- Home

- »

- Advanced Interior Materials

- »

-

Plasma Processing In Mining Market, Industry Report, 2033GVR Report cover

![Plasma Processing In Mining Market Size, Share & Trends Report]()

Plasma Processing In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Plasma Smelting/Extractive Metallurgy, Plasma Waste & Tailings Treatment), By Material (Complex Primary Ores, Secondary Scrap/Residues), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-830-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plasma Processing In Mining Market Summary

The global plasma processing in mining market size was estimated at USD 2.54 billion in 2024 and is projected to reach USD 4.70 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The market is expected to be driven by rising demand for efficient metal extraction from complex ores, stricter environmental regulations that favor cleaner processing methods, and technological advancements that enhance scalability and energy efficiency.

Key Market Trends & Insights

- Asia Pacific held the largest share of over 54.0% in 2024 of the global plasma processing in mining market.

- The U.S. is a leading market for plasma processing in mining, driven by strong demand for high-purity metals and investments in sustainable industrial technologies.

- Based on application, plasma smelting / extractive metallurgy held the largest share of over 54.0% in 2024 of the global plasma processing in mining market.

- Based on material, e-waste/black mass is expected to register the fastest growth rate of 7.6% across the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.54 billion

- 2033 Projected Market Size: USD 4.70 billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The industry is increasingly driven by the need for environmentally sustainable mining practices. Plasma-based technologies reduce chemical waste, lower emissions, and enable cleaner extraction from low-grade and complex ores, thereby helping mining operations comply with increasingly stringent environmental regulations. This shift toward eco-friendly processing aligns with global sustainability initiatives and the growing demand for responsible sourcing of metals and minerals.

Technological advances are a significant growth driver for the market. Innovations in thermal-plasma and plasma-assisted processing systems have improved efficiency, scalability, and energy consumption, making plasma processing more viable for large-scale mining operations. Enhanced precision and higher recovery rates from complex ores further encourage adoption, while ongoing R&D investments continue to expand the capabilities and applications of plasma technology in the mining sector.

Drivers, Opportunities & Restraints

The industry is primarily driven by the demand for environmentally sustainable and efficient metal extraction. Plasma-based technologies reduce chemical waste and lower emissions compared to conventional smelting, making them aligned with global decarbonization goals. For instance, on April 17, 2024, PyroGenesis Canada Inc. signed a contract with a global mining-parts manufacturer to evaluate electric plasma torches for metal casting operations, highlighting the industry's adoption of cleaner and more efficient processing. Growing environmental regulations and corporate sustainability initiatives are pushing mining companies to adopt cleaner technologies, further supporting market growth. Additionally, the rising demand for high-purity metals in electronics and aerospace industries is increasing the need for plasma-enabled extraction methods.

Significant opportunities exist in processing complex, low-grade, or refractory ores that conventional methods struggle to handle, enabling higher recovery rates of precious and strategic metals. PlasmaOne Inc. demonstrated this by starting the first commercial-scale platinum-group metal plasma smelting plant in South Korea on October 1, 2024, achieving a recovery rate of ~99.85% with minimal emissions, thereby showcasing the potential of plasma processing to expand accessible mineral resources and improve resource efficiency. There is also potential to recover metals from mining waste and tailings, promoting circular economy principles. Moreover, ongoing technological innovations in plasma systems are expected to reduce operational costs and increase scalability, attracting broader adoption across global mining operations.

High capital costs, energy requirements, and limited large-scale commercial deployment continue to restrain market growth. Plasma furnaces and torches require substantial electricity and supporting infrastructure, making their adoption challenging in regions with high energy costs or unstable power grids. For example, despite successful trials, some mining companies have paused the implementation of plasma furnaces due to economic uncertainties and high operational expenses, illustrating the financial and technical hurdles facing widespread adoption. The variability in ore composition also necessitates careful optimization of plasma processes, which can introduce complexity and increase costs. Additionally, the need for specialized technical expertise to operate and maintain plasma systems limits the rapid deployment of these systems in many mining regions.

Application Insights

Based on application, plasma smelting/extractive metallurgy held the largest share of 54.7% in 2024 of the global plasma processing in mining market. Plasma smelting and extractive metallurgy dominate the industry, driven by their ability to extract metals from complex and refractory ores efficiently. These systems, including high-temperature plasma furnaces and torches, allow higher recovery rates and superior metal purity compared to conventional smelting methods. Environmental regulations and sustainability initiatives further fuel the adoption of plasma smelting, as it reduces chemical waste and lowers emissions. Major commercial deployments, such as PlasmaOne’s 2024 platinum-group metal plant, demonstrate the scalability and industrial relevance of this application.

Plasma waste and tailings treatment, plasma-based secondary metal recovery, and other niche applications are growing steadily but currently occupy a smaller share of the market. Plasma waste treatment enables the recovery of metals from tailings and by-products, promoting circular economy practices. Meanwhile, secondary metal recovery focuses on extracting metals from scrap, residues, and e-waste. Though adoption is limited compared to plasma smelting, these segments are gaining attention due to the increasing emphasis on resource efficiency and the economic potential of recovering metals from secondary feedstocks.

