- Home

- »

- Medical Devices

- »

-

Plasmid DNA Contract Manufacturing Market Size Report, 2030GVR Report cover

![Plasmid DNA Contract Manufacturing Market Size, Share & Trends Report]()

Plasmid DNA Contract Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Cell & Gene Therapy, Immunotherapy), By Therapeutic Area (Cancer, Infectious Diseases), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-2

- Number of Report Pages: 275

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

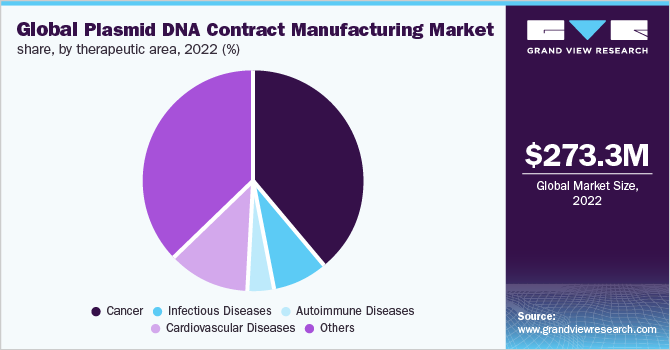

The global plasmid DNA contract manufacturing market size was valued at USD 273.3 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 19.3% from 2023 to 2030. The rapidly growing field of cell and gene therapy is creating overwhelming enthusiasm across the plasmid DNA contract manufacturing market. The increasing usage of gene therapy and mostly CAR-Ts has significantly boosted the demand for plasmid DNA, thus simultaneously supporting its contract manufacturing services. Additionally, technological advancements to overcome the challenges of conventional methods for vector production are anticipated to support the growth of this plasmid DNA contract manufacturing market.

The COVID-19 restrictions fully halted research-based operations and interrupted the healthcare industry. However, the plasmid DNA contract manufacturing market witnessed positive growth in 2020 and 2021. The high growth of the market during the COVID-19 pandemic is due to the increasing research-based activities pertaining to the treatment of the SARS-CoV-2 infection. Several companies initiated the process of research and development of plasmid DNA-based vaccines as a treatment option for COVID-19. For instance, in July 2021, Zydus Cadila announced an application for Emergency Use Authorization for its three-dose Plasmid DNA ZyCoV-D Vaccine against COVID-19.

An increasing number of companies expanding their capacities in the production of plasmid DNA is one of the major factors augmenting the growth of the plasmid DNA contract manufacturing market. For instance, in December 2020, Thermo Fisher Scientific announced the expansion of a new plasmid DNA manufacturing facility in California, with an aim to scale up its cell and gene therapy offerings across plasmid DNA therapeutics. The company cited increasing worldwide demand for vital mRNA-based vaccines and plasmid DNA therapies as the driver for the investment.

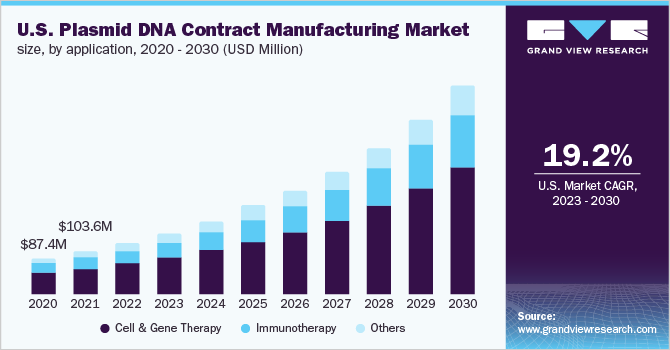

Application Insights

The plasmid DNA contract manufacturing market is broadly classified into cell & gene therapy, immunotherapy, and others on the basis of application. The cell & gene therapy segment held the leading market share at 60.3% in 2022 and is further anticipated to dominate the market during the forecast period. High shares of the segment are attributable to the increasing number of contract developers expanding their services to include cell & gene-based plasmid DNA manufacturing services. For instance, in October 2022, Ray Therapeutics, along with Forge Biologics, a CDMO, extended their collaboration agreement for the manufacturing of clinical-stage plasmid DNA with an aim to support Ray Therapeutics’ lead optogenetics gene therapy program.

The immunotherapy segment of the plasmid DNA contract manufacturing market is anticipated to witness a stable growth rate of 19.4% across the forecast period. The high growth of the segment is majorly due to the increasing research and development activities pertaining to immunotherapy. Increasing demand for oncology immunotherapy is another significant factor boosting the segment’s growth. The rising number of cancer cases has led to the growth in the development of a larger number of oncology-based immunotherapy products, thus supporting the segment’s growth in the plasmid DNA contract manufacturing market.

End-user Insights

Based on the end-user, the plasmid DNA contract manufacturing market is classified into pharmaceutical and biotechnology companies and research institutes. The pharmaceutical and biotechnology companies segment held the lion’s share of 59.2% in 2022. High shares of the segment are majorly due to the increasing pipeline for plasmid DNA-based therapeutics across the globe. Moreover, an increasing number of pharma and biopharma companies outsourcing their plasmid DNA manufacturing services to contract manufacturers is another primary factor boosting the growth of the plasmid DNA contract manufacturing market. For instance, in February 2022, a survey conducted by Industry Standard Research (ISR), stated that in the survey almost around 46% of respondents indicated they will outsource their Plasmid DNA manufacturing capabilities to contract developers and this is significantly going to increase by 50% in the next five years.

