends

Thepharmacy benefit management market in the U.S. is experiencing significant growth, driven by the pharmacy benefit managers' function as intermediaries between insurance providers and pharmaceutical manufacturers. As per the National Association of Insurance Commissioners, around 66 PBM companies are operating in the U.S., controlling the pharmacy benefit of more than 266 million Americans. The demand for PBM (pharmacy benefit management) services is on the rise owing to an increase in the number of insurance providers with in-house pharmacy benefit groups to manage the covered population. PBM systems lower the overall costs by combining health plans with customers to form bigger networks that enable negotiations and discounts.

Moreover, the market growth is being driven by vertical integration, especially post the two major alliances of CVS-Aetna and Cigna-Express Scripts. The supply chain dynamics are predicted to change considerably in the coming years, especially post these mergers. Partnerships of PBM organizations with health insurance companies are estimated to benefit further the growth of the market and the role of PBMs in the decision-making process. Such alliances in the market improve the affordability and personalization of health insurance plans and provide more alternatives through better alignment with healthcare professionals.

Europe Pharmacy Benefit Management Market Trends

The pharmacy benefit management market in Europe is expected to witness at the fastest CAGR during the forecast period, owing to the Rising pharmaceutical expenditures, which reached an estimated USD 42.04 billion in 2023, have heightened the need for cost-effective drug management solutions. PBMs play a crucial role in negotiating drug prices, managing formularies, and ensuring medication adherence, thereby helping to control these escalating costs. Moreover, the growing adoption of value-based care models is another significant driver. These models emphasize the quality and outcomes of care rather than the volume of services provided, aligning with PBMs' objectives of optimizing medication use and improving patient health outcomes.

The UK pharmacy benefit management market accounted for the largest market revenue share in Europe in 2024. The UK government's USD 468.46 million investment in clinical trials is a pivotal development for the pharmacy benefit management (PBM) market, as it directly addresses several challenges and opportunities within the pharmaceutical sector. This funding aims to establish 18 new commercial research delivery centres, enhancing the UK's capacity for clinical trials and expediting patient access to innovative treatments. For PBMs, this initiative offers a dual advantage, such as accelerating the introduction of new medications, enabling PBMs to negotiate more effectively with pharmaceutical companies, and potentially securing better pricing and access terms for health plans and employers. Moreover, the expansion of clinical trial infrastructure can lead to a more diverse and competitive pharmaceutical market, providing PBMs with a broader range of treatment options to manage and offer to their clients.

Oceania Pharmacy Benefit Management Market Trends

The pharmacy benefit management market in Oceania is expected to register at a considerable CAGR over the forecast period, owing to the rising healthcare costs, which are prompting both public and private sectors to seek cost-effective solutions for managing prescription drug expenses. Moreover, government healthcare reforms aimed at expanding insurance coverage and improving drug price transparency are creating a more favorable environment for PBM growth. These factors collectively contribute to the expansion of the pharmacy benefit management industry in Oceania, as stakeholders seek to optimize medication management and control rising healthcare costs.

The Australia pharmacy benefit management market isexpected to register at a significant CAGR over the forecast period. The Eighth Community Pharmacy Agreement (8CPA), signed between the Australian Government and the Pharmacy Guild of Australia, significantly influences the PBM market in Australia by introducing structural reforms aimed at reducing medication costs and enhancing service delivery. Commenced in July 2024, the 8CPA allocated a substantial USD 26.5 billion over five years to community pharmacies, encompassing USD 22.5 billion for dispensing prescriptions and USD 1.05 billion for various pharmacy services and programs. In addition, the 8CPA implements a temporary freeze on Pharmaceutical Benefits Scheme (PBS) co-payment indexation for one year for general patients and five years for concessional patients, effectively reducing out-of-pocket expenses for medications. These measures alleviate financial burdens on patients and provide community pharmacies with greater financial certainty, thereby fostering a more sustainable and efficient pharmacy sector.

Key Pharmacy Benefit Management Company Insights

The market is fragmented, with the presence of many country-level pharmacy benefit management providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Pharmacy Benefit Management Companies:

The following are the leading companies in the pharmacy benefit management market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Health

- Cigna

- Optum, Inc.

- MedImpact

- Anthem

- Change Healthcare

- Prime Therapeutics LLC

- HUB International Limited.

- Elixir Rx Solutions LLC

- Express Scripts Canada

Recent Developments

-

In April 2025, EmpiRx Health partnered with Giant Eagle, Inc., to transform pharmacy benefits management (PBM) for its employees. This collaboration introduces a clinically driven PBM model that places pharmacists at the center of care, focusing on optimizing the utilization of high-cost specialty and branded medications to control costs. The partnership also aims to establish a national network of pharmacy chains and benefits plan sponsors, working collectively to improve patient health outcomes and address the escalating issue of rising drug costs.

"At Giant Eagle, we have always been laser focused on what's best for our customers and Team Members," said Janis Leigh, Executive Vice President and Chief People Officer, Giant Eagle, Inc. "EmpiRx Health's patient-first operating approach ensures that our Team Members can receive the highest quality pharmacy benefits and care, ensuring their health and well-being and providing affordable prescription drug costs."

-

In March 2025, Northwind Pharmaceuticals partnered with Healthee to offer employers enhanced control over prescription drug costs, improved pharmacy oversight, and actionable claims insights. This collaboration combines Northwind's transparent pass-through PBM model with Healthee's comprehensive benefits navigation tools, including cost transparency, plan comparison, and telehealth services. The partnership aims to empower employers to make data-driven decisions that reduce costs and improve employee health outcomes, aligning with the shared commitment of both companies to transparency and value in healthcare.

"For years, employers have struggled with the lack of clarity and oversight in their pharmacy benefits," said CEO and Co-founder of Healthee. "With Northwind Pharmaceuticals, we are changing the benefits game - offering our clients a new level of control over their prescription drug spend and empowering them to make data-driven benefits decisions that impact their bottom line."

Pharmacy Benefit Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 810.50 billion

Revenue forecast in 2033

USD 1,726.27 billion

Growth rate

CAGR of 9.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Business model, end use, region

Regional scope

North America; Europe; Oceania; Rest of World

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Australia; New Zealand

Key companies profiled

CVS Health; Cigna; Optum, Inc.; MedImpact; Anthem; Change Healthcare; Prime Therapeutics LLC; HUB International Limited; Elixir Rx Solutions LLC; Express Scripts Canada

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmacy Benefit Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmacy benefit management market report based on business model, end-use, and region.

-

Business Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standalone PBM

-

Health Insurance Providers

-

Retail Pharmacy

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Federal

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Oceania

-

Australia

-

New Zealand

-

-

Rest of World

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.