- Home

- »

- Electronic Security

- »

-

Physical Security Market Size, Share & Trends Report, 2030GVR Report cover

![Physical Security Market Size, Share & Trends Report]()

Physical Security Market Size, Share & Trends Analysis Report By Component (Systems, Services), By Organization Size, By End-user (Residential, Commercial, Retail, Utility & Energy), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-293-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global physical security market size was valued at USD 127.01 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The need to secure the physical environment from activities such as crime, vandalism, potential burglaries, theft, and fire incidences is one of the crucial factors expected to drive the market. Moreover, factors such as increased spending on the security to protect organization’s critical asset, adoption of cloud-based data storages, advanced analytics, as well as technological developments in access control and video surveillance are some of the key trends expected to drive the market growth.

In addition, the shifting focus from legacy solutions such as badge readers, alarm systems, and door locks to advanced logical security which encompasses breach detection, threat management, and intrusion prevention, among others, has helped the organization and government agencies to deter crime incidence and breach at a higher success rate.

For instance, in September 2022, Axis Communications launched two multidirectional, dual-sensor cameras. They are designed for 24/7 operation in difficult lighting conditions and provide excellent wide-angle overviews and zoomed-in detailed coverage. These powerful cameras use a deep learning processing unit based on ARTPEC-8 (DLPU), making it possible to collect and analyze more data and improve processing and storage capacities.

This will help securely communicate precise information about the emergency, such as the severity, kind of danger, and position within the affected building, all before the first rescuers arrive. Governments across different countries and regions are taking up smart city initiatives to enhance their infrastructure and are hence deploying improved security systems. Additionally, modernizing the existing infrastructure with robust security measures and strengthening the security of government agencies have been some of the top priorities for governments across developed countries.

Organizations are increasingly concerned about employee safety and are hence setting up systems to prevent unauthorized access; further driving the demand for physical security solutions. The physical security environment continues to evolve globally. During the past few years, numerous sectors and leading industries such as BFSI, residential, government, and transport, among others have witnessed a swift growth in the number of security breaches.

Furthermore, the growing concerns to ensure the safety of resources, people, and vital assets, against physical threats and unique vulnerabilities are anticipated to become major factors driving the need for a robust security environment. Moreover, rising threat incidents have surged the need to strengthen efforts to maintain a highly secured physical infrastructure at residential as well as business premises.

For instance, in August 2022, Uber and ADT teamed up to integrate ADT's mobile safety solutions into the Uber app. ADT is the most reputable name in smart home and small business security. Uber users in the U.S. can now contact ADT professional monitoring specialists by phone or text to receive live assistance. By integrating ADT's 24/7 professional monitoring, Safe by ADT helps secure millions of gig economy employees and customers. It gives them access to assurance and emergency services when they most need them.

Governments across major regions are continuously involved in strengthening their physical security infrastructure to curb the growing threats. For instance, in December 2021, Axis Communications, AB., a Sweden-based company that provides services to private sectors and governments around the world, launched its body-worn camera for the private security of government officials. The body-worn cameras have advantages of multiple benefits for liability protection, personal safety, and operational efficiency.

The advent of technology such as the Internet of Things (IoT) has potentially created vulnerabilities with additional entry points into the data systems through the connectivity of physical objects. However, IoT has also widened the scope of opportunities for the consumer by enabling data protection through the advanced connected networks of the physical security system.

Furthermore, innovations and technological advancement in integrated sensors, video, and access systems for IoT-enabled devices are anticipated to spur the market at a high rate. For instance, in September 2021, Intel Corporation stated that it uses a software-based IoT platform to manage its physical security and virtual device access. Further, this also ensures that only authorized workers have physical access to the devices through keys or access credentials.

Component Insights

The system segment led the market in 2022, accounting for more than 65.0% share of the global revenue. Further, the sub-segments of systems include physical access control systems (PACS), video surveillance systems, perimeter intrusion detection and prevention, physical security information management(PSIM), physical identity and access management (PIAM), plus fire and life safety.

The video surveillance system segment dominated the market in 2021 with a share of more than 52.0%. The system included in video surveillance systems is analog cameras, axis network cameras, video encoders, monitors, and storage solutions. Technological advancements such as UHD, coupled with decreasing cost of equipment, have led to increased adoption of video surveillance systems to enhance remote monitoring and physical security. Increasing physical security and safety concerns and stringent regulatory compliances are some of the potential factors driving the segment's growth.

