- Home

- »

- Advanced Interior Materials

- »

-

Phosphate Rock Market Size & Share, Industry Report, 2033GVR Report cover

![Phosphate Rock Market Size, Share & Trends Report]()

Phosphate Rock Market (2026 - 2033) Size, Share & Trends Analysis Report By End-use (Fertilizers, Food Additives, Feed Additives, Electronics, Chemicals), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-281-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phosphate Rock Market Summary

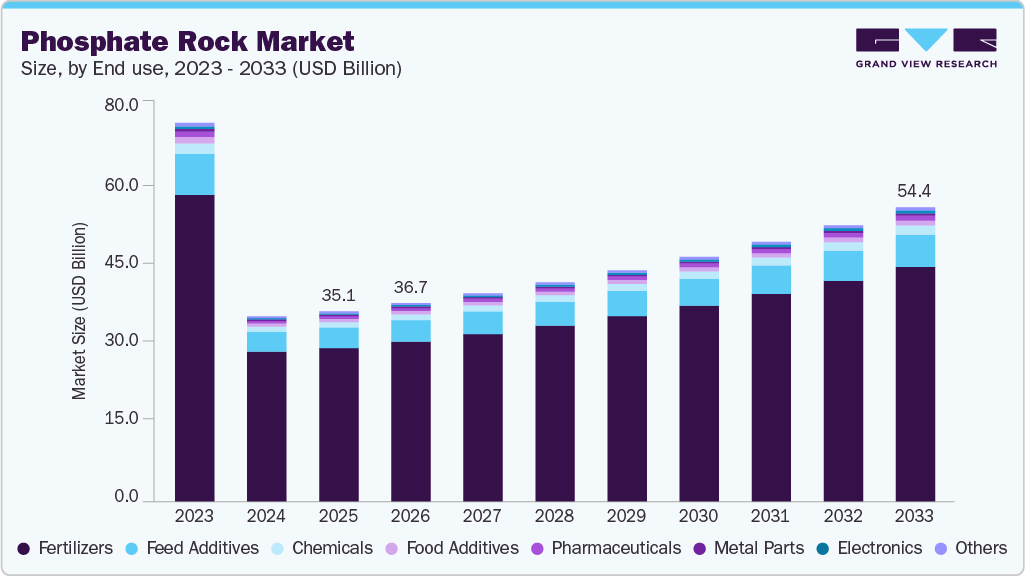

The global phosphate rock market size was estimated at USD 35.11 billion in 2025 and is projected to reach USD 54.38 billion by 2033, growing at a CAGR of 5.8% from 2026 to 2033. The market growth is primarily propelled by the non-negotiable demand for phosphorus in feeding a growing world population.

Key Market Trends & Insights

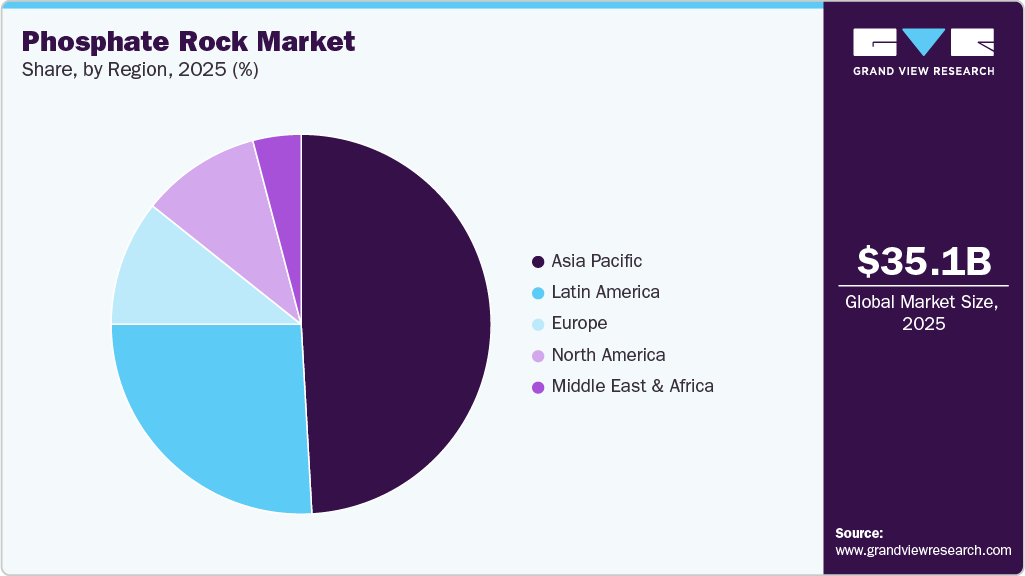

- Asia Pacific dominated the market with the largest revenue share of over 49.0% in 2025.

