- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Container Market Size, Share & Demand, Industry Report, 2025GVR Report cover

![Plastic Container Market Size, Share & Trends Report]()

Plastic Container Market Size, Share & Trends Analysis Report By Material (PET, HDPE), By End Use (Beverages, Cosmetic, Industrial), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-327-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Report Overview

The global plastic container market size was valued at USD 85.5 billion in 2018. Plastic containers are expected to witness substantial growth as this packaging type is easy to handle and lightweight. Various manufacturers including L’Oréal, Unilever, and PepsiCo are increasingly using plastic packaging due to its lower cost of production. Moreover, innovation in advanced materials such as LLDPE, coupled with the increasing importance of cost-effectiveness, is expected to expand the market reach.

Packaging plays an important role in adding value to the product. Increasing demand for protective packaging from the food and pharmaceutical sectors in order to enhance the shelf life of the finished goods is expected to have a positive impact on the growth of the market. Plastic packaging is increasingly preferred due to its innovative visual appeal for consumer attraction and convenience. Changing lifestyle and food preferences in emerging economies including China and India are expected to expand the scope of convenience foods, which, in turn, will promote the utility of packaging.

The growing use of various innovative technologies such as biodegradable packaging and aseptic packaging is expected to play a crucial role in increasing the shelf life of the product. Shelf life is considered to be one of the important aspects of the product, owing to which the consumers are looking for innovative packaging products with an extended shelf life.

Increasing demand for lightweight packaging has led companies to develop alternative solutions. The shelf life of the product can be extended by protecting the product from oxygen, moisture, and other potential agents such as microorganisms. Therefore, plastic containers are those protective mediums that have superior barrier properties and can protect the product from various deteriorating agents.

The rising importance of e-commerce as a shopping medium at a global level owing to the increasing penetration of smartphone users is expected to play a crucial role in expanding the scope of packaging. Falling crude oil prices at a global level in light of increasing inventory levels in OPEC countries are expected to ensure the availability of plastic resin as feedstock in low prices for container manufacturing firms.

Material Insights

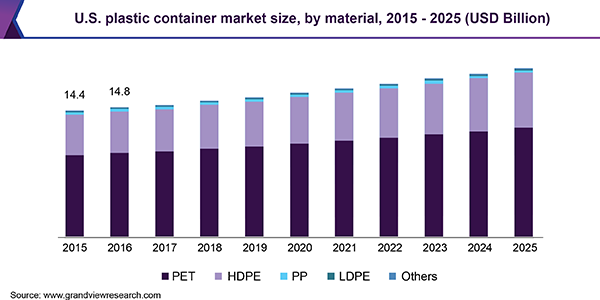

The PET segment dominated the market, accounting for 55.5% share of global revenue in 2018. PET is the most popular choice for packaging bottled water, carbonated soft drinks, and juice owing to its numerous benefits to manufacturers and consumers. PET is considered to be non-toxic, lightweight, and strong, which is recyclable. Around, 70% of mineral water, soft drinks, and juice are packed in PET containers. Increasing consumption of bottled water and juice is expected to expand the scope of PET packaging over the forecast period.

HDPE is expected to expand at a CAGR of 4.2% from 2019 to 2025. HDPE is a preferred material for the packaging of shampoo, detergent, household cleaners, and milk. The global cosmetic market is expected to witness significant growth in the near future, resulting in increased demand for HDPE containers over the forecast period. Moreover, rising urbanization and increasing spending on cosmetic and household cleaner are expected to increase the scope of HDPE packaging.

End-Use Insights

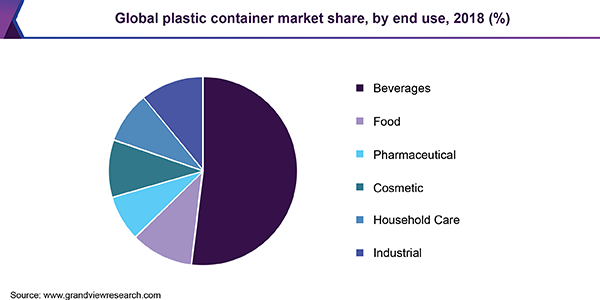

The beverages segment held more than 50.0% share of global revenue in 2018. Increasing consumption of bottled water, juice, and functional drinks is expected to drive the market for beverage packaging over the forecast period. The global bottled water market is growing rapidly and around 600 million households consumed bottled water in 2018. Furthermore, increasing the consumption of soft drinks in India and Thailand is expected to increase the scope of the plastic container over the forecast period. According to PepsiCo Indian’s bottling partner Varun beverages, India’s per capita consumption of soft drinks is expected to reach 84 bottles by 2021, which is expected to have a positive impact on the growth of the market.

