- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Philippines Liquid Dietary Supplements Market Report, 2030GVR Report cover

![Philippines Liquid Dietary Supplements Market Size, Share & Trends Report]()

Philippines Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Type, By Application, By End-user, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-691-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Philippines Liquid Dietary Supplements Market Summary

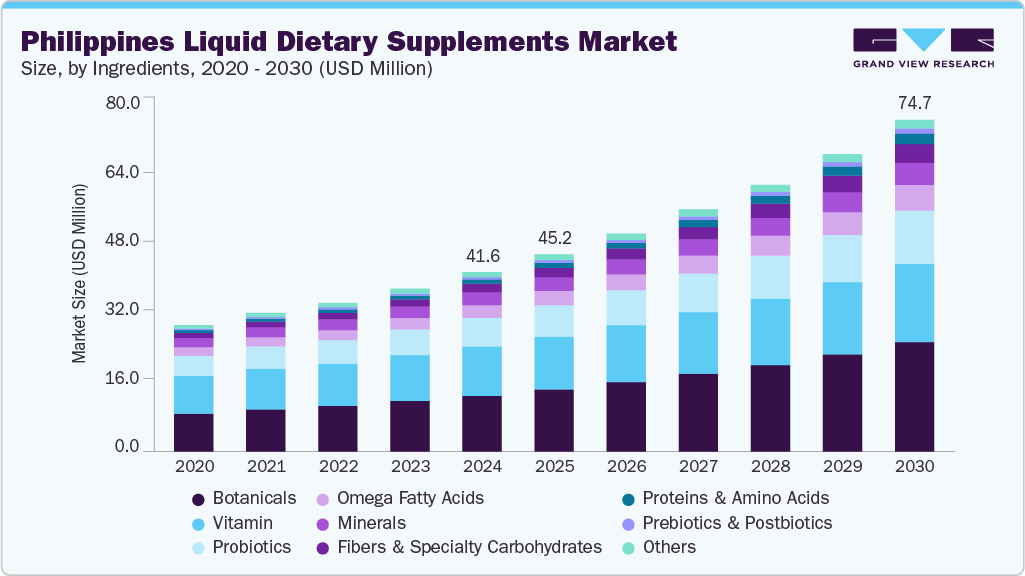

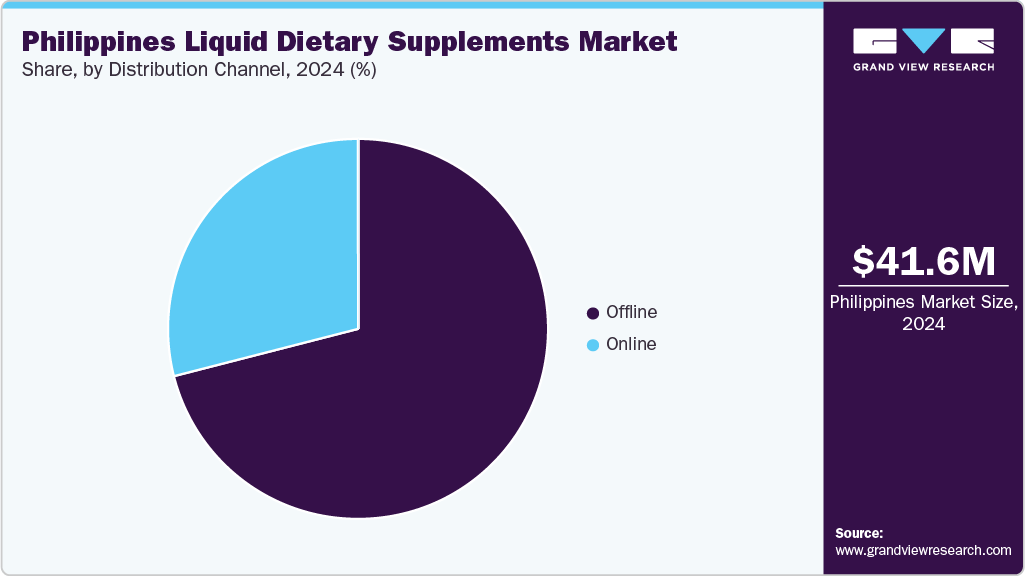

The Philippines liquid dietary supplements market size was estimated at USD 41.6 million in 2024 and is projected to reach USD 74.7 million by 2030, growing at a CAGR of 10.3% from 2025 to 2030. This growth is fueled by rising health awareness, foreign investment, and the expansion of multinational health brands.