- China’s phosphate rock demand is mainly fueled by fertilizer use in cereals, oilseeds, vegetables.

- By end use, the fertilizers segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 35.11 Billion

- 2033 Projected Market Size: USD 54.38 Billion

- CAGR (2026-2033): 5.8%

- Asia Pacific: Largest market in 2025

Phosphate-based fertilizers are a critical component of modern agriculture, with mineral fertilizers as a whole responsible for an estimated 50% of global crop yields. This creates immense, inelastic demand, particularly in large agricultural economies. For instance, China, the world's largest producer, mined approximately 110 million metric tons of phosphate rock in 2024 to support its domestic food security and fertilizer industry. Similarly, major importers like India consume around 9-10 million tons of phosphate fertilizers (expressed as P₂O₅) annually, relying on consistent raw material imports to sustain yields for its vast population.

Geopolitical and production concentration critically shape market stability and investment. The phosphate rock industry is defined by extreme reserve concentration, with Morocco, China, the U.S., and Russia collectively controlling approximately 84% of global phosphate rock reserves according to the U.S. Geological Survey. This creates supply chain vulnerability, as seen when China imposed steep export tariffs in 2021, causing immediate global price spikes. In response, new production is coming online in other regions to diversify supply; for example, Saudi Arabia's major Ma'aden Wa'ad Al Shamal project is designed to process up to 16 million tons of ore annually, producing about 3 million tons of finished phosphate fertilizers.

Technological advancements are essential drivers for maintaining supply from lower-grade deposits and meeting environmental standards. As high-grade reserves are depleted, modern beneficiation techniques are crucial. In advanced operations, flotation and other methods can achieve phosphate recovery rates of 85-95% from mined ore. Environmental regulations also directly influence production geography and methods. In Florida, a historic production hub, annual output has declined from a peak of over 40 million tons in 1980 to recent levels of 18-20 million tons, partly due to stricter regulations, pushing capital investment toward large-scale, efficient operations in regions like Morocco's massive mining complex.

Price Trend Analysis

The average selling price of phosphate rock has been highly influenced by global supply-demand imbalances, geopolitical developments, and cost-side pressures over the past decade. While prices were largely stable in the pre-pandemic period, the post-2020 phase witnessed significant volatility driven by supply disruptions, export restrictions, and surging input costs. The sharp price spike during 2021-2023 reflects an exceptional tightening of global availability. In contrast, the subsequent correction and steady upward outlook indicate market normalization with a structurally higher price floor supported by rising production and compliance costs.

Drivers, Opportunities & Restraints

The phosphate rock market is fundamentally underpinned by the relentless growth in fertilizer demand, a direct consequence of the imperative to feed a burgeoning global population, which is projected to reach 9.7 billion by 2050 according to the UN. To meet the required 70% increase in food production, intensive agriculture reliant on fertilizer inputs is non-negotiable. Phosphate-based fertilizers, such as DAP and MAP, are irreplaceable for root development and energy transfer in plants. With approximately 85-90% of all mined phosphate rock destined for fertilizer production, this demographic and agricultural imperative creates an inelastic, long-term demand baseline for the market, ensuring consistent offtake regardless of short-term price fluctuations.

Beyond agriculture, phosphate consumption is directly engineered into the biofuel refining process itself, creating an inelastic industrial demand. In biodiesel production, phosphoric acid is a critical chemical agent used to neutralize catalysts and purify the final fuel by removing soaps and impurities. Industry technical guidelines estimate a consumption of roughly 2.5 to 3.5 kg of 85% phosphoric acid per metric ton of biodiesel produced. In ethanol fermentation, phosphate salts, primarily diammonium phosphate (DAP) or ammonium phosphate, are vital yeast nutrients that regulate metabolism and optimize yield. Standard industry practice indicates usage in the range of 0.5 to 1.0 kg of DAP per cubic meter of ethanol. Unlike fertilizer, this phosphate is largely non-recoverable, creating a direct, consumptive link between refinery output and phosphate chemical sales.

The environmental footprint of phosphate rock mining and processing is staggering. In the U.S., an estimated 1 billion tons of phosphogypsum are stored in roughly 24 active stacks in Florida, with about 30 million new tons generated annually as waste. This material is voluminous and weakly radioactive, classified as TENORM. The risks are not theoretical; in 2021, a breach at the Piney Point phosphogypsum stack prompted the emergency discharge of over 200 million gallons of nutrient-rich, process-contaminated water into Tampa Bay. While red tide algae blooms are complex, multi-factor events, scientific consensus agrees that this discharge significantly exacerbated harmful algal conditions, leading to widespread marine mortality. This incident starkly illustrates the acute local ecological damage that underpins global regulatory concern.