Material Insights

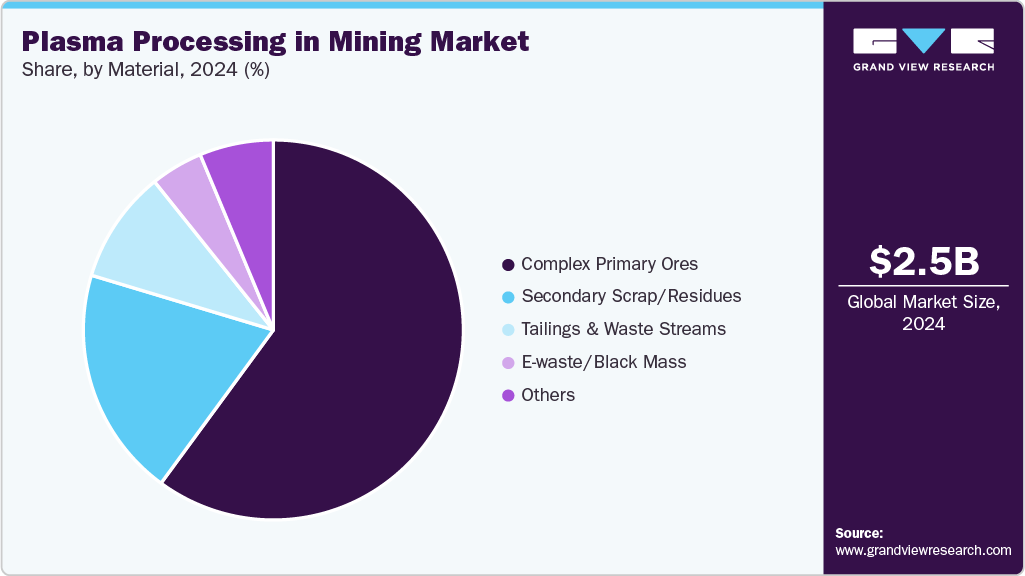

Complex primary ores represent the largest material segment in plasma processing, as these low-grade or refractory ores are challenging to process with conventional methods. Plasma-based extraction enables higher recovery rates and produces high-purity metals, making it an ideal process for the production of strategic and precious metals. The ability to process such ores efficiently has positioned plasma technology as a key solution in modern mining, especially in regions with limited access to high-grade ore. This segment benefits from the combination of technological advancement and sustainability drivers that enhance both operational efficiency and environmental compliance.

E-waste/black mass is expected to register the fastest growth rate of 7.6% across the forecast period. Secondary scrap, tailings and waste streams, e-waste/black mass, and other miscellaneous feedstocks are smaller yet growing segments. Plasma processing in these materials allows recovery of residual or strategic metals, contributing to circular economic initiatives and reducing environmental impact. While adoption is currently limited, these segments are expected to expand as industries increasingly focus on sustainability, resource efficiency, and the recovery of critical and rare metals from non-traditional sources.

While complex primary ores dominate, plasma processing of secondary and unconventional feedstocks is gaining strategic importance. Tailings, mining waste streams, and e-waste/black mass contain valuable metals that are often underutilized due to the limitations of conventional extraction methods. Plasma technology enables efficient recovery of these metals, including precious, strategic, and rare-earth elements, while minimizing environmental impact. As regulatory pressures and sustainability goals intensify, mining companies and recycling firms are increasingly investing in plasma-based recovery solutions, unlocking new revenue streams and promoting circular economy practices.

Regional Insights

Asia Pacific held the largest share of over 54.0% in 2024 of the global plasma processing in mining market. Asia-Pacific is expected to see rapid growth in plasma processing in mining, driven by industrial demand and the prevalence of complex or low-grade ores. In August 2024, a mining company in India deployed a pilot plasma smelting plant to process copper and zinc concentrates, significantly improving metal purity while reducing emissions compared to traditional smelting. This project demonstrates the region’s leadership in adopting plasma-based solutions for efficient and sustainable ore processing.

North America Plasma Processing In Mining Market Trends

The plasma processing in mining market in North America is growing as mining and metallurgical companies explore cleaner, more efficient extraction technologies. For example, in June 2024, a Canadian mining company successfully piloted a thermal plasma system to recover nickel and cobalt from low-grade ores, achieving higher recovery rates with reduced chemical waste. This instance highlights the region’s push toward sustainable and high-efficiency metal processing solutions, positioning North America as a key industry for plasma-based mining technologies.

U.S. Plasma Processing In Mining Market Trends

The U.S. is a leading market for plasma processing in mining, driven by strong demand for high-purity metals and investments in sustainable industrial technologies. In September 2024, a U.S.-based battery recycling facility began implementing plasma-assisted recovery to extract lithium and rare-earth metals from spent batteries, demonstrating the growing application of plasma technologies in secondary metal recovery. Such initiatives reflect increasing adoption of plasma solutions in both primary and secondary metal extraction operations.

