- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Resin Market Size & Share, Industry Report, 2033GVR Report cover

![Plastic Resin Market Size, Share & Trends Report]()

Plastic Resin Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Crystalline, Non-crystalline, Engineering Plastic, Super Engineering Plastic), By Application (Packaging, Automotive, Construction, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-877-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Resin Market Summary

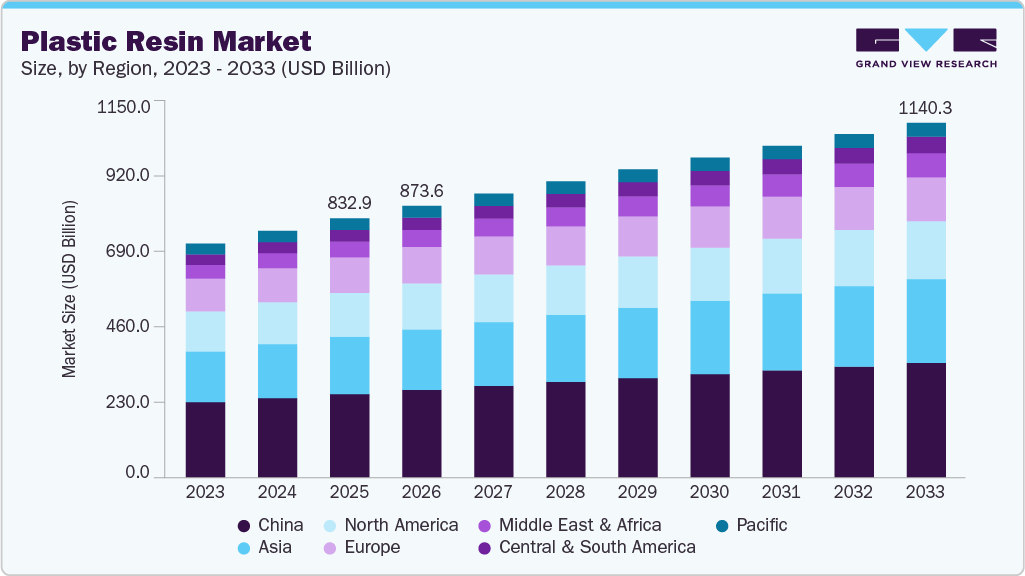

The global plastic resin market size was estimated at USD 832.86 billion in 2025 and is projected to reach USD 1,140.30 billion by 2033, growing at a CAGR of 3.9% from 2026 to 2033. Capacity additions and feedstock availability are key drivers shaping the global market, as they directly influence supply, cost structures, and regional competitiveness.

Key Market Trends & Insights

- In terms of region, Asia Pacific dominated plastic resin market with the largest revenue share of 22.12% in 2025.

- China dominated the global plastic resin industry with the largest revenue share of 44.70% in 2025.

- The plastic resin industry in Saudi Arabia is expected to grow at a substantial CAGR of 6.0% from 2026 to 2033.

- By product, the engineering plastic segment is expected to grow at a considerable CAGR of 5.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 832.86 Billion

- 2033 Projected Market Size: USD 1,140.30 Billion

- CAGR (2026-2033): 3.9%

- Asia: Largest market in 2025

Trends in raw material availability for the market are being shaped by feedstock supply, price volatility, and a strong push toward circular and lower-carbon inputs. Producers continue to balance ethane, LPG, and naphtha feedstock mixes to optimize crackers for cost and product slate. North American ethane-advantaged crackers produce ethylene at a lower cost, whereas Europe and parts of Asia remain more naphtha-dependent and therefore more vulnerable to fluctuations in oil prices.

Drivers, Opportunities & Restraints

Capacity additions and feedstock availability are key drivers shaping the global plastic resin industry, as they directly influence supply, cost structures, and regional competitiveness. Capacity additions refer to new or expanded ethylene, propylene, and polymer production facilities that increase the volume of available resin supply. Feedstock availability refers to the accessibility and cost of raw materials, including naphtha, ethane, LPG, and alternative feedstocks such as recycled monomers. Together, these factors determine how efficiently major producers can meet rising demand from downstream converters and end-use industries.