End Use Insights

The primary driver for phosphate rock demand within the fertilizers segment is the intensification of global agriculture, specifically the need to enhance crop yields per unit of arable land. As the total area of fertile land remains finite or even diminishes due to urbanization and degradation, reliance on phosphate-based fertilizers to maximize productivity on existing farmland becomes critical. This intensification is further propelled by dietary shifts, particularly in emerging economies, towards greater meat and dairy consumption, which substantially increases the demand for animal feed crops. Producing these resource-intensive crops necessitates heavier fertilizer application, directly driving phosphate rock consumption independent of raw population numbers.

The electronics segment's demand for phosphate rock derivatives is primarily driven by the relentless growth and innovation in semiconductor manufacturing. High-purity phosphoric acid is an essential wet-etching agent in the production of silicon-based integrated circuits (ICs). It is specifically used to selectively remove silicon nitride layers without attacking the underlying silicon dioxide, a critical step in photolithography. As semiconductor nodes shrink to 3 nanometers and below, the precision and purity of these chemicals become paramount. The global push for more advanced chips, fueled by artificial intelligence, 5G infrastructure, and high-performance computing, directly translates into sustained and growing demand for ultra-high-purity phosphoric acid, often requiring specifications with metal impurity levels in the parts-per-billion (ppb) range.

Regional Insights

The Asia Pacific phosphate rock market is a mix of major producers and import-reliant countries. China remains a leading producer, supplying both domestic and export markets, while countries such as India, Japan, and South Korea heavily depend on imports to meet their fertilizer manufacturing requirements. Trade and pricing trends in 2025 indicate tighter availability of high-quality phosphate rock in the international market, leading to slight price volatility. Australia continues to benefit from strong export demand, while India is expanding storage and blending capacities to mitigate supply risks. Import-reliant nations such as Japan and South Korea are negotiating long-term contracts to secure stable raw material availability, while also investing in research for low-phosphate and more efficient fertilizer formulations.

China’s phosphate rock market demand is primarily driven by fertilizer production for cereals, oilseeds, vegetables, and horticultural crops. Government programs promoting soil nutrient balance, sustainable agriculture, and food security reinforce consistent domestic demand. China is a major producer of phosphate rock, with mining operations concentrated in the provinces of Sichuan, Guizhou, and Yunnan. In 2025, government measures to regulate phosphate exports and control domestic prices have influenced global trade flows, prompting importers such as India to diversify sourcing.

North America Phosphate Rock Market Trends

The rising demand for fertilizers to support high-yield agriculture is the principal growth driver for phosphate rock in North America. Farmers are applying more phosphate-based fertilizers to boost crop productivity and replenish soil nutrients after intensive cropping cycles, which keeps feedstock demand for wet-process phosphoric acid and granular phosphate products high. Domestic production remains concentrated in a few states. At the same time, the region still imports significant volumes when local supply or processing capacity is constrained, thereby making it sensitive to global trade flows and price swings.

The U.S. remains one of the largest and most established markets for phosphate rock globally, driven primarily by its large-scale, input-intensive agricultural sector. Phosphate rock is a key raw material for phosphatic fertilizers, which are used extensively in the cultivation of corn, soybeans, wheat, and other major crops. On the supply side, phosphate rock production in the U.S. is supported by long-established mining operations, primarily located in Florida, North Carolina, Idaho, and Utah. Domestic production has remained relatively stable in recent years; however, growth is constrained by factors such as declining ore grades, environmental regulations, and limited expansion of economically viable reserves.

Europe Phosphate Rock Market Trends

Europe’s phosphate rock industry is largely demand-driven, with consumption closely linked to fertilizer production rather than domestic mining. Phosphate rock is a crucial input for phosphatic fertilizers used in the production of cereals, oilseeds, fruits, and vegetables, particularly in Western and Central Europe. Stringent environmental and nutrient-management regulations influence fertilizer application rates, resulting in relatively stable, yet controlled, growth in phosphate demand. Europe has very limited indigenous phosphate rock resources and remains heavily dependent on imports to meet its requirements. Imported phosphate rock and intermediates are processed by a well-established fertilizer and chemical manufacturing industry, making the region sensitive to global supply availability, pricing volatility, and geopolitical developments affecting key exporting countries.

Latin America Phosphate Rock Market Trends

Agricultural demand for phosphate rock remains the primary driver for the Latin America phosphate rock industry. Fertilizer consumption is concentrated in staple crops, such as soybeans, corn, wheat, and sugarcane, as well as horticultural products. In 2025, record harvests in Brazil and Argentina, combined with favorable commodity prices, are expected to sustain high phosphate fertilizer usage. Meanwhile, government programs in Mexico and Brazil aim to promote food security and optimize nutrient application.