Key Market Trends & Insights

- By ingredients, the botanicals segment held the highest market share of 31.2% in 2024

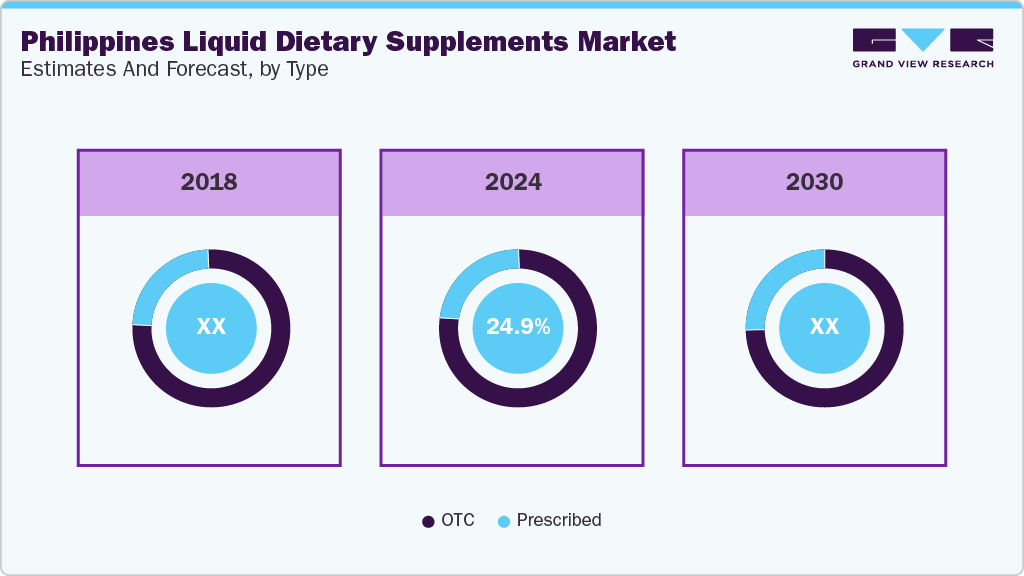

- Based on type, the OTC segment held the highest market share of 75.1% in 2024

- Based on application, the bone & joint health segment held the highest market share of 12.2% in 2024.

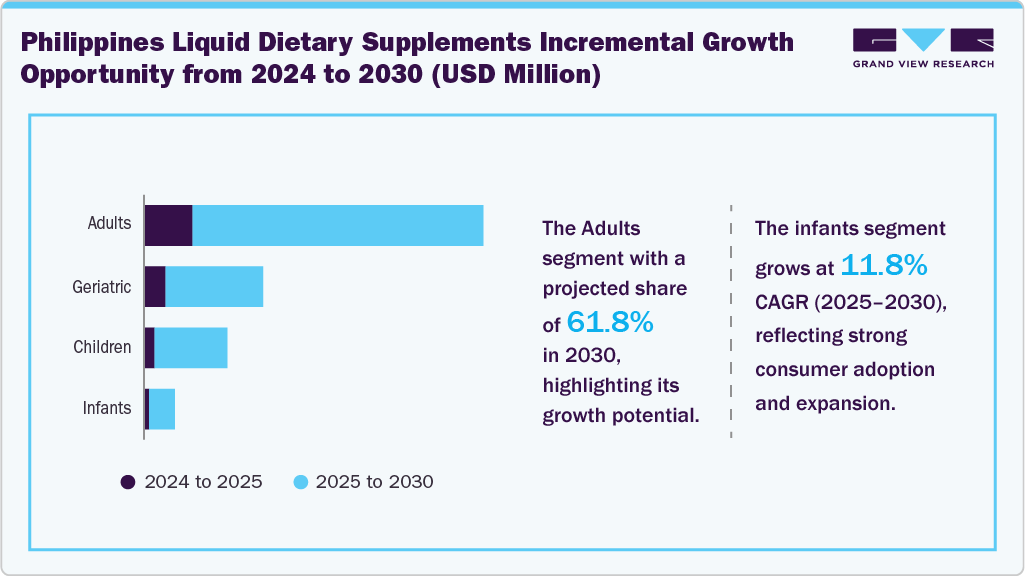

- By end user, the adult segment held the highest market share of 62.9% in 2024.