The industrial segment held a significant market share in 2018 and is expected to expand at a CAGR of 3.3% from 2019 to 2025. Increasing production of chemicals in China, India, and Germany is expected to drive the global market over the forecast period. China and Germany are the largest consumers of plastic containers in the world owing to the increasing production of industrial lubricants, grease, and paints.

The use of plastic containers is growing in the cosmetic industry. China’s cosmetic industry is one of the largest consumers of plastic containers in the world. An increase in demand is attributed to the growing consumption and production of cosmetic products in the country. Moreover, various cosmetic manufacturers are shifting their production facility to China owing to the availability of raw material and cheap labor. This is expected to increase the demand for plastic packaging over the forecast period.

Increasing awareness related to health and hygiene has led to an increase in demand for household cleaner. In addition, growing urbanization and rising disposable income are expected to increase demand for household cleaner, which is expected to expand the scope of plastic containers in the sanitization industry. According to studies, an average American family spends around USD 500 - USD 600 on household cleaning supplies every year. Increasing spending is expected to increase demand for plastic packaging in the sanitization industry over the forecast period.

Regional Insights

Asia Pacific dominated the global plastic container market with more than 30.0% share of global revenue in 2018. Increasing consumption of bottled water, soft drinks, and juice is the main factor driving the regional market over the next few years. Furthermore, the presence of a large number of pharmaceutical and cosmetic product manufacturers in China, India, and South Korea has led to an increase in demand for plastic containers over the forecast period. In addition, increasing penetration of automotive manufacturers in India, China, and South Korea owing to favorable government initiatives is expected to fuel demand for automotive lubricants and greases, resulting in the expansion of the scope of plastic containers over the forecast period.

Europe is expected to expand at a CAGR of 4.1% from 2019 to 2025. The market is driven by increasing consumption of packed food. The hectic working schedule has increased the demand for the convenient food product. Moreover, changing lifestyles and eating habits resulted into increasing demand for nutritious beverages, thus fueling the demand for plastic packaging over the forecast period.

North America held a significant market share in 2018. As a result of growing awareness related to health and hygiene, spending on the household cleaner is increasing in the region. This, in turn, is expected to fuel demand for plastic containers over the forecast period. The U.S. is the largest market in North America and it accounted for more than 75.0% share of the North America market in 2018. The major share is attributed to the increasing consumption of functional beverages, coupled with rising demand for convenient food products.

Key Companies & Market Share Insights

The global market is highly competitive. The top five players accounted for less than 10.0% share of the global market in 2018. Some of the other players operating in the market are Amcor Limited; Berry Global Inc.; Alpha Packaging; Silgan Holdings Inc.; CKS Packaging, Inc.; CCC Packaging; Polytainers Inc.; Airlite Plastics; RPC Group Plc.; and Reynolds. Market players are adopting strategies such as mergers and acquisitions to increase product offerings. Moreover, companies are focusing on expanding their production capacity and are adopting innovative technologies in order to meet consumer demand for convenient packaging.

Plastic Container Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 88.7 billion

Revenue forecast in 2025

USD 112.5 billion

Growth Rate

CAGR of 4% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; China; Brazil; and UAE

Key companies profiled

Amcor Limited; Berry Global Inc.; Alpha Packaging; Silgan Holdings Inc.; CKS Packaging, Inc.; CCC Packaging; Polytainers Inc.; Airlite Plastics; RPC Group Plc.; and Reynolds.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global plastic container market report on the basis of material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2015 - 2025)

-

PET

-

PP

-

HDPE

-

LDPE

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2015 - 2025)

-

Beverages

-

Food

-

Pharmaceutical

-

Cosmetic

-

Household Care

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic container market size was estimated at USD 88.7 billion in 2019 and is expected to reach USD 92.0 billion in 2020.

b. The global plastic container market is expected to grow at a compound annual growth rate of 4% from 2019 to 2025 to reach USD 112.5 billion by 2025.

b. The Asia Pacific dominated the plastic container market with a share of 31.6% in 2019. This is attributable to the increasing consumption of water, soft drinks, and juice owing to the changing consumer lifestyle.

b. Some key players operating in the plastic container market include Amcor Limited; Berry Global Inc.; Alpha Packaging; Silgan Holdings Inc.; CKS Packaging, Inc.; CCC Packaging; Polytainers Inc.; Airlite Plastics; RPC Group Plc.; and Reynolds.

b. Key factors that are driving the plastic container market growth include changing lifestyle and food preference in emerging economies including China and India, which are expected to expand the scope of convenience foods, which, in turn, will promote the utility of packaging.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."