- Home

- »

- Plastics, Polymers & Resins

- »

-

Photopolymers Market Size & Share, Industry Report, 2033GVR Report cover

![Photopolymers Market Size, Share & Trends Report]()

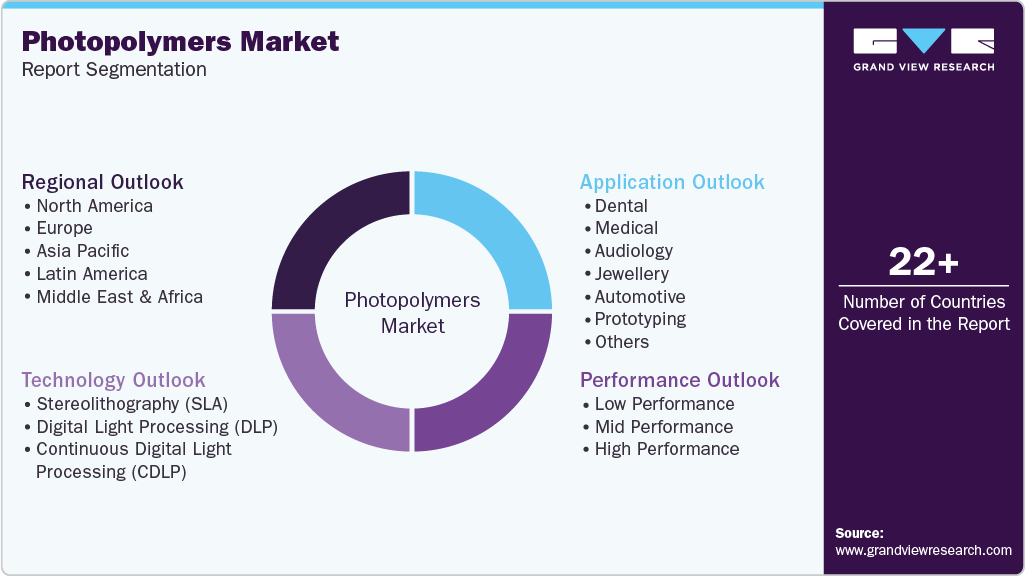

Photopolymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Performance (Low, Mid, High), By Technology (SLA, DLP, cDLP), By Application (Dental, Medical, Audiology, Jewellery), By Region and Segment Forecasts

- Report ID: GVR-4-68040-123-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Photopolymers Market Summary

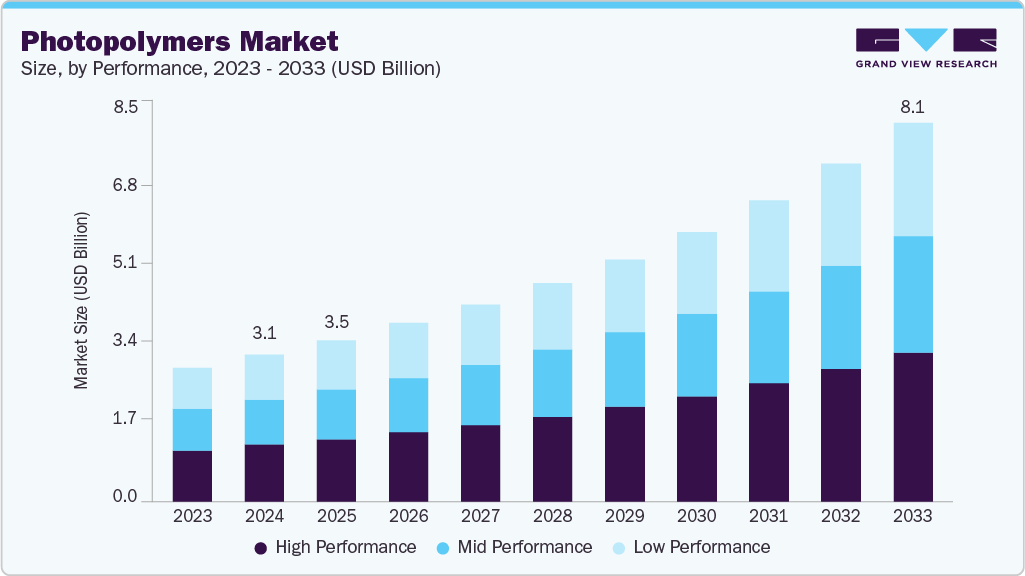

The global photopolymers market size was estimated at USD 3.14 billion in 2024 and is projected to reach USD 8.11 billion by 2033, growing at a CAGR of 11.3% from 2025 to 2033. The growth of the market can be attributed to increasing utilization of high-speed printing, durable complex 3D printed objects, along with design precision are anticipated to propel the demand for the market.

