- Home

- »

- Electronic Devices

- »

-

Photonics Market Size And Share, Industry Report, 2030GVR Report cover

![Photonics Market Size, Share & Trends Report]()

Photonics Market (2025 - 2030) Size, Share & Trends Analysis Report By Products (Waveguides, Optical Modulators, Optical Interconnects, LED, Lasers), By Application (Consumer Electronics, Displays, Communication, Metrology), By Region, And Segment Forecasts

- Report ID: 978-1-68038-997-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Photonics Market Summary

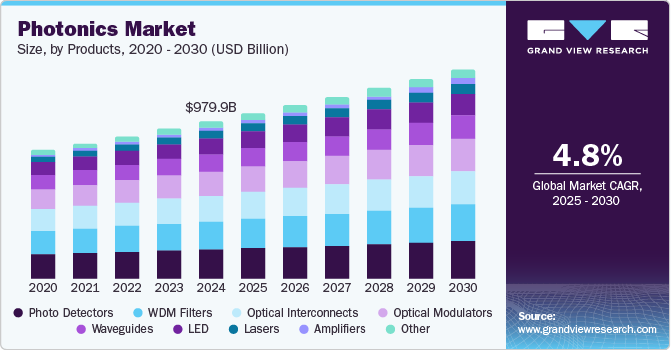

The global photonics market size was estimated at USD 979.90 billion in 2024 and is projected to reach USD 1301.49 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The rapid advancement of technology in sectors such as telecommunications, healthcare, and manufacturing has significantly boosted the demand for photonic applications.

Key Market Trends & Insights

- The North America photonics market dominated the global market with a revenue share of 35.5% in 2024.

- The U.S. photonics market dominated the regional market in 2024.

- By products, the photo detectors segment dominated the market with a revenue share of 18.8% in 2024.

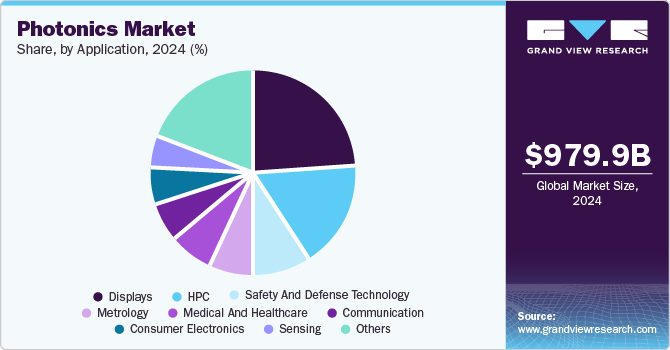

- By application, the display segment dominated the market with the highest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 979.90 Billion

- 2030 Projected Market Size: USD 1301.49 Billion

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as laser technologies and optical sensors are becoming integral to modern systems, enhancing efficiency and performance across various industries. In addition, the increasing need for high-speed data transmission, driven by the expansion of cloud services and the proliferation of internet-connected devices, is propelling market growth.

The ongoing advancements in laser technology and optical sensors are anticipated to enhance applications in fields such as autonomous vehicles and renewable energy solutions. For instance, researchers at CEA-LETI have developed microelectromechanical systems (MEMS) for optical beam steering, enhancing scanning rates and precision. This innovation is crucial for self-driving cars, which rely on accurate environmental mapping to ensure safety and performance. Moreover, government investments in research and development are likely to stimulate innovation within the photonics industry, particularly in high-performance computing and quantum technologies.

Moreover, the rising adoption of 5G technology worldwide necessitates robust infrastructure for high-speed communication networks. This trend is particularly pronounced in developing countries, where investments in telecommunications infrastructure are accelerating. The integration of photonics in various industries to meet these demands will create new growth opportunities. Furthermore, as industries increasingly recognize the benefits of photonic technologies for enhancing efficiency and reducing energy consumption, demand is expected to rise across multiple sectors.