Furthermore, the rapid development of the commercial and institutional infrastructure across several regions has driven the demand for video surveillance, thereby boosting segment growth. For instance, in March 2022, Ouster Inc. and Hexagon AB, which produces and manufactures security systems, launched a joint security solution, Ouster×Accur8vision, a video surveillance software for protecting and monitoring critical infrastructures such as residential properties, airports, commercial buildings, or crowded settings. This would improve existing security systems by adding a layer of awareness to detect future threats ahead of time.

The services component segment is expected to showcase lucrative growth during the forecast period. Services comprise deployment, maintenance, and updating of the equipment as well as software, which further improves performance by providing the user with optimum control of the complete security infrastructure. Rapid infrastructure development in emerging economies and advancements in technology, such as Ultra High Definition (UHD) surveillance, have led to an increased demand for additional physical security services.

Further, the subsegments of services include system integration, remote monitoring, and others. The system integration segment dominates with a market share of 48.0% in 2021. The segment is driven by the factors such as new technologies, changing approach of the customers toward security operations, demand for a cost-effective physical security system, stringent regulatory compliance, and rapid growth of enterprises.

Wide usage of cloud computing solutions in organizations, increasing automation, and an integrated approach in business processes are projected to drive the implementation of integrated solutions. For instance, in February 2022, TUCHWARE, a provider of IOT-based services and products in physical security and surveillance, launched its new smart lock series XS, an advanced technology lock with cloud computing solutions.

The smart lock has the features of Bluetooth, physical security, unlocking or locking the door remotely, sharing access with family or friends, and having a remote check on who is coming and going.

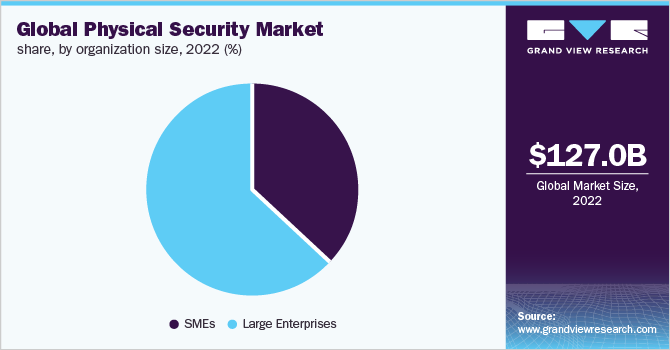

Organization Size

The large enterprise segment led the market in 2022, accounting for above 60% share of the global revenue. The segment is driven by the factors such as more significant infrastructure to safeguard, highly critical information to protect, and greater revenue to spend. So, they are the early adopters of physical security. Further, protecting their data from thefts, cyberattacks, and unauthorized access lets the segment shift toward physical security solutions.

Cyber threats are most likely to target businesses that store essential personal and sensitive information. These threats further result in information security incidents, financial losses, information security, and data breaches. For instance, in October 2021, Alert Enterprise Inc., a cyber-physical security provider, and a software development company partnered with Bio Connect Inc., a prominent provider of biometric devices and technologies.

In this partnership, the companies would invest in launching a cloud service policy-based access control (PBAC) to provide a physical security solution for large enterprises. The PBAC connects to a cloud authorization service and enables businesses to quickly develop dynamic permission for employees to access facilities and protect their highly critical information from cyber-attacks or thefts.

The SMEs segment is anticipated to foresee significant growth during the forecast period. The segment can be attributed to theft, environmental dangers, and intruders, as small businesses also have a lot of resources and people to protect. For instance, in February 2022, U.S. Small Business Administration (SBA), a U.S. state government agency that helps small businesses and entrepreneurs, provided USD 3 million in funding to help SMEs across the U.S. to develop a physical security infrastructure. As there is an increase in the number of threats and fraudsters evolving around small businesses, this funding would help them secure their premises by physical security and protecting their resources and people.

End-user Insights

The government segment led the market in 2022, accounting for more than 18% of the revenue share in 2022. In this rapidly changing and complex environment, government agencies must figure out how to upgrade their security defenses while working with legacy equipment and staying within budget. For instance, in July 2022, The European Parliament, the European Commission, and the European Union (EU) agreed on a European guideline on critical entity resilience. This directive aims to safeguard essential providers of the process by enhancing their stability and resilience, hence more efficiently guaranteeing the consistency of such operations.