Key Market Trends & Insights

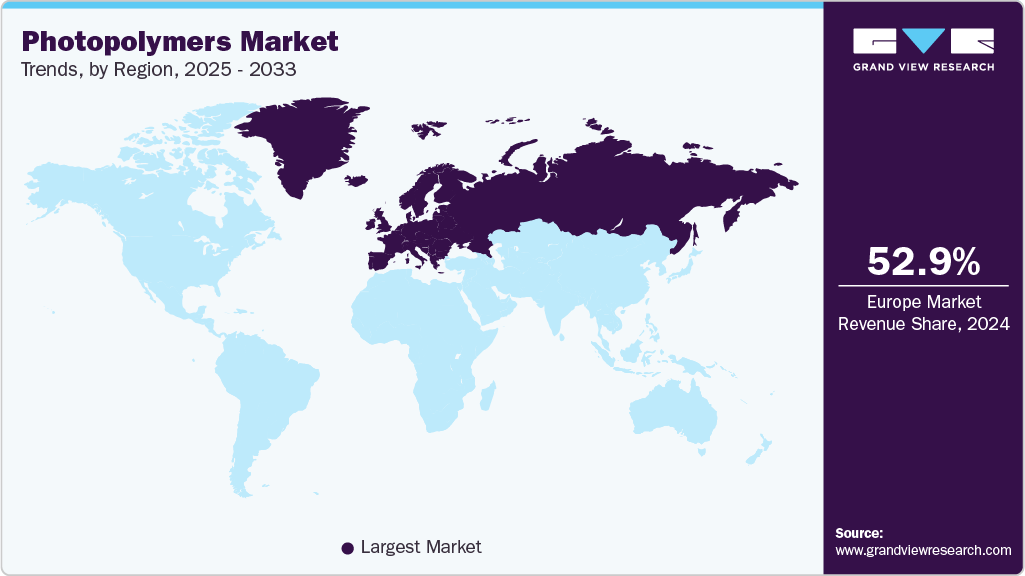

- Europe dominated the photopolymers market with the largest revenue share of 52.91%in 2024.

- The photopolymers market in Germany is expected to grow at a fastest CAGR of 12.0% from 2025 to 2033.

- By performance, the high performance segment is expected to grow at a fastest CAGR of 11.5% from 2025 to 2033 in terms of revenue.

- By technology, the stereolithography (SLA) segment is expected to grow at a fastest CAGR of 11.0% from 2025 to 2033 in terms of revenue.

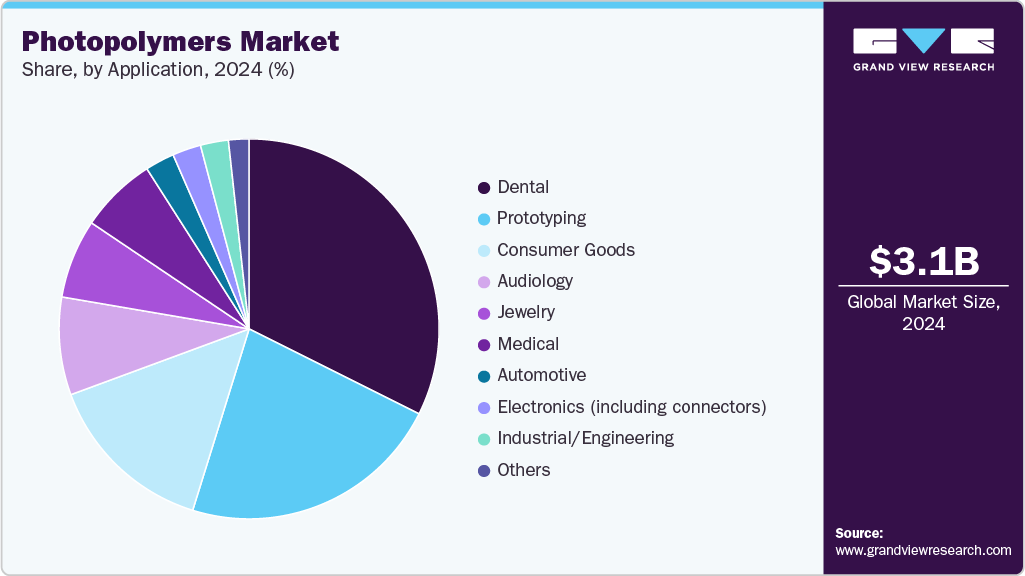

- By application, the dental segment is expected to grow at a fastest CAGR of 11.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.14 billion

- 2033 Projected Market Size: USD 8.11 billion

- CAGR (2025-2033): 11.3%

- Europe: Largest market in 2024

Rising demand for prototyping across automotive industry and designs for understanding complex surgical procedures have increased the demand for photopolymer for 3D printing. Furthermore, increasing demand for artificial jewelry and prosthetics across the global population are further propelling the market growth. The U.S. dominated photopolymers market in North America in 2024 owing to the rising demand for photopolymers from the automotive industry in the country. Original equipment manufacturers (OEMs) in the U.S. are focusing on upgrading traditional prototyping and component-developing methods.