Bio-based resins represent a significant market opportunity as customers and regulators seek materials with lower carbon footprints and reduced reliance on fossil fuels. These resins are derived from renewable resources such as sugarcane, corn, or cellulose, and include polymers like bio-PE, bio-PET, and polylactic acid. As brands pledge sustainability goals and governments offer incentives for green products, demand for bio-based resins is growing in packaging, consumer goods, and automotive applications. The market impact includes new revenue streams for resin producers willing to invest in biorefinery partnerships and a stronger competitive position for companies that can deliver certified renewable content at scale.

Raw materials used in plastic manufacturing are primarily derived from hydrocarbon-based resources, such as crude oil, natural gas, and coal, as well as inorganic inputs like salt and sand. In the plastics value chain, fluctuations in these upstream inputs directly affect plastic compounding operations, as compounders rely on base resins along with additives, fillers, and modifiers whose costs are closely linked to energy and feedstock prices. For instance, polyethylene processing in North America benefits from relatively low-cost natural gas, supporting competitive compounding and conversion activities in the region.

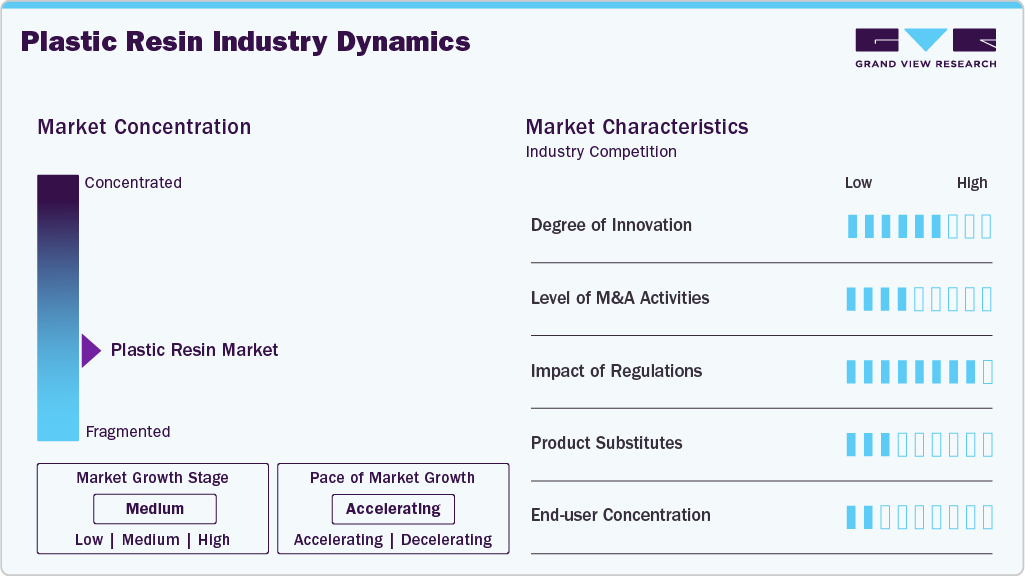

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., Evonik Industries AG, Sumitomo Chemical Co., Ltd, Arkema, Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Lotte Chemical Corporation, Exxon Mobil Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in the plastic resin industry is currently centered on developing sustainable and high-performance materials that balance functionality with environmental commitments. Advances in bio-based resins derived from renewable feedstocks such as sugarcane and agricultural waste are gaining traction, reducing dependency on fossil feedstocks while maintaining performance parity with conventional polymers. Enhanced recycling technologies, including chemical recycling that regenerates resins to near-virgin quality, are unlocking circular economy value and differentiating producers in competitive end-use sectors.