- Based on distribution channel, the offline segment held the highest market share of 70.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 41.6 Million

- 2030 Projected Market Size: USD 74.7 Million

- CAGR (2025-2030): 10.3%

As wellness-focused businesses increase, functional supplements are becoming central to market development. The Philippines liquid dietary supplements market has witnessed a significant growth. Increasing sedentary lifestyle, including remote and hybrid work models, has significantly transformed consumer behavior, creating demand for home-use dietary supplements. As employees and students are inclined towards a balance between work and health, they are looking for setups that can be adjusted for different purposes. In response to it, brands have introduced flavored, ready-to-drink formats for daily use. Moreover, awareness campaigns and digital marketing channels have played a crucial role in educating consumers about the benefits of liquid supplements in the long run.

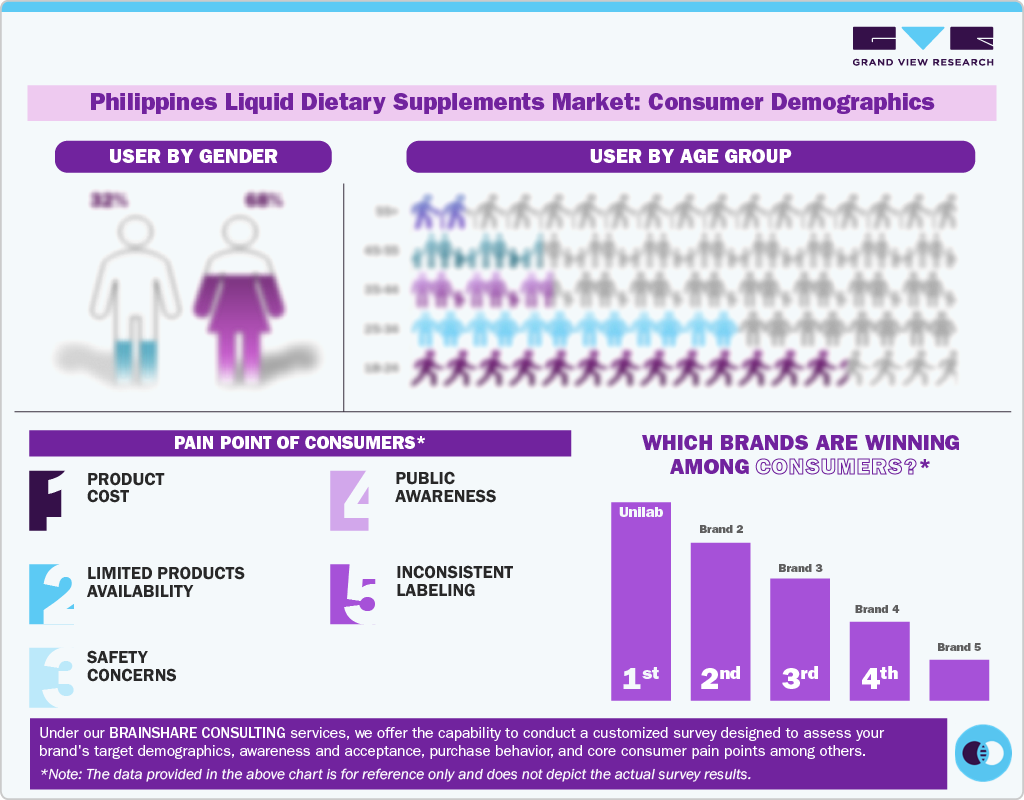

Consumer Insights

A significant population of Filipinos is becoming health-conscious, leading to a growing preference for convenient and fast-acting wellness solutions. This trend reflects a growing demand for liquid dietary supplements, which are preferred for their ease of use and faster absorption as compared to traditional dosages. In urban areas, there is a rising interest in supplements that support immunity, digestion, and skin health. Additionally, consumers prefer products that are natural and free from additives. These changing health priorities and lifestyle habits contribute to the rapid growth of the liquid dietary supplements market in the Philippines.