The requirement for manufacturing automotive components such as high-performance components at a large scale, ensuring an abundant supply of spare parts using 3D printing, and easing general component manufacturing is anticipated to propel the demand for photopolymers used for 3D printing of components across the U.S. during the forecast period.

Drivers, Opportunities & Restraints

A key driver of the photopolymers market is the growing demand for sustainable and eco-friendly printing solutions across multiple industries. Photopolymers offer low solvent content, reduced volatile organic compound emissions, and the potential for recyclability, making them attractive for companies aiming to meet environmental standards. Additionally, the rising complexity of packaging designs and the need for intricate patterns in high-end product labeling are fueling the shift toward photopolymers, which provide high fidelity and durability in printed materials.

Emerging applications in healthcare, electronics, and biomedical devices present a significant growth opportunity for the photopolymers market. With increasing demand for biocompatible materials, microfluidic devices, and printed circuit boards, photopolymers can serve as critical materials due to their precision molding capabilities and light-sensitive properties. Expanding research in 3D printing and additive manufacturing further enhances the potential for photopolymers to penetrate niche segments, where conventional materials often fall short in meeting accuracy, customization, and material performance requirements.

High production costs and complex formulation processes pose a notable restraint for the photopolymers market. The requirement for specialized raw materials, stringent quality control, and advanced curing technologies increases capital investment and operational expenses. Additionally, limited awareness and technical expertise among smaller end-users can slow adoption, particularly in emerging economies where conventional printing and molding solutions remain more cost-effective, thereby restricting broader market penetration.

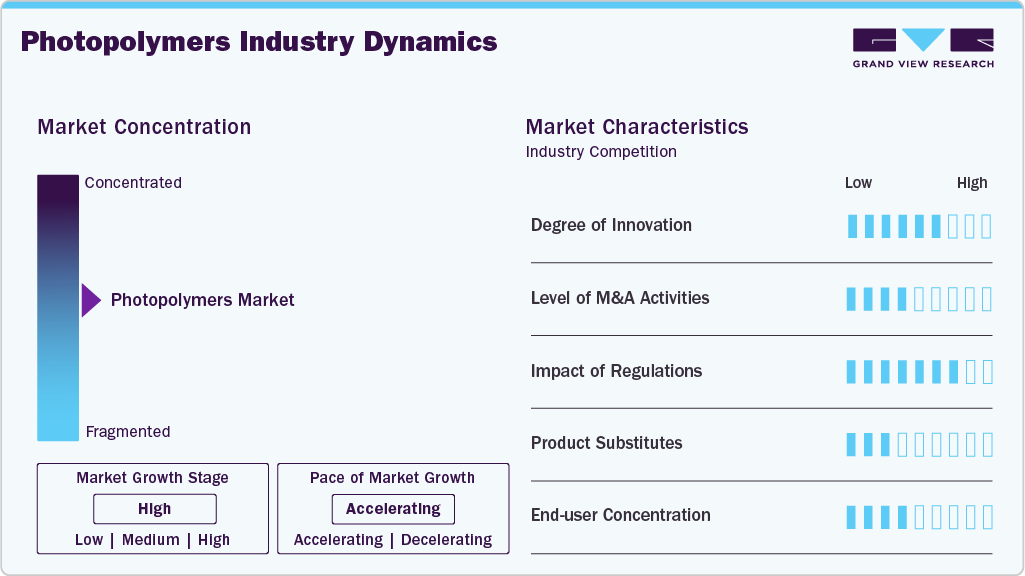

Market Concentration & Characteristics

The market growth stage of the photopolymers market is high, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies like Henkel AG & Co. KGaA, Arkema, Stratasys, BASF SE, Keystone Industries, Formlabs, Carbon, Inc., Evonik Industries AG, Liqcreate, ANYCUBIC Technology Co., Ltd., RAHN AG, polySpectra, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The photopolymers market faces moderate pressure from alternative materials such as traditional thermoplastics, epoxy resins, and UV-curable inks that can fulfill similar functional requirements in certain applications. While substitutes often offer lower costs, they generally lack the high-resolution printing capability and precision molding advantages inherent to photopolymers. Companies seeking performance-critical or highly customized outputs continue to favor photopolymers, though price-sensitive segments may temporarily shift toward conventional materials, influencing market adoption patterns.