The plastic resin industry faces substitution pressure from specialty polymers and non-polymer materials that address specific performance gaps or sustainability goals. High-performance resins such as polysulfone, polyphenylene sulfide, and semi-aromatic polyamides serve as engineered alternatives where heat resistance, mechanical stability, or chemical durability is critical. In some applications, materials like glass, metal, wood, and ceramics are also chosen over plastics for environmental or lifecycle reasons. Bio-based and biodegradable polymers increasingly act as lower-impact substitutes for traditional resins.

Product Insights

Crystalline dominated the market across all product segments in terms of revenue, accounting for a 58.23% market share in 2025, and is forecasted to grow at a 3.8% CAGR from 2026 to 2033. Crystalline plastic resins form the backbone of global plastics consumption due to their high volume of usage and broad processing flexibility. Resins such as polyethylene, polypropylene, PET, and epoxy are widely used in packaging, containers, films, fibers, coatings, and structural applications where predictable stiffness and chemical resistance are required. Their ordered molecular structure enables faster processing cycles and consistent mechanical behavior, supporting large-scale production. Demand for these resins is closely tied to consumer goods, packaging, construction materials, and infrastructure development, making them highly sensitive to economic activity and capacity additions across major producing regions.

Engineering plastic is anticipated to grow at a substantial CAGR of 5.0% through the forecast period. Engineering plastic resins occupy the middle ground between commodity plastics and high-end specialty polymers. Resins, including nylon, PBT, PC, PU, PPO, and related PA, are chosen for applications that require higher strength, heat resistance, and long-term reliability. They are widely used in automotive systems, electrical and electronic components, industrial equipment, and durable consumer products. Demand for engineering resins is growing as the adoption of vehicle electrification, automation, and higher performance requirements in compact designs increases, where predictable mechanical behavior and extended service life are crucial.

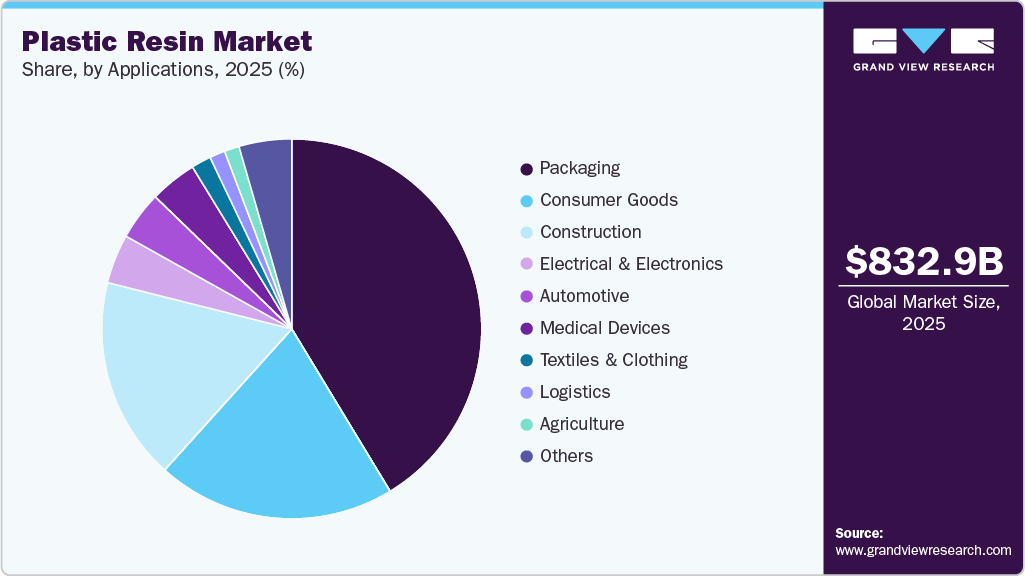

Applications Insights

Packaging dominated the market across the applications segmentation in terms of revenue, accounting for a market share of 41.32% in 2025, and is forecasted to grow at a 4.0% CAGR from 2026 to 2033. Packaging is the largest single application that pulls resin demand across multiple supply chains. Brands, retailers, and converters require consistent volumes of low-cost, processable resins for a wide range of applications, including primary food packaging, transportation, and protective packaging. That consistent, high-volume pull shapes where producers allocate capacity and how c ompounders formulate grades for barrier, sealability, or stiffness.