Recent consumer trends in the Philippines indicate a growing emphasis on preventive healthcare. Many individuals prioritize daily wellness over reactive treatments, a trend particularly evident among younger demographics and working professionals. These individuals look for convenient ways to maintain their health amid busy schedules. Liquid supplements have become increasingly popular because they fit well with on-the-go lifestyles, allowing for quick intake without needing water or food. Furthermore, the rise of social media and the influence of wellness influencers have significantly impacted consumer purchasing behavior. As a result, consumers are more inclined to try trending or endorsed liquid products.

Ingredient Insights

Botanicals dominated the market and accounted for a share of 31.2% in 2024. Increasing consumer preference for natural, plant-based dietary supplements has led to a rise in botanical-based supplements. Liquid formats facilitate better absorption and are easier to consume, particularly for individuals with digestive disorders or difficulties swallowing pills. Botanicals such as ginger, green tea, and aloevera are popular for their anti-inflammatory, antioxidant, and digestive support properties. The growing availability of these supplements through online platforms and retailers has further boosted their demand.

Proteins and amino acids are projected to grow at the fastest CAGR of 15.2% over the forecast period. The market is primarily driven by increasing health awareness and the growing popularity of fitness and active lifestyles. More Filipinos are engaged in an active lifestyle, which is driving demand for convenient and effective nutrition support, such as protein powders. Protein powder is a popular dietary supplement, especially among athletes, bodybuilders, and fitness enthusiasts, as it aids in muscle repair and growth.

Type Insights

The OTC segment dominated the market and accounted for a share of 75.1% in 2024 due to the accessibility of supplements through pharmacies, supermarkets, and online platforms. Filipinos prefer purchasing supplements, such as multivitamins, iron, zinc, and vitamin D, over the counter, which does not require a prescription. In March 2025, Sole Pharma announced its expansion in the Southeast Asian region, particularly the Philippines, to cater to the growing demand for high-quality health supplements.

The prescribed segment accounted for the highest CAGR during the forecast period. The increased emphasis on preventive healthcare and chronic disease management supports this. Professionals increasingly recommend liquid dietary supplements for nutritional deficiencies and chronic disease management. This is particularly important for elderly patients, children, and those who face difficulty swallowing pills.

Application Insights

Bone and joint health dominated the market in 2024. Liquid dietary supplements for bone and joint health are becoming increasingly popular in the Philippines. These supplements contain collagen, calcium, vitamins, and many more. These supplements help improve bone density, reduce joint inflammation, and improve mobility. Older Adults prefer liquid forms of these supplements due to their ease of use. With growing awareness of osteoporosis, arthritis and age-related mobility issues, there is an increasing demand. Moreover, the convenience of purchasing these products online through platforms such as Shopee and Lazada has increased their accessibility.

Prenatal health segment is projected to grow at the fastest CAGR of 15.5% over the forecast period. In the Philippines, liquid prenatal dietary supplements are gaining traction beyond just correcting anemia. A St. Luke’s Medical Center study in Quezon City found that 93.8% of pregnant Filipino women had low vitamin D levels, with 26.5% also developing gestational diabetes mellitus. Vitamin D-based liquid supplements, often combined with DHA, methylated folate, iron, choline, and calcium, effectively address widespread micronutrient deficiencies. Urban mothers often prefer clean-label, vegan-friendly options.

End-user Insights

Adults dominated the Philippines' liquid dietary supplements market and accounted for a share of 62.9% in 2024. Filipinos are increasingly including liquid dietary supplements as part of their daily diets. This shift is attributed to growing awareness of preventive healthcare, especially among working professionals and the aged population who seek immunity-boosting, joint health, and stress management solutions. Liquid supplements appeal to adults due to their quick absorption, which is suitable for busy lifestyles. The demand for liquid supplements enriched with vitamins, minerals, collagen, and herbal extracts continues to grow.