Products Insights

The photo detectors segment dominated the market with a revenue share of 18.8% in 2024. This dominance can be attributed to the growing demand for efficient light detection technologies across various applications, including telecommunications, consumer electronics, and industrial automation. The increasing reliance on optical communication systems, where photo detectors play a crucial role in converting light signals into electrical signals, has significantly boosted their market presence. As industries continue to adopt advanced photonics solutions, the need for high-performance photo detectors is expected to remain robust.

The amplifiers segment is projected to grow at the highest CAGR during the forecast period. This rapid expansion is driven by the rising demand for optical amplifiers in telecommunications networks, particularly with the rollout of 5G technology. As data transmission speed increases and network infrastructures evolve, optical amplifiers become essential for maintaining signal integrity over long distances. The ongoing advancements in amplifier technologies, such as semiconductor optical and fiber amplifiers, are also contributing to this segment's growth within the photonics industry. For instance, a group of researchers in Japan achieved a new internet speed record of 402 Tbps using commercially available optical fiber. The researchers combined various amplification technologies, including six types of doped fiber optical amplifiers and both distributed and discrete Raman amplification, to reach this speed.

Application Insights

The display segment dominated the market with the highest share in 2024, reflecting a robust demand for high-quality visual technologies. Innovations in display technologies, including organic light-emitting diodes (OLEDs) and liquid crystal displays (LCDs), have enhanced consumer electronics and industrial applications. The increasing integration of photonics in display systems allows for improved energy efficiency and superior image quality, further solidifying this segment's dominance. As consumer preferences shift towards more immersive visual experiences, the displays segment is expected to continue thriving.

The medical and healthcare segment is anticipated to grow at the fastest CAGR over the forecast period due to advancements in diagnostic and therapeutic technologies that utilize photonics. Clinical studies have shown that photodynamic therapy (PDT) can be curative, especially for early-stage tumors. It has the potential to extend survival in cases of inoperable cancers and significantly enhance patients' quality of life. Applications such as laser surgery, optical imaging, and phototherapy are gaining traction as healthcare providers seek more effective treatment options. The increasing focus on minimally invasive procedures and early disease detection is driving investments in photonic solutions within the healthcare sector. As a result, this segment will likely play a pivotal role in shaping the future landscape of the photonics industry.

Regional Insights

The North America photonics market dominated the global market with a revenue share of 35.5% in 2024, driven by the region's strong technological infrastructure and extensive investment in research and development. The presence of major technology companies and research institutions fosters innovation and accelerates the adoption of photonics technologies across various sectors, including telecommunications, healthcare, and manufacturing. In addition, the growing demand for high-speed data communication solutions and advanced imaging systems has further solidified North America's leadership position in the photonics industry.

U.S. Photonics Market Trends

The U.S. photonics market dominated the regional market in 2024, benefiting from government funding and private sector investments in advancing laser technologies and optical systems. Initiatives such as the American Institute of Manufacturing Photonics have bolstered R&D efforts, facilitating the development of cutting-edge applications in the defense and healthcare sectors. Furthermore, the growing need for efficient data processing and transmission in large-scale data centers underscores the critical role of photonics technologies in supporting high-speed communication networks.

Europe Photonics Market Trends

The Europe photonics market is expected to grow at a significant CAGR during the forecast period, driven by advancements in laser-based manufacturing and the demand for energy-efficient solutions, particularly in the LED sector. The region is a leader in developing innovative laser products that enhance manufacturing processes and support renewable energy initiatives, such as wind power and photovoltaic cells. Key countries, including Germany, Switzerland, and Poland, are at the forefront of this growth, with notable progress in micro-optics and smart lighting technologies.

Asia Pacific Photonics Market Trends

The Asia Pacific photonics market is anticipated to grow at the highest CAGR during the forecast period, driven by rapid technological advancements and increasing investments in research and development. This region is witnessing significant innovations in laser technologies, optical sensors, and display systems, which are enhancing productivity and efficiency across various industries. The growing adoption of smart technologies and automation further fuels demand for photonic applications, positioning Asia Pacific as one of the key players in the global photonics industry.