The residential segment is anticipated to register prominent growth during the forecast period due to the high number of damages caused to assets and resources during thefts and other attacks. Application in residential properties has enhanced user experience along with protecting assets from any potential risks. Safety is achieved by the integration of comprehensive video surveillance systems, smart access control, and rapid intrusion detection system.

Globally, the U.S. is currently the largest market for physical security equipment used for the residential sector. The growth is attributed to the development of smart homes coupled with the increased use of advanced video surveillance and access control systems. For instance, in April 2022, Knightscope, Inc., a U.S.-based robotics and physical security camera company, launched Knightscope K5 Autonomous Security Robot (ASR). Various companies in the U.S. have already started implementing K5 ASR in their outdoor space of residential and business premises for a rigorous security program and enabling a safer environment for their employees and customers.

Advancements in physical security technology such as IoT, coupled with growing awareness about cyber-attacks among consumers, drive demand for physical security systems designed for protecting government and banking institutions. Moreover, remote monitoring through cloud-based services has made it easier to supervise and control the physical environment.

Transportation is also estimated to portray significant growth during the forecast period. There is a high demand for equipment used in surveillance, overseeing traffic congestion, and monitoring crowds. The rising number of incidents such as accidents and terror attacks across the globe has led to increased spending on safety and physical security.

The physical security environment continues to evolve globally, making it prone to cybercrime. In the past few years, several industries and sectors, such as BFSI, residential, government, and transportation, have witnessed several cases of security breaches. These factors are expected to further drive the demand for physical security systems.

For instance, in March 2022, Edge360, a security solutions provider, partnered with Quanergy Systems, Inc., an AI-driven LiDAR platform. This partnership would let Edge360 provide LiDAR-based video surveillance to support business intelligence and physical security in residential buildings and financial sectors. Further, it would also offer unique features such as personnel in a real-world 3D representation, active tracking of objects, analytical data, and high-definition IP video.

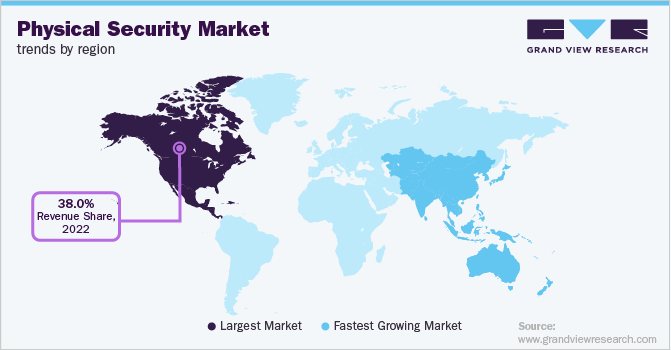

Regional Insights

North America dominated the market in 2022, accounting for more than 38.0% share of the global revenue. This trend is expected to continue through the forecast period. North America accounts for the highest adoption of advanced physical security systems. The regional market is driven by the factors such as strong economic growth, regulatory reforms, and rising investments by SMEs in physical security solutions.

Moreover, several public facilities and transportation systems, such as airports, seaports, railways, and bus stations, are focusing on safeguarding their infrastructure through security layers. For instance, in January 2022, Allied Universal, a U.S.-based security provider company, acquired Norred & Associates Inc., (Allied Universal) a security firm. This acquisition would let Allied Universal provide a full range of security services to bus stations, railways, and airports in the region, including investigation, security consulting, manned guarding, and pre-employment screening.

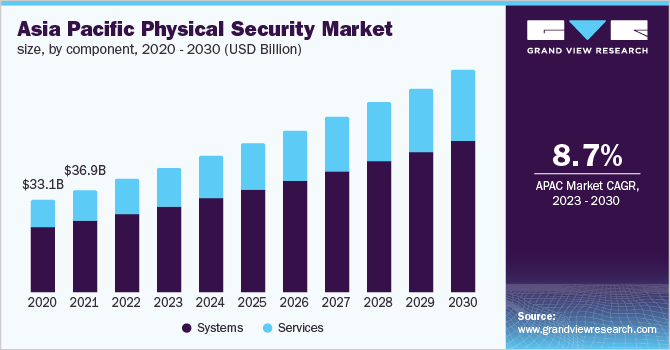

Asia Pacific is expected to register the highest CAGR during the forecast period. This growth can be attributed to the increasing demand for smart security solutions across India and China. Significant investments by the Chinese government in safe city projects which primarily focus on city surveillance and traffic monitoring are anticipated to drive market growth.