Regulatory frameworks concerning chemical safety, environmental compliance, and biocompatibility significantly influence the photopolymers market. Stricter standards on VOC emissions, hazardous substances, and medical-grade material certifications drive manufacturers to innovate safer and more sustainable formulations. Compliance with these regulations not only adds operational complexity but also creates a competitive advantage for companies that can deliver certified, high-performance photopolymers, reinforcing trust among end-users in critical applications like healthcare and electronics.

Performance Insights

High Performance dominated the photopolymers market across the performance segmentation in terms of revenue, accounting for a market share of 38.55% in 2024. The high-performance 3D printing refers to technologies that offer exceptional capabilities in terms of high speed, precision, material options, and the highest print quality. These high-performance 3D printing technologies include selective laser melting (SLM), electron beam melting (EBM), continuous liquid interface production (CLIP), and multi-material 3D printing.

The Mid Performance segment is anticipated to grow at a substantial CAGR of 11.2% through the forecast period. Mid-performance 3D printing refers to technologies that can balance affordability and performance. These technologies include Digital Light Processing (DLP), Multi Jet Fusion (MJF), Poly Jet, and Bound Metal Deposition (BMD) by Desktop Metal, which can provide decent printing speed, accuracy, and material options without reaching the highest levels of performance in advanced or industrial-grade systems.

Technology Insights

Stereolithography (SLA) dominated the photopolymers market across the technology segmentation in terms of revenue, accounting for a market share of 57.01% in 2024. SLA is the most commonly used 3D printing technology across the world. It utilizes laser light sources to carry out 3D printing of objects. The global demand for SLA-based 3D printing has rapidly increased in recent years owing to its ability to print 25-300-micron components at a high XY resolution utilizing plastic resins and photopolymers.

The Digital Light Processing (DLP) segment is anticipated to grow at a substantial CAGR of 10.4% through the forecast period. DLP photopolymer technology is gaining traction due to its high-speed production capabilities, making it ideal for small-batch manufacturing and rapid prototyping. By projecting light across entire layers simultaneously, DLP reduces print time without compromising resolution, which is particularly valuable for industries focused on short lead times and agile product development. The technology’s adaptability to both functional and aesthetic applications is encouraging companies to integrate DLP into their production workflows, driving its growth in competitive markets.

Application Insights

Dental dominated the photopolymers market across the application segmentation in terms of revenue, accounting for a market share of 32.38% in 2024, and is forecasted to grow at 11.2% CAGR from 2025 to 2033. The photopolymers in 3D printing across the dental industry have witnessed a rise in demand in the past few years on account of their benefits, such as high-quality molds, perfect & precise designs, smoother surfaces, and higher durability, in comparison to the traditional process of manufacturing molds using thermoforming.

The prototyping segment is expected to expand at a substantial CAGR of 10.9% through the forecast period. Prototyping applications drive the photopolymers market as industries increasingly prioritize rapid product development and design iteration. Photopolymers enable engineers and designers to quickly fabricate complex geometries with high dimensional accuracy, allowing for early-stage testing and validation. The push for shorter time-to-market and reduced development costs in sectors such as automotive, consumer electronics, and industrial equipment underlines the strategic importance of photopolymers in prototyping workflows.

Regional Insights

Europe held the largest share of 52.91% in terms of revenue of the photopolymers market in 2024 and is expected to grow at the fastest CAGR of 11.6% over the forecast period. The photopolymers market in Europe is being driven by the region’s strong focus on sustainable manufacturing and eco-friendly printing solutions. Companies are increasingly adopting photopolymers due to their low solvent content, recyclability, and compatibility with UV and LED curing technologies. Growth is particularly fueled by demand from the packaging and labeling industries, where stringent environmental regulations and brand emphasis on sustainable packaging are pushing the shift from conventional inks and resins to advanced photopolymers.

North America Photopolymers Market Trends

In North America, the photopolymers market is propelled by the growing adoption of 3D printing in healthcare, electronics, and aerospace applications. The region’s investment in research and development for photopolymer formulations tailored for medical devices, surgical guides, and microfluidics is significant. Additionally, the focus on reducing lead times and achieving high-resolution, durable prints across industrial sectors is accelerating the integration of photopolymers into production and prototyping workflows.