China photonics market dominated the regional market in 2024, establishing itself as a global leader in optoelectronics and photonic technologies. The country has made substantial investments in research and development, particularly within its Optics Valley, which hosts numerous high-tech enterprises specializing in fiber optics and optoelectronics. China's strategic focus on developing a self-sufficient photonics industry is evident through significant funding for innovative projects and partnerships with commercial enterprises.

Key Photonics Company Insights

The photonics market includes several notable companies contributing to its diverse applications and innovations. 3SP TECHNOLOGIES S.A.S. specializes in advanced semiconductor lasers, enhancing capabilities in telecommunications and industrial sectors. Coherent Corp. focuses on laser-based solutions for various applications, including materials processing and life sciences. Hamamatsu Photonics is recognized for its expertise in photodetectors and imaging technologies, which play a crucial role in medical diagnostics and environmental monitoring.

-

Coherent Corp. specializes in laser-based solutions for various applications, including materials processing, life sciences, and telecommunications. The company focuses on developing advanced technologies that enhance the efficiency and performance of photonic systems. Coherent's product portfolio includes high-performance lasers and optical components designed to meet the growing demands of various industries, particularly in data communication and manufacturing processes.

-

Hamamatsu Photonics K.K. is a manufacturer specializing in optical sensors, light sources, and various photonic devices used in scientific, technical, and medical applications. The company produces many products, including photomultiplier tubes, imaging equipment, and optical semiconductor elements. Hamamatsu's innovations play a significant role in advancing technologies within the photonics market, particularly in areas such as medical diagnostics and environmental monitoring.

Key Photonics Companies:

The following are the leading companies in the photonics market. These companies collectively hold the largest market share and dictate industry trends.

- 3SP TECHNOLOGIES S.A.S.

- Coherent Corp.

- Hamamatsu Photonics K.K.

- TRUMPF

- Lumentum Operations LLC

- Infinera Corporation

- INNOLUME

- IPG Photonics Corporation

- Cisco Systems, Inc.

- Luna Innovations Incorporated

Recent Development

-

In March 2024, VLC Photonics, a subsidiary of Hitachi specializing in integrated photonics services, announced a strategic partnership with OpenLight, a company specializing in custom PASIC chip manufacturing and design. This collaboration allows VLC Photonics to enhance its design and testing services by incorporating the OpenLight Process Design Kit (PDK). As a result, VLC can support a larger number of designs simultaneously on the Tower Semiconductor PH18DA process, accelerating the development of Photonic Integrated Circuits (PICs) and advancing the silicon photonics industry across various applications.

-

In July 2023, Celestial AI announced the successful completion of a Series B funding round, raising USD 100 million for its innovative Photonic Fabric technology platform. This funding was led by Koch Disruptive Technologies (KDT), IAG Capital Partners, and Temasek’s Xora Innovation fund, with participation from notable investors such as Samsung Catalyst, Smart Global Holdings, and Porsche Automobil Holding SE. The Photonic Fabric platform is designed to significantly enhance optical connectivity performance, positioning it as a leading solution in the photonics market.

Photonics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1028.81 billion

Revenue forecast in 2030

USD 1301.49 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA;South Africa

Key companies profiled

3SP TECHNOLOGIES S.A.S. ; Coherent Corp.; Hamamatsu Photonics K.K.; TRUMPF; Lumentum Operations LLC; Infinera Corporation; INNOLUME; IPG Photonics Corporation; Cisco Systems, Inc.; Luna Innovations Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Photonics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global photonics market report based on products, application, and region:

-

Products Outlook (Revenue, USD Billion, 2018 - 2030)

-

Waveguides

-

Optical Modulators

-

Optical Interconnects

-

LED

-

WDM Filters

-

Photo Detectors

-

Lasers

-

Amplifiers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Displays

-

Safety and Defense Technology

-

Communication

-

Metrology

-

Sensing

-

Medical and Healthcare

-

HPC

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.