Key Phosphate Rock Company Insights

Some of the key players operating in the market include Ma’aden and PhosAgro.

-

Saudi Arabian Mining Company (Ma'aden), together with its subsidiaries, operates as a mining and metals company in the Kingdom of Saudi Arabia, as well as in India, Pakistan, Bangladesh, Singapore, Korea, the United States, Europe, Australia, Brazil, Africa, and the GCC, with an international presence. The company operates through four strategic business units: the Phosphate Strategic Business Unit, the Aluminium Strategic Business Unit, the Base Metals and New Minerals Strategic Business Unit, and all other segments. It primarily mines for gold, phosphate rock, bauxite, kaolin, and magnesite, as well as copper, zinc, and silver concentrates.

-

PhosAgro, together with its subsidiaries, produces and distributes apatite concentrate and mineral fertilizers in Russia and internationally. The company offers nitrogen fertilizers, nitrogen-phosphorus fertilizers, complex fertilizers with microelements, and water-soluble and liquid complex fertilizers. Additionally, it provides urea, diammonium phosphate, monoammonium phosphate, ammonium nitrate, ammonium polyphosphate, and monoammonium phosphate fertilizers.

Key Phosphate Rock Companies:

The following are the leading companies in the phosphate rock market. These companies collectively hold the largest market share and dictate industry trends.

- Guizhou Kailin Holdings (Group) Co., Ltd.

- Hubei Xingfa Chemicals

- Ma’aden

- Misr Phosphate Company

- OCP SA (Group)

- PhosAgro

- The Mosaic Company

- Wengfu Group

- Yunnan Phosphate Haikou Co., Ltd. (YPH)

- Yuntianhua Group Co., Ltd

Recent Developments

-

In November 2025, Hubei Xingfa Chemicals commissioned upgraded phosphate chemical and industrial phosphoric acid production lines as part of its capacity optimization program. The expansion strengthens Xingfa’s position in phosphate intermediates used for fertilizers and industrial applications. It also improves operational efficiency and product quality while supporting growing domestic demand.

-

In November 2024, PhosAgro expanded its fertilizer distribution and logistics infrastructure to improve market reach and service efficiency. The investment focused on strengthening downstream delivery capabilities for phosphate fertilizers. This expansion supports higher sales volumes and improved customer access across key regions.

Phosphate Rock Market Report Scope

Report Attribute

Details

Market definition

The market represents the total consumption of phosphate rock in various end uses.

Market size value in 2026

USD 36.67 billion

Revenue forecast in 2033

USD 54.38 billion

Growth rate

CAGR of 5.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD billion, volume in million tons, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, key factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; Egypt; Morocco; Jordan; Tunisia

Key companies profiled

Guizhou Kailin Holdings (Group) Co., Ltd.; Hubei Xingfa Chemicals; Ma’aden; Misr Phosphate Company; OCP SA (Group); PhosAgro; The Mosaic Company; Wengfu Group; Yunnan Phosphate Haikou Co., Ltd. (YPH); Yuntianhua Group Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phosphate Rock Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global phosphate rock market report based on end use, and region:

-

End Use Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Fertilizers

-

Food Additives

-

Feed Additives

-

Pharmaceuticals

-

Electronics

-

Chemicals

-

Metal Parts

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Russia

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Egypt

-

Morocco

-

South Africa

-

Tunisia

-

Jordan

-

-

Frequently Asked Questions About This Report

b. The global phosphate rock market size was estimated at USD 35.11 billion in 2025 and is expected to reach USD 36.67 billion in 2026.

b. The global phosphate rock market is expected to grow at a compound annual growth rate of 5.8% from 2026 to 2033 to reach USD 54.38 billion by 2033.

b. The fertilizers segment dominated the phosphate rock market with a revenue share of nearly 80% in 2025.

b. Some of the key vendors of the global phosphate rock market are Guizhou Kailin Holdings (Group) Co., Ltd., Hubei Xingfa Chemicals, Ma’aden, Misr Phosphate Company, OCP SA (Group), PhosAgro, The Mosaic Company, Wengfu Group, Yunnan Phosphate Haikou Co., Ltd. (YPH), Yuntianhua Group Co., Ltd., among others.

b. The key factors that are driving the phosphate rock market include rising global demand for phosphate fertilizers to support agricultural productivity, population growth increasing food consumption, expansion of intensive farming practices, limited availability of high quality arable land, growing use of phosphate based chemicals in industrial applications, and sustained investment in mining and beneficiation capacities across major producing regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.