Europe Plasma Processing In Mining Market Trends

Strict environmental regulations and a strong focus on sustainable mining practices support Europe’s plasma processing in mining market. In March 2025, a German metallurgical company successfully tested a plasma furnace for recovering rare-earth elements from mining tailings, achieving minimal emissions and high metal recovery rates. This development reflects Europe’s drive to integrate advanced plasma technologies into mining and metal extraction operations, particularly for strategic and critical metals.

Key Plasma Processing In Mining Companies Insights

Key players operating in the plasma processing in mining market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include PyroGenesis Canada Inc., Tetronics International, PlasmaOne Inc., and Others.

-

PyroGenesis Canada Inc. was established in 1992 and is headquartered in Montreal, Canada. The company is publicly listed on the Toronto Stock Exchange. Its primary businesses include plasma torch manufacturing, plasma-based waste treatment, and advanced metallurgical processing. Plasma-based metallurgical processing is further segmented into plasma smelting/extractive metallurgy, plasma-based secondary metal recovery, and plasma treatment of mining residues and tailings.

-

Tetronics International was established in 1989 and is headquartered in London, United Kingdom. It is a private company specializing in plasma technology solutions. Its primary businesses include DC plasma arc systems, hazardous waste treatment, and resource recovery. Resource recovery is further segmented into metal recovery from ores, recycling of industrial residues, and treatment of e-waste and tailings.

-

PlasmaOne Inc. was established in 2015 and is headquartered in Seoul, South Korea. It is a private company focused on advanced plasma smelting solutions. Its primary businesses include the plasma smelting of platinum-group metals, the treatment of low-grade ores, and the recovery of metals from industrial waste. Plasma smelting is further segmented into continuous DC plasma furnaces, pilot-scale extraction plants, and full-scale commercial ore processing facilities.

Key Plasma Processing In Mining Companies:

The following are the leading companies in the plasma processing in mining market. These companies collectively hold the largest Market share and dictate industry trends.

- Alfa Energy Solutions

- Europlasma

- Enercon Industries Corp.

- High Temperature Technologies Corp.

- Plasma Energy Corporation

- PlasmaOne Inc.

- Plasma‑Therm, LLC

- PyroGenesis Canada Inc.

- Tetronics International

- Westinghouse Plasma Company

Recent Developments

-

PyroGenesis Canada Inc. signed a contract in April 2024 with a global mining-parts manufacturer to evaluate its electric plasma torches for use in metal cast-houses. This project represents a strategic move to expand the application of plasma technology in sustainable metal processing and enhance operational efficiency in North American mining and metallurgy operations.

-

PlasmaOne Inc. launched its first commercial-scale platinum-group metal plasma smelting plant in South Korea in October 2024. This development demonstrates the company’s commitment to advancing high-purity metal extraction from complex ores while minimizing environmental impact and promoting sustainable mining practices.

-

Tetronics International commenced a pilot project in June 2024 in the United Kingdom to recover metals from industrial waste streams using DC plasma arc technology. This initiative highlights Tetronics’ focus on resource recovery, circular economy solutions, and reducing hazardous waste through advanced plasma-based metallurgical processes.

Plasma Processing In Mining Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total value of mining and metallurgical materials that undergo plasma-based processing each year.

Market size value in 2025

USD 2.70 billion

Revenue forecast in 2033

USD 4.70 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK.; Italy; China; India; Japan; Brazil; South Africa; UAE

Key companies profiled

Alfa Energy Solutions; Europlasma; Enercon Industries Corp.; High Temperature Technologies Corp.; Plasma Energy Corporation; PlasmaOne Inc.; Plasma‑Therm, LLC; PyroGenesis Canada Inc.; Tetronics International; Westinghouse Plasma Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Plasma Processing In Mining Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global plasma processing in mining market report by application, material, and region:

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plasma Smelting / Extractive Metallurgy

-

Plasma Waste & Tailings Treatment

-

Plasma-Based Secondary Metal Recovery

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Complex Primary Ores

-

Secondary Scrap / Residues

-

Tailings & Waste Streams

-

E-waste / Black Mass

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plasma processing in mining market size was estimated at USD 2.54 billion in 2024 and is expected to reach USD 2.70 billion in 2025.

b. The global plasma processing in mining market is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2025 to 2033, reaching USD 4.70 billion by 2033.

b. Based on applications, plasma smelting / extractive metallurgy held the largest share of over 54.0% in 2024 of the global plasma processing in mining market.

b. Some of the key vendors in the global plasma processing in mining market are Alfa Energy Solutions, Europlasma, Enercon Industries Corp., High Temperature Technologies Corp., Plasma Energy Corporation, PlasmaOne Inc., Plasma‑Therm, LLC, PyroGenesis Canada Inc., Tetronics International, Westinghouse Plasma Company, and others.

b. The global plasma processing in mining market is driven by the increasing demand for efficient and sustainable metal extraction from complex and low-grade ores. Growing environmental regulations and corporate sustainability initiatives are encouraging the adoption of plasma-based technologies to reduce emissions and chemical waste.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.