The infant segment is projected to grow at the fastest CAGR over the forecast period. The infant segment is an emerging market in the Philippines' liquid dietary supplements, driven by an increased focus on children’s early nutrition and immune support system. Rising awareness among Filipino parents about the importance of nutrition during the infant stage, due to various reasons such as brain development and immunity prompting a rise in the use of dietary supplements. Liquid formats are prescribed for infants due to their ease of administration, pleasant taste and fast absorption.

Distribution Channel Insights

Offline distribution channels led the market with a revenue share of 70.9% in 2024. In the Philippines, offline retail channels are essential for the liquid dietary supplements market. Major pharmacy chain stores play a significant role in this sector, particularly for adults who prefer in-person consultations and immediate access to products. Many consumers still prefer to physically inspect products, read labels, and ask questions—particularly when trying new liquid formulations.

Online distribution channels are expected to grow at the fastest CAGR over the forecast period. The e-commerce in the Philippines is increasingly popular, with online supplement sales driven by increased use of the internet and the convenience of home delivery. As more people prefer digital platforms for health-related purchases, E-commerce platforms have made these supplements more accessible, particularly to younger consumers and remote workers who are seeking health solutions without leaving their homes. Online platforms offer discounts, subscriptions, and user reviews, which play a crucial role in influencing purchasing behavior. Brands are utilizing social media influencers to enhance product visibility and build trust among consumers.

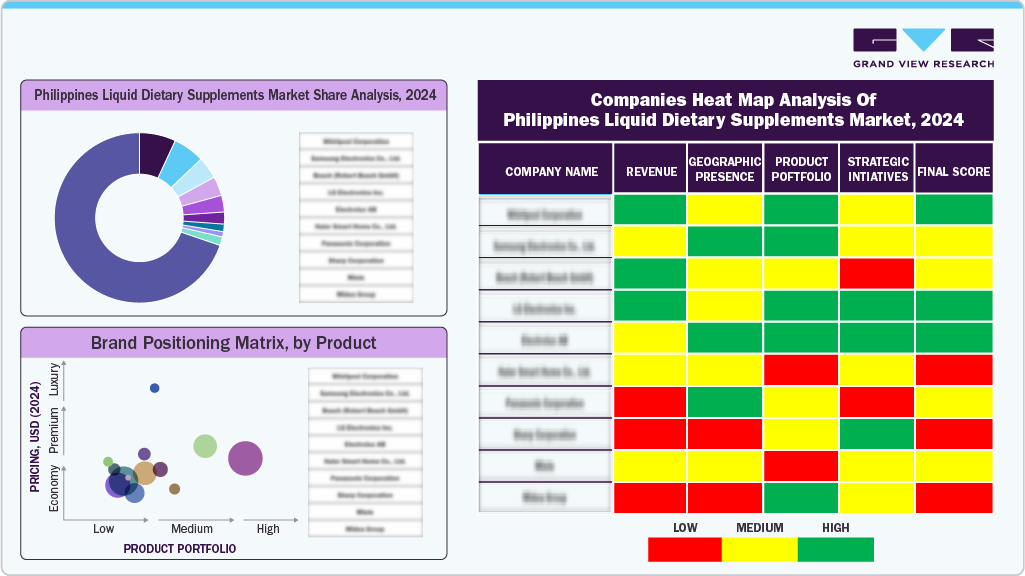

Key Philippines Liquid Dietary Supplements Company Insights

Some key companies operating in the market include Amway; Nestlé; Herbalife, Inc.; Abbott; among others.

-

Herbalife is a global nutrition company that develops and sells dietary supplements, shakes, and personal wellness products. It operates via multi-level marketing across more than 90 countries. Herbalife Philippines operates through a direct-selling model, offering a wide range of nutrition, weight management, and wellness products via independent distributors.

Key Philippines Liquid Dietary Supplements Companies:

- Amway

- Nestlé

- Herbalife, Inc.

- Abbott

Philippines Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.7 million

Revenue forecast in 2030

USD 74.7 million

Growth rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end-user, distribution channel

Country scope

Philippines

Key companies profiled

Amway; Nestlé; Herbalife, Inc.; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Philippines Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Philippines liquid dietary supplements market report based on ingredients, type, application, end-user, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.