U.S. Photopolymers Market Trends

The U.S. photopolymers market benefits from increasing demand for personalized and on-demand manufacturing solutions, particularly in healthcare, dental, and consumer electronics sectors. Advanced digital printing and additive manufacturing adoption are expanding the use of photopolymers in creating patient-specific medical components and high-precision prototypes. Moreover, the U.S. market is supported by a strong ecosystem of photopolymer suppliers and end-users focused on innovation, which encourages the development of specialized, high-performance resin solutions.

Asia Pacific Photopolymers Market Trends

The Asia Pacific photopolymers market is driven by rapid industrialization, expanding electronics and automotive sectors, and the growing adoption of additive manufacturing technologies. Countries such as China, Japan, and South Korea are increasingly utilizing photopolymers for high-resolution printing, flexible packaging, and precision prototyping. Additionally, rising demand from medical and dental applications in the region, coupled with cost advantages in manufacturing and material production, is fueling significant growth opportunities for photopolymer suppliers.

The Germany photopolymers market is primarily driven by the country’s advanced industrial and automotive sectors, which demand high-precision, durable components for prototyping and end-use applications. The strong presence of additive manufacturing facilities and innovation hubs focused on Industry 4.0 initiatives encourages the adoption of SLA and DLP-based photopolymer solutions. German manufacturers are leveraging photopolymers for rapid prototyping, tooling, and functional parts, reflecting the nation’s emphasis on quality, precision, and technological competitiveness.

Key Photopolymers Company Insights

The Photopolymers Market is highly competitive, with several key players dominating the landscape. Major companies include Henkel AG & Co. KGaA, Arkema, Stratasys, BASF SE, Keystone Industries, Formlabs, Carbon, Inc., Evonik Industries AG, Liqcreate, ANYCUBIC Technology Co., Ltd., RAHN AG, polySpectra. The photopolymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Photopolymers Companies:

The following are the leading companies in the photopolymers market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- Arkema

- Stratasys

- BASF SE

- Keystone Industries

- Formlabs

- Carbon, Inc.

- Evonik Industries AG

- Liqcreate

- ANYCUBIC Technology Co., Ltd.

- RAHN AG

- polySpectra

Recent Developments

-

In April 2025, polySpectra and Tethon 3D jointly launched ThOR 10, a new composite photopolymer resin engineered for industrial 3D printing. ThOR 10 combined polySpectra’s thermally stable, impact-resistant Cyclic Olefin Resin (COR) with Tethon 3D’s ceramic fillers to create a highly rugged material with improved impact strength and stiffness.

-

In April 2023, Henkel launched a new high-performance photopolymer resin called Loctite 3D IND249 for industrial 3D printing. The resin featured high stiffness, high temperature resistance, and strong mechanical properties, making it ideal for production applications like mold tooling and manufacturing aids.

Photopolymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.45 billion

Revenue forecast in 2033

USD 8.11 billion

Growth rate

CAGR of 11.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Performance, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Austria; UK; France; Spain; Italy; Netherlands; Belgium; China; Australia; South Korea; Southeast Asia; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Henkel AG & Co. KGaA; Arkema; Stratasys; BASF SE; Keystone Industries; Formlabs; Carbon, Inc.; Evonik Industries AG; Liqcreate; ANYCUBIC Technology Co., Ltd.; RAHN AG; polySpectra

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Photopolymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global photopolymers market report on the basis of performance, technology, application, and region:

-

Performance Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

Low Performance

-

Mid Performance

-

High Performance

-

-

Technology Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

Stereolithography (SLA)

-

Digital Light Processing (DLP)

-

Continuous Digital Light Processing (CDLP)

-

-

Application Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

Dental

-

Medical

-

Audiology

-

Jewellery

-

Automotive

-

Prototyping

-

Industrial/Engineering

-

Electronics (including connectors)

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Austria

-

UK

-

France

-

Spain

-

Italy

-

The Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

Australia

-

South Korea

-

Southeast Asia

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global photopolymers market size was estimated at USD 3.14 billion in 2024 and is expected to reach USD 3.45 billion in 2025.

b. The global photopolymers market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2033 to reach USD 8.11 billion by 2033.

b. High Performance dominated the photopolymers market across the performance segmentation in terms of revenue, accounting for a market share of 38.55% in 2024 and is forecasted to grow at 11.5% CAGR from 2025 to 2033.

b. Some key players operating in the photopolymers market include Henkel AG & Co. KGaA, Arkema, Stratasys, BASF SE, Keystone Industries, Formlabs, Carbon, Inc., Evonik Industries AG, Liqcreate, ANYCUBIC Technology Co., Ltd., RAHN AG, and polySpectra.

b. The growth of the market can be attributed to increasing utilization of high-speed printing, durable complex 3D printed objects, along with design precision are anticipated to propel the demand for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.