Since the establishment of the China Smart City Industry Alliance in 2010, the country has developed 500 smart cities throughout the country. In 2012, China started to encourage the implementation of technologies such as artificial intelligence and IoT for national smart city development to enhance urban planning and development. By the end of 2020, the Chinese government plans to develop 100 more cities.

For instance, in February 2022, Hangzhou Hikvision Digital Technology Co., Ltd, a video surveillance equipment provider, launched a new product Hikvision AX PRO wireless external Tri-tech detector and a dedicated camera. The newly launched product provides precise detection, a clear image, and a modular design, increasing alarm safety for small businesses and homeworkers. Further, the Hikvision AX PRO wireless external Tri-tech detector and a dedicated camera would be used in the smart city for smart security across China.

Key Companies & Market Share Insights

Market leaders focus on providing diverse solutions to cater to various applications so as to gain a higher market share. Companies also focus on strategic alliances, mergers, and acquisitions to enhance their product offerings and improve their market share. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

They provide a variety of systems and services and have gained attraction from several end-use industries. For instance, in July 2021, Hexagon AB., which produces and manufactures security systems, acquired Immersal-Part of Hexagon., visual positioning and spatial mapping systems company. This acquisition would let Hexagon AB. use AR applications to have a real-world experience, further improving performance, saving time and public safety, and improving safety protocols and physical security.

Besides in May 2021, Johnson Controls partners with DigiCert, Inc., a leading service provider of PKI solutions, to bring advanced digital, physical security solutions to buildings. Further, this partnership would enable Johnson Control to offer its customers trusted connectivity and advanced security with the advanced PKI technology from DigiCert, Inc. Some of the prominent players in the global physical security market include:

-

Hangzhou Hikvision Digital Technology Co., Ltd.

-

Honeywell International, Inc.

-

Genetec Inc.

-

Cisco Systems Inc.

-

Axis Communications AB

-

Pelco

-

Robert Bosch GmbH

-

Johnson Controls

-

ADT LLC

-

Siemens

Physical Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 136.95 billion

Revenue forecast in 2030

USD 216.43 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, organization size, end-user, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc.; Genetec Inc.; Cisco Systems Inc.; Axis Communications AB; Pelco; Robert Bosch GmbH; Johnson Control International Plc; ADT LLC; Siemens.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physical Security Market Segmentation

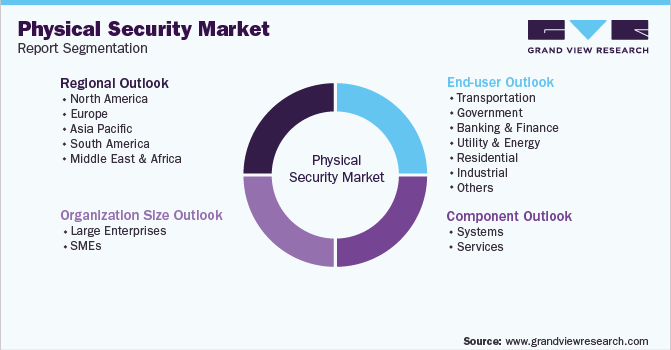

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global physical security market report based on the component, organization size, end-user, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Systems

-

Physical Access Control System (PACS)

-

Video Surveillance System

-

Perimeter Intrusion Detection And Prevention

-

Physical Security Information Management (PSIM)

-

Physical Identity & Access Management (PIAM)

-

Fire And Life Safety

-

-

Services

-

System Integration

-

Remote Monitoring

-

Others

-

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Government

-

Banking & Finance

-

Utility & Energy

-

Residential

-

Industrial

-

Retail

-

Commercial

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global physical security market size was estimated at USD 127.01 billion in 2022 and is expected to reach USD 136.95 billion in 2023

b. The global physical security market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 216.43 billion by 2030.

b. Video surveillance systems dominated the market with a share of more than 51% in 2022. This is attributable to technological advancements such as UHD, coupled with the decreasing cost of equipment.

b. Some key players operating in the physical security market include Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc.; Genetec Inc.; Cisc Systems Inc.; Axis Communications AB; Pelco; Robert Bosch GmbH; Johnson Control International Plc; and ADT LLC.

b. Key factors that are driving the physical security market growth include the increasing importance of improving physical security for organizations and identifying potential threats.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."