Agriculture is expected to expand at a substantial CAGR of 5.4% through the forecast period. Agricultural applications generate continuous, season-timed resin demand as farmers and agri-businesses invest in productivity and water efficiency solutions. Drivers include the need to increase yields and reduce post-harvest losses through the use of protective films, irrigation systems, and durable containers. LDPE and LLDPE films are heavily utilized for mulching, greenhouse covers, and silage wraps due to their film-forming and UV resistance properties.

Regional Insights

The region’s resin landscape is increasingly shaped by large, country-level upstream capacity additions and feedstock economics, rather than downstream demand growth. India is emerging as a key center for upstream growth. Government-led programs such as PCPIRs, plastic parks, and incentive schemes are supporting multiple greenfield cracker and monomer projects. These investments are expanding domestic ethylene, propylene, and PVC capacity, gradually reducing structural import dependence.

China Plastic Resin Market Trends

The plastic resin market in China held the largest share, accounting for 44.70% of the revenue in 2025, and is expected to grow at the fastest CAGR of 3.9% over the forecast period, driven by continued refinery and petrochemical investment, as well as state-backed capacity expansions. The production of primary feedstocks, such as ethylene and propylene, is large-scale and increasingly integrated with refining, which keeps supply growth supply-led rather than demand-pulled. According to the National Bureau of Statistics of China, ethylene output in May 2024 was 2.57 million tons, underscoring the country’s massive upstream throughput that helps explain why resin exports and inter-regional shipments originate from China’s integrated complexes.

North America Plastic Resin Market Trends

The plastic resin market in North America is anchored by a large, feedstock-driven petrochemical complex centered on the U.S. Gulf Coast. Cheap and abundant natural gas liquids, particularly ethane from shale plays, provide U.S. crackers with a cost advantage for ethylene and downstream PE production. This feedstock strength supports large-scale capacity additions, export-oriented polymer flows, and a cluster of integrated producers that schedule resin output to match global demand windows. According to the U.S. Energy Information Administration, U.S. ethane production was forecast to average about 2.8 million barrels per day in both 2024 and 2025, supporting higher domestic ethane consumption and rising exports.

The U.S. plastic resin market remains one of the world’s largest producers of primary plastic resins, underpinned by competitive feedstock economics from abundant shale gas. Ethylene and propylene production along the U.S. Gulf Coast, supported by low-cost ethane and propane, drives domestic PE (PE), PP (PP), and PVC resin output more than end-market demand conditions. Polyolefins dominate the supply base, with PE and PP making up a significant share of primary resin production and setting the regional pricing tone. According to the American Chemistry Council, total U.S. resin production increased in 2024 by approximately 5% across key thermoplastics from 2023, including PE and high-density grades, reflecting continued upstream capacity utilization and modest supply growth.

Europe Plastic Resin Market Trends

The plastic resin market in Europe is defined by high energy and feedstock costs, regulatory burden, and ongoing capacity rationalization. Unlike shale-rich regions, much of Europe’s polymer production relies on naphtha feedstock and imported intermediates, which increases variable costs when oil prices and carbon costs rise. Producers have responded with plant shutdowns and deferrals, and recent industry studies show material capacity reductions announced across 2023 and 2024, which tighten local availability for certain polymers and push more trade flows toward import reliance.

Key Plastic Resin Company Insights

The industry is highly competitive, with several key players dominating the landscape. Major companies include BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., Evonik Industries AG, Sumitomo Chemical Co., Ltd, Arkema, Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Lotte Chemical Corporation, Exxon Mobil Corporation, Formosa Plastics Corporation, Covestro AG, Toray Industries, Inc., Mitsui & Co. Plastics Ltd., TEIJIN LIMITED, INEOS Group, Eni S.p.A., LG Chem, LANXESS AG, CHIMEI Corporation, Huntsman International LLC, and LyondellBasell Industries Holdings B.V. The industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Plastic Resin Companies:

The following key companies have been profiled for this study on the plastic resin market

- BASF SE

- SABIC

- Dow

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- LOTTE Chemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- TORAY INDUSTRIES, INC.