The research institutes segment on the other hand is anticipated to witness a stable growth rate of 19.0% across the forecast period owing to increasing funding for cell & gene therapy-based research. Research institutes are significantly focusing on the R&D of cell & gene therapies due to the growing demand for the same. Hence, the increasing funding coupled with the growing demand for plasmid DNA-based therapeutics will strongly propel the segment’s growth in the plasmid DNA contract manufacturing market.

Therapeutic Area Insights

Based on therapeutic areas, the plasmid DNA contract manufacturing market is classified into cancer, infectious diseases, autoimmune diseases, cardiovascular diseases, and others. The cancer segment dominated the plasmid DNA contract manufacturing market with a revenue share of 39.0% in 2022. The high growth of the segment is majorly due to the increasing pipeline and current therapeutics of plasmid DNA in the field of oncology. Moreover, the increasing prevalence rate of cancer cases across the globe is another considerable factor supporting the research-based activities of plasmid DNA for oncology.

The infectious diseases segment on the other hand is anticipated to witness a lucrative growth rate of 19.5% across the forecast period in the plasmid DNA contract manufacturing market. Significant growth of the segment is majorly due to the increasing product commercialization of plasmid DNA therapeutics in the treatment of infectious diseases. For instance, in April 2020, INOVIO and Richter-Helm BioLogics GmbH & Co. KG announced a partnership agreement to expand its manufacturing capabilities to support large-scale manufacturing of INOVIO's investigational DNA vaccine INO-4800, for COVID-19 infection.

Regional Insights

Based on regional insights, North America dominated the plasmid DNA contract manufacturing market in 2022 with a revenue share of 48.7%. High shares of the segment are primarily due to the increasing rate of outsourcing activities pertaining to cell & gene therapies across the region and especially in the U.S. For instance, a survey conducted by BioPlan’s 17th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production stated that approximately 25% of the respondents showed a strong likelihood of outsourcing their production capacities to the U.S. Moreover, an increasing number of contract developers penetrating the U.S. plasmid DNA contract manufacturing market is another significant factor supporting the region’s growth.

On the other hand, Asia Pacific is anticipated to witness a lucrative growth rate of 19.9% across the analysis timeframe. The high growth of the region is primarily due to the increasing rate of outsourcing activities happening across the region. This is attributable to the fact that the region is less expensive in terms of labor and wage charges which attracts a large number of companies to outsource their production capabilities in the region, especially in countries such as India and China.

Key Companies & Market Share Insights

Market players are adopting a variety of inorganic strategic activities, such as mergers & acquisitions, partnerships, and geographic expansion with an aim to strengthen their position in the plasmid DNA contract manufacturing market. Some prominent players in the global plasmid DNA contract manufacturing market include:

-

Charles River Laboratories

-

VGXI, Inc.

-

PlasmidFactory GmbH & Co. KG

-

Boehringer Ingelheim

-

BioCina

-

TriLink Biotechnologies

-

Esco Aster PTE. LTD

-

Thermo Fisher Scientific, Inc.

-

VIVE biotech

-

Lonza

Plasmid DNA Contract Manufacturing Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 324.9 million

Revenue forecast in 2030

USD 1,117.5 million

Growth Rate

CAGR 19.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, therapeutic area, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Rest of EU; India; Japan; China; Australia; Thailand; South Korea; Rest of APAC; Brazil; Mexico; Argentina; Rest of LATAM; South Africa; Saudi Arabia; UAE; Kuwait; Rest of MEA

Key companies profiled

Charles River Laboratories, VGXI, Inc.; PlasmidFactory GmbH & Co. KG; Boehringer Ingelheim; BioCina; TriLink Biotechnologies; Aster PTE. LTD; Thermo Fisher Scientific, Inc.; VIVE biotech; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plasmid DNA Contract Manufacturing Market Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the plasmid DNA contract manufacturing market report based on application, therapeutic area, end-user, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Gene Therapy

-

Immunotherapy

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Autoimmune Diseases

-

Cardiovascular Diseases

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global plasmid DNA contract manufacturing market size was estimated at USD 273.3 million in 2022 and is expected to reach USD 324.9 million in 2023.

b. The global plasmid DNA contract manufacturing market is expected to grow at a compound annual growth rate of 19.3% from 2023 to 2030 to reach USD 1,117.5 million by 2030.

b. By application, the cell & gene therapy segment held a market share of 60.3% in 2022. Increasing application of cell & gene therapy coupled with growing investment across research & development of the same are a few of the factors boosting the segment's growth.

b. Some key players operating in the market include Charles River Laboratories, VGXI, Inc., PlasmidFactory GmbH & Co. KG, Boehringer Ingelheim, and a few others.

b. The increasing usage of gene therapy and mostly CAR-Ts has significantly boosted the demand for plasmid DNA, thus simultaneously supporting its contract manufacturing services. Additionally, technological advancements to overcome the challenges of conventional methods for vector production are anticipated to support the growth of this plasmid DNA contract manufacturing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.