- MITSUI & CO. LTD

- TEIJIN LIMITED

- LG Chem

- Avient Corporation

Recent Developments

-

In May 2025, Aster Chemicals and Energy reached an agreement to acquire Chevron Phillips Singapore Chemicals (owner of a 400 kilotons per year HDPE plant). While a derivatives asset, the transaction signals a reshaping of the portfolio around petrochemical assets and can indirectly affect local monomer feedstock demand and commercial flows in Southeast Asia.

-

In January 2025, Howard Energy Partners closed the acquisition of EPIC Midstream’s ethylene pipeline system. The purchase secures a strategic midstream asset that transports ethylene monomer from Gulf Coast crackers to storage hubs, improving logistics for downstream resin manufacturers and merchant monomer traders.

Plastic Resin Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 873.55 billion

Revenue forecast in 2033

USD 1,140.30 billion

Growth rate

CAGR of 3.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Market Segmentation

Product, applications, region

Regional scope

North America; Europe; China, Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Poland; Spain; India; Japan; South Korea; Singapore; Malaysia; Thailand; Indonesia; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; UAE; Oman

Key companies profiled

BASF SE; SABIC; Dow Inc.; DuPont de Nemours, Inc.; Evonik Industries AG; Sumitomo Chemical Co., Ltd; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastics Corporation; Toray Industries, Inc.; MITSUI & CO. LTD; TEIJIN LIMITED; LG Chem; Avient Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Resin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the plastic resin market report based on product, applications, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Crystalline

-

Epoxy

-

Polyethylene

-

Polyethylene Terephthalate (PET)

-

Polypropylene

-

-

Non-crystalline

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Acrylonitrile butadiene styrene (ABS)

-

Polymethyl Methacrylate (PMMA)

-

-

Engineering Plastic

-

Nylon

-

Polybutylene Terephthalate (PBT)

-

Polycarbonate (PC)

-

Polyurethane (PU)

-

Polyphenylene Oxide (PPO)

-

Polyamide

-

-

Super Engineering Plastic

-

Polyphenylene Sulfide (PPS)

-

Polyether Ether Ketone (PEEK)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Liquid Crystal Polymer (LCP)

-

-

Other Products

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Food

-

Beverage

-

Medical

-

Retail

-

Other packaging applications

-

-

Automotive

-

Construction

-

Electrical & Electronics

-

OA Equipment and Home Appliances

-

Electronic Materials

-

Other E&E applications

-

-

Logistics

-

Consumer Goods

-

Textiles & Clothing

-

Clothing

-

Industrial use

-

Other textile & clothing applications

-

-

Furniture & Bedding

-

Agriculture

-

Medical Devices

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Poland

-

Spain

-

-

China

-

Asia

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Thailand

-

Indonesia

-

Vietnam

-

Australia

-

-

Pacific

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global plastic resin market size was estimated at USD 832.86 billion in 2025 and is expected to reach USD 873.55 billion in 2026.

b. The global plastic resin market is expected to grow at a compound annual growth rate of 3.9% from 2026 to 2033 to reach USD 1,140.30 billion by 2033.

b. Crystalline dominated the market across all product segments in terms of revenue, accounting for a 58.23% market share in 2025, and is forecasted to grow at a 3.8% CAGR from 2026 to 2033.

b. Some key players operating in the plastic resin market include BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., Evonik Industries AG, Sumitomo Chemical Co., Ltd, Arkema, Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Lotte Chemical Corporation, and Exxon Mobil Corporation.

b. Capacity additions and feedstock availability are key drivers shaping the global plastic resin market, as they directly influence supply, cost structures, and